Planet Labs (PL)

Planet Labs is one of our favorite stocks. Its healthy backlog suggests it has a strong sales pipeline that will drive growth for many quarters.― StockStory Analyst Team

1. News

2. Summary

Why We Like Planet Labs

Pioneering the concept of "agile aerospace" with hundreds of small but powerful satellites, Planet Labs (NYSE:PL) operates the world's largest fleet of Earth observation satellites, capturing daily images of our planet to provide insights on deforestation, agriculture, and climate change.

- Annual revenue growth of 23.1% over the last five years was superb and indicates its market share increased during this cycle

- Earnings per share grew by 38.3% annually over the last three years, massively outpacing its peers

- Exciting sales outlook for the upcoming 12 months calls for 25.3% growth, an acceleration from its two-year trend

Planet Labs is a no-brainer. The price seems reasonable relative to its quality, and we think now is a favorable time to buy.

Why Is Now The Time To Buy Planet Labs?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Planet Labs?

Planet Labs is trading at $22.34 per share, or 741x forward EV-to-EBITDA. While the stock’s optically high multiple could cause short-term volatility, we think the valuation is reasonable given its quality characteristics.

By definition, where you buy a stock impacts returns. Still, our extensive analysis shows that investors should worry much more about business quality than entry price if the ultimate goal is long-term returns.

3. Planet Labs (PL) Research Report: Q3 CY2025 Update

Earth imaging satellite company Planet Labs (NYSE:PL) announced better-than-expected revenue in Q3 CY2025, with sales up 32.6% year on year to $81.25 million. On top of that, next quarter’s revenue guidance ($78 million at the midpoint) was surprisingly good and 6.3% above what analysts were expecting. Its non-GAAP loss of $0 per share was significantly above analysts’ consensus estimates.

Planet Labs (PL) Q3 CY2025 Highlights:

- Revenue: $81.25 million vs analyst estimates of $72.13 million (32.6% year-on-year growth, 12.7% beat)

- Adjusted EPS: $0 vs analyst estimates of -$0.04 (significant beat)

- Adjusted EBITDA: $5.62 million (6.9% margin)

- Revenue Guidance for Q4 CY2025 is $78 million at the midpoint, above analyst estimates of $73.39 million

- EBITDA guidance for the full year is $7 million at the midpoint, above analyst estimates of -$3.21 million

- Operating Margin: -22.6%, up from -36.9% in the same quarter last year

- Free Cash Flow was $911,000, up from -$3.56 million in the same quarter last year

- Backlog: $734.5 million at quarter end

- Market Capitalization: $3.95 billion

Company Overview

Pioneering the concept of "agile aerospace" with hundreds of small but powerful satellites, Planet Labs (NYSE:PL) operates the world's largest fleet of Earth observation satellites, capturing daily images of our planet to provide insights on deforestation, agriculture, and climate change.

Planet Labs designs, builds, and launches compact satellites that collectively image the entire Earth every day. These satellites collect medium and high-resolution imagery that forms a continuously updating, searchable visual record of our changing planet. The company has amassed an extensive historical archive of over 2,700 images on average for every point on Earth's landmass, creating a unique dataset for analysis.

The company's business model revolves around selling access to this imagery and related analytics through cloud-based subscription and usage-based contracts. Customers can integrate Planet's data directly into their workflows through web applications or APIs, with options ranging from daily monitoring feeds to targeted high-resolution imaging of specific locations.

A forestry company might use Planet's daily imagery to detect illegal logging activities across vast territories that would be impossible to monitor from the ground. An agricultural business could track crop health throughout the growing season to optimize irrigation and fertilizer application. Government agencies might employ the data for disaster response, monitoring flood extent or wildfire spread in near real-time.

Beyond raw imagery, Planet offers derived analytics products that use machine learning to automatically detect objects, classify land use, and measure environmental variables like soil moisture or vegetation biomass. These capabilities transform satellite data into actionable intelligence for customers across sectors including agriculture, forestry, energy, finance, and government.

The company maintains a global presence with operations throughout the United States, Canada, Europe, and Asia. Its satellite fleet represents a significant technological achievement in miniaturization, allowing Planet to deploy hundreds of satellites at a fraction of the cost of traditional satellite systems while maintaining rapid iteration cycles to improve capabilities.

4. Data & Business Process Services

A combination of increasing reliance on data and analytics across various industries and the desire for cost efficiency through outsourcing could mean that companies in this space gain. As functions such as payroll, HR, and credit risk assessment rely on more digitization, key players in the data & business process services industry could be increased demand. On the other hand, the sector faces headwinds from growing regulatory scrutiny on data privacy and security, with laws like GDPR and evolving U.S. regulations potentially limiting data collection and monetization strategies. Additionally, rising cyber threats pose risks to firms handling sensitive personal and financial information, creating outsized headline risk when things go wrong in this area.

Planet Labs competes with other satellite imagery providers including Maxar Technologies (NYSE:MAXR), BlackSky Technology (NYSE:BKSY), and Airbus's Intelligence business unit. The company also faces competition from drone-based imaging services and public satellite programs like NASA/USGS Landsat and the European Space Agency's Copernicus program.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $282.5 million in revenue over the past 12 months, Planet Labs is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

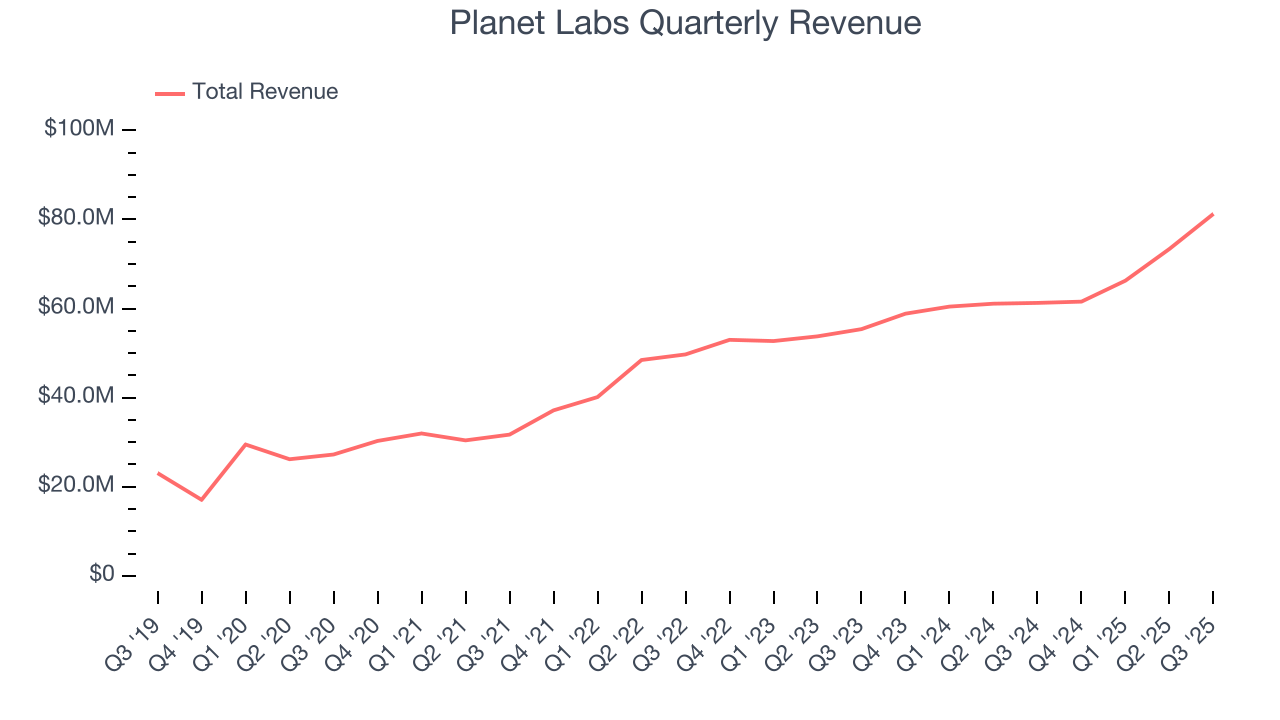

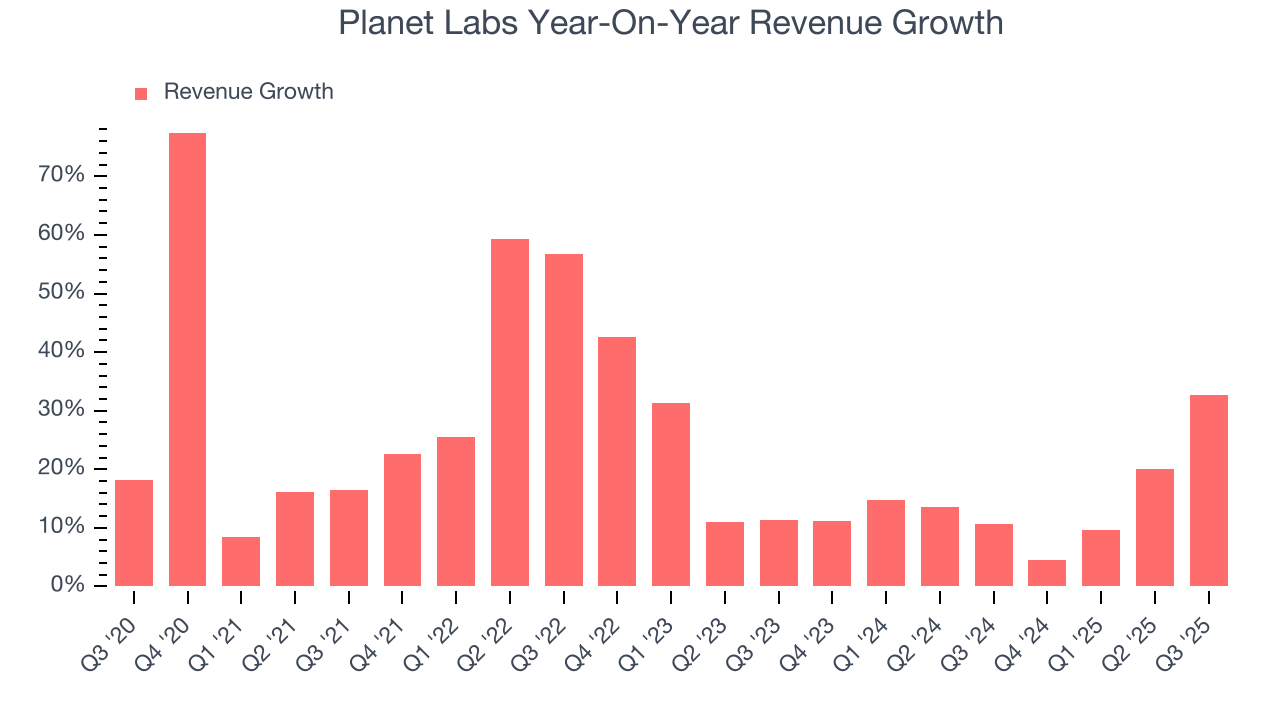

As you can see below, Planet Labs grew its sales at an incredible 23.1% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Planet Labs’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Planet Labs’s annualized revenue growth of 14.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Planet Labs reported wonderful year-on-year revenue growth of 32.6%, and its $81.25 million of revenue exceeded Wall Street’s estimates by 12.7%. Company management is currently guiding for a 26.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.6% over the next 12 months, similar to its two-year rate. This projection is eye-popping and indicates the market sees success for its products and services.

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

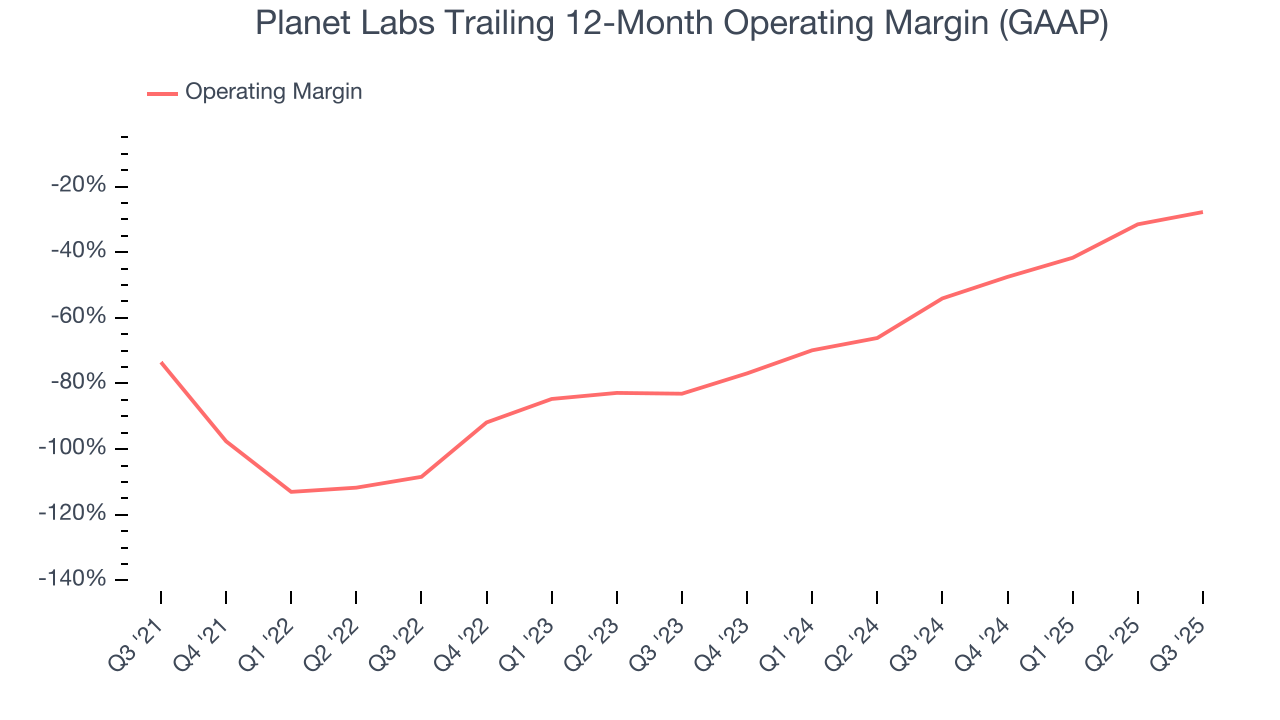

Planet Labs’s high expenses have contributed to an average operating margin of negative 64.4% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Planet Labs’s operating margin rose by 45.7 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q3, Planet Labs generated a negative 22.6% operating margin.

7. Earnings Per Share

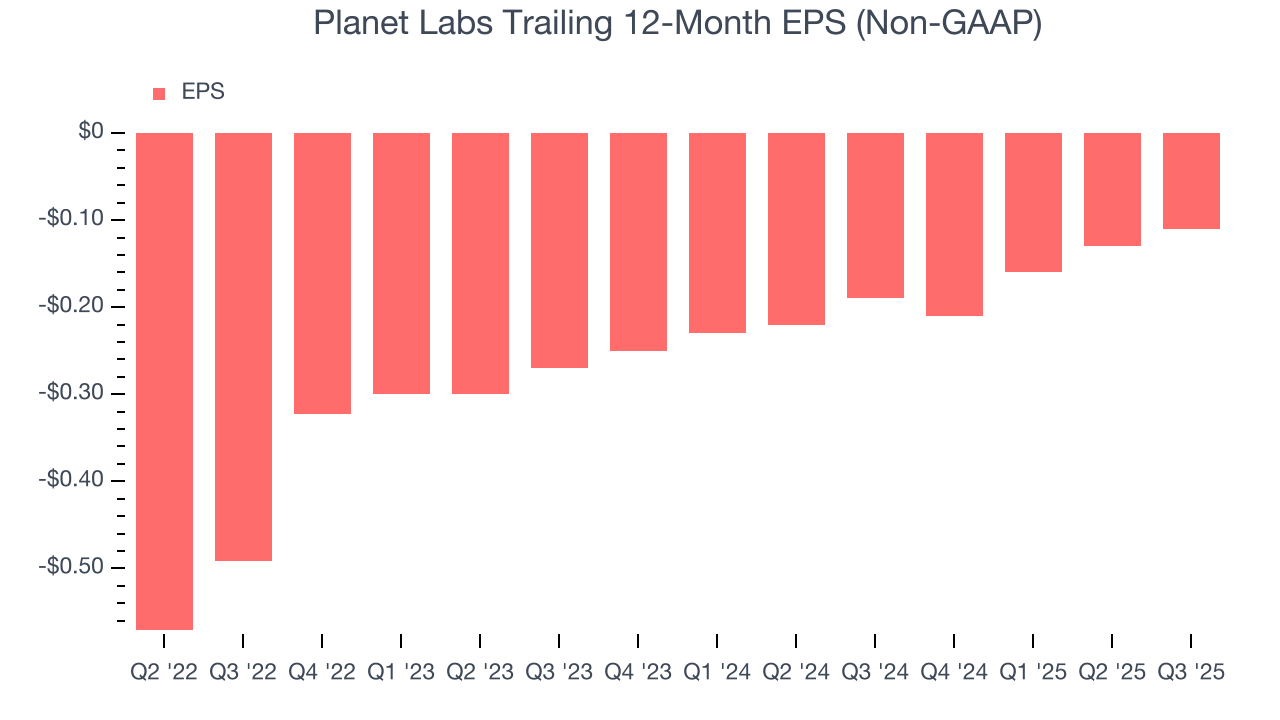

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Planet Labs’s full-year earnings are still negative, it reduced its losses and improved its EPS by 36.2% annually over the last two years.

In Q3, Planet Labs reported adjusted EPS of $0, up from negative $0.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Planet Labs to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.11 will advance to negative $0.09.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

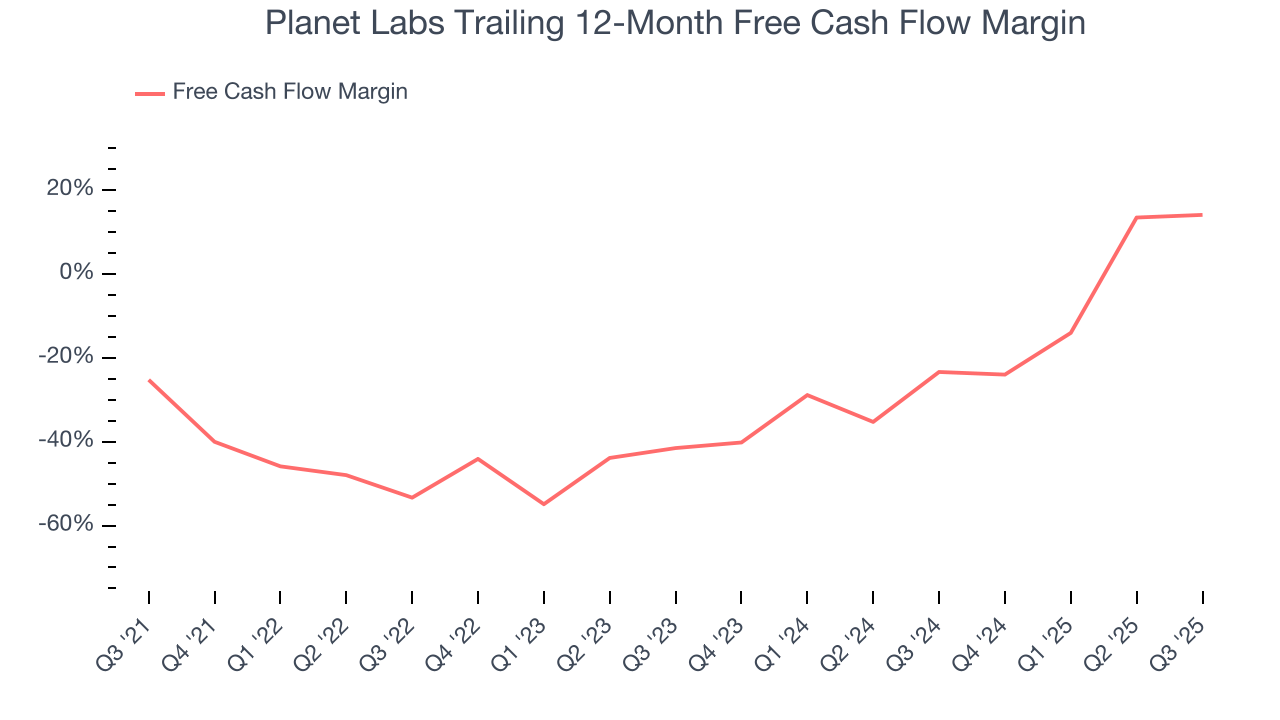

While Planet Labs posted positive free cash flow this quarter, the broader story hasn’t been so clean. Planet Labs’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 22.2%, meaning it lit $22.24 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Planet Labs’s margin expanded by 39.3 percentage points during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

Planet Labs’s free cash flow clocked in at $911,000 in Q3, equivalent to a 1.1% margin. Its cash flow turned positive after being negative in the same quarter last year, marking a potential inflection point.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

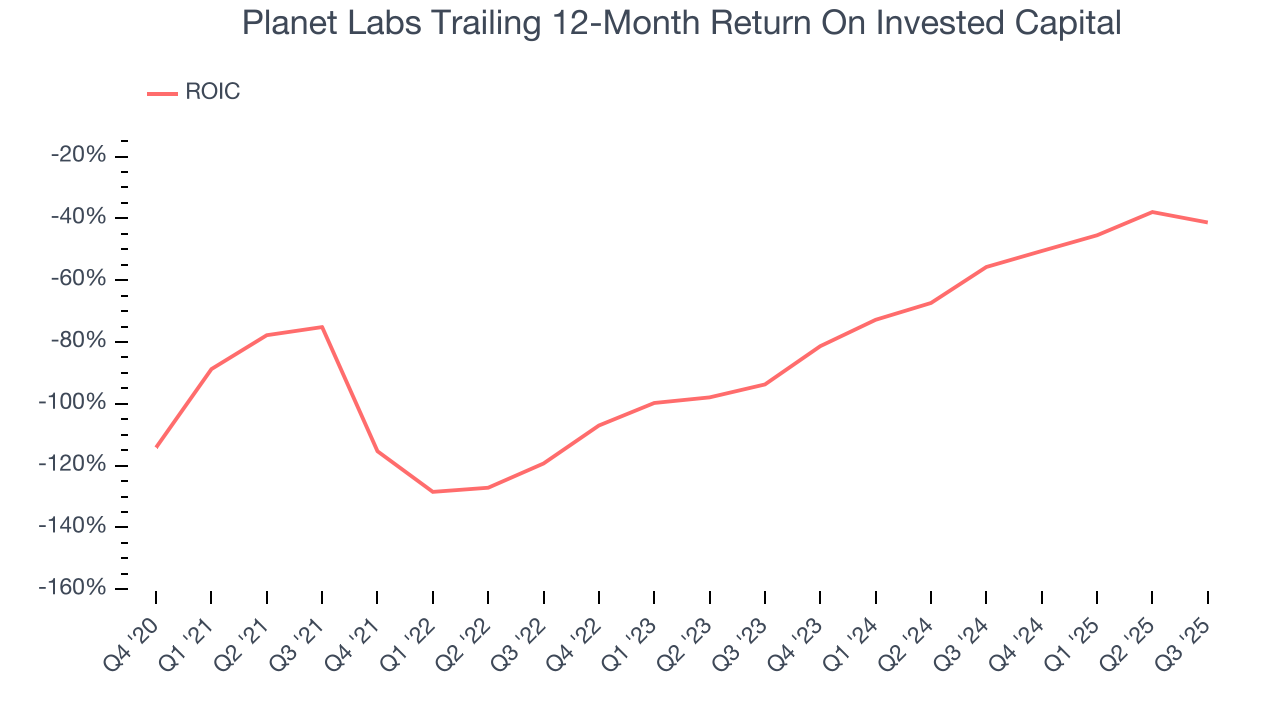

Although Planet Labs has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 66.5%, meaning management lost money while trying to expand the business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Planet Labs’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Balance Sheet Assessment

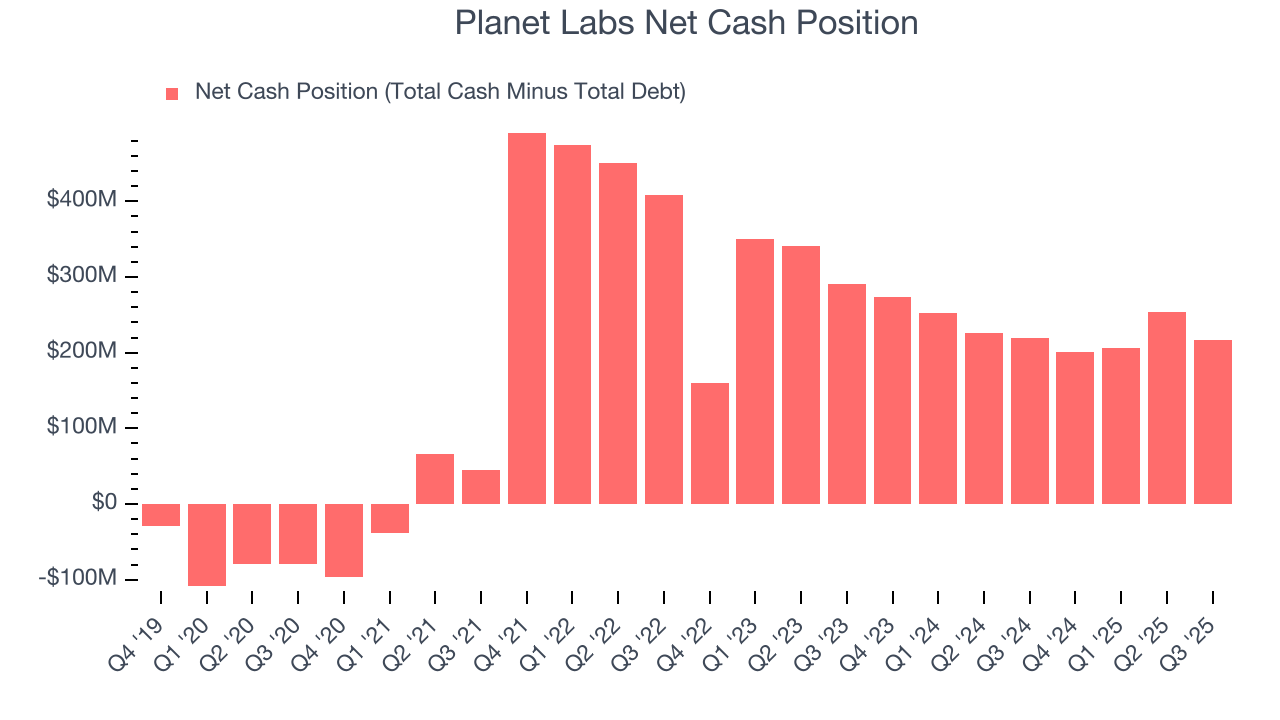

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Planet Labs is a well-capitalized company with $678.2 million of cash and $461.4 million of debt on its balance sheet. This $216.9 million net cash position is 5.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Planet Labs’s Q3 Results

It was good to see Planet Labs beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Looking ahead, guidance was above expectations across the board. Zooming out, we think this quarter was very strong. The stock traded up 17.8% to $15.32 immediately following the results.

12. Is Now The Time To Buy Planet Labs?

Updated: February 18, 2026 at 10:41 PM EST

When considering an investment in Planet Labs, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Planet Labs is truly a cream-of-the-crop business services company. To begin with, its revenue growth was exceptional over the last five years, and its growth over the next 12 months is expected to accelerate. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its backlog growth has been marvelous. On top of that, Planet Labs’s rising cash profitability gives it more optionality.

Planet Labs’s EV-to-EBITDA ratio based on the next 12 months is 733.8x. You get what you pay for, and in this case, the higher valuation is warranted because Planet Labs’s fundamentals clearly illustrate it’s a special business. We think the stock is attractive here.

Wall Street analysts have a consensus one-year price target of $24.71 on the company (compared to the current share price of $23.79), implying they see 3.9% upside in buying Planet Labs in the short term.