Ingredion (INGR)

We’re cautious of Ingredion. Its low gross margin indicates weak unit economics and its declining sales suggest its offerings are unpopular.― StockStory Analyst Team

1. News

2. Summary

Why We Think Ingredion Will Underperform

Known for its ability to turn ordinary corn into thousands of different food ingredients, Ingredion (NYSE:INGR) transforms grains, fruits, vegetables and other plant-based materials into specialty starches, sweeteners and other ingredients for food, beverage and industrial markets.

- Products aren't resonating with the market as its revenue declined by 3.1% annually over the last three years

- Projected sales growth of 2% for the next 12 months suggests sluggish demand

- A positive is that its powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently

Ingredion’s quality doesn’t meet our hurdle. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Ingredion

Why There Are Better Opportunities Than Ingredion

At $113.61 per share, Ingredion trades at 10.1x forward P/E. Yes, this valuation multiple is lower than that of other consumer staples peers, but we’ll remind you that you often get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Ingredion (INGR) Research Report: Q4 CY2025 Update

Food ingredient solutions provider Ingredion (NYSE:INGR) fell short of the markets revenue expectations in Q4 CY2025, with sales falling 2.4% year on year to $1.76 billion. Its non-GAAP profit of $2.53 per share was 3.1% below analysts’ consensus estimates.

Ingredion (INGR) Q4 CY2025 Highlights:

- Revenue: $1.76 billion vs analyst estimates of $1.79 billion (2.4% year-on-year decline, 1.6% miss)

- Adjusted EPS: $2.53 vs analyst expectations of $2.61 (3.1% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $11.40 at the midpoint, in line with analyst estimates

- Operating Margin: 12.5%, up from 9% in the same quarter last year

- Free Cash Flow Margin: 15.4%, down from 16.9% in the same quarter last year

- Constant Currency Revenue fell 3% year on year (-0.8% in the same quarter last year)

- Market Capitalization: $7.45 billion

Company Overview

Known for its ability to turn ordinary corn into thousands of different food ingredients, Ingredion (NYSE:INGR) transforms grains, fruits, vegetables and other plant-based materials into specialty starches, sweeteners and other ingredients for food, beverage and industrial markets.

Ingredion operates through three main segments that serve customers in over 60 industries worldwide. The Texture & Healthful Solutions segment focuses on specialty starches and clean-label texturizers that improve mouthfeel and structure in foods. Food & Industrial Ingredients segments in both Latin America and U.S./Canada convert corn into more basic starches, sweeteners, and co-products.

The company's ingredients perform critical functions in countless products – starches provide texture in yogurt, thicken sauces, and add crispness to snacks, while sweeteners like high fructose corn syrup and dextrose provide not just sweetness but functionality in brewing, baking, and confectionery. Beyond food, Ingredion's industrial starches strengthen paper products, improve textile performance, and even contribute to pharmaceutical and cosmetic applications.

A typical food manufacturer might use Ingredion's modified food starch to ensure a frozen meal maintains its texture after reheating, or its clean-label texturizers to replace artificial ingredients while maintaining consumer appeal. Ingredion generates revenue through both firm-priced and fee-based contracts with food giants and smaller producers alike, with particular strength in markets seeking healthier, clean-label options that maintain sensory appeal.

4. Ingredients, Flavors & Fragrances

Ingredients, flavors, and fragrances companies supply essential components to food, beverage, personal care, and household product manufacturers. These firms develop proprietary formulations that enhance taste, scent, and texture, creating customer stickiness through specialized expertise and regulatory-approved ingredient portfolios. Tailwinds include growing consumer demand for natural and clean-label products, expansion in emerging markets, and innovation in plant-based and functional ingredients. However, headwinds persist from volatile raw material costs, particularly for agricultural and petrochemical inputs. Regulatory scrutiny over synthetic additives and fragrance allergens poses compliance challenges, while consolidation among major customers increases pricing pressure and negotiating leverage against suppliers.

Ingredion competes with global agricultural processors and ingredient suppliers including Archer-Daniels-Midland (NYSE:ADM), Tate & Lyle (OTC:TATYF), Cargill (privately held), and Roquette (privately held), along with regional players like ALMEX in Latin American markets.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $7.22 billion in revenue over the past 12 months, Ingredion is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. For Ingredion to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

As you can see below, Ingredion’s demand was weak over the last three years. Its sales fell by 3.1% annually, a poor baseline for our analysis.

This quarter, Ingredion missed Wall Street’s estimates and reported a rather uninspiring 2.4% year-on-year revenue decline, generating $1.76 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1% over the next 12 months. Although this projection implies its newer products will spur better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

Ingredion has bad unit economics for a consumer staples company, giving it less room to reinvest and develop new products. As you can see below, it averaged a 24.7% gross margin over the last two years. That means Ingredion paid its suppliers a lot of money ($75.30 for every $100 in revenue) to run its business.

Ingredion’s gross profit margin came in at 24.5% this quarter, in line with the same quarter last year. On a wider time horizon, Ingredion’s full-year margin has been trending up over the past 12 months, increasing by 1.2 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

7. Operating Margin

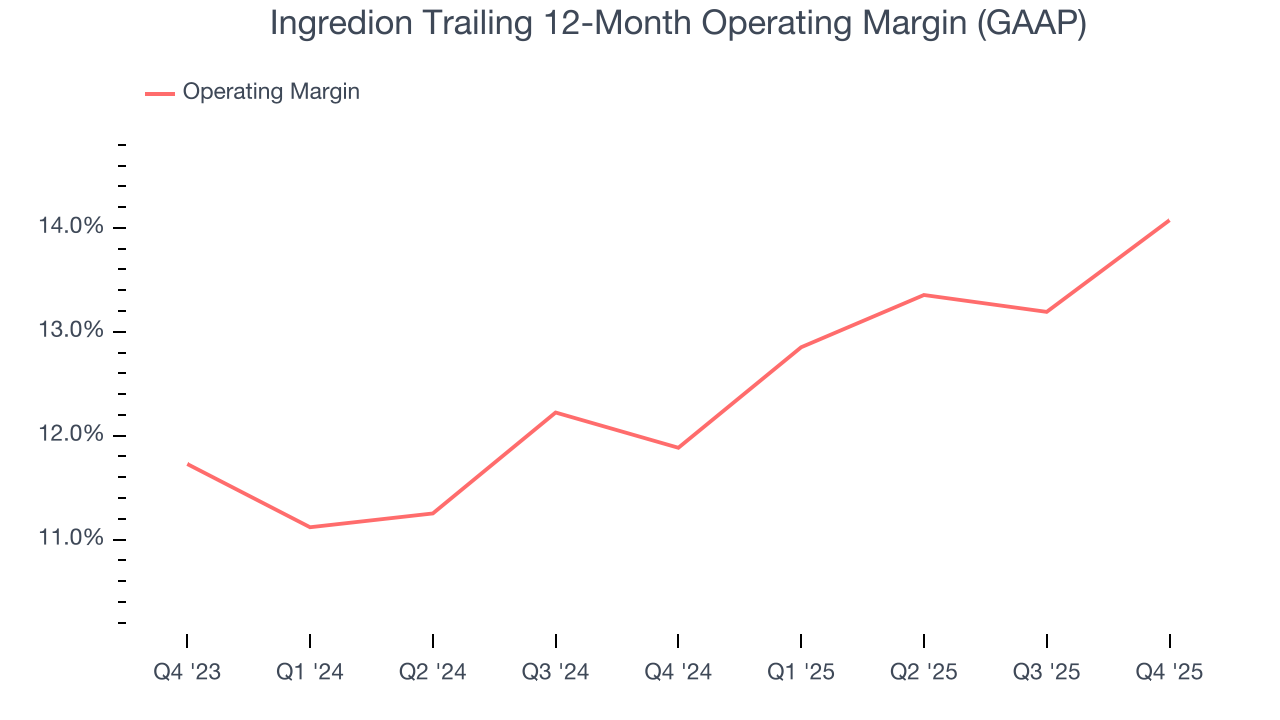

Ingredion has managed its cost base well over the last two years. It demonstrated solid profitability for a consumer staples business, producing an average operating margin of 13%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Ingredion’s operating margin rose by 2.2 percentage points over the last year, showing its efficiency has improved.

In Q4, Ingredion generated an operating margin profit margin of 12.5%, up 3.5 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

8. Earnings Per Share

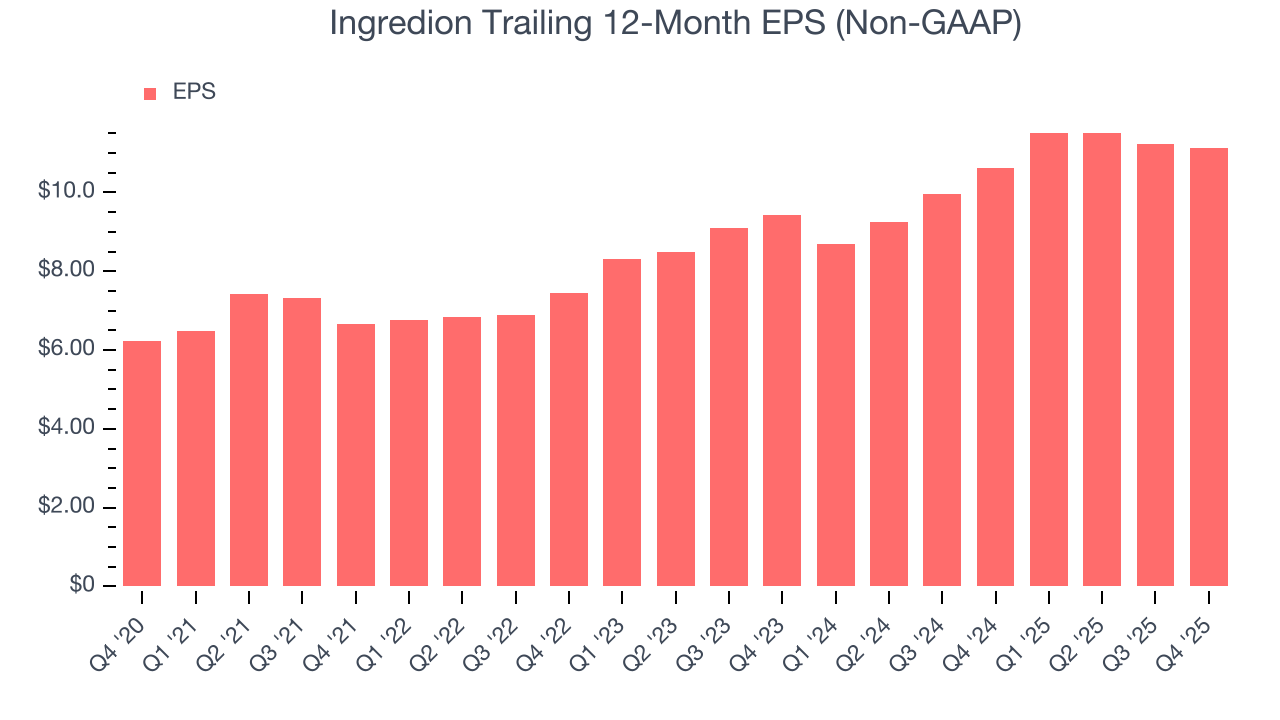

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Ingredion’s EPS grew at a remarkable 14.3% compounded annual growth rate over the last three years, higher than its 3.1% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

In Q4, Ingredion reported adjusted EPS of $2.53, down from $2.63 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Ingredion’s full-year EPS of $11.12 to grow 2.9%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Ingredion has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.2% over the last two years, quite impressive for a consumer staples business.

Taking a step back, we can see that Ingredion’s margin dropped by 8.2 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity.

Ingredion’s free cash flow clocked in at $270 million in Q4, equivalent to a 15.4% margin. The company’s cash profitability regressed as it was 1.6 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Ingredion hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 16.2%, higher than most consumer staples businesses.

11. Balance Sheet Assessment

Ingredion reported $1.03 billion of cash and $1.79 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.25 billion of EBITDA over the last 12 months, we view Ingredion’s 0.6× net-debt-to-EBITDA ratio as safe. We also see its $19 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Ingredion’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its gross margin fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $117.20 immediately following the results.

13. Is Now The Time To Buy Ingredion?

Updated: March 4, 2026 at 11:59 PM EST

Before making an investment decision, investors should account for Ingredion’s business fundamentals and valuation in addition to what happened in the latest quarter.

Ingredion’s business quality ultimately falls short of our standards. First off, its revenue has declined over the last three years. While its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cushion, the downside is its cash profitability fell over the last year. On top of that, its projected EPS for the next year is lacking.

Ingredion’s P/E ratio based on the next 12 months is 10.1x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $127 on the company (compared to the current share price of $113.61).