Humana (HUM)

We’d invest in Humana. Its market-beating ROIC illustrates its ability to invest in highly profitable ventures.― StockStory Analyst Team

1. News

2. Summary

Why We Like Humana

With over 80% of its revenue derived from federal government contracts, Humana (NYSE:HUM) provides health insurance plans and healthcare services to approximately 17 million members, with a strong focus on Medicare Advantage plans for seniors.

- Stellar returns on capital showcase management’s ability to surface highly profitable business ventures

- Enormous revenue base of $126.3 billion gives it leverage over plan holders and advantageous reimbursement terms with healthcare providers

- Estimated revenue growth of 12.1% for the next 12 months implies its momentum over the last two years will continue

We’re fond of companies like Humana. The valuation looks reasonable based on its quality, so this might be a good time to buy some shares.

Why Is Now The Time To Buy Humana?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Humana?

Humana is trading at $266.25 per share, or 19.7x forward P/E. This multiple is lower than most healthcare companies, and we think the stock is a deal when considering its quality characteristics.

Entry price matters much less than business quality when investing for the long term, but hey, it certainly doesn’t hurt to get in at an attractive price.

3. Humana (HUM) Research Report: Q3 CY2025 Update

Health insurance company Humana (NYSE:HUM) announced better-than-expected revenue in Q3 CY2025, with sales up 11.4% year on year to $32.65 billion. The company expects the full year’s revenue to be around $128 billion, close to analysts’ estimates. Its GAAP profit of $1.62 per share was 43.4% below analysts’ consensus estimates.

Humana (HUM) Q3 CY2025 Highlights:

- Revenue: $32.65 billion vs analyst estimates of $31.97 billion (11.4% year-on-year growth, 2.1% beat)

- EPS (GAAP): $1.62 vs analyst expectations of $2.86 (43.4% miss)

- Adjusted EBITDA: $573 million vs analyst estimates of $818.1 million (1.8% margin, 30% miss)

- The company reconfirmed its revenue guidance for the full year of $128 billion at the midpoint

- Operating Margin: 1.2%, down from 2.5% in the same quarter last year

- Free Cash Flow Margin: 2.6%, down from 5.9% in the same quarter last year

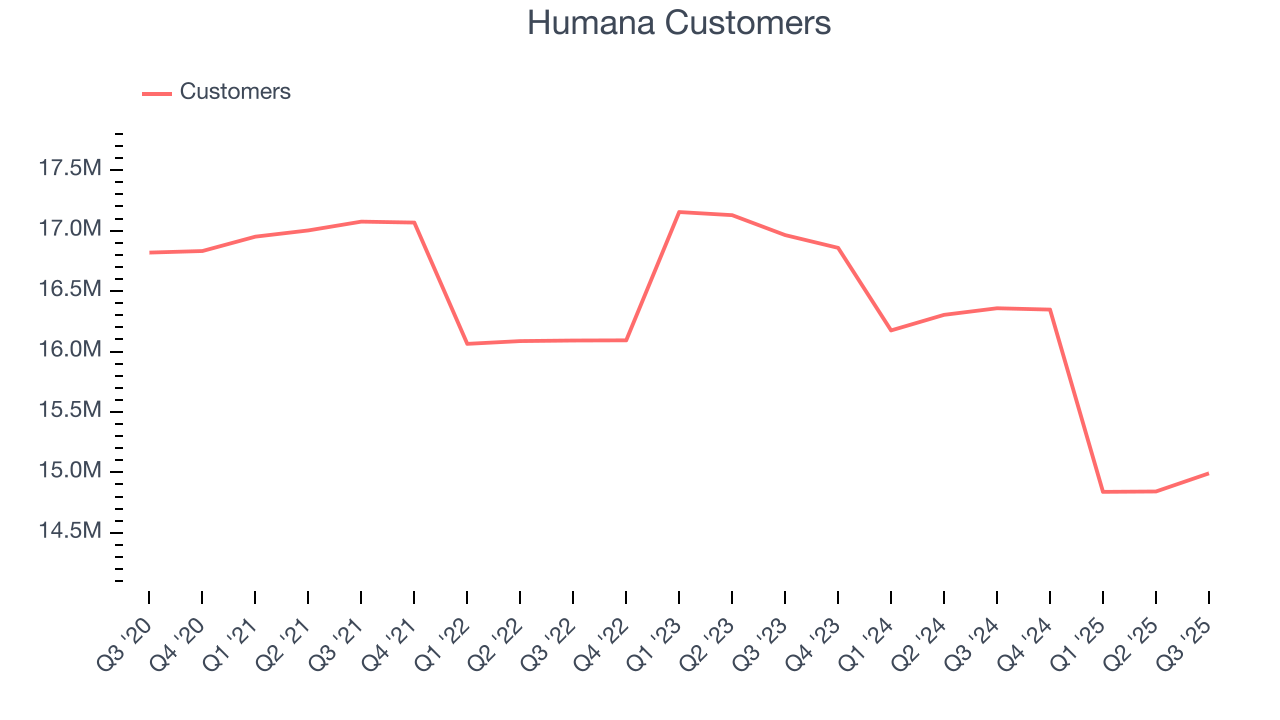

- Customers: 14.99 million, up from 14.84 million in the previous quarter

- Market Capitalization: $33.9 billion

Company Overview

With over 80% of its revenue derived from federal government contracts, Humana (NYSE:HUM) provides health insurance plans and healthcare services to approximately 17 million members, with a strong focus on Medicare Advantage plans for seniors.

Humana operates through two main segments: Insurance and CenterWell. The Insurance segment offers various Medicare products, including Medicare Advantage plans, stand-alone prescription drug plans, and Medicare Supplement policies. It also provides Medicaid plans through state-based contracts in multiple states and specialty insurance products like dental and vision coverage.

The company's Medicare Advantage plans typically offer enhanced benefits beyond traditional Medicare, such as reduced cost sharing, prescription drug coverage, care coordination, and wellness programs. As of 2023, Humana served approximately 5.4 million individual Medicare Advantage members across all 50 states, making it one of the largest providers in this market.

CenterWell, Humana's second segment, represents the company's healthcare services operations. This includes CenterWell Pharmacy (mail-order and specialty pharmacy services), CenterWell Senior Primary Care (senior-focused medical centers), and CenterWell Home Health (home healthcare services). Through these services, Humana delivers an integrated care model that aims to improve health outcomes while controlling costs.

For example, a 75-year-old Medicare Advantage member might visit a CenterWell Senior Primary Care center for regular checkups, receive medications through CenterWell Pharmacy, and recover from surgery with the help of CenterWell Home Health nurses—all coordinated through Humana's care management programs.

Humana employs various provider payment models, including value-based care arrangements where healthcare providers share financial risk for patient outcomes. These arrangements covered approximately 2.2 million members as of 2023, representing about 13% of Humana's total medical membership.

The company markets its products through multiple channels, including television, direct mail, telemarketing, and a sales force of approximately 1,000 representatives. It also partners with independent brokers and agents to sell Medicare and specialty products, and has a marketing arrangement with Walmart for its Medicare prescription drug plans.

4. Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Humana's main competitors include UnitedHealth Group (NYSE: UNH), CVS Health's Aetna (NYSE: CVS), Cigna Group (NYSE: CI), Elevance Health (formerly Anthem) (NYSE: ELV), and Centene Corporation (NYSE: CNC). In the Medicare Advantage space specifically, UnitedHealth's UnitedHealthcare and CVS Health's Aetna are Humana's strongest competitors.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $126.3 billion in revenue over the past 12 months, Humana is one of the most scaled enterprises in healthcare. This is particularly important because health insurance providers companies are volume-driven businesses due to their low margins.

6. Revenue Growth

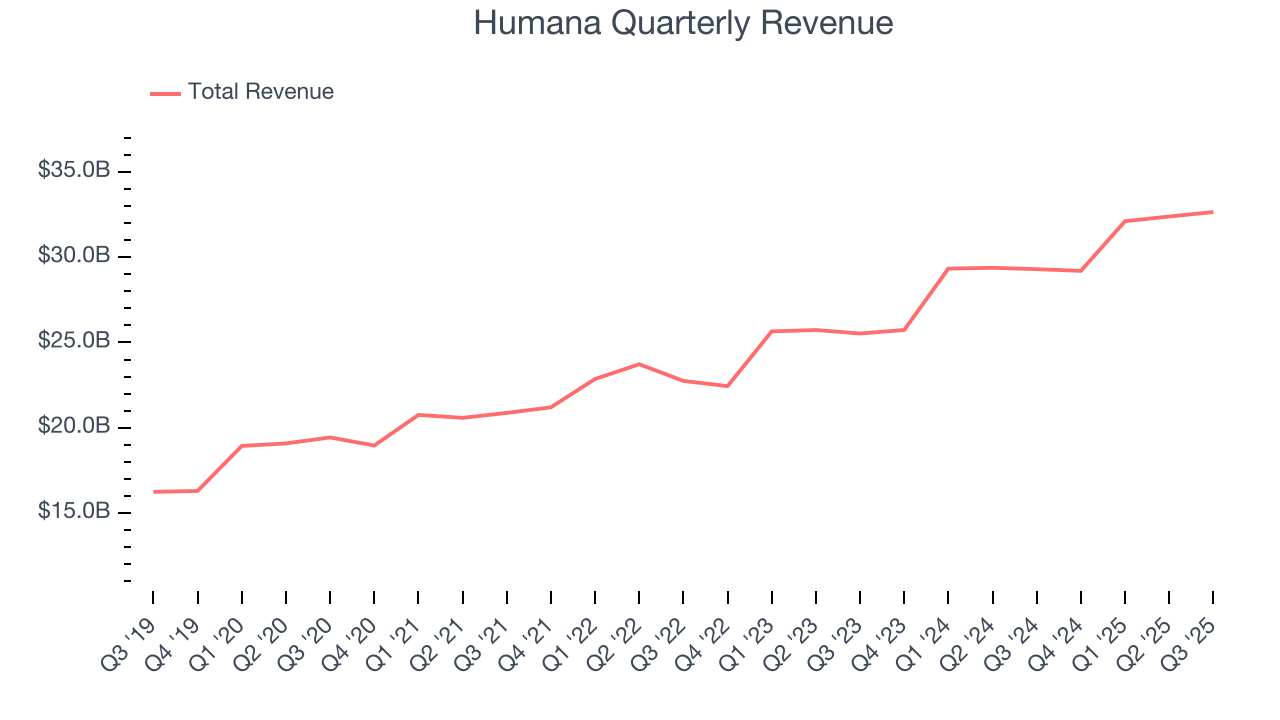

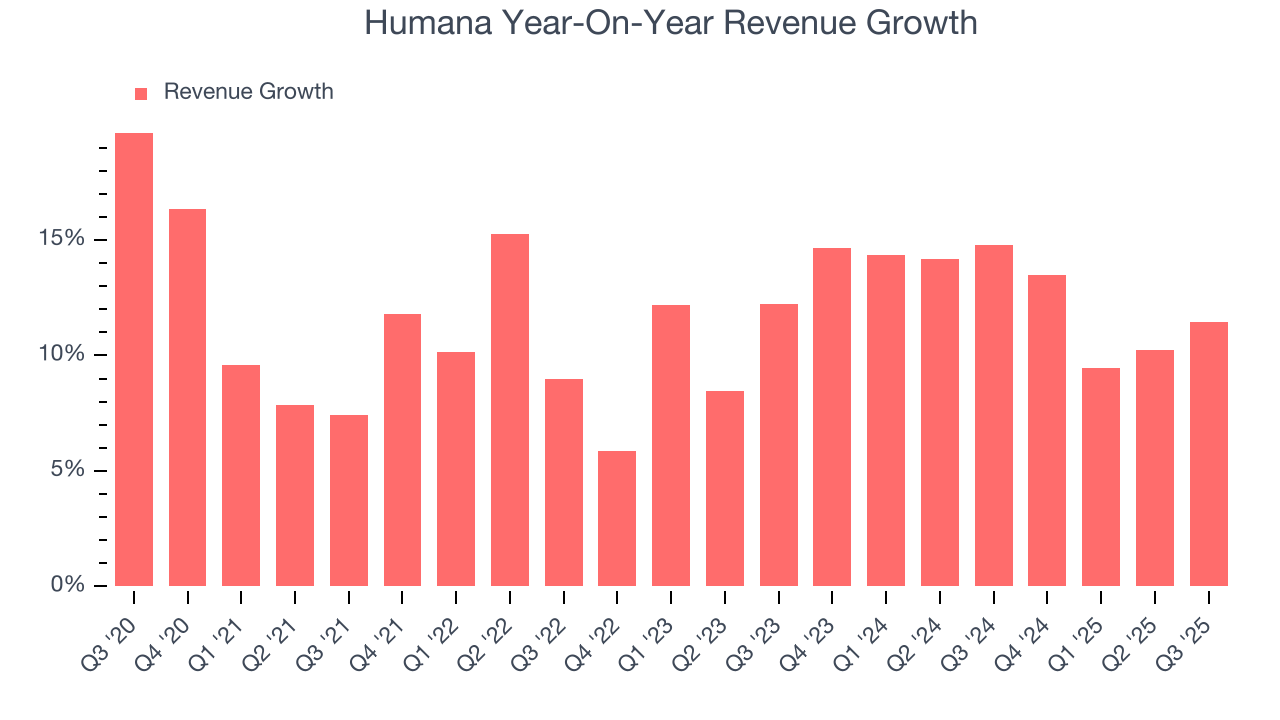

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Humana grew its sales at a decent 11.4% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Humana’s annualized revenue growth of 12.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its number of customers, which reached 14.99 million in the latest quarter. Over the last two years, Humana’s customer base averaged 4.7% year-on-year declines. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, Humana reported year-on-year revenue growth of 11.4%, and its $32.65 billion of revenue exceeded Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 6.7% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and suggests the market is baking in success for its products and services.

7. Operating Margin

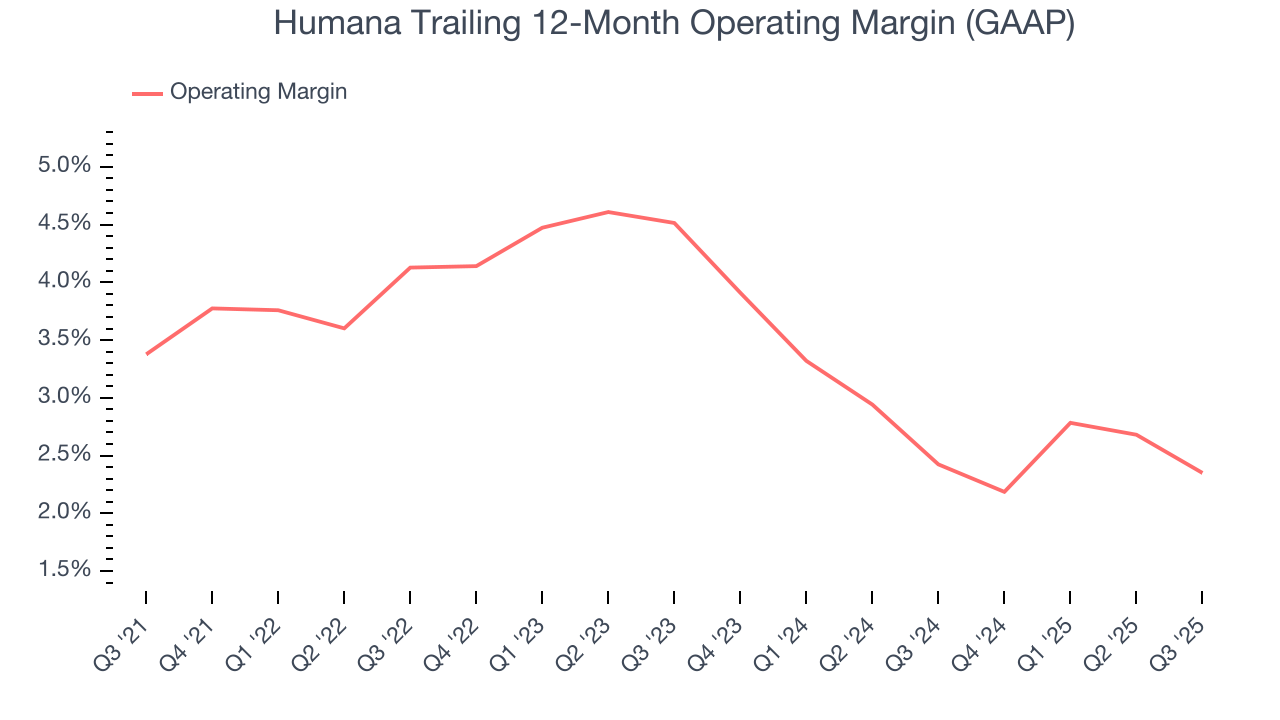

Humana was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.3% was weak for a healthcare business.

Analyzing the trend in its profitability, Humana’s operating margin decreased by 1 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 2.2 percentage points on a two-year basis. We still like Humana but would like to see it make some adjustments.

This quarter, Humana generated an operating margin profit margin of 1.2%, down 1.3 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

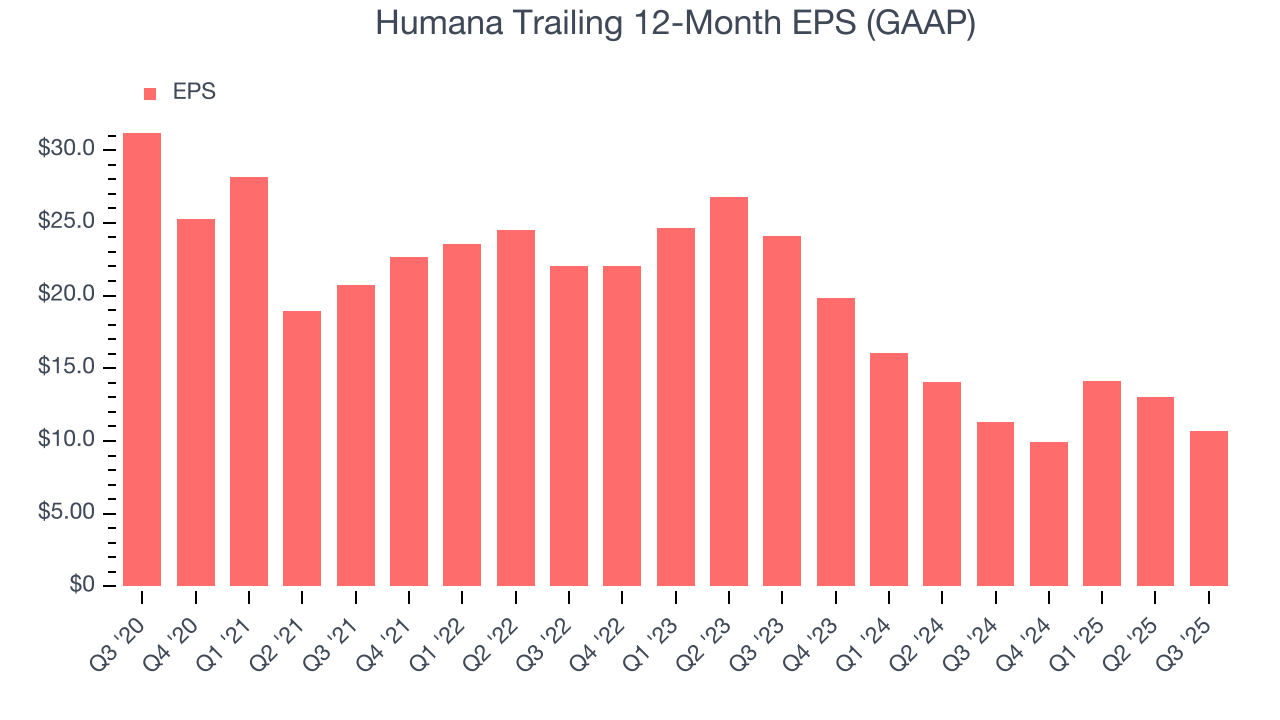

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Humana, its EPS declined by 19.3% annually over the last five years while its revenue grew by 11.4%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Humana’s earnings can give us a better understanding of its performance. As we mentioned earlier, Humana’s operating margin declined by 1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Humana reported EPS of $1.62, down from $3.97 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Humana’s full-year EPS of $10.66 to grow 28.1%.

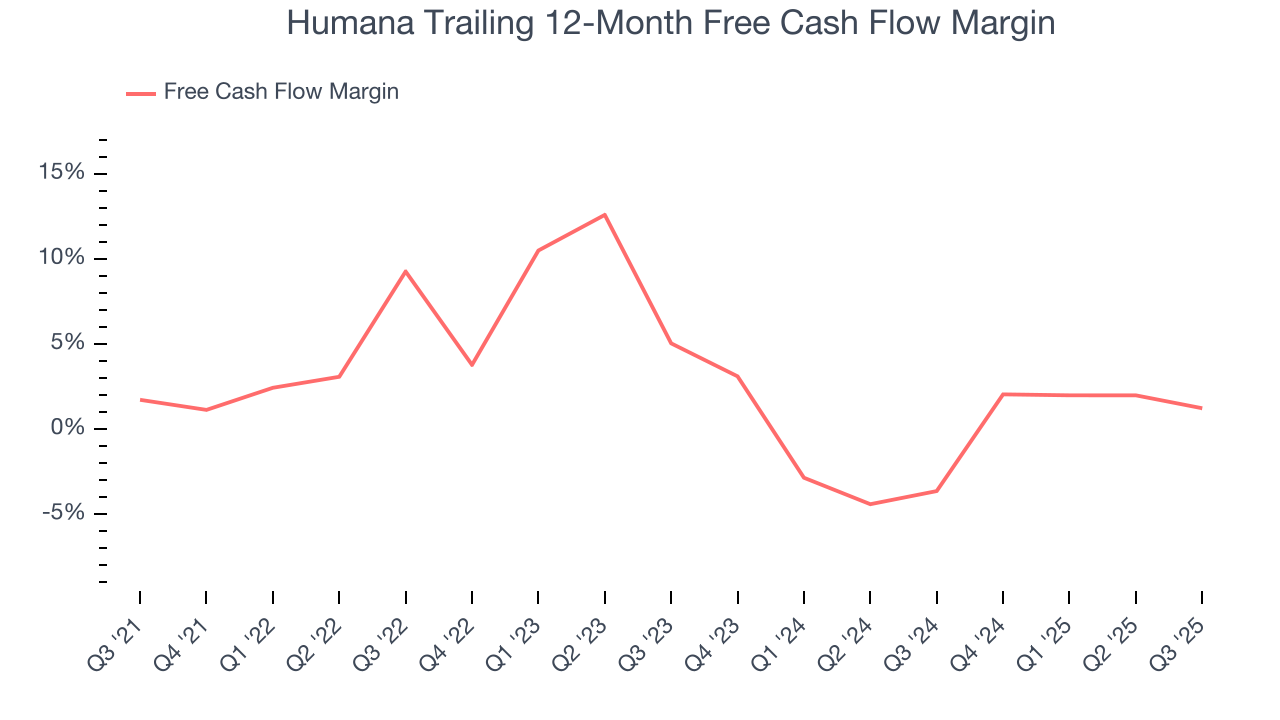

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Humana has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.4%, subpar for a healthcare business.

Humana’s free cash flow clocked in at $836 million in Q3, equivalent to a 2.6% margin. The company’s cash profitability regressed as it was 3.3 percentage points lower than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Humana’s five-year average ROIC was 35%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Humana’s ROIC has decreased over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

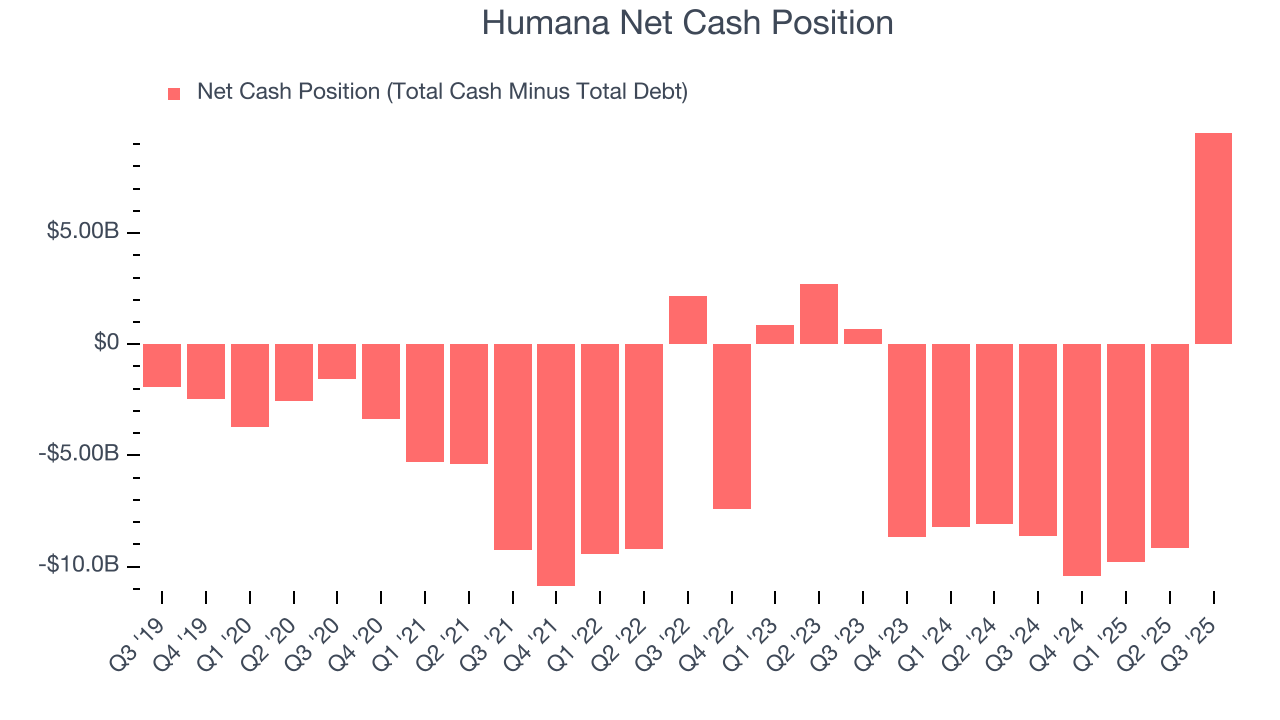

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Humana is a profitable, well-capitalized company with $22.12 billion of cash and $12.61 billion of debt on its balance sheet. This $9.52 billion net cash position is 28.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Humana’s Q3 Results

It was encouraging to see Humana beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed and its customer base fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $281.87 immediately after reporting.

13. Is Now The Time To Buy Humana?

Updated: January 23, 2026 at 10:54 PM EST

Before making an investment decision, investors should account for Humana’s business fundamentals and valuation in addition to what happened in the latest quarter.

Humana is a high-quality business worth owning. For starters, its revenue growth was good over the last five years, and analysts believe it can continue growing at these levels. And while its declining EPS over the last five years makes it a less attractive asset to the public markets, its scale gives it meaningful leverage when negotiating reimbursement rates. On top of that, Humana’s stellar ROIC suggests it has been a well-run company historically.

Humana’s P/E ratio based on the next 12 months is 19.7x. Looking at the healthcare landscape today, Humana’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $288.42 on the company (compared to the current share price of $266.25), implying they see 8.3% upside in buying Humana in the short term.