Moody's (MCO)

We’d invest in Moody's. Its superb 63.8% ROE illustrates its skill in making high-return investments.― StockStory Analyst Team

1. News

2. Summary

Why We Like Moody's

Founded in 1900 during America's railroad boom when investors needed reliable information on bond risks, Moody's (NYSE:MCO) provides credit ratings, risk assessment tools, and analytical solutions that help organizations evaluate financial risks and make informed investment decisions.

- Market-beating return on equity illustrates that management has a knack for investing in profitable ventures

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 22.3% over the last two years outstripped its revenue performance

- 14.5% annual revenue growth over the last two years surpassed the sector average as its products resonated with customers

We’re optimistic about Moody's. This is one of our top financials stocks.

Is Now The Time To Buy Moody's?

High Quality

Investable

Underperform

Is Now The Time To Buy Moody's?

At $514.60 per share, Moody's trades at 31.9x forward P/E. The lofty multiple means expectations are high for this company over the next six to twelve months.

If you’re a fan of the company and its story, we suggest a small position as the long-term outlook seems solid. We’d still note its valuation could cause choppy short-term results.

3. Moody's (MCO) Research Report: Q3 CY2025 Update

Credit rating agency Moody's (NYSE:MCO) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 10.7% year on year to $2.01 billion. Its non-GAAP profit of $3.92 per share was 6.4% above analysts’ consensus estimates.

Moody's (MCO) Q3 CY2025 Highlights:

- Revenue: $2.01 billion vs analyst estimates of $1.96 billion (10.7% year-on-year growth, 2.4% beat)

- Pre-tax Profit: $867 million (43.2% margin, 23.3% year-on-year growth)

- Adjusted EPS: $3.92 vs analyst estimates of $3.68 (6.4% beat)

- Adjusted EPS guidance for the full year is $14.63 at the midpoint, beating analyst estimates by 3.6%

- Market Capitalization: $86.99 billion

Company Overview

Founded in 1900 during America's railroad boom when investors needed reliable information on bond risks, Moody's (NYSE:MCO) provides credit ratings, risk assessment tools, and analytical solutions that help organizations evaluate financial risks and make informed investment decisions.

Moody's operates through two main business segments: Moody's Investors Service (MIS) and Moody's Analytics (MA). The MIS division assigns credit ratings to debt securities, structured finance products, and the entities that issue them—including corporations, financial institutions, and governments worldwide. These ratings, which range from Aaa (highest quality) to C (lowest quality), serve as critical benchmarks that influence borrowing costs and investor decisions in global capital markets.

The Moody's Analytics segment complements the ratings business by offering a suite of tools that help organizations assess and manage various types of risk. This includes software platforms for credit analysis, economic research, financial modeling, and regulatory compliance. For example, a regional bank might use Moody's analytics software to evaluate loan portfolios and stress-test their performance under different economic scenarios.

Moody's generates revenue primarily through subscription services and transaction-based fees. When a company issues new bonds, it typically pays Moody's to rate those securities. Similarly, financial institutions pay subscription fees to access Moody's research, data, and software tools. The company's services are particularly valuable during periods of market uncertainty, when investors rely heavily on independent risk assessments.

As a globally recognized authority in credit analysis, Moody's operates in more than 40 countries, serving thousands of corporations, financial institutions, governments, and other entities seeking to raise capital or manage risk. The company's assessments influence trillions of dollars in investment decisions annually, making it a fundamental component of the global financial infrastructure.

4. Financial Exchanges & Data

Financial exchanges and data providers operate trading platforms and sell market information. They enjoy relatively stable revenue from trading fees and subscriptions, increasing demand for data analytics, and expansion opportunities in emerging markets. Challenges include regulatory oversight of market structure, competition from alternative trading venues, and substantial technology investments needed to maintain low-latency trading infrastructure and data security.

Moody's main competitors include S&P Global (NYSE:SPGI) and Fitch Ratings (owned by Hearst Corporation), which together form the "Big Three" credit rating agencies. The company also competes with smaller rating agencies like DBRS (owned by Morningstar), as well as financial data and analytics providers such as Bloomberg, FactSet (NYSE:FDS), and MSCI (NYSE:MSCI).

5. Revenue Growth

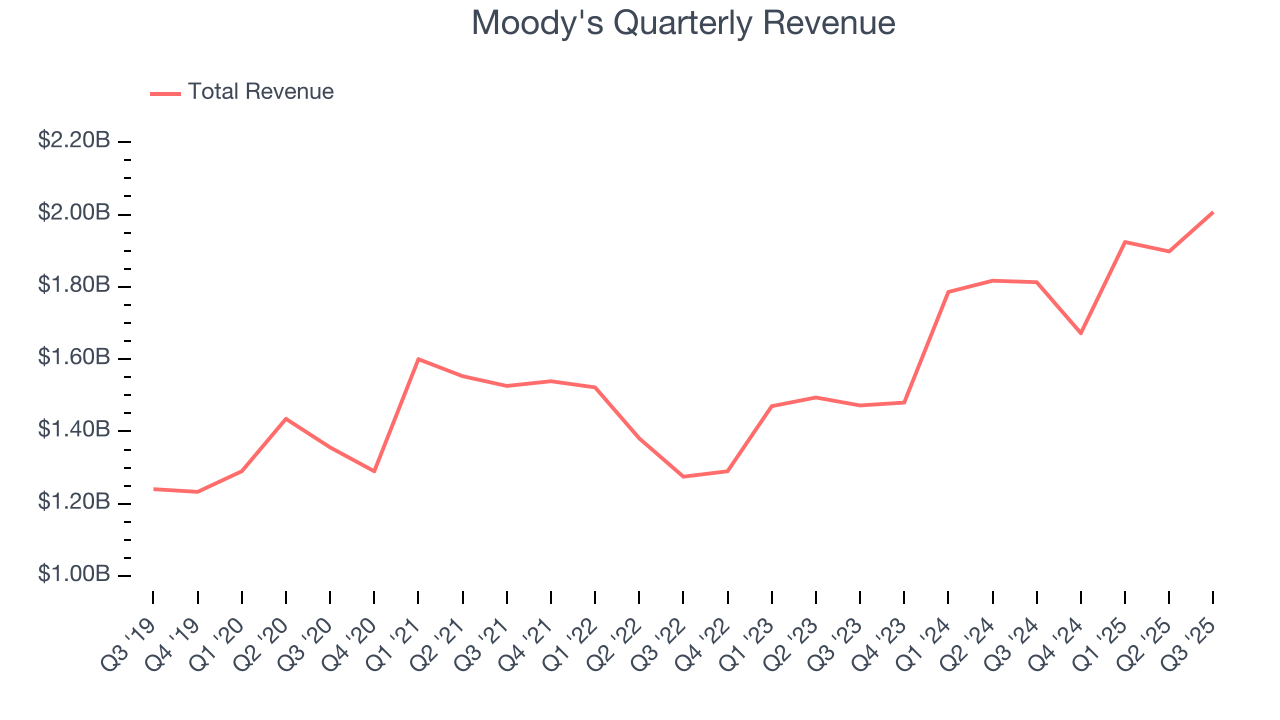

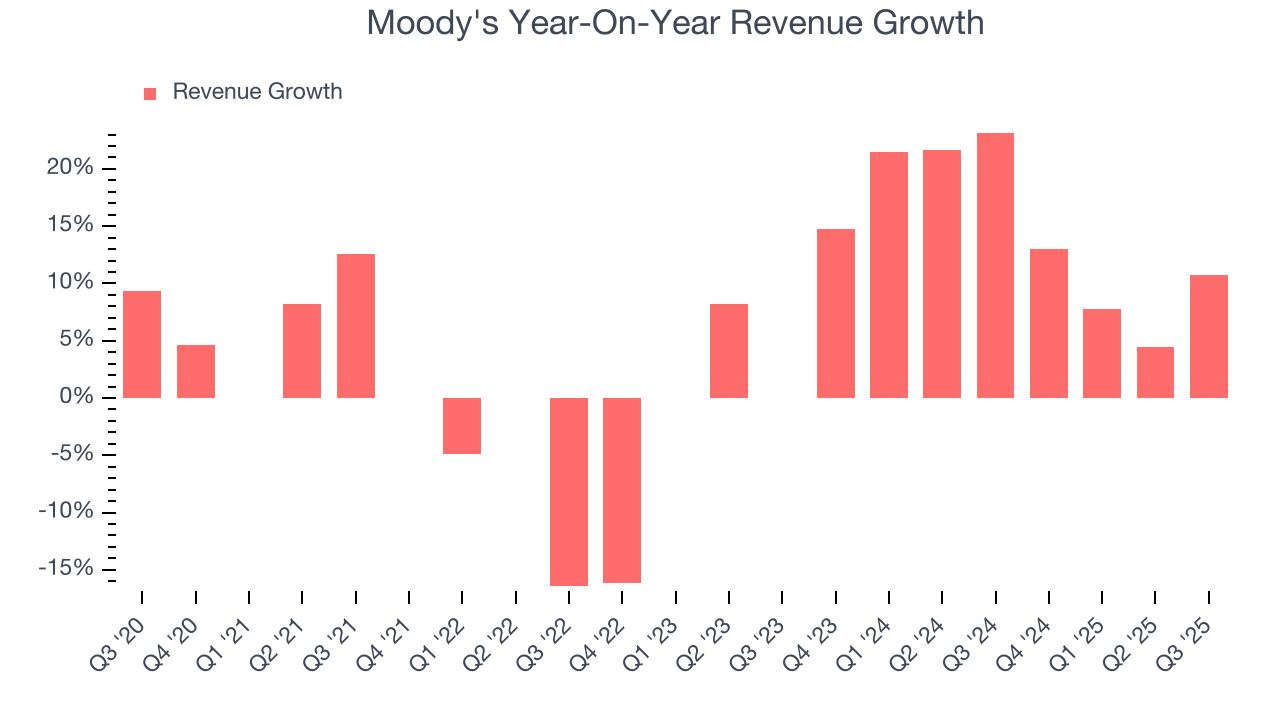

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Moody’s revenue grew at a mediocre 7.1% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about Moody's.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Moody’s annualized revenue growth of 14.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Moody's reported year-on-year revenue growth of 10.7%, and its $2.01 billion of revenue exceeded Wall Street’s estimates by 2.4%.

6. Pre-Tax Profit Margin

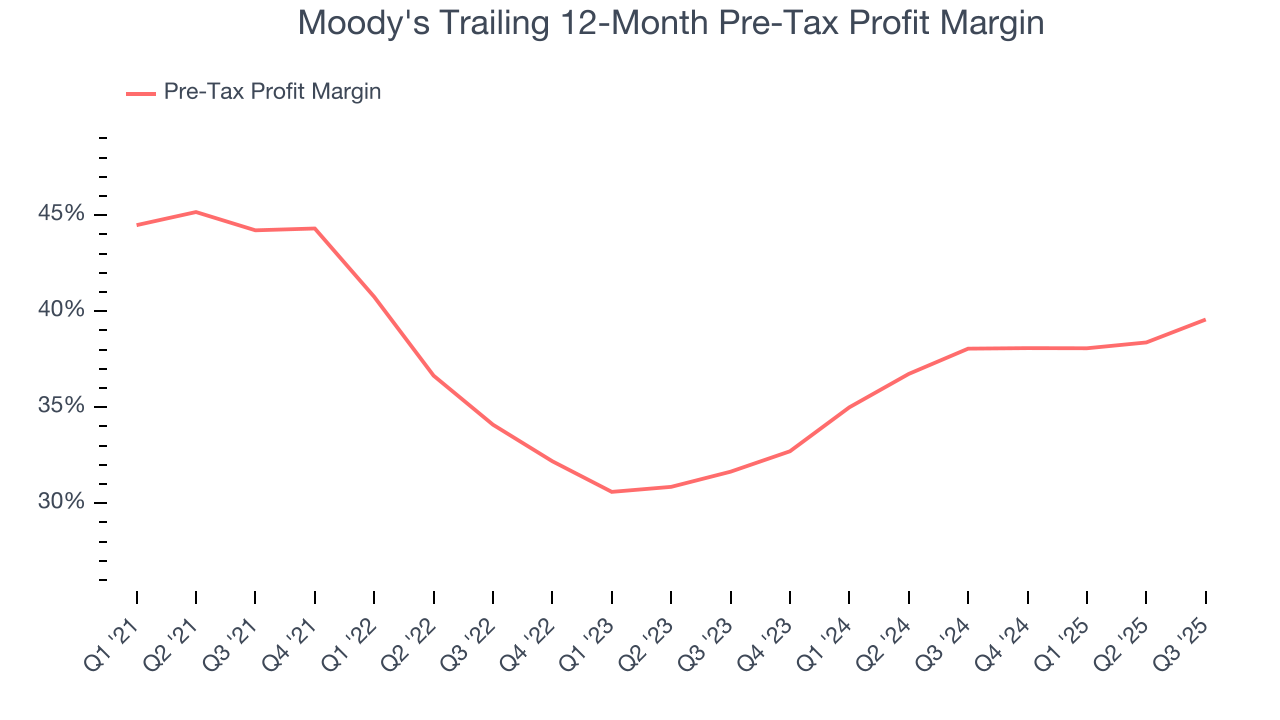

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Financial Exchanges & Data companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because for financials businesses, interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company's control - should not.

Over the last four years, Moody’s pre-tax profit margin has risen by 4.6 percentage points, going from 44.2% to 39.6%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 7.9 percentage points on a two-year basis.

In Q3, Moody’s pre-tax profit margin was 43.2%. This result was 4.4 percentage points better than the same quarter last year.

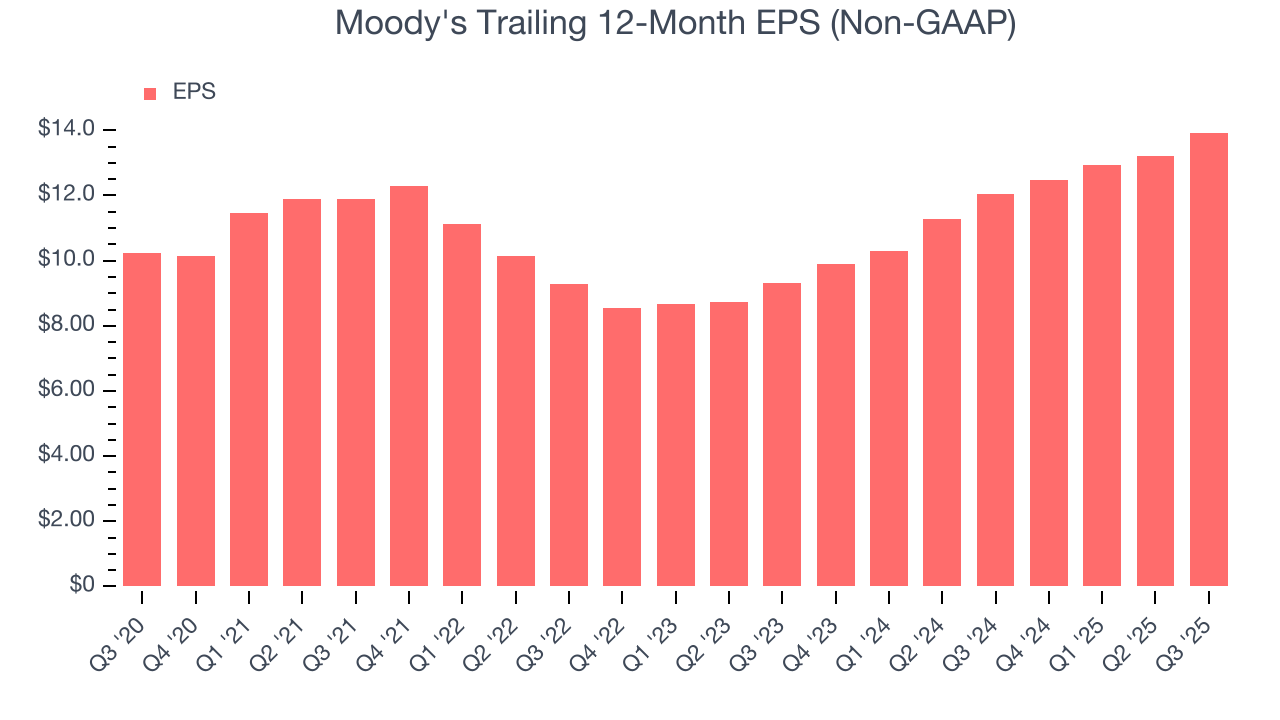

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Moody’s unimpressive 6.4% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Moody’s two-year annual EPS growth of 22.3% was great and topped its 14.5% two-year revenue growth.

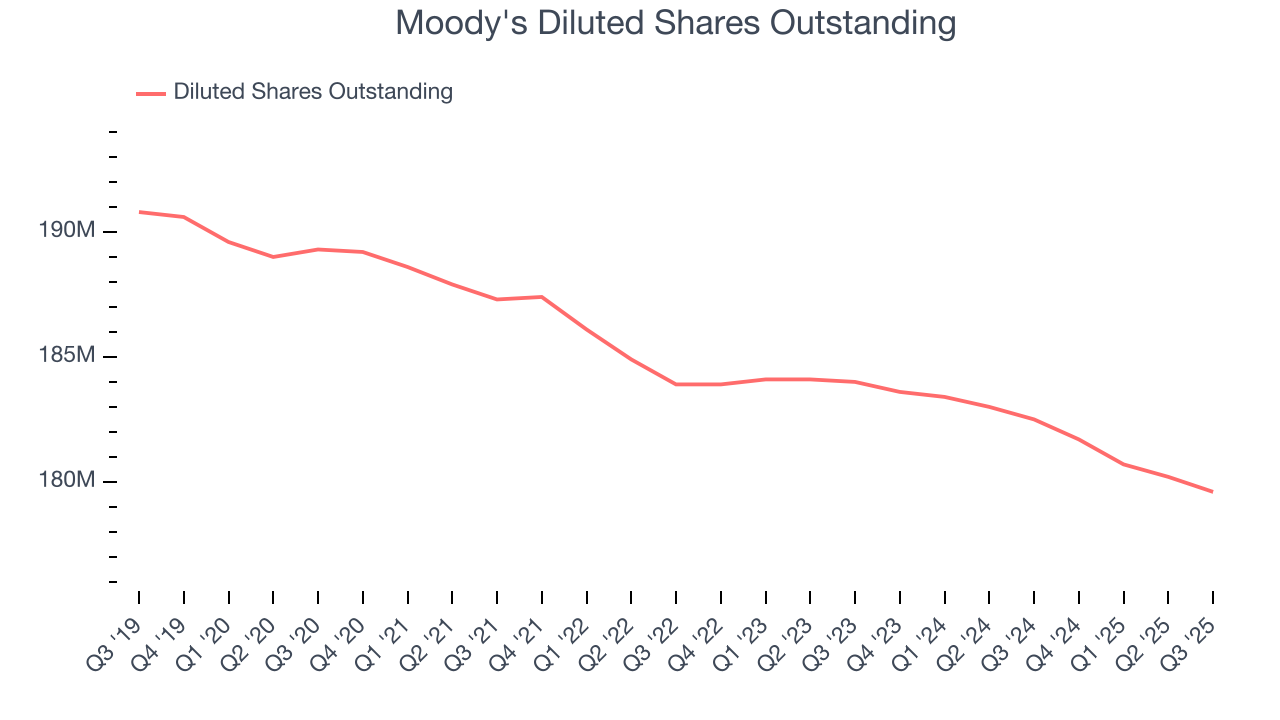

Diving into the nuances of Moody’s earnings can give us a better understanding of its performance. Moody’s pre-tax profit margin has expanded over the last two yearswhile its share count has shrunk 2.4%. Improving profitability and share buybacks are positive signs for shareholders as they juice EPS growth relative to revenue growth.

In Q3, Moody's reported adjusted EPS of $3.92, up from $3.21 in the same quarter last year. This print beat analysts’ estimates by 6.4%. Over the next 12 months, Wall Street expects Moody’s full-year EPS of $13.93 to grow 10.5%.

8. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Moody's has averaged an ROE of 63.9%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Moody's has a strong competitive moat.

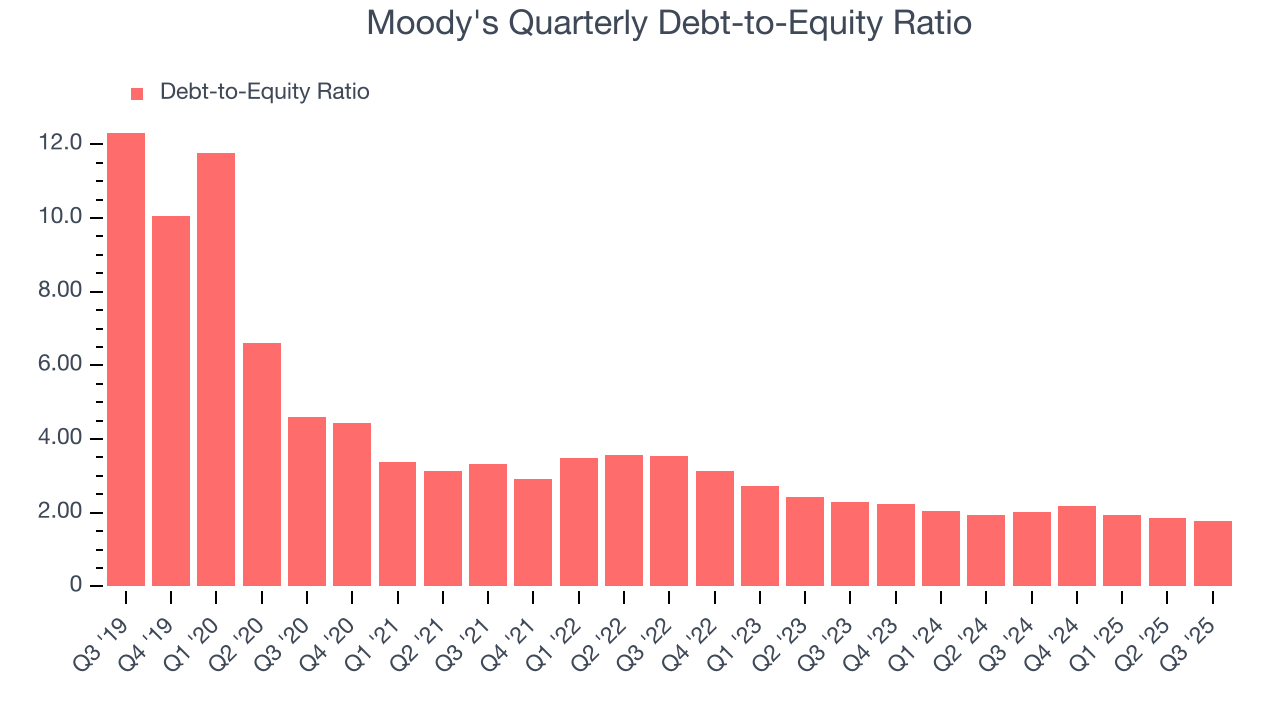

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Moody's currently has $7.08 billion of debt and $3.96 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1.9×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Moody’s Q3 Results

It was great to see Moody’s full-year EPS guidance top analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $480.13 immediately following the results.

11. Is Now The Time To Buy Moody's?

Updated: January 30, 2026 at 11:40 PM EST

Before investing in or passing on Moody's, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Moody's is an amazing business ranking highly on our list. Although its revenue growth was mediocre over the last five years, its growth over the next 12 months is expected to be higher. On top of that, its stellar ROE suggests it has been a well-run company historically.

Moody’s P/E ratio based on the next 12 months is 31.9x. Some good news is baked into the stock given its multiple, but we’ll happily own Moody's as its fundamentals really stand out. It’s often wise to hold investments like this for at least three to five years, as the power of long-term compounding negates short-term price swings that can accompany relatively high valuations.

Wall Street analysts have a consensus one-year price target of $575.53 on the company (compared to the current share price of $514.60).