Martin Marietta Materials (MLM)

1. News

2. Martin Marietta Materials (MLM) Research Report: Q3 CY2025 Update

Construction materials supplier Martin Marietta Materials (NYSE:MLM) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 12.4% year on year to $1.85 billion. The company’s full-year revenue guidance of $6.16 billion at the midpoint came in 11.7% below analysts’ estimates. Its non-GAAP profit of $6.85 per share was 2.5% above analysts’ consensus estimates.

Martin Marietta Materials (MLM) Q3 CY2025 Highlights:

- Revenue: $1.85 billion vs analyst estimates of $2.06 billion (12.4% year-on-year growth, 10.5% miss)

- Adjusted EPS: $6.85 vs analyst estimates of $6.68 (2.5% beat)

- Adjusted EBITDA: $743 million vs analyst estimates of $730.3 million (40.2% margin, 1.7% beat)

- EBITDA guidance for the full year is $2.32 million at the midpoint, below analyst estimates of $2.3 billion

- Operating Margin: 27.4%, up from 24.7% in the same quarter last year

- Free Cash Flow Margin: 19.6%, similar to the same quarter last year

- Market Capitalization: $37.55 billion

Company Overview

Operating one of North America's largest networks of quarries, including 14 underground mines, Martin Marietta Materials (NYSE:MLM) is a natural resource-based building materials company that supplies aggregates, cement, and other construction materials for infrastructure and building projects.

The company's core business revolves around producing crushed stone, sand, and gravel through approximately 390 quarries, mines, and distribution yards across 28 states, Canada, and The Bahamas. These materials serve as the foundation for roads, bridges, and buildings. Martin Marietta organizes its operations into East and West Groups, with the former focusing on aggregates and asphalt products, while the latter provides these materials plus cement, ready mixed concrete, and paving services.

For construction projects, Martin Marietta's materials provide essential building blocks. A highway contractor might use the company's crushed stone as a base layer for roadways, its cement to bind materials together, and its asphalt for the road surface. The company employs an extensive distribution network including trucks, rail lines, and ships to transport heavy materials economically over long distances, with dedicated distribution facilities that extend its market reach.

Beyond construction materials, Martin Marietta operates a Magnesia Specialties segment that produces dolomitic lime primarily for steel production and magnesia-based chemicals used in industrial applications like flame retardants, wastewater treatment, and paper production. This diversification provides the company with revenue streams outside traditional construction cycles.

3. Building Materials

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

Martin Marietta Materials' main competitors include Vulcan Materials Company (NYSE:VMC), Summit Materials (NYSE:SUM), CRH plc (NYSE:CRH), and Eagle Materials (NYSE:EXP) in the construction materials sector.

4. Revenue Growth

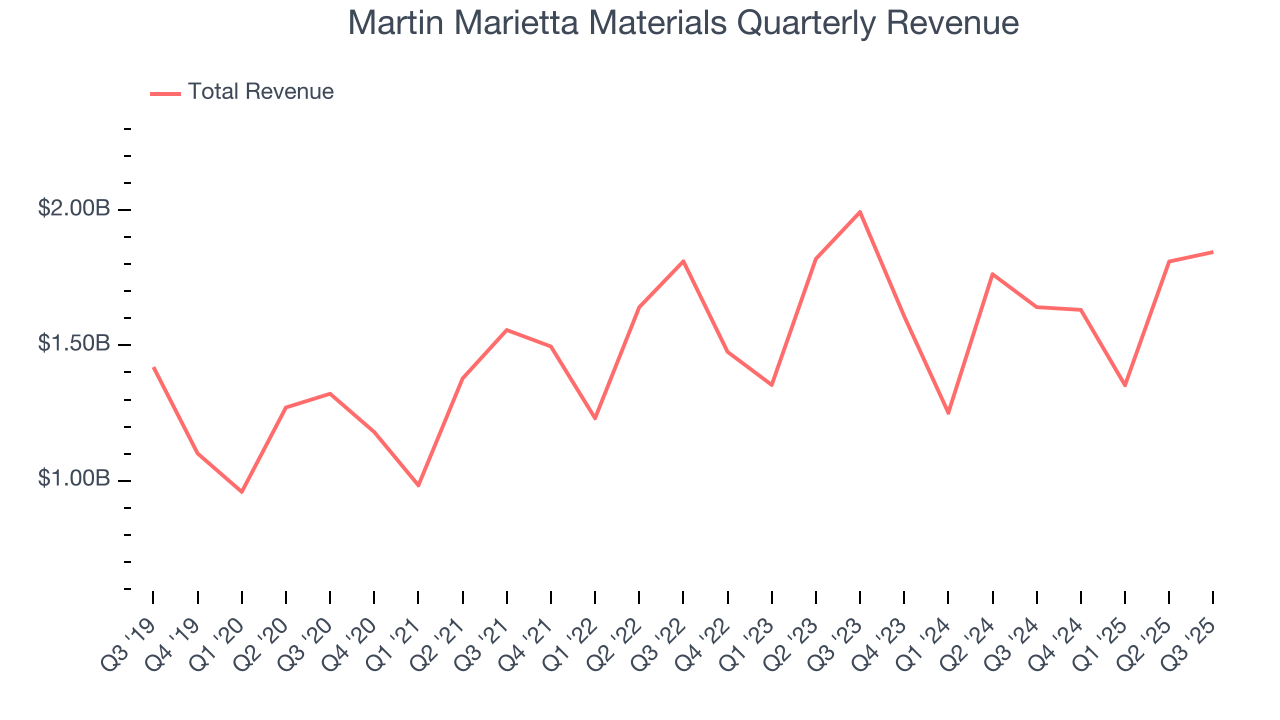

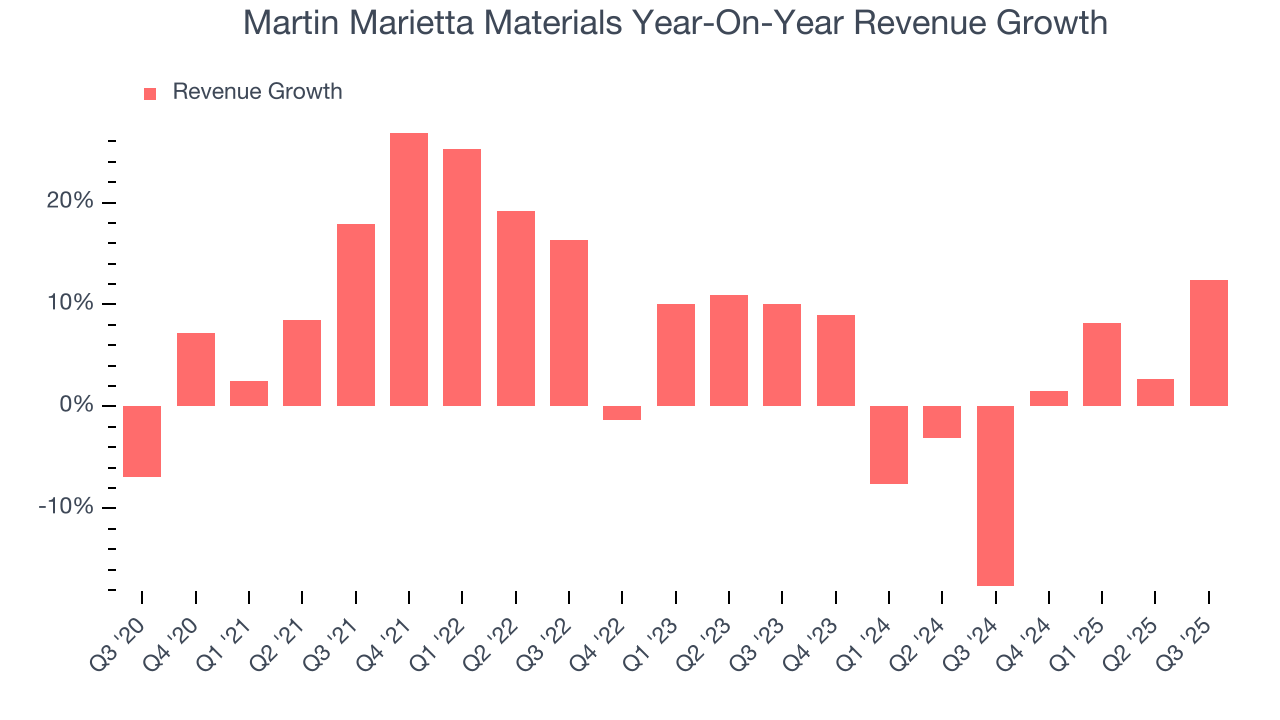

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Martin Marietta Materials’s 7.4% annualized revenue growth over the last five years was mediocre. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Martin Marietta Materials’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Martin Marietta Materials’s revenue grew by 12.4% year on year to $1.85 billion but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

5. Gross Margin & Pricing Power

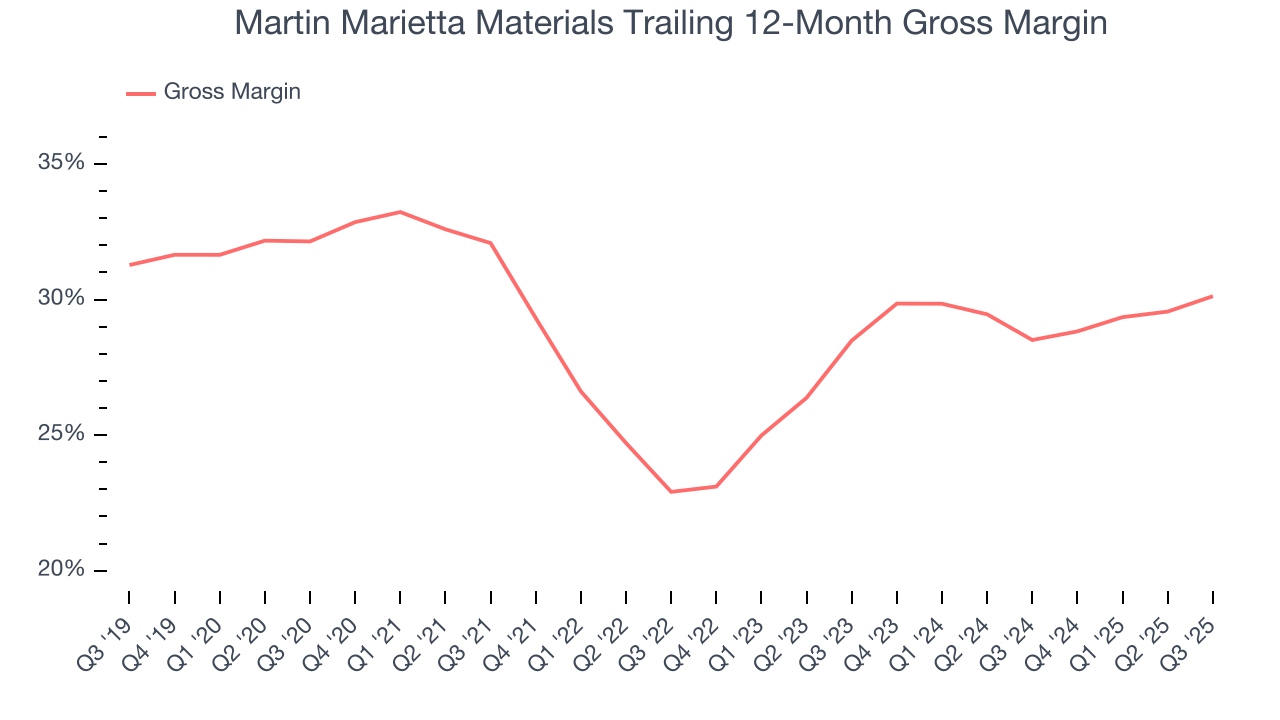

Martin Marietta Materials’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 28.3% gross margin over the last five years. That means Martin Marietta Materials paid its suppliers a lot of money ($71.68 for every $100 in revenue) to run its business.

In Q3, Martin Marietta Materials produced a 33.1% gross profit margin, marking a 1.9 percentage point increase from 31.2% in the same quarter last year. Martin Marietta Materials’s full-year margin has also been trending up over the past 12 months, increasing by 1.6 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

6. Operating Margin

Martin Marietta Materials has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 21%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Martin Marietta Materials’s operating margin rose by 3.7 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Martin Marietta Materials generated an operating margin profit margin of 27.4%, up 2.6 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

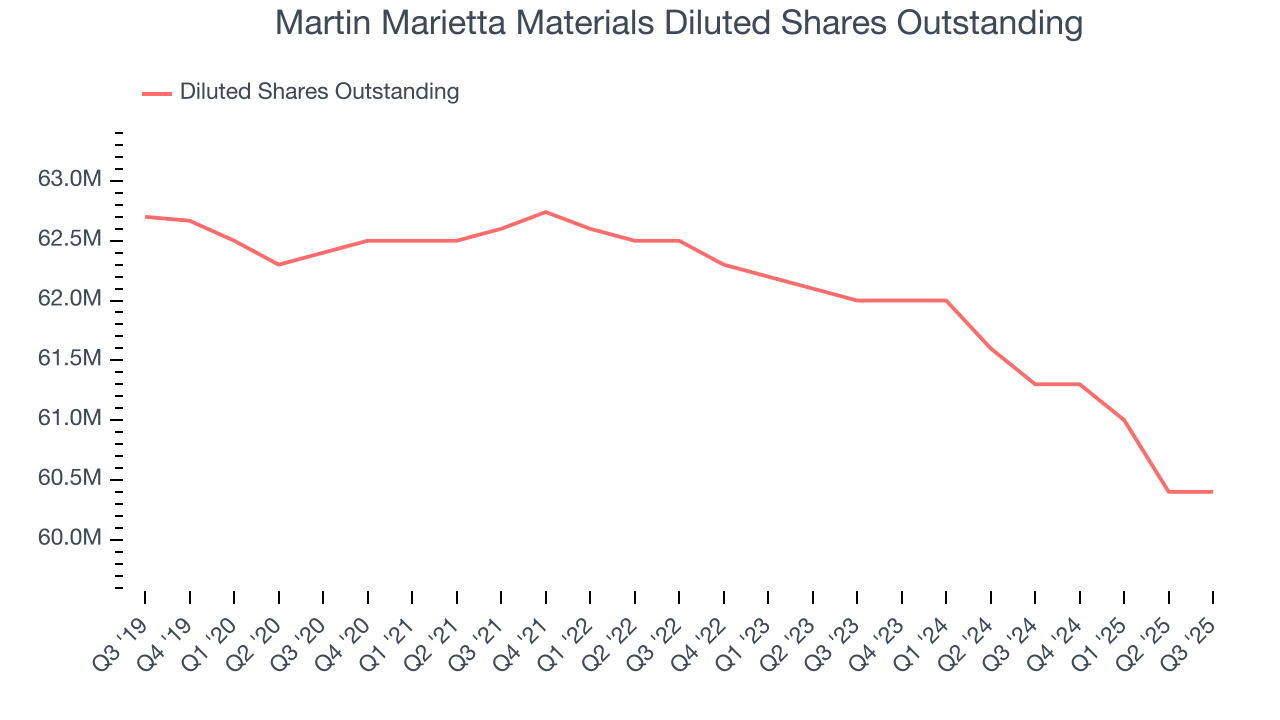

Martin Marietta Materials’s EPS grew at a remarkable 14% compounded annual growth rate over the last five years, higher than its 7.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Martin Marietta Materials’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Martin Marietta Materials’s operating margin expanded by 3.7 percentage points over the last five years. On top of that, its share count shrank by 3.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Martin Marietta Materials, its two-year annual EPS growth of 3.9% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Martin Marietta Materials reported adjusted EPS of $6.85, up from $5.95 in the same quarter last year. This print beat analysts’ estimates by 2.5%. Over the next 12 months, Wall Street expects Martin Marietta Materials’s full-year EPS of $18.99 to grow 12.3%.

8. Cash Is King

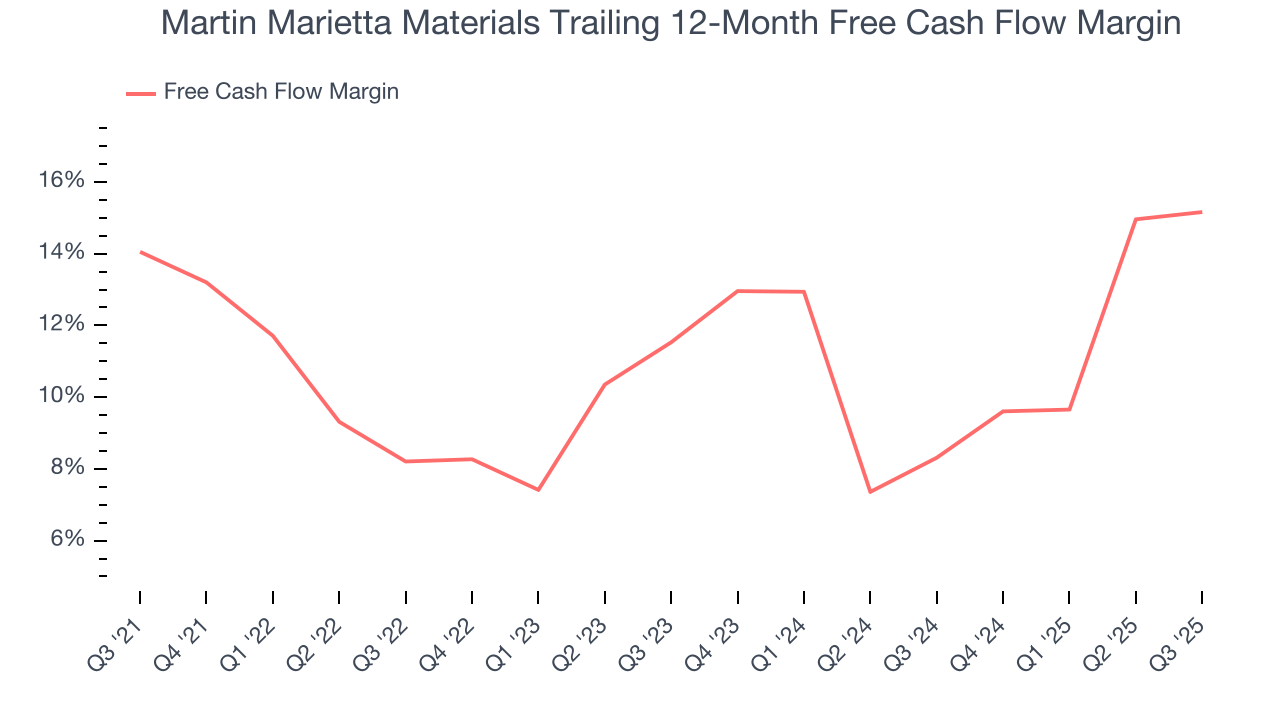

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Martin Marietta Materials has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 11.4% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Martin Marietta Materials’s margin expanded by 1.1 percentage points during that time. This is encouraging because it gives the company more optionality.

Martin Marietta Materials’s free cash flow clocked in at $361 million in Q3, equivalent to a 19.6% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

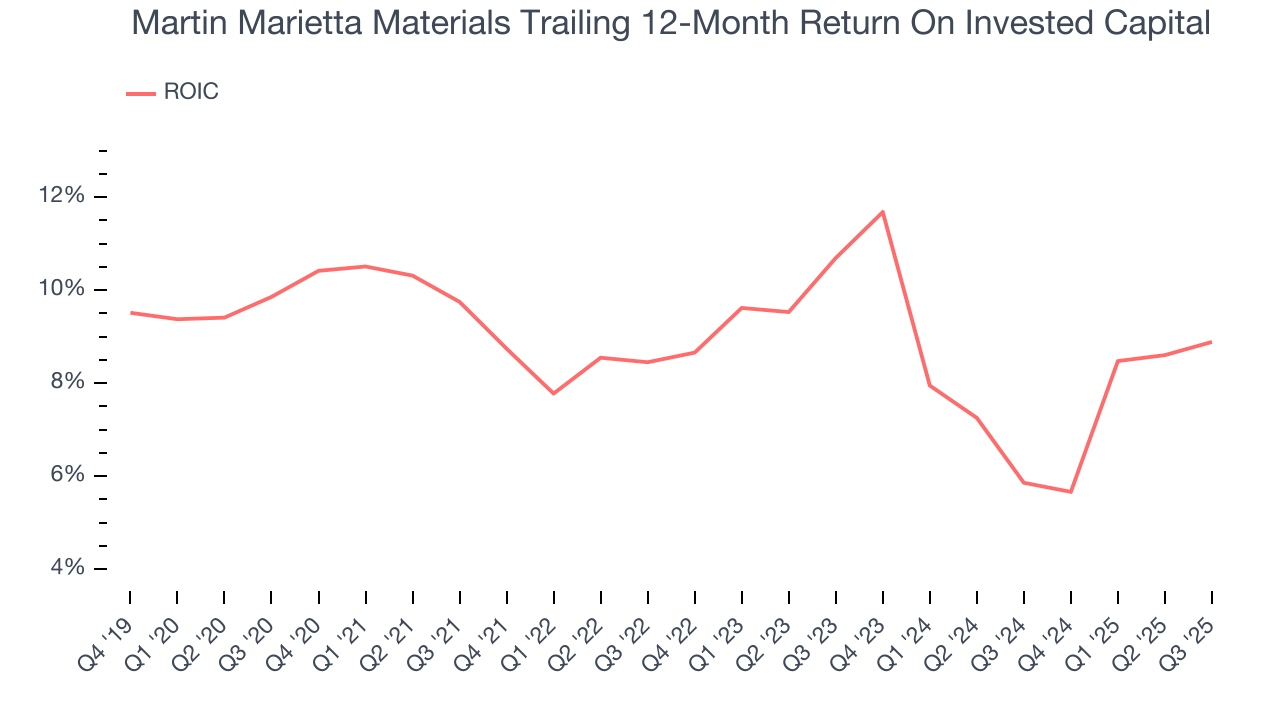

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Martin Marietta Materials historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.7%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Martin Marietta Materials’s ROIC averaged 1.7 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

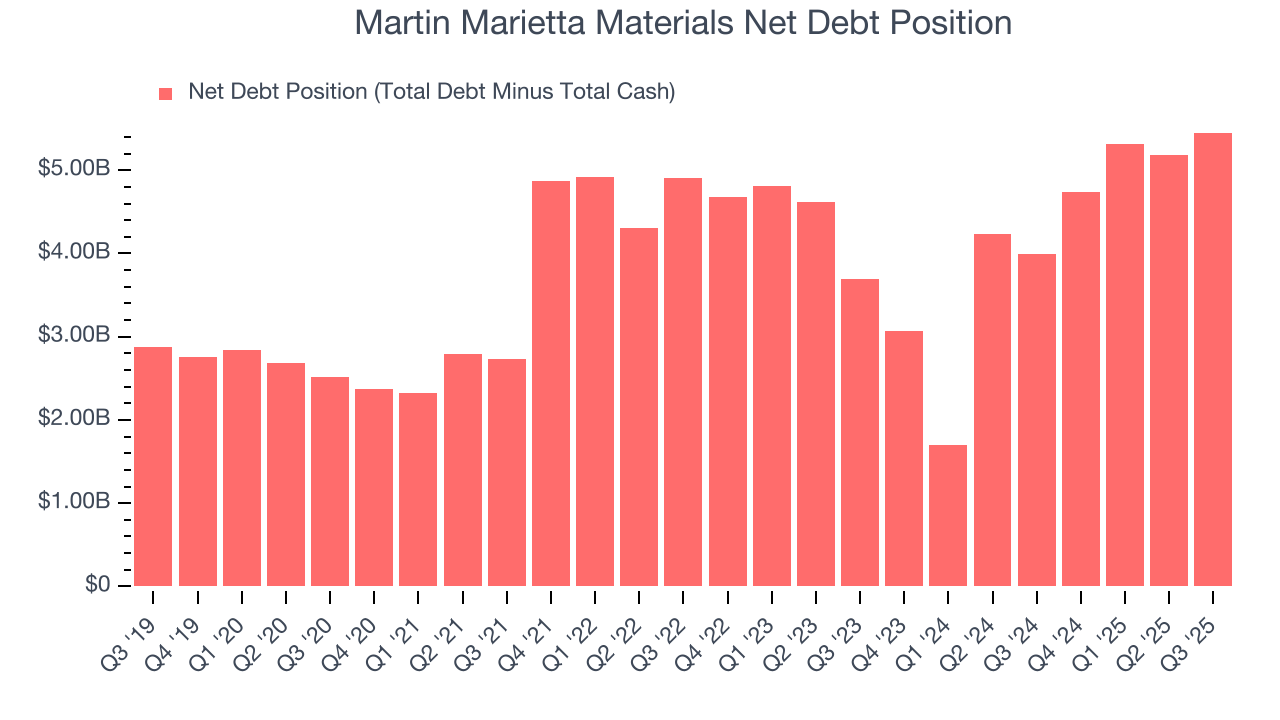

10. Balance Sheet Assessment

Martin Marietta Materials reported $70 million of cash and $5.52 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.27 billion of EBITDA over the last 12 months, we view Martin Marietta Materials’s 2.4× net-debt-to-EBITDA ratio as safe. We also see its $125 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Martin Marietta Materials’s Q3 Results

It was encouraging to see Martin Marietta Materials beat analysts’ adjusted operating income expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $622.66 immediately after reporting.

12. Is Now The Time To Buy Martin Marietta Materials?

When considering an investment in Martin Marietta Materials, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Martin Marietta Materials isn’t a terrible business, but it isn’t one of our picks. For starters, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its impressive operating margins show it has a highly efficient business model, the downside is its mediocre ROIC lags the market and is a headwind for its stock price. On top of that, its diminishing returns show management's prior bets haven't worked out.

Martin Marietta Materials’s P/E ratio based on the next 12 months is 29.2x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $673.29 on the company (compared to the current share price of $622.66).