CarMax (KMX)

We wouldn’t buy CarMax. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think CarMax Will Underperform

Known for its transparent, customer-centric approach and wide selection of vehicles, Carmax (NYSE:KMX) is the largest automotive retailer in the United States.

- Sales tumbled by 6.4% annually over the last three years, showing consumer trends are working against its favor

- Widely-available products (and therefore stiff competition) result in an inferior gross margin of 6% that must be offset through higher volumes

- 16× net-debt-to-EBITDA ratio shows it’s overleveraged and increases the probability of shareholder dilution if things turn unexpectedly

CarMax falls short of our quality standards. Our attention is focused on better businesses.

Why There Are Better Opportunities Than CarMax

High Quality

Investable

Underperform

Why There Are Better Opportunities Than CarMax

At $44.50 per share, CarMax trades at 19.7x forward P/E. This multiple rich for the business quality. Not a great combination.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. CarMax (KMX) Research Report: Q4 CY2025 Update

Used automotive vehicle retailer Carmax (NYSE:KMX) reported revenue ahead of Wall Streets expectations in Q4 CY2025, but sales fell by 6.9% year on year to $5.79 billion. Its GAAP profit of $0.43 per share was 36.1% above analysts’ consensus estimates.

CarMax (KMX) Q4 CY2025 Highlights:

- Revenue: $5.79 billion vs analyst estimates of $5.61 billion (6.9% year-on-year decline, 3.3% beat)

- EPS (GAAP): $0.43 vs analyst estimates of $0.32 (36.1% beat)

- Q4 guidance: "we anticipate lowering retail used unit margins in the fourth quarter." and "we expect marketing spend on a total unit basis to be up year-over-year in the fourth quarter, though to a lesser degree than during the third quarter, with a focus on investing in acquisition to drive buys and sales."

- Operating Margin: 0.1%, down from 3.2% in the same quarter last year

- Free Cash Flow was $1.11 billion, up from -$150.6 million in the same quarter last year

- Locations: 250 at quarter end, up from 245 in the same quarter last year

- Same-Store Sales fell 8.1% year on year (0.5% in the same quarter last year)

- Market Capitalization: $6.03 billion

Company Overview

Known for its transparent, customer-centric approach and wide selection of vehicles, Carmax (NYSE:KMX) is the largest automotive retailer in the United States.

Founded in 1993, the company is headquartered in Richmond, Virginia, and operates over 200 stores across the country. Carmax offers a unique car buying experience by providing customers with a no-haggle, no-pressure environment where they can browse a wide selection of high-quality used cars, and take them for test drives without a salesperson. Carmax also offers a range of services such as financing, warranties, and trade-ins.

The core customer for Carmax is someone who is looking for a used car but wants a hassle-free, transparent buying process. Typically, these customers are looking for a car that is less than five years old and has low mileage. Carmax addresses their needs by offering a wide selection of high-quality used cars at competitive prices. Customers can also take advantage of the company's financing options, which include pre-approval and a range of payment plans.

The average Carmax store is around 50,000 square feet and is located in suburban or urban areas. The stores are laid out in a way that makes it easy for customers to browse the cars and take them for test drives. The cars are organized by make and model, and customers can easily find information about each car's features, history, and pricing.

Carmax launched its e-commerce presence in 2019. Customers can browse and purchase cars online, as well as schedule a test drive and arrange for delivery or pickup. The company's online platform also includes a range of resources such as car reviews, buying guides, and financing calculators.

An interesting fact about Carmax is that the company has been consistently ranked as one of the best companies to work for by Fortune magazine. This is in part due to the company's commitment to employee development and training, as well as its focus on creating a positive work culture. Carmax also supports various community initiatives, such as providing funding for education and job training programs.

4. Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Competitors in the auto retail space include AutoNation (NYSE:AN), Carvana (NYSE:CVNA), Group 1 Automotive (NYSE:GPI), and Lithia Motors (NYSE:LAD).

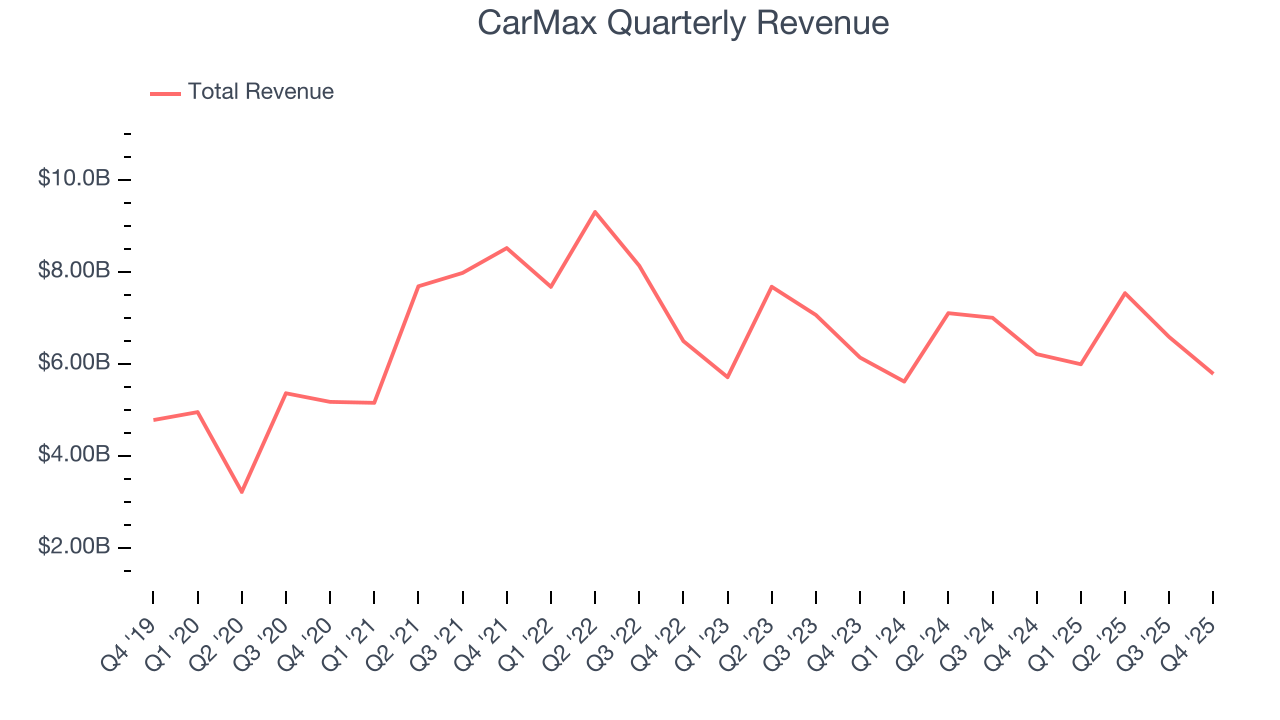

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $25.94 billion in revenue over the past 12 months, CarMax is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To expand meaningfully, CarMax likely needs to tweak its prices or enter new markets.

As you can see below, CarMax struggled to generate demand over the last three years (we compare to 2019 to normalize for COVID-19 impacts). Its sales dropped by 6.4% annually despite opening new stores. This implies its underperformance was driven by lower sales at existing, established locations.

This quarter, CarMax’s revenue fell by 6.9% year on year to $5.79 billion but beat Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to decline by 2.7% over the next 12 months. it’s hard to get excited about a company that is struggling with demand.

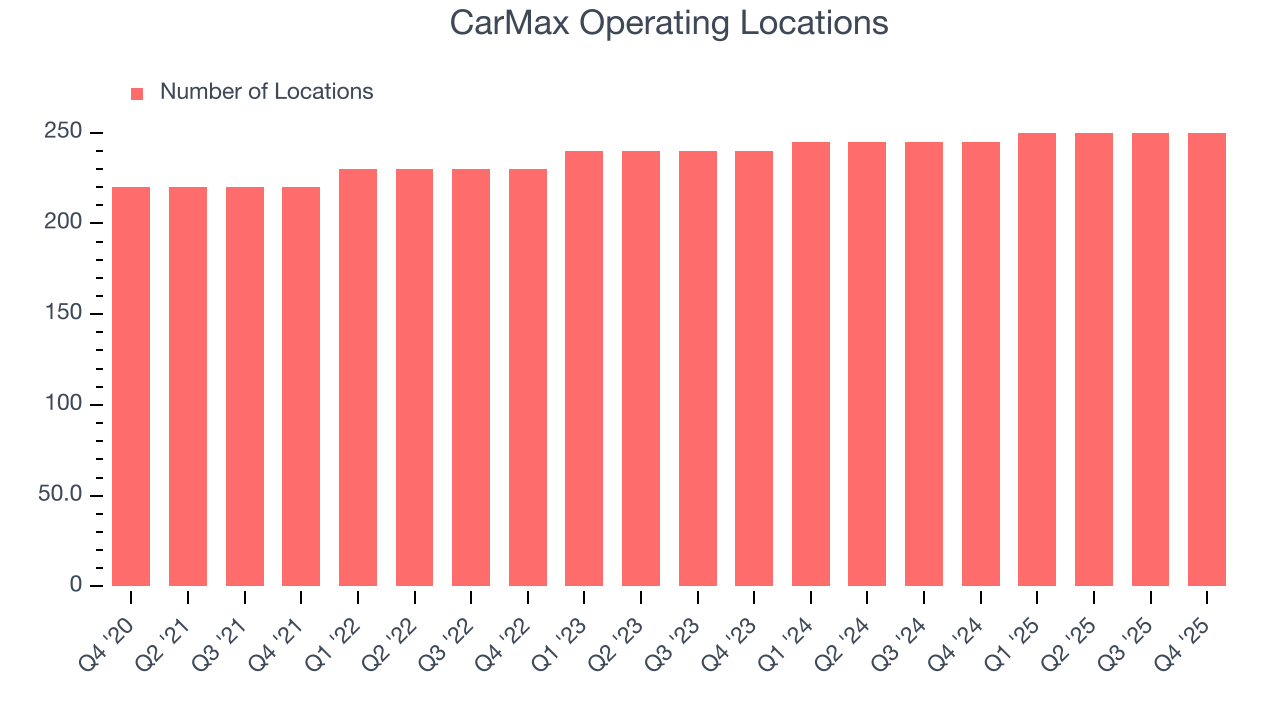

6. Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

CarMax operated 250 locations in the latest quarter. It has generally opened new stores over the last two years and averaged 2.1% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

CarMax’s demand has been shrinking over the last two years as its same-store sales have averaged 1.3% annual declines. This performance is concerning - it shows CarMax artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, CarMax’s same-store sales fell by 8.1% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

7. Gross Margin & Pricing Power

CarMax has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 11% gross margin over the last two years. Said differently, CarMax had to pay a chunky $89.05 to its suppliers for every $100 in revenue.

This quarter, CarMax’s gross profit margin was 10.2%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

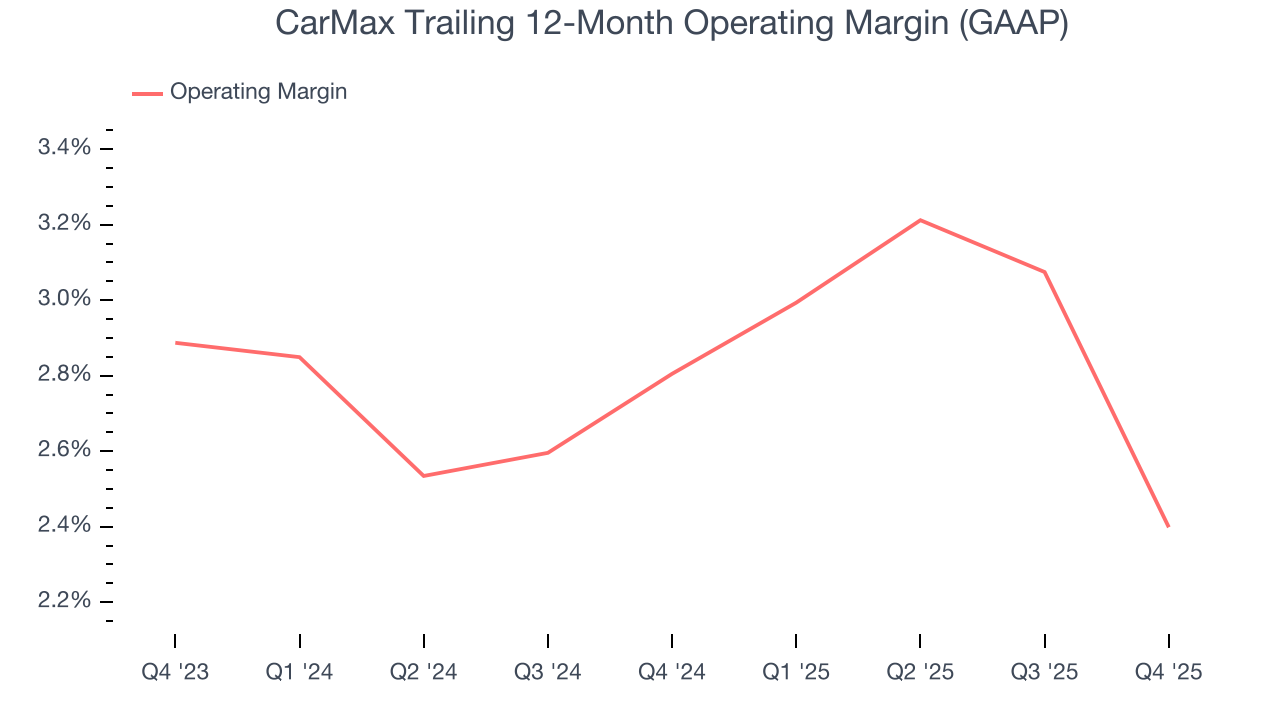

8. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

CarMax’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 2.6% over the last two years. This profitability was lousy for a consumer retail business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, CarMax’s operating margin might fluctuated slightly but has generally stayed the same over the last year, which doesn’t help its cause.

In Q4, CarMax’s breakeven margin was down 3 percentage points year on year. Since CarMax’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

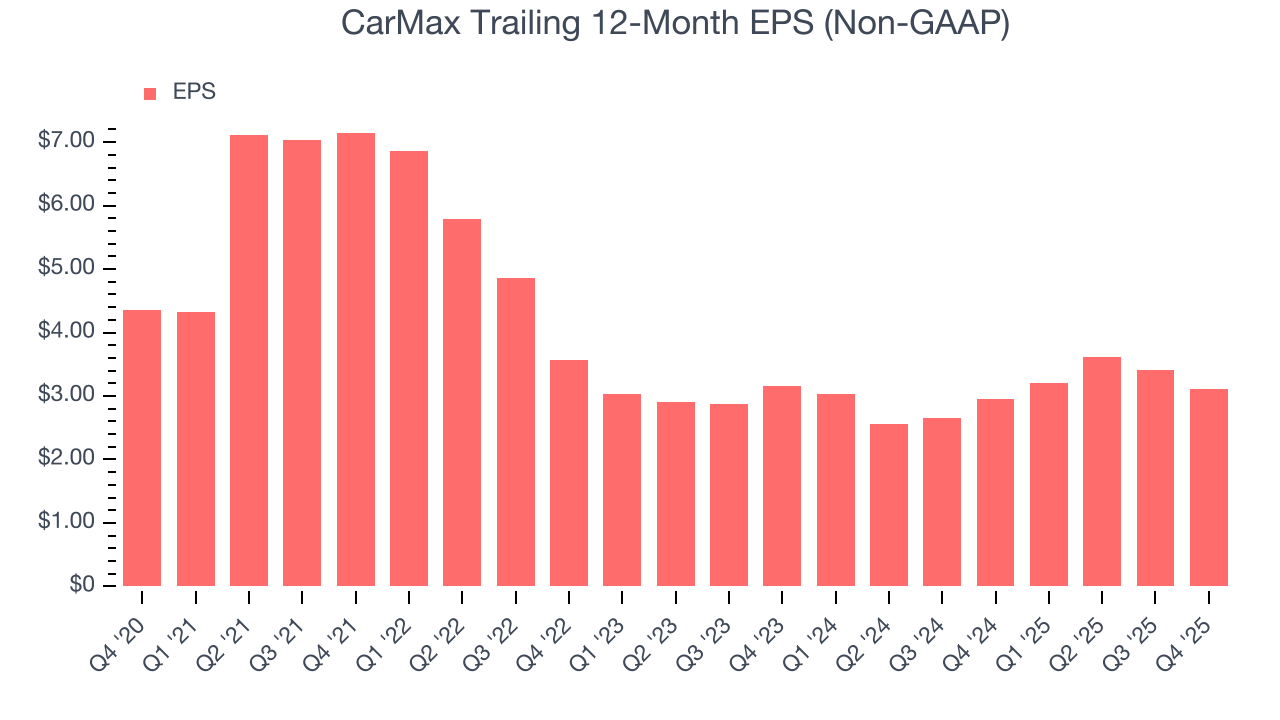

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for CarMax, its EPS and revenue declined by 4.5% and 6.4% annually over the last three years. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS because it could imply changing secular trends and preferences. If the tide turns unexpectedly, CarMax’s low margin of safety could leave its stock price susceptible to large downswings.

In Q4, CarMax reported adjusted EPS of $0.51, down from $0.81 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects CarMax’s full-year EPS of $3.11 to shrink by 25.7%.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

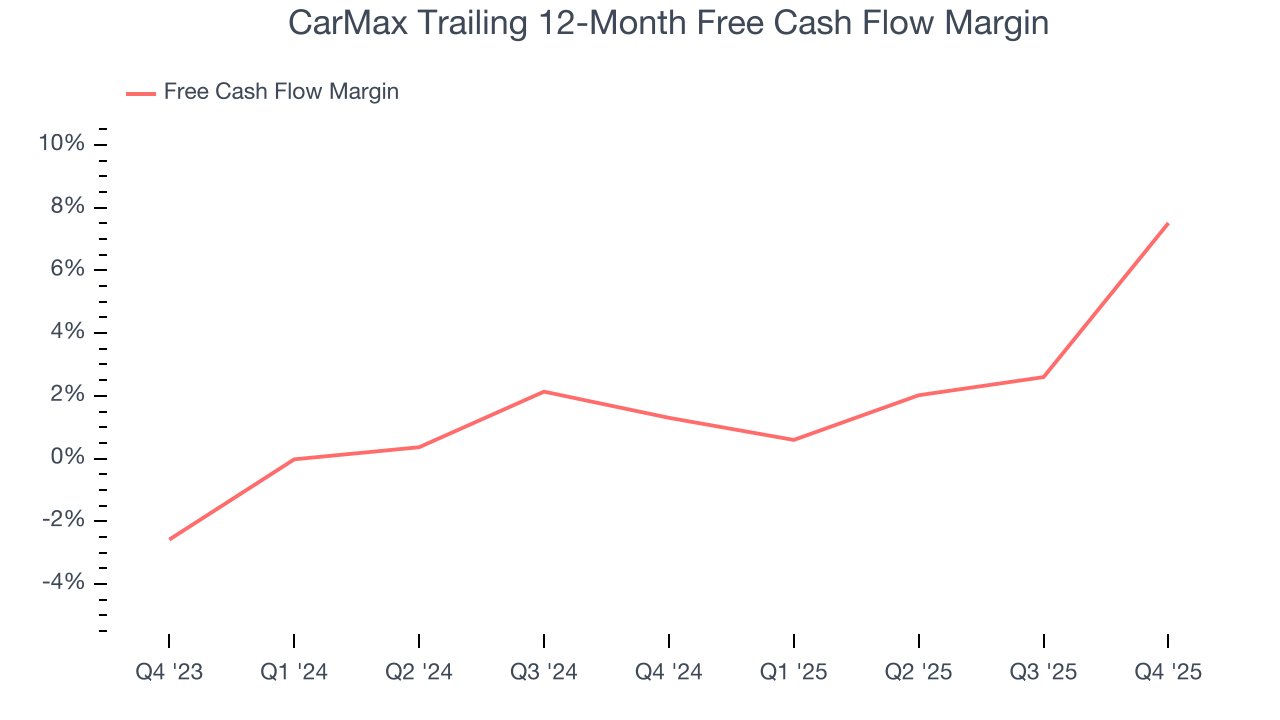

CarMax has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 4.4% over the last two years, better than the broader consumer retail sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that CarMax’s margin expanded by 6.2 percentage points over the last year. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

CarMax’s free cash flow clocked in at $1.11 billion in Q4, equivalent to a 19.2% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

CarMax historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.2%, lower than the typical cost of capital (how much it costs to raise money) for consumer retail companies.

12. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

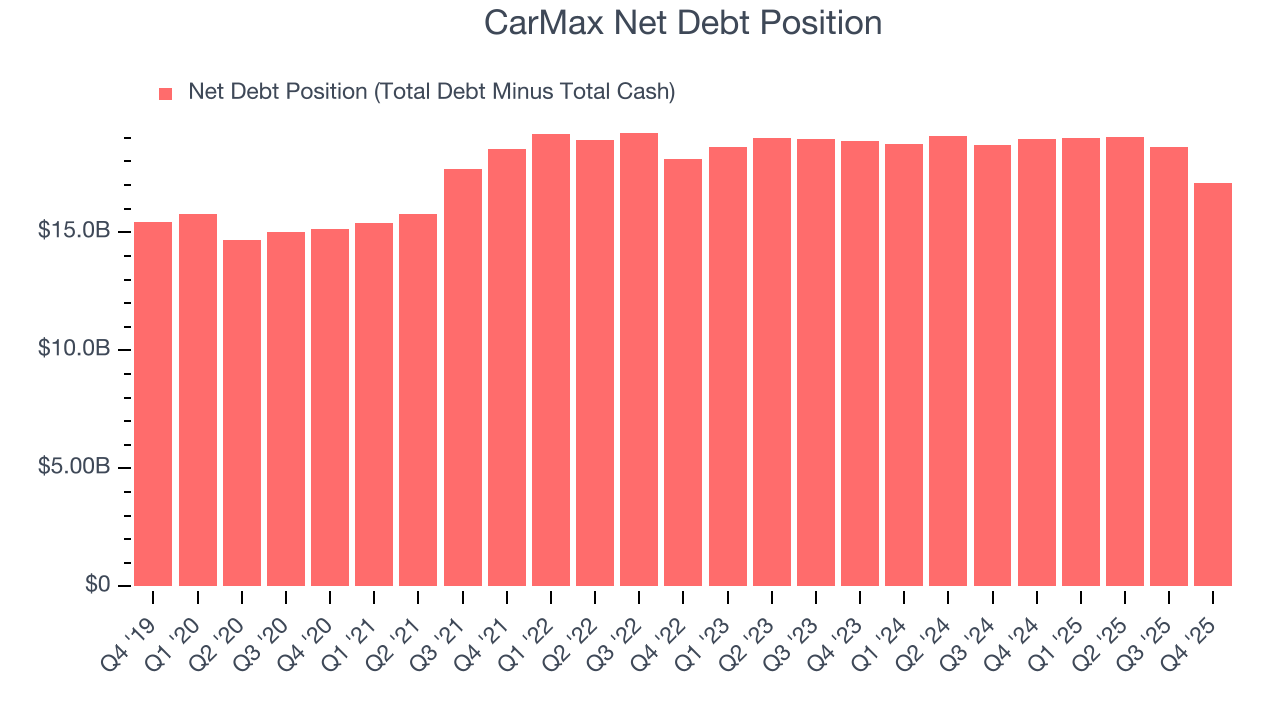

CarMax’s $17.85 billion of debt exceeds the $772.3 million of cash on its balance sheet. Furthermore, its 17× net-debt-to-EBITDA ratio (based on its EBITDA of $980.3 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. CarMax could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope CarMax can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

13. Key Takeaways from CarMax’s Q4 Results

It was good to see CarMax beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, management gave qualitative Q4 guidance that calls for lower margins to reinvigorate sales, something the market seems to dislike. Overall, this print was mixed but still had some key positives. The market seemed to be hoping for more, and the stock traded down 4.4% to $39.25 immediately after reporting.

14. Is Now The Time To Buy CarMax?

Updated: February 19, 2026 at 9:47 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in CarMax.

We cheer for all companies serving everyday consumers, but in the case of CarMax, we’ll be cheering from the sidelines. To begin with, its revenue has declined over the last three years. While its popular brand gives it meaningful influence over consumers’ purchasing decisions, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses.

CarMax’s P/E ratio based on the next 12 months is 19.7x. This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $39.62 on the company (compared to the current share price of $44.50), implying they don’t see much short-term potential in CarMax.