Progressive (PGR)

Progressive is a world-class company. Its elite revenue growth and returns on capital demonstrate it can grow rapidly and profitably.― StockStory Analyst Team

1. News

2. Summary

Why We Like Progressive

Starting as a small auto insurance company in 1937 with a pioneering focus on high-risk drivers, Progressive (NYSE:PGR) is a major auto, property, and commercial insurance provider that offers policies through independent agents, online platforms, and over the phone.

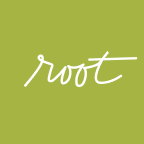

- Impressive 15.5% annual revenue growth over the last five years indicates it’s winning market share this cycle

- Incremental sales over the last two years have been highly profitable as its earnings per share increased by 72.1% annually, topping its revenue gains

- Strong 18% annualized net premiums earned expansion over the last two years shows it’s capturing market share this cycle

We’re optimistic about Progressive. Any surprise this is one of our favorite stocks?

Is Now The Time To Buy Progressive?

High Quality

Investable

Underperform

Is Now The Time To Buy Progressive?

Progressive’s stock price of $211.25 implies a valuation ratio of 3.3x forward P/B. The lofty multiple means expectations are high for this company over the next six to twelve months.

Do you like the business model and believe in the company’s future? If so, you can own a smaller position, as our work shows that high-quality companies outperform the market over a multi-year period regardless of valuation at entry.

3. Progressive (PGR) Research Report: Q4 CY2025 Update

Insurance company Progressive (NYSE:PGR) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 12.2% year on year to $22.75 billion. Its non-GAAP profit of $4.67 per share was 5.3% above analysts’ consensus estimates.

Progressive (PGR) Q4 CY2025 Highlights:

- Revenue: $22.75 billion vs analyst estimates of $22.54 billion (12.2% year-on-year growth, 0.9% beat)

- Adjusted EPS: $4.67 vs analyst estimates of $4.43 (5.3% beat)

- Market Capitalization: $124.8 billion

Company Overview

Starting as a small auto insurance company in 1937 with a pioneering focus on high-risk drivers, Progressive (NYSE:PGR) is a major auto, property, and commercial insurance provider that offers policies through independent agents, online platforms, and over the phone.

Progressive operates through three main segments: Personal Lines, Commercial Lines, and Property. The Personal Lines segment, its largest business, provides auto insurance and specialty coverage for recreational vehicles like motorcycles, boats, and RVs. The Commercial Lines segment focuses on business auto policies for small fleets, along with business liability, property insurance, and workers' compensation primarily for the transportation industry.

Progressive distributes its products through two distinct channels. Its Agency channel works with over 40,000 independent insurance agencies nationwide, while its Direct channel allows customers to purchase policies online, through the Progressive mobile app, or by phone. This multi-channel approach gives customers flexibility in how they interact with the company.

A key part of Progressive's strategy is its usage-based insurance program called Snapshot, which collects driving data through a mobile app or device to offer personalized rates based on actual driving behavior. For example, a customer who primarily drives during daylight hours and maintains safe speeds might receive a lower premium than someone with riskier driving patterns.

Progressive generates revenue primarily through insurance premiums, with additional income from investments and service fees. The company has embraced a "Destination Era" strategy focused on building deeper customer relationships by bundling multiple insurance products together, such as auto and homeowners policies, to increase customer retention and lifetime value.

4. Property & Casualty Insurance

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

Progressive's main competitors include other large personal and commercial insurers such as State Farm, Allstate (NYSE:ALL), GEICO (owned by Berkshire Hathaway, NYSE:BRK.A, NYSE:BRK.B), Liberty Mutual, Farmers Insurance, and Travelers (NYSE:TRV).

5. Revenue Growth

Big picture, insurers generate revenue from three key sources. The first is the core business of underwriting policies. The second source is income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Thankfully, Progressive’s 15.5% annualized revenue growth over the last five years was incredible. Its growth surpassed the average insurance company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Progressive’s annualized revenue growth of 18.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Progressive reported year-on-year revenue growth of 12.2%, and its $22.75 billion of revenue exceeded Wall Street’s estimates by 0.9%.

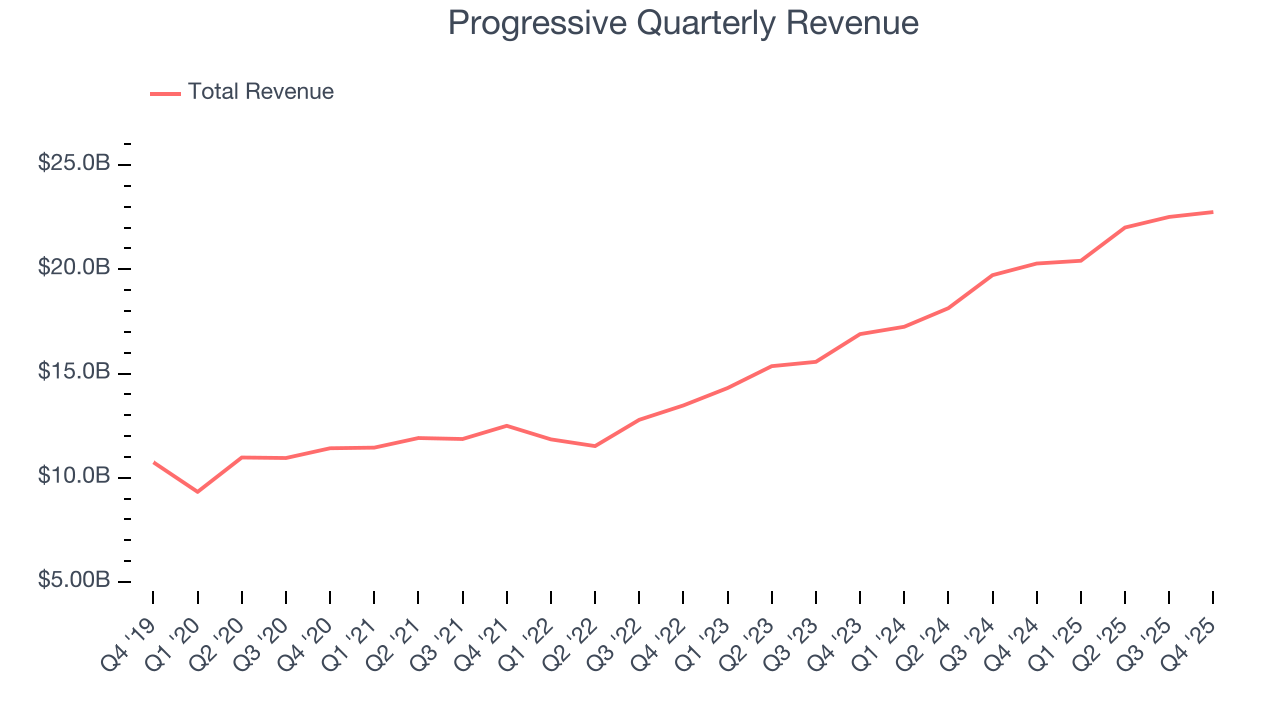

Net premiums earned made up 94.6% of the company’s total revenue during the last five years, meaning Progressive lives and dies by its underwriting activities because non-insurance operations barely move the needle.

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

6. Net Premiums Earned

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

Progressive’s net premiums earned has grown at a 15.8% annualized rate over the last five years, much better than the broader insurance industry and in line with its total revenue.

When analyzing Progressive’s net premiums earned over the last two years, we can see that growth accelerated to 18.8% annually. This performance was similar to its total revenue.

7. Combined Ratio

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

Combined ratio sums operating costs (salaries, commissions, overhead) with what is paid out in claims (losses) and divides this by net premiums earned. Combined ratios under 100% means profits while ones over 100% mean losses on its core operations of selling insurance policies.

Given the calculation, a lower expense ratio is better. Over the last four years, Progressive’s combined ratio has swelled by 8 percentage points, going from 95.2% to 87.2%. It has also improved by 7.9 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

8. Earnings Per Share

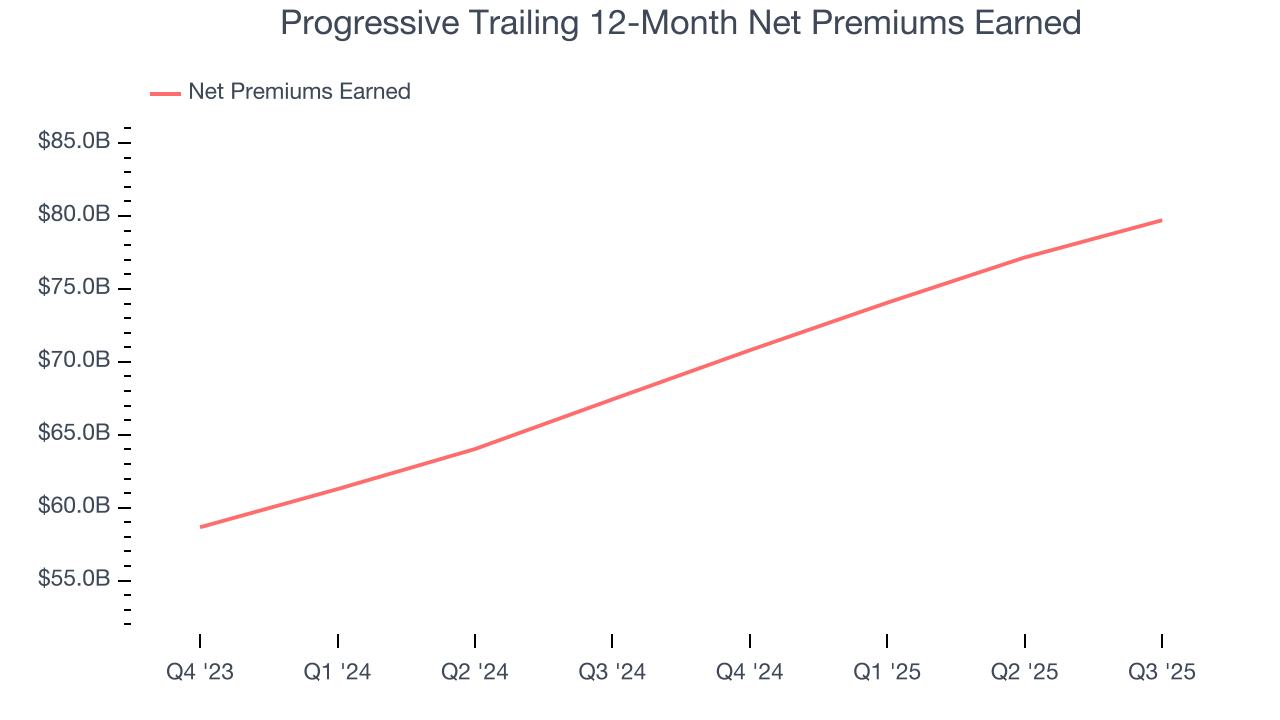

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Progressive’s EPS grew at a remarkable 19.4% compounded annual growth rate over the last five years, higher than its 15.5% annualized revenue growth. However, we take this with a grain of salt because its combined ratio didn’t improve and it didn’t repurchase its shares, meaning the delta came from factors we consider non-core or less sustainable over the long term.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Progressive, its two-year annual EPS growth of 72.1% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Progressive reported adjusted EPS of $4.67, up from $4.08 in the same quarter last year. This print beat analysts’ estimates by 5.3%. Over the next 12 months, Wall Street expects Progressive’s full-year EPS of $18.25 to shrink by 13%.

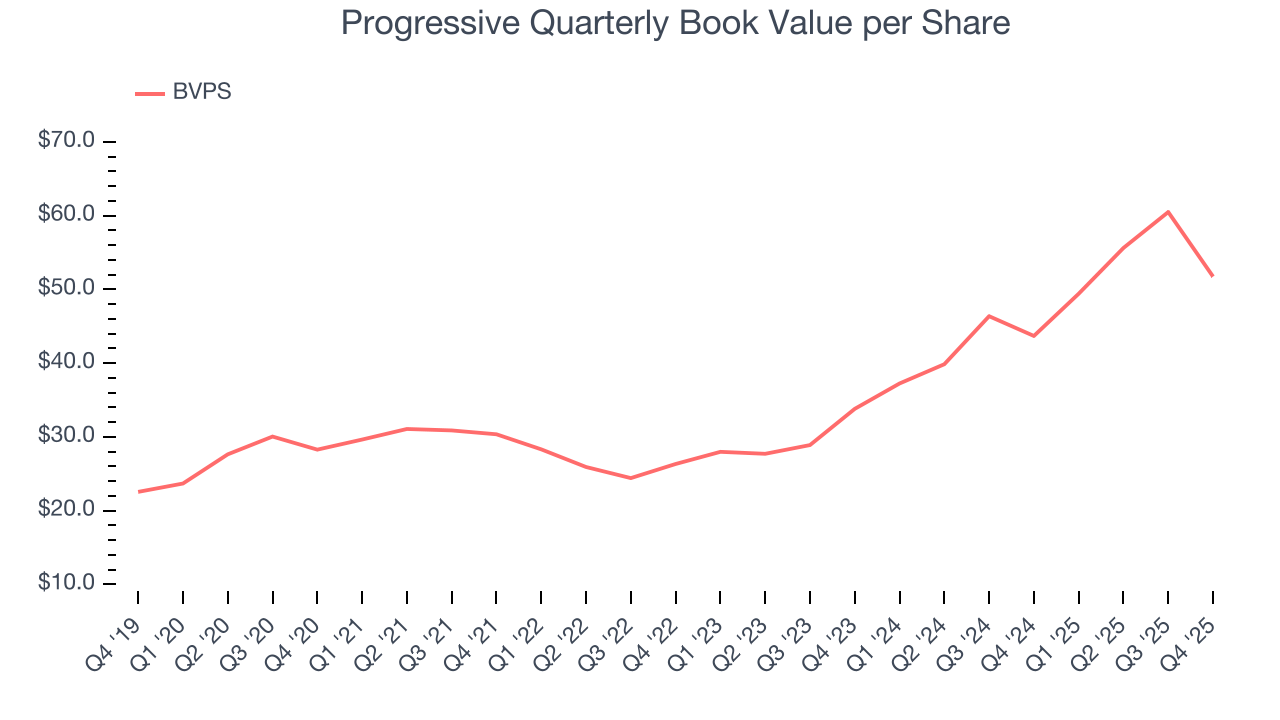

9. Book Value Per Share (BVPS)

Insurance companies are balance sheet businesses, collecting premiums upfront and paying out claims over time. The float–premiums collected but not yet paid out–are invested, creating an asset base supported by a liability structure. Book value per share (BVPS) captures this dynamic by measuring these assets (investment portfolio, cash, reinsurance recoverables) less liabilities (claim reserves, debt, future policy benefits). BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality. While other (and more commonly known) per-share metrics like EPS can sometimes be lumpy due to reserve releases or one-time items and can be managed or skewed while still following accounting rules, BVPS reflects long-term capital growth and is harder to manipulate.

Progressive’s BVPS grew at an excellent 12.8% annual clip over the last five years. BVPS growth has also accelerated recently, growing by 23.7% annually over the last two years from $33.80 to $51.74 per share.

Over the next 12 months, Consensus estimates call for Progressive’s BVPS to grow by 31.5% to $51.69, elite growth rate.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Progressive currently has $6.90 billion of debt and $30.32 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.2×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 1.0× for an insurance business. Anything below 0.5× is a bonus.

11. Return on Equity

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, Progressive has averaged an ROE of 22.8%, exceptional for a company operating in a sector where the average shakes out around 12.5% and those putting up 20%+ are greatly admired. This shows Progressive has a strong competitive moat.

12. Key Takeaways from Progressive’s Q4 Results

It was good to see Progressive narrowly top analysts’ revenue expectations this quarter. Overall, this print had some key positives. The stock remained flat at $213.29 immediately after reporting.

13. Is Now The Time To Buy Progressive?

Updated: March 6, 2026 at 11:43 PM EST

Before deciding whether to buy Progressive or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Progressive is truly a cream-of-the-crop insurance company. For starters, its revenue growth was exceptional over the last five years. And while its projected EPS for the next year is lacking, its estimated BVPS growth for the next 12 months is great. Additionally, Progressive’s stellar ROE suggests it has been a well-run company historically.

Progressive’s P/B ratio based on the next 12 months is 3.3x. There’s no doubt it’s a bit of a market darling given the lofty multiple, but we don’t mind owning an elite business, even if it’s expensive. We’re in the camp that investments like this should be held for at least three to five years to negate the short-term price volatility that can come with high valuations.

Wall Street analysts have a consensus one-year price target of $238.10 on the company (compared to the current share price of $211.25).