Penske Automotive Group (PAG)

1. News

2. Penske Automotive Group (PAG) Research Report: Q3 CY2025 Update

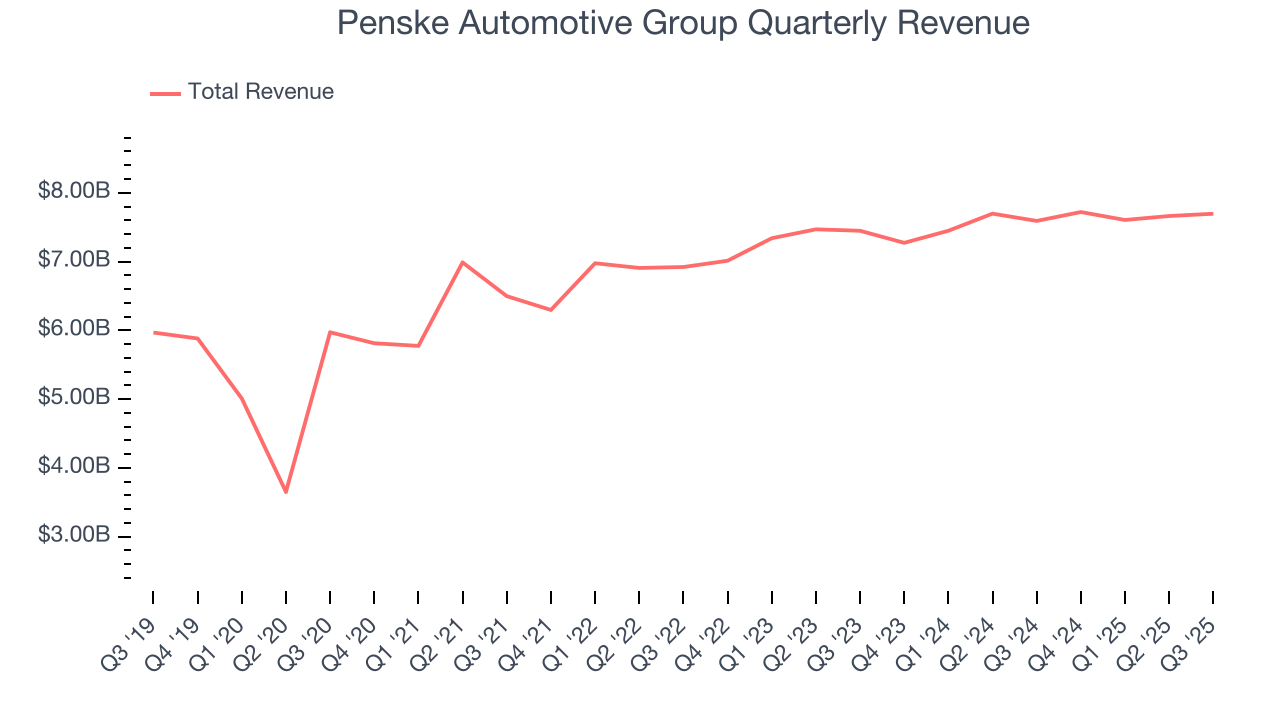

Global automotive retailer Penske Automotive Group (NYSE:PAG) met Wall Streets revenue expectations in Q3 CY2025, with sales up 1.4% year on year to $7.7 billion. Its non-GAAP profit of $3.23 per share was 5% below analysts’ consensus estimates.

Penske Automotive Group (PAG) Q3 CY2025 Highlights:

- Revenue: $7.7 billion vs analyst estimates of $7.7 billion (1.4% year-on-year growth, in line)

- Adjusted EPS: $3.23 vs analyst expectations of $3.40 (5% miss)

- Adjusted EBITDA: $357.1 million vs analyst estimates of $371.2 million (4.6% margin, 3.8% miss)

- Operating Margin: 3.9%, in line with the same quarter last year

- Free Cash Flow Margin: 3.9%, up from 2.5% in the same quarter last year

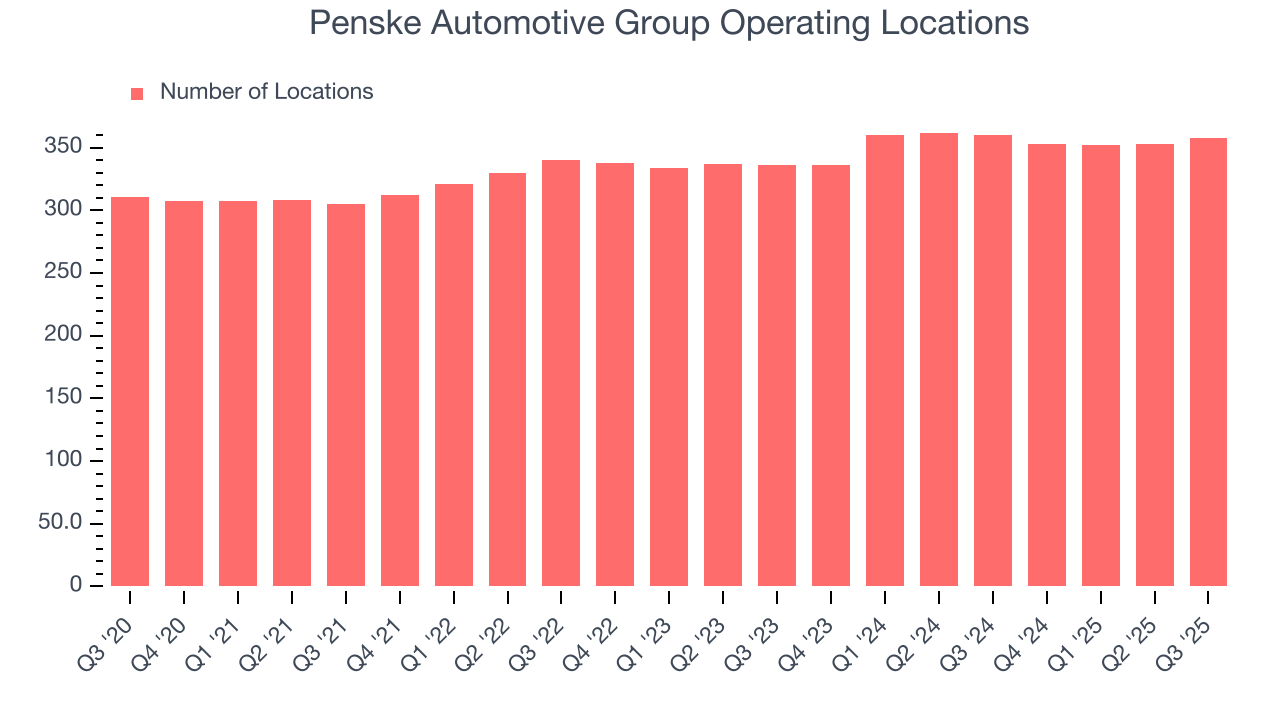

- Locations: 358 at quarter end, down from 360 in the same quarter last year

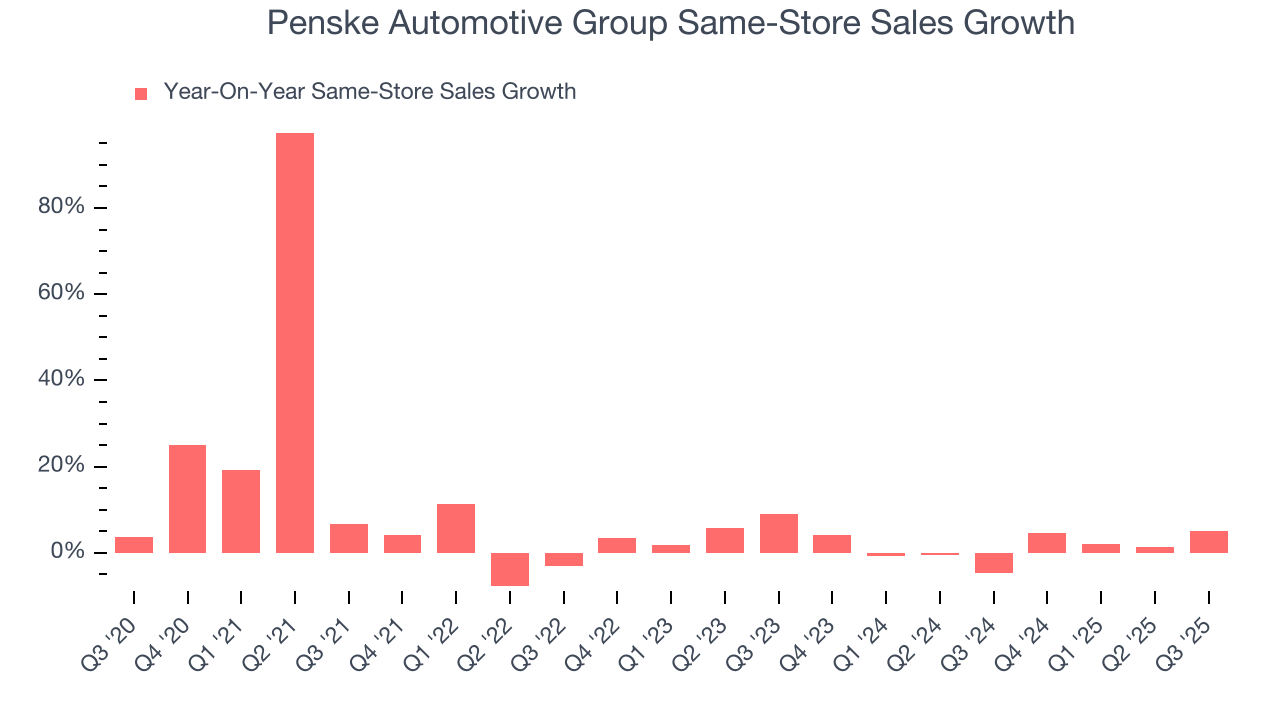

- Same-Store Sales rose 5.1% year on year (-4.8% in the same quarter last year)

- Market Capitalization: $10.42 billion

Company Overview

With a diverse global network spanning the US, UK, Canada, Germany, Italy, Japan, and Australia, Penske Automotive Group (NYSE:PAG) operates automotive and commercial truck dealerships across the globe, selling new and used vehicles while providing service, parts, and financing options.

The company's operations are divided into several segments. Its retail automotive business includes 353 franchised dealerships and 16 used vehicle locations operating under brands like CarShop and Sytner Select. Premium brands such as Audi, BMW, Land Rover, Mercedes-Benz, and Porsche account for 72% of its franchised dealership revenue. Beyond vehicle sales, Penske generates significant revenue through service and parts operations, finance and insurance products, and aftermarket accessories.

The company's Premier Truck Group operates 45 commercial truck dealerships primarily selling Freightliner and Western Star trucks across the US and Canada. These locations offer maintenance, repair services, and parts, generating approximately 65% of the commercial truck division's gross profit.

Penske Australia distributes Western Star trucks, MAN trucks and buses, and Dennis Eagle refuse vehicles in Australia, New Zealand, and parts of the Pacific, along with diesel engines and power systems from manufacturers like MTU and Detroit Diesel.

Additionally, the company holds a 28.9% stake in Penske Transportation Solutions, which manages a fleet of over 435,000 trucks, tractors, and trailers under lease, rental, or maintenance contracts. This division provides logistics services including dedicated contract carriage, distribution center management, and freight management for diverse clients ranging from multinational corporations to individual consumers.

3. Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Penske Automotive Group competes with other major automotive retailers such as AutoNation (NYSE:AN), Lithia Motors (NYSE:LAD), Group 1 Automotive (NYSE:GPI), and Sonic Automotive (NYSE:SAH). In its commercial truck operations, competitors include dealers of brands like Ford, International, Kenworth, Mack, Peterbilt, and Volvo.

4. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $30.68 billion in revenue over the past 12 months, Penske Automotive Group is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To expand meaningfully, Penske Automotive Group likely needs to tweak its prices or enter new markets.

As you can see below, Penske Automotive Group grew its sales at a sluggish 4.2% compounded annual growth rate over the last three years (we compare to 2019 to normalize for COVID-19 impacts) as it barely increased sales at existing, established locations.

This quarter, Penske Automotive Group grew its revenue by 1.4% year on year, and its $7.7 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products will face some demand challenges.

5. Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Penske Automotive Group operated 358 locations in the latest quarter. It has opened new stores quickly over the last two years, averaging 2.7% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Penske Automotive Group’s demand within its existing locations has been relatively stable over the last two years but was below most retailers. On average, the company’s same-store sales have grown by 1.4% per year. This performance suggests it should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Penske Automotive Group’s same-store sales rose 5.1% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

6. Gross Margin & Pricing Power

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

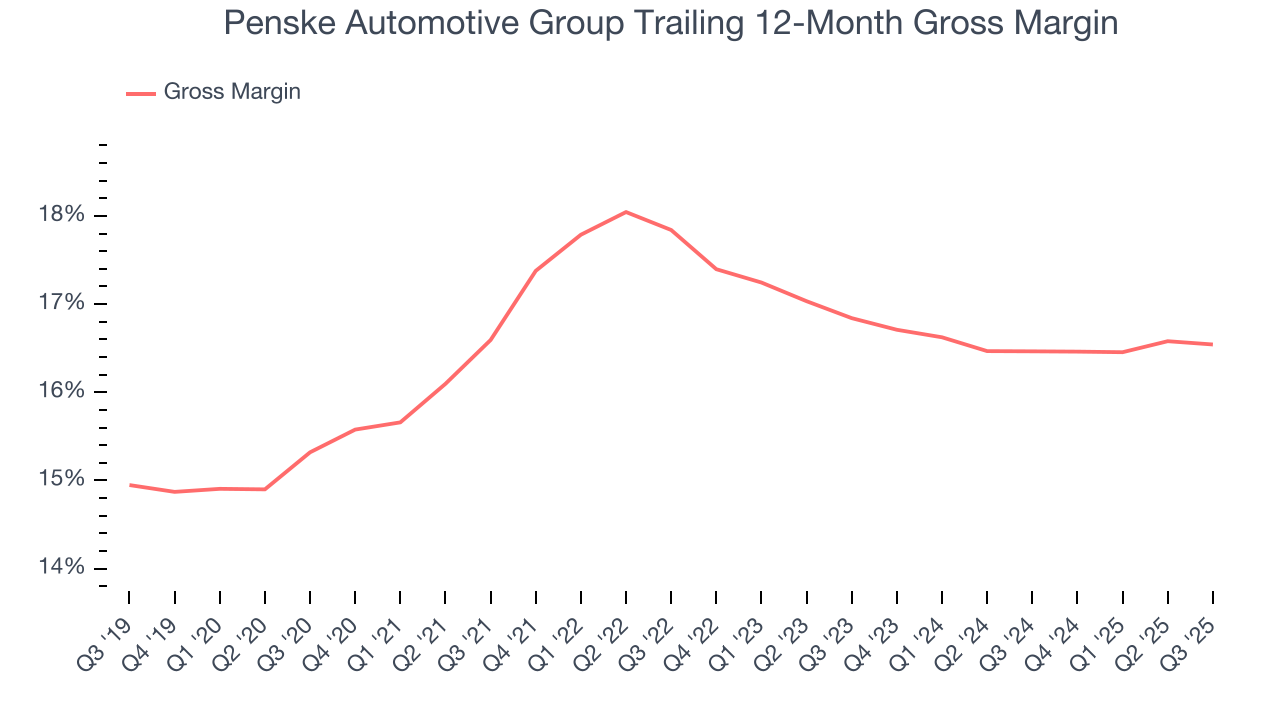

Penske Automotive Group has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 16.5% gross margin over the last two years. Said differently, Penske Automotive Group had to pay a chunky $83.50 to its suppliers for every $100 in revenue.

Penske Automotive Group produced a 16.2% gross profit margin in Q3, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

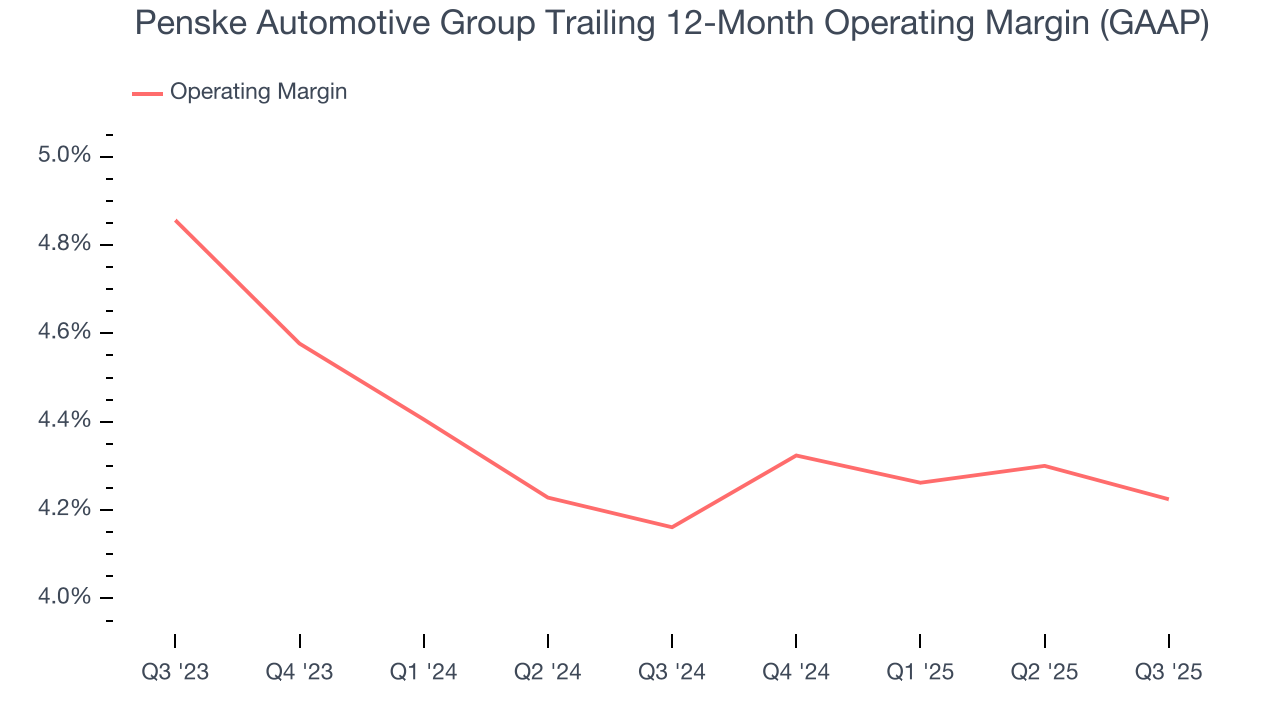

Penske Automotive Group’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 4.2% over the last two years. This profitability was lousy for a consumer retail business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, Penske Automotive Group’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Penske Automotive Group generated an operating margin profit margin of 3.9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

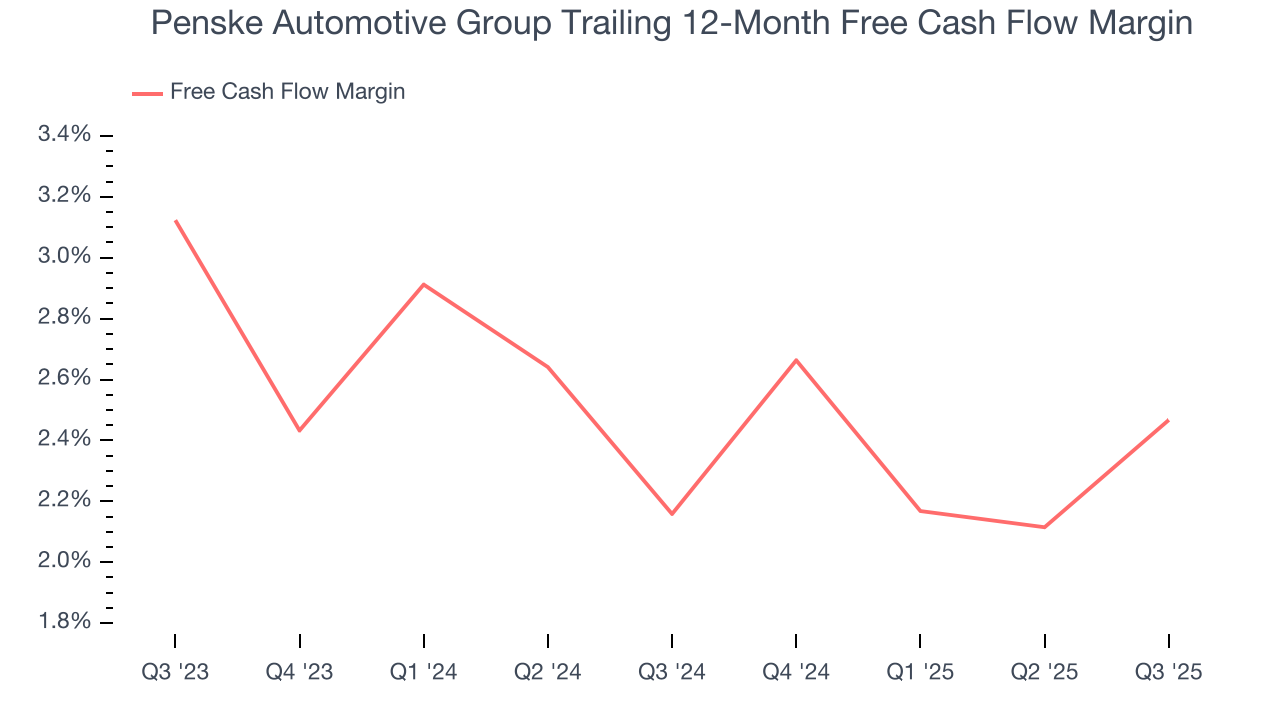

Penske Automotive Group has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, subpar for a consumer retail business.

Penske Automotive Group’s free cash flow clocked in at $300.4 million in Q3, equivalent to a 3.9% margin. This result was good as its margin was 1.4 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Penske Automotive Group historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10.7%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

10. Balance Sheet Assessment

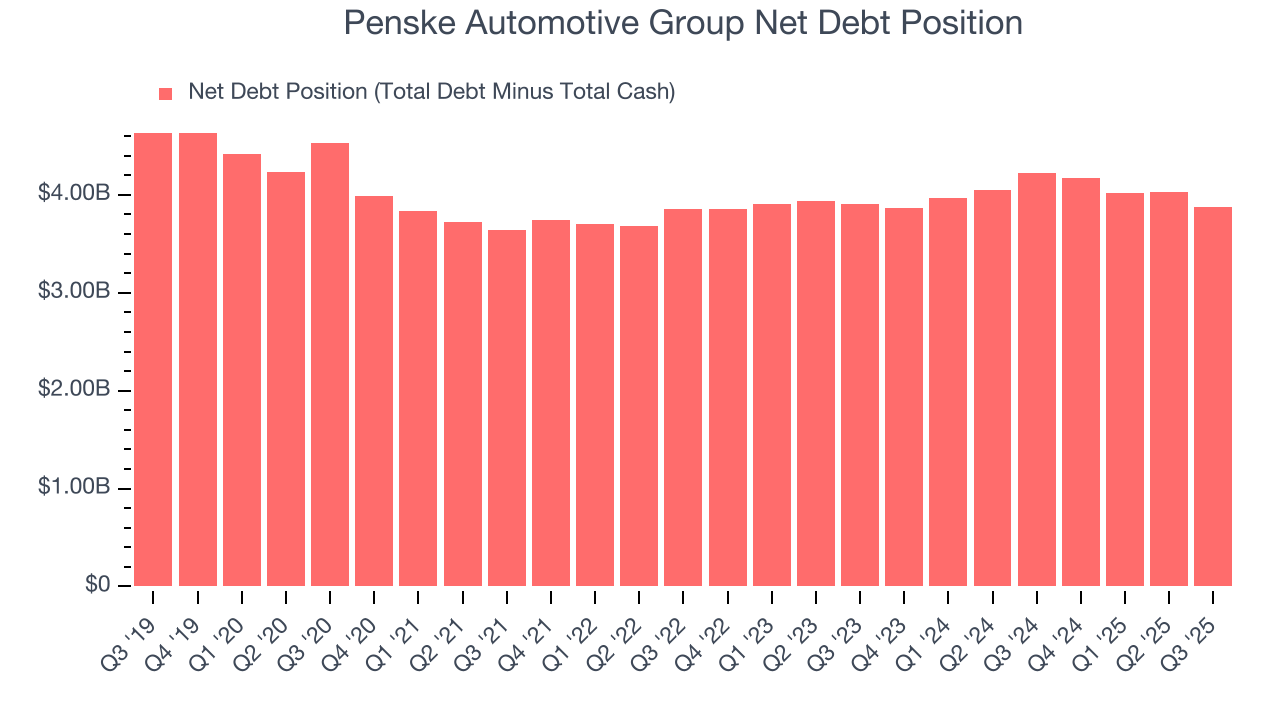

Penske Automotive Group reported $80.3 million of cash and $3.96 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.51 billion of EBITDA over the last 12 months, we view Penske Automotive Group’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $265.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Penske Automotive Group’s Q3 Results

We were impressed by how significantly Penske Automotive Group blew past analysts’ same-store sales expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $158.16 immediately following the results.

12. Is Now The Time To Buy Penske Automotive Group?

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Penske Automotive Group.

Penske Automotive Group isn’t a terrible business, but it doesn’t pass our quality test. First off, its revenue growth was a little slower over the last three years, and analysts expect its demand to deteriorate over the next 12 months. And while its new store openings show it’s growing its brand, the downside is its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses. On top of that, its declining EPS over the last three years makes it a less attractive asset to the public markets.

Penske Automotive Group’s P/E ratio based on the next 12 months is 11.6x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $180.89 on the company (compared to the current share price of $158.16).