Old Republic International (ORI)

Old Republic International is in for a bumpy ride. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why We Think Old Republic International Will Underperform

Founded during the Roaring Twenties in 1923 and weathering nearly a century of economic cycles, Old Republic International (NYSE:ORI) is a diversified insurance holding company that provides property, liability, title, and mortgage guaranty insurance through its various subsidiaries.

- 1.5% annual book value per share growth over the last two years was slower than its insurance peers

- Earnings growth underperformed the sector average over the last two years as its EPS grew by just 9.4% annually

- Muted 3% annual book value per share growth over the last five years shows its capital generation lagged behind its insurance peers

Old Republic International is skating on thin ice. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Old Republic International

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Old Republic International

At $39.11 per share, Old Republic International trades at 1.7x forward P/B. This multiple is cheaper than most insurance peers, but we think this is justified.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Old Republic International (ORI) Research Report: Q4 CY2025 Update

Insurance conglomerate Old Republic International (NYSE:ORI) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 10.8% year on year to $2.39 billion. Its non-GAAP profit of $0.74 per share was 16.2% below analysts’ consensus estimates.

Old Republic International (ORI) Q4 CY2025 Highlights:

- Net Premiums Earned: $2.13 billion vs analyst estimates of $2.09 billion (13.8% year-on-year growth, 2.2% beat)

- Revenue: $2.39 billion vs analyst estimates of $2.32 billion (10.8% year-on-year growth, 2.8% beat)

- Combined Ratio: 96% vs analyst estimates of 94.1% (190 basis point miss)

- Adjusted EPS: $0.74 vs analyst expectations of $0.88 (16.2% miss)

- Book Value per Share: $24.21 vs analyst estimates of $24.94 (5.8% year-on-year growth, 2.9% miss)

- Market Capitalization: $10.5 billion

Company Overview

Founded during the Roaring Twenties in 1923 and weathering nearly a century of economic cycles, Old Republic International (NYSE:ORI) is a diversified insurance holding company that provides property, liability, title, and mortgage guaranty insurance through its various subsidiaries.

Old Republic operates through three main segments, with its General Insurance division forming the backbone of its business. This segment focuses on commercial lines insurance for specific sectors including transportation, construction, healthcare, and financial services. The company offers a wide range of coverages including commercial auto, liability, workers' compensation, and specialty financial indemnity products like directors and officers (D&O) insurance.

The Title Insurance segment represents another significant portion of Old Republic's business. This division issues policies that protect real estate purchasers and lenders against losses from defects in property titles. When someone buys a home, for example, Old Republic's title insurance would protect them if unknown liens or ownership claims emerged after purchase. Beyond basic title policies, the company provides related services such as escrow closing and construction disbursement.

The third segment, Republic Financial Indemnity Group (RFIG), is in run-off mode, meaning it no longer writes new policies but continues to service existing ones. This division previously offered mortgage guaranty insurance that protected lenders against defaults on residential mortgages with down payments below 20%.

Old Republic distributes its products primarily through independent agents and brokers, with approximately 94% of General Insurance premiums generated through these channels. For its Title Insurance business, the company relies on referrals from real estate professionals, lenders, and its network of 270 company branch offices across all 50 states.

4. Property & Casualty Insurance

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

Old Republic's competitors in the property and casualty insurance space include The Travelers Companies (NYSE:TRV), Chubb Limited (NYSE:CB), and The Hartford Financial Services Group (NYSE:HIG). In the title insurance segment, it competes with First American Financial (NYSE:FAF), Fidelity National Financial (NYSE:FNF), and Stewart Information Services (NYSE:STC).

5. Revenue Growth

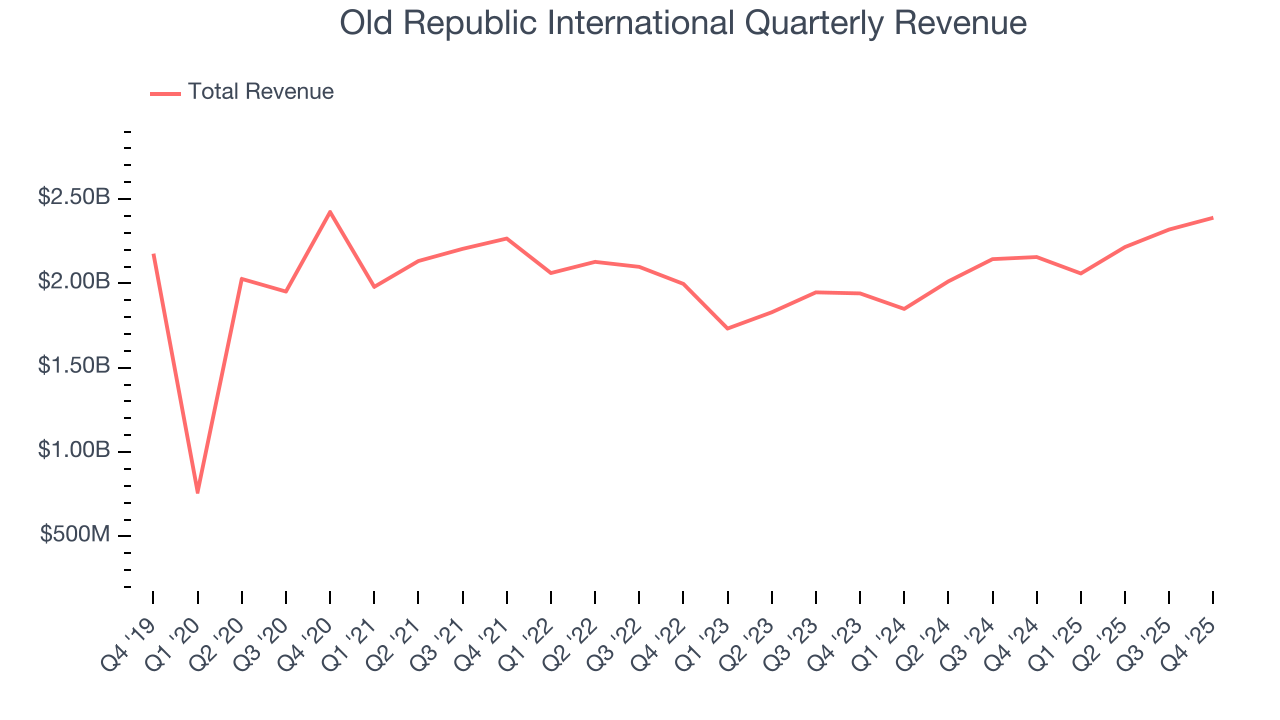

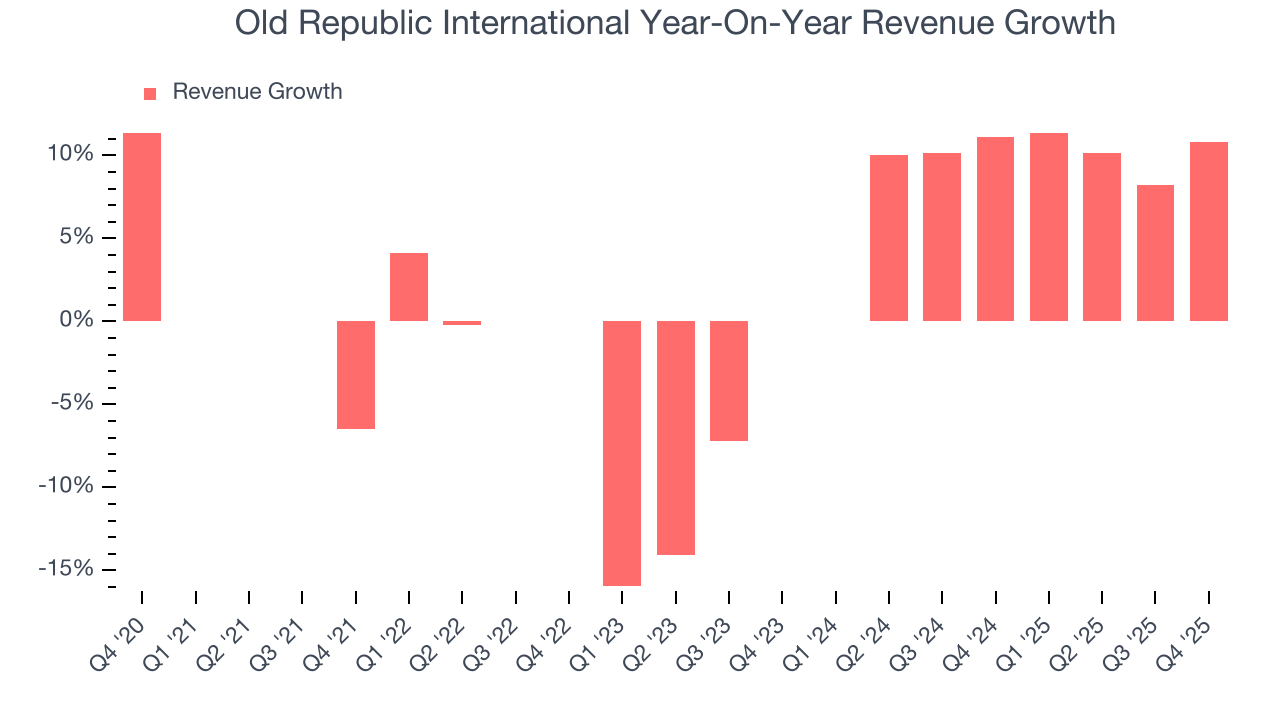

Insurance companies earn revenue from three primary sources: 1) The core insurance business itself, often called underwriting and represented in the income statement as premiums 2) Income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities 3) Fees from various sources such as policy administration, annuities, or other value-added services. Unfortunately, Old Republic International’s 4.6% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the insurance sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Old Republic International’s annualized revenue growth of 9.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Old Republic International reported year-on-year revenue growth of 10.8%, and its $2.39 billion of revenue exceeded Wall Street’s estimates by 2.8%.

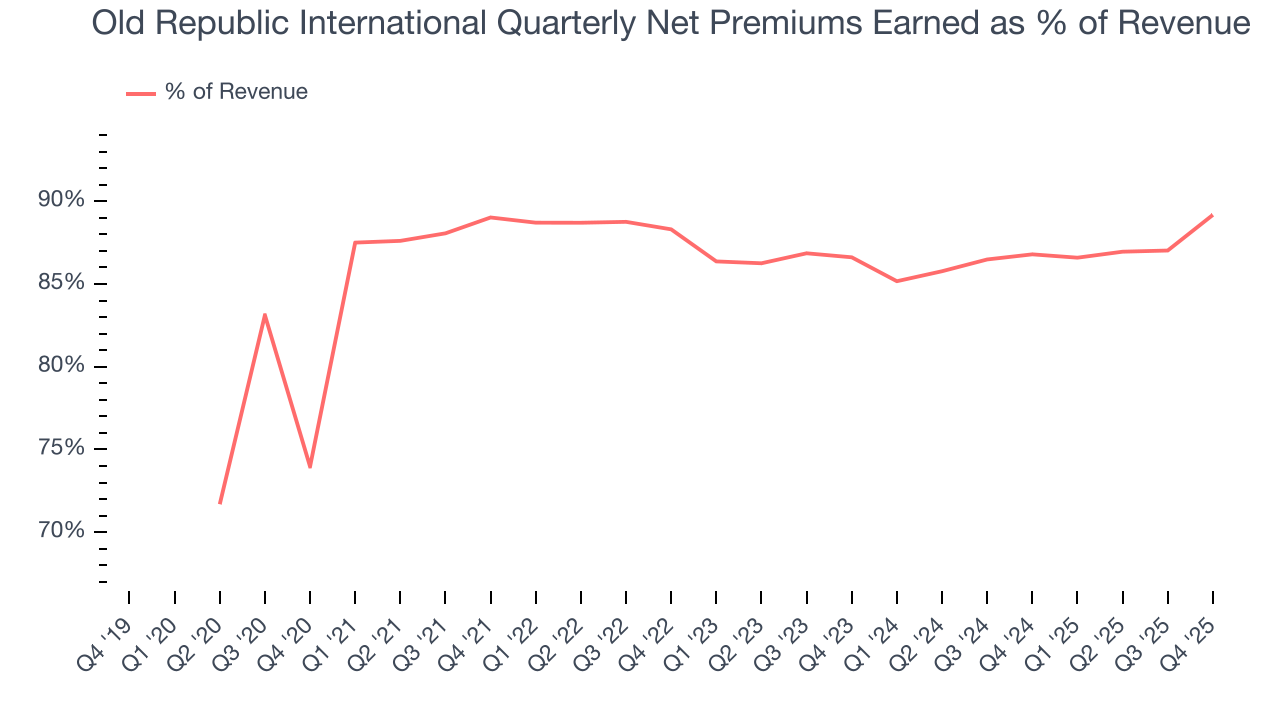

Net premiums earned made up 87.4% of the company’s total revenue during the last five years, meaning Old Republic International barely relies on non-insurance activities to drive its overall growth.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

6. Net Premiums Earned

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

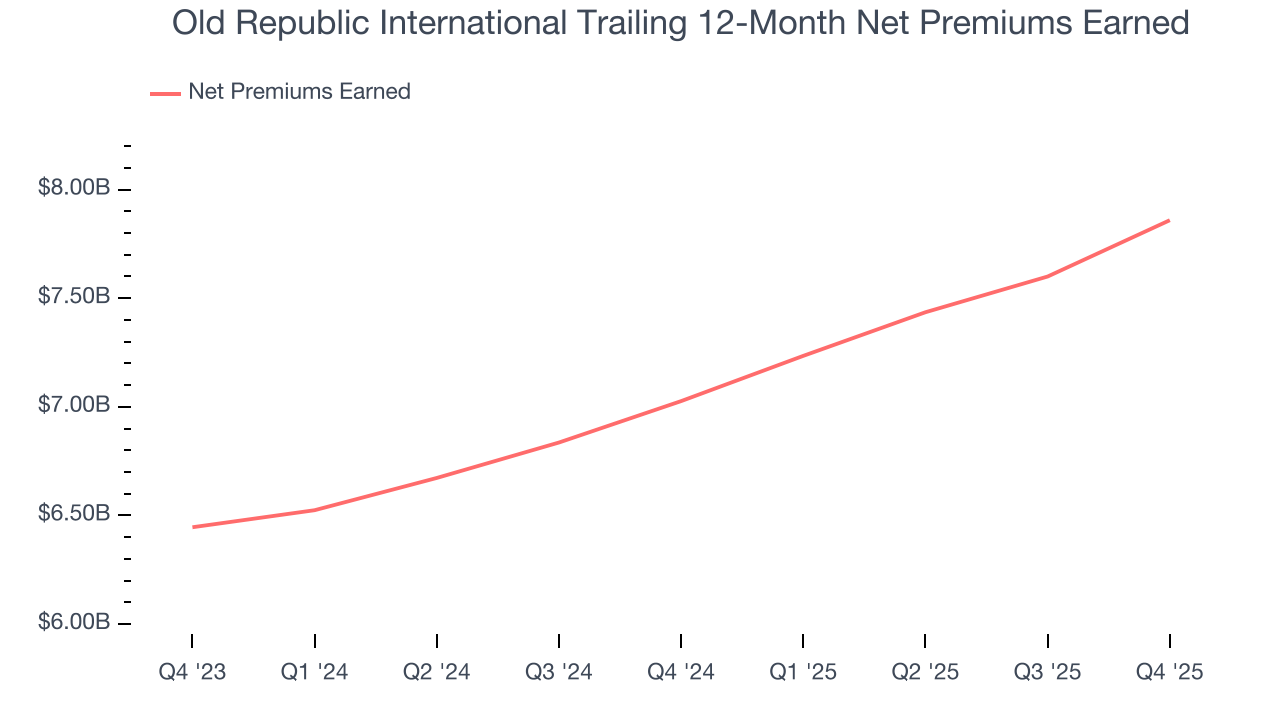

Old Republic International’s net premiums earned has grown at a 4.4% annualized rate over the last five years, worse than the broader insurance industry and in line with its total revenue.

When analyzing Old Republic International’s net premiums earned over the last two years, we can see that growth accelerated to 10.4% annually. This performance was similar to its total revenue.

This quarter, Old Republic International’s net premiums earned was $2.13 billion, up a hearty 13.8% year on year and topping Wall Street Consensus estimates by 2.2%.

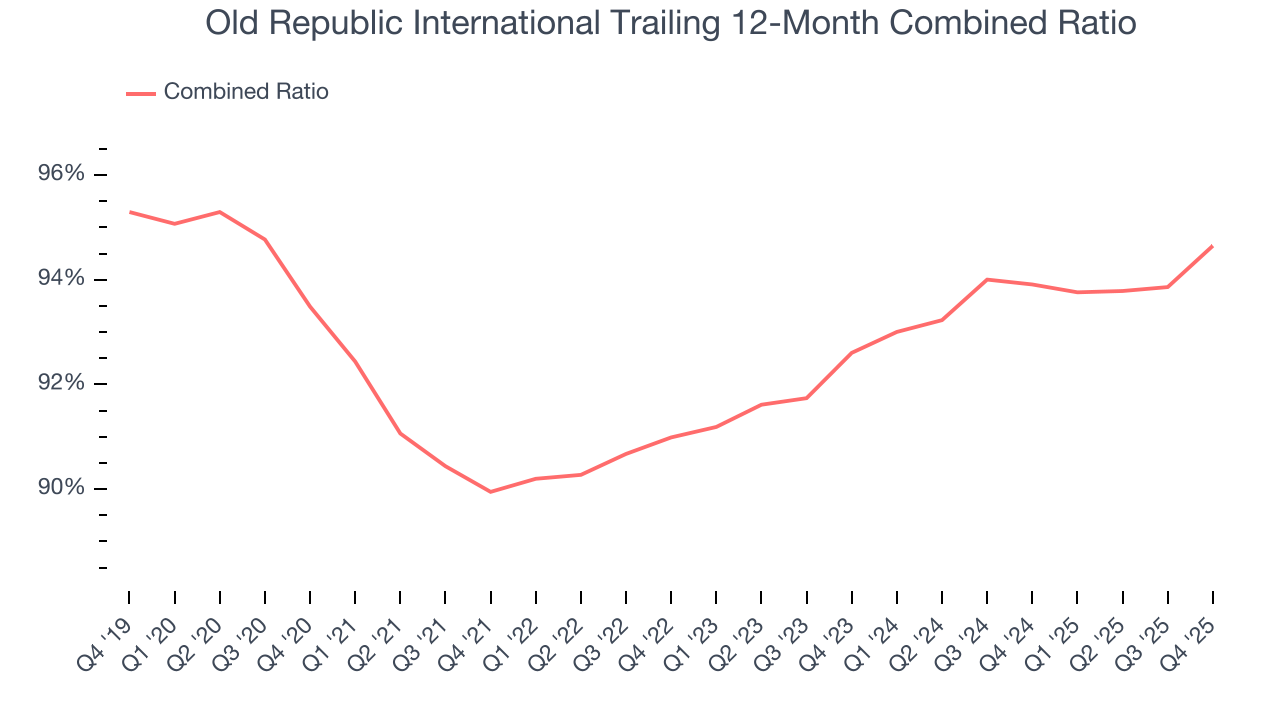

7. Combined Ratio

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

The combined ratio sums the costs of underwriting (salaries, commissions, overhead) as well as what an insurer pays out in claims (losses) and divides it by net premiums earned. If a company boasts a combined ratio under 100%, it is underwriting profitably. If above 100%, it is losing money on its core operations of selling insurance policies.

Given the calculation, a lower expense ratio is better. Over the last five years, Old Republic International’s combined ratio has increased by 1.2 percentage points, going from 89.9% to 94.6%. It has also worsened by 2 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

Old Republic International’s combined ratio came in at 96% this quarter, falling short of analysts’ expectations by 190 basis points (100 basis points = 1 percentage point). This result was 3.2 percentage points worse than the same quarter last year.

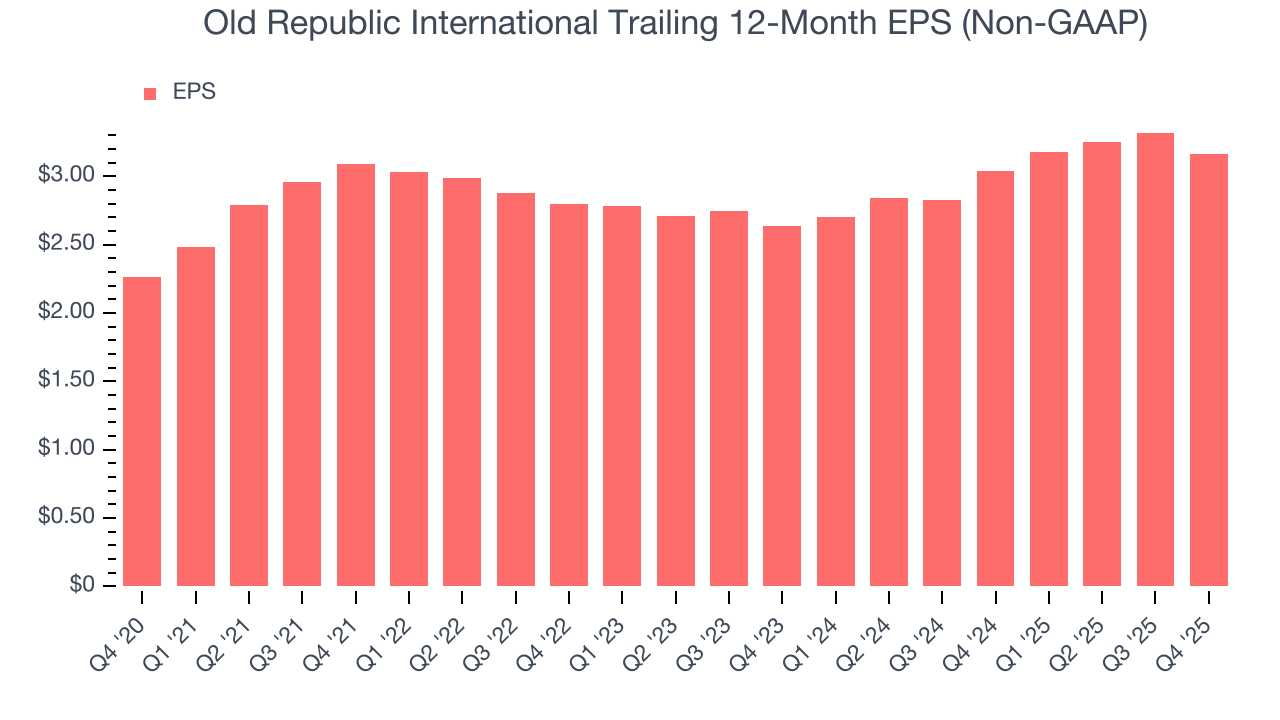

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Old Republic International’s EPS grew at an unimpressive 6.9% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 4.6% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Old Republic International, its two-year annual EPS growth of 9.4% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q4, Old Republic International reported adjusted EPS of $0.74, down from $0.90 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Old Republic International’s full-year EPS of $3.16 to grow 9.2%.

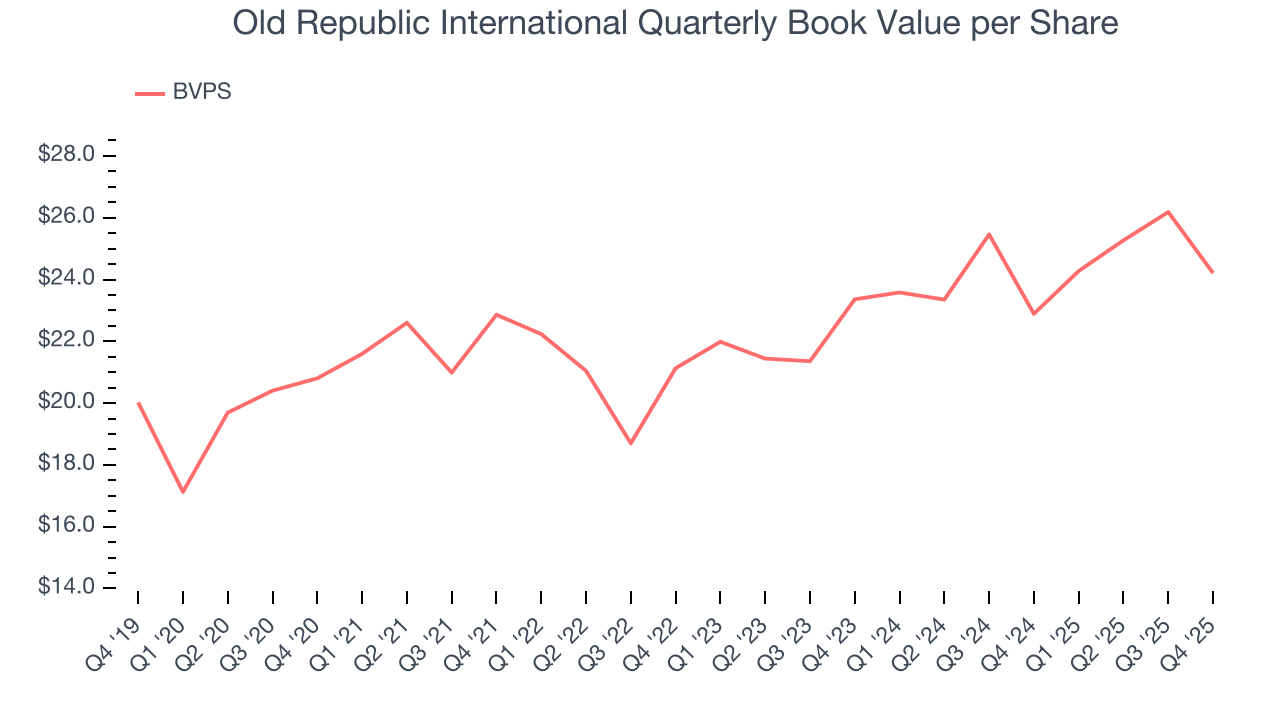

9. Book Value Per Share (BVPS)

Insurance companies are balance sheet businesses, collecting premiums upfront and paying out claims over time. The float–premiums collected but not yet paid out–are invested, creating an asset base supported by a liability structure. Book value per share (BVPS) captures this dynamic by measuring these assets (investment portfolio, cash, reinsurance recoverables) less liabilities (claim reserves, debt, future policy benefits). BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality because it reflects long-term capital growth and is harder to manipulate than more commonly-used metrics like EPS.

Old Republic International’s BVPS grew at a sluggish 3.1% annual clip over the last five years. BVPS growth has also recently decelerated a bit to 1.8% annual growth over the last two years (from $23.36 to $24.21 per share).

Over the next 12 months, Consensus estimates call for Old Republic International’s BVPS to grow by 8.6% to $24.94, mediocre growth rate.

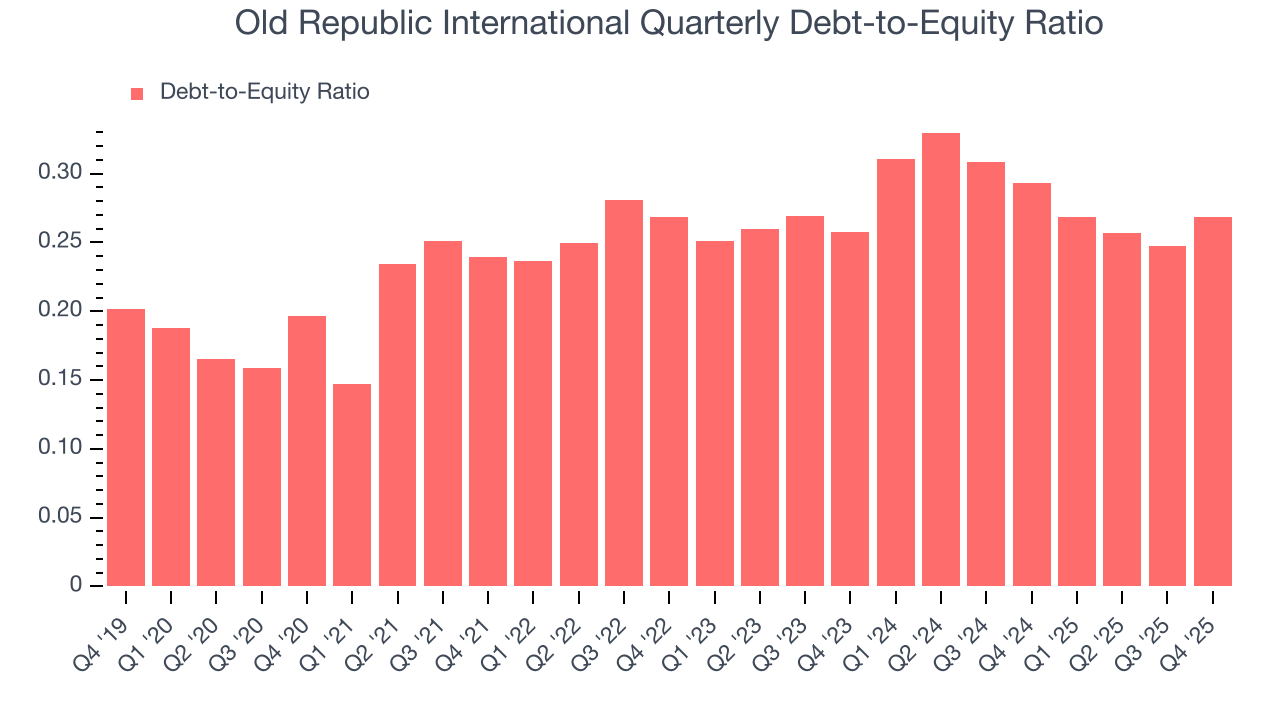

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Old Republic International currently has $1.59 billion of debt and $5.91 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.3×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 1.0× for an insurance business. Anything below 0.5× is a bonus.

11. Return on Equity

Return on equity (ROE) is a crucial yardstick for insurance companies, measuring their ability to generate returns on the capital provided by shareholders. Insurers that consistently deliver superior ROE tend to create more value for their investors over time through strategic capital allocation and shareholder-friendly policies.

Over the last five years, Old Republic International has averaged an ROE of 14.7%, healthy for a company operating in a sector where the average shakes out around 12.5% and those putting up 20%+ are greatly admired. This is a bright spot for Old Republic International.

12. Key Takeaways from Old Republic International’s Q4 Results

We enjoyed seeing Old Republic International beat analysts’ net premiums earned expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed and its book value per share fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.1% to $41.78 immediately after reporting.

13. Is Now The Time To Buy Old Republic International?

Updated: January 22, 2026 at 11:13 PM EST

When considering an investment in Old Republic International, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We see the value of companies helping consumers, but in the case of Old Republic International, we’re out. To kick things off, its revenue growth was uninspiring over the last five years. And while its solid ROE suggests it has grown profitably in the past, the downside is its projected EPS for the next year is lacking. On top of that, its BVPS growth was weak over the last five years.

Old Republic International’s P/B ratio based on the next 12 months is 1.7x. This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $42.50 on the company (compared to the current share price of $39.11).