Ingram Micro (INGM)

We wouldn’t recommend Ingram Micro. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Ingram Micro Will Underperform

Operating as the crucial link in the global technology supply chain with a presence in 57 countries, Ingram Micro (NYSE:INGM) is a global technology distributor that connects manufacturers with resellers, providing hardware, software, cloud services, and logistics expertise.

- Falling earnings per share over the last three years has some investors worried as stock prices ultimately follow EPS over the long term

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 0.3% for the last five years

- Poor expense management has led to an adjusted operating margin that is below the industry average

Ingram Micro’s quality doesn’t meet our bar. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Ingram Micro

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Ingram Micro

Ingram Micro is trading at $22.67 per share, or 8.2x forward P/E. Ingram Micro’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Ingram Micro (INGM) Research Report: Q4 CY2025 Update

IT distribution giant Ingram Micro (NYSE:INGM) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 11.5% year on year to $14.88 billion. The company expects next quarter’s revenue to be around $12.63 billion, close to analysts’ estimates. Its GAAP profit of $0.51 per share was 23.6% below analysts’ consensus estimates.

Ingram Micro (INGM) Q4 CY2025 Highlights:

- Revenue: $14.88 billion vs analyst estimates of $14.18 billion (11.5% year-on-year growth, 5% beat)

- EPS (GAAP): $0.51 vs analyst expectations of $0.67 (23.6% miss)

- Adjusted EBITDA: $430.9 million vs analyst estimates of $398.4 million (2.9% margin, 8.1% beat)

- Revenue Guidance for Q1 CY2026 is $12.63 billion at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 2.1%, in line with the same quarter last year

- Free Cash Flow Margin: 10.2%, up from 2.1% in the same quarter last year

- Market Capitalization: $4.86 billion

Company Overview

Operating as the crucial link in the global technology supply chain with a presence in 57 countries, Ingram Micro (NYSE:INGM) is a global technology distributor that connects manufacturers with resellers, providing hardware, software, cloud services, and logistics expertise.

Ingram Micro serves as a vital intermediary in the technology ecosystem, sourcing products from over 1,500 vendor partners including industry giants like Apple, Microsoft, Cisco, and Dell, and distributing them to more than 161,000 customers worldwide. These customers include value-added resellers, system integrators, retailers, and managed service providers who rely on Ingram's vast infrastructure and logistics capabilities.

The company operates through three main business lines. Its Technology Solutions division distributes a wide range of hardware and software products, from personal computers and smartphones to enterprise-grade servers and networking equipment. The Cloud division offers a marketplace with over 200 cloud solutions managing more than 36 million seats, allowing partners to sell third-party cloud-based services and subscriptions. Additionally, the company provides IT asset disposition services, helping organizations securely dispose of used technology through refurbishment, recycling, and resale.

A retailer might use Ingram Micro to source inventory of laptops, tablets, and accessories from multiple manufacturers through a single purchasing channel, while a managed service provider might leverage Ingram's cloud marketplace to offer Microsoft 365 subscriptions to their business clients without having to manage the relationship with Microsoft directly.

Ingram Micro generates revenue primarily through product sales and service fees. The company has been transforming from a traditional distributor to a technology solutions provider, investing heavily in its digital platform called Xvantage. This AI-powered platform automates many processes that previously required manual intervention, such as order status updates, price quotes, and vendor catalog management.

The company's global footprint includes 134 logistics and service centers worldwide, enabling it to reach approximately 90% of the global population with technology products and services. Ingram Micro's scale and infrastructure allow it to handle more than 850 million units of technology products across over 220,000 unique SKUs annually.

4. IT Distribution & Solutions

IT Distribution & Solutions will be buoyed by the increasing complexity of IT ecosystems, rising cloud adoption, and demand for cybersecurity solutions. Enterprises are less likely than ever to embark on these complicated journeys solo, and companies in the sector boast expertise and scale in these areas. However, cloud migration also means less need for hardware, which could dent demand for large portions of the product portfolio and hurt margins. Additionally, planning for potentially supply chain disruptions is ongoing, as the COVID-19 pandemic showed how damaging a pause in global trade could be in areas like semiconductor procurement.

Ingram Micro's primary competitors include global technology distributors such as TD SYNNEX (NYSE:SNX), Arrow Electronics (NYSE:ARW), and ScanSource (NASDAQ:SCSC), as well as regional players like ALSO Holding (SWX:ALSN), Esprinet (BIT:PRT), and cloud-focused distributors such as Pax8 and AppDirect.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $52.56 billion in revenue over the past 12 months, Ingram Micro is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. To expand meaningfully, Ingram Micro likely needs to tweak its prices, innovate with new offerings, or enter new markets.

As you can see below, Ingram Micro’s sales grew at a sluggish 1.4% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Ingram Micro’s annualized revenue growth of 4.6% over the last two years is above its five-year trend, which is encouraging.

This quarter, Ingram Micro reported year-on-year revenue growth of 11.5%, and its $14.88 billion of revenue exceeded Wall Street’s estimates by 5%. Company management is currently guiding for a 2.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

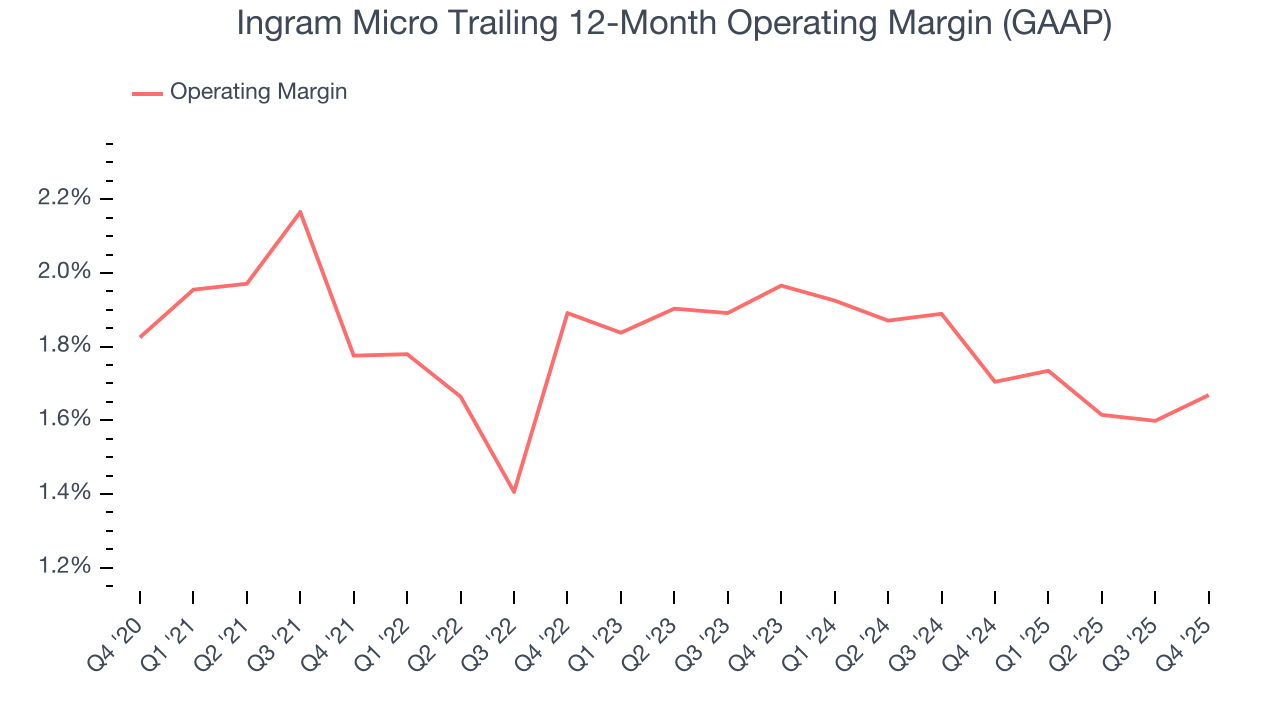

6. Operating Margin

Ingram Micro’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 1.8% over the last five years. This profitability was inadequate for a business services business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, Ingram Micro’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Ingram Micro generated an operating margin profit margin of 2.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

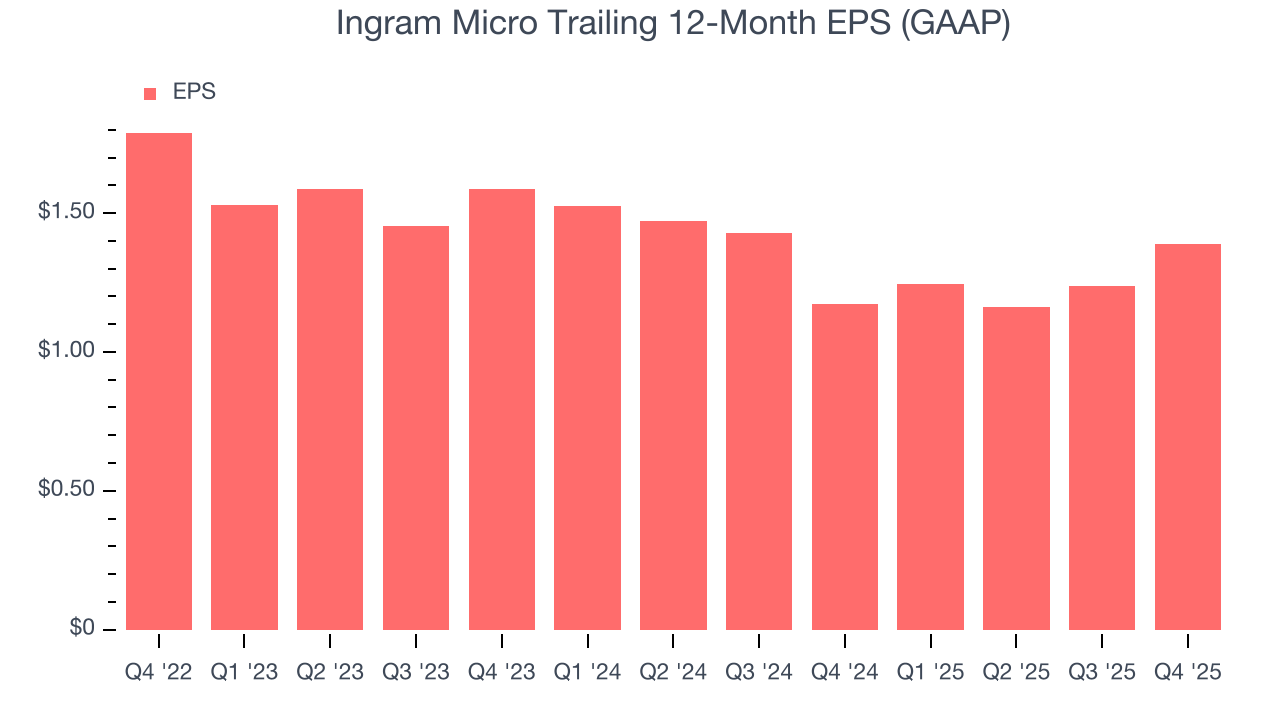

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Ingram Micro’s full-year EPS dropped 57.9%, or 16.4% annually, over the last three years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Ingram Micro’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Ingram Micro, its two-year annual EPS declines of 6.4% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q4, Ingram Micro reported EPS of $0.51, up from $0.36 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Ingram Micro’s full-year EPS of $1.39 to grow 68.3%.

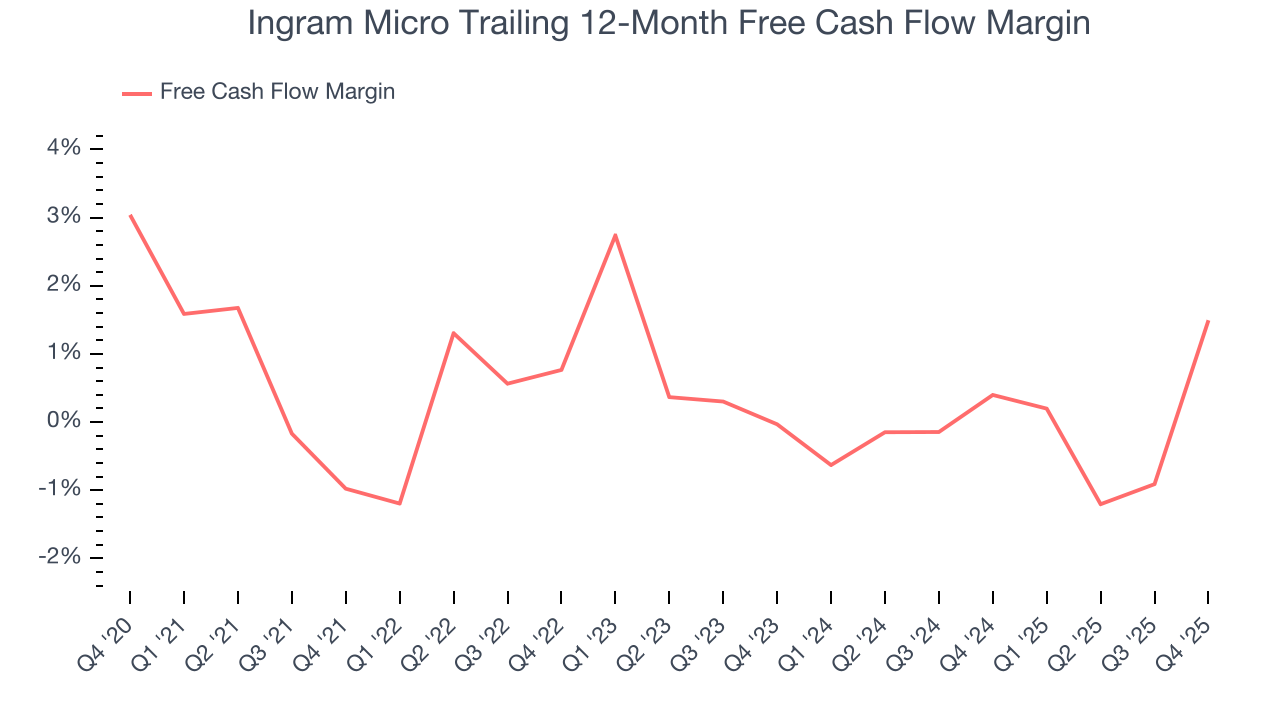

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Ingram Micro broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Ingram Micro’s margin expanded by 2.5 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Ingram Micro’s free cash flow clocked in at $1.52 billion in Q4, equivalent to a 10.2% margin. This result was good as its margin was 8.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Ingram Micro historically did a mediocre job investing in profitable growth initiatives. Its four-year average ROIC was 9.8%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Ingram Micro’s ROIC averaged 3 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

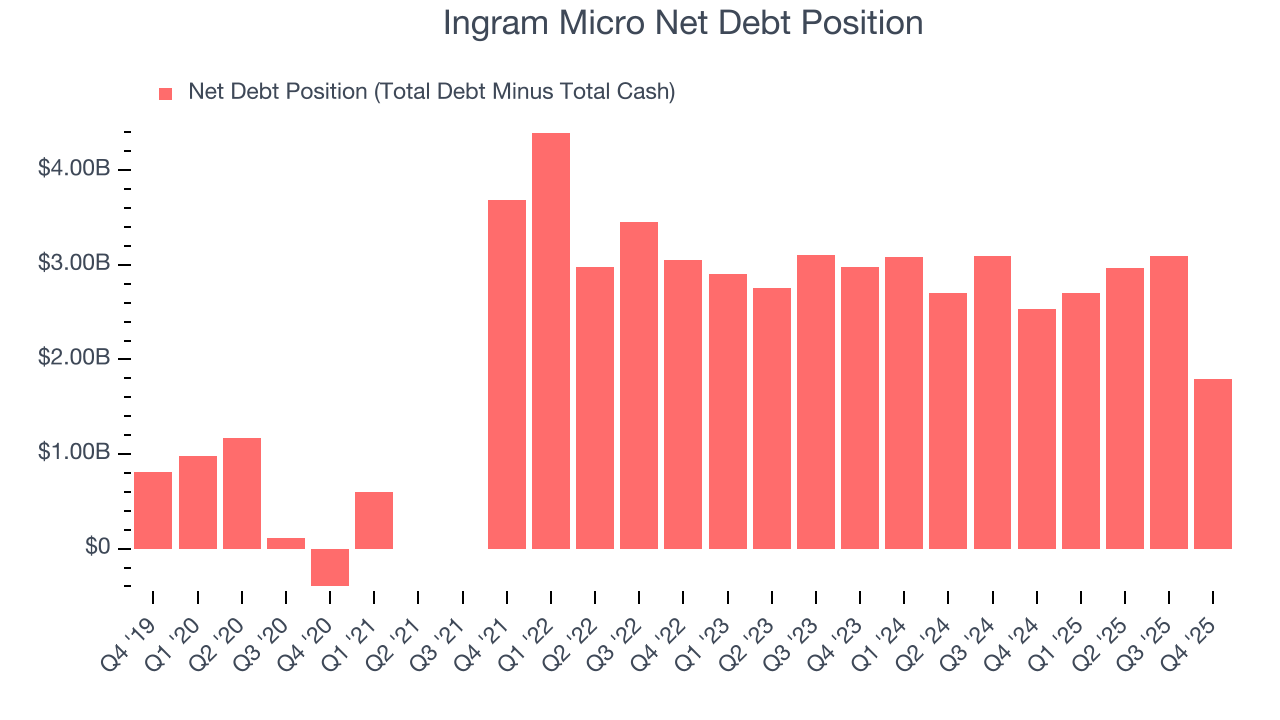

10. Balance Sheet Assessment

Ingram Micro reported $1.86 billion of cash and $3.66 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.36 billion of EBITDA over the last 12 months, we view Ingram Micro’s 1.3× net-debt-to-EBITDA ratio as safe. We also see its $128.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Ingram Micro’s Q4 Results

We enjoyed seeing Ingram Micro beat analysts’ revenue expectations this quarter. We were also glad its revenue guidance for next quarter was in line with Wall Street’s estimates. On the other hand, its EPS missed. Overall, this quarter could have been better. The stock traded up 7.8% to $23.04 immediately after reporting.

12. Is Now The Time To Buy Ingram Micro?

Updated: March 5, 2026 at 11:55 PM EST

When considering an investment in Ingram Micro, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We cheer for all companies making their customers lives easier, but in the case of Ingram Micro, we’ll be cheering from the sidelines. First off, its revenue growth was weak over the last five years, and analysts don’t see anything changing over the next 12 months. While its scale makes it a trusted partner with negotiating leverage, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its low free cash flow margins give it little breathing room.

Ingram Micro’s P/E ratio based on the next 12 months is 8.2x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $25.55 on the company (compared to the current share price of $22.67).