HubSpot (HUBS)

HubSpot is intriguing. Its blend of strong revenue growth and impressive unit economics gives it attractive upside.― StockStory Analyst Team

1. News

2. Summary

Why HubSpot Is Interesting

Born from the idea that traditional interruptive marketing was becoming less effective, HubSpot (NYSE:HUBS) provides an integrated platform that helps businesses attract, engage, and manage customer relationships through marketing, sales, service, and content management tools.

- Superior software functionality and low servicing costs are reflected in its top-tier gross margin of 83.8%

- Average billings growth of 22.5% over the last year enhances its liquidity and shows there is steady demand for its products

- A blemish is its operating margin improvement of 2.8 percentage points over the last year demonstrates its ability to scale efficiently

HubSpot shows some signs of a high-quality business. If you like the company, the valuation seems reasonable.

Why Is Now The Time To Buy HubSpot?

High Quality

Investable

Underperform

Why Is Now The Time To Buy HubSpot?

HubSpot’s stock price of $217.20 implies a valuation ratio of 3.3x forward price-to-sales. HubSpot’s valuation seems like a good deal for the revenue momentum you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. HubSpot (HUBS) Research Report: Q4 CY2025 Update

Customer platform provider HubSpot (NYSE:HUBS) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 20.4% year on year to $846.7 million. Guidance for next quarter’s revenue was optimistic at $862.5 million at the midpoint, 2.9% above analysts’ estimates. Its non-GAAP profit of $3.09 per share was 3.4% above analysts’ consensus estimates.

HubSpot (HUBS) Q4 CY2025 Highlights:

- Revenue: $846.7 million vs analyst estimates of $829.9 million (20.4% year-on-year growth, 2% beat)

- Adjusted EPS: $3.09 vs analyst estimates of $2.99 (3.4% beat)

- Revenue Guidance for Q1 CY2026 is $862.5 million at the midpoint, above analyst estimates of $838.2 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $12.42 at the midpoint, beating analyst estimates by 8.4%

- Operating Margin: 5.7%, up from -1.5% in the same quarter last year

- Free Cash Flow Margin: 24.7%, up from 17.6% in the previous quarter

- Billings: $969.3 million at quarter end, up 26.3% year on year

- Market Capitalization: $12.15 billion

Company Overview

Born from the idea that traditional interruptive marketing was becoming less effective, HubSpot (NYSE:HUBS) provides an integrated platform that helps businesses attract, engage, and manage customer relationships through marketing, sales, service, and content management tools.

HubSpot's platform consists of multiple integrated "Hubs" built on top of a Smart CRM (Customer Relationship Management) system that maintains a unified view of customer interactions. These Hubs include Marketing, Sales, Service, Content, Operations, and Commerce, each designed to manage different aspects of the customer relationship lifecycle. The platform is enhanced by "Breeze," HubSpot's AI technology that powers productivity tools, automation, and data enrichment across the system.

Mid-market B2B companies primarily use HubSpot's platform to streamline their customer-facing operations. For example, a growing software company might use Marketing Hub to attract visitors through SEO and content marketing, convert them into leads with landing pages, nurture them with automated email campaigns, and then track their journey through the sales process using Sales Hub.

HubSpot offers its platform through a tiered subscription model, ranging from free basic tools to comprehensive enterprise packages. Revenue comes primarily from these subscriptions, with additional income from professional services. The company has built its technology on scalable, distributed systems capable of processing billions of data points weekly, allowing customers to gain insights across channels like social media, email, and website visits in near real-time.

4. Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

HubSpot competes with Salesforce (NYSE:CRM) in CRM and marketing automation, Adobe (NASDAQ:ADBE) for marketing and content tools, Zendesk (private) for customer service, and Microsoft Dynamics (NASDAQ:MSFT) for integrated business solutions. Other competitors include Zoho, monday.com (NASDAQ:MNDY), and Freshworks (NASDAQ:FRSH).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, HubSpot’s 28.8% annualized revenue growth over the last five years was impressive. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. HubSpot’s annualized revenue growth of 20.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, HubSpot reported robust year-on-year revenue growth of 20.4%, and its $846.7 million of revenue topped Wall Street estimates by 2%. Company management is currently guiding for a 20.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.3% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and suggests the market is baking in some success for its newer products and services.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

HubSpot’s billings punched in at $969.3 million in Q4, and over the last four quarters, its growth was impressive as it averaged 22.4% year-on-year increases. This alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

HubSpot does a decent job acquiring new customers, and its CAC payback period checked in at 46.7 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

HubSpot’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an elite 83.8% gross margin over the last year. That means HubSpot only paid its providers $16.24 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. HubSpot has seen gross margins decline by 0.6 percentage points over the last 2 year, which is slightly worse than average for software.

HubSpot’s gross profit margin came in at 83.7% this quarter , marking a 1.6 percentage point decrease from 85.3% in the same quarter last year. HubSpot’s full-year margin has also been trending down over the past 12 months, decreasing by 1.3 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

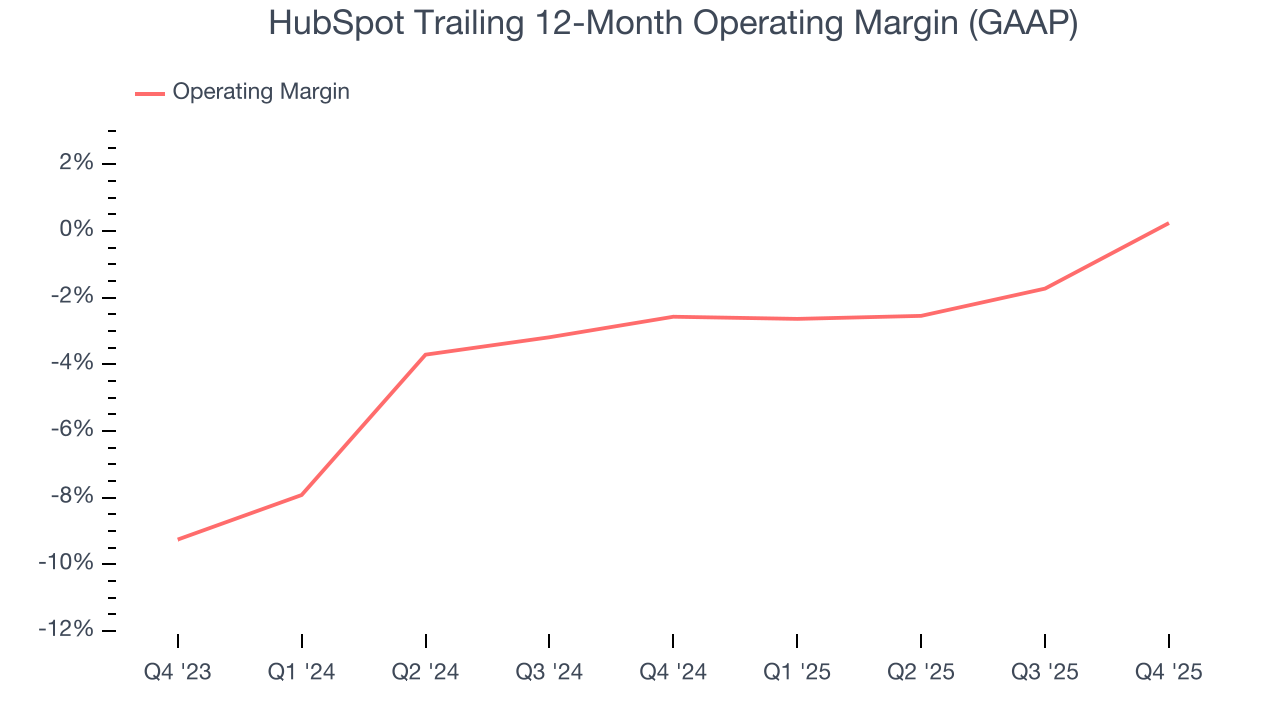

9. Operating Margin

HubSpot was roughly breakeven when averaging the last year of quarterly operating profits, decent for a software business.

Analyzing the trend in its profitability, HubSpot’s operating margin rose by 2.8 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, HubSpot generated an operating margin profit margin of 5.7%, up 7.2 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

HubSpot has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 18.6% over the last year, slightly better than the broader software sector.

HubSpot’s free cash flow clocked in at $209.4 million in Q4, equivalent to a 24.7% margin. This result was good as its margin was 2.2 percentage points higher than in the same quarter last year. Its cash profitability was also above its one-year level, and we hope the company can build on this trend.

Over the next year, analysts’ consensus estimates show they’re expecting HubSpot’s free cash flow margin of 18.6% for the last 12 months to remain the same.

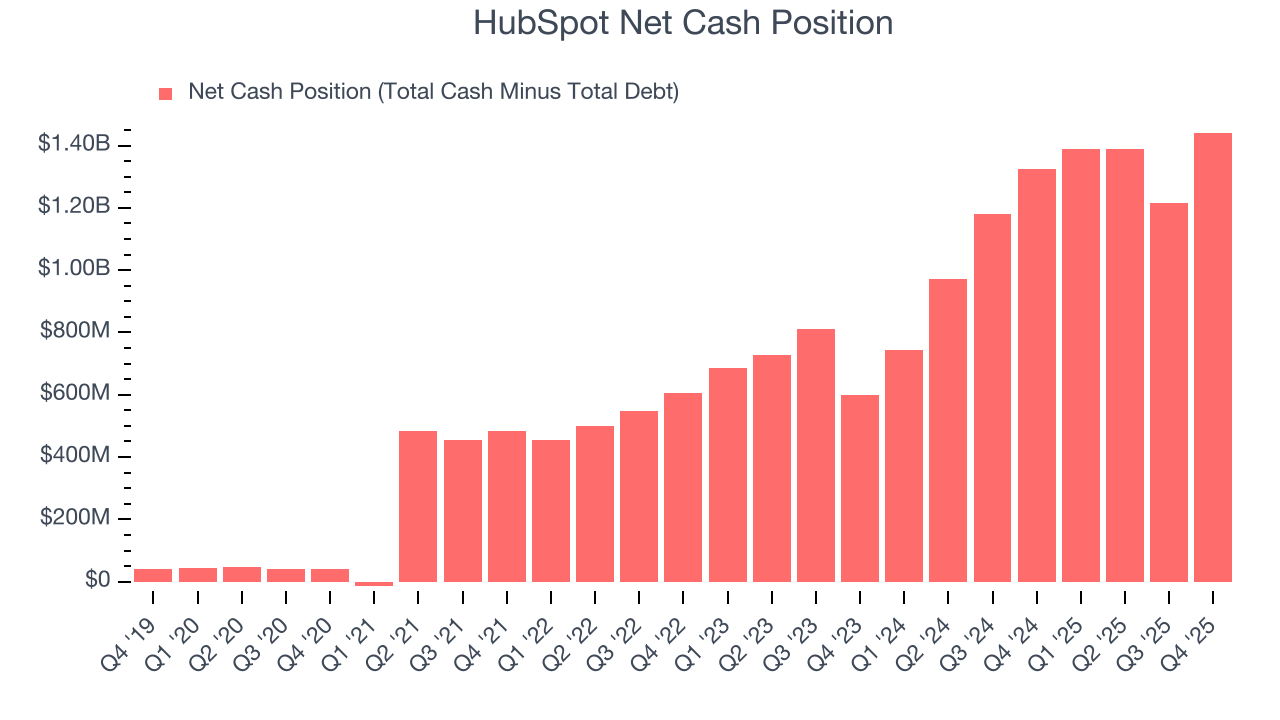

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

HubSpot is a profitable, well-capitalized company with $1.70 billion of cash and $262.3 million of debt on its balance sheet. This $1.44 billion net cash position is 12% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from HubSpot’s Q4 Results

We were impressed by how significantly HubSpot blew past analysts’ billings expectations this quarter. We were also glad its EPS guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this was a solid print. The market seemed to be hoping for more, and the stock traded down 3.5% to $201.85 immediately following the results.

13. Is Now The Time To Buy HubSpot?

Updated: February 23, 2026 at 9:02 PM EST

Before making an investment decision, investors should account for HubSpot’s business fundamentals and valuation in addition to what happened in the latest quarter.

There are some positives when it comes to HubSpot’s fundamentals. First off, its revenue growth was strong over the last five years. And while its expanding operating margin shows it’s becoming more efficient at building and selling its software, its admirable gross margin indicates excellent unit economics. On top of that, its splendid ARR growth shows it’s securing more long-term contracts and becoming a more predictable business.

HubSpot’s price-to-sales ratio based on the next 12 months is 3.3x. Looking at the software landscape right now, HubSpot trades at a pretty interesting price. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $374.75 on the company (compared to the current share price of $217.20), implying they see 72.5% upside in buying HubSpot in the short term.