Lamb Weston (LW)

We’re cautious of Lamb Weston. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Lamb Weston Will Underperform

Best known for its Grown in Idaho brand, Lamb Weston (NYSE:LW) produces and distributes potato products such as frozen french fries and mashed potatoes.

- Projected sales are flat for the next 12 months, implying demand will slow from its three-year trend

- Gross margin of 23.9% is an output of its commoditized products

- A bright spot is that its unit sales averaged 5.3% growth over the past two years and imply healthy demand for its products

Lamb Weston is in the doghouse. There are more promising alternatives.

Why There Are Better Opportunities Than Lamb Weston

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Lamb Weston

Lamb Weston is trading at $59.37 per share, or 18.6x forward P/E. This multiple is high given its weaker fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. Lamb Weston (LW) Research Report: Q4 CY2025 Update

Potato products company Lamb Weston (NYSE:LW) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 1.1% year on year to $1.62 billion. On the other hand, the company’s full-year revenue guidance of $6.45 billion at the midpoint came in 1% below analysts’ estimates. Its non-GAAP profit of $0.69 per share was 6.4% above analysts’ consensus estimates.

Lamb Weston (LW) Q4 CY2025 Highlights:

- Revenue: $1.62 billion vs analyst estimates of $1.59 billion (1.1% year-on-year growth, 1.8% beat)

- Adjusted EPS: $0.69 vs analyst estimates of $0.65 (6.4% beat)

- Adjusted EBITDA: $285.7 million vs analyst estimates of $273.4 million (17.7% margin, 4.5% beat)

- The company reconfirmed its revenue guidance for the full year of $6.45 billion at the midpoint

- EBITDA guidance for the full year is $1.1 billion at the midpoint, below analyst estimates of $1.19 billion

- Operating Margin: 8.6%, up from 1.2% in the same quarter last year

- Free Cash Flow was $101 million, up from -$49.6 million in the same quarter last year

- Organic Revenue rose 1% year on year vs analyst estimates of 1.5% declines (254 basis point beat)

- Sales Volumes rose 8% year on year (-6% in the same quarter last year)

- Market Capitalization: $8.27 billion

Company Overview

Best known for its Grown in Idaho brand, Lamb Weston (NYSE:LW) produces and distributes potato products such as frozen french fries and mashed potatoes.

The company was founded in 1950 and began as a small regional supplier of frozen potato products in the Pacific Northwest. Over the subsequent decades, Lamb Weston merged with and was spun off from Conagra.

Today, Lamb Weston's product portfolio still centers around potato products, whether it be frozen curly fries or potato chips of various cuts and textures. The company goes to market with its Grown in Idaho and Alexia brands, selling both to individual consumers as well as restaurants and food service businesses.

As such, Lamb Weston’s core customers can be the global fast-food chain with fries on the menu or the mom/dad that does the grocery shopping for the family. Either way, both these customers want a dependable brand that offers convenience and competitive prices. For the retail customer, Lamb Weston products can be found at supermarkets, regional grocery stores, and large general merchandise retailers that sell food.

4. Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors offering frozen or potato-based packaged foods include Hormel Foods (NYSE:HRL), Conagra Brands (NYSE:CAG), Kraft Heinz (NASDAQ:KHC), and private company McCain Foods.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $6.47 billion in revenue over the past 12 months, Lamb Weston is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions.

As you can see below, Lamb Weston grew its sales at a solid 12.8% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Lamb Weston reported modest year-on-year revenue growth of 1.1% but beat Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products will face some demand challenges.

6. Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Lamb Weston generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

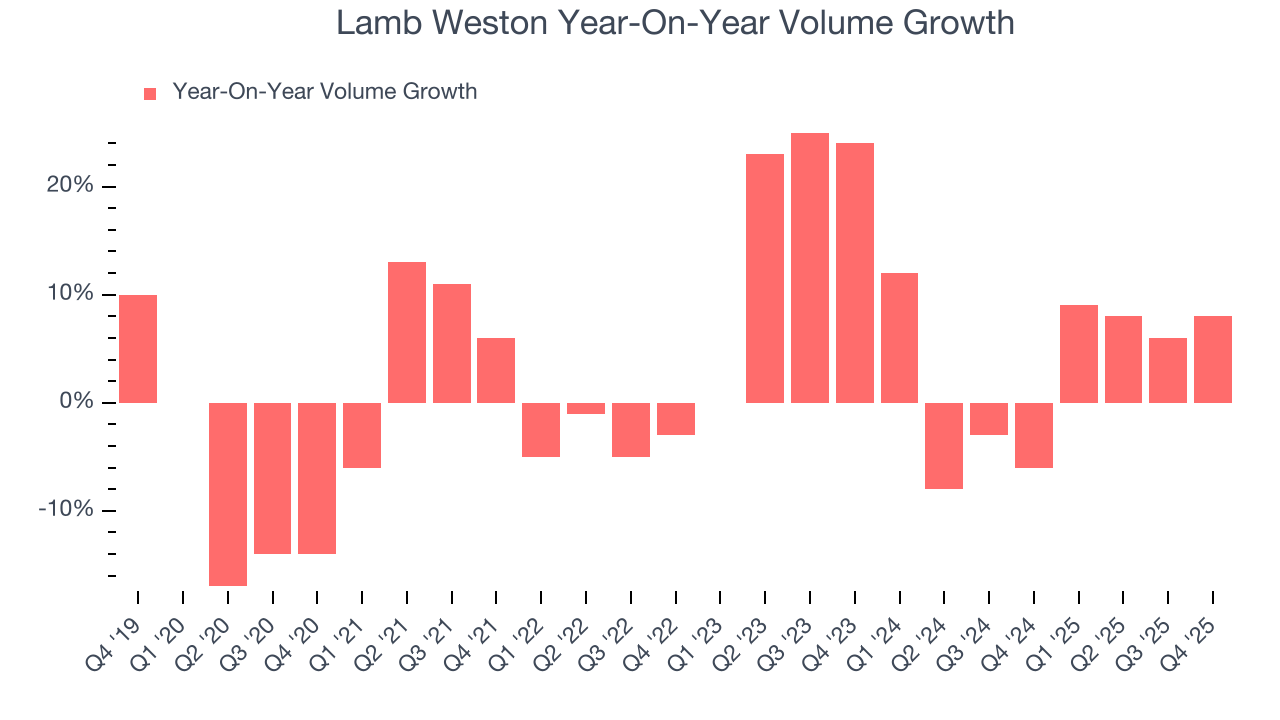

Over the last two years, Lamb Weston’s average quarterly volume growth was a healthy 3.3%. In the context of its 1.3% average organic revenue growth, we can see that most of the company’s gains have come from more customers purchasing its products.

In Lamb Weston’s Q4 2026, sales volumes jumped 8% year on year. This result was an acceleration from its historical levels, certainly a positive signal.

7. Gross Margin & Pricing Power

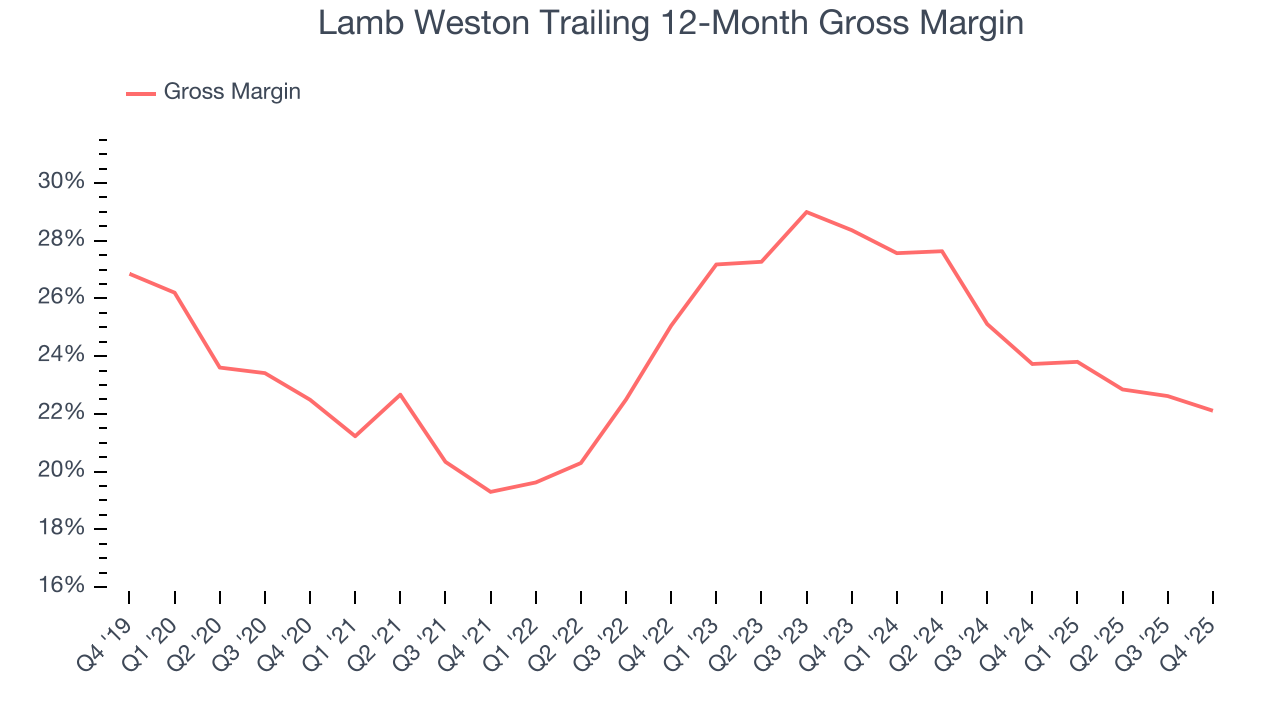

Lamb Weston has bad unit economics for a consumer staples company, giving it less room to reinvest and develop new products. As you can see below, it averaged a 22.9% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $77.09 went towards paying for raw materials, production of goods, transportation, and distribution.

Lamb Weston’s gross profit margin came in at 20% this quarter, down 2 percentage points year on year. Lamb Weston’s full-year margin has also been trending down over the past 12 months, decreasing by 1.6 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

8. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

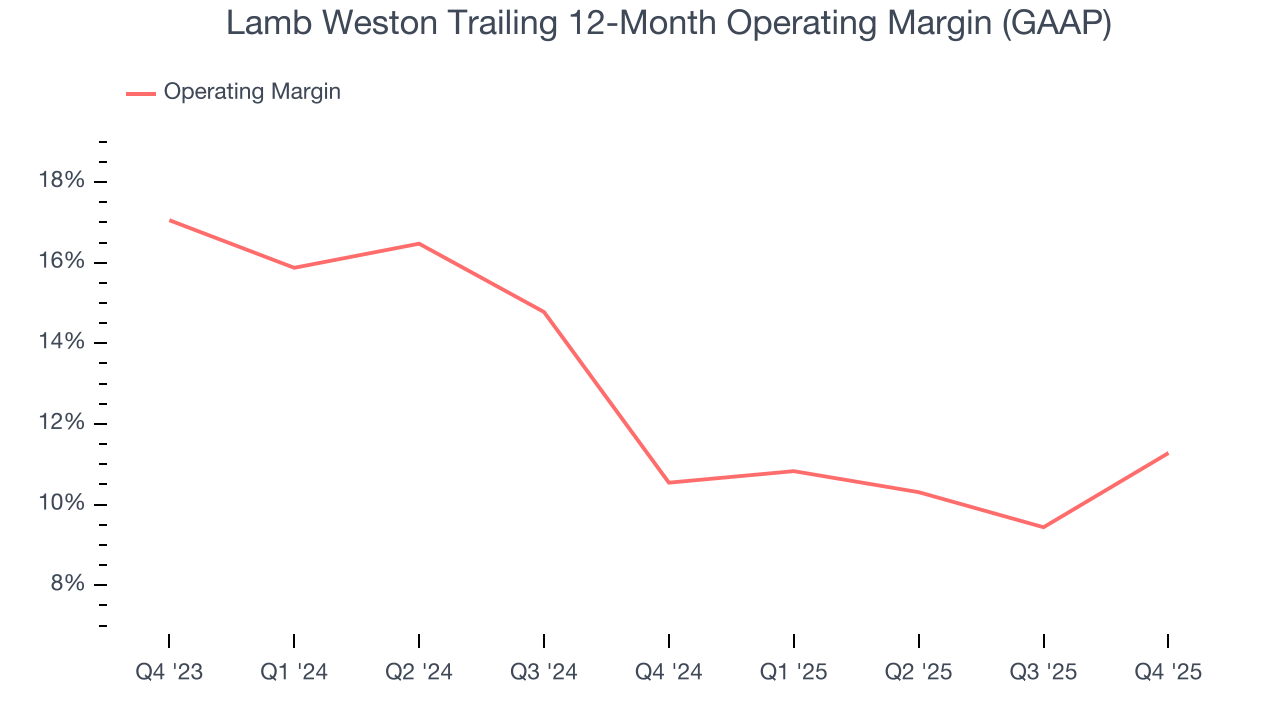

Lamb Weston’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 10.9% over the last two years. This profitability was higher than the broader consumer staples sector, showing it did a decent job managing its expenses.

Analyzing the trend in its profitability, Lamb Weston’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Lamb Weston generated an operating margin profit margin of 8.6%, up 7.4 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, and administrative overhead grew slower than its revenue.

9. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

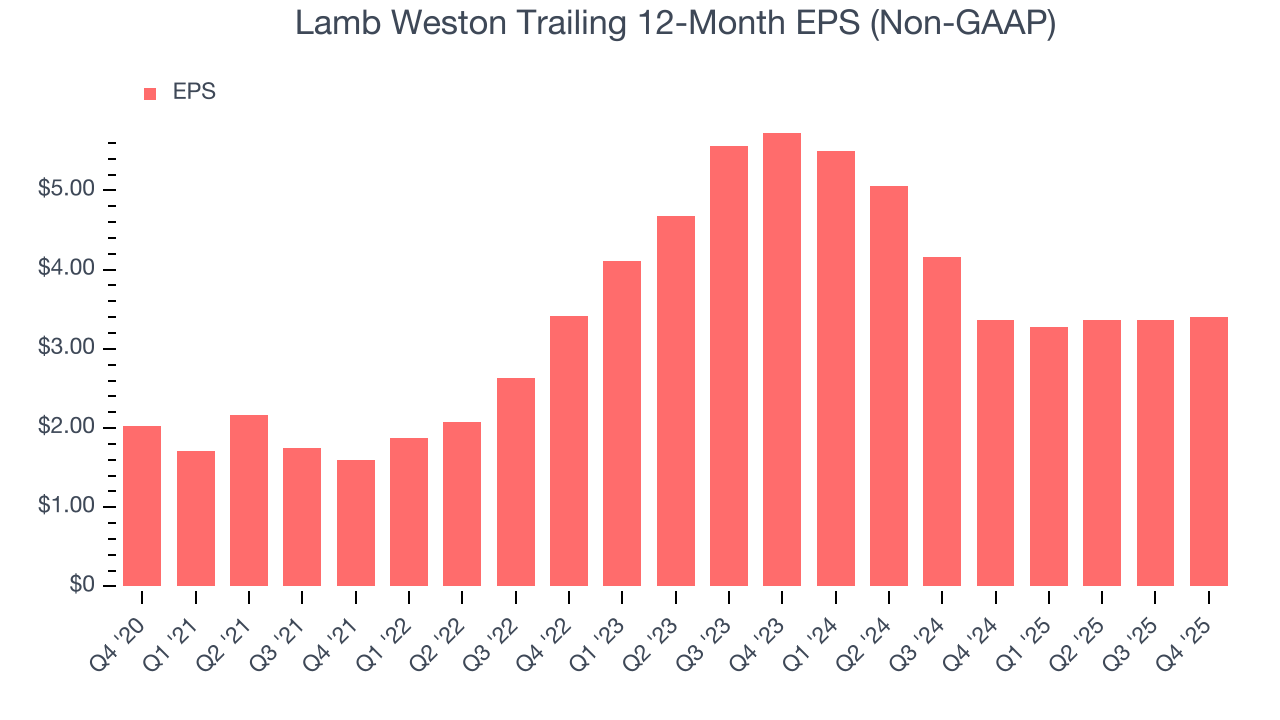

In Q4, Lamb Weston reported adjusted EPS of $0.69, up from $0.66 in the same quarter last year. This print beat analysts’ estimates by 6.4%. Over the next 12 months, Wall Street expects Lamb Weston’s full-year EPS of $3.40 to shrink by 1.4%.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

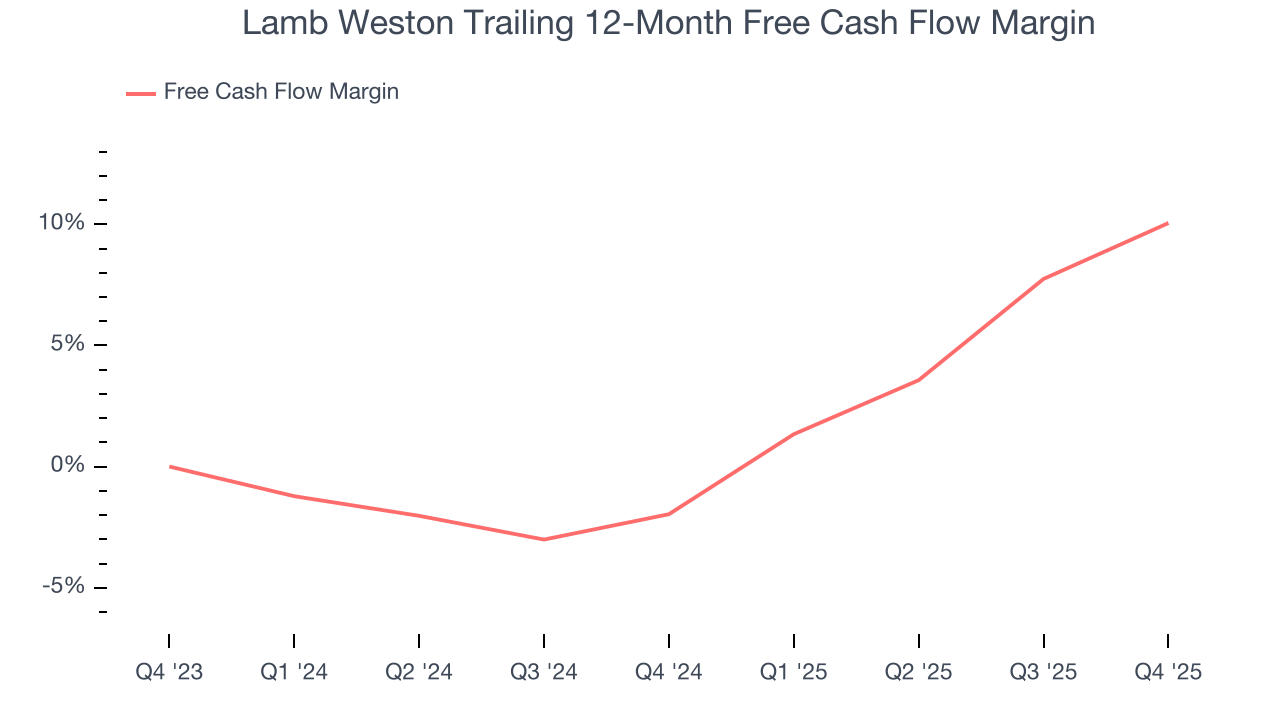

Lamb Weston has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.1%, subpar for a consumer staples business.

Taking a step back, an encouraging sign is that Lamb Weston’s margin expanded by 12 percentage points over the last year. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Lamb Weston’s free cash flow clocked in at $101 million in Q4, equivalent to a 6.2% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

11. Return on Invested Capital (ROIC)

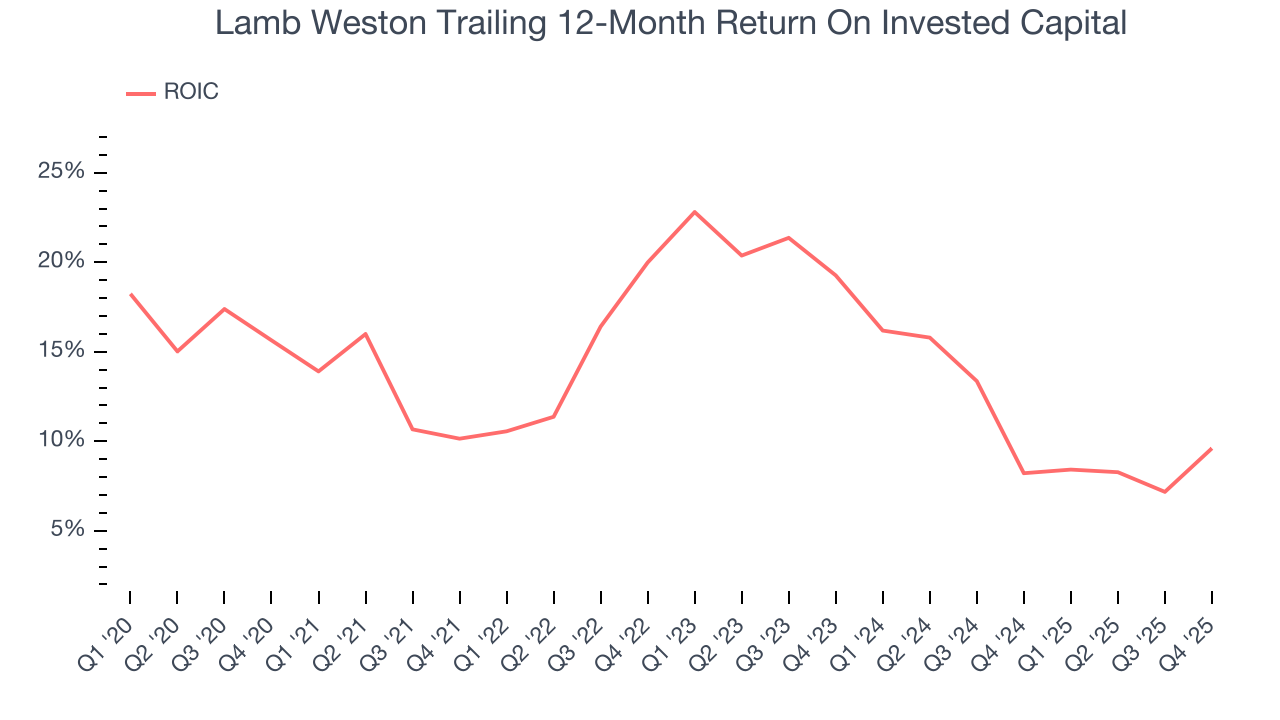

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Lamb Weston’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 13.4%, slightly better than typical consumer staples business.

12. Balance Sheet Assessment

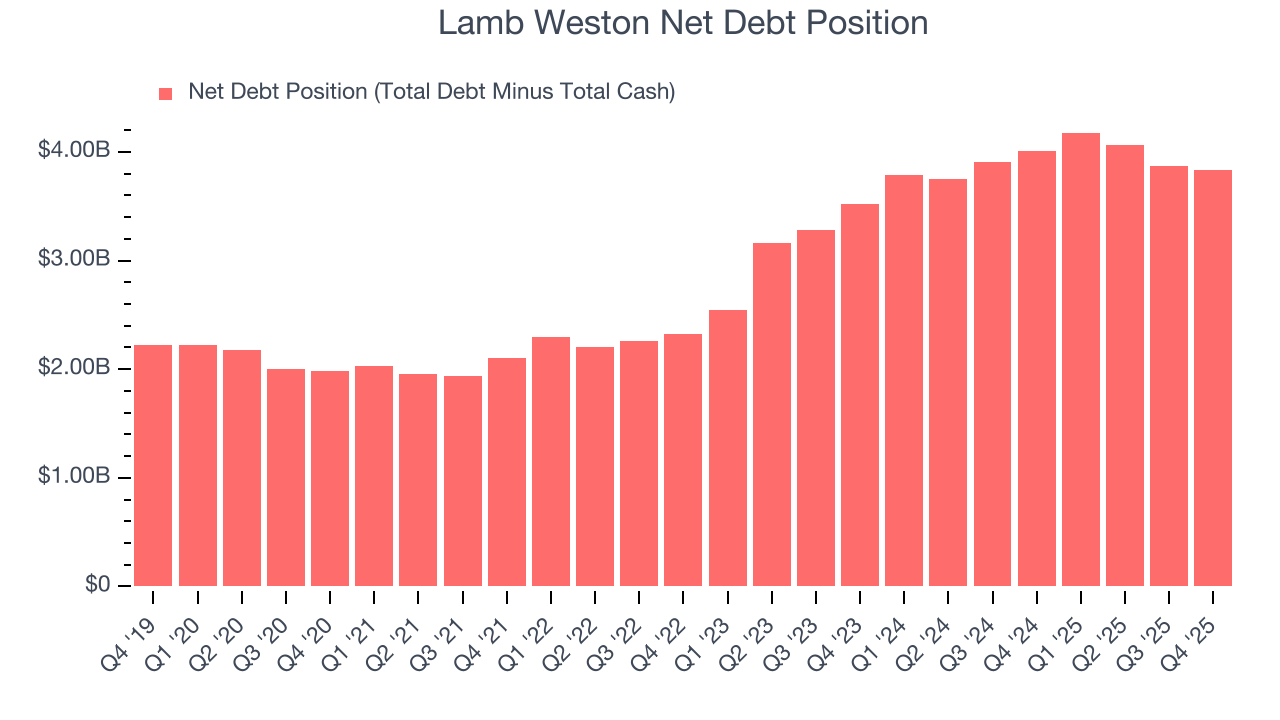

Lamb Weston reported $82.7 million of cash and $3.92 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.25 billion of EBITDA over the last 12 months, we view Lamb Weston’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $90.9 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Lamb Weston’s Q4 Results

We enjoyed seeing Lamb Weston beat analysts’ organic revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its gross margin missed and full-year EBITDA guidance fell short of Wall Street’s estimates. The latter is weighing on shares. The market seemed to be hoping for more, and the stock traded down 9.6% to $53.63 immediately following the results.

14. Is Now The Time To Buy Lamb Weston?

Updated: December 19, 2025 at 8:42 AM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Lamb Weston, you should also grasp the company’s longer-term business quality and valuation.

Lamb Weston isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was good over the last three years, it’s expected to deteriorate over the next 12 months and its projected EPS for the next year is lacking. And while the company’s rising cash profitability gives it more optionality, the downside is its gross margins make it more difficult to reach positive operating profits compared to other consumer staples businesses.

Lamb Weston’s P/E ratio based on the next 12 months is 17.7x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $66.27 on the company (compared to the current share price of $53.63).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.