Oscar Health (OSCR)

Oscar Health is a special business. Its strong sales growth shows it won market share, and there’s a decent chance its momentum will continue.― StockStory Analyst Team

1. News

2. Summary

Why We Like Oscar Health

Founded in 2012 to simplify the notoriously complex American healthcare system, Oscar Health (NYSE:OSCR) is a technology-focused health insurance company that offers individual and small group health plans through its cloud-native platform.

- Impressive 50.7% annual revenue growth over the last five years indicates it’s winning market share this cycle

- Earnings per share grew by 30.3% annually over the last four years and trumped its peers

- Projected revenue growth of 13.3% for the next 12 months suggests its momentum from the last two years will persist

Oscar Health sets the bar. The valuation seems reasonable when considering its quality, and we think now is an opportune time to buy the stock.

Why Is Now The Time To Buy Oscar Health?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Oscar Health?

At $16.55 per share, Oscar Health trades at 0.3x forward price-to-sales. Looking at the healthcare landscape today, Oscar Health’s qualities really stand out, and we like it at this price.

It seems like an opportune time to buy the stock if you believe in the long-term prospects of the business.

3. Oscar Health (OSCR) Research Report: Q3 CY2025 Update

Health insurance company Oscar Health (NYSE:OSCR) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 23.2% year on year to $2.99 billion. On the other hand, the company’s full-year revenue guidance of $12.1 billion at the midpoint came in 0.5% above analysts’ estimates. Its GAAP loss of $0.53 per share was 6.8% below analysts’ consensus estimates.

Oscar Health (OSCR) Q3 CY2025 Highlights:

- Revenue: $2.99 billion vs analyst estimates of $3.09 billion (23.2% year-on-year growth, 3.3% miss)

- EPS (GAAP): -$0.53 vs analyst expectations of -$0.50 (6.8% miss)

- Adjusted EBITDA: -$101.5 million vs analyst estimates of -$119.5 million (-3.4% margin, 15.1% beat)

- Operating Margin: -4.3%, down from -2% in the same quarter last year

- Free Cash Flow was -$973.7 million compared to -$507.7 million in the same quarter last year

- Market Capitalization: $4.40 billion

Company Overview

Founded in 2012 to simplify the notoriously complex American healthcare system, Oscar Health (NYSE:OSCR) is a technology-focused health insurance company that offers individual and small group health plans through its cloud-native platform.

Oscar Health operates primarily in the Affordable Care Act (ACA) marketplace, offering various metal-tier plans (Bronze, Silver, Gold, and Platinum) that differ in premium costs and cost-sharing structures. The company differentiates itself through its proprietary technology platform that powers both its insurance business and services for other healthcare organizations through its +Oscar offering.

At the core of Oscar's business model is what it calls its "member engagement engine" – a system designed to build trust with members, collect personalized health data, and guide users to appropriate care options. Members interact with features like Care Teams, which help navigate healthcare decisions, and Campaign Builder, which delivers personalized health recommendations based on predictive analytics.

For example, an Oscar member with diabetes might receive targeted communications about preventive care appointments, medication adherence reminders, and connections to in-network specialists – all coordinated through the platform. This approach aims to improve health outcomes while managing costs.

Oscar generates revenue primarily through insurance premiums, including those paid directly by members and government subsidies through the ACA's Advanced Premium Tax Credit program. The company also earns revenue by licensing its technology platform to other healthcare organizations through +Oscar, which serves approximately 500,000 lives beyond Oscar's own insurance members.

Oscar operates in 20 states across the U.S., partnering with health systems and provider networks to create exclusive provider organization (EPO) networks for individual plans, while its small group plans (offered through a partnership with Cigna) utilize broader preferred provider organization (PPO) networks.

4. Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Oscar Health competes with major health insurance providers like UnitedHealth Group (NYSE:UNH), Cigna (NYSE:CI), Anthem/Elevance Health (NYSE:ELV), and Centene (NYSE:CNC), as well as other tech-focused insurance companies like Bright Health Group (NYSE:BHG) and Clover Health (NASDAQ:CLOV).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $11.29 billion in revenue over the past 12 months, Oscar Health has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

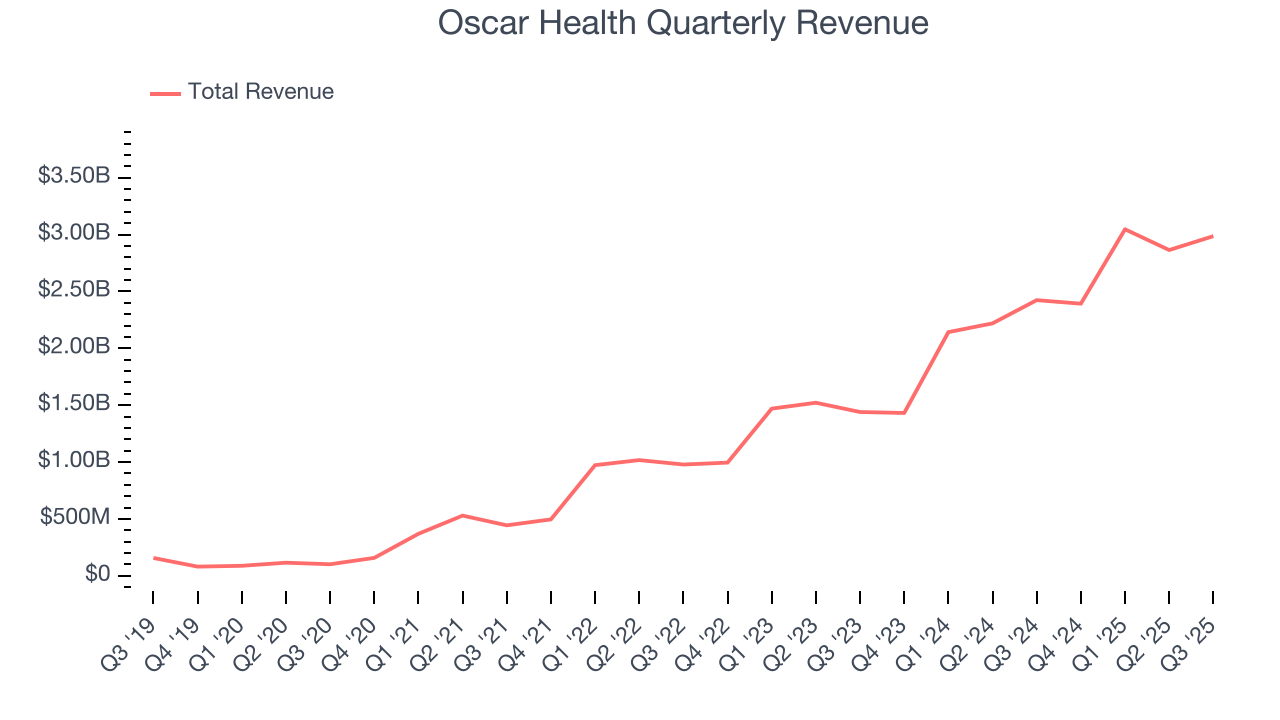

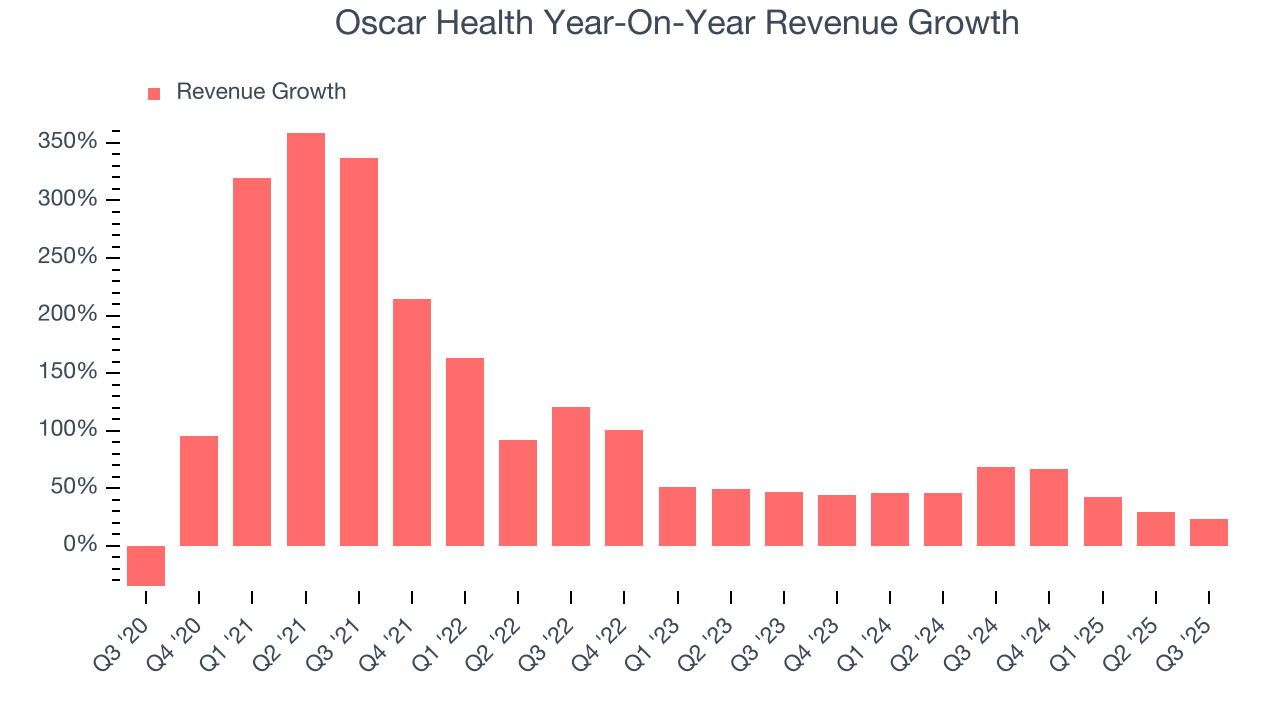

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Oscar Health grew its sales at an incredible 96.4% compounded annual growth rate. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Oscar Health’s annualized revenue growth of 44.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Oscar Health generated an excellent 23.2% year-on-year revenue growth rate, but its $2.99 billion of revenue fell short of Wall Street’s high expectations.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

7. Operating Margin

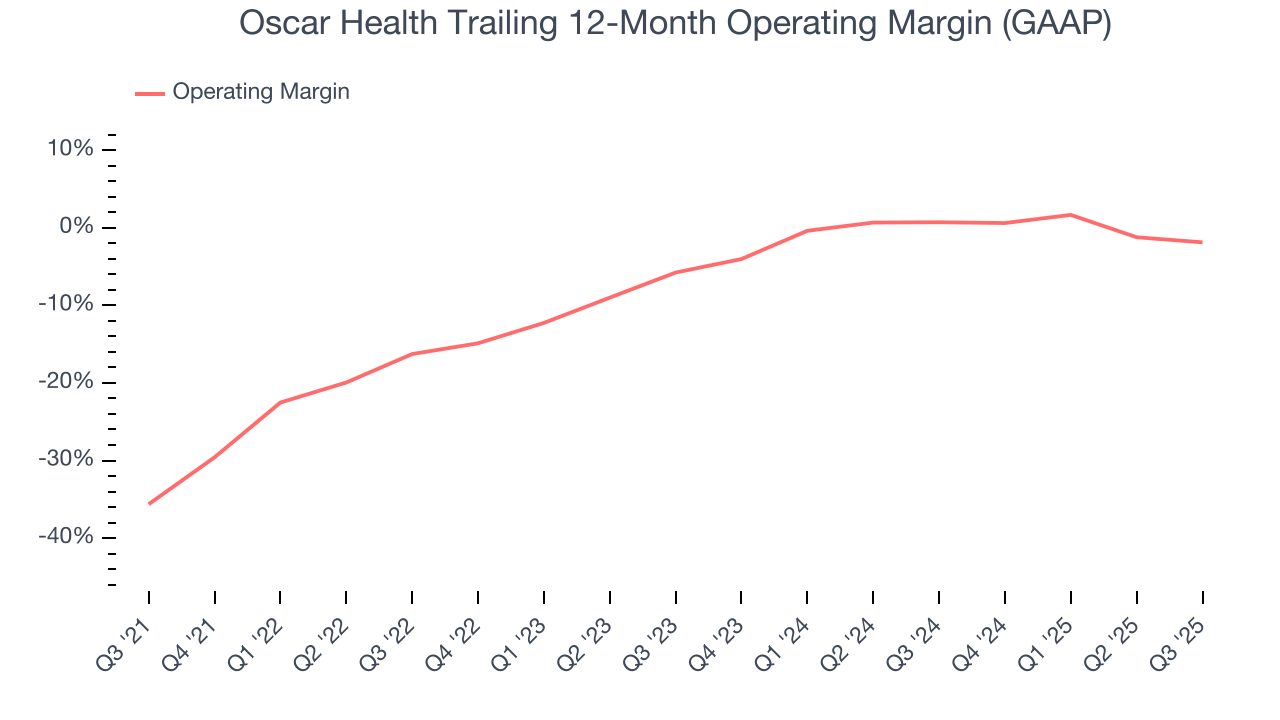

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Oscar Health’s high expenses have contributed to an average operating margin of negative 5.2% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Oscar Health’s operating margin rose by 33.8 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 3.9 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

Oscar Health’s operating margin was negative 4.3% this quarter.

8. Earnings Per Share

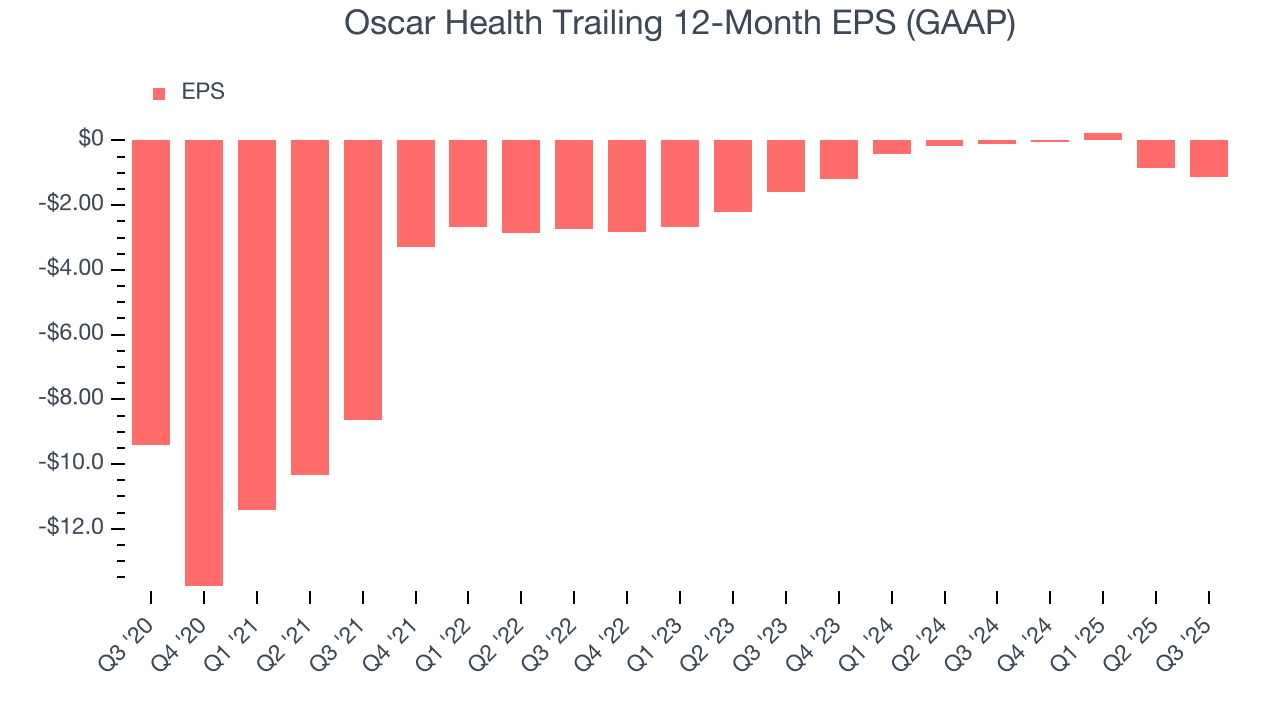

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Oscar Health’s full-year earnings are still negative, it reduced its losses and improved its EPS by 34.4% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q3, Oscar Health reported EPS of negative $0.53, down from negative $0.22 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Oscar Health to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.14 will advance to negative $0.87.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

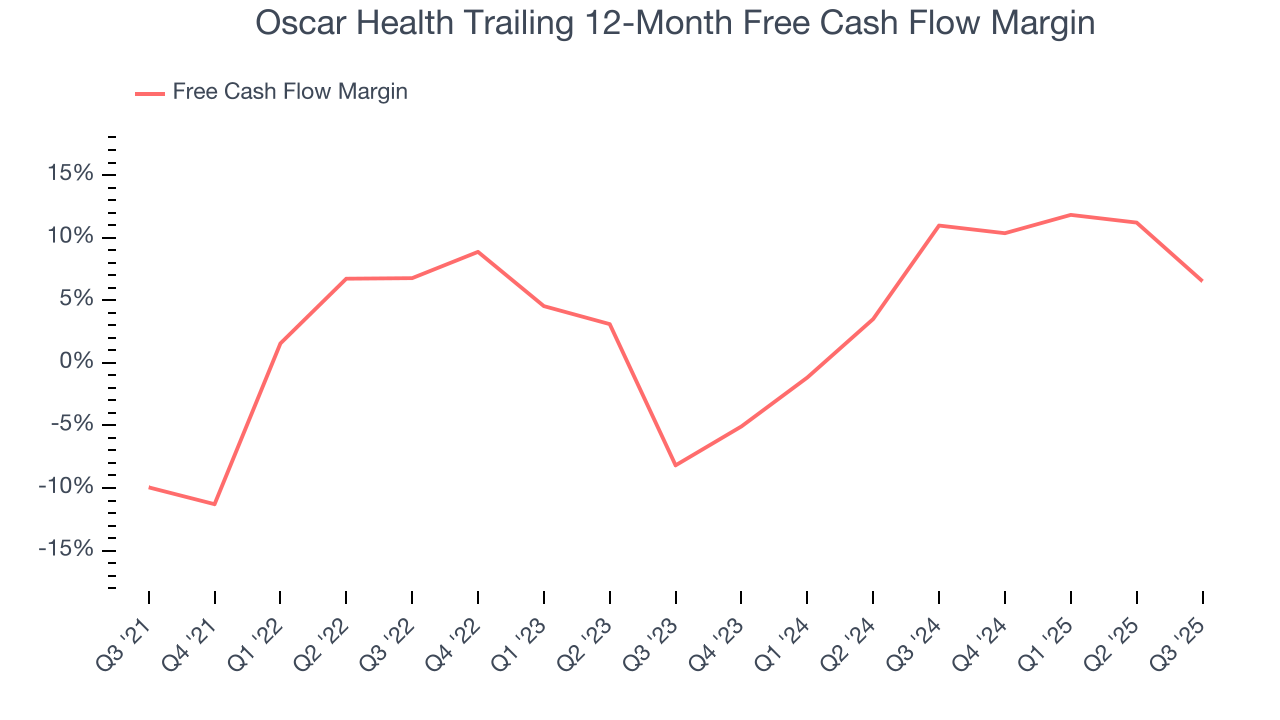

Oscar Health has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.3%, subpar for a healthcare business.

Taking a step back, an encouraging sign is that Oscar Health’s margin expanded by 16.5 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Oscar Health burned through $973.7 million of cash in Q3, equivalent to a negative 32.6% margin. The company’s cash burn increased from $507.7 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings.

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Oscar Health is a well-capitalized company with $3.06 billion of cash and $686.3 million of debt on its balance sheet. This $2.38 billion net cash position is 54.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Oscar Health’s Q3 Results

It was good to see Oscar Health provide full-year revenue guidance that slightly beat analysts’ expectations. On the other hand, its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter was mixed. Still, the stock traded up 7.8% to $18.37 immediately after reporting.

12. Is Now The Time To Buy Oscar Health?

Updated: November 25, 2025 at 11:40 PM EST

When considering an investment in Oscar Health, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Oscar Health is an amazing business ranking highly on our list. For starters, its revenue growth was exceptional over the last five years. And while its operating margins reveal poor profitability compared to other healthcare companies, its rising cash profitability gives it more optionality. On top of that, Oscar Health’s expanding adjusted operating margin shows the business has become more efficient.

Oscar Health’s forward price-to-sales ratio is 0.3x. Looking at the healthcare landscape today, Oscar Health’s qualities really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $12.88 on the company (compared to the current share price of $16.40).