Horace Mann Educators (HMN)

Horace Mann Educators is up against the odds. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Horace Mann Educators Will Underperform

Founded in 1945 and named after the 19th-century education reformer known as the "father of American public education," Horace Mann Educators (NYSE:HMN) is an insurance company that specializes in providing auto, property, life, and retirement products tailored for educators and other public service employees.

- Products and services are facing significant credit quality challenges during this cycle as book value per share has declined by 3.3% annually over the last five years

- Underwhelming 6.8% return on equity reflects management’s difficulties in finding profitable growth opportunities

- Earnings per share lagged its peers over the last five years as they only grew by 6.7% annually

Horace Mann Educators doesn’t pass our quality test. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Horace Mann Educators

Why There Are Better Opportunities Than Horace Mann Educators

At $46.95 per share, Horace Mann Educators trades at 1.1x forward P/B. This multiple is lower than most insurance companies, but for good reason.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Horace Mann Educators (HMN) Research Report: Q4 CY2025 Update

Educator-focused insurance company Horace Mann Educators (NYSE:HMN) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 6.3% year on year to $434.8 million. Its non-GAAP profit of $1.21 per share was 2.8% above analysts’ consensus estimates.

Horace Mann Educators (HMN) Q4 CY2025 Highlights:

- Revenue: $434.8 million vs analyst estimates of $446.2 million (6.3% year-on-year growth, 2.5% miss)

- Adjusted EPS: $1.21 vs analyst estimates of $1.18 (2.8% beat)

- Book Value per Share: $36.47 vs analyst estimates of $40.58 (15.8% year-on-year growth, 10.1% miss)

- Market Capitalization: $1.83 billion

Company Overview

Founded in 1945 and named after the 19th-century education reformer known as the "father of American public education," Horace Mann Educators (NYSE:HMN) is an insurance company that specializes in providing auto, property, life, and retirement products tailored for educators and other public service employees.

Operating through two main divisions—Retail and Worksite—Horace Mann serves approximately one million households, with about 80% of its customer base consisting of educators. The Retail Division offers auto, home, and umbrella insurance policies with educator-specific benefits, such as liability coverage for transporting students and reimbursement for stolen school fundraising items. This division also markets 403(b) tax-qualified annuities, retirement plans, and life insurance products tailored to educators' unique financial needs.

The Worksite Division focuses on employer-sponsored benefits and supplemental insurance products distributed through workplace channels. These include accident, critical illness, disability, and term life insurance that schools and districts can offer as part of employee benefit packages to help with recruitment and retention.

A school district might partner with Horace Mann to provide group disability coverage for all teachers as part of their benefits package, while individual teachers could separately purchase auto insurance with educator-specific discounts through the company's Retail Division. The company also offers programs addressing educators' unique financial challenges, such as its Student Loan Solutions program that provides guidance on qualifying for federal student loan forgiveness available to public sector employees.

Horace Mann maintains partnerships with national, state, and local education associations, which helps the company identify emerging financial wellness issues affecting educators. The company distributes its products through local agents who serve as trusted advisors in their educational communities, as well as through centralized phone and online channels.

4. Life Insurance

Life insurance companies collect premiums from policyholders in exchange for providing a future death benefit or retirement income stream. Interest rates matter for the sector (and make it cyclical), with higher rates allowing insurers to reinvest their fixed-income portfolios at more attractive yields and vice versa. Additionally, favorable demographic shifts, such as an aging population, are driving strong demand for retirement products while AI and data analytics offer significant opportunities to improve underwriting accuracy and operational efficiency. Conversely, the industry faces headwinds from persistent competition from agile insurtechs that threaten traditional distribution models.

Horace Mann Educators competes with large national insurance providers like Allstate, State Farm, Liberty Mutual, and Nationwide in the property and casualty market. In the retirement and financial products space, its competitors include TIAA, Voya Financial (NYSE:VOYA), and Lincoln National (NYSE:LNC).

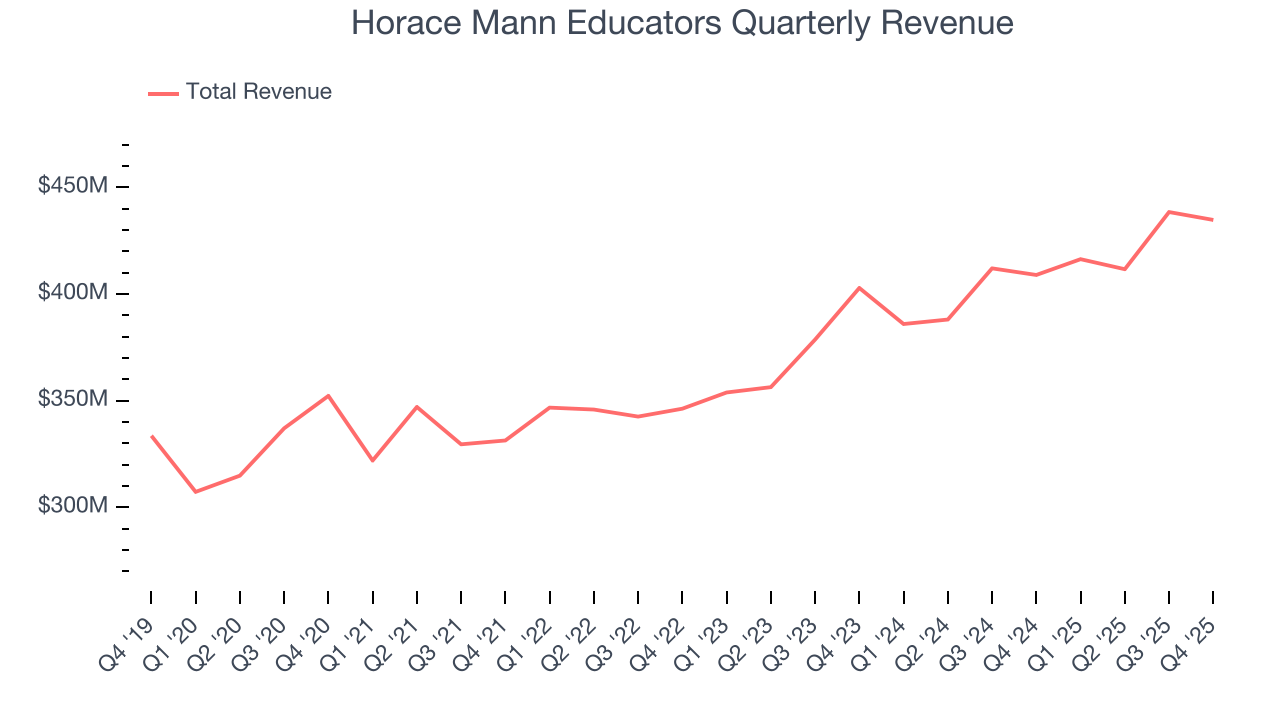

5. Revenue Growth

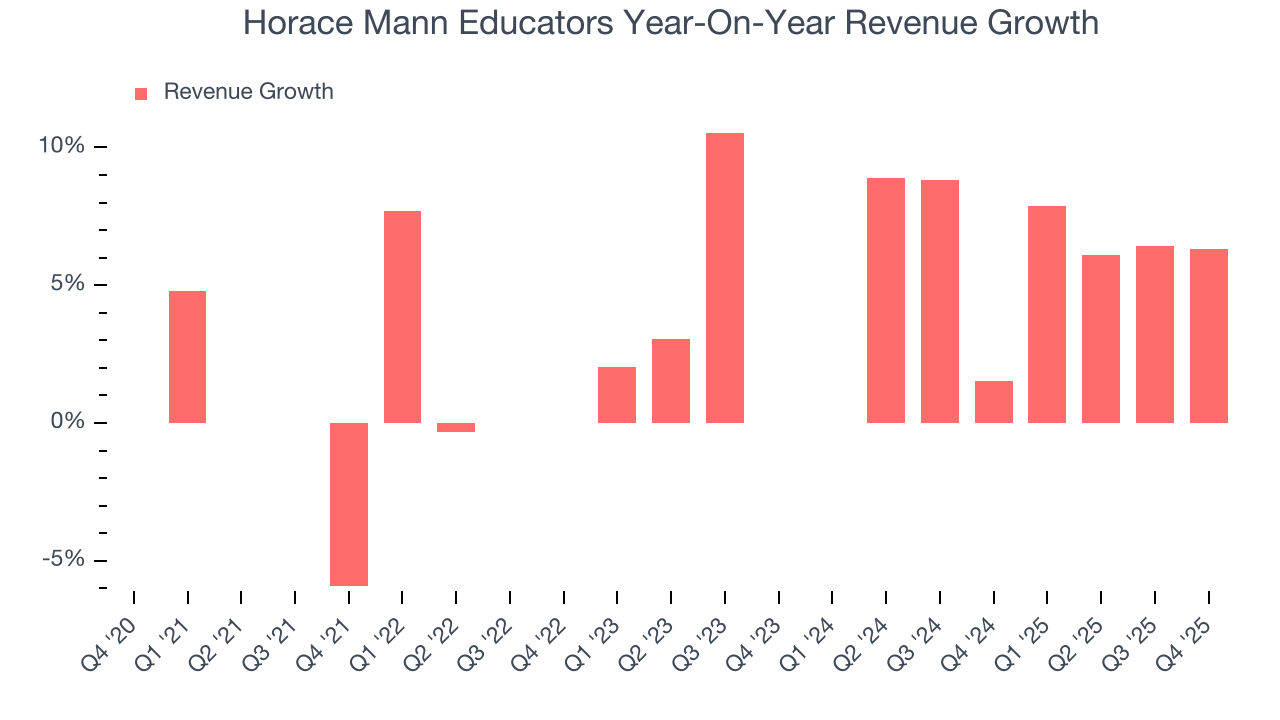

Big picture, insurers generate revenue from three key sources. The first is the core business of underwriting policies. The second source is income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Over the last five years, Horace Mann Educators grew its revenue at a tepid 5.3% compounded annual growth rate. This was below our standard for the insurance sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Horace Mann Educators’s annualized revenue growth of 6.8% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Horace Mann Educators’s revenue grew by 6.3% year on year to $434.8 million, missing Wall Street’s estimates.

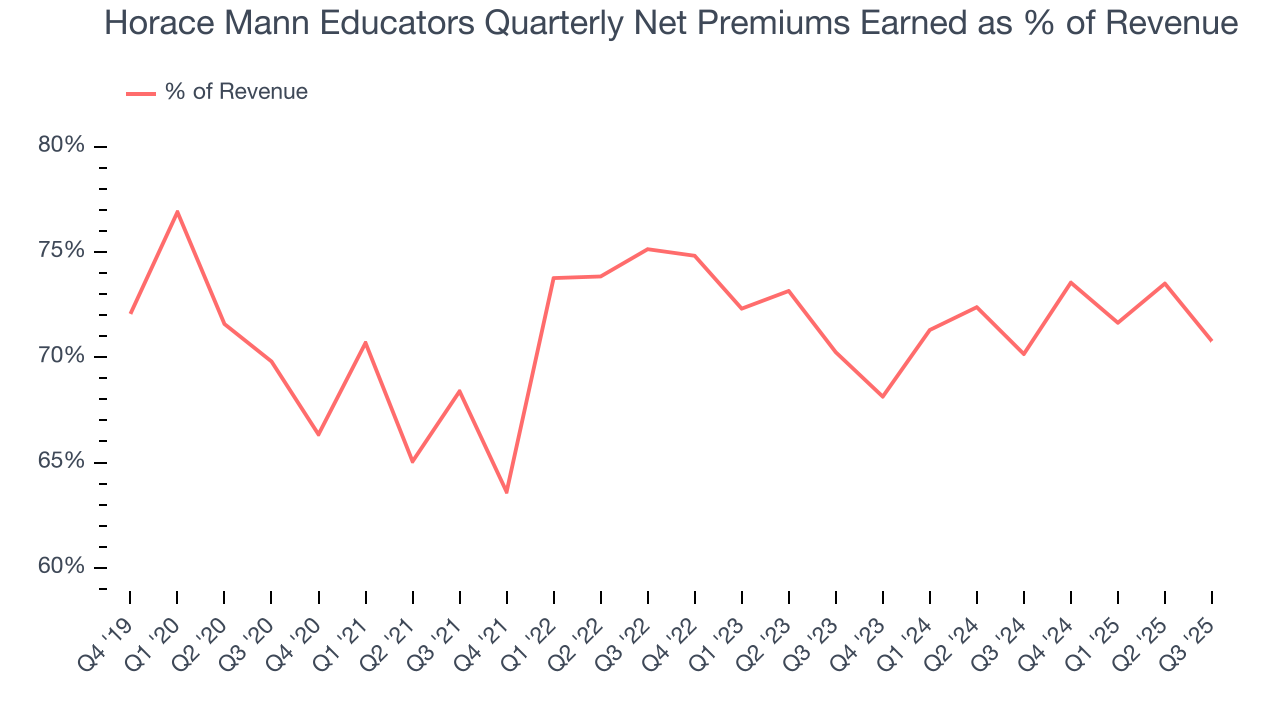

Net premiums earned made up 71.2% of the company’s total revenue during the last five years, meaning insurance operations are Horace Mann Educators’s largest source of revenue.

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

6. Net Premiums Earned

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore gross premiums less what’s ceded to reinsurers as a risk mitigation and transfer strategy.

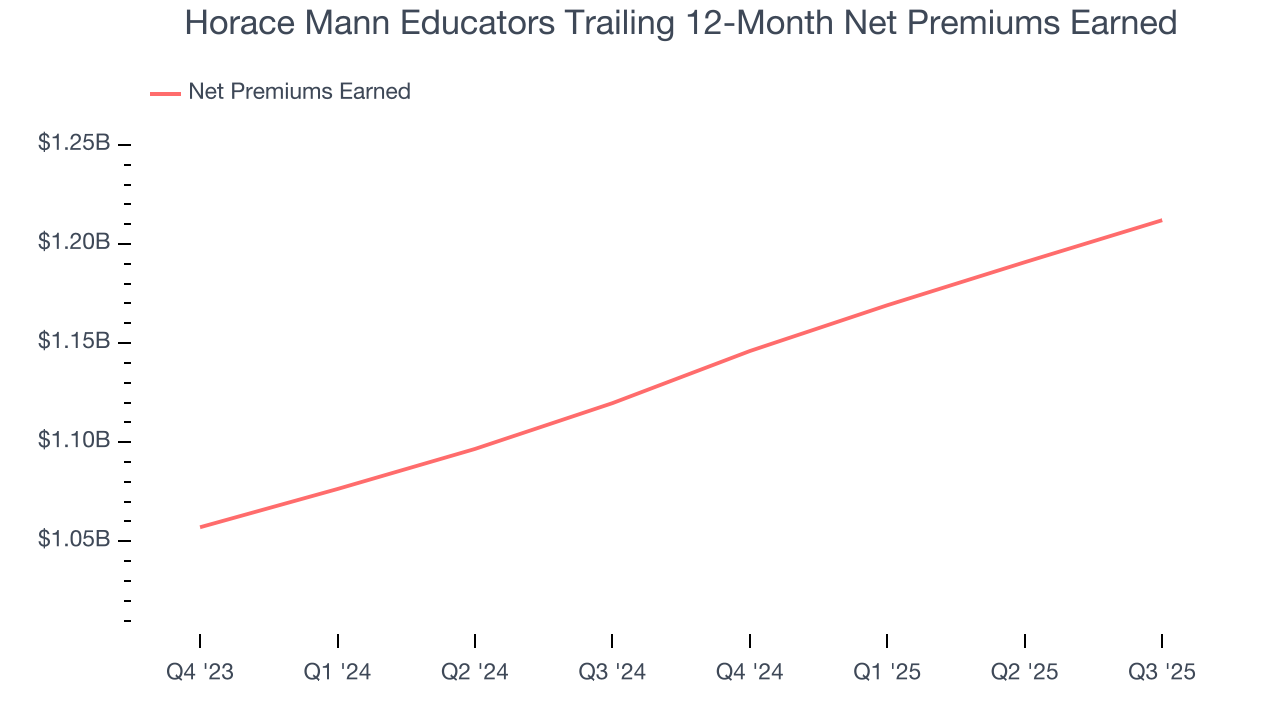

Horace Mann Educators’s net premiums earned has grown at a 5.5% annualized rate over the last five years, worse than the broader insurance industry and in line with its total revenue.

When analyzing Horace Mann Educators’s net premiums earned over the last two years, we can see that growth accelerated to 7.9% annually. Since two-year net premiums earned grew faster than total revenue over this period, it's implied that other line items such as investment income grew at a slower rate. While these supplementary streams affect the bottom line, their contribution can fluctuate. Some firms have been more successful and consistent in investing their float over the long term, but sharp movements in the fixed income and equity markets can play a substantial role in short-term performance.

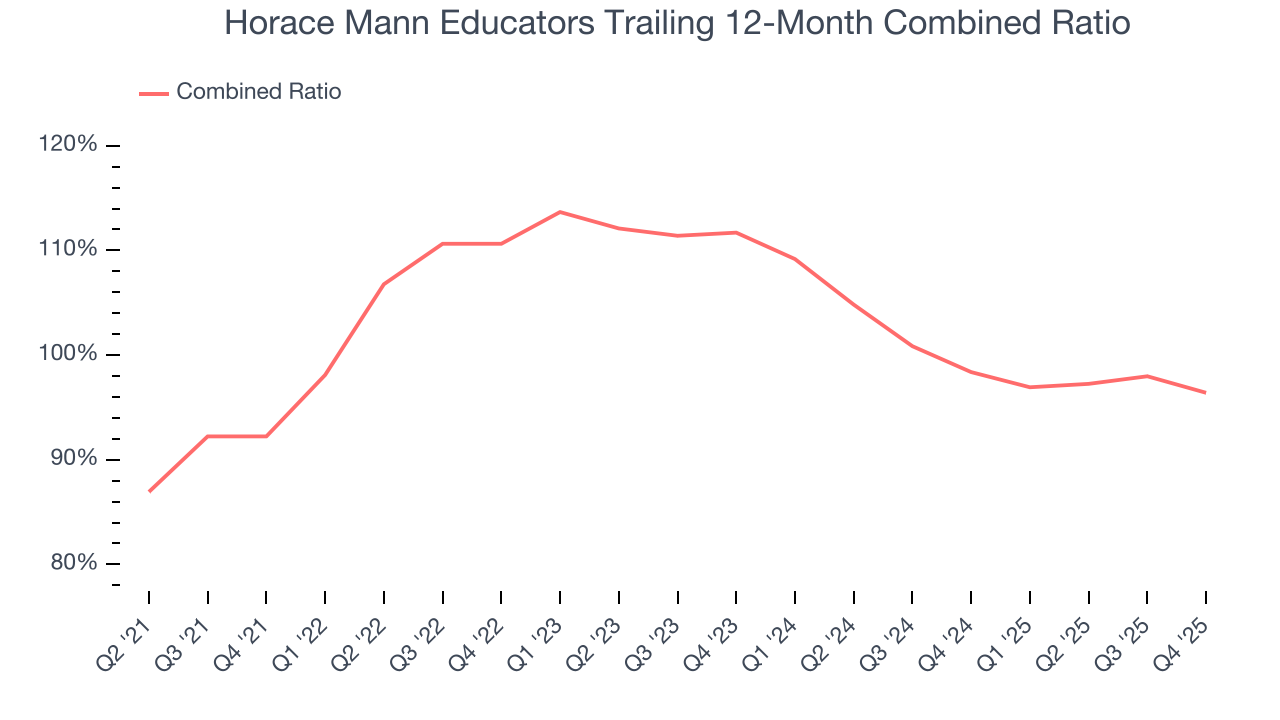

7. Combined Ratio

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

The combined ratio is:

- The costs of underwriting (salaries, commissions, overhead) + what an insurer pays out in claims, all divided by net premiums earned

If a company boasts a combined ratio under 100%, it is underwriting profitably. If above 100%, it is losing money on its core operations of selling insurance policies.

Given the calculation, a lower expense ratio is better. Over the last four years, Horace Mann Educators’s combined ratio has increased by 4.2 percentage points, going from 92.2% to 96.4%. Luckily, it seems the company has recently taken steps to address its expense base as its combined ratio improved by 15.3 percentage points on a two-year basis.

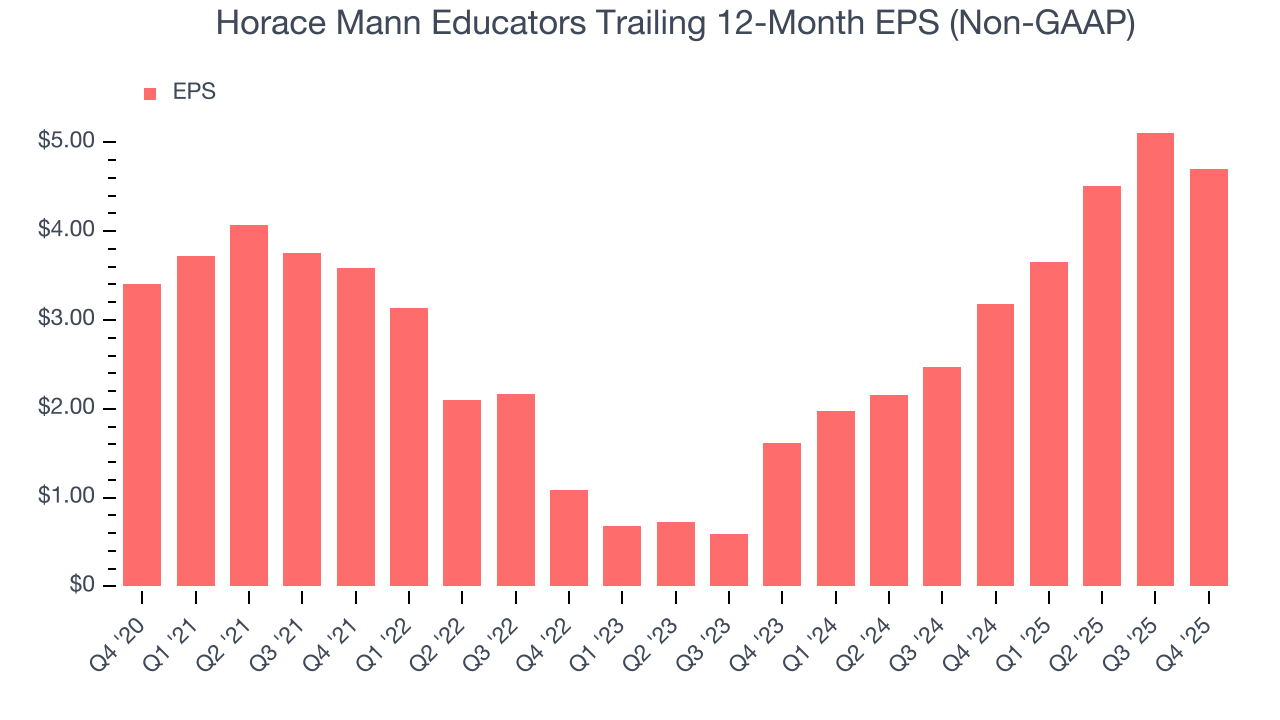

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Horace Mann Educators’s unimpressive 6.7% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Horace Mann Educators, its two-year annual EPS growth of 70.9% was higher than its five-year trend. This acceleration made it one of the faster-growing insurance companies in recent history.

In Q4, Horace Mann Educators reported adjusted EPS of $1.21, down from $1.62 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 2.8%. Over the next 12 months, Wall Street expects Horace Mann Educators’s full-year EPS of $4.70 to stay about the same.

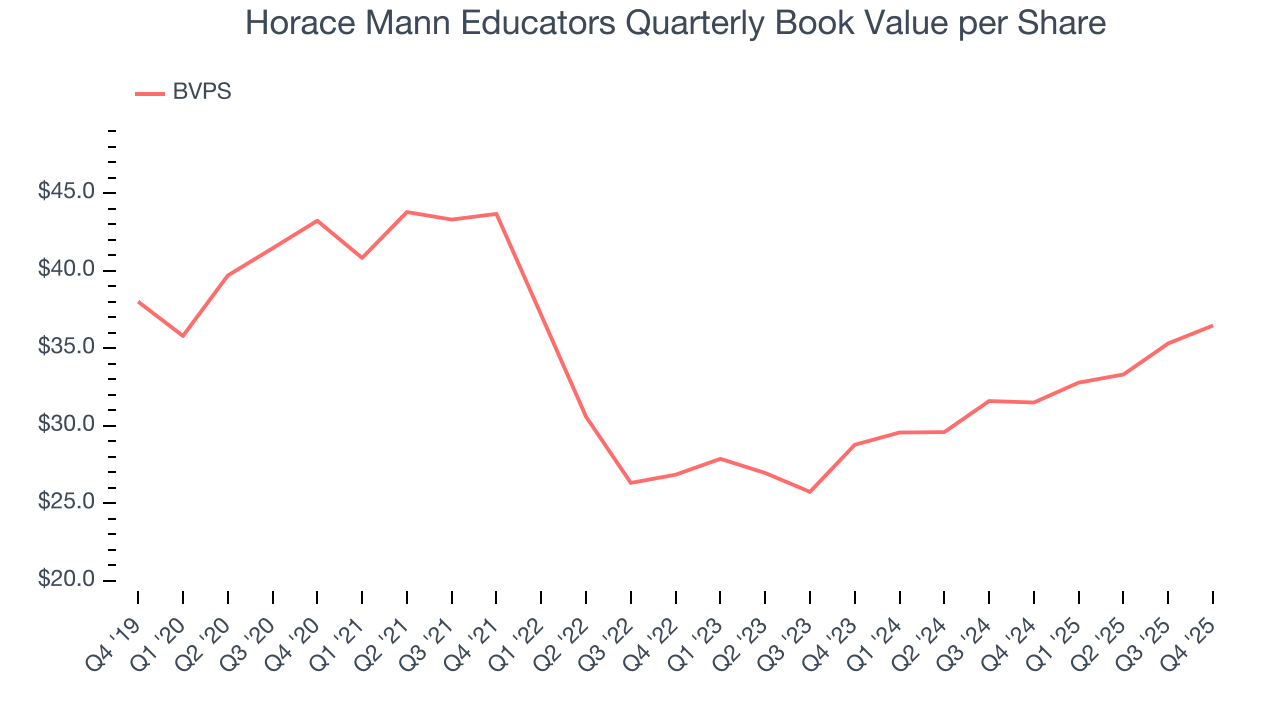

9. Book Value Per Share (BVPS)

Insurers are balance sheet businesses, collecting premiums upfront and paying out claims over time. Premiums collected but not yet paid out, often referred to as the float, are invested and create an asset base supported by a liability structure. Book value per share (BVPS) captures this dynamic by measuring these assets (investment portfolio, cash, reinsurance recoverables) less liabilities (claim reserves, debt, future policy benefits). BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality. While other (and more commonly known) per-share metrics like EPS can sometimes be lumpy due to reserve releases or one-time items and can be managed or skewed while still following accounting rules, BVPS reflects long-term capital growth and is harder to manipulate.

Horace Mann Educators’s BVPS declined at a 3.3% annual clip over the last five years. However, BVPS growth has accelerated recently, growing by 12.6% annually over the last two years from $28.78 to $36.47 per share.

Over the next 12 months, Consensus estimates call for Horace Mann Educators’s BVPS to grow by 20.6% to $40.58, elite growth rate.

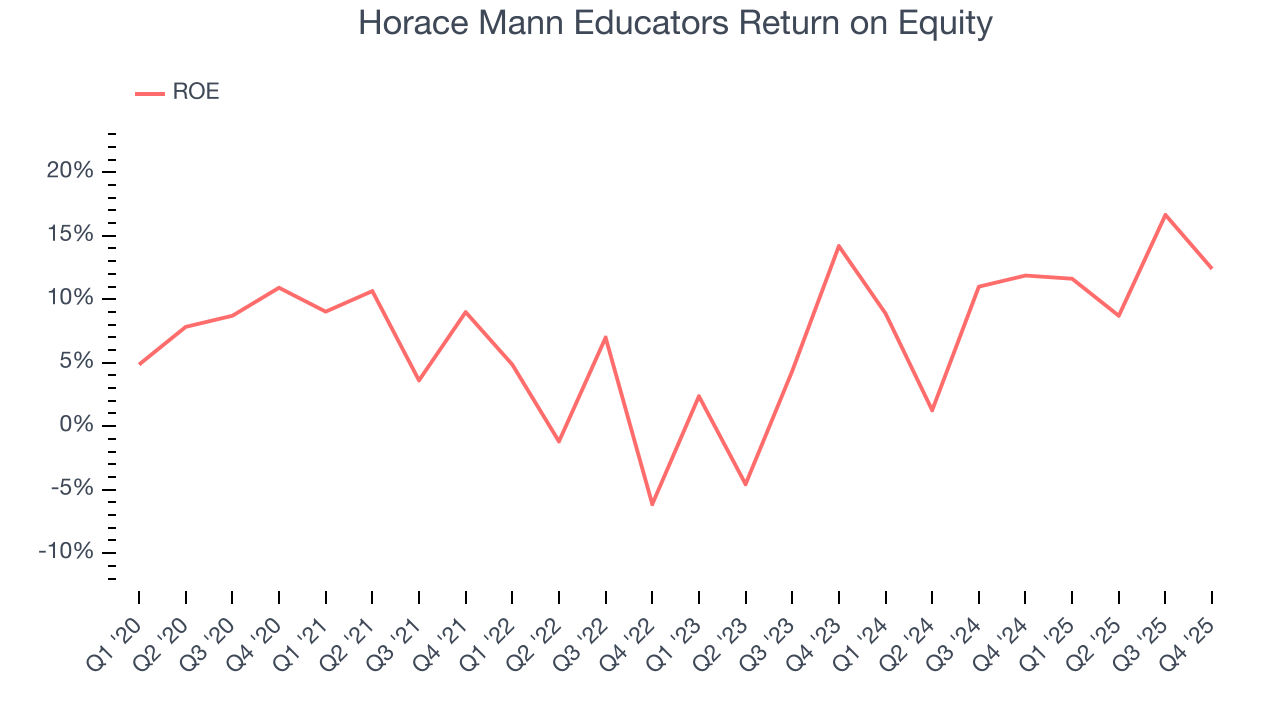

10. Return on Equity

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, Horace Mann Educators has averaged an ROE of 6.8%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

11. Key Takeaways from Horace Mann Educators’s Q4 Results

The company's revenue missed and its book value per share also fell short of Wall Street’s estimates. On the other hand, EPS managed to beat. Overall, this was a mixed quarter. The stock remained flat at $44.90 immediately after reporting.

12. Is Now The Time To Buy Horace Mann Educators?

Updated: February 3, 2026 at 11:53 PM EST

Before deciding whether to buy Horace Mann Educators or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We see the value of companies helping consumers, but in the case of Horace Mann Educators, we’re out. To begin with, its revenue growth was uninspiring over the last five years. And while its estimated BVPS growth for the next 12 months is great, the downside is its BVPS has declined over the last five years. On top of that, its projected EPS for the next year is lacking.

Horace Mann Educators’s P/B ratio based on the next 12 months is 1.1x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $50.67 on the company (compared to the current share price of $46.95).