Hershey (HSY)

We’re cautious of Hershey. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Hershey Is Not Exciting

Best known for its milk chocolate bar and Hershey's Kisses, Hershey (NYSE:HSY) is an iconic company known for its chocolate products.

- Absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

- Performance over the past three years shows its incremental sales were much less profitable, as its earnings per share fell by 3.8% annually

- On the plus side, its impressive free cash flow profitability enables the company to fund new investments or reward investors with share buybacks/dividends

Hershey’s quality doesn’t meet our bar. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Hershey

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Hershey

Hershey is trading at $205.98 per share, or 30.7x forward P/E. Not only is Hershey’s multiple richer than most consumer staples peers, but it’s also expensive for its revenue characteristics.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Hershey (HSY) Research Report: Q4 CY2025 Update

Chocolate company Hershey (NYSE:HSY) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 7% year on year to $3.09 billion. Its non-GAAP profit of $1.71 per share was 21.8% above analysts’ consensus estimates.

Hershey (HSY) Q4 CY2025 Highlights:

- Revenue: $3.09 billion vs analyst estimates of $2.98 billion (7% year-on-year growth, 3.8% beat)

- Adjusted EPS: $1.71 vs analyst estimates of $1.40 (21.8% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $8.36 at the midpoint, beating analyst estimates by 17.9%

- Operating Margin: 14.4%, down from 32.5% in the same quarter last year

- Organic Revenue rose 5.7% year on year (beat)

- Sales Volumes fell 3% year on year (6% in the same quarter last year)

- Market Capitalization: $41.73 billion

Company Overview

Best known for its milk chocolate bar and Hershey's Kisses, Hershey (NYSE:HSY) is an iconic company known for its chocolate products.

The company was founded in 1894 by Milton S. Hershey, and it set itself apart from the crowd with its commitment to using high-quality ingredients and a special manufacturing process known as conching, which gives its chocolate a smooth and creamy texture.

In addition to its simple milk chocolate bar and signature Kiss wrapped in foil, Hershey is also known for Reese's Peanut Butter Cups, Kit Kat, Twizzlers, and Jolly Rancher hard candies. Hershey’s appeal is broad, but its core customer is someone with a sweet tooth. The company’s products are often associated with celebratory moments such as trick-or-treating on Halloween or roasting s’mores with your family. Despite trends in health and wellness, consumers still seek treats that provide moments of happiness.

Hershey's products can be found in a wide range of retail outlets such as grocery stores, convenience stores, drugstores, mass merchandisers, and even online retailers. In response to shifting consumer habits, Hershey also has an online store where customers can purchase Hershey products, merchandise, and gifts for others directly from the company.

4. Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors that offer chocolate products and treats include Crunch from Nestle (SWX:NESN), Cadbury and Toblerone from Mondelez (NASDAQ:MDLZ), and M&M's and Snickers from private company Mars.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $11.69 billion in revenue over the past 12 months, Hershey is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To expand meaningfully, Hershey likely needs to tweak its prices, innovate with new products, or enter new markets.

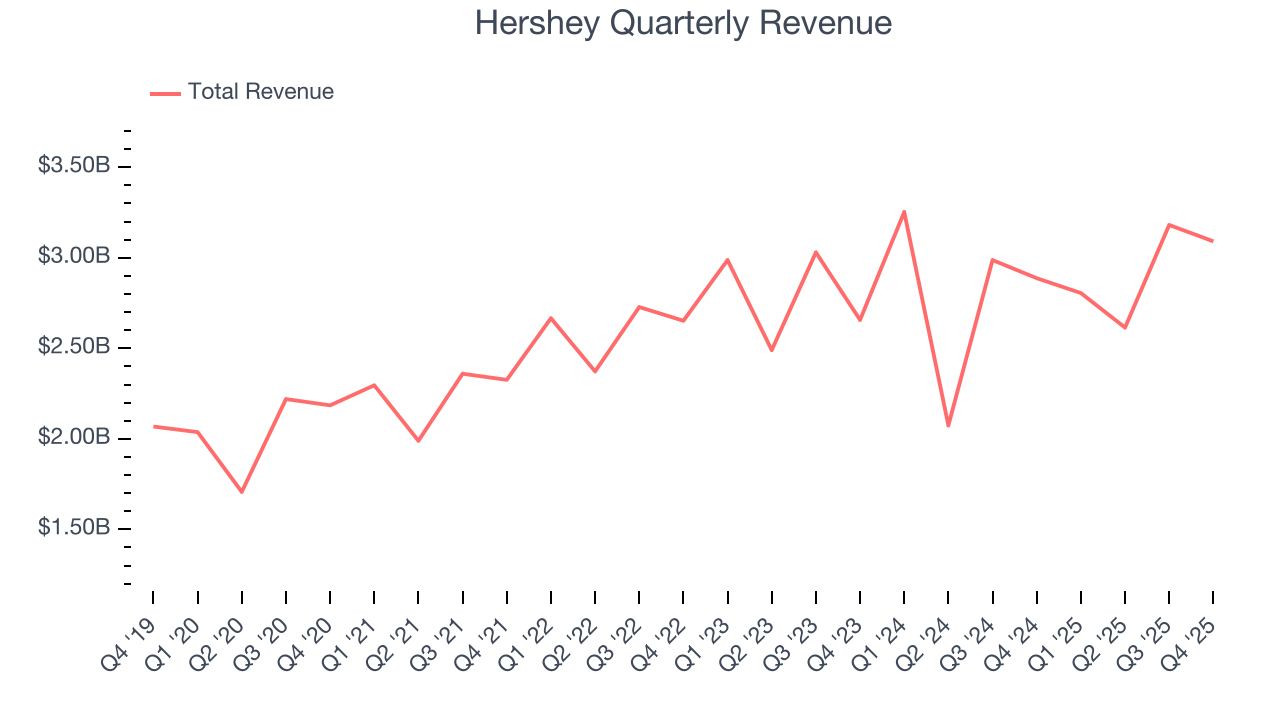

As you can see below, Hershey grew its sales at a sluggish 3.9% compounded annual growth rate over the last three years as consumers bought less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Hershey reported year-on-year revenue growth of 7%, and its $3.09 billion of revenue exceeded Wall Street’s estimates by 3.8%.

Looking ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and indicates its products will face some demand challenges.

6. Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

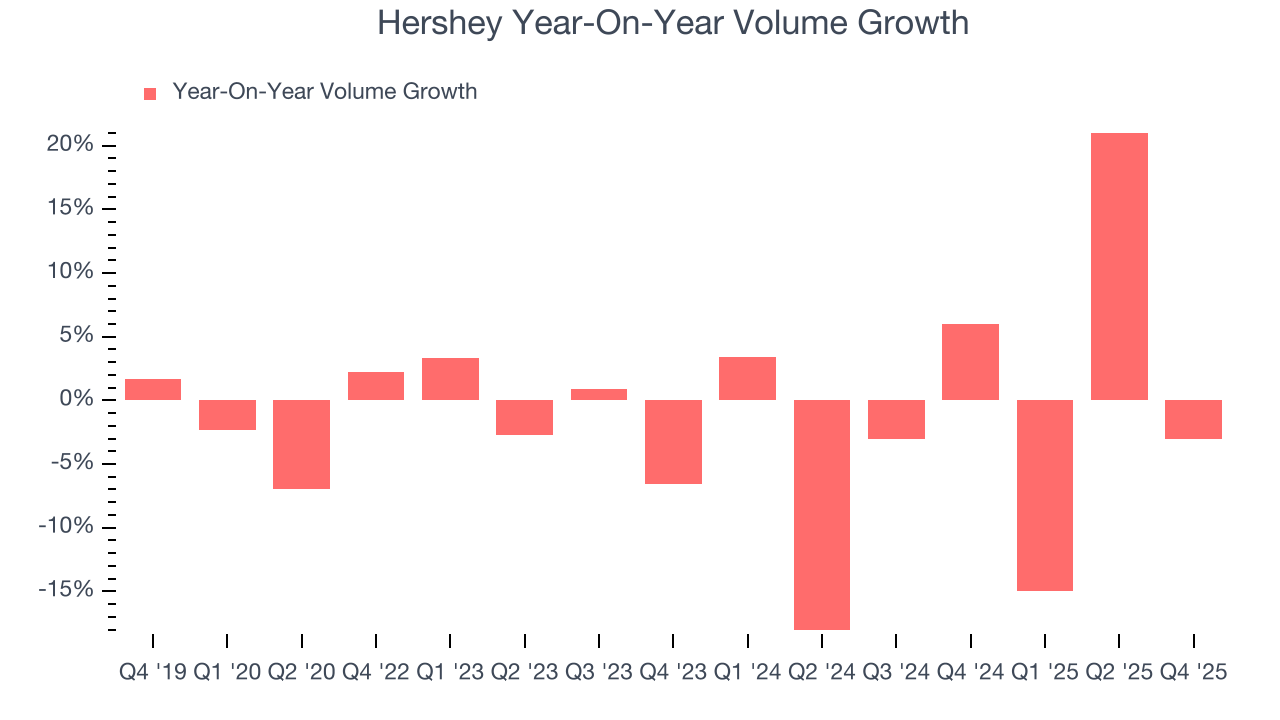

Hershey’s average quarterly sales volumes have shrunk by 1.2% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In Hershey’s Q4 2025, sales volumes dropped 3% year on year. This result represents a further deceleration from its historical levels, showing the business is struggling to move its products.

7. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

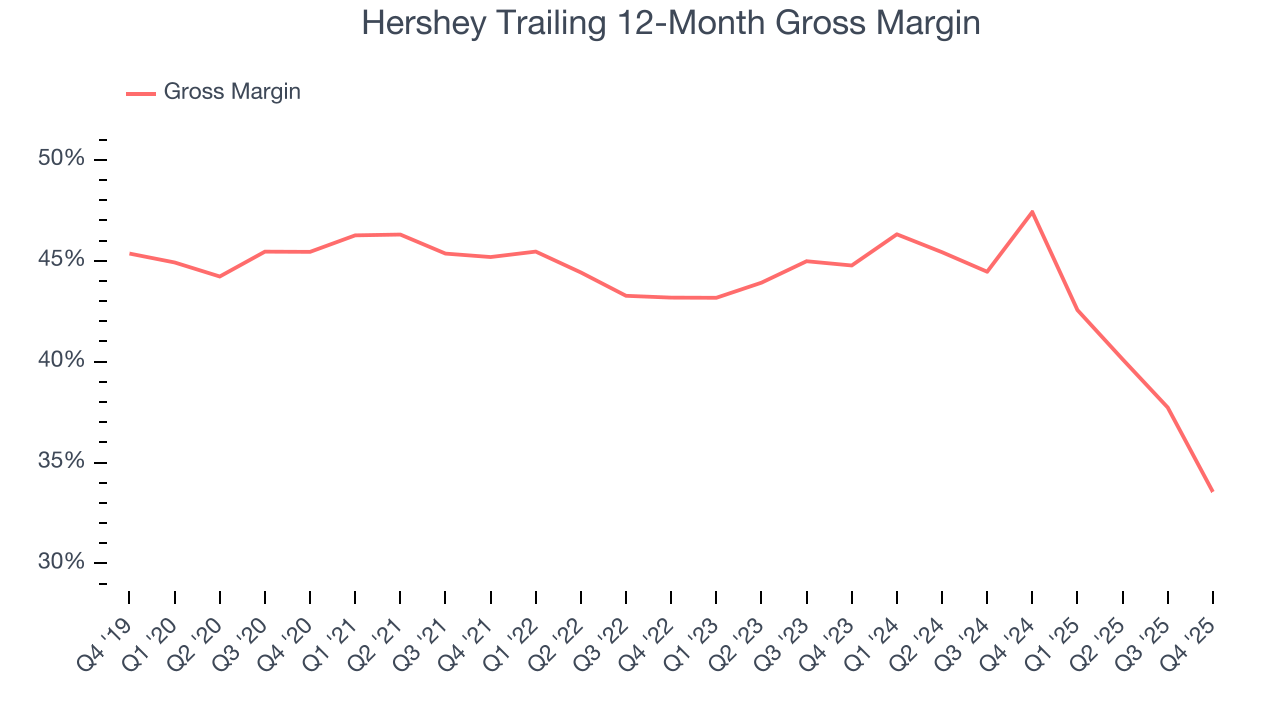

Hershey has good unit economics for a consumer staples company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it averaged an impressive 40.3% gross margin over the last two years. That means for every $100 in revenue, $59.67 went towards paying for raw materials, production of goods, transportation, and distribution.

Hershey produced a 37% gross profit margin in Q4, marking a 16.9 percentage point decrease from 53.9% in the same quarter last year. Hershey’s full-year margin has also been trending down over the past 12 months, decreasing by 13.9 percentage points. If this move continues, it could suggest deteriorating pricing power and higher input costs (such as raw materials and manufacturing expenses).

8. Operating Margin

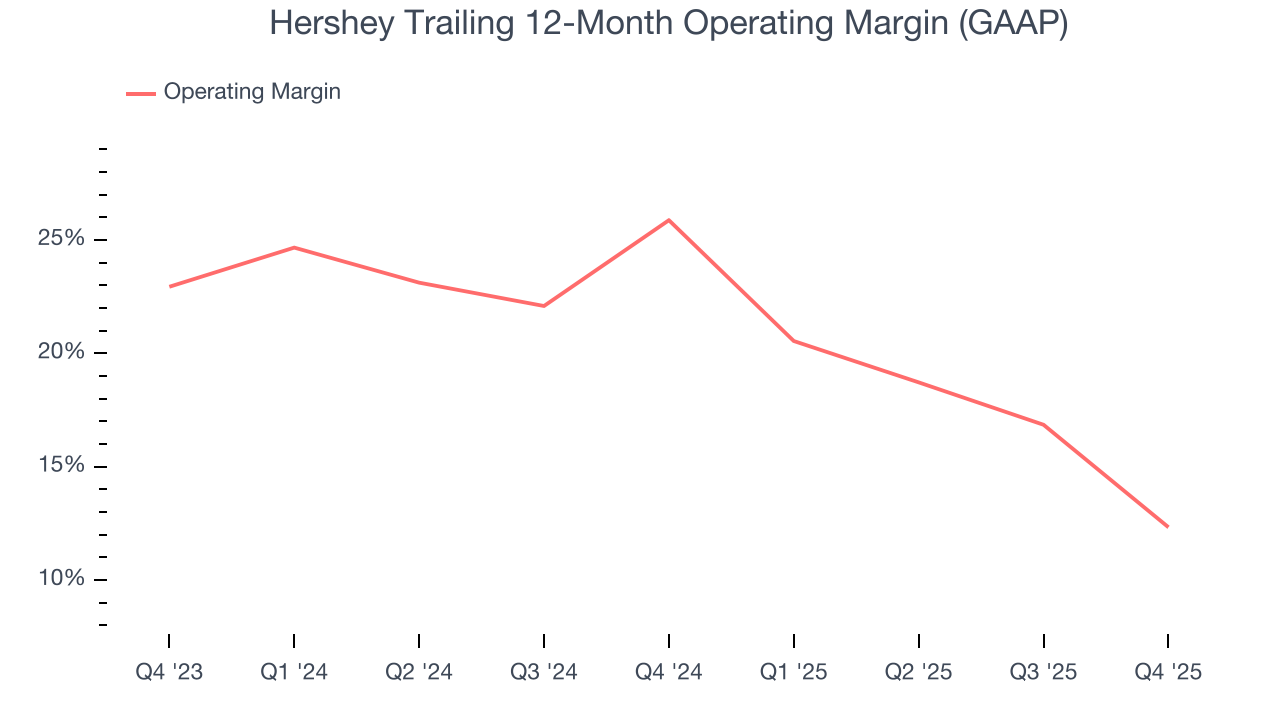

Hershey has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 19%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Hershey’s operating margin decreased by 13.5 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Hershey generated an operating margin profit margin of 14.4%, down 18.1 percentage points year on year. Since Hershey’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

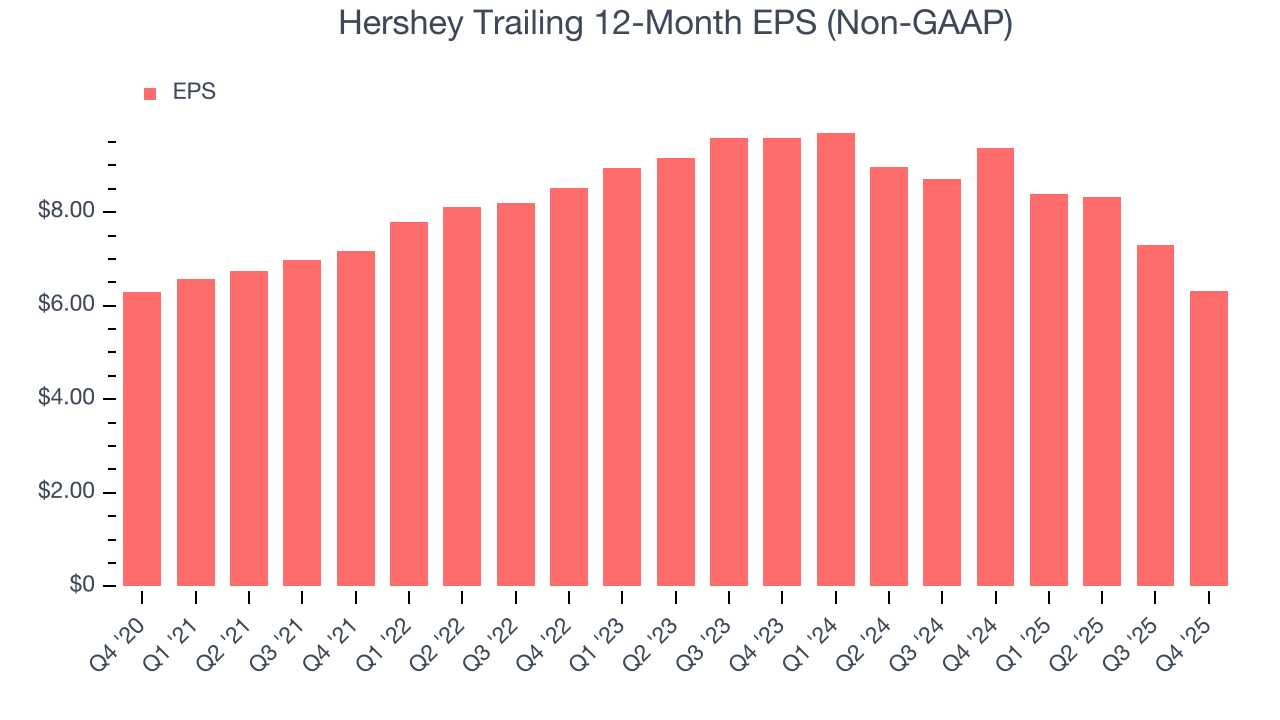

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Hershey, its EPS declined by 9.5% annually over the last three years while its revenue grew by 3.9%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q4, Hershey reported adjusted EPS of $1.71, down from $2.69 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Hershey’s full-year EPS of $6.31 to grow 12.3%.

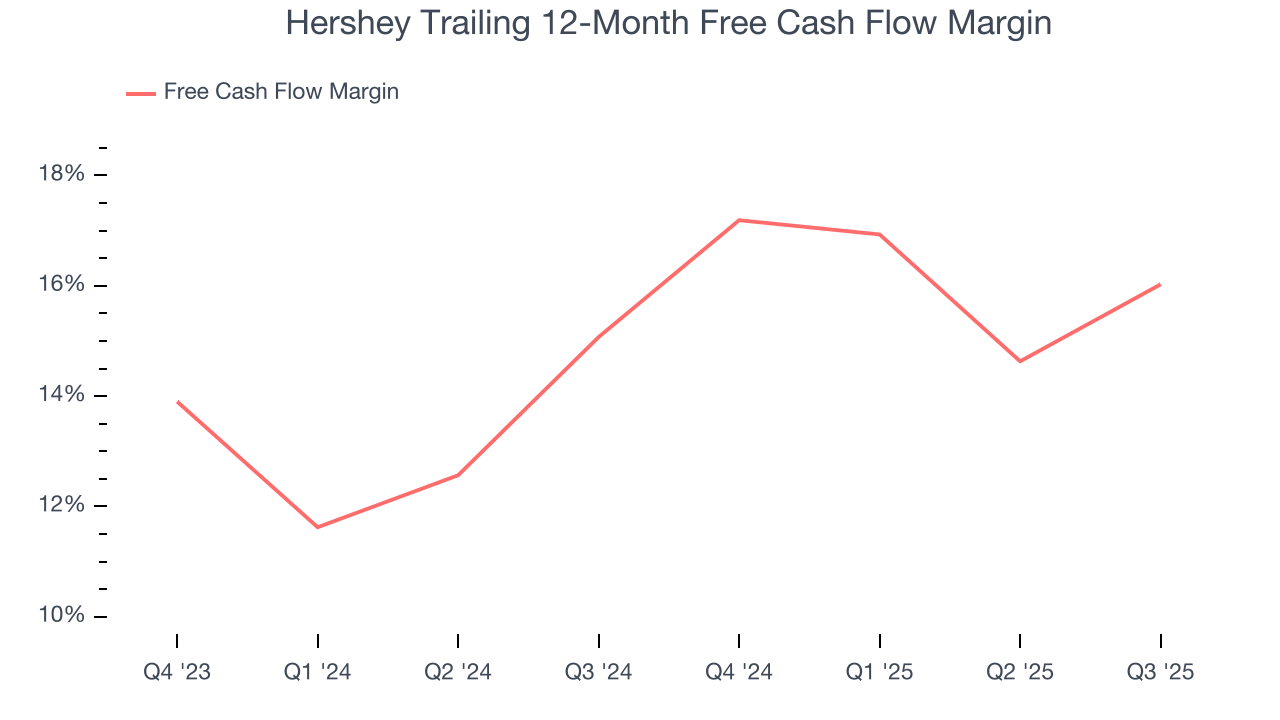

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Hershey has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 14.9% over the last two years.

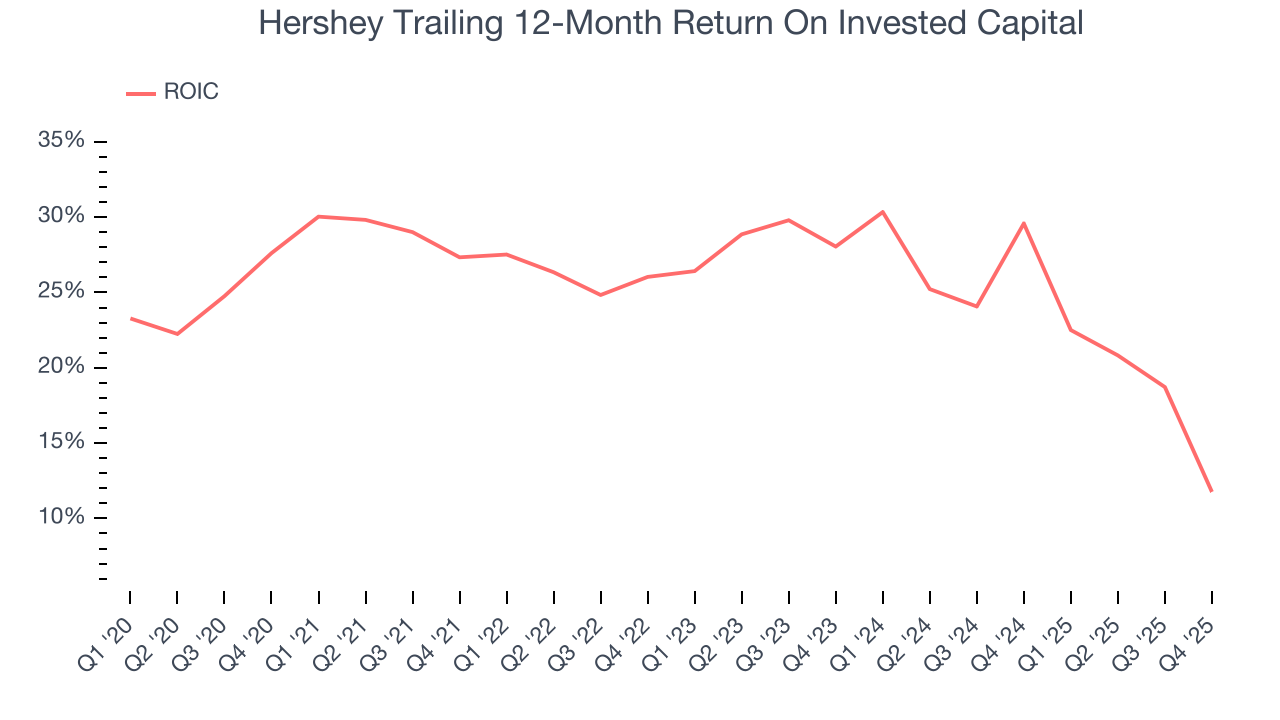

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Hershey hasn’t been the highest-quality company lately because of its poor revenue and EPS performance, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 24.6%, impressive for a consumer staples business.

12. Key Takeaways from Hershey’s Q4 Results

We were impressed by Hershey’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also glad its organic revenue in the quarter outperformed Wall Street’s estimates, leading to an EPS beat. Zooming out, we think this was a solid print. The stock traded up 3.5% to $213 immediately after reporting.

13. Is Now The Time To Buy Hershey?

Updated: February 5, 2026 at 7:19 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Hershey.

Hershey isn’t a terrible business, but it isn’t one of our picks. For starters, its revenue growth was a little slower over the last three years, and analysts expect its demand to deteriorate over the next 12 months. And while its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its declining operating margin shows the business has become less efficient. On top of that, its declining EPS over the last three years makes it a less attractive asset to the public markets.

Hershey’s P/E ratio based on the next 12 months is 29x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $199.39 on the company (compared to the current share price of $213), implying they don’t see much short-term potential in Hershey.