Lithia (LAD)

We’re wary of Lithia. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Lithia Will Underperform

With a strong presence in the Western US, Lithia Motors (NYSE:LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

- Gross margin of 15.5% is below its competitors, leaving less money for marketing and promotions

- Earnings per share fell by 8.3% annually over the last three years while its revenue grew, showing its incremental sales were much less profitable

- High net-debt-to-EBITDA ratio of 8× could force the company to raise capital at unfavorable terms if market conditions deteriorate

Lithia lacks the business quality we seek. You should search for better opportunities.

Why There Are Better Opportunities Than Lithia

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Lithia

Lithia is trading at $320.18 per share, or 9.1x forward P/E. This sure is a cheap multiple, but you get what you pay for.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Lithia (LAD) Research Report: Q4 CY2025 Update

Automotive retailer Lithia Motors (NYSE:LAD) missed Wall Street’s revenue expectations in Q4 CY2025, with sales flat year on year at $9.20 billion. Its non-GAAP profit of $6.74 per share was 16.8% below analysts’ consensus estimates.

Lithia (LAD) Q4 CY2025 Highlights:

- Revenue: $9.20 billion vs analyst estimates of $9.26 billion (flat year on year, 0.6% miss)

- Adjusted EPS: $6.74 vs analyst expectations of $8.10 (16.8% miss)

- Adjusted EBITDA: $364.1 million vs analyst estimates of $400.4 million (4% margin, 9.1% miss)

- Operating Margin: 3.7%, in line with the same quarter last year

- Free Cash Flow was $30.5 million, up from -$17.7 million in the same quarter last year

- Same-Store Sales were flat year on year (3.1% in the same quarter last year)

- Market Capitalization: $7.92 billion

Company Overview

With a strong presence in the Western US, Lithia Motors (NYSE:LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

In addition to the broad selection of cars, Lithia also integrates sales, financing, and service in a single location, which streamlines the car-buying process and offers convenience to shoppers and customers. The core customer is therefore someone in the market to purchase a vehicle. This potential customer–typically an individual or family that relies on a car for work, errands, and general family activities–may not know whether they want a new car or a used one, a sedan or an SUV. However, this customer values the selection that Lithia offers.

Lithia Motors locations range from around 20,000 to 50,000 square feet. These stores are standalone and typically positioned in high-traffic areas, often near major highways or busy city centers. Vehicles are usually positioned outside so passersby can see popular or new models. Inside, more vehicles are displayed and sales professionals are available to talk shop, set up test drives, or answer questions about financing.

In addition to its physical locations, Lithia Motors has an online presence that was launched in 2018. You can either use the platform to research and check what’s for sale at nearby locations, or you can use it to actually buy a car.

4. Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Competitors in the auto retail space include AutoNation (NYSE:AN), Carvana (NYSE:CVNA), and Group 1 Automotive (NYSE:GPI).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

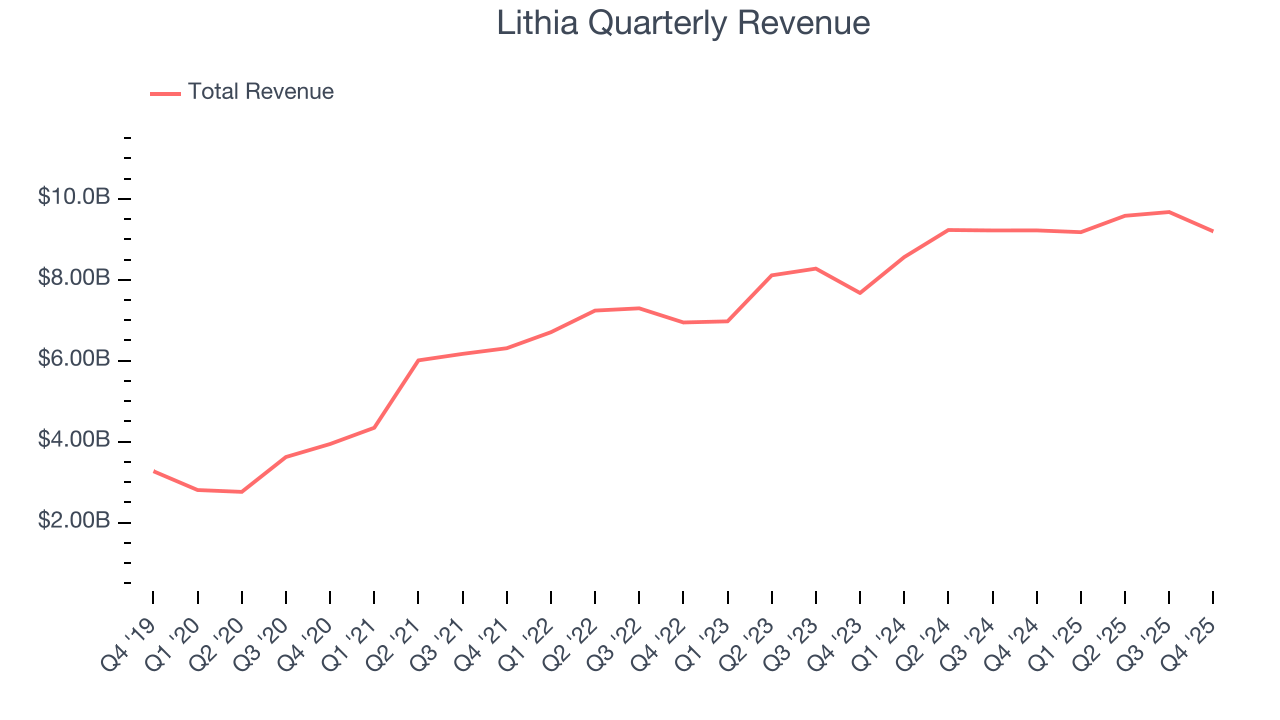

With $37.63 billion in revenue over the past 12 months, Lithia is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions.

As you can see below, Lithia’s 10.1% annualized revenue growth over the last three years was decent as it opened new stores and expanded its reach.

This quarter, Lithia missed Wall Street’s estimates and reported a rather uninspiring 0.3% year-on-year revenue decline, generating $9.20 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months, a deceleration versus the last three years. We still think its growth trajectory is attractive given its scale and indicates the market is forecasting success for its products.

6. Store Performance

Number of Stores

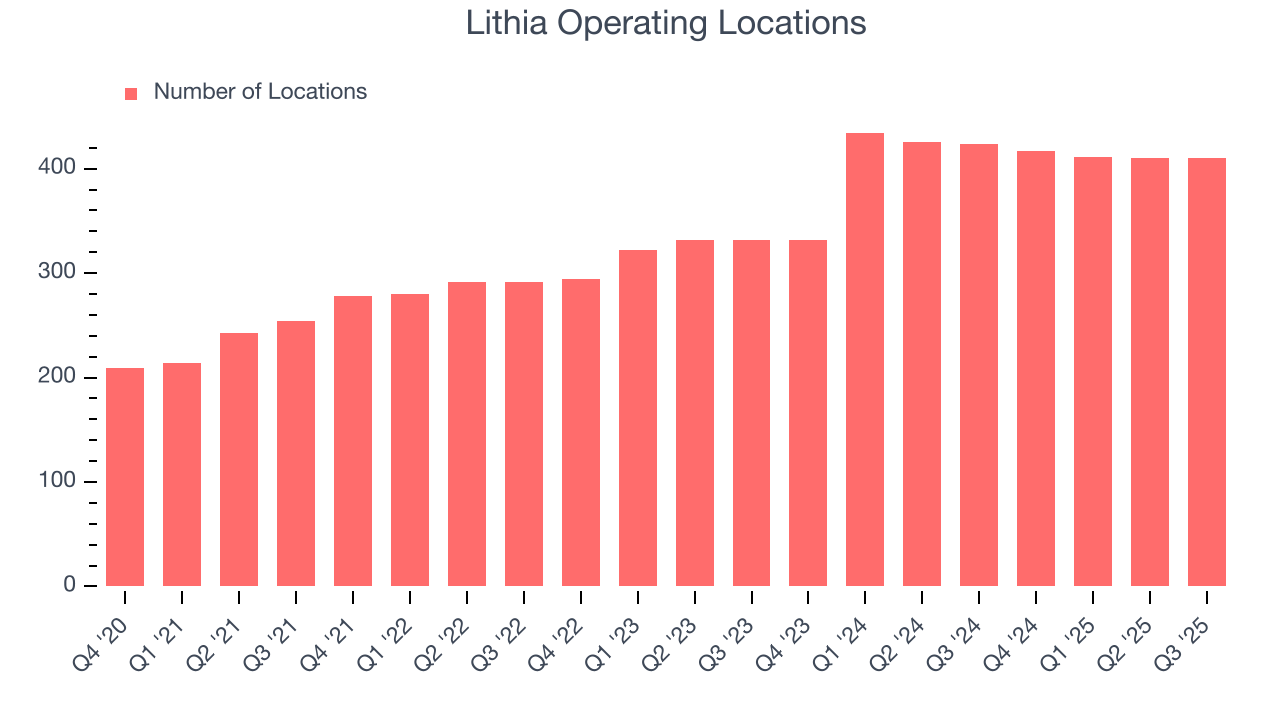

Lithia opened new stores at a rapid clip over the last two years, averaging 15% annual growth, much faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Lithia reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

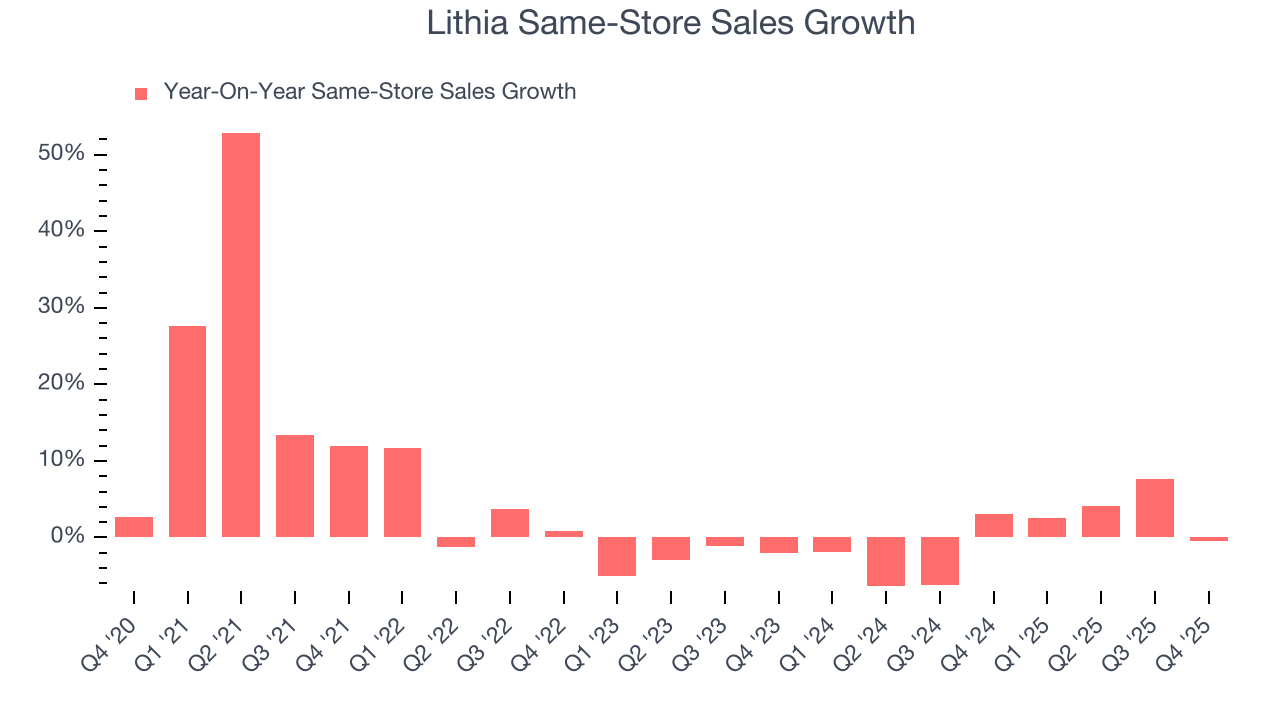

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Lithia’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Lithia should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Lithia’s year on year same-store sales were flat. This performance was more or less in line with its historical levels.

7. Gross Margin & Pricing Power

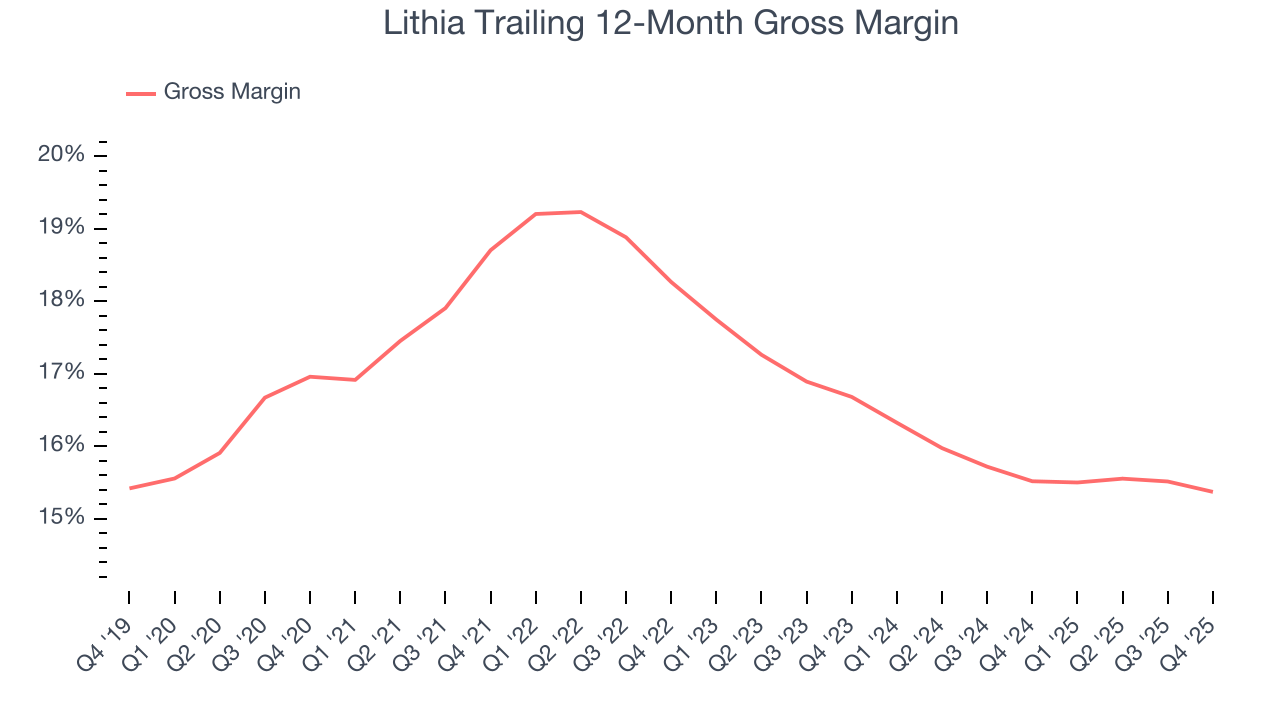

Lithia has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 15.4% gross margin over the last two years. That means Lithia paid its suppliers a lot of money ($84.56 for every $100 in revenue) to run its business.

Lithia produced a 14.9% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

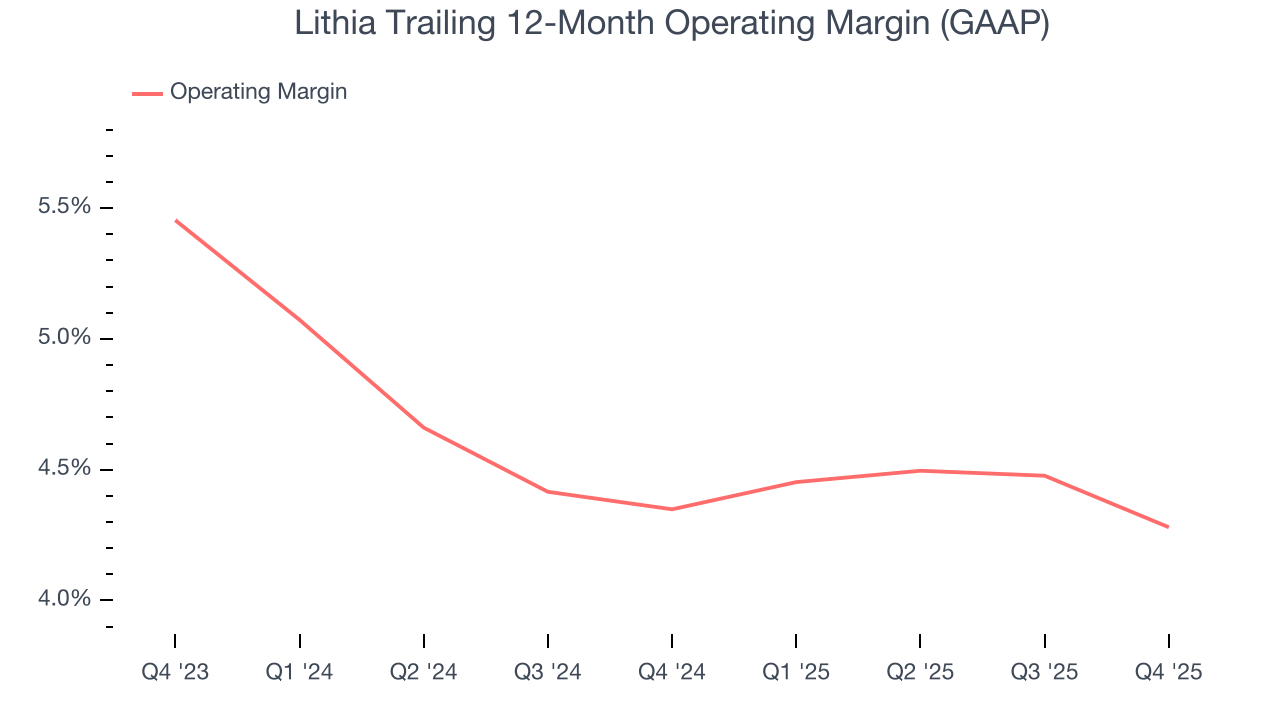

Lithia’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 4.3% over the last two years. This profitability was lousy for a consumer retail business and caused by its suboptimal cost structureand low gross margin.

Looking at the trend in its profitability, Lithia’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Lithia generated an operating margin profit margin of 3.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Earnings Per Share

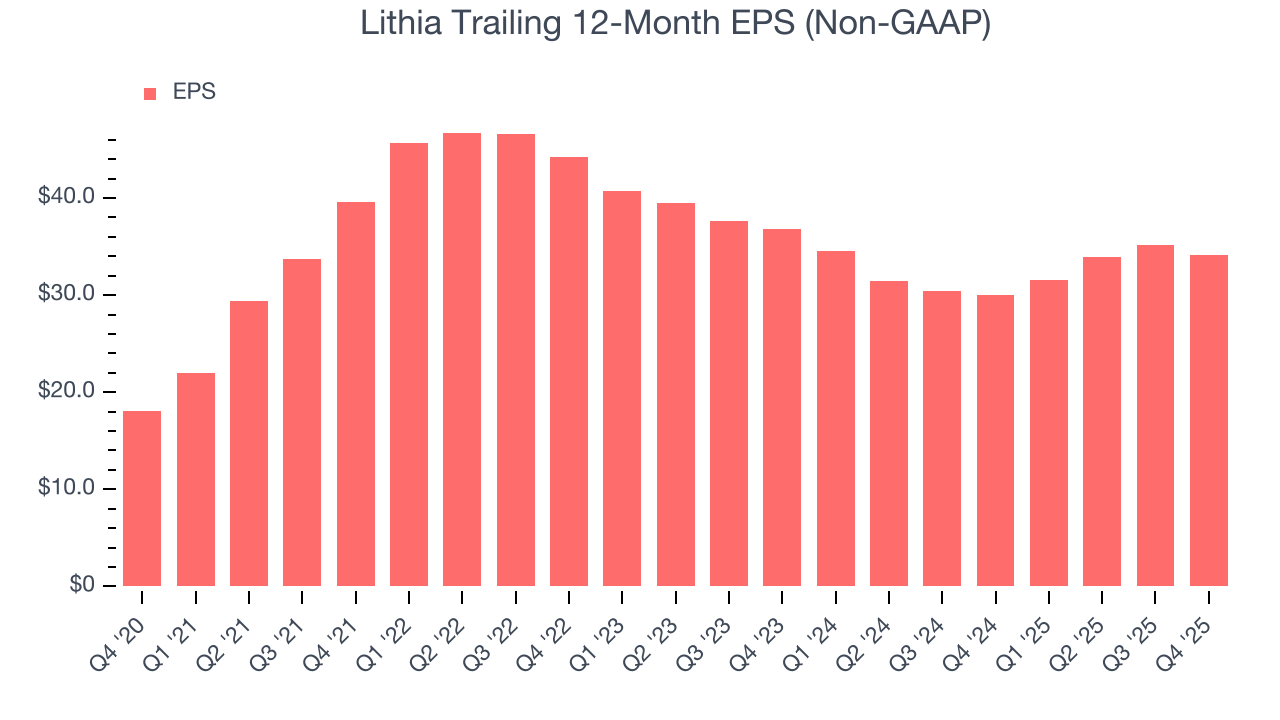

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Lithia, its EPS declined by 8.3% annually over the last three years while its revenue grew by 10.1%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q4, Lithia reported adjusted EPS of $6.74, down from $7.79 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Lithia’s full-year EPS of $34.14 to grow 10.4%.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

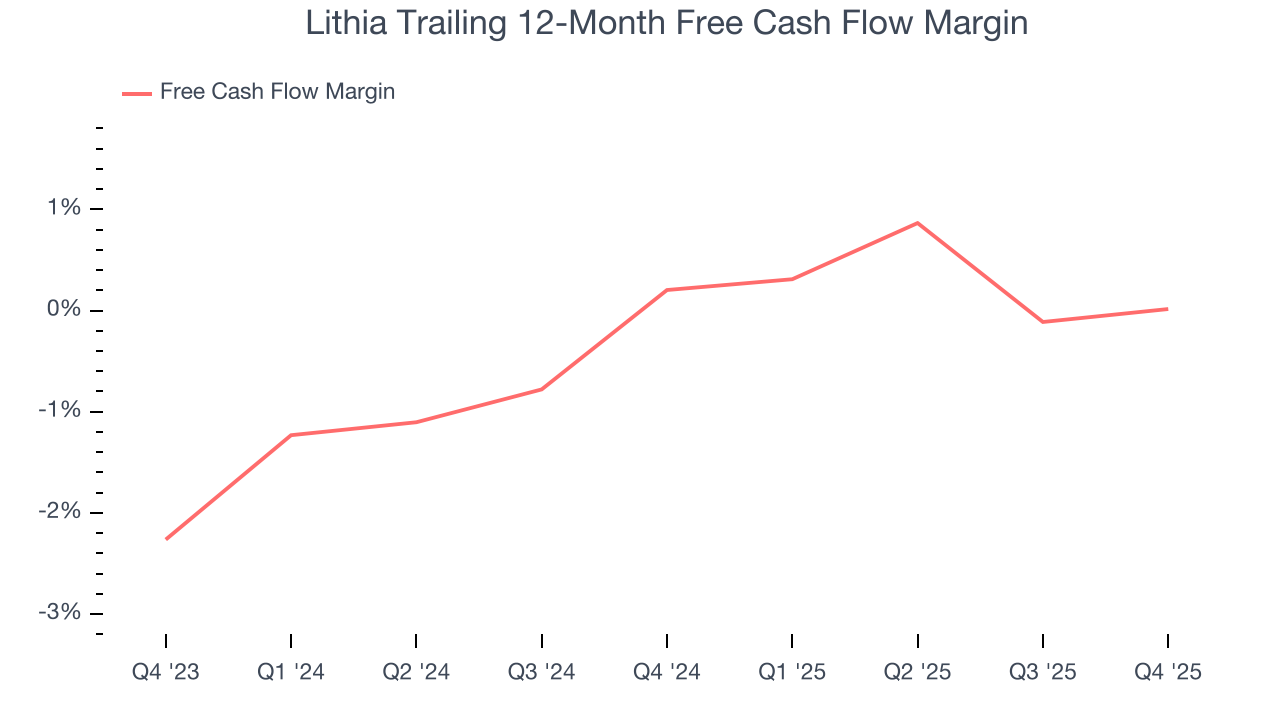

Lithia broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Lithia broke even from a free cash flow perspective in Q4. This cash profitability was in line with the comparable period last year and its two-year average.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Lithia historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10.5%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

12. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

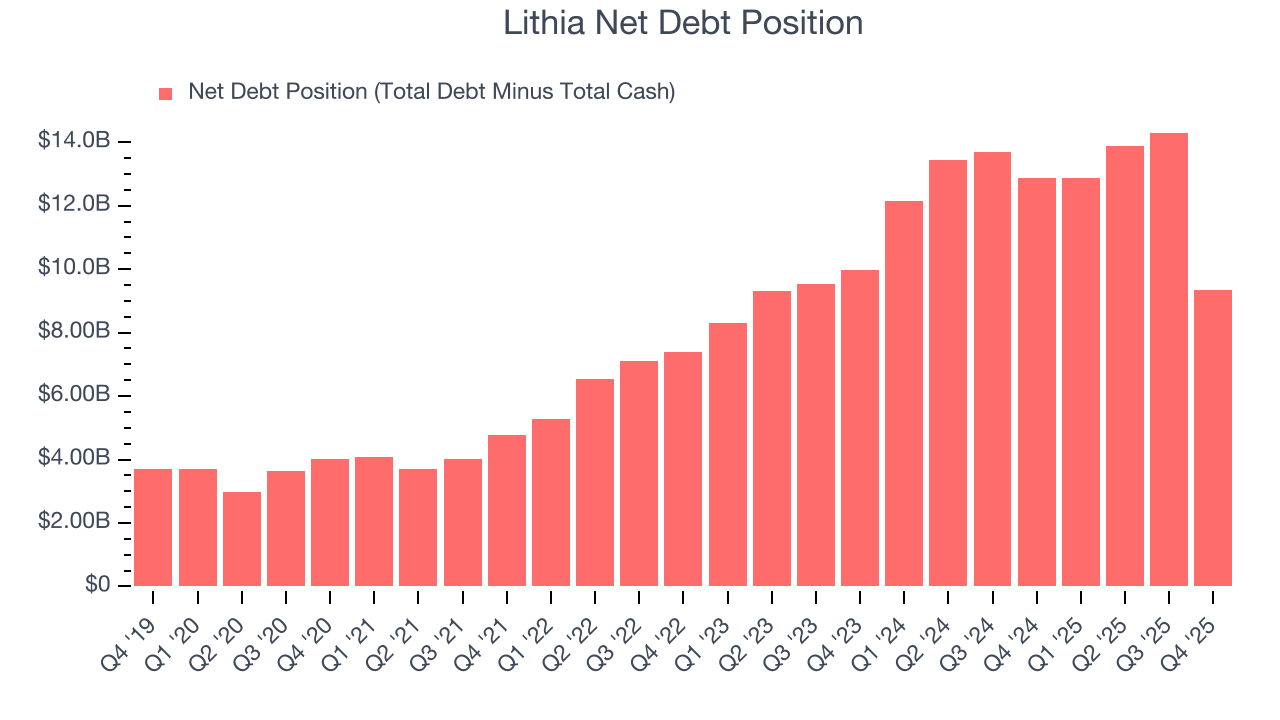

Lithia’s $9.68 billion of debt exceeds the $341.8 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $1.82 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Lithia could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Lithia can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

13. Key Takeaways from Lithia’s Q4 Results

We struggled to find many positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 4% to $311.94 immediately after reporting.

14. Is Now The Time To Buy Lithia?

Updated: February 11, 2026 at 9:37 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Lithia isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was decent over the last three years, it’s expected to deteriorate over the next 12 months and its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses. And while the company’s new store openings have increased its brand equity, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets.

Lithia’s P/E ratio based on the next 12 months is 8.7x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $396.71 on the company (compared to the current share price of $320.18).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.