Invesco (IVZ)

Invesco is up against the odds. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Invesco Will Underperform

With roots dating back to 1935 when it pioneered the first mutual fund with an objective of capital growth, Invesco (NYSE:IVZ) is a global asset management firm that offers investment solutions across equities, fixed income, alternatives, and multi-asset strategies.

- Flat earnings per share over the last five years underperformed the sector average

- Sales were flat over the last five years, indicating it’s failed to expand this cycle

- Below-average return on equity indicates management struggled to find compelling investment opportunities

Invesco is skating on thin ice. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Invesco

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Invesco

Invesco’s stock price of $26.40 implies a valuation ratio of 9.4x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Invesco (IVZ) Research Report: Q4 CY2025 Update

Asset management firm Invesco (NYSE:IVZ) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 8.8% year on year to $1.26 billion. Its non-GAAP profit of $0.62 per share was 7.1% above analysts’ consensus estimates.

Invesco (IVZ) Q4 CY2025 Highlights:

- Assets Under Management: $2.2 trillion vs analyst estimates of $2.17 trillion (19.2% year-on-year growth, 1.5% beat)

- Revenue: $1.26 billion vs analyst estimates of $1.25 billion (8.8% year-on-year growth, 1.1% beat)

- Pre-tax Profit: $457.8 million (36.4% margin)

- Adjusted EPS: $0.62 vs analyst estimates of $0.58 (7.1% beat)

- Market Capitalization: $12.74 billion

Company Overview

With roots dating back to 1935 when it pioneered the first mutual fund with an objective of capital growth, Invesco (NYSE:IVZ) is a global asset management firm that offers investment solutions across equities, fixed income, alternatives, and multi-asset strategies.

Invesco manages assets for a diverse client base that includes retail investors, institutional clients, and high-net-worth individuals. The company's investment products span traditional mutual funds, exchange-traded funds (ETFs), separately managed accounts, and specialized investment vehicles. Through its various investment teams located across the globe, Invesco employs different investment approaches including fundamental analysis, quantitative strategies, and factor-based investing.

The firm's ETF business operates primarily under the Invesco QQQ brand, which tracks the Nasdaq-100 Index, and the broader Invesco ETF suite. For institutional clients like pension funds, insurance companies, and sovereign wealth funds, Invesco provides customized portfolio solutions designed to meet specific investment objectives and risk parameters. A retail investor might use Invesco's funds in their retirement account to gain exposure to international markets or specific sectors like technology or real estate.

Invesco generates revenue primarily through management fees calculated as a percentage of assets under management (AUM). The fee structure varies by product type, with specialized or actively managed strategies typically commanding higher fees than passive index products. The company also offers wealth management services, investment consulting, and administrative platform solutions.

With operations spanning North America, Europe, the Middle East, and Asia-Pacific regions, Invesco maintains a global footprint while adapting to local market conditions and regulatory environments. The company has grown both organically and through strategic acquisitions, including the purchase of OppenheimerFunds, which significantly expanded its U.S. retail business.

4. Custody Bank

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

Invesco competes with other major asset managers including BlackRock (NYSE:BLK), Vanguard Group, State Street Global Advisors (NYSE:STT), T. Rowe Price (NASDAQ:TROW), and Franklin Templeton (NYSE:BEN) in the increasingly competitive investment management industry.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Invesco struggled to consistently increase demand as its $4.66 billion of revenue for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Invesco’s annualized revenue growth of 4% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Invesco reported year-on-year revenue growth of 8.8%, and its $1.26 billion of revenue exceeded Wall Street’s estimates by 1.1%.

6. Assets Under Management (AUM)

Assets Under Management (AUM) encompasses all client funds under a firm's investment management umbrella. The recurring fee structure on these assets provides consistent revenue generation, offering financial stability even during periods of poor investment returns, though sustained underperformance can impact future asset flows.

Invesco’s AUM has grown at an annual rate of 11.4% over the last five years, a step above the broader financials industry and faster than its total revenue. When analyzing Invesco’s AUM over the last two years, we can see that growth accelerated to 15.8% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. Just remember that while assets are relevant to watch, we don't place too much emphasis on them because they ebb and flow with the market.

Invesco’s AUM punched in at $2.2 trillion this quarter, beating analysts’ expectations by 1.5%. This print was 19.2% higher than the same quarter last year.

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Custody Bank companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, Invesco’s pre-tax profit margin has fallen by 6.8 percentage points, going from 47.5% to 30.6%. It has also expanded by 36.1 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

In Q4, Invesco’s pre-tax profit margin was 36.4%. This result was 8.9 percentage points better than the same quarter last year.

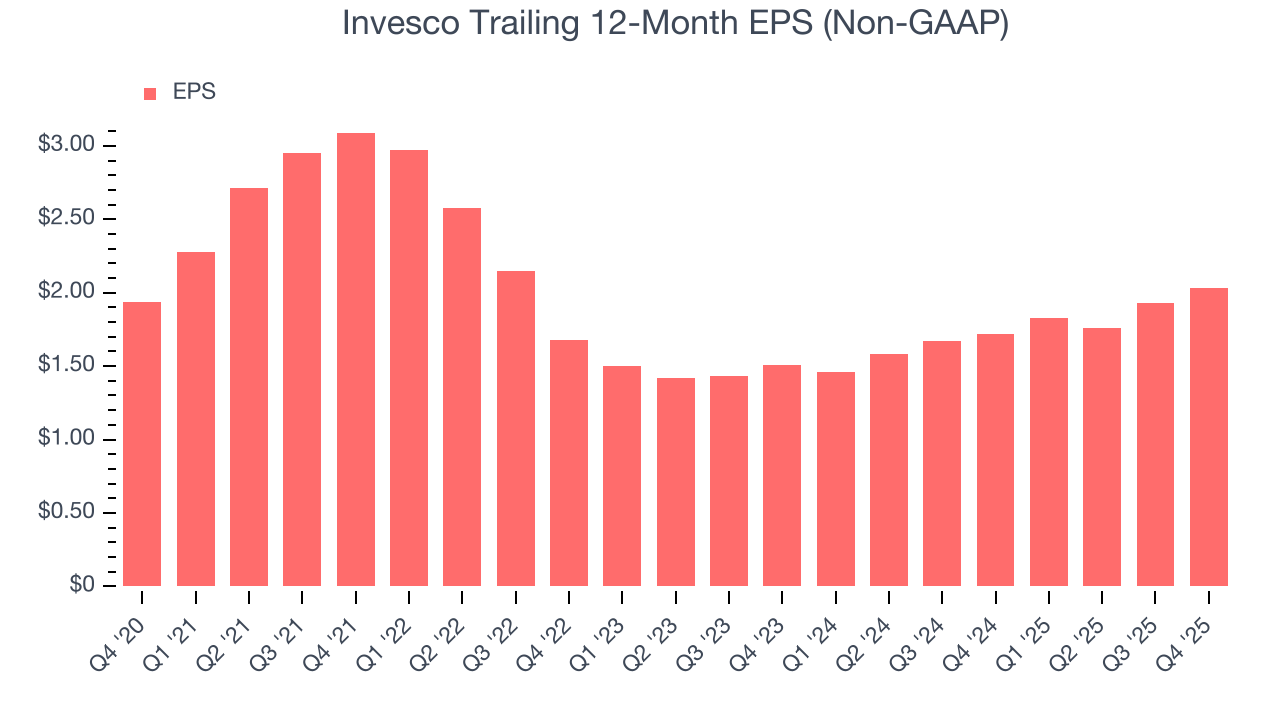

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Invesco’s EPS was flat over the last five years, just like its revenue. This performance was underwhelming across the board.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Invesco’s two-year annual EPS growth of 15.9% was good and topped its 4% two-year revenue growth.

Diving into the nuances of Invesco’s earnings can give us a better understanding of its performance. Invesco’s pre-tax profit margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Invesco reported adjusted EPS of $0.62, up from $0.52 in the same quarter last year. This print beat analysts’ estimates by 7.1%. Over the next 12 months, Wall Street expects Invesco’s full-year EPS of $2.03 to grow 30.7%.

9. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Invesco has averaged an ROE of 5.7%, uninspiring for a company operating in a sector where the average shakes out around 10%.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Invesco currently has $1.83 billion of debt and $13 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.1×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from Invesco’s Q4 Results

It was good to see Invesco narrowly top analysts’ AUM expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 5.6% to $30.22 immediately after reporting.

12. Is Now The Time To Buy Invesco?

Updated: February 26, 2026 at 12:07 AM EST

Before deciding whether to buy Invesco or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Invesco doesn’t pass our quality test. For starters, its revenue growth was weak over the last five years. While its AUM growth was solid over the last five years, the downside is its declining pre-tax profit margin shows the business has become less efficient. On top of that, its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Invesco’s P/E ratio based on the next 12 months is 9.7x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $30.14 on the company (compared to the current share price of $26.77).