Howmet (HWM)

Not many stocks excite us like Howmet. Its high free cash flow margin and returns on capital show it can produce cash and invest it wisely.― StockStory Analyst Team

1. News

2. Summary

Why We Like Howmet

Inventing the first forged aluminum truck wheel, Howmet (NYSE:HWM) specializes in lightweight metals engineering and manufacturing multi-material components used in vehicles.

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 21.6% over the last five years outstripped its revenue performance

- Excellent operating margin highlights the strength of its business model, and it turbocharged its profits by achieving some fixed cost leverage

- Robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders, and its growing cash flow gives it even more resources to deploy

Howmet is a market leader. No coincidence the stock is up 742% over the last five years.

Is Now The Time To Buy Howmet?

High Quality

Investable

Underperform

Is Now The Time To Buy Howmet?

At $238.05 per share, Howmet trades at 53.2x forward P/E. The premium valuation means there’s much good news priced into the stock - we certainly can’t argue with that.

If you like the business model and believe the bull case, you can own a smaller position; our work shows that high-quality companies outperform the market over a multi-year period regardless of entry price.

3. Howmet (HWM) Research Report: Q4 CY2025 Update

Aerospace and defense company Howmet (NYSE:HWM) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 14.6% year on year to $2.17 billion. On top of that, next quarter’s revenue guidance ($2.24 billion at the midpoint) was surprisingly good and 3.5% above what analysts were expecting. Its non-GAAP profit of $1.05 per share was 8.7% above analysts’ consensus estimates.

Howmet (HWM) Q4 CY2025 Highlights:

- Revenue: $2.17 billion vs analyst estimates of $2.12 billion (14.6% year-on-year growth, 2.3% beat)

- Adjusted EPS: $1.05 vs analyst estimates of $0.97 (8.7% beat)

- Adjusted EBITDA: $650 million vs analyst estimates of $623.2 million (30% margin, 4.3% beat)

- Revenue Guidance for Q1 CY2026 is $2.24 billion at the midpoint, above analyst estimates of $2.16 billion

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.45 at the midpoint, in line with analyst estimates

- EBITDA guidance for the upcoming financial year 2026 is $2.76 billion at the midpoint, in line with analyst expectations

- Operating Margin: 22.6%, in line with the same quarter last year

- Free Cash Flow Margin: 24.4%, up from 20% in the same quarter last year

- Market Capitalization: $92.82 billion

Company Overview

Inventing the first forged aluminum truck wheel, Howmet (NYSE:HWM) specializes in lightweight metals engineering and manufacturing multi-material components used in vehicles.

Howmet Aerospace originated in 1920, focusing initially on metal fabrication before transitioning to components for jet engines and gas turbines. The company grew through acquisitions and strategic expansions, enhancing its technological and production capabilities. In 2000, Howmet merged with Alcoa, joining its engineered products and solutions segment, which significantly boosted its resources for precision engineering. The company became part of Arconic after Alcoa split into two entities in 2016. In 2020, Arconic further divided into Howmet Aerospace and Arconic Corporation, allowing each entity to specialize on its core operations. Today, Howmet Aerospace stands as a provider of advanced engineered solutions for the aerospace and transportation industries, known for its critical role in developing technologies essential for modern aircraft and industrial applications.

Howmet Aerospace offers a comprehensive range of high-performance components and engineered products tailored primarily for the aerospace and commercial transportation industries. The product lineup includes everything from precision-engineered jet engine components utilized in both commercial and defense aviation, to aerospace fastening systems that enhance aircraft efficiency and safety. Additionally, Howmet is known for its pioneering forged aluminum wheels, which significantly reduce weight and fuel consumption in commercial vehicles. Further, Howmet provides advanced airfoils and coatings capable of withstanding extreme temperatures, along with structural parts crafted from titanium and nickel superalloys for the aerospace sector.

Howmet Aerospace generates revenue through the sale of its engineered products. The company's largest revenue source is from the aerospace sector, complemented by revenue from the commercial transportation industry. Revenue is also derived from contracts with the U.S. government as well as foreign government agencies. Additionally, Howmet offers aftermarket services, including repair and maintenance for aerospace products, contributing to recurring revenue streams. The company also extends its market reach to industrial sectors such as gas turbines, oil and gas, providing a diverse income base. These revenue streams are supported by long-term contracts and partnerships with key industry players, providing some visibility into future earnings.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Howmet’s competitors include Boeing (NYSE:BA), Lockheed Martin (NYSE:LMT), and TransDigm (NYSE:TDG)

5. Revenue Growth

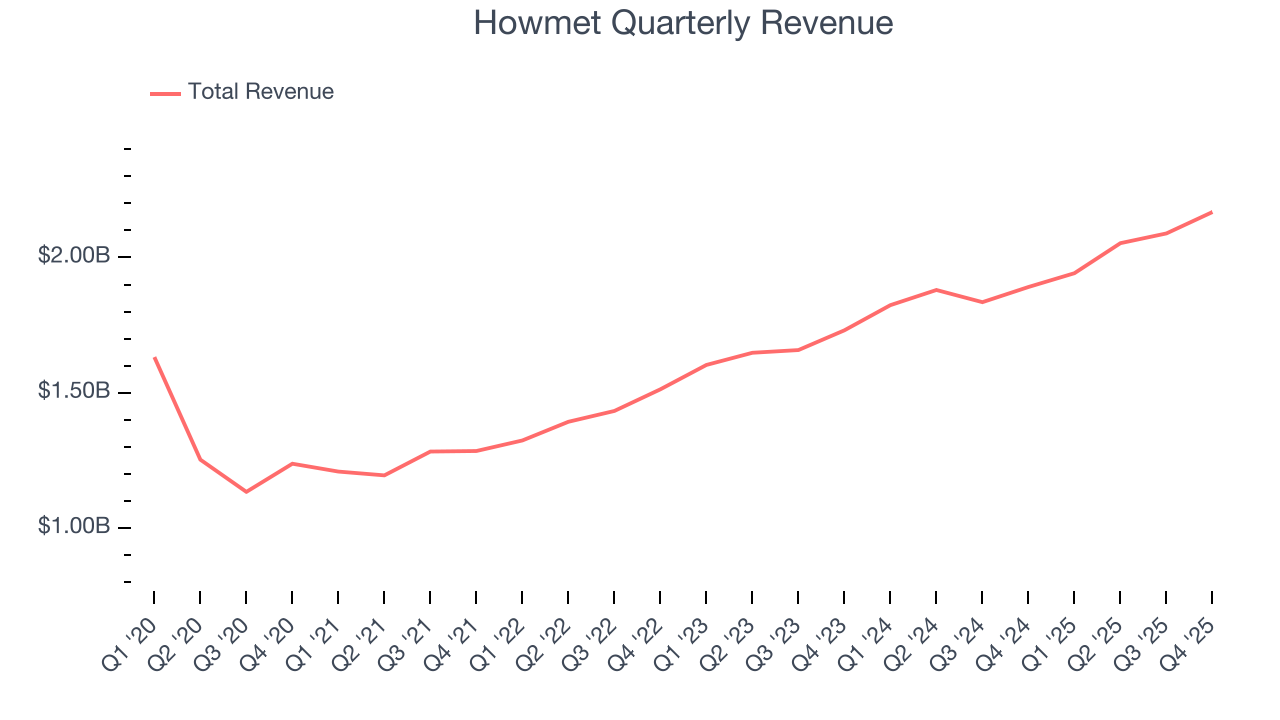

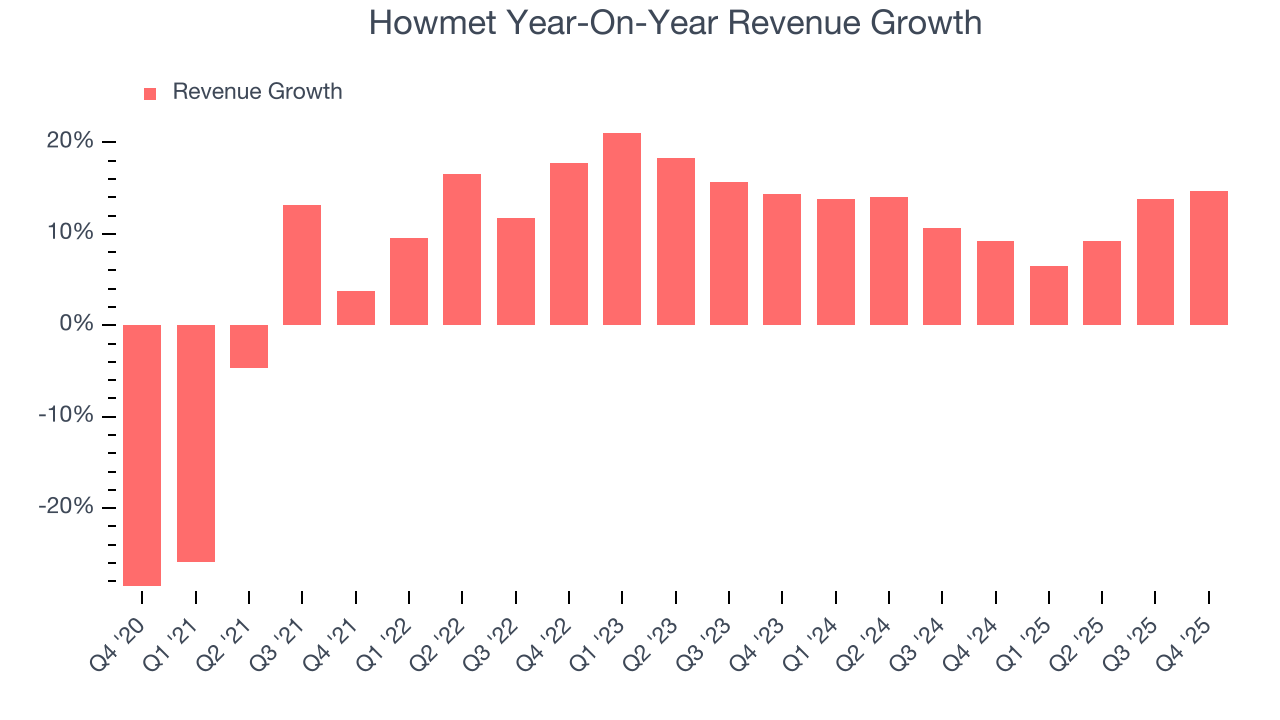

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Howmet’s sales grew at a solid 9.4% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Howmet’s annualized revenue growth of 11.5% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

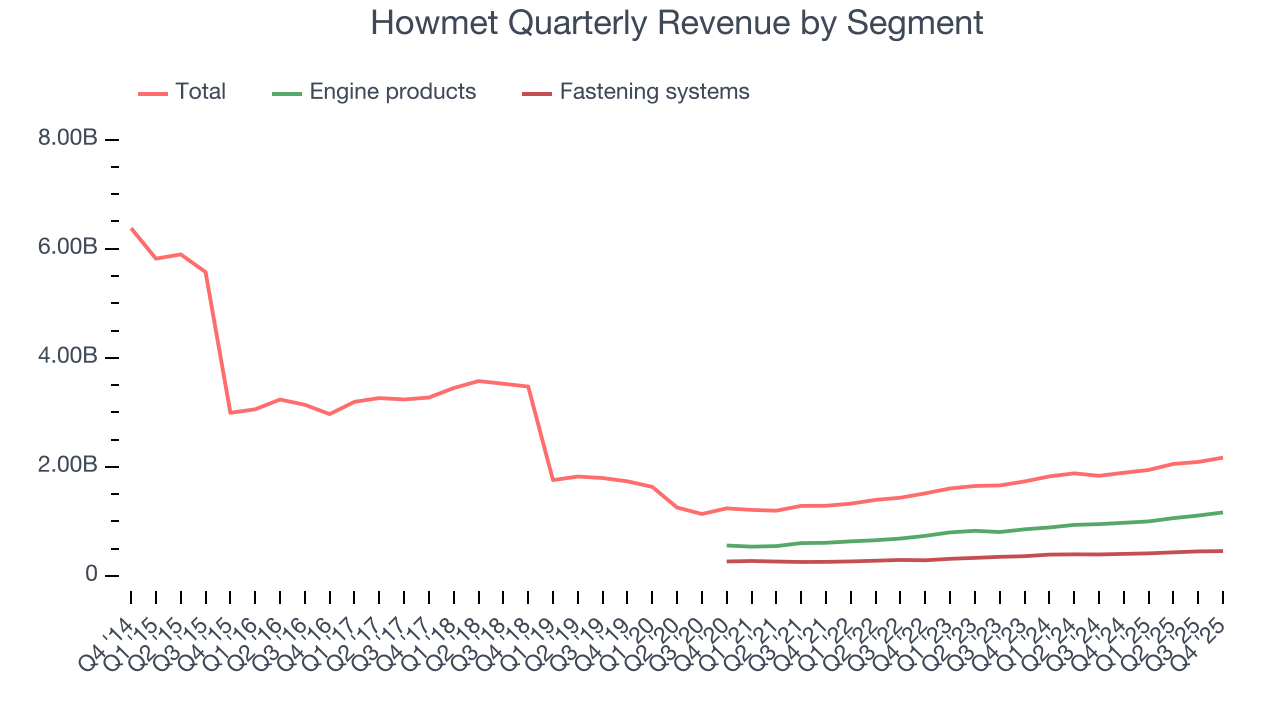

We can better understand the company’s revenue dynamics by analyzing its most important segments, Engine products and Fastening systems, which are 53.6% and 20.9% of revenue. Over the last two years, Howmet’s Engine products revenue (aircraft engines, industrial turbines) averaged 14.8% year-on-year growth while its Fastening systems revenue (connector products and tools) averaged 13.9% growth.

This quarter, Howmet reported year-on-year revenue growth of 14.6%, and its $2.17 billion of revenue exceeded Wall Street’s estimates by 2.3%. Company management is currently guiding for a 15.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11% over the next 12 months, similar to its two-year rate. This projection is healthy and indicates the market is baking in success for its products and services.

6. Operating Margin

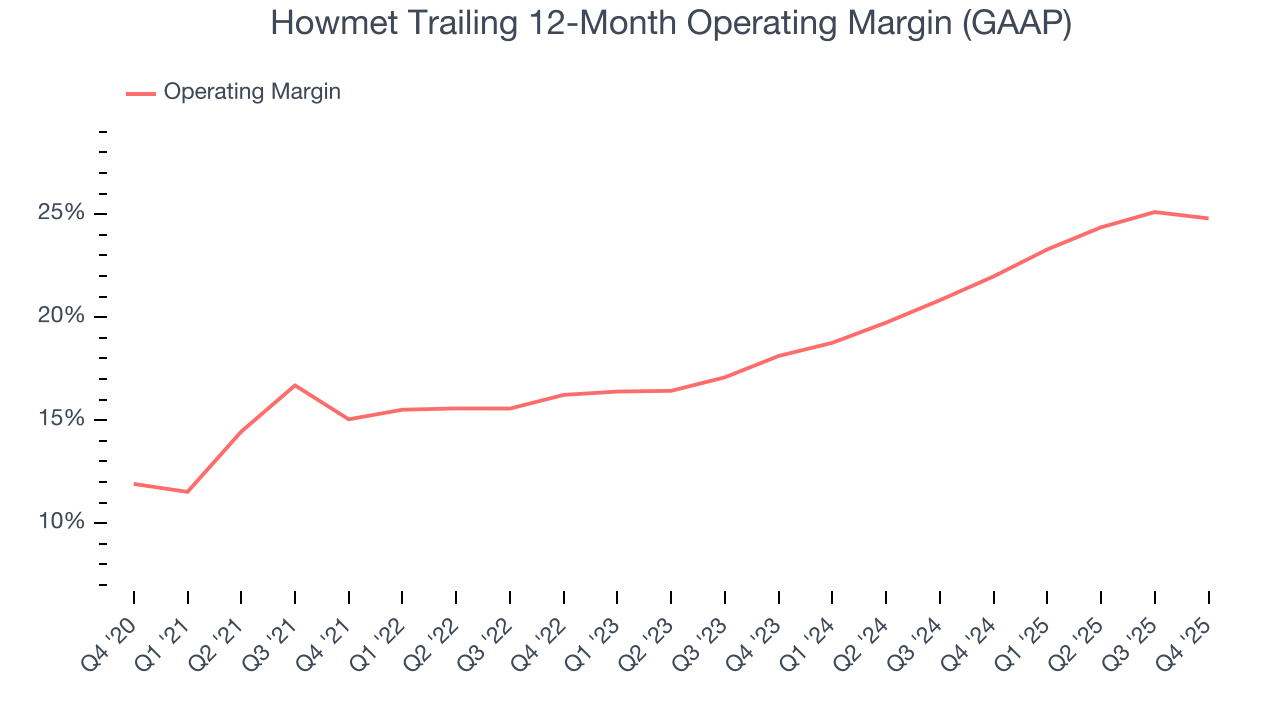

Howmet has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 19.9%.

Looking at the trend in its profitability, Howmet’s operating margin rose by 9.7 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q4, Howmet generated an operating margin profit margin of 22.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

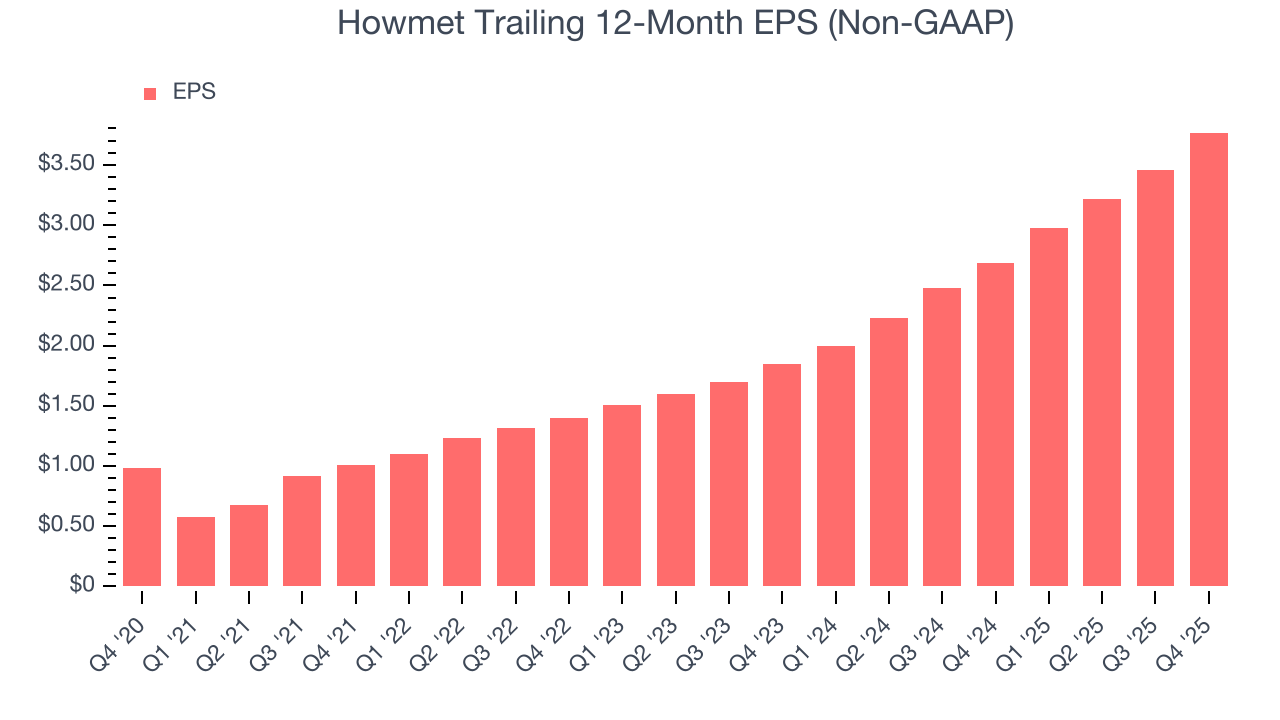

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Howmet’s EPS grew at an astounding 30.9% compounded annual growth rate over the last five years, higher than its 9.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

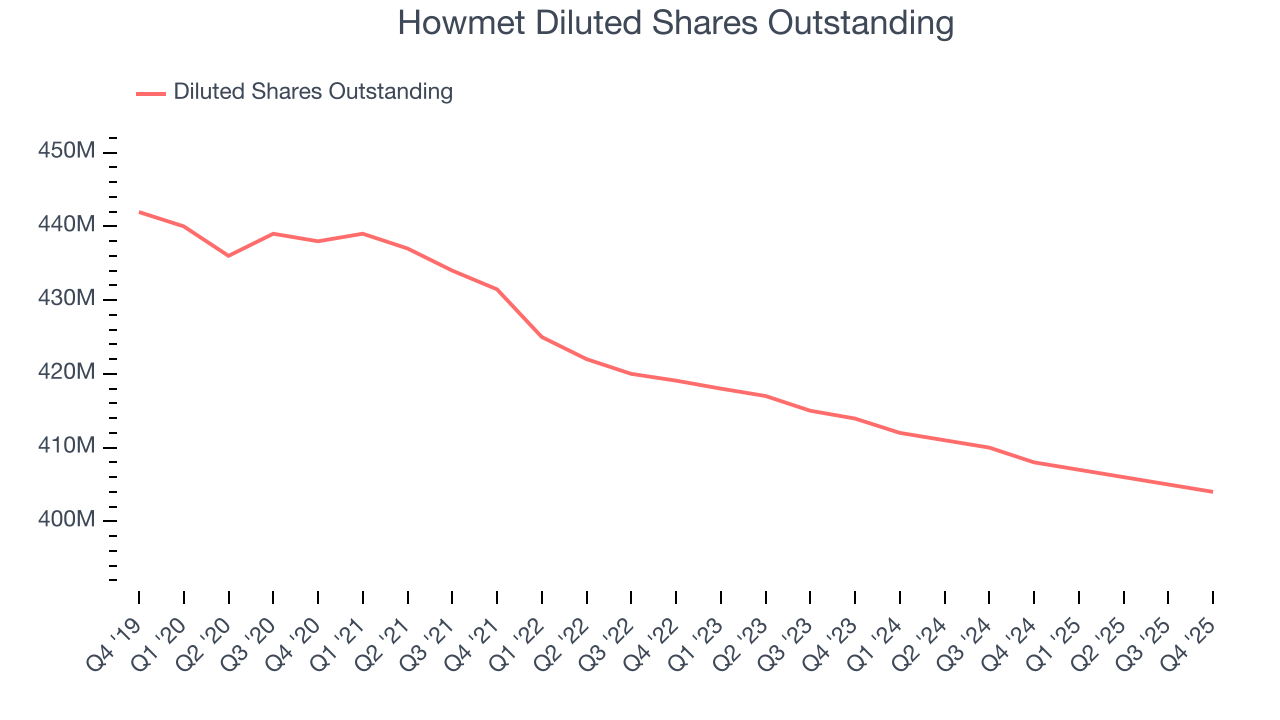

Diving into Howmet’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Howmet’s operating margin was flat this quarter but expanded by 9.7 percentage points over the last five years. On top of that, its share count shrank by 7.8%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Howmet, its two-year annual EPS growth of 42.8% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Howmet reported adjusted EPS of $1.05, up from $0.74 in the same quarter last year. This print beat analysts’ estimates by 8.7%. Over the next 12 months, Wall Street expects Howmet’s full-year EPS of $3.77 to grow 17.9%.

8. Cash Is King

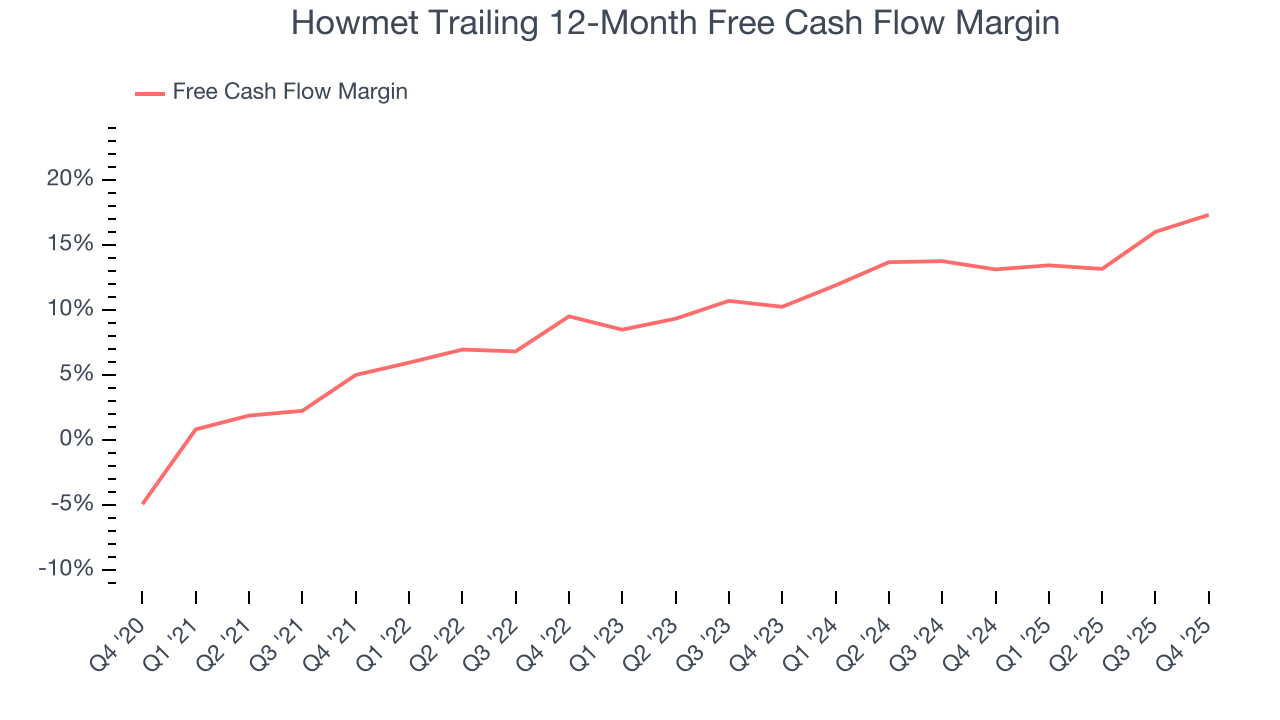

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Howmet has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 11.8% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Howmet’s margin expanded by 12.3 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Howmet’s free cash flow clocked in at $530 million in Q4, equivalent to a 24.4% margin. This result was good as its margin was 4.5 percentage points higher than in the same quarter last year, building on its favorable historical trend.

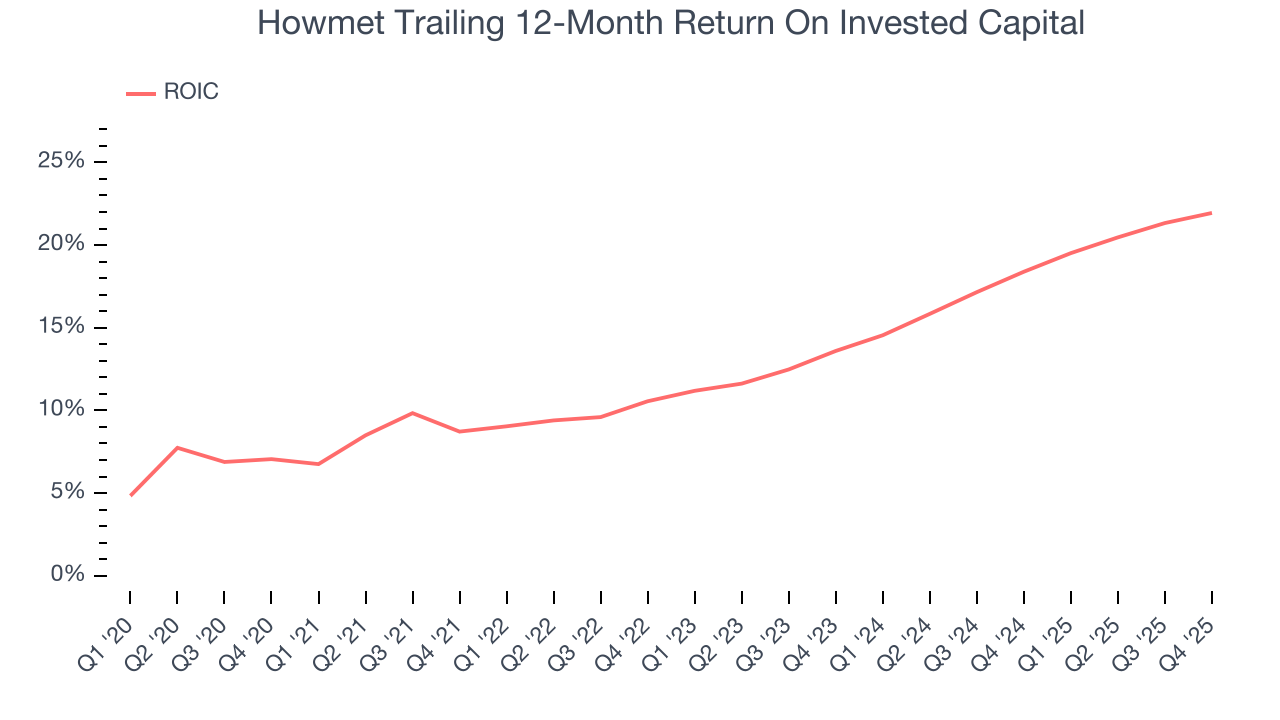

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Howmet’s five-year average ROIC was 14.6%, beating other industrials companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Howmet’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

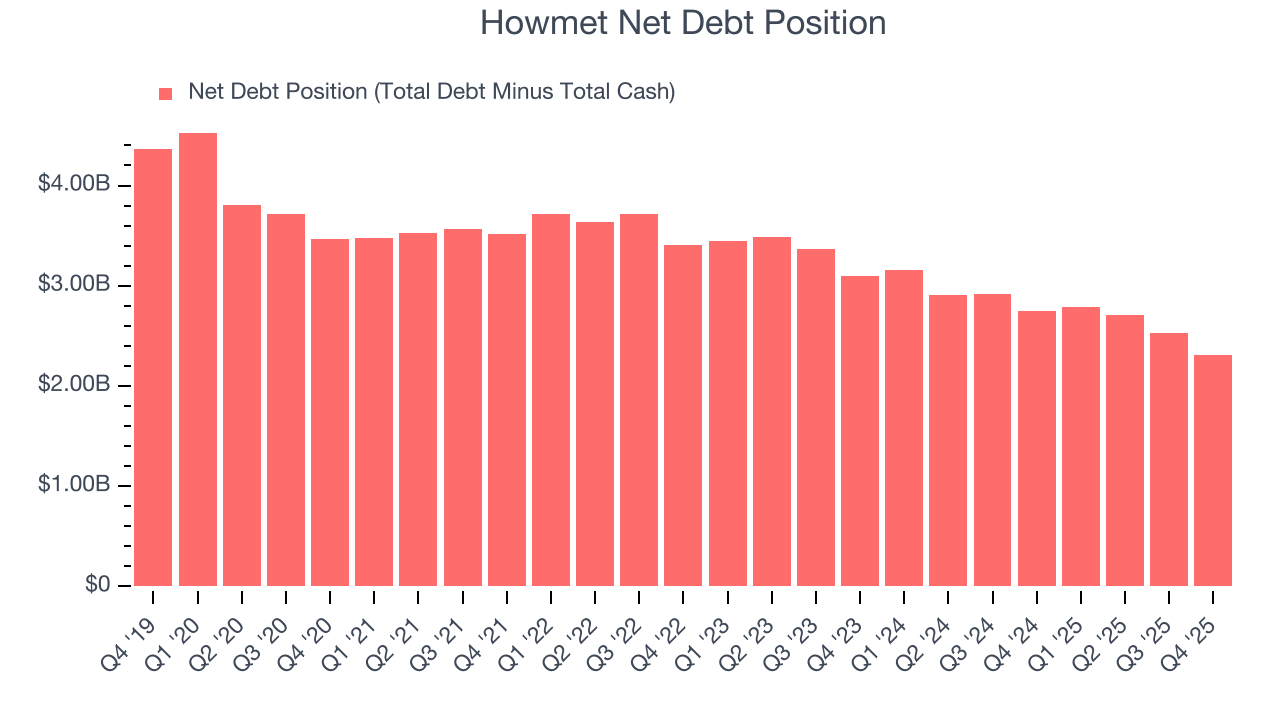

10. Balance Sheet Assessment

Howmet reported $742 million of cash and $3.05 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.41 billion of EBITDA over the last 12 months, we view Howmet’s 1.0× net-debt-to-EBITDA ratio as safe. We also see its $64 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Howmet’s Q4 Results

It was great to see Howmet’s EBITDA guidance for next quarter top analysts’ expectations. We were also glad its Engine products revenue topped Wall Street’s estimates. On the other hand, its Fastening systems revenue missed and its full-year revenue guidance was in line with Wall Street’s estimates. Overall, we think this was still a decent quarter with some key metrics above expectations. The stock traded up 2.4% to $236.31 immediately following the results.

12. Is Now The Time To Buy Howmet?

Updated: February 12, 2026 at 7:20 AM EST

Before deciding whether to buy Howmet or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There is a lot to like about Howmet. To begin with, its revenue growth was solid over the last five years, and its growth over the next 12 months is expected to accelerate. On top of that, its impressive operating margins show it has a highly efficient business model, and its rising cash profitability gives it more optionality.

Howmet’s P/E ratio based on the next 12 months is 51.9x. Expectations are high given its premium multiple, but we’ll happily own Howmet as its fundamentals illustrate it’s clearly doing something special. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with high valuations.

Wall Street analysts have a consensus one-year price target of $246.75 on the company (compared to the current share price of $236.31).