Mastercard (MA)

Not many stocks excite us like Mastercard. Its exceptional revenue growth and returns on capital show it can expand quickly and profitably.― StockStory Analyst Team

1. News

2. Summary

Why We Like Mastercard

Recognizable by its iconic "Priceless" advertising campaign that has run in over 120 countries, Mastercard (NYSE:MA) operates a global payments network that connects consumers, financial institutions, merchants, and businesses, enabling electronic transactions and providing payment solutions.

- ROE punches in at 164%, illustrating management’s expertise in identifying profitable investments

- Incremental sales over the last five years have been more profitable as its earnings per share increased by 19% annually, topping its revenue gains

- Market share has increased this cycle as its 15.1% annual revenue growth over the last five years was exceptional

We’re optimistic about Mastercard. This is one of the best financials stocks in our coverage.

Is Now The Time To Buy Mastercard?

Is Now The Time To Buy Mastercard?

Mastercard’s stock price of $521.15 implies a valuation ratio of 28.3x forward P/E. There are high expectations given this pricey multiple; we can’t deny that.

Are you a fan of the company and believe in the bull case? If so, you can own a smaller position, as high-quality companies tend to outperform the market over a long-term period regardless of entry price.

3. Mastercard (MA) Research Report: Q4 CY2025 Update

Global payments technology company Mastercard (NYSE:MA) met Wall Streets revenue expectations in Q4 CY2025, with sales up 17.6% year on year to $8.81 billion. Its non-GAAP profit of $4.76 per share was 12.3% above analysts’ consensus estimates.

Mastercard (MA) Q4 CY2025 Highlights:

- Volume: $0.10 vs analyst estimates of $0.07 (16.2% year-on-year decline, 43.5% beat)

- Revenue: $8.81 billion vs analyst estimates of $8.77 billion (17.6% year-on-year growth, in line)

- Pre-tax Profit: $4.88 billion (55.4% margin)

- Adjusted EPS: $4.76 vs analyst estimates of $4.24 (12.3% beat)

- Market Capitalization: $468.2 billion

Company Overview

Recognizable by its iconic "Priceless" advertising campaign that has run in over 120 countries, Mastercard (NYSE:MA) operates a global payments network that connects consumers, financial institutions, merchants, and businesses, enabling electronic transactions and providing payment solutions.

Mastercard's network serves as the backbone of its business, facilitating the authorization, clearing, and settlement of payment transactions. The company operates what's known as a "four-party" payment system involving account holders, merchants, and their respective financial institutions. Rather than issuing cards or setting interest rates itself, Mastercard provides the infrastructure and rules that enable these transactions to occur securely and efficiently.

The company generates revenue primarily through fees based on the gross dollar volume of activity on cards bearing its brands, as well as from transaction switching services. Mastercard's portfolio includes credit, debit, and prepaid payment products under brands like Mastercard, Maestro, and Cirrus, catering to consumers across standard, premium, and affluent segments.

Beyond its core payment network, Mastercard has expanded into value-added services and solutions. These include security offerings that protect against fraud and cyber threats, data analytics that provide business intelligence, marketing services that help financial institutions acquire and engage customers, and consulting services that optimize payment strategies. The company also offers processing capabilities, digital authentication solutions, and open banking platforms.

For example, a retailer might use Mastercard's fraud detection technology to identify suspicious transactions in real-time, while a bank might leverage its data insights to create targeted marketing campaigns for cardholders. Mastercard's tokenization services replace sensitive card information with unique digital identifiers, allowing consumers to make secure purchases using smartphones or other connected devices.

4. Credit Card

Credit card companies facilitate electronic payments and extend revolving credit to consumers. Growth comes from increasing digital payment adoption, cross-border transaction growth, and value-added services for cardholders and merchants. Challenges include regulatory scrutiny of fees and practices, competition from alternative payment methods, and potential credit losses during economic downturns.

Mastercard's primary competitors include Visa, which operates the largest payment network globally, American Express, which uses a closed-loop network model, and regional players like China UnionPay, JCB (Japan Credit Bureau), and Discover. The company also faces competition from emerging payment technologies and fintech companies offering alternative payment methods.

5. Revenue Growth

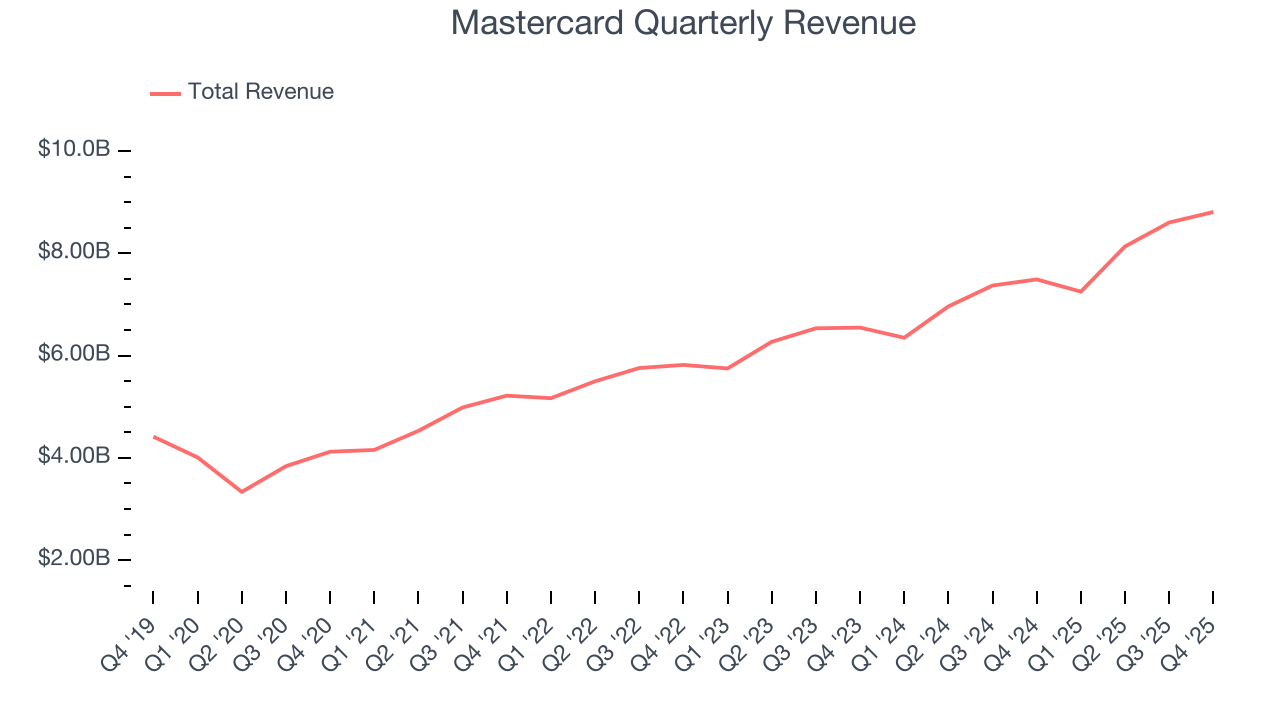

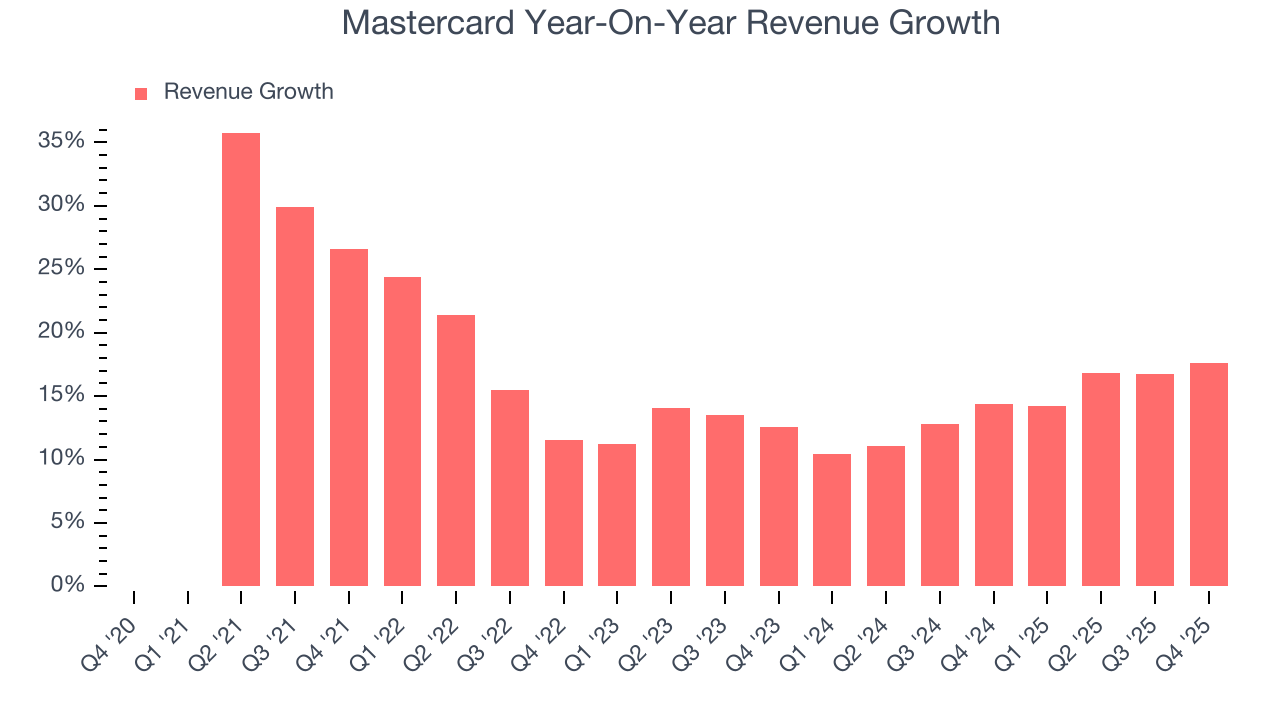

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Mastercard’s 16.5% annualized revenue growth over the last five years was impressive. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Mastercard’s annualized revenue growth of 14.3% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Mastercard’s year-on-year revenue growth was 17.6%, and its $8.81 billion of revenue was in line with Wall Street’s estimates.

6. Volume

Financial services companies rely heavily on the total number of transactions and loan originations to drive top-line growth. Understanding these volumes is essential for finding winners in the sector.

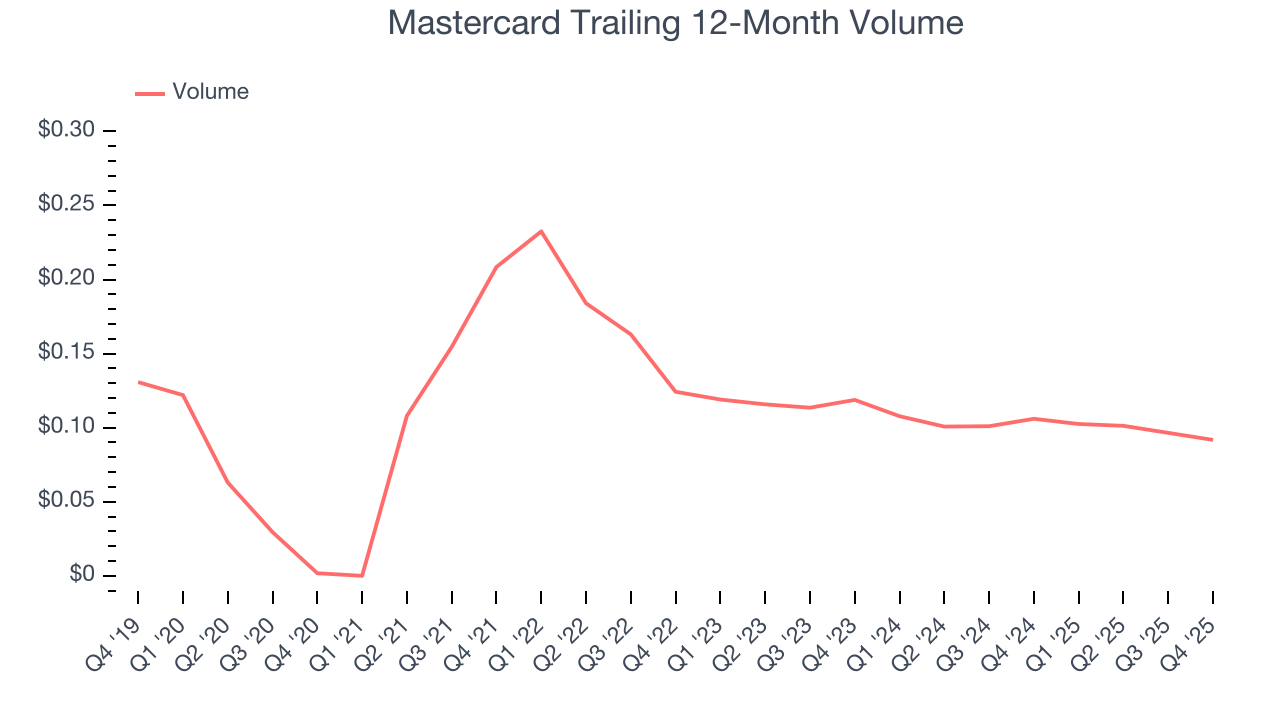

Mastercard’s volumes have grown at an annual rate of 121% over the last five years, much better than the broader financials industry and faster than its total revenue. When analyzing Mastercard’s volumes over the last two years, we can see its volumes dropped by 12.1% annually. Its recent performance could be a roadblock for any valuation multiple expansion.

In Q4, Mastercard’s volumes were $0.10, beating analysts’ expectations by 43.5%. This print was 16.2% lower than the same quarter last year.

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Credit Card companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Financials companies manage interest-bearing assets and liabilities, making the interest income and expenses included in pre-tax profit essential to their profit calculation. Taxes, being external factors beyond management control, are appropriately excluded from this alternative margin measure.

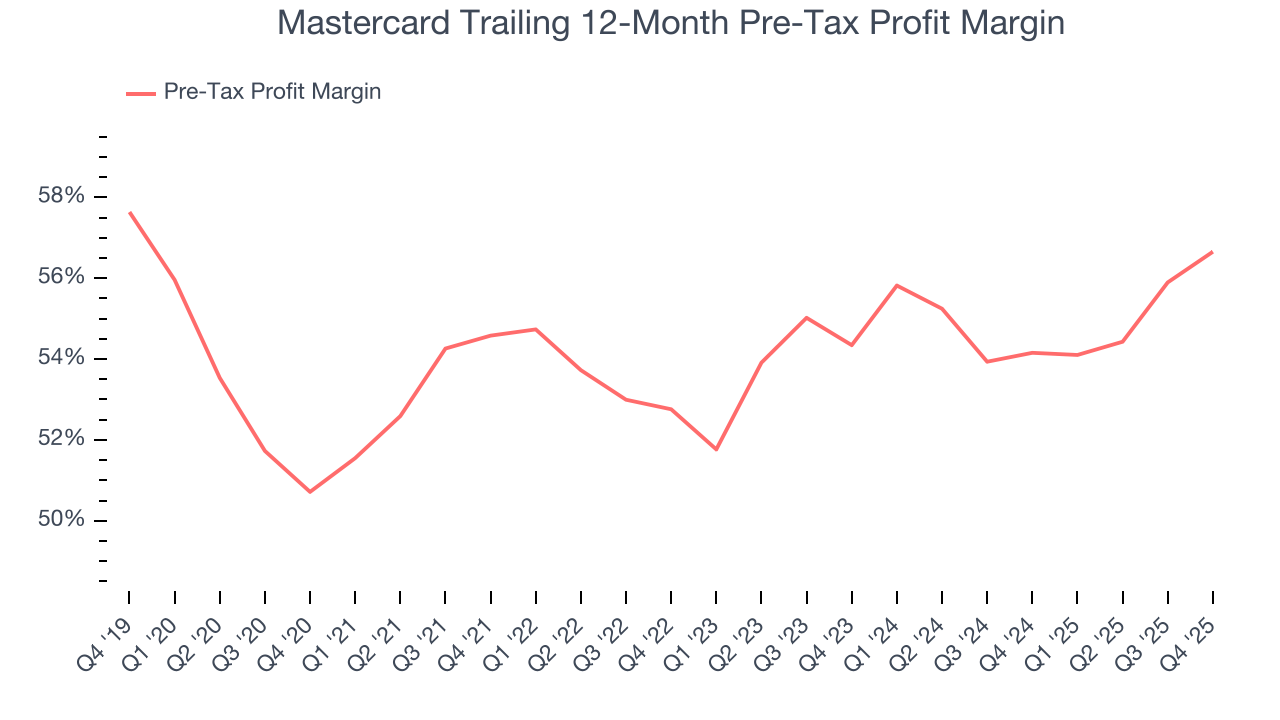

Over the last five years, Mastercard’s pre-tax profit margin has fallen by 5.9 percentage points, going from 54.6% to 56.7%. It has also expanded by 2.3 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

In Q4, Mastercard’s pre-tax profit margin was 55.4%. This result was 3.4 percentage points better than the same quarter last year.

8. Earnings Per Share

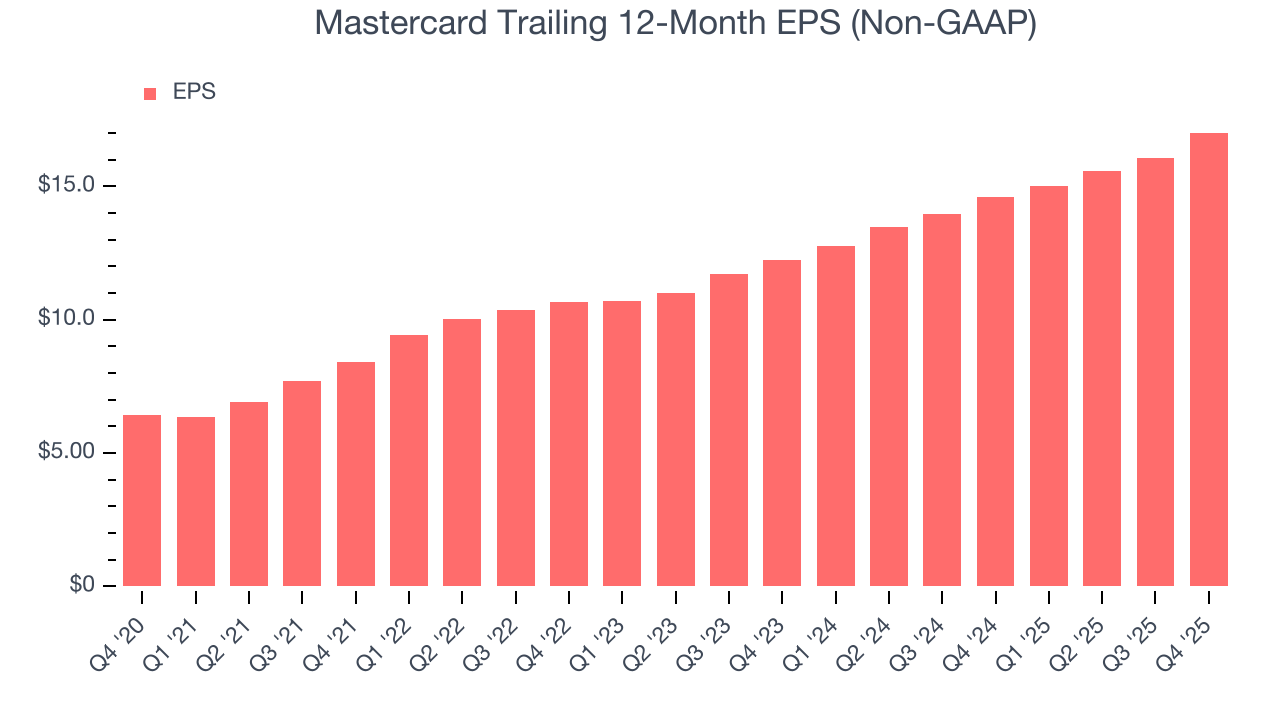

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Mastercard’s EPS grew at a spectacular 21.5% compounded annual growth rate over the last five years, higher than its 16.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Mastercard, its two-year annual EPS growth of 17.8% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Mastercard reported adjusted EPS of $4.76, up from $3.82 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Mastercard’s full-year EPS of $17.02 to grow 12.6%.

9. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Mastercard has averaged an ROE of 167%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Mastercard has a strong competitive moat.

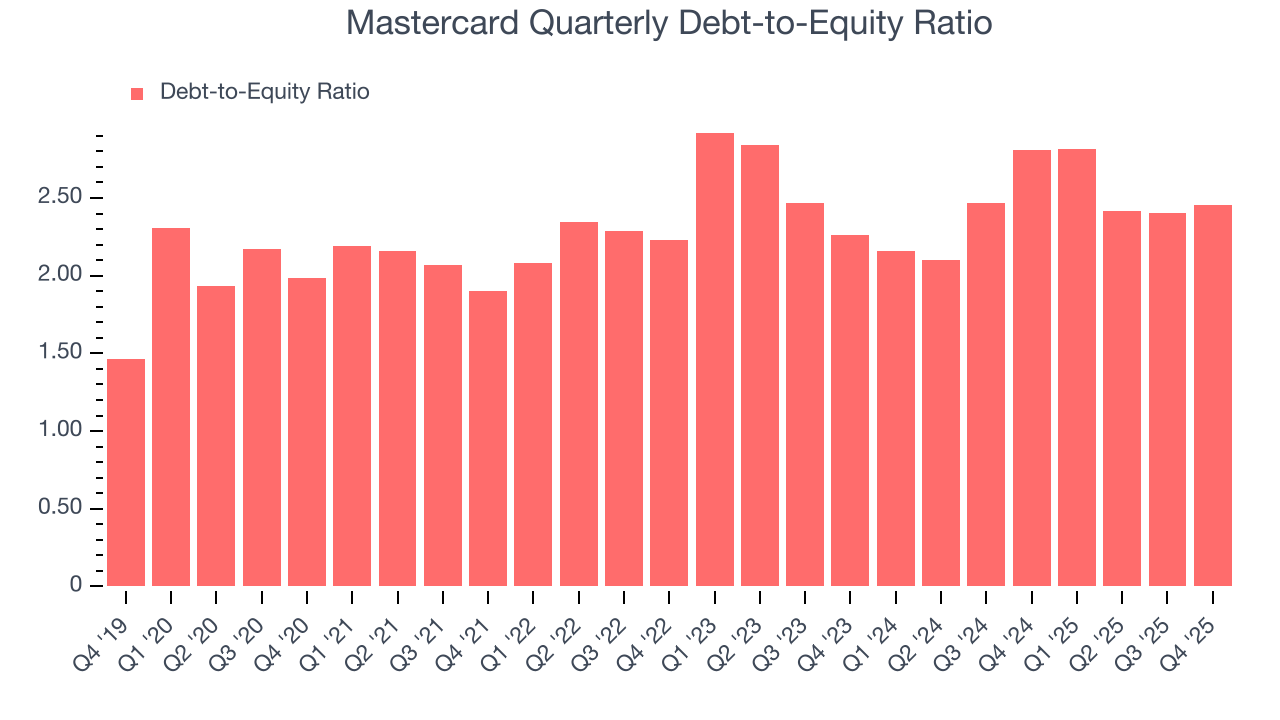

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Mastercard currently has $19 billion of debt and $7.74 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 2.5×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from Mastercard’s Q4 Results

We were impressed by how significantly Mastercard blew past analysts’ transaction volumes expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 2.3% to $533.14 immediately following the results.

12. Is Now The Time To Buy Mastercard?

Updated: January 29, 2026 at 8:56 AM EST

When considering an investment in Mastercard, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are multiple reasons why we think Mastercard is an elite financials company. First of all, the company’s revenue growth was impressive over the last five years. On top of that, its stellar ROE suggests it has been a well-run company historically, and its transaction volume growth was exceptional over the last five years.

Mastercard’s P/E ratio based on the next 12 months is 27.2x. This multiple isn’t necessarily cheap, but we’ll happily own Mastercard as its fundamentals illustrate it’s clearly doing something special. We’re in the camp that investments like this should be held for at least three to five years to negate the short-term price volatility that can come with relatively high valuations.

Wall Street analysts have a consensus one-year price target of $662.81 on the company (compared to the current share price of $533.14).