Penske Automotive Group (PAG)

We’re wary of Penske Automotive Group. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Penske Automotive Group Will Underperform

With a diverse global network spanning the US, UK, Canada, Germany, Italy, Japan, and Australia, Penske Automotive Group (NYSE:PAG) operates automotive and commercial truck dealerships across the globe, selling new and used vehicles while providing service, parts, and financing options.

- Gross margin of 16.5% is below its competitors, leaving less money for marketing and promotions

- Earnings per share fell by 8.8% annually over the last three years while its revenue grew, showing its incremental sales were much less profitable

- Store expansion strategy seems risky considering the weak same-store sales performance at existing locations

Penske Automotive Group’s quality is not up to our standards. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Penske Automotive Group

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Penske Automotive Group

Penske Automotive Group is trading at $164.46 per share, or 12.4x forward P/E. The current valuation may be appropriate, but we’re still not buyers of the stock.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Penske Automotive Group (PAG) Research Report: Q4 CY2025 Update

Global automotive retailer Penske Automotive Group (NYSE:PAG) beat Wall Street’s revenue expectations in Q4 CY2025, but sales were flat year on year at $7.77 billion. Its GAAP profit of $2.83 per share was 6.4% below analysts’ consensus estimates.

Penske Automotive Group (PAG) Q4 CY2025 Highlights:

- Revenue: $7.77 billion vs analyst estimates of $7.60 billion (flat year on year, 2.2% beat)

- EPS (GAAP): $2.83 vs analyst expectations of $3.02 (6.4% miss)

- Adjusted EBITDA: $326 million vs analyst estimates of $347.1 million (4.2% margin, 6.1% miss)

- Operating Margin: 3.5%, in line with the same quarter last year

- Same-Store Sales fell 4% year on year (4.7% in the same quarter last year)

- Market Capitalization: $10.83 billion

Company Overview

With a diverse global network spanning the US, UK, Canada, Germany, Italy, Japan, and Australia, Penske Automotive Group (NYSE:PAG) operates automotive and commercial truck dealerships across the globe, selling new and used vehicles while providing service, parts, and financing options.

The company's operations are divided into several segments. Its retail automotive business includes 353 franchised dealerships and 16 used vehicle locations operating under brands like CarShop and Sytner Select. Premium brands such as Audi, BMW, Land Rover, Mercedes-Benz, and Porsche account for 72% of its franchised dealership revenue. Beyond vehicle sales, Penske generates significant revenue through service and parts operations, finance and insurance products, and aftermarket accessories.

The company's Premier Truck Group operates 45 commercial truck dealerships primarily selling Freightliner and Western Star trucks across the US and Canada. These locations offer maintenance, repair services, and parts, generating approximately 65% of the commercial truck division's gross profit.

Penske Australia distributes Western Star trucks, MAN trucks and buses, and Dennis Eagle refuse vehicles in Australia, New Zealand, and parts of the Pacific, along with diesel engines and power systems from manufacturers like MTU and Detroit Diesel.

Additionally, the company holds a 28.9% stake in Penske Transportation Solutions, which manages a fleet of over 435,000 trucks, tractors, and trailers under lease, rental, or maintenance contracts. This division provides logistics services including dedicated contract carriage, distribution center management, and freight management for diverse clients ranging from multinational corporations to individual consumers.

4. Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Penske Automotive Group competes with other major automotive retailers such as AutoNation (NYSE:AN), Lithia Motors (NYSE:LAD), Group 1 Automotive (NYSE:GPI), and Sonic Automotive (NYSE:SAH). In its commercial truck operations, competitors include dealers of brands like Ford, International, Kenworth, Mack, Peterbilt, and Volvo.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $30.73 billion in revenue over the past 12 months, Penske Automotive Group is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. To expand meaningfully, Penske Automotive Group likely needs to tweak its prices or enter new markets.

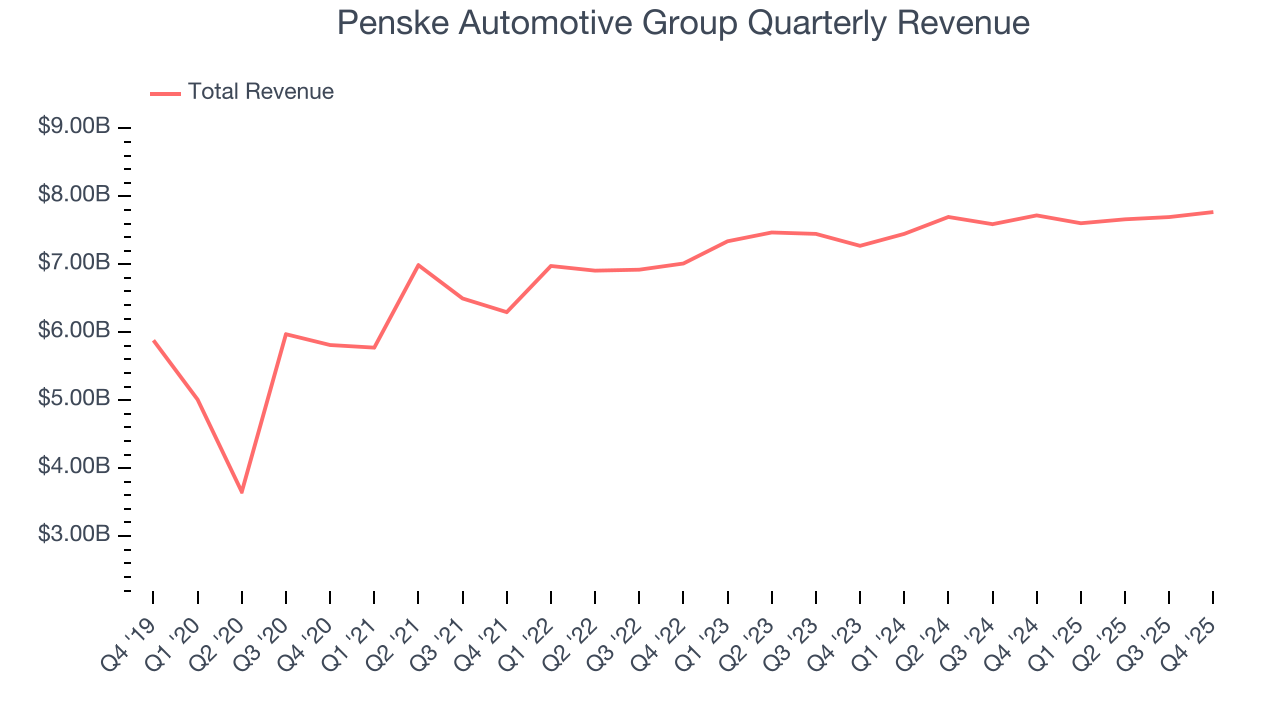

As you can see below, Penske Automotive Group’s sales grew at a sluggish 3.4% compounded annual growth rate over the last three years.

This quarter, Penske Automotive Group’s $7.77 billion of revenue was flat year on year but beat Wall Street’s estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and suggests its products will see some demand headwinds.

6. Store Performance

Number of Stores

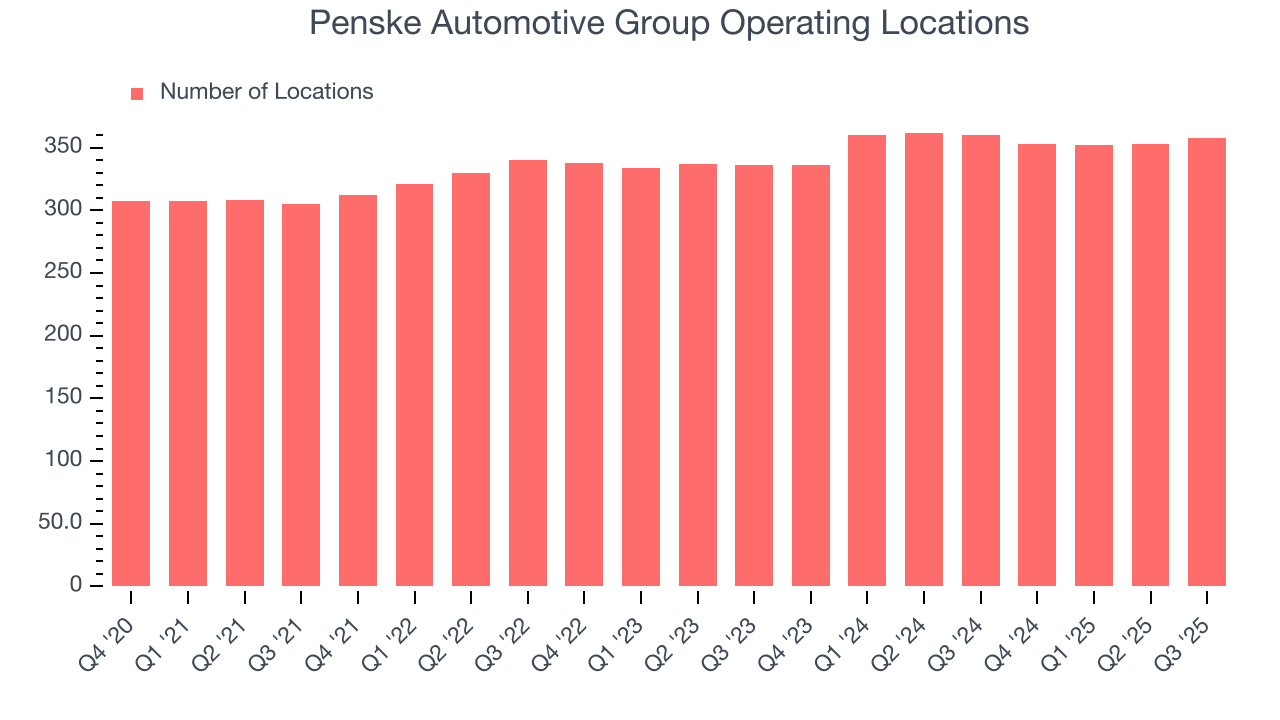

Penske Automotive Group opened new stores quickly over the last two years, averaging 3.1% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Penske Automotive Group reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

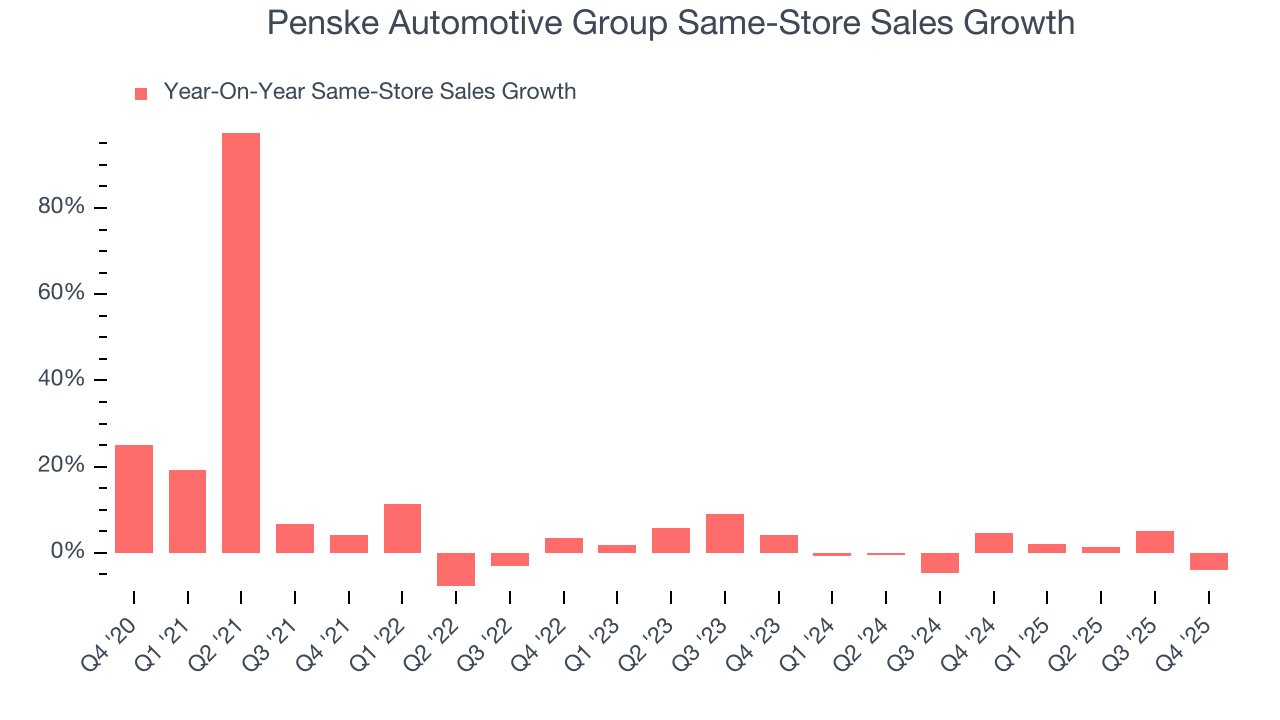

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Penske Automotive Group’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Penske Automotive Group should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Penske Automotive Group’s same-store sales fell by 4% year on year. This decline was a reversal from its historical levels.

7. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

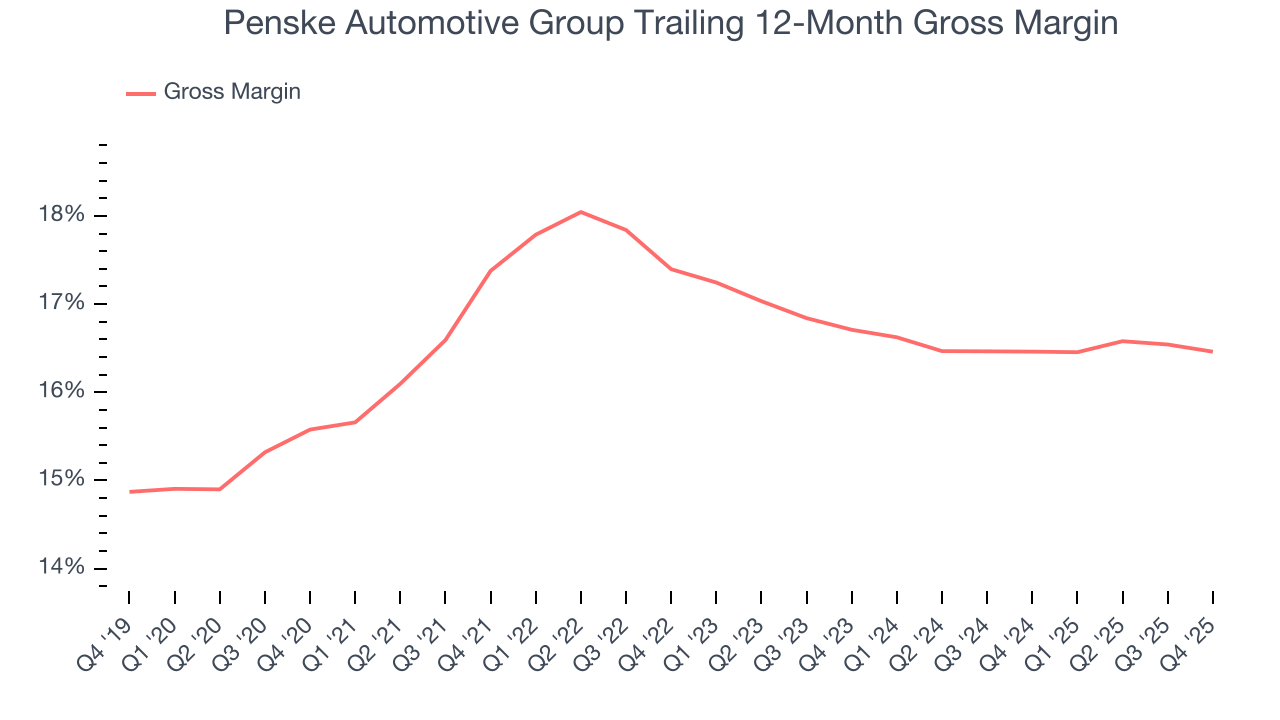

Penske Automotive Group has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 16.5% gross margin over the last two years. That means Penske Automotive Group paid its suppliers a lot of money ($83.54 for every $100 in revenue) to run its business.

This quarter, Penske Automotive Group’s gross profit margin was 16%, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

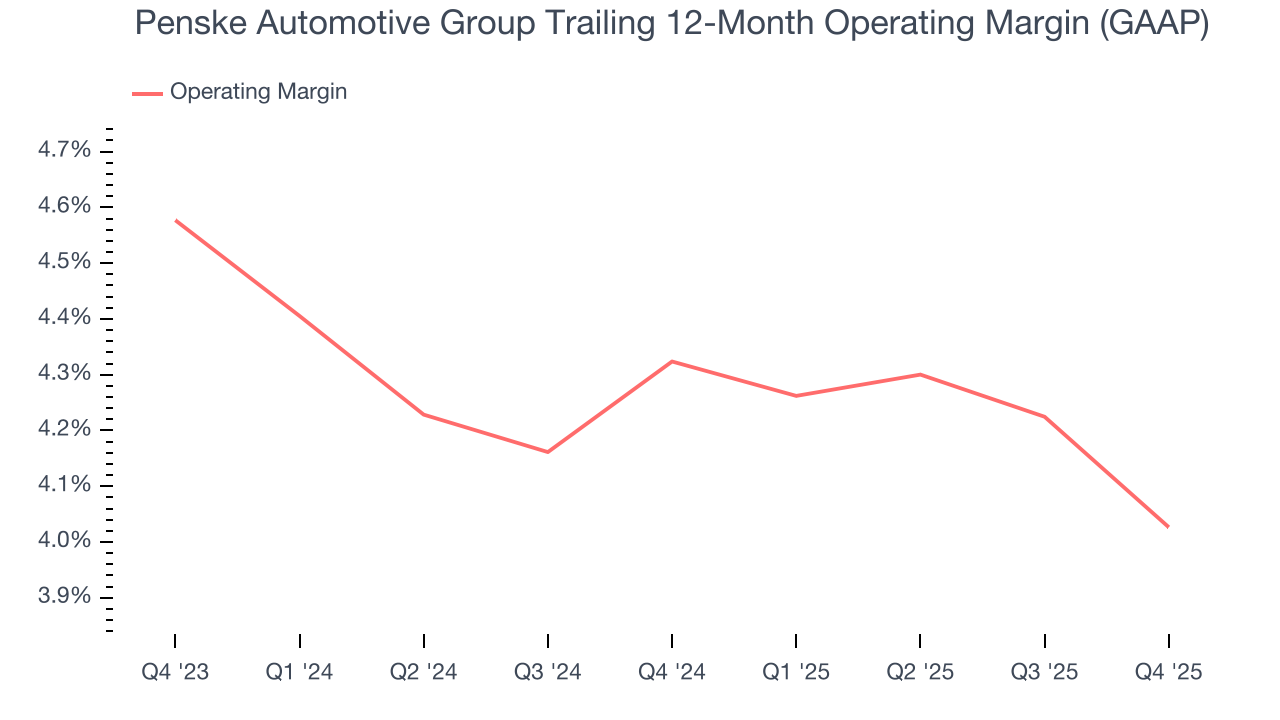

8. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Penske Automotive Group’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 4.2% over the last two years. This profitability was lousy for a consumer retail business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, Penske Automotive Group’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Penske Automotive Group generated an operating margin profit margin of 3.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

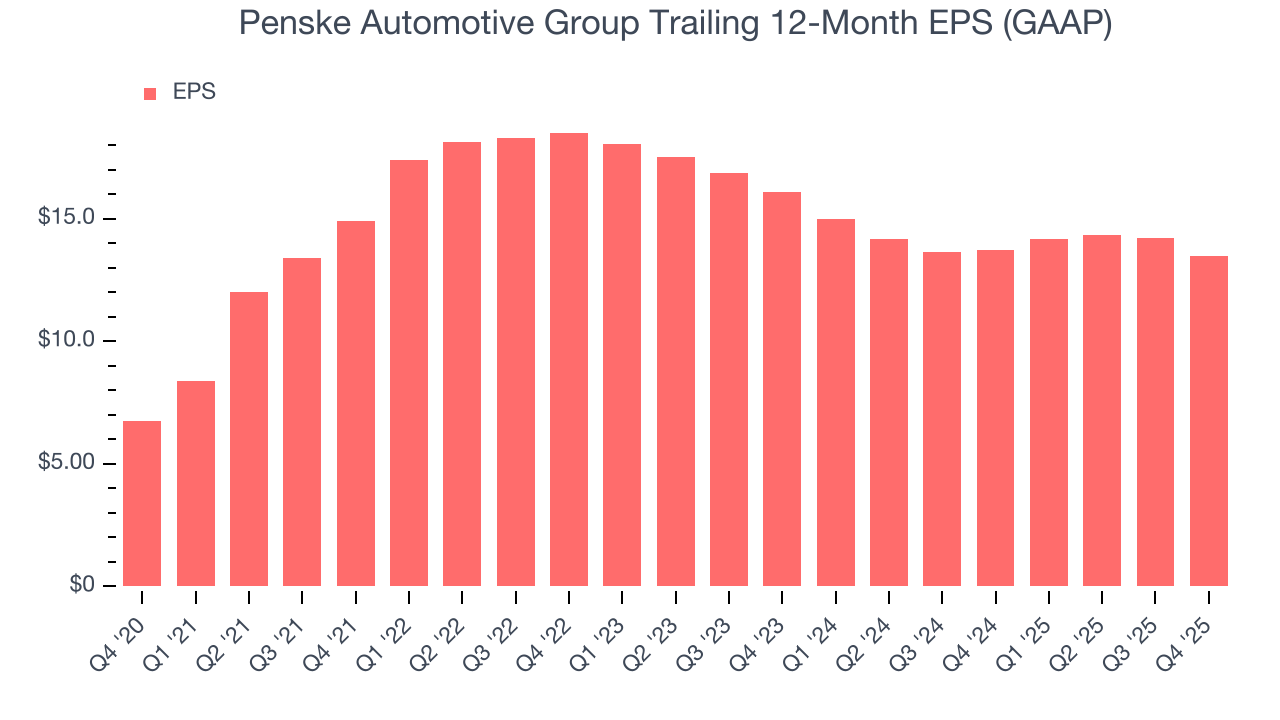

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Penske Automotive Group, its EPS declined by 10% annually over the last three years while its revenue grew by 3.4%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q4, Penske Automotive Group reported EPS of $2.83, down from $3.54 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Penske Automotive Group’s full-year EPS of $13.49 to grow 1%.

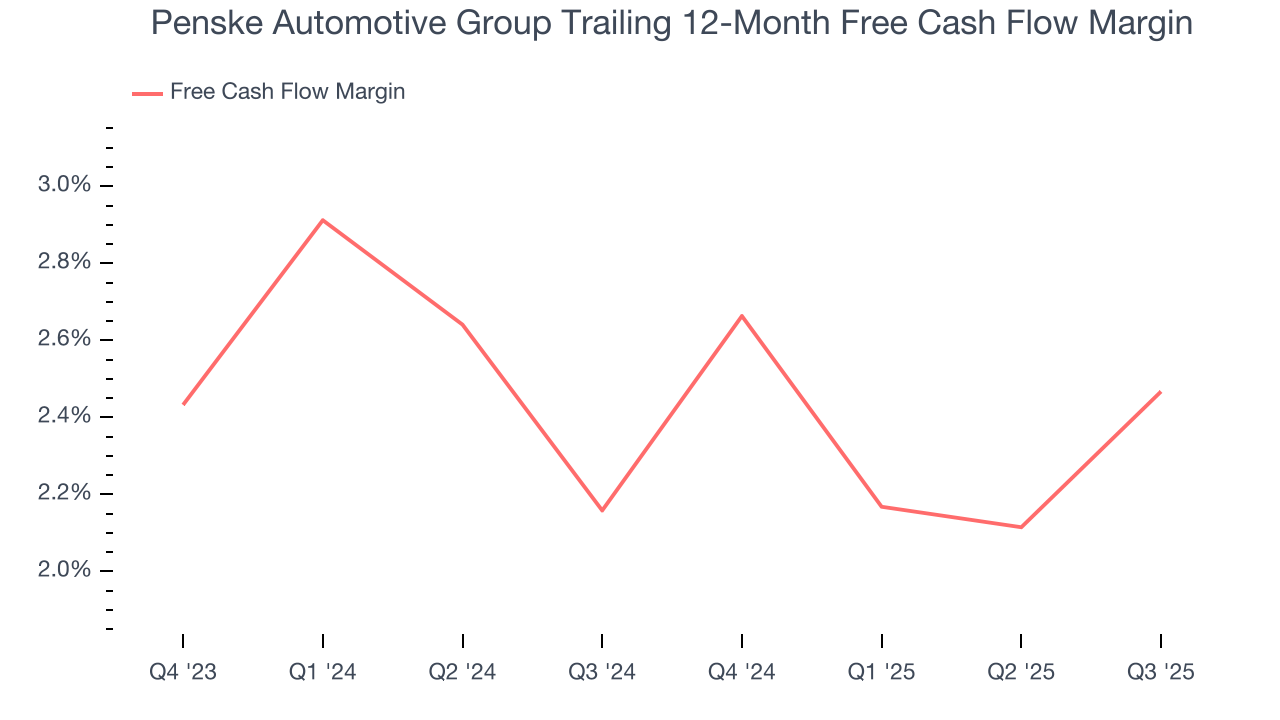

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Penske Automotive Group has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 2.7% over the last two years, slightly better than the broader consumer retail sector.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Penske Automotive Group historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10.4%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

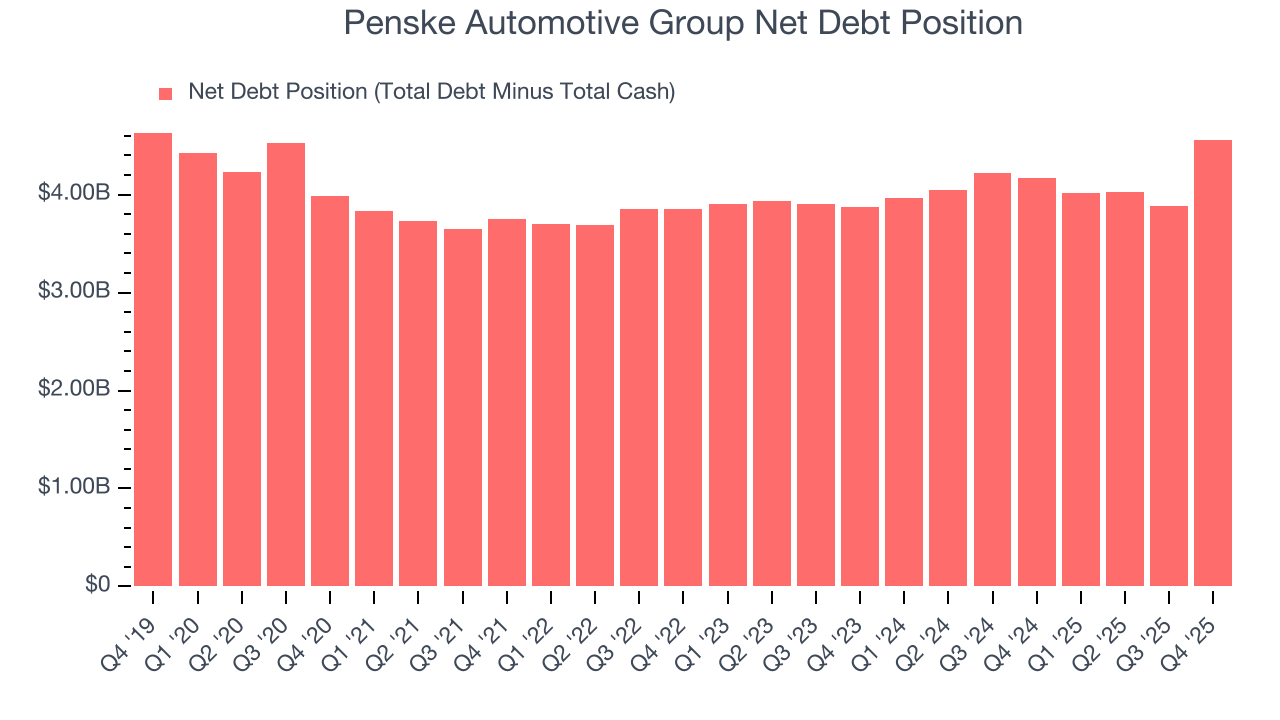

12. Balance Sheet Assessment

Penske Automotive Group reported $64.7 million of cash and $4.63 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.46 billion of EBITDA over the last 12 months, we view Penske Automotive Group’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $168.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Penske Automotive Group’s Q4 Results

We enjoyed seeing Penske Automotive Group beat analysts’ revenue expectations this quarter. We were also happy its gross margin narrowly outperformed Wall Street’s estimates. On the other hand, its EBITDA missed and its same-store sales fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $164.40 immediately after reporting.

14. Is Now The Time To Buy Penske Automotive Group?

Updated: February 11, 2026 at 7:18 AM EST

Before making an investment decision, investors should account for Penske Automotive Group’s business fundamentals and valuation in addition to what happened in the latest quarter.

Penske Automotive Group falls short of our quality standards. To kick things off, its revenue growth was uninspiring over the last three years, and analysts expect its demand to deteriorate over the next 12 months. And while its new store openings show it’s growing its brand, the downside is its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses. On top of that, its declining EPS over the last three years makes it a less attractive asset to the public markets.

Penske Automotive Group’s P/E ratio based on the next 12 months is 12x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $180.33 on the company (compared to the current share price of $164.40).