Northrop Grumman (NOC)

Northrop Grumman is up against the odds. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Northrop Grumman Will Underperform

Responsible for the development of the first stealth bomber, Northrop Grumman (NYSE:NOC) specializes in providing aerospace, defense, and security solutions for various industry applications.

- Earnings per share lagged its peers over the last two years as they only grew by 2% annually

- Large revenue base makes it harder to increase sales quickly, and its annual revenue growth of 2.9% over the last two years was below our standards for the industrials sector

- Core business is underperforming as its organic revenue has disappointed over the past two years, suggesting it might need acquisitions to stimulate growth

Northrop Grumman is skating on thin ice. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Northrop Grumman

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Northrop Grumman

Northrop Grumman’s stock price of $657.58 implies a valuation ratio of 24.4x forward P/E. This multiple expensive for its subpar fundamentals.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Northrop Grumman (NOC) Research Report: Q4 CY2025 Update

Security and aerospace company Northrop Grumman (NYSE:NOC) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 9.6% year on year to $11.71 billion. On the other hand, the company’s full-year revenue guidance of $43.75 billion at the midpoint came in 1.1% below analysts’ estimates. Its GAAP profit of $9.99 per share was 43.5% above analysts’ consensus estimates.

Northrop Grumman (NOC) Q4 CY2025 Highlights:

- Revenue: $11.71 billion vs analyst estimates of $11.63 billion (9.6% year-on-year growth, 0.7% beat)

- EPS (GAAP): $9.99 vs analyst estimates of $6.96 (43.5% beat)

- Adjusted EBITDA: $1.73 billion vs analyst estimates of $1.63 billion (14.8% margin, 6% beat)

- Operating Margin: 10.9%, in line with the same quarter last year

- Free Cash Flow Margin: 27.6%, up from 16.5% in the same quarter last year

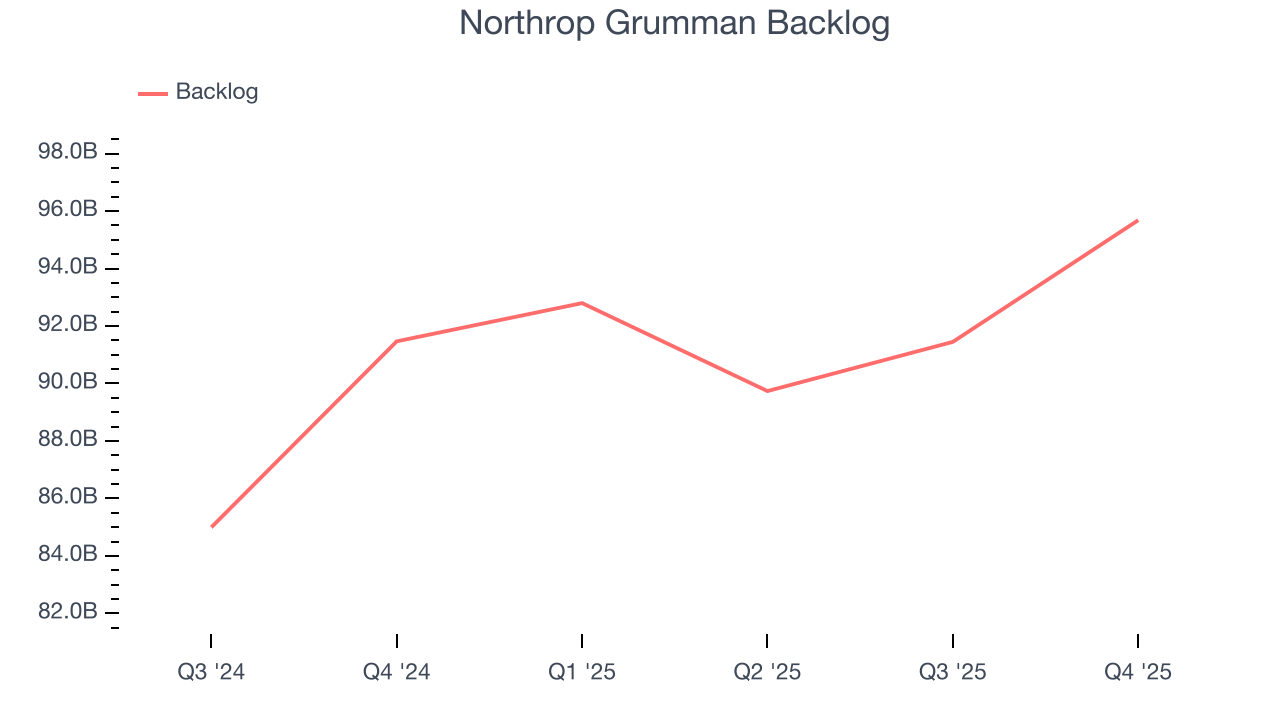

- Backlog: $95.68 billion at quarter end, up 4.6% year on year

- Market Capitalization: $94.33 billion

Company Overview

Responsible for the development of the first stealth bomber, Northrop Grumman (NYSE:NOC) specializes in providing aerospace, defense, and security solutions for various industry applications.

Northrop Grumman originally focused on producing aircraft such as fighter planes for the U.S. Navy during World War 2. Since then, it has expanded its product portfolio to include a range of aerospace and defense products including aircraft, defense systems, space systems, and information systems.

The company primarily engages in business with various branches of the U.S. Department of Defense in addition to allied nations and international defense organizations. Northrop Grumman also services other U.S. government agencies involved in national security, intelligence, and space exploration. One application of the company's diverse services has been in NASA's Artemis program, where it developed solid rocket boosters for the NASA Space Launch System.

Besides direct negotiations, international sales are conducted through government-to-government agreements and partnerships meant to establish markets in new regions. Domestically, Northrop Grumann secures contracts through proposals and auction processes with peer companies, which vary in scope and duration with the proposition. A majority of the company’s business is in the defense sector, but recently, technologies such as cybersecurity and space exploration have gained traction among commercial entities.

4. Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

Northrop Grumman’s peers and competitors include Boeing (NYSE:BA), Raytheon (NYSE:RTX), General Dynamics (NYSE:GD), and Lockheed Martin (NYSE:LMT).

5. Revenue Growth

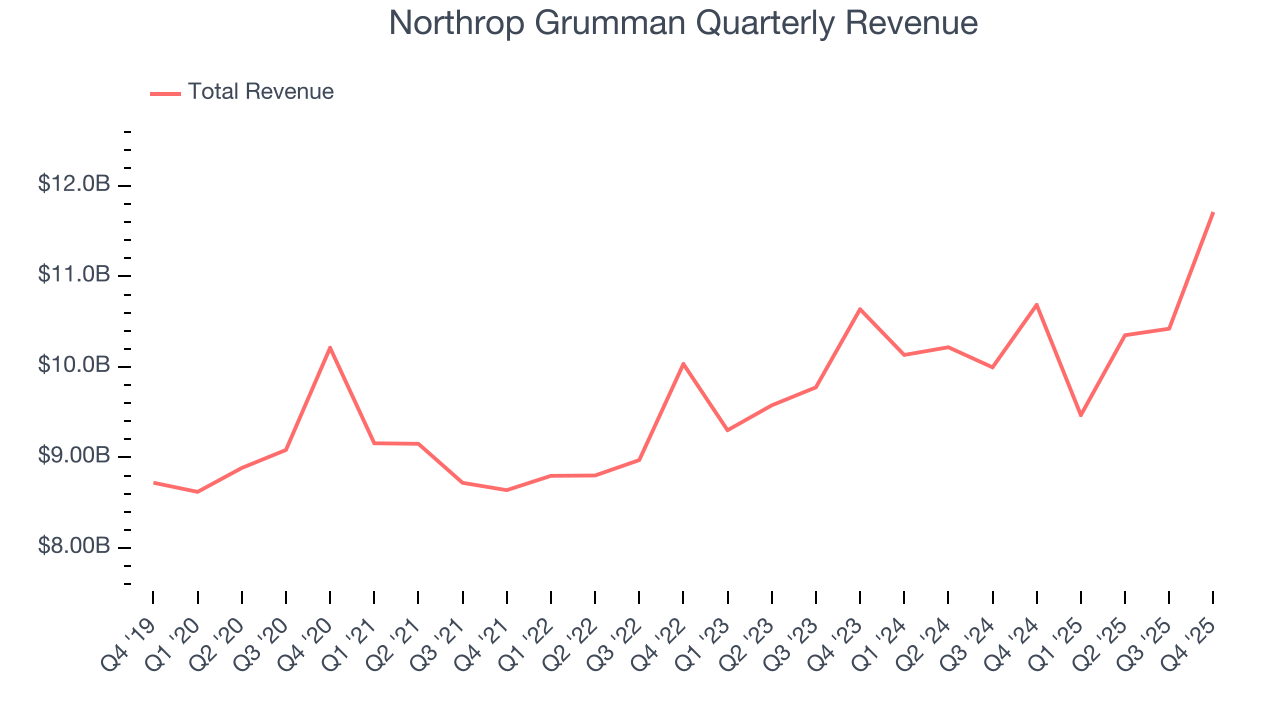

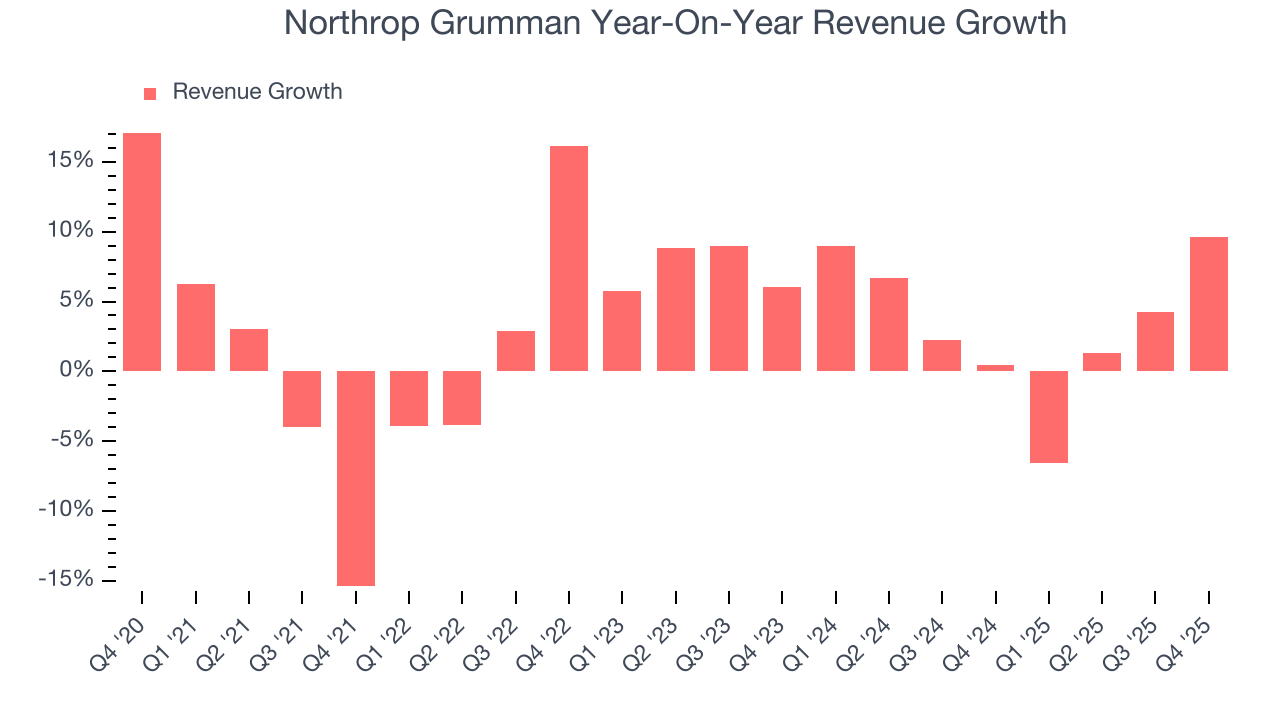

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Northrop Grumman grew its sales at a sluggish 2.7% compounded annual growth rate. This was below our standards and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Northrop Grumman’s annualized revenue growth of 3.3% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

Northrop Grumman also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Northrop Grumman’s backlog reached $95.68 billion in the latest quarter and averaged 6.1% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Northrop Grumman’s products and services but raises concerns about capacity constraints.

This quarter, Northrop Grumman reported year-on-year revenue growth of 9.6%, and its $11.71 billion of revenue exceeded Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

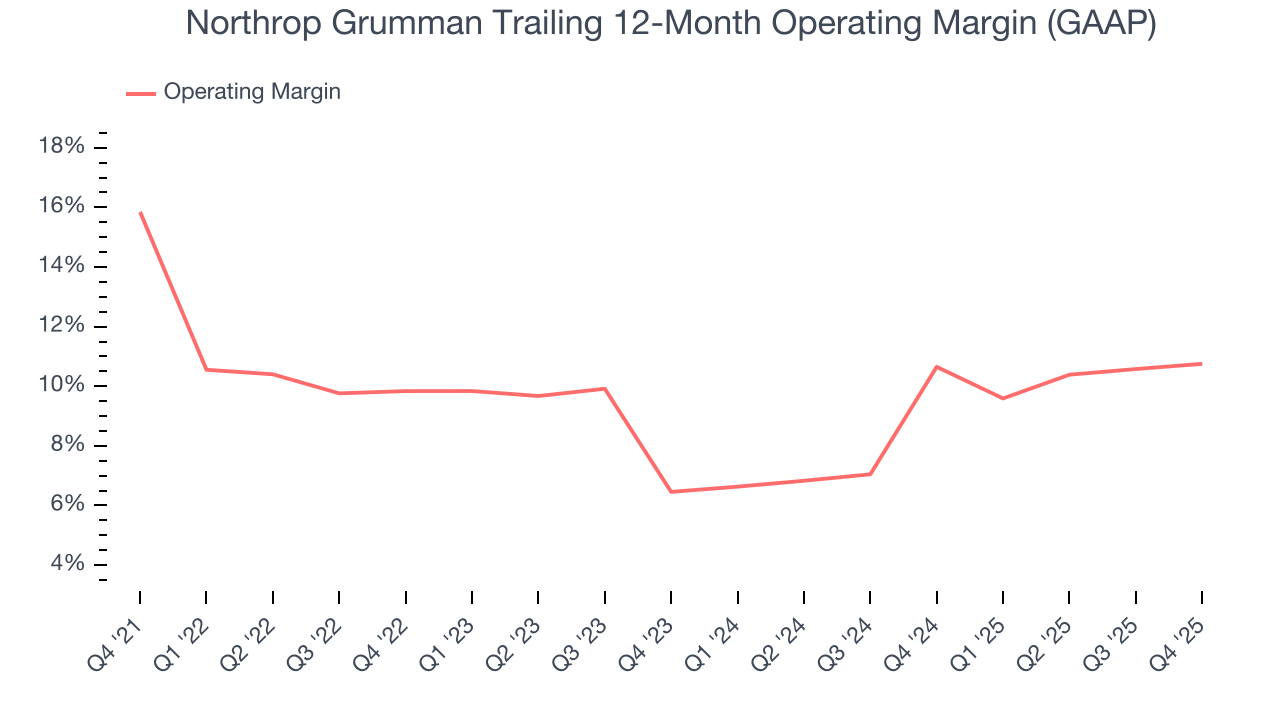

Northrop Grumman has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.6%.

Analyzing the trend in its profitability, Northrop Grumman’s operating margin decreased by 5.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Northrop Grumman generated an operating margin profit margin of 10.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

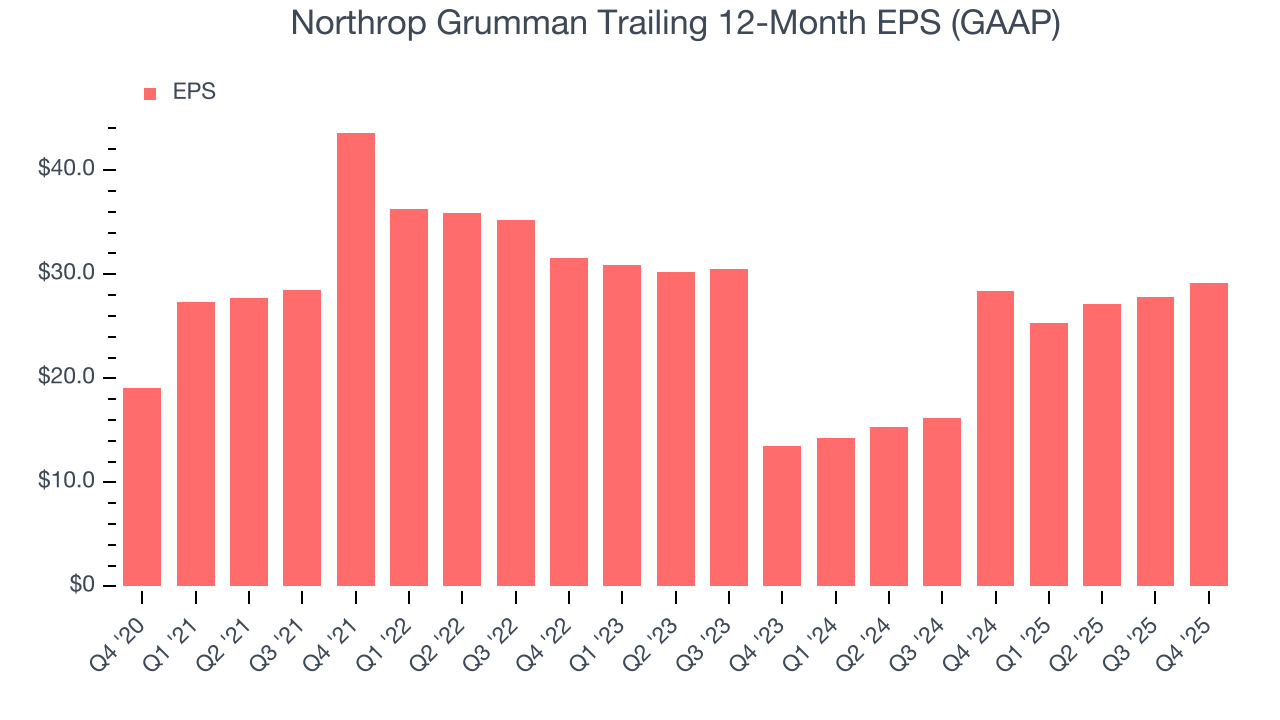

Northrop Grumman’s EPS grew at a decent 8.9% compounded annual growth rate over the last five years, higher than its 2.7% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

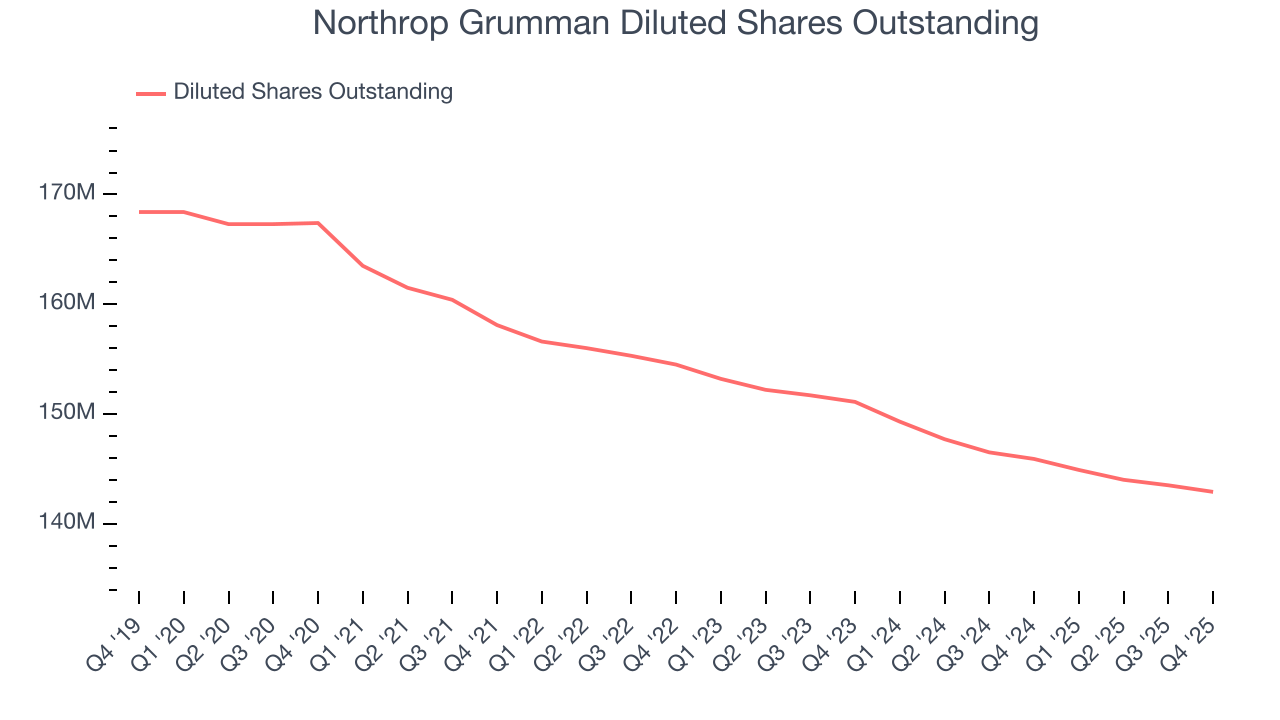

We can take a deeper look into Northrop Grumman’s earnings quality to better understand the drivers of its performance. A five-year view shows that Northrop Grumman has repurchased its stock, shrinking its share count by 14.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Northrop Grumman, its two-year annual EPS growth of 47.1% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q4, Northrop Grumman reported EPS of $9.99, up from $8.66 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Northrop Grumman’s full-year EPS of $29.13 to stay about the same.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

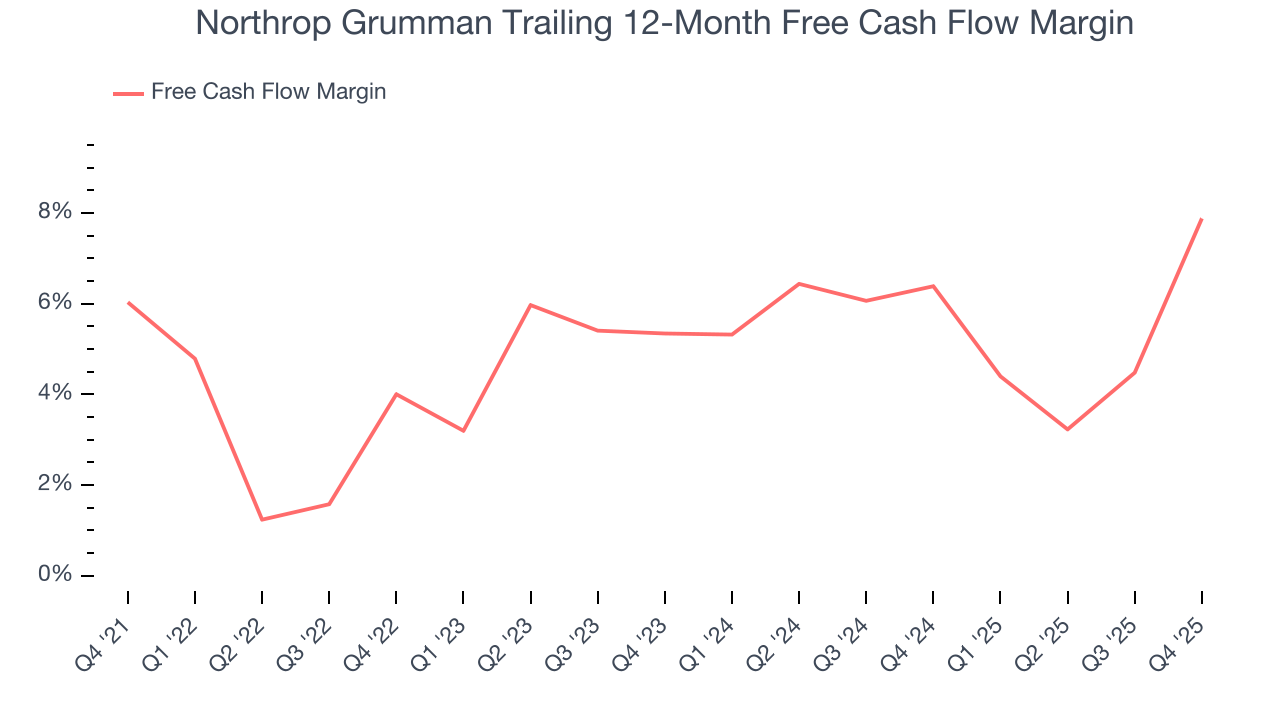

Northrop Grumman has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6%, subpar for an industrials business.

Taking a step back, an encouraging sign is that Northrop Grumman’s margin expanded by 1.8 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Northrop Grumman’s free cash flow clocked in at $3.24 billion in Q4, equivalent to a 27.6% margin. This result was good as its margin was 11.1 percentage points higher than in the same quarter last year, building on its favorable historical trend.

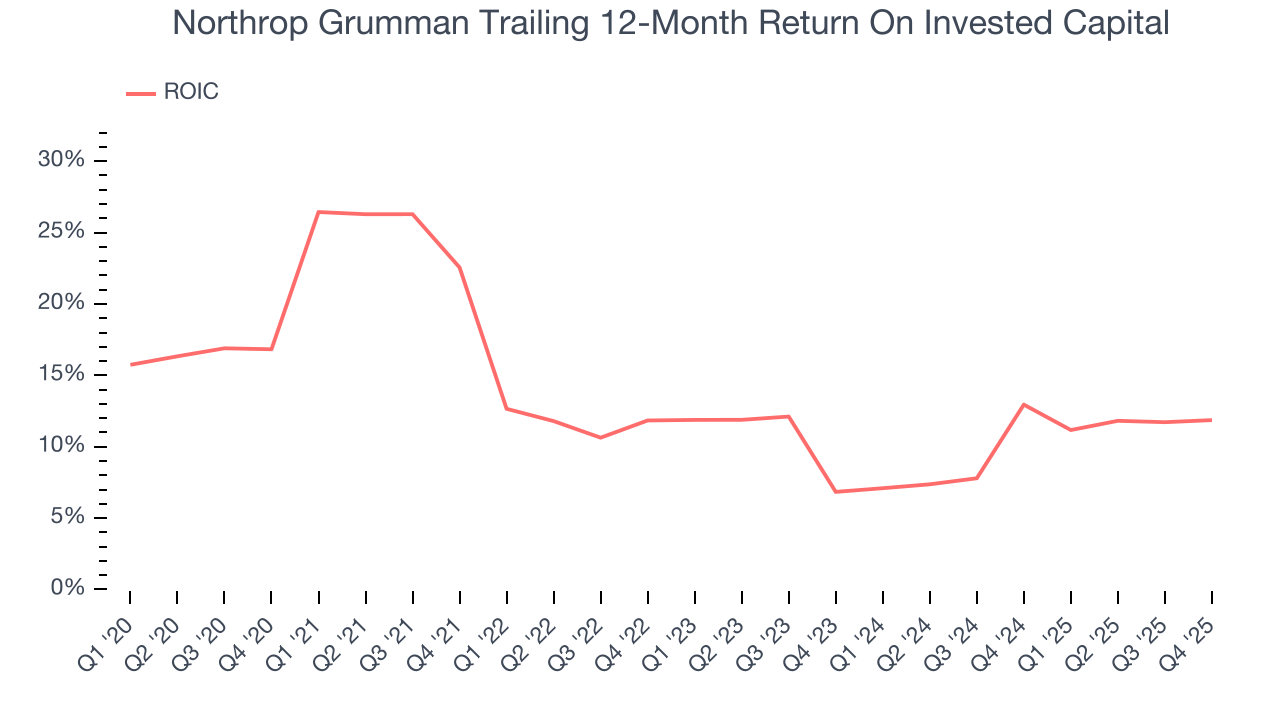

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Northrop Grumman hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 13.2%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Northrop Grumman’s ROIC decreased by 4.8 percentage points annually over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

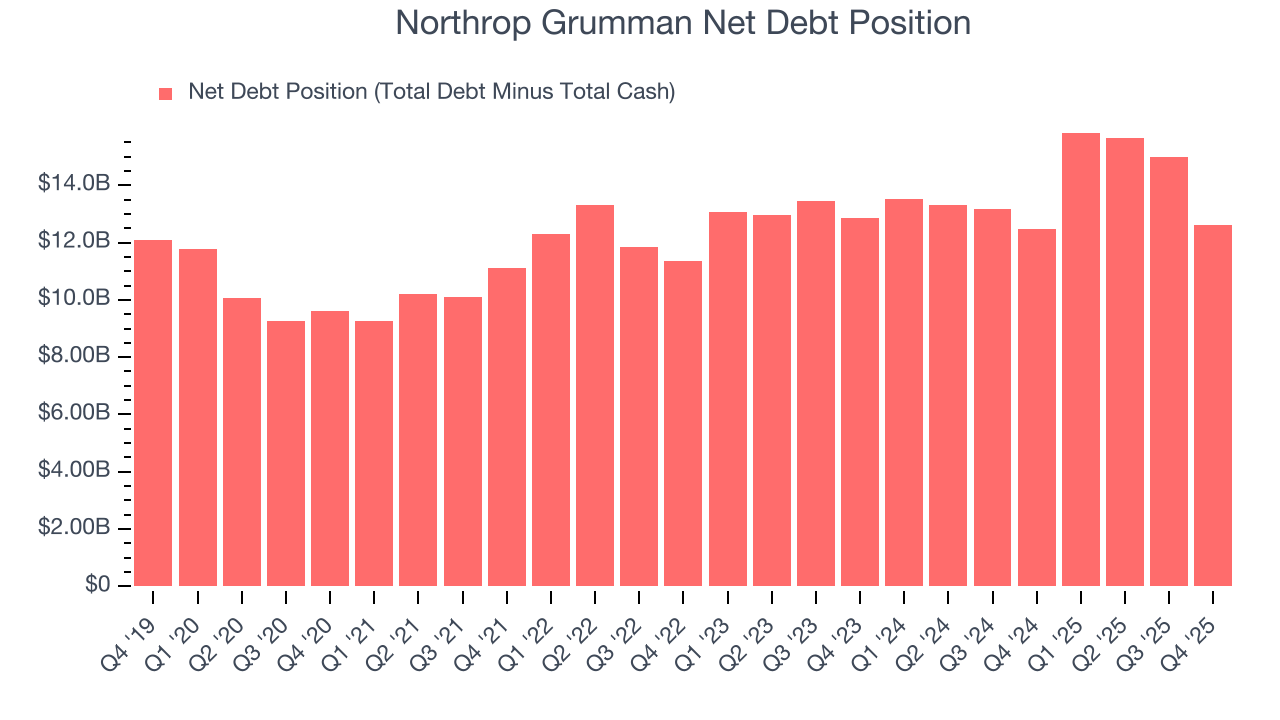

10. Balance Sheet Assessment

Northrop Grumman reported $4.40 billion of cash and $17.02 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $6.04 billion of EBITDA over the last 12 months, we view Northrop Grumman’s 2.1× net-debt-to-EBITDA ratio as safe. We also see its $315 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Northrop Grumman’s Q4 Results

It was good to see Northrop Grumman beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance slightly missed. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $655.17 immediately following the results.

12. Is Now The Time To Buy Northrop Grumman?

Updated: January 27, 2026 at 7:01 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Northrop Grumman.

Northrop Grumman isn’t a terrible business, but it doesn’t pass our quality test. First off, its revenue growth was weak over the last five years. And while its solid ROIC suggests it has grown profitably in the past, the downside is its projected EPS for the next year is lacking. On top of that, its declining operating margin shows the business has become less efficient.

Northrop Grumman’s P/E ratio based on the next 12 months is 22.9x. Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $680.44 on the company (compared to the current share price of $655.17).