Molina Healthcare (MOH)

We see potential in Molina Healthcare. Its scale gives it meaningful leverage when negotiating reimbursement rates.― StockStory Analyst Team

1. News

2. Summary

Why Molina Healthcare Is Interesting

Founded in 1980 as a provider for underserved communities in Southern California, Molina Healthcare (NYSE:MOH) provides managed healthcare services primarily to low-income individuals through Medicaid, Medicare, and Marketplace insurance programs across 21 states.

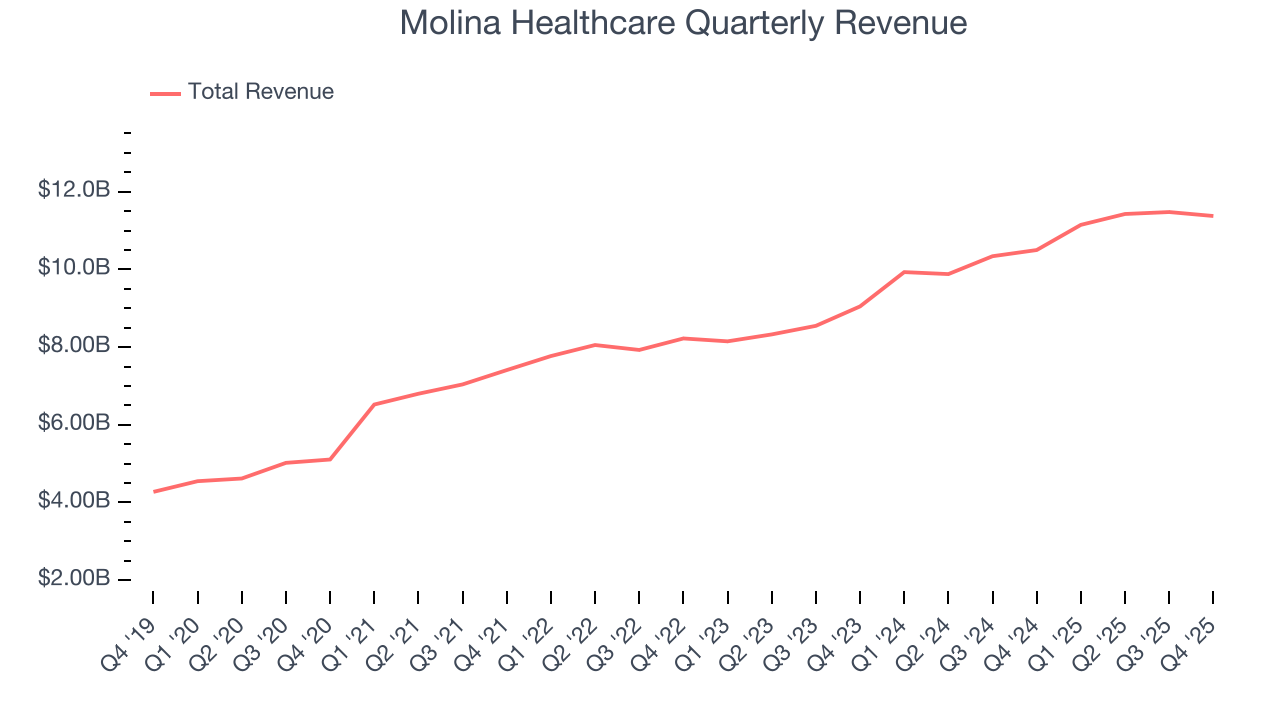

- Scale advantages are evident in its $44.55 billion revenue base, which provides operating leverage when demand is strong

- Impressive 19.3% annual revenue growth over the last five years indicates it’s winning market share this cycle

- One pitfall is its adjusted operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

Molina Healthcare has some respectable qualities. If you’ve been itching to buy the stock, the valuation looks fair.

Why Is Now The Time To Buy Molina Healthcare?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Molina Healthcare?

At $178.43 per share, Molina Healthcare trades at 15.5x forward P/E. Molina Healthcare’s multiple is lower than that of many healthcare companies. Even so, we think it is justified for the top-line growth you get.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. Molina Healthcare (MOH) Research Report: Q4 CY2025 Update

Healthcare insurance company Molina Healthcare (NYSE:MOH) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 8.3% year on year to $11.38 billion. On the other hand, the company’s full-year revenue guidance of $44.5 billion at the midpoint came in 4.9% below analysts’ estimates. Its non-GAAP loss of $2.75 per share was significantly below analysts’ consensus estimates.

Molina Healthcare (MOH) Q4 CY2025 Highlights:

- Revenue: $11.38 billion vs analyst estimates of $10.97 billion (8.3% year-on-year growth, 3.7% beat)

- Adjusted EPS: -$2.75 vs analyst estimates of $0.33 (significant miss)

- Adjusted EBITDA: -$98 million vs analyst estimates of $102.6 million (-0.9% margin, significant miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $5 at the midpoint, missing analyst estimates by 63.5%

- Operating Margin: -1.4%, down from 3.6% in the same quarter last year

- Free Cash Flow was -$297 million compared to -$235 million in the same quarter last year

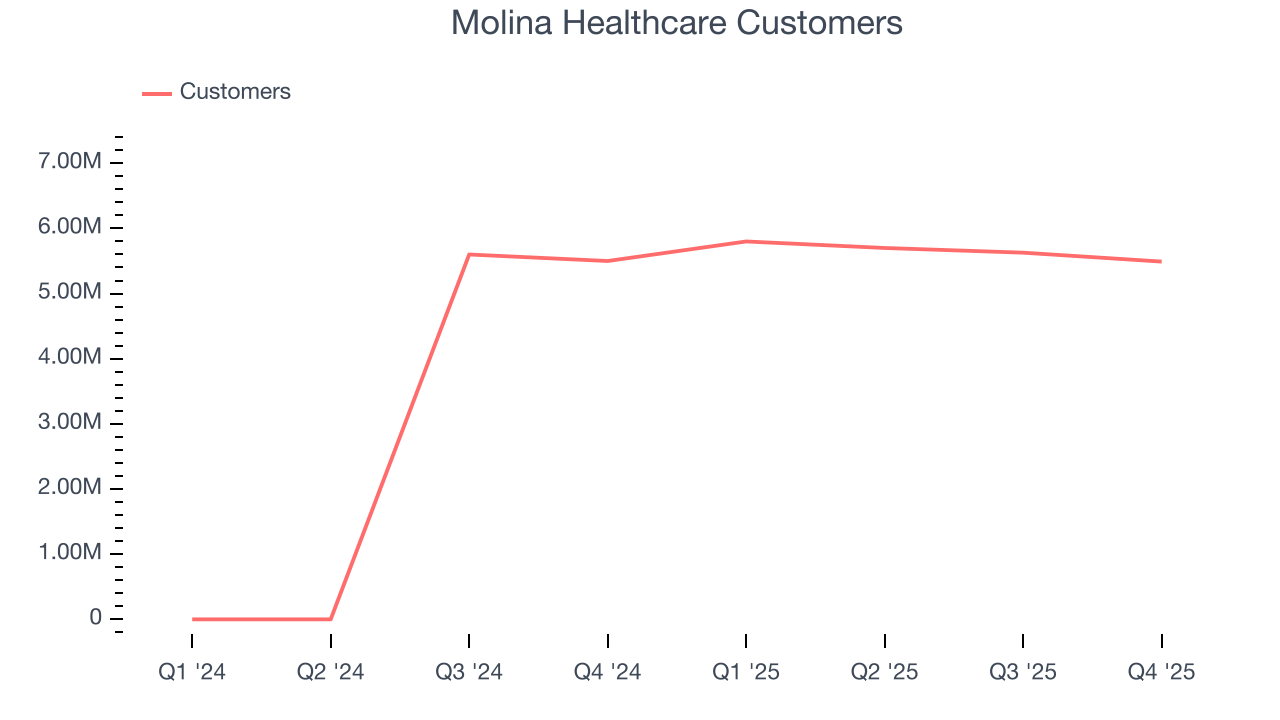

- Customers: 5.49 million, down from 5.63 million in the previous quarter

- Market Capitalization: $9.15 billion

Company Overview

Founded in 1980 as a provider for underserved communities in Southern California, Molina Healthcare (NYSE:MOH) provides managed healthcare services primarily to low-income individuals through Medicaid, Medicare, and Marketplace insurance programs across 21 states.

Molina operates as a pure-play government-sponsored healthcare business with four main segments: Medicaid, Medicare, Marketplace, and a smaller segment offering long-term services consulting. The company serves approximately 5.5 million members, with Medicaid representing about 79% of its premium revenue.

In the Medicaid segment, Molina participates in various programs including Temporary Assistance for Needy Families (TANF), Aged, Blind or Disabled (ABD) coverage, Children's Health Insurance Program (CHIP), Medicaid Expansion, and Long Term Services and Supports (LTSS). The company contracts with state agencies, typically for three to five-year terms.

For Medicare, Molina offers Medicare Advantage plans with prescription drug coverage (MAPD) and several specialized programs for dual-eligible individuals who qualify for both Medicare and Medicaid. These include Dual Eligible Special Needs Plans (D-SNP) and more integrated options that coordinate care between the two programs.

In the Marketplace segment, established under the Affordable Care Act, Molina offers plans in most states where it operates Medicaid programs. This strategy allows members to maintain their providers when transitioning between Medicaid and Marketplace coverage.

Molina contracts with a network of healthcare providers including physicians, hospitals, and pharmacies. The company pays providers through various methods including capitation (fixed monthly payments per member) and fee-for-service arrangements. To manage medical costs, Molina emphasizes preventive care and appropriate utilization of specialty and hospital services.

The company employs various medical management strategies including utilization management, population health programs, and pharmacy management. These approaches help identify at-risk members, customize interventions, and promote cost-effective care while addressing physical health, behavioral health, and social determinants of health.

4. Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Molina Healthcare's primary competitors in the Medicaid managed care space include Centene Corporation, CVS Health Corporation, Elevance Health (formerly Anthem), UnitedHealth Group, and various large not-for-profit healthcare organizations. In the Marketplace segment, Centene Corporation is Molina's main competitor for low-income members.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $45.43 billion in revenue over the past 12 months, Molina Healthcare boasts impressive economies of scale. It may not be as large as heavyweights such as UnitedHealth Group and The Cigna Group from a topline perspective, but its heft is still an important advantage in a healthcare industry that is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

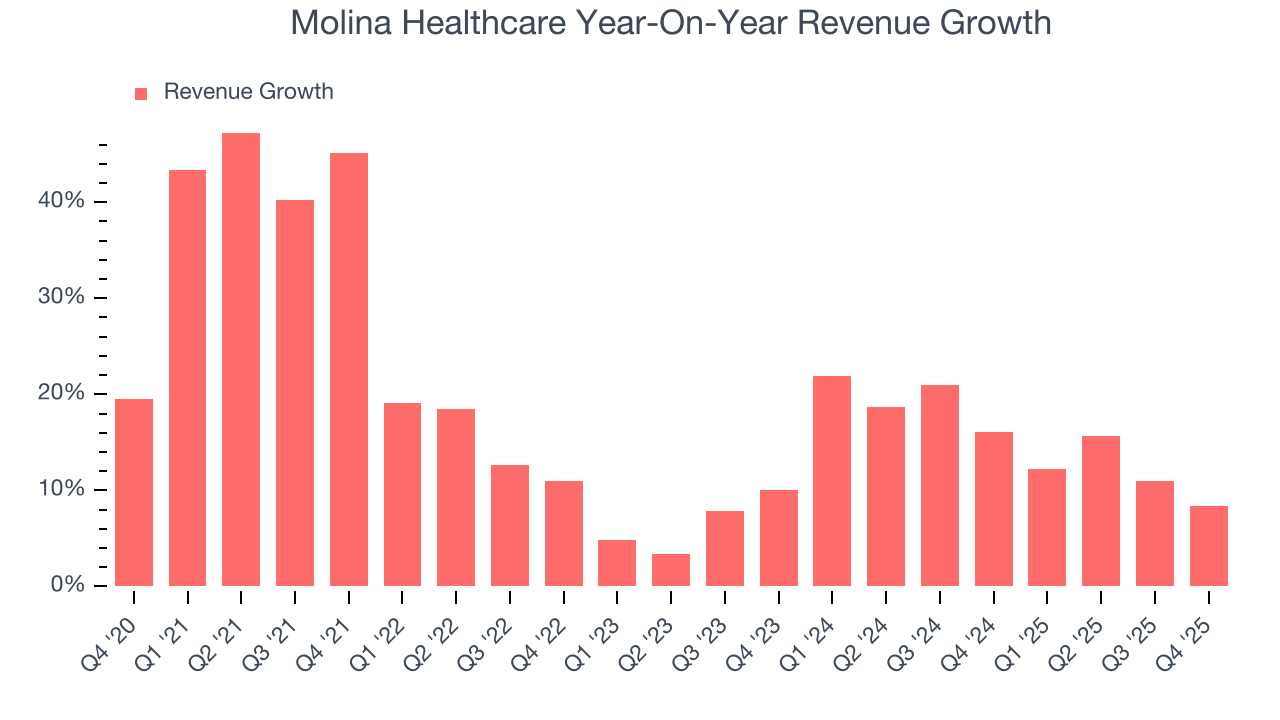

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Molina Healthcare’s 18.7% annualized revenue growth over the last five years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Molina Healthcare’s annualized revenue growth of 15.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 5.49 million in the latest quarter. Over the last two years, Molina Healthcare’s customer base averaged 50,884,975% year-on-year growth. Because this number is better than its revenue growth, we can see the average customer spent less money each year on the company’s products and services.

This quarter, Molina Healthcare reported year-on-year revenue growth of 8.3%, and its $11.38 billion of revenue exceeded Wall Street’s estimates by 3.7%.

Looking ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

7. Operating Margin

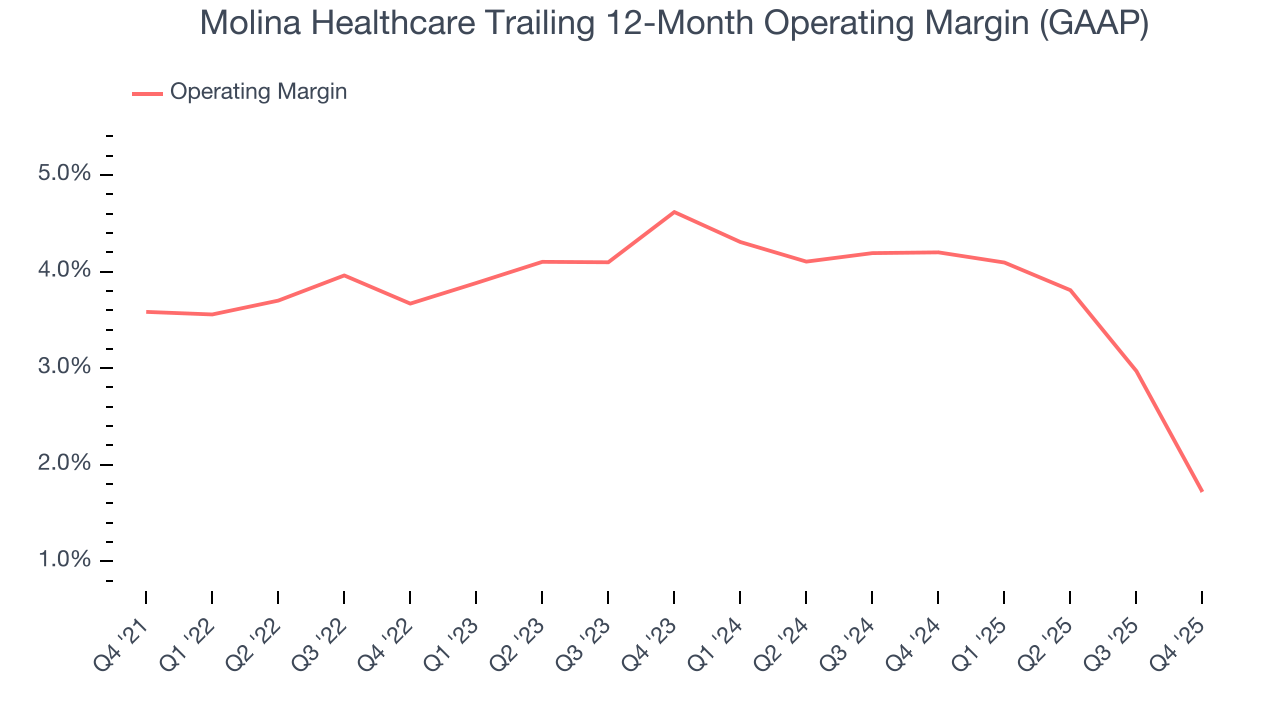

Molina Healthcare was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.5% was weak for a healthcare business.

Analyzing the trend in its profitability, Molina Healthcare’s operating margin decreased by 1.9 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 2.9 percentage points on a two-year basis. We still like Molina Healthcare but would like to see it make some adjustments.

In Q4, Molina Healthcare generated an operating margin profit margin of negative 1.4%, down 5 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

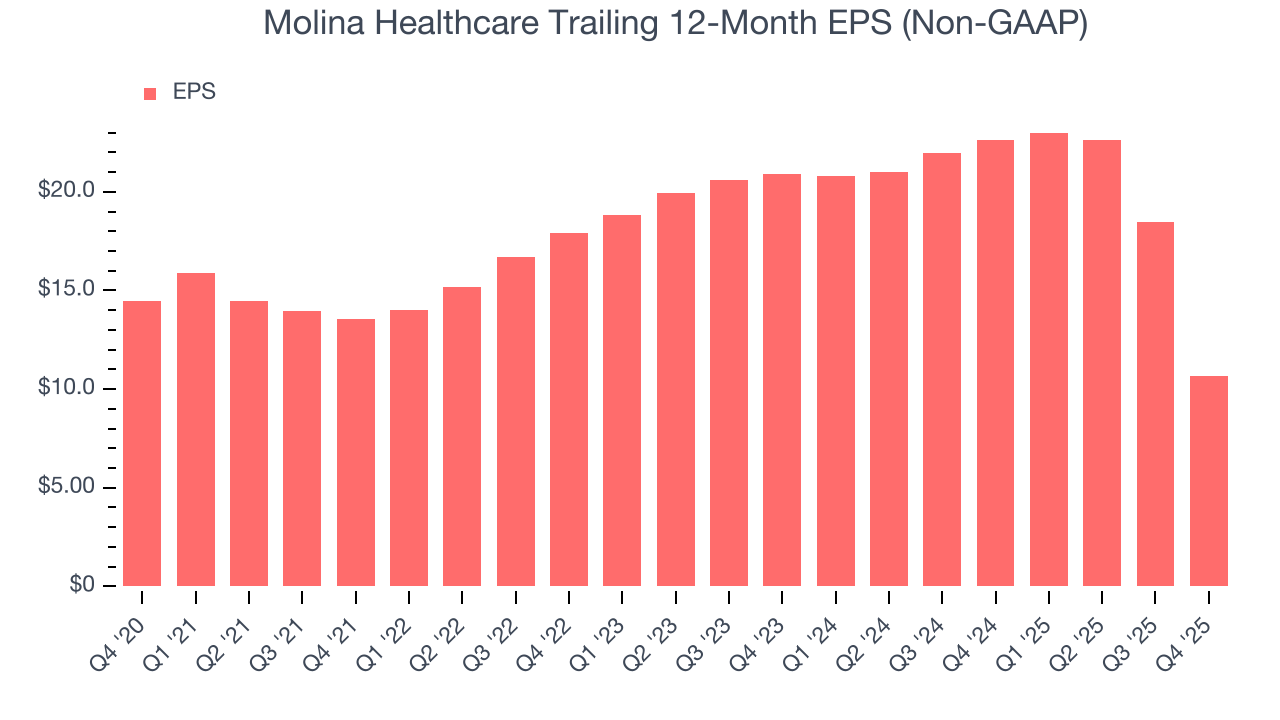

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Molina Healthcare, its EPS declined by 5.9% annually over the last five years while its revenue grew by 18.7%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Molina Healthcare’s earnings to better understand the drivers of its performance. As we mentioned earlier, Molina Healthcare’s operating margin declined by 1.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Molina Healthcare reported adjusted EPS of negative $2.75, down from $5.05 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Molina Healthcare’s full-year EPS of $10.65 to grow 26.5%.

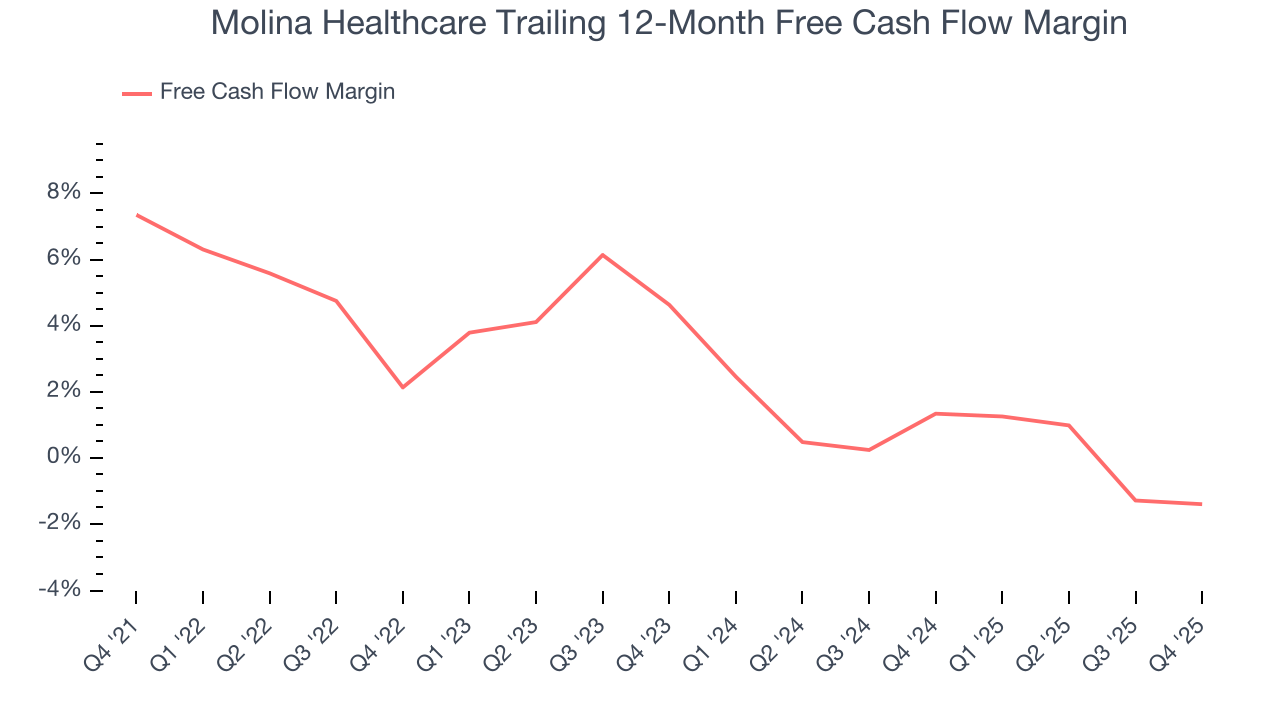

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Molina Healthcare has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, subpar for a healthcare business.

Taking a step back, we can see that Molina Healthcare’s margin dropped by 8.8 percentage points during that time. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Molina Healthcare burned through $297 million of cash in Q4, equivalent to a negative 2.6% margin. The company’s cash burn increased from $235 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings.

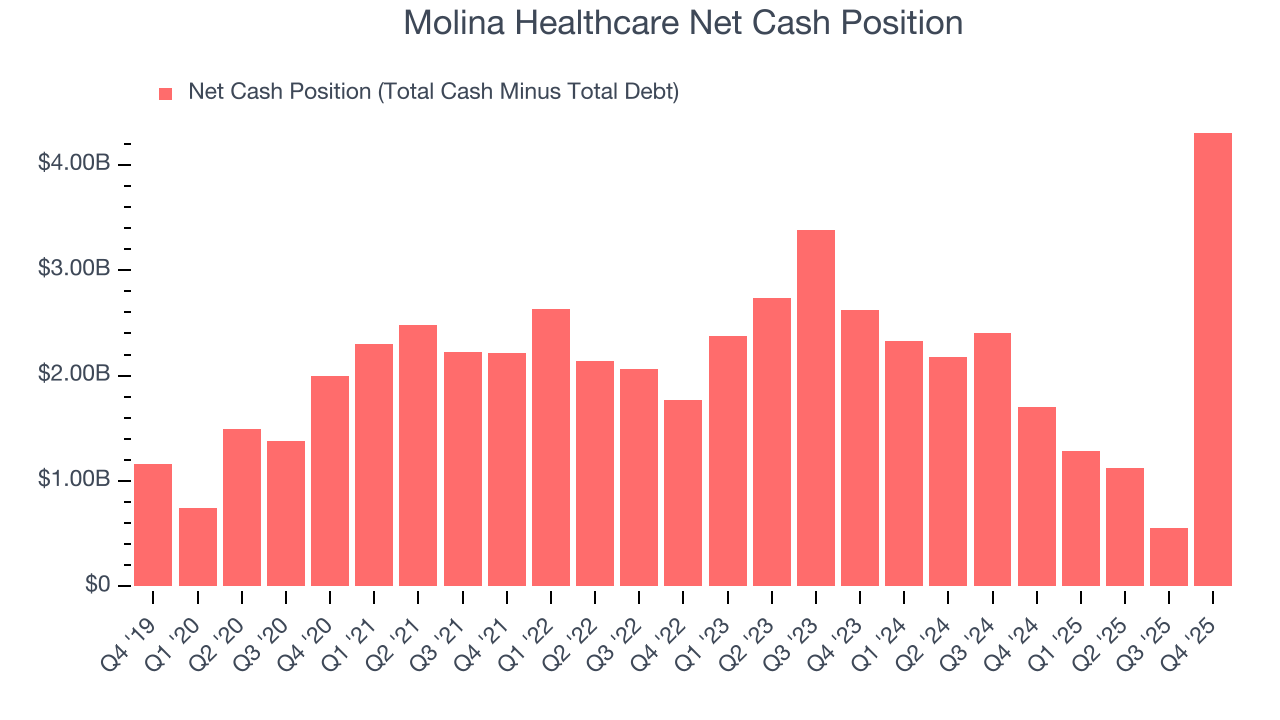

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Molina Healthcare is a well-capitalized company with $8.26 billion of cash and $3.95 billion of debt on its balance sheet. This $4.31 billion net cash position is 47.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Molina Healthcare’s Q4 Results

We enjoyed seeing Molina Healthcare beat analysts’ revenue expectations this quarter. On the other hand, its full-year revenue guidance missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 33.4% to $117.80 immediately after reporting.

12. Is Now The Time To Buy Molina Healthcare?

Before deciding whether to buy Molina Healthcare or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

In our opinion, Molina Healthcare is a solid company. First off, its revenue growth was impressive over the last five years. And while its declining EPS over the last five years makes it a less attractive asset to the public markets, its customer growth has been marvelous. On top of that, its scale gives it meaningful leverage when negotiating reimbursement rates.

Molina Healthcare’s P/E ratio based on the next 12 months is 13.1x. Looking at the healthcare landscape right now, Molina Healthcare trades at a pretty interesting price. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $186.69 on the company (compared to the current share price of $117.80), implying they see 58.5% upside in buying Molina Healthcare in the short term.