Moody's (MCO)

We see solid potential in Moody's. Its stellar 63.8% ROE illustrates management’s exceptional investing abilities.― StockStory Analyst Team

1. News

2. Summary

Why We Like Moody's

Founded in 1900 during America's railroad boom when investors needed reliable information on bond risks, Moody's (NYSE:MCO) provides credit ratings, risk assessment tools, and analytical solutions that help organizations evaluate financial risks and make informed investment decisions.

- Industry-leading 63.8% return on equity demonstrates management’s skill in finding high-return investments

- Performance over the past two years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 22.3% outpaced its revenue gains

- Offerings and unique value proposition resonate with customers, as seen in its above-market 14.5% annual sales growth over the last two years

We have an affinity for Moody's. This is a fantastic business you don’t see often.

Is Now The Time To Buy Moody's?

High Quality

Investable

Underperform

Is Now The Time To Buy Moody's?

At $426.71 per share, Moody's trades at 26.4x forward P/E. The premium valuation means there’s much good news priced into the stock - we certainly can’t argue with that.

Are you a fan of the company and its story? If so, we suggest a small position as the long-term outlook seems promising. We’d still note its valuation could cause choppy short-term results.

3. Moody's (MCO) Research Report: Q4 CY2025 Update

Credit rating agency Moody's (NYSE:MCO) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 13% year on year to $1.89 billion. Its non-GAAP profit of $3.64 per share was 6.1% above analysts’ consensus estimates.

Moody's (MCO) Q4 CY2025 Highlights:

- Revenue: $1.89 billion vs analyst estimates of $1.86 billion (13% year-on-year growth, 1.6% beat)

- Pre-tax Profit: $687 million (36.4% margin)

- Adjusted EPS: $3.64 vs analyst estimates of $3.44 (6.1% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $16.70 at the midpoint, beating analyst estimates by 1.5%

- Market Capitalization: $75.5 billion

Company Overview

Founded in 1900 during America's railroad boom when investors needed reliable information on bond risks, Moody's (NYSE:MCO) provides credit ratings, risk assessment tools, and analytical solutions that help organizations evaluate financial risks and make informed investment decisions.

Moody's operates through two main business segments: Moody's Investors Service (MIS) and Moody's Analytics (MA). The MIS division assigns credit ratings to debt securities, structured finance products, and the entities that issue them—including corporations, financial institutions, and governments worldwide. These ratings, which range from Aaa (highest quality) to C (lowest quality), serve as critical benchmarks that influence borrowing costs and investor decisions in global capital markets.

The Moody's Analytics segment complements the ratings business by offering a suite of tools that help organizations assess and manage various types of risk. This includes software platforms for credit analysis, economic research, financial modeling, and regulatory compliance. For example, a regional bank might use Moody's analytics software to evaluate loan portfolios and stress-test their performance under different economic scenarios.

Moody's generates revenue primarily through subscription services and transaction-based fees. When a company issues new bonds, it typically pays Moody's to rate those securities. Similarly, financial institutions pay subscription fees to access Moody's research, data, and software tools. The company's services are particularly valuable during periods of market uncertainty, when investors rely heavily on independent risk assessments.

As a globally recognized authority in credit analysis, Moody's operates in more than 40 countries, serving thousands of corporations, financial institutions, governments, and other entities seeking to raise capital or manage risk. The company's assessments influence trillions of dollars in investment decisions annually, making it a fundamental component of the global financial infrastructure.

4. Financial Exchanges & Data

Financial exchanges and data providers operate trading platforms and sell market information. They enjoy relatively stable revenue from trading fees and subscriptions, increasing demand for data analytics, and expansion opportunities in emerging markets. Challenges include regulatory oversight of market structure, competition from alternative trading venues, and substantial technology investments needed to maintain low-latency trading infrastructure and data security.

Moody's main competitors include S&P Global (NYSE:SPGI) and Fitch Ratings (owned by Hearst Corporation), which together form the "Big Three" credit rating agencies. The company also competes with smaller rating agencies like DBRS (owned by Morningstar), as well as financial data and analytics providers such as Bloomberg, FactSet (NYSE:FDS), and MSCI (NYSE:MSCI).

5. Revenue Growth

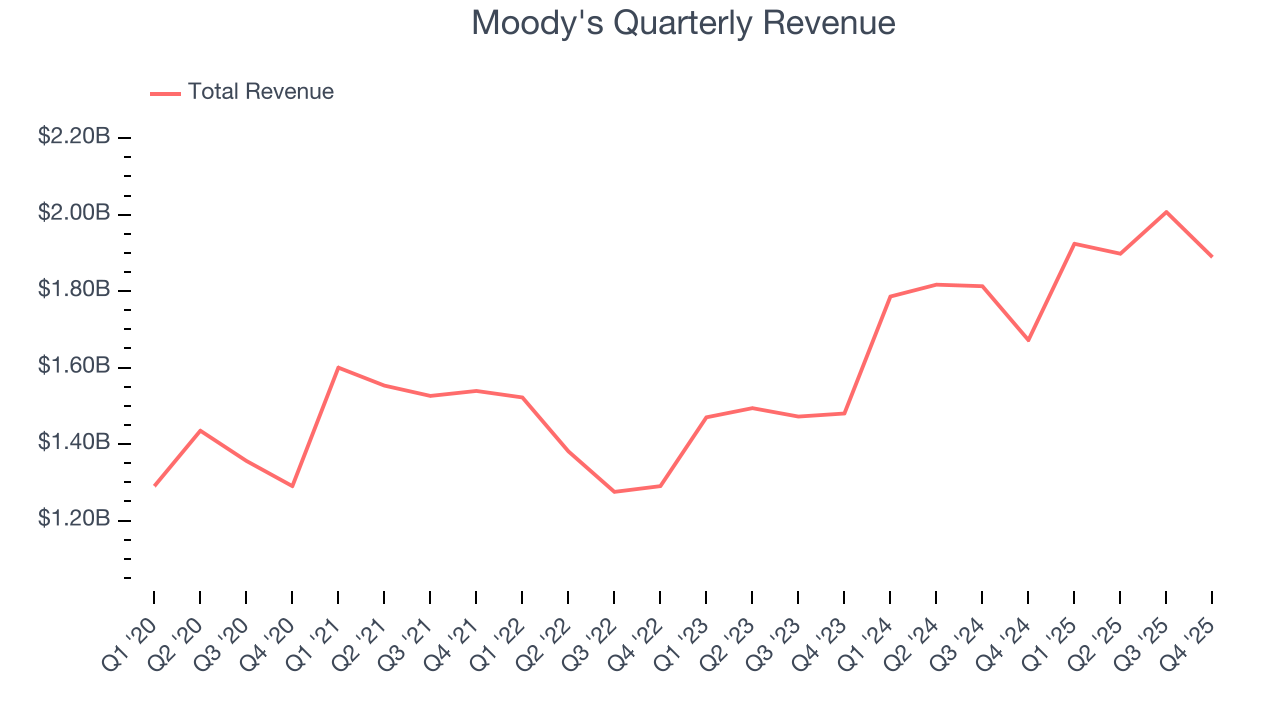

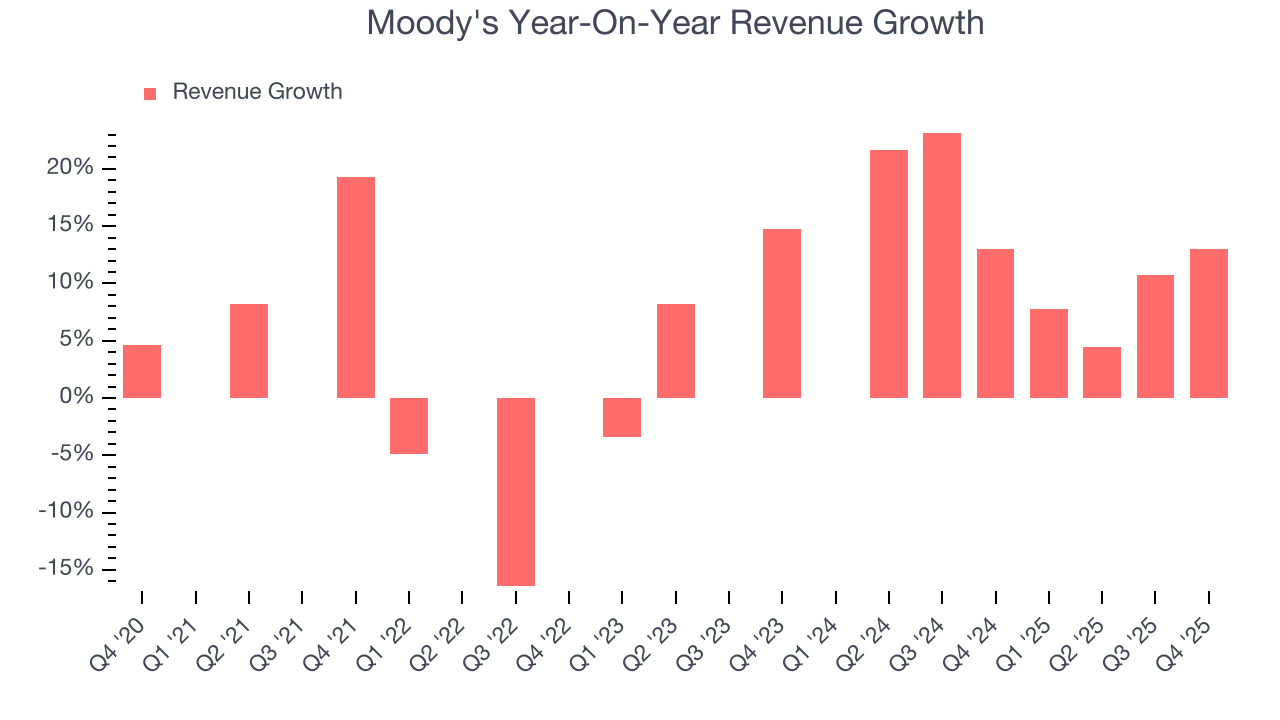

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Moody’s 7.5% annualized revenue growth over the last five years was decent. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Moody’s annualized revenue growth of 14.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Moody's reported year-on-year revenue growth of 13%, and its $1.89 billion of revenue exceeded Wall Street’s estimates by 1.6%.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Financial Exchanges & Data companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

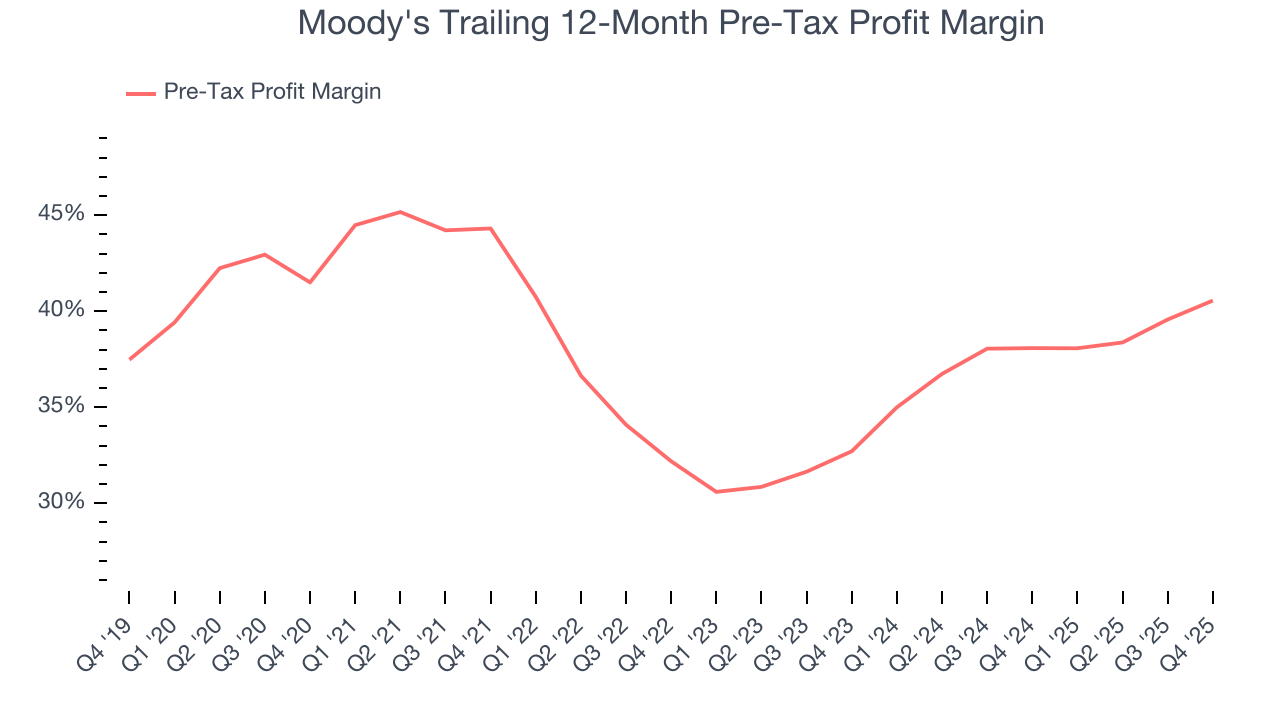

Over the last five years, Moody’s pre-tax profit margin couldn’t build momentum, hanging around 40.6%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 7.8 percentage points on a two-year basis.

In Q4, Moody’s pre-tax profit margin was 36.4%. This result was 5 percentage points better than the same quarter last year.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

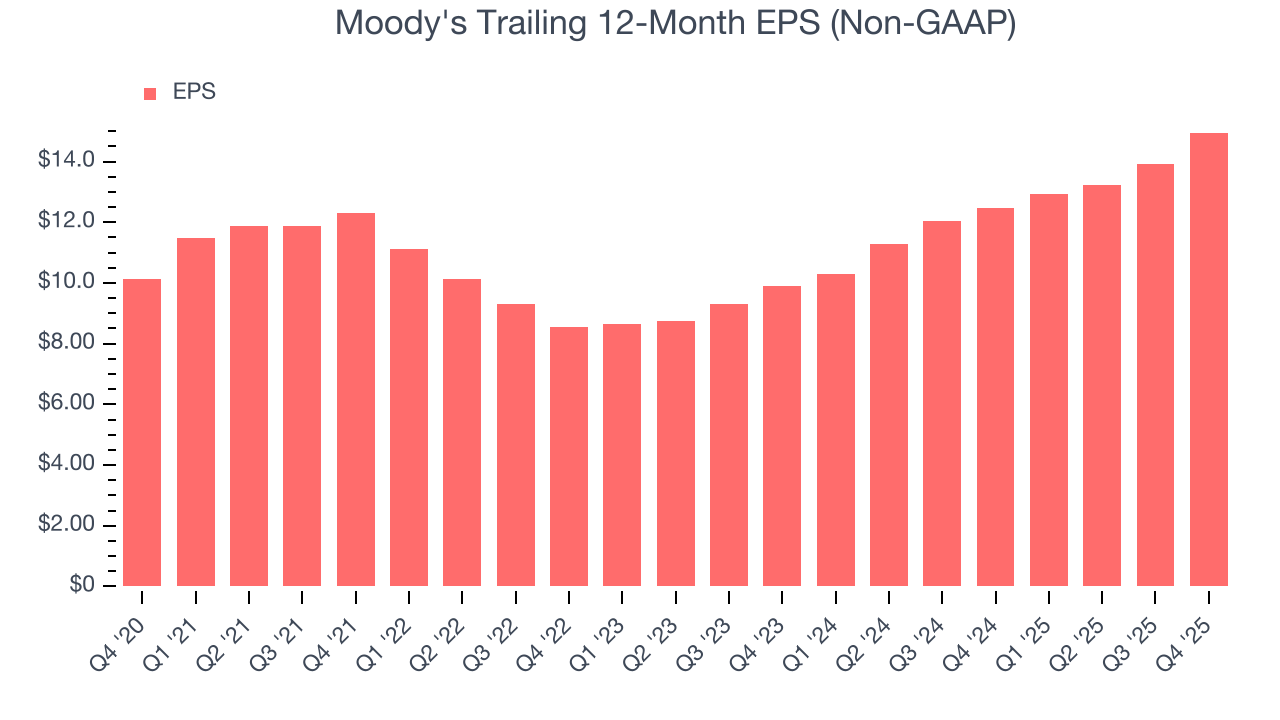

Moody’s unimpressive 8.1% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Moody’s two-year annual EPS growth of 22.8% was great and topped its 14.2% two-year revenue growth.

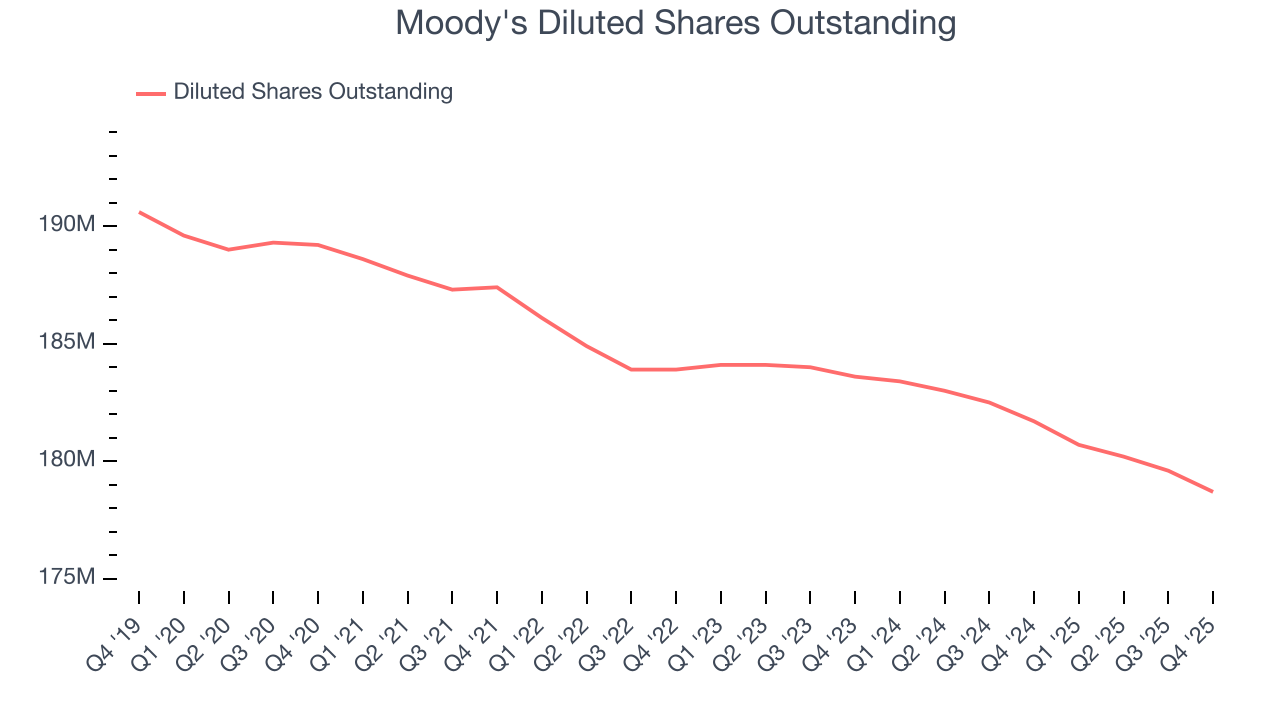

Diving into Moody’s quality of earnings can give us a better understanding of its performance. Moody’s pre-tax profit margin has expanded over the last two yearswhile its share count has shrunk 2.7%. Improving profitability and share buybacks are positive signs for shareholders as they juice EPS growth relative to revenue growth.

In Q4, Moody's reported adjusted EPS of $3.64, up from $2.62 in the same quarter last year. This print beat analysts’ estimates by 6.1%. Over the next 12 months, Wall Street expects Moody’s full-year EPS of $14.95 to grow 10.1%.

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Moody's has averaged an ROE of 63.4%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Moody's has a strong competitive moat.

9. Balance Sheet Assessment

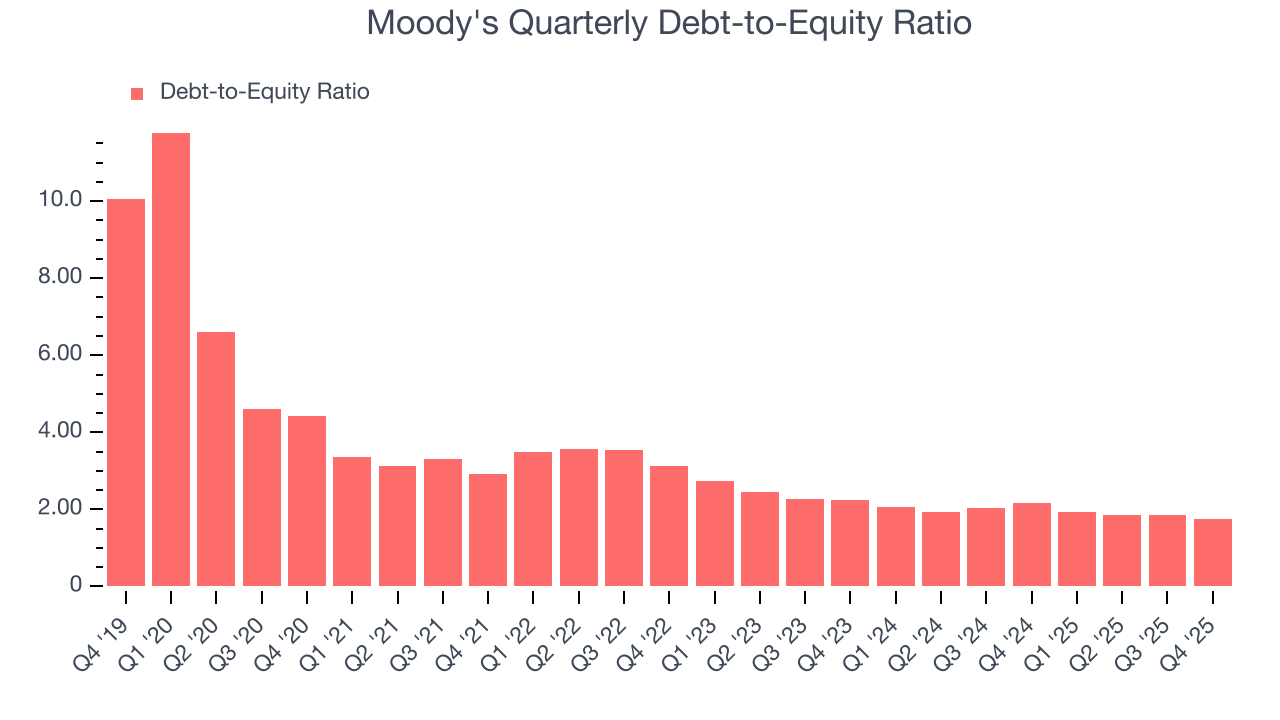

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Moody's currently has $7.09 billion of debt and $4.05 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1.8×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Moody’s Q4 Results

It was good to see Moody's beat analysts’ EPS expectations this quarter. We were also glad its full-year EPS guidance slightly exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 3% to $436 immediately after reporting.

11. Is Now The Time To Buy Moody's?

Updated: February 18, 2026 at 7:29 AM EST

Before deciding whether to buy Moody's or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There are several reasons why we think Moody's is a great business. First, the company’s revenue growth was decent over the last five years, and analysts believe it can continue growing at these levels. And while its pre-tax profit margin didn’t move over the last five years, its stellar ROE suggests it has been a well-run company historically.

Moody’s P/E ratio based on the next 12 months is 25.7x. Some good news is baked into the stock given its multiple, but we’ll happily own Moody's as its fundamentals really stand out. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with relatively high valuations.

Wall Street analysts have a consensus one-year price target of $570.70 on the company (compared to the current share price of $436).