1. News

2. Summary

Why We Like Nelnet

Starting as a student loan servicer in the 1970s and evolving through the changing landscape of education finance, Nelnet (NYSE:NNI) provides student loan servicing, education technology, payment processing, and banking services while managing a portfolio of education loans.

- Incremental sales over the last two years have been highly profitable as its earnings per share increased by 37.2% annually, topping its revenue gains

- Annual revenue growth of 18% over the past two years was outstanding, reflecting market share gains this cycle

- ROE of 10.7% shows management can invest its resources competently

Nelnet is a standout company. The valuation seems reasonable when considering its quality, so this might be a prudent time to buy some shares.

Why Is Now The Time To Buy Nelnet?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Nelnet?

Nelnet is trading at $140.20 per share, or 17.3x forward P/E. Scanning the financials landscape, we think this multiple is reasonable - arguably even attractive - for the quality you get.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Entry price matters less, but if you can get a good one, all the better.

3. Nelnet (NNI) Research Report: Q3 CY2025 Update

Education finance company Nelnet (NYSE:NNI) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 47.6% year on year to $427.8 million. Its GAAP profit of $2.94 per share was 93.4% above analysts’ consensus estimates.

Nelnet (NNI) Q3 CY2025 Highlights:

Company Overview

Starting as a student loan servicer in the 1970s and evolving through the changing landscape of education finance, Nelnet (NYSE:NNI) provides student loan servicing, education technology, payment processing, and banking services while managing a portfolio of education loans.

Nelnet operates through four main segments that work together to serve students, families, schools, and financial institutions. Its Loan Servicing and Systems segment handles the administration of student loans for the Department of Education—Nelnet's largest customer—as well as for private lenders. The company processes payments, manages applications, provides customer service, and handles compliance requirements for millions of borrowers.

The Education Technology Services and Payments segment offers financial management tools, school information systems, and payment processing solutions. Through its FACTS brand, Nelnet provides tuition management services to nearly 12,000 K-12 schools, helping families make recurring payments over time while offering schools grant assessment and accounting services. For higher education, Nelnet Campus Commerce delivers payment technologies to over 1,000 colleges and universities worldwide.

Nelnet's Asset Generation and Management segment maintains a portfolio of student loans, primarily federally insured FFELP loans, generating income from the spread between loan yields and financing costs. Meanwhile, Nelnet Bank, launched as an internet industrial bank, focuses on private education loans and unsecured consumer lending.

Beyond these core operations, Nelnet has diversified into renewable energy investments, real estate, and venture capital. The company has invested in solar projects nationwide, providing tax equity investments and developing solar assets. Its venture capital portfolio includes investments in 91 entities, with its largest stake in Hudl, a sports performance analysis company. Nelnet also maintains a significant investment in ALLO, a fiber communications company serving communities across Nebraska, Colorado, and Arizona.

4. Student Loan

Student loan providers finance higher education expenses. Growth opportunities exist in private loan offerings, refinancing existing debt, and international education funding. Challenges include political uncertainty around potential loan forgiveness programs, default risk correlation with employment markets, and increasing scrutiny of educational outcomes relative to debt burdens.

Nelnet's competitors in loan servicing include Navient (NASDAQ:NAVI), MOHELA, and Maximus Federal Services. In the education technology and payment processing space, it competes with Blackbaud (NASDAQ:BLKB), Ellucian, and PowerSchool (NYSE:PWSC). For its banking operations, competitors include Sallie Mae (NASDAQ:SLM) and Discover Financial Services (NYSE:DFS).

5. Revenue Growth

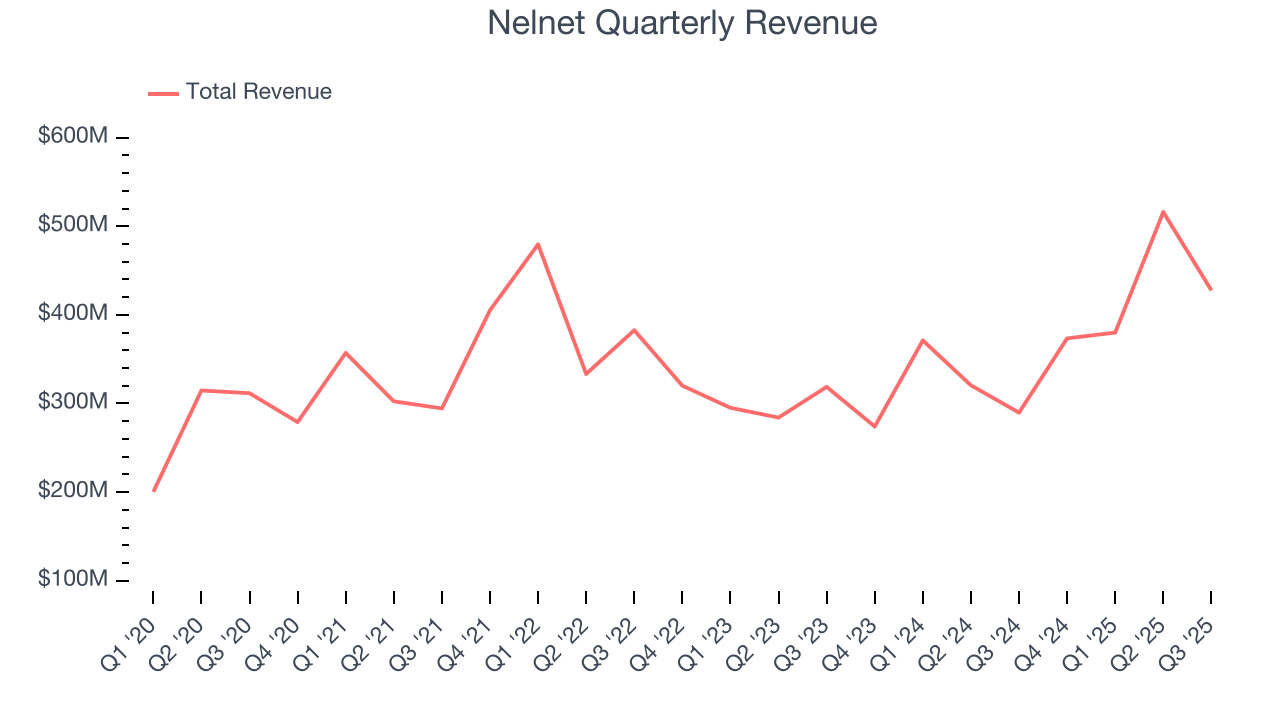

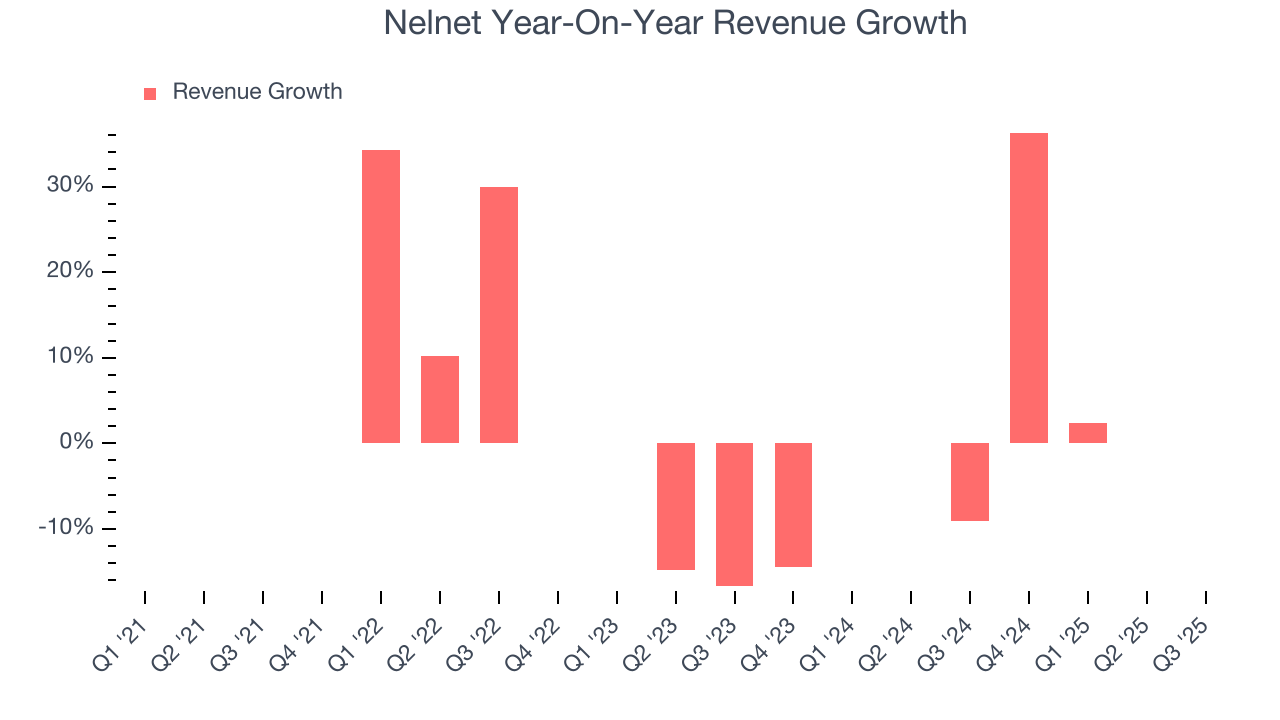

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Nelnet grew its revenue at a decent 9.9% compounded annual growth rate. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Nelnet’s annualized revenue growth of 18% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Nelnet reported magnificent year-on-year revenue growth of 47.6%, and its $427.8 million of revenue beat Wall Street’s estimates by 15%.

6. Pre-Tax Profit Margin

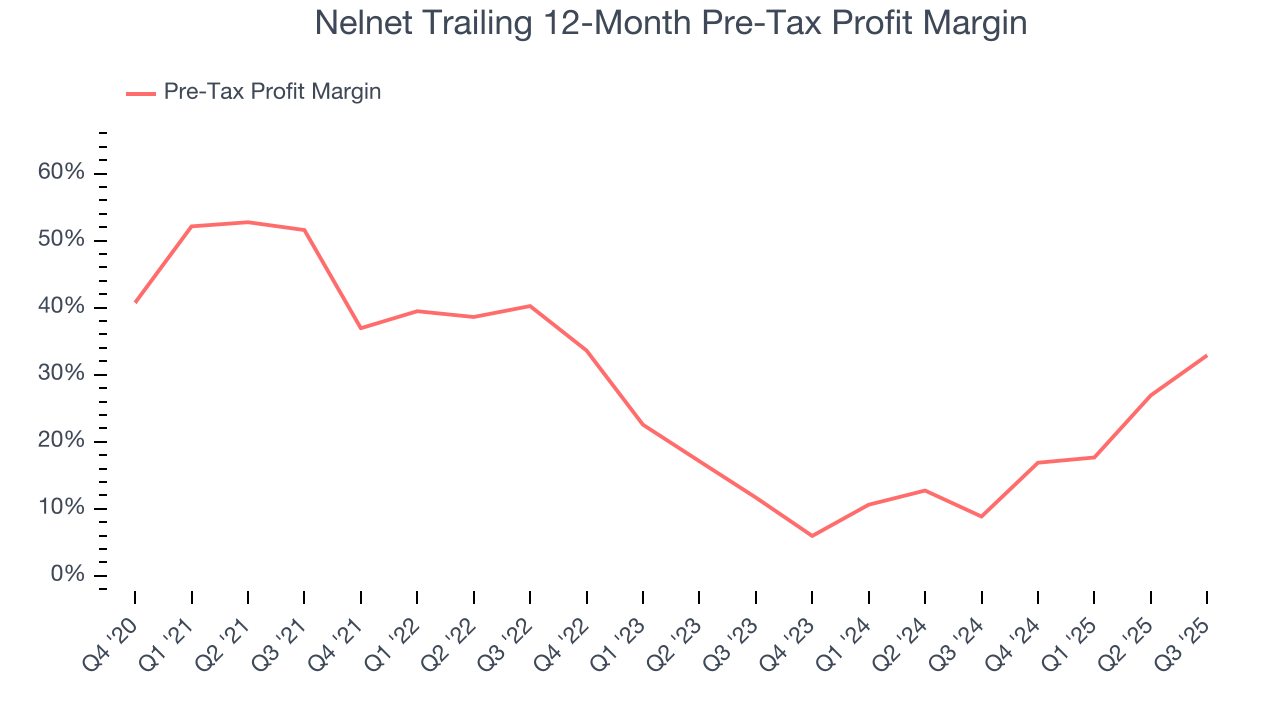

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Student Loan companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last four years, Nelnet’s pre-tax profit margin has risen by 18.7 percentage points, going from 51.6% to 32.9%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 21.2 percentage points on a two-year basis.

Nelnet’s pre-tax profit margin came in at 31.9% this quarter. This result was 32.7 percentage points better than the same quarter last year.

7. Earnings Per Share

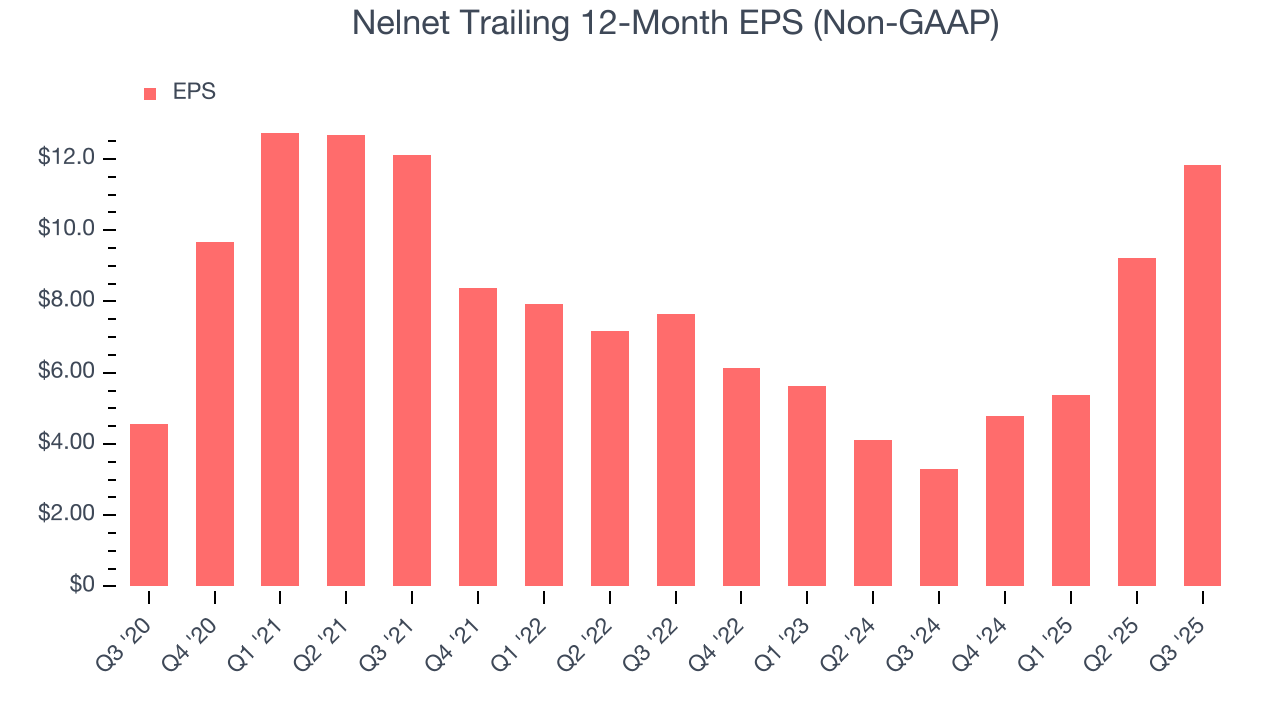

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Nelnet’s EPS grew at a spectacular 21% compounded annual growth rate over the last five years, higher than its 9.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Nelnet, its two-year annual EPS growth of 37.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Nelnet reported adjusted EPS of $2.95, up from $0.34 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Nelnet’s full-year EPS of $11.83 to shrink by 30.9%.

8. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Nelnet has averaged an ROE of 10.6%, respectable for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired.

9. Balance Sheet Assessment

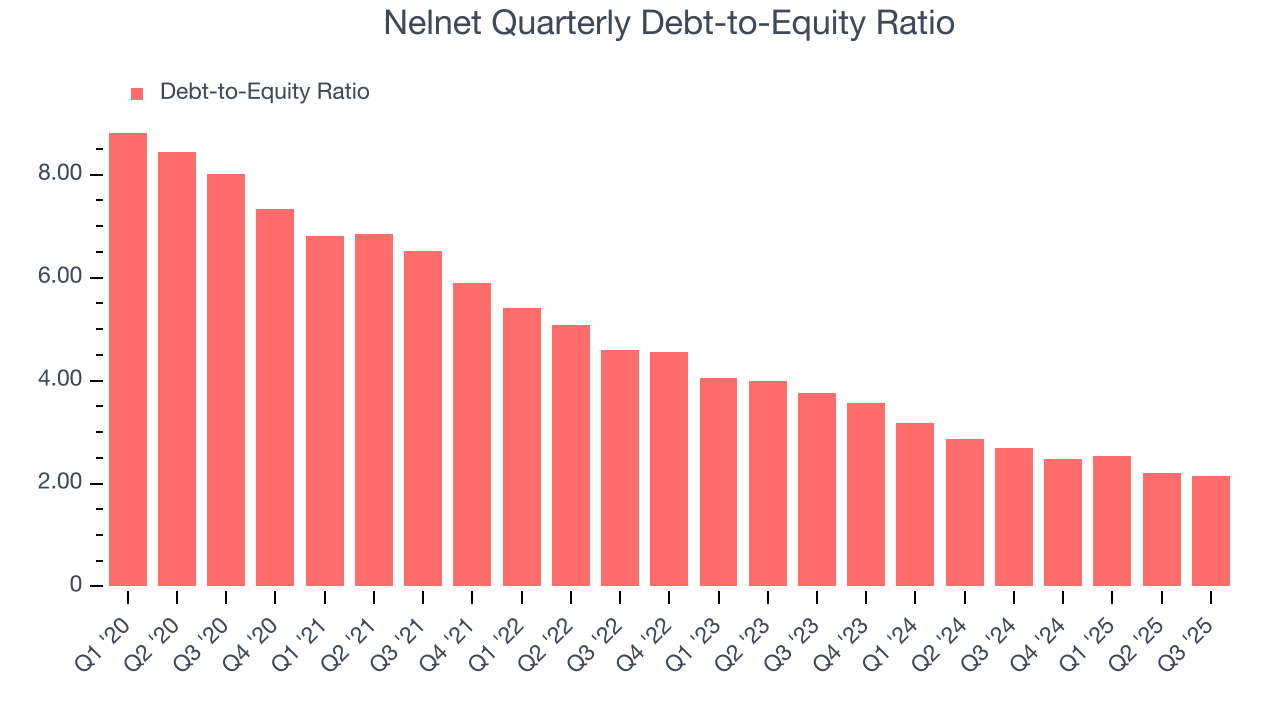

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Nelnet currently has $7.82 billion of debt and $3.65 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 2.3×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Nelnet’s Q3 Results

It was good to see Nelnet beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its net interest income slightly missed. Zooming out, we think this was a solid print. The stock traded up 2.4% to $133 immediately after reporting.

11. Is Now The Time To Buy Nelnet?

Updated: January 9, 2026 at 11:52 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Nelnet.

There are several reasons why we think Nelnet is a great business. For starters, its revenue growth was decent over the last five years. On top of that, its expanding pre-tax profit margin shows the business has become more efficient, and its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders.

Nelnet’s P/E ratio based on the next 12 months is 17.3x. Looking across the spectrum of financials companies today, Nelnet’s fundamentals shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $140 on the company (compared to the current share price of $140.20).