Jabil (JBL)

We’re skeptical of Jabil. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why Jabil Is Not Exciting

With manufacturing facilities spanning the globe from China to Mexico to the United States, Jabil (NYSE:JBL) provides electronics design, manufacturing, and supply chain solutions to companies across various industries, from healthcare to automotive to cloud computing.

- Annual sales growth of 2.4% over the last five years lagged behind its business services peers as its large revenue base made it difficult to generate incremental demand

- Subpar adjusted operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

- A consolation is that its enormous revenue base of $31.11 billion provides significant distribution advantages

Jabil’s quality doesn’t meet our bar. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Jabil

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Jabil

At $240.85 per share, Jabil trades at 19.7x forward P/E. This multiple expensive for its subpar fundamentals.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Jabil (JBL) Research Report: Q4 CY2025 Update

Electronics manufacturing services provider Jabil (NYSE:JBL) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 18.7% year on year to $8.31 billion. Guidance for next quarter’s revenue was optimistic at $7.75 billion at the midpoint, 2.6% above analysts’ estimates. Its non-GAAP profit of $2.85 per share was 4.4% above analysts’ consensus estimates.

Jabil (JBL) Q4 CY2025 Highlights:

- Revenue: $8.31 billion vs analyst estimates of $8.00 billion (18.7% year-on-year growth, 3.8% beat)

- Adjusted EPS: $2.85 vs analyst estimates of $2.73 (4.4% beat)

- Adjusted EBITDA: $613 million vs analyst estimates of $598.3 million (7.4% margin, 2.5% beat)

- The company lifted its revenue guidance for the full year to $32.4 billion at the midpoint from $31.3 billion, a 3.5% increase

- Management raised its full-year Adjusted EPS guidance to $11.55 at the midpoint, a 5% increase

- Operating Margin: 3.4%, in line with the same quarter last year

- Free Cash Flow Margin: 3.3%, similar to the same quarter last year

- Market Capitalization: $22.71 billion

Company Overview

With manufacturing facilities spanning the globe from China to Mexico to the United States, Jabil (NYSE:JBL) provides electronics design, manufacturing, and supply chain solutions to companies across various industries, from healthcare to automotive to cloud computing.

Jabil operates as a manufacturing partner for thousands of companies, handling everything from initial product design to final assembly and distribution. The company's services help clients reduce time-to-market, manage inventory more efficiently, and optimize their supply chains without having to build and maintain their own manufacturing infrastructure.

The company is organized into three main segments: Regulated Industries (serving automotive, healthcare, and renewable energy markets), Intelligent Infrastructure (supporting AI infrastructure, cloud data centers, and networking), and Connected Living and Digital Commerce (focusing on consumer products and retail automation).

When a medical device company needs to produce a new health monitoring system, for example, Jabil might handle the entire process—designing the electronics, sourcing components, manufacturing the device, testing it for quality, and even managing distribution to hospitals or retailers.

Jabil's revenue comes from manufacturing contracts with clients across diverse industries. The company maintains long-term relationships with major technology and industrial companies, with Apple being one of its largest customers. Its global manufacturing footprint allows clients to produce products in optimal locations based on cost, logistics, and market access considerations.

Beyond basic manufacturing, Jabil offers specialized design services including electronic hardware design, mechanical engineering, optical systems development, and user experience design. The company has evolved from a traditional electronics manufacturer to a comprehensive solutions provider, helping clients navigate complex technologies like artificial intelligence, electrification, and advanced healthcare devices.

4. Electronic Components & Manufacturing

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

Jabil competes with other electronics manufacturing services providers including Foxconn (TPE:2317), Flex Ltd. (NASDAQ:FLEX), Sanmina Corporation (NASDAQ:SANM), and Celestica Inc. (NYSE:CLS).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $31.11 billion in revenue over the past 12 months, Jabil is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. For Jabil to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

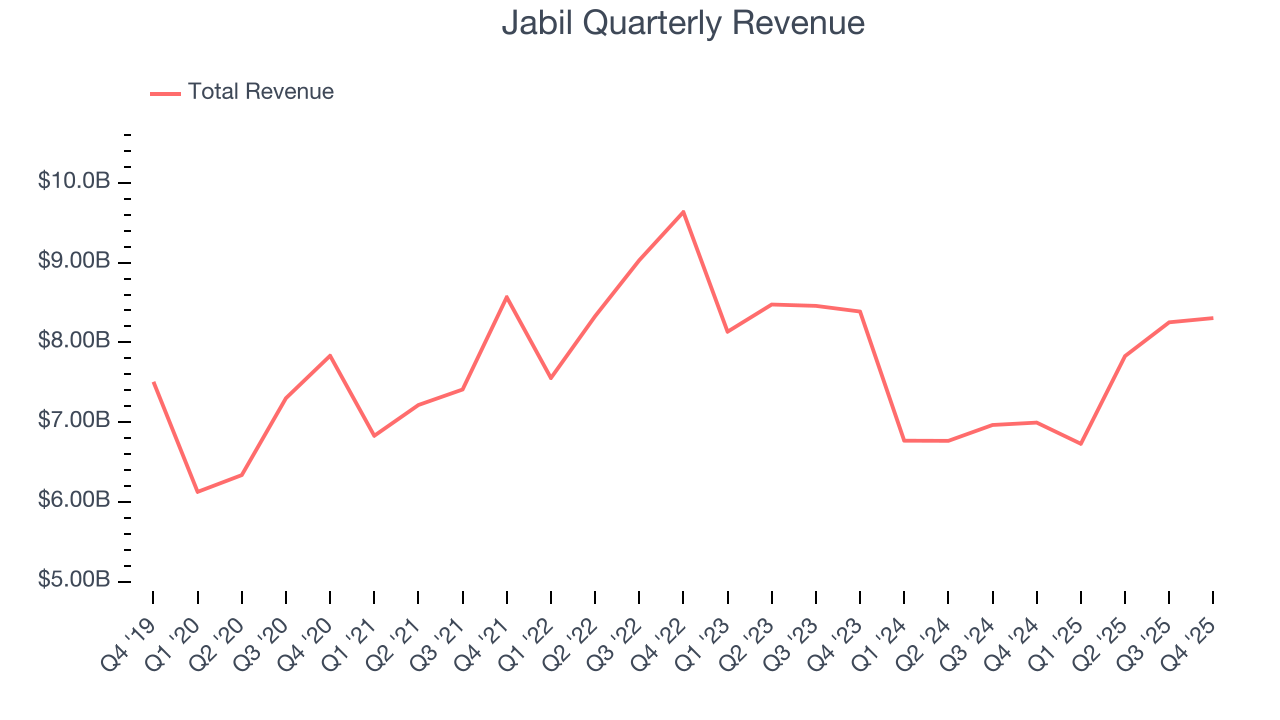

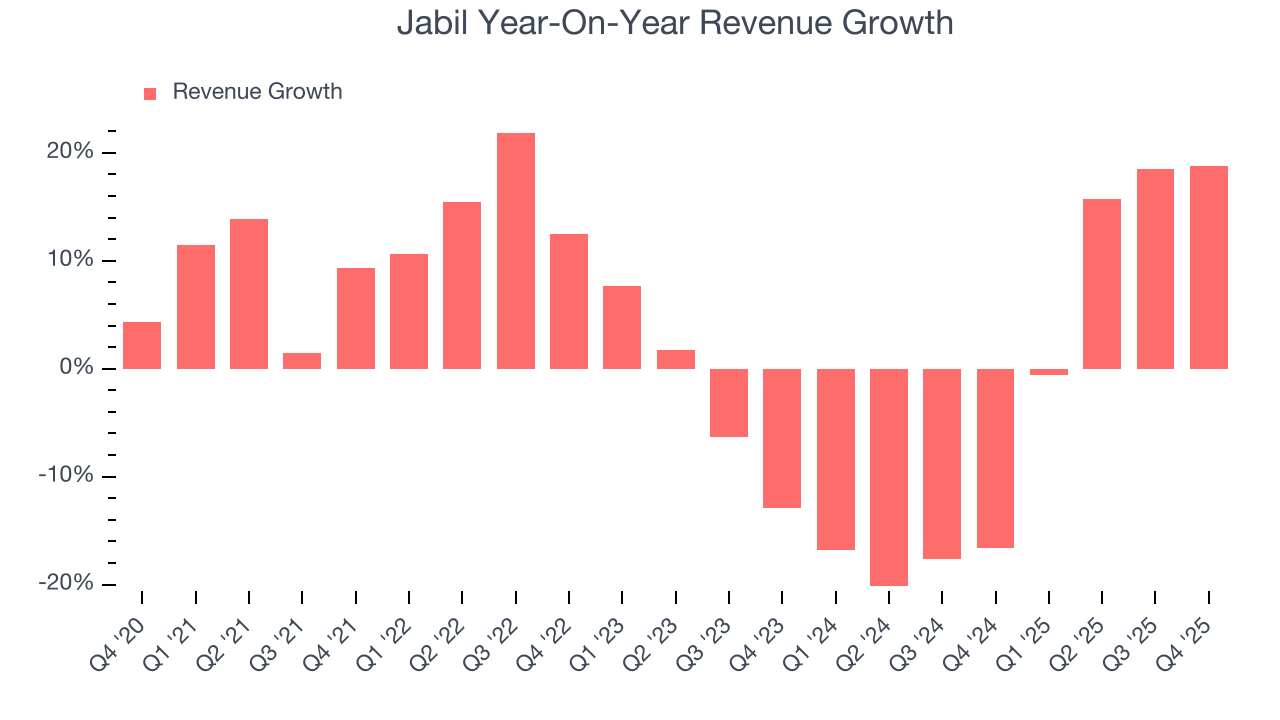

As you can see below, Jabil grew its sales at a sluggish 2.4% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Jabil’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.6% annually.

This quarter, Jabil reported year-on-year revenue growth of 18.7%, and its $8.31 billion of revenue exceeded Wall Street’s estimates by 3.8%. Company management is currently guiding for a 15.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

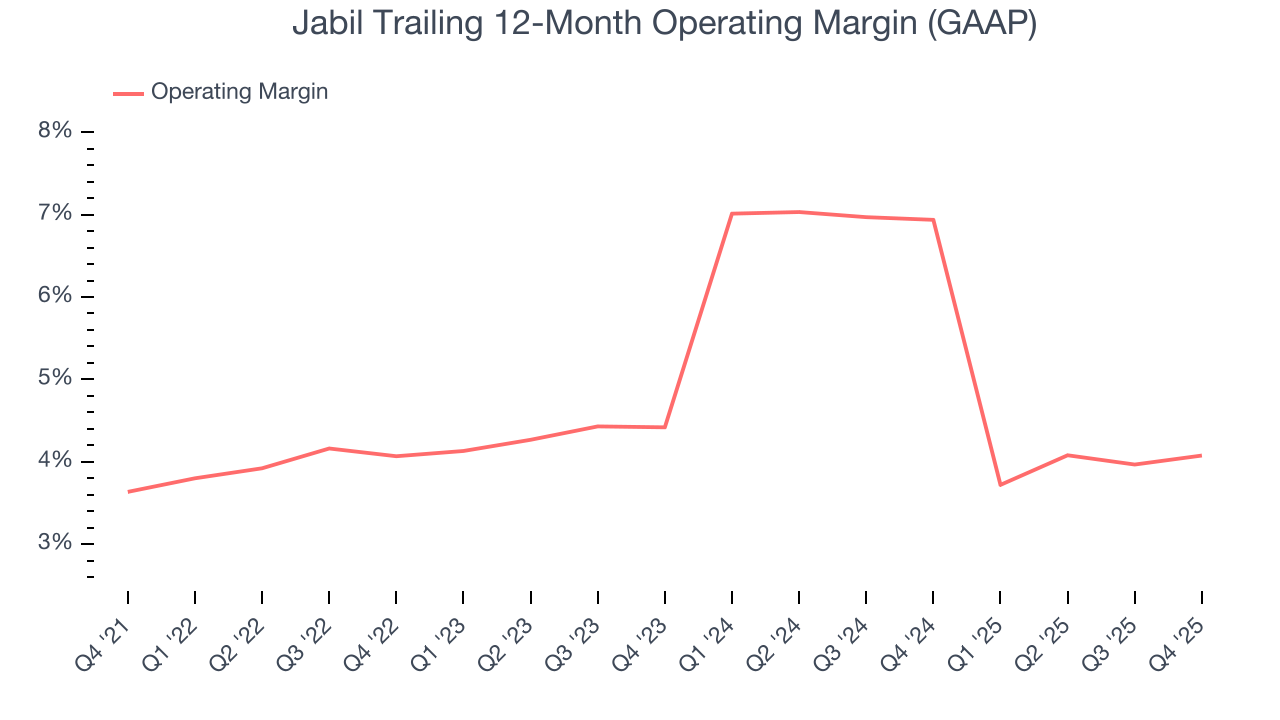

Jabil’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 4.6% over the last five years. This profitability was lousy for a business services business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, Jabil’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Jabil generated an operating margin profit margin of 3.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

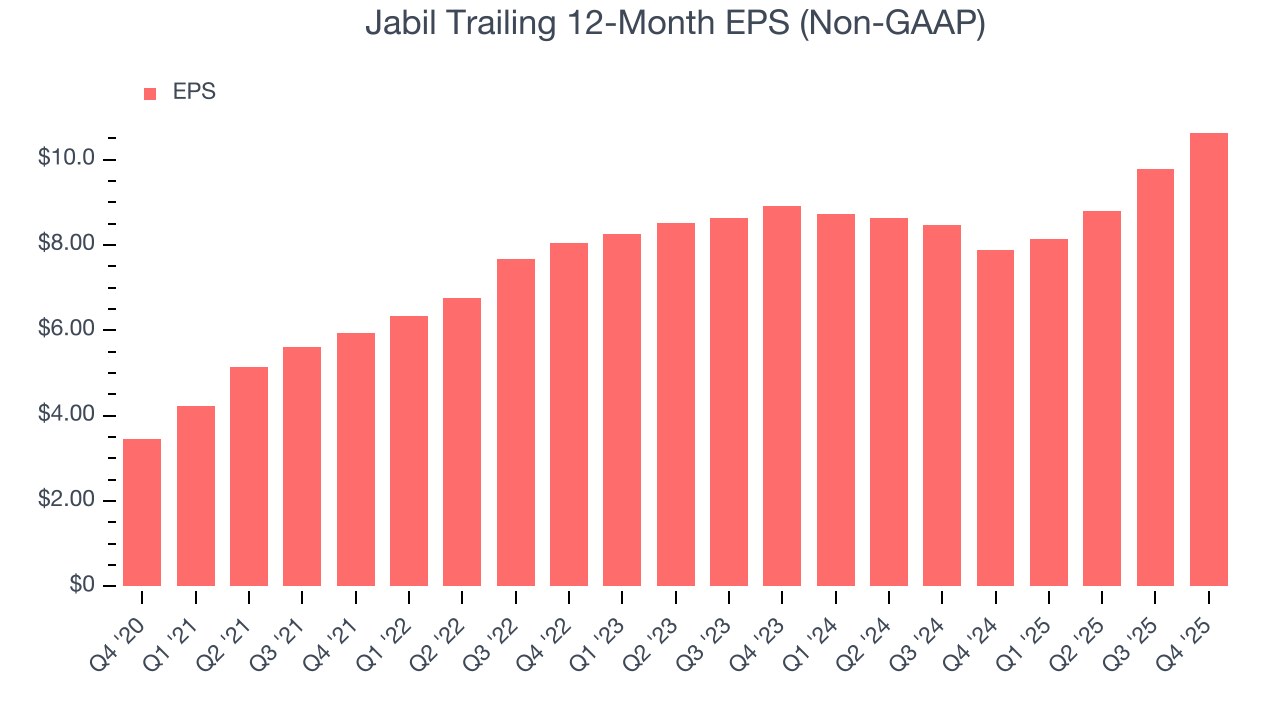

Jabil’s EPS grew at an astounding 25.2% compounded annual growth rate over the last five years, higher than its 2.4% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Jabil, its two-year annual EPS growth of 9.2% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Jabil reported adjusted EPS of $2.85, up from $2 in the same quarter last year. This print beat analysts’ estimates by 4.4%. Over the next 12 months, Wall Street expects Jabil’s full-year EPS of $10.63 to grow 7%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

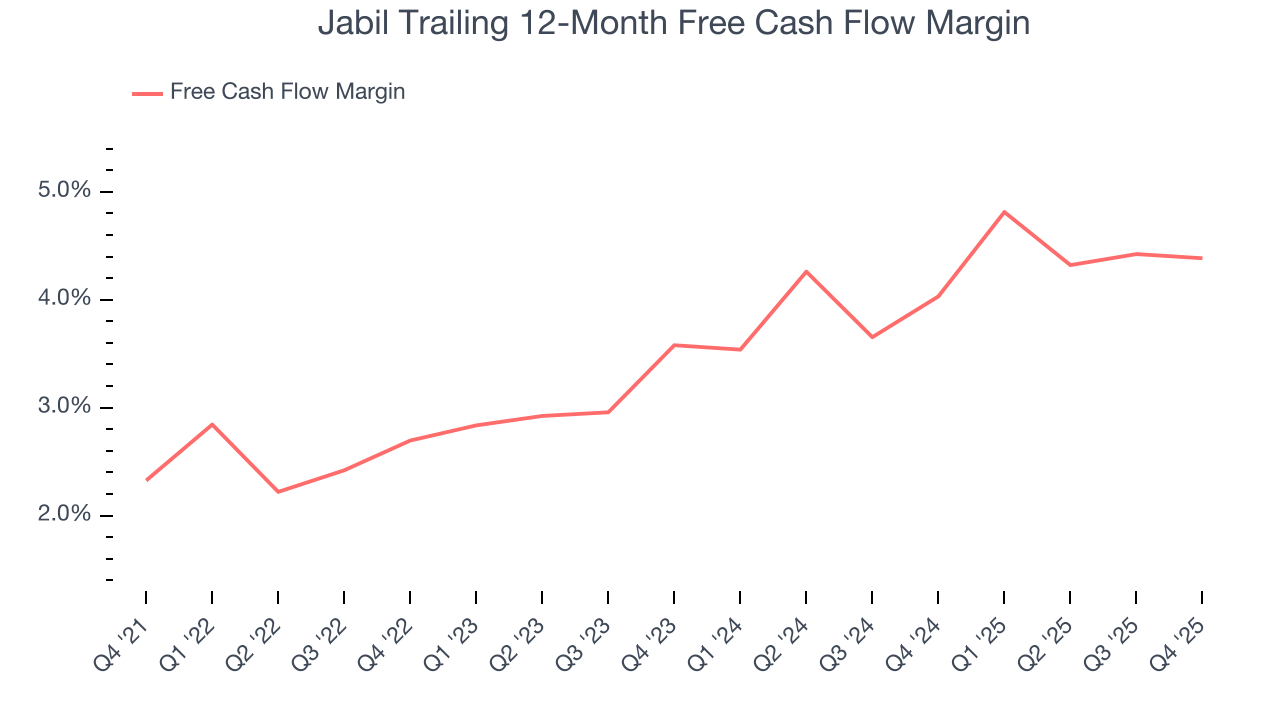

Jabil has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.4%, subpar for a business services business.

Taking a step back, an encouraging sign is that Jabil’s margin expanded by 2.1 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Jabil’s free cash flow clocked in at $272 million in Q4, equivalent to a 3.3% margin. This cash profitability was in line with the comparable period last year and its five-year average.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

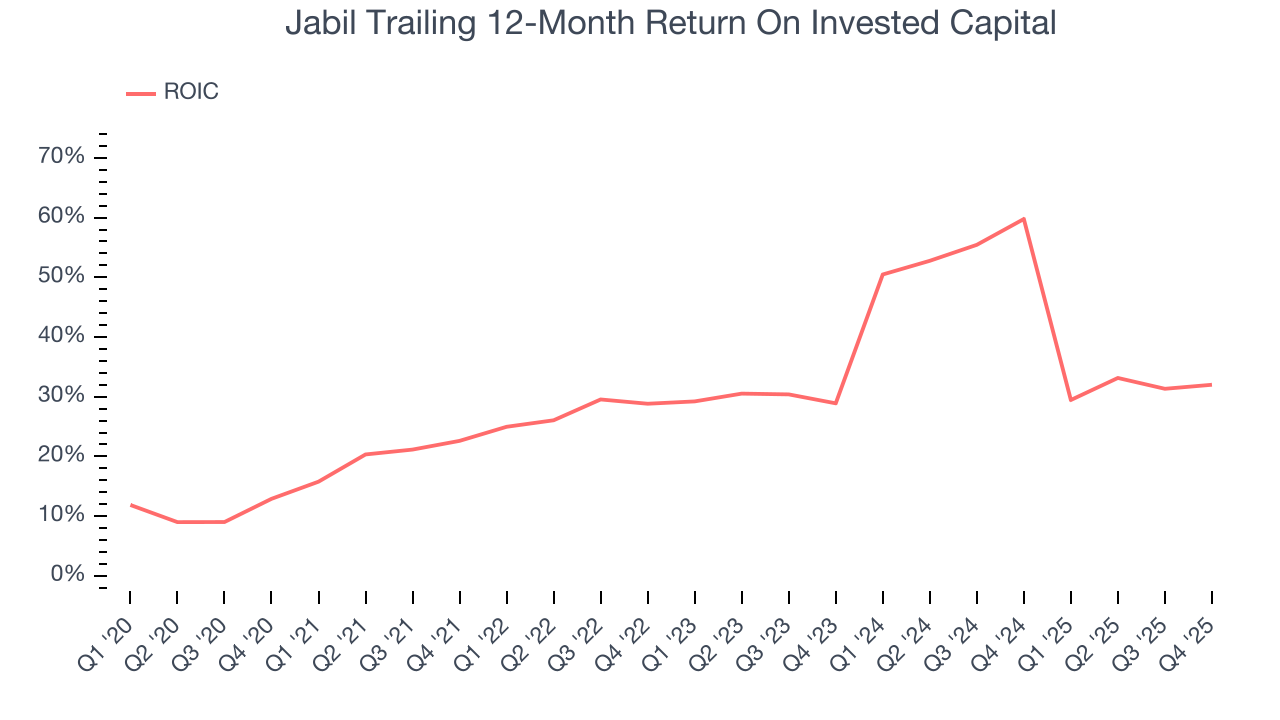

Although Jabil hasn’t been the highest-quality company lately because of its poor top-line performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 34.4%, splendid for a business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Jabil’s ROIC has increased significantly over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

10. Balance Sheet Assessment

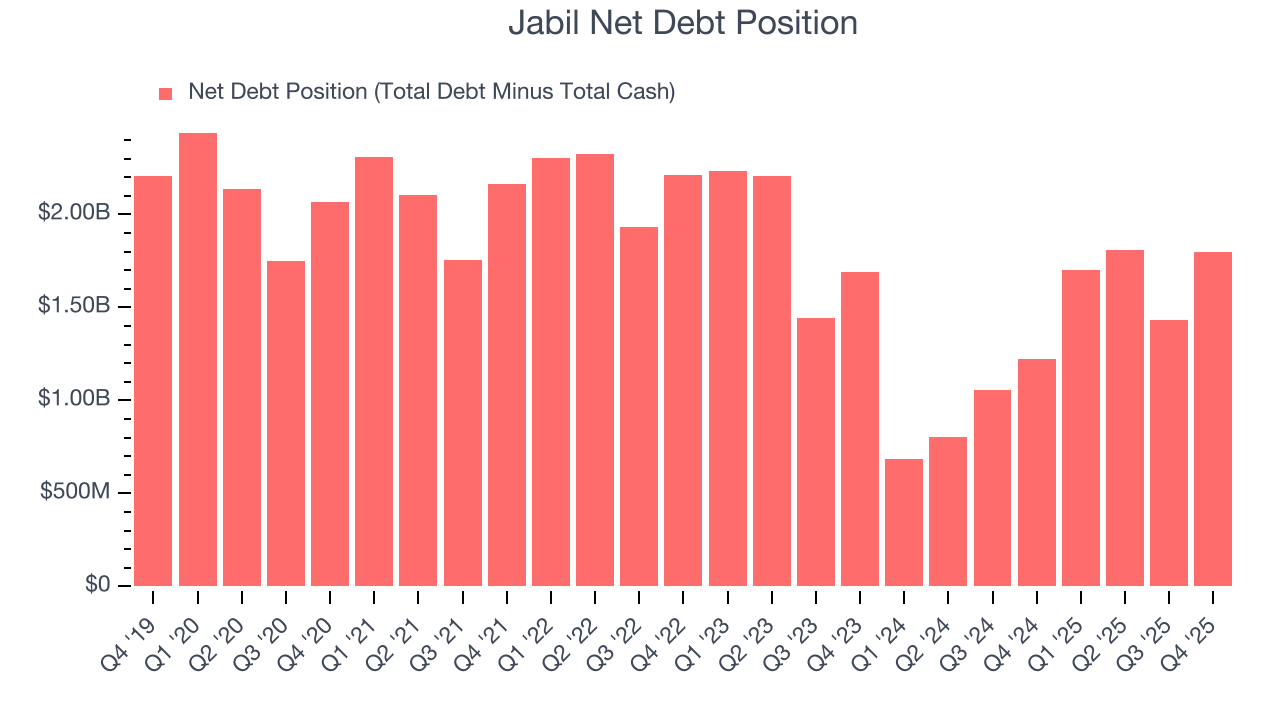

Jabil reported $1.57 billion of cash and $3.37 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.38 billion of EBITDA over the last 12 months, we view Jabil’s 0.8× net-debt-to-EBITDA ratio as safe. We also see its $46 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Jabil’s Q4 Results

We were impressed by Jabil’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS guidance for next quarter outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 4.6% to $222.25 immediately following the results.

12. Is Now The Time To Buy Jabil?

Updated: February 5, 2026 at 9:06 PM EST

Are you wondering whether to buy Jabil or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Jabil isn’t a terrible business, but it isn’t one of our picks. To kick things off, its revenue growth was weak over the last five years. And while its scale makes it a trusted partner with negotiating leverage, the downside is its operating margins reveal poor profitability compared to other business services companies. On top of that, its low free cash flow margins give it little breathing room.

Jabil’s P/E ratio based on the next 12 months is 19.7x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $264.50 on the company (compared to the current share price of $240.85).