Performance Food Group (PFGC)

Performance Food Group is up against the odds. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Performance Food Group Will Underperform

With a massive network spanning 155 distribution centers and delivering over 250,000 different food products, Performance Food Group (NYSE:PFGC) distributes food and food-related products to over 300,000 restaurants, convenience stores, theaters, and institutions across North America.

- The company has faced growth challenges as its 19.8% annual revenue increases over the last five years fell short of other consumer discretionary companies

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

Performance Food Group’s quality doesn’t meet our expectations. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Performance Food Group

Why There Are Better Opportunities Than Performance Food Group

At $97.07 per share, Performance Food Group trades at 18.7x forward P/E. This valuation is fair for the quality you get, but we’re on the sidelines for now.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Performance Food Group (PFGC) Research Report: Q4 CY2025 Update

Food distribution giant Performance Food Group (NYSE:PFGC) met Wall Streets revenue expectations in Q4 CY2025, with sales up 5.2% year on year to $16.44 billion. On the other hand, next quarter’s revenue guidance of $16.15 billion was less impressive, coming in 0.5% below analysts’ estimates. Its non-GAAP profit of $0.98 per share was 10% below analysts’ consensus estimates.

Performance Food Group (PFGC) Q4 CY2025 Highlights:

- Revenue: $16.44 billion vs analyst estimates of $16.52 billion (5.2% year-on-year growth, in line)

- Adjusted EPS: $0.98 vs analyst expectations of $1.09 (10% miss)

- Adjusted EBITDA: $451.2 million vs analyst estimates of $464.2 million (2.7% margin, 2.8% miss)

- The company reconfirmed its revenue guidance for the full year of $67.75 billion at the midpoint

- EBITDA guidance for the full year is $1.93 billion at the midpoint, below analyst estimates of $1.98 billion

- Operating Margin: 1.2%, in line with the same quarter last year

- Free Cash Flow Margin: 3%, up from 1.4% in the same quarter last year

- Sales Volumes rose 3.4% year on year (9.8% in the same quarter last year)

- Market Capitalization: $15.22 billion

Company Overview

With a massive network spanning 155 distribution centers and delivering over 250,000 different food products, Performance Food Group (NYSE:PFGC) distributes food and food-related products to over 300,000 restaurants, convenience stores, theaters, and institutions across North America.

The company operates through three distinct segments. The Foodservice segment serves independent restaurants and national chains with everything from custom-cut meats to frozen foods and kitchen supplies. This segment particularly focuses on independent restaurants, which typically use more of the company's higher-margin proprietary Performance Brands products and value-added services. The Convenience segment supplies traditional convenience stores, drug stores, and other specialty retailers with products ranging from cigarettes and snacks to fresh food and beverages. Finally, the Specialty segment distributes candy, snacks, and beverages to vending operators, theaters, and office coffee service providers.

Beyond merely moving products from manufacturers to customers, Performance Food Group adds value through industry expertise in menu development, product selection, and operational strategy. The company's scale allows it to serve as an important partner to both suppliers seeking market access and customers requiring reliable supply chains. For example, a regional restaurant chain might work with Performance Food Group to develop custom menu items, while a movie theater chain relies on the company's logistics capabilities to ensure concession stands remain stocked with popcorn and candy nationwide. The company generates revenue primarily through the markup on products it distributes, with higher margins on its private-label Performance Brands.

4. Distributors

Distributors serve as intermediaries connecting manufacturers with retailers or end customers, managing logistics, inventory, and fulfillment across various product categories. Tailwinds include supply chain complexity driving demand for specialized distribution expertise, e-commerce growth requiring robust fulfillment networks, and businesses outsourcing logistics to focus on core operations. Consolidation opportunities may benefit scale players. Headwinds include margin pressure from powerful suppliers and customers, competition from manufacturers selling direct, and rising transportation and labor costs. Additionally, economic downturns reduce demand volumes, while inventory management challenges and potential supply chain disruptions introduce operational risks requiring sophisticated systems.

Performance Food Group competes with other major food distributors including Sysco Corporation (NYSE: SYY), US Foods Holding Corp (NYSE: USFD), and United Natural Foods (NYSE: UNFI), as well as with regional distributors and wholesale club stores that serve food service establishments.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Performance Food Group grew its sales at a 19.8% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Performance Food Group’s recent performance shows its demand has slowed as its annualized revenue growth of 6.6% over the last two years was below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its number of units sold. Over the last two years, Performance Food Group’s units sold averaged 6% year-on-year growth. Because this number is in line with its revenue growth, we can see the company kept its prices fairly consistent.

This quarter, Performance Food Group grew its revenue by 5.2% year on year, and its $16.44 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 5.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not lead to better top-line performance yet.

6. Operating Margin

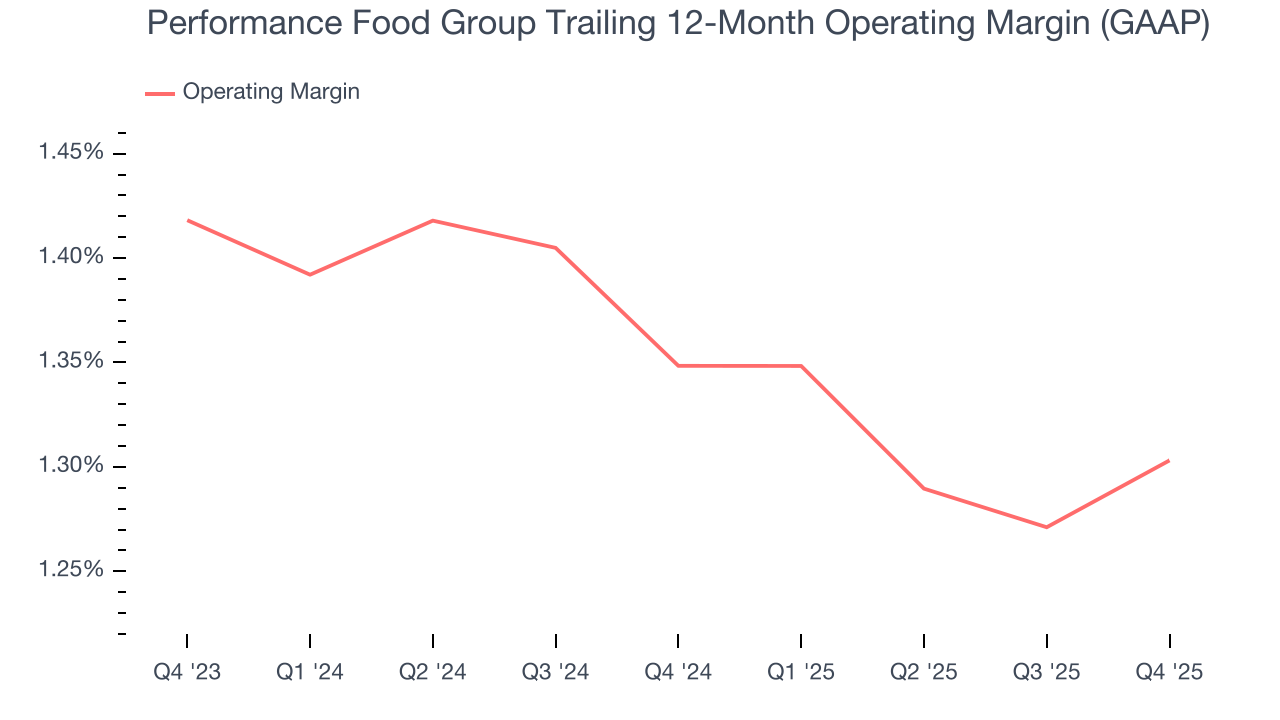

Performance Food Group’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 1.3% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

In Q4, Performance Food Group generated an operating margin profit margin of 1.2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Performance Food Group’s EPS grew at an astounding 69.7% compounded annual growth rate over the last five years, higher than its 19.8% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, Performance Food Group reported adjusted EPS of $0.98, in line with the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Performance Food Group’s full-year EPS of $4.50 to grow 21.6%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Performance Food Group has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.1%, lousy for a consumer discretionary business.

Performance Food Group’s free cash flow clocked in at $488.6 million in Q4, equivalent to a 3% margin. This result was good as its margin was 1.6 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Performance Food Group historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.5%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Performance Food Group’s ROIC averaged 3.2 percentage point increases over the last few years. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

Performance Food Group reported $41 million of cash and $7.99 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.86 billion of EBITDA over the last 12 months, we view Performance Food Group’s 4.3× net-debt-to-EBITDA ratio as safe. We also see its $295.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Performance Food Group’s Q4 Results

We struggled to find many positives in these results. Its EPS missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 7.8% to $89.50 immediately after reporting.

12. Is Now The Time To Buy Performance Food Group?

Updated: March 1, 2026 at 12:35 AM EST

Are you wondering whether to buy Performance Food Group or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Performance Food Group doesn’t pass our quality test. While its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its low free cash flow margins give it little breathing room.

Performance Food Group’s P/E ratio based on the next 12 months is 18.7x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $117.38 on the company (compared to the current share price of $97.07).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.