IQVIA (IQV)

IQVIA doesn’t excite us. Its revenue growth has been weak and its profitability has caved, showing it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why IQVIA Is Not Exciting

Created from the 2016 merger of Quintiles (a clinical research organization) and IMS Health (a healthcare data specialist), IQVIA (NYSE:IQV) provides clinical research services, data analytics, and technology solutions to help pharmaceutical companies develop and market medications more effectively.

- The company has faced growth challenges as its 6.9% annual revenue increases over the last five years fell short of other healthcare companies

- One positive is that its earnings per share grew by 13.2% annually over the last five years and beat its peers

IQVIA doesn’t pass our quality test. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than IQVIA

High Quality

Investable

Underperform

Why There Are Better Opportunities Than IQVIA

At $178.54 per share, IQVIA trades at 14x forward P/E. This multiple is lower than most healthcare companies, but for good reason.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. IQVIA (IQV) Research Report: Q4 CY2025 Update

Clinical research company IQVIA (NYSE: IQV) announced better-than-expected revenue in Q4 CY2025, with sales up 10.3% year on year to $4.36 billion. The company’s full-year revenue guidance of $17.25 billion at the midpoint came in 1% above analysts’ estimates. Its non-GAAP profit of $3.42 per share was 0.7% above analysts’ consensus estimates.

IQVIA (IQV) Q4 CY2025 Highlights:

- Revenue: $4.36 billion vs analyst estimates of $4.24 billion (10.3% year-on-year growth, 2.9% beat)

- Adjusted EPS: $3.42 vs analyst estimates of $3.40 (0.7% beat)

- Adjusted EBITDA: $1.05 billion vs analyst estimates of $1.04 billion (24% margin, in line)

- Adjusted EPS guidance for the upcoming financial year 2026 is $12.70 at the midpoint, missing analyst estimates by 2%

- EBITDA guidance for the upcoming financial year 2026 is $4 billion at the midpoint, in line with analyst expectations

- Operating Margin: 14.4%, down from 15.8% in the same quarter last year

- Free Cash Flow Margin: 12.9%, down from 18.2% in the same quarter last year

- Constant Currency Revenue rose 8.1% year on year (3% in the same quarter last year)

- Market Capitalization: $34.49 billion

Company Overview

Created from the 2016 merger of Quintiles (a clinical research organization) and IMS Health (a healthcare data specialist), IQVIA (NYSE:IQV) provides clinical research services, data analytics, and technology solutions to help pharmaceutical companies develop and market medications more effectively.

IQVIA sits at the intersection of healthcare data, technology, and clinical expertise. The company maintains one of the world's largest healthcare information repositories, containing over 1.2 billion non-identified patient records spanning medical claims, prescriptions, electronic medical records, and other healthcare data. This massive dataset—approximately 64 petabytes—covers about 90% of the world's pharmaceuticals by sales.

The company operates through three main segments. The Technology & Analytics Solutions segment provides cloud-based applications, real-world evidence platforms, and analytics services that help pharmaceutical companies optimize their commercial strategies and understand market dynamics. The Research & Development Solutions segment offers clinical trial management services, including patient recruitment, site monitoring, laboratory testing, and regulatory support. The Contract Sales & Medical Solutions segment provides healthcare provider engagement services and patient support programs.

For example, a pharmaceutical company developing a new cancer drug might engage IQVIA to design and manage clinical trials, analyze real-world data to identify potential patients, and later help launch the drug with specialized sales representatives and patient support programs.

IQVIA's business model generates revenue through long-term contracts with pharmaceutical companies, biotechnology firms, medical device manufacturers, and other healthcare organizations. The company employs approximately 88,000 people across more than 100 countries, allowing it to support global clinical trials and provide localized commercial insights.

The company places significant emphasis on privacy protection, employing various technologies and safeguards to protect patient data while still enabling valuable healthcare research. IQVIA has also invested heavily in artificial intelligence capabilities, developing healthcare-specific AI tools that help clients analyze complex datasets and improve decision-making throughout the drug development and commercialization process.

4. Drug Development Inputs & Services

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

IQVIA's competitors include clinical research organizations like ICON plc, Parexel International, and Pharmaceutical Product Development (part of Thermo Fisher Scientific), as well as healthcare analytics and technology providers such as Optum Insight (UnitedHealth Group), Clarivate, and Veeva Systems.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $16.31 billion in revenue over the past 12 months, IQVIA has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, IQVIA grew its sales at a decent 7.5% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. IQVIA’s recent performance shows its demand has slowed as its annualized revenue growth of 4.3% over the last two years was below its five-year trend.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 4.1% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that IQVIA has properly hedged its foreign currency exposure.

This quarter, IQVIA reported year-on-year revenue growth of 10.3%, and its $4.36 billion of revenue exceeded Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

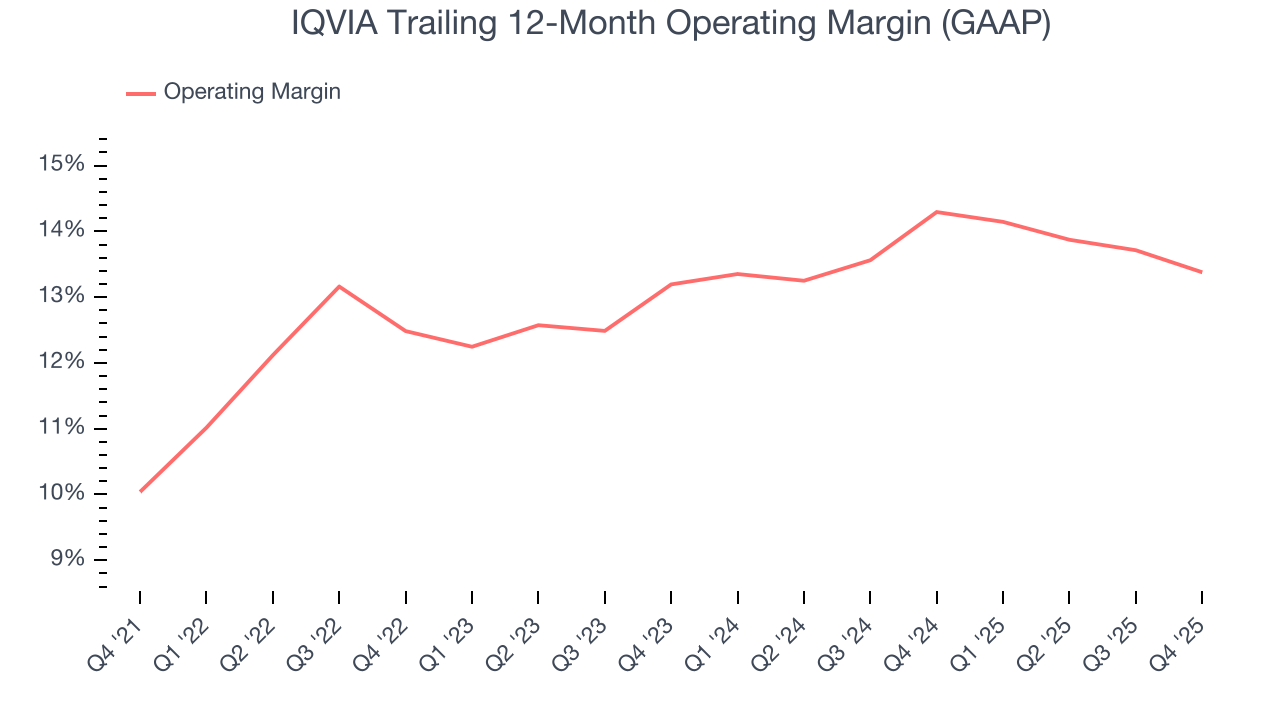

7. Operating Margin

IQVIA has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 12.7%, higher than the broader healthcare sector.

Looking at the trend in its profitability, IQVIA’s operating margin rose by 3.3 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, IQVIA generated an operating margin profit margin of 14.4%, down 1.4 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

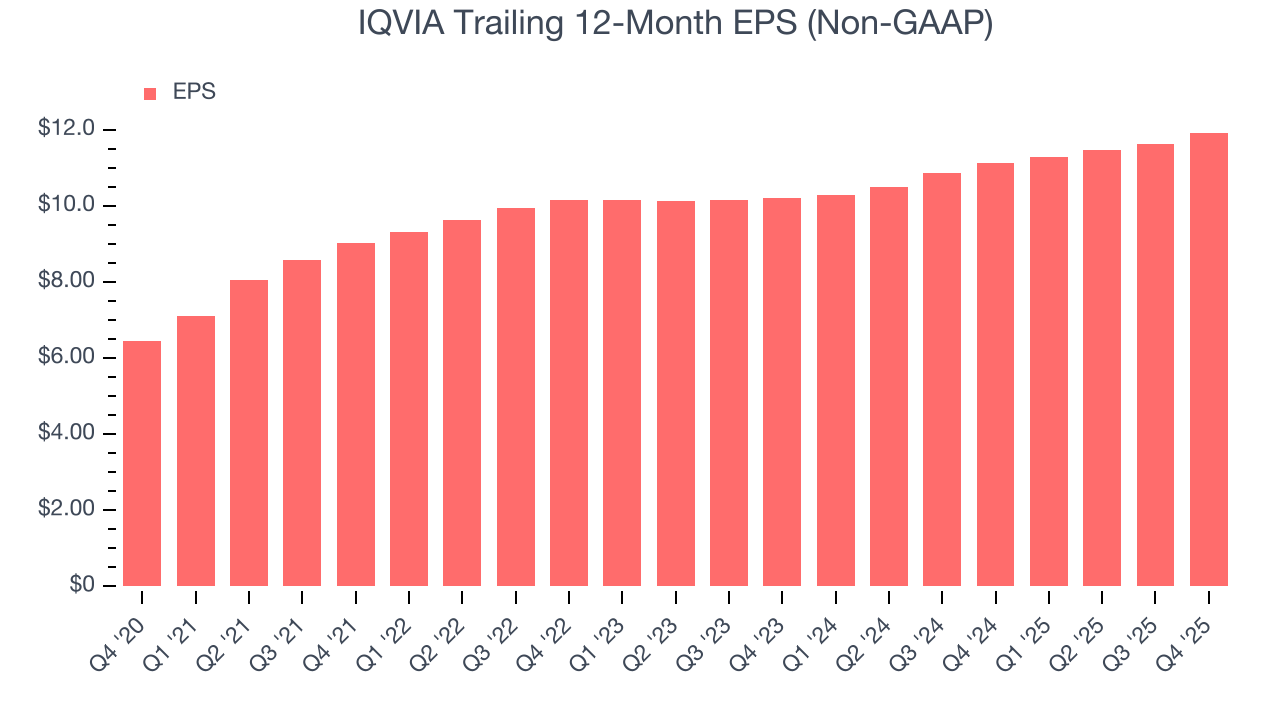

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

IQVIA’s EPS grew at a spectacular 13.1% compounded annual growth rate over the last five years, higher than its 7.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of IQVIA’s earnings can give us a better understanding of its performance. As we mentioned earlier, IQVIA’s operating margin declined this quarter but expanded by 3.3 percentage points over the last five years. Its share count also shrank by 12%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, IQVIA reported adjusted EPS of $3.42, up from $3.12 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects IQVIA’s full-year EPS of $11.93 to grow 7.9%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

IQVIA has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.7% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that IQVIA’s margin dropped by 4 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

IQVIA’s free cash flow clocked in at $561 million in Q4, equivalent to a 12.9% margin. The company’s cash profitability regressed as it was 5.4 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

IQVIA’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 8.3%, slightly better than typical healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, IQVIA’s ROIC increased by 2.6 percentage points annually each year over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

11. Balance Sheet Assessment

IQVIA reported $2.14 billion of cash and $15.95 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.79 billion of EBITDA over the last 12 months, we view IQVIA’s 3.6× net-debt-to-EBITDA ratio as safe. We also see its $320 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from IQVIA’s Q4 Results

We enjoyed seeing IQVIA beat analysts’ constant currency revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed. Overall, this print had some key positives. The stock remained flat at $201.50 immediately after reporting.

13. Is Now The Time To Buy IQVIA?

Updated: March 5, 2026 at 11:45 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in IQVIA.

IQVIA’s business quality ultimately falls short of our standards. First off, its revenue growth was mediocre over the last five years. And while IQVIA’s spectacular EPS growth over the last five years shows its profits are trickling down to shareholders, its cash profitability fell over the last five years.

IQVIA’s P/E ratio based on the next 12 months is 14x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $235.52 on the company (compared to the current share price of $178.54).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.