RB Global (RBA)

We admire RB Global. Its blend of high growth and robust profitability makes for an attractive return algorithm.― StockStory Analyst Team

1. News

2. Summary

Why We Like RB Global

Born from the 1958 founding of Ritchie Bros. Auctioneers and rebranded in 2023, RB Global (NYSE:RBA) operates global marketplaces that connect buyers and sellers of commercial assets, vehicles, and equipment across multiple industries.

- Annual revenue growth of 27.2% over the past five years was outstanding, reflecting market share gains this cycle

- Earnings per share grew by 18.9% annually over the last five years and trumped its peers

- Successful business model is illustrated by its impressive adjusted operating margin

We see a bright future for RB Global. The price seems reasonable relative to its quality, so this might be a favorable time to invest in some shares.

Why Is Now The Time To Buy RB Global?

High Quality

Investable

Underperform

Why Is Now The Time To Buy RB Global?

RB Global’s stock price of $99.58 implies a valuation ratio of 22.7x forward P/E. Most companies in the business services sector may feature a cheaper multiple, but we think RB Global is priced fairly given its fundamentals.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Over the long term, entry price doesn’t matter nearly as much as business fundamentals.

3. RB Global (RBA) Research Report: Q4 CY2025 Update

Commercial asset marketplace RB Global (NYSE:RBA) announced better-than-expected revenue in Q4 CY2025, with sales up 5.4% year on year to $1.20 billion. Its non-GAAP profit of $1.11 per share was 11.8% above analysts’ consensus estimates.

RB Global (RBA) Q4 CY2025 Highlights:

- Revenue: $1.20 billion vs analyst estimates of $1.17 billion (5.4% year-on-year growth, 2.7% beat)

- Adjusted EPS: $1.11 vs analyst estimates of $0.99 (11.8% beat)

- Adjusted EBITDA: $379.6 million vs analyst estimates of $356.5 million (31.5% margin, 6.5% beat)

- EBITDA guidance for the upcoming financial year 2026 is $1.5 billion at the midpoint, above analyst estimates of $1.49 billion

- Operating Margin: 14.7%, down from 18.1% in the same quarter last year

- Free Cash Flow Margin: 15.5%, up from 9.5% in the same quarter last year

- Market Capitalization: $18.94 billion

Company Overview

Born from the 1958 founding of Ritchie Bros. Auctioneers and rebranded in 2023, RB Global (NYSE:RBA) operates global marketplaces that connect buyers and sellers of commercial assets, vehicles, and equipment across multiple industries.

RB Global serves as a crucial intermediary in the commercial asset ecosystem through its omnichannel platform that facilitates transactions across automotive, construction, transportation, agriculture, energy, and natural resources sectors. The company's diverse customer base includes insurance companies, dealers, fleet owners, government entities, and original equipment manufacturers.

The company offers multiple transaction solutions tailored to different customer needs. These include traditional auctions (both onsite and online), make-offer/buy-now formats, and specialized marketplaces for government assets and salvage vehicles. A significant expansion occurred in 2023 when RB Global acquired IAA, Inc., a leading marketplace for total loss, damaged, and low-value vehicles, strengthening its position in the automotive sector.

Beyond simply connecting buyers and sellers, RB Global provides a comprehensive suite of value-added services. These include financial services that match loan applicants with lenders, inspection and appraisal services that provide buyers with confidence in their purchases, and logistics solutions that handle transportation and customs clearance. For example, a construction company looking to sell unused excavators might use RB Global's inspection services to document the equipment's condition, list it on their marketplace, and then utilize their logistics services to ship the sold equipment to the buyer.

The company monetizes its platform through various contract options, including commission-based models where sellers pay a percentage of the sale price, fixed commission fees, guaranteed minimum contracts, and inventory contracts where RB Global purchases assets outright before reselling them.

RB Global's data services division provides market intelligence that helps customers make informed decisions about buying and selling assets. This includes tools for estimating vehicle values based on historical auction data and equipment market analysis.

4. Asset Management & Auction Services

Like in other industries, the shift to online platforms can lower transaction costs and improve liquidity for sellers. Increasing digitization, AI-driven pricing analytics, and automation in logistics can enhance efficiency for operators who invest in technology and software. On the other hand, challenges include potential regulatory scrutiny on auction transparency, data privacy concerns with AI-driven valuation models, and shifting environmental policies that could impact the resale market for internal combustion vehicles. Additionally, supply chain volatility in new car production may create unpredictable swings in used vehicle supply, impacting auction volumes.

RB Global's primary competitors include Copart, Inc. (NASDAQ:CPRT), which specializes in online vehicle auctions and remarketing services, Total Resource Auctions (a subsidiary of Cox Enterprises), and various independent auction companies that focus on damaged vehicles and commercial equipment.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.59 billion in revenue over the past 12 months, RB Global is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

As you can see below, RB Global’s 27.2% annualized revenue growth over the last five years was incredible. This is a great starting point for our analysis because it shows RB Global’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. RB Global’s annualized revenue growth of 11.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, RB Global reported year-on-year revenue growth of 5.4%, and its $1.20 billion of revenue exceeded Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

RB Global has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 16.8%.

Looking at the trend in its profitability, RB Global’s operating margin decreased by 1.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, RB Global generated an operating margin profit margin of 14.7%, down 3.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

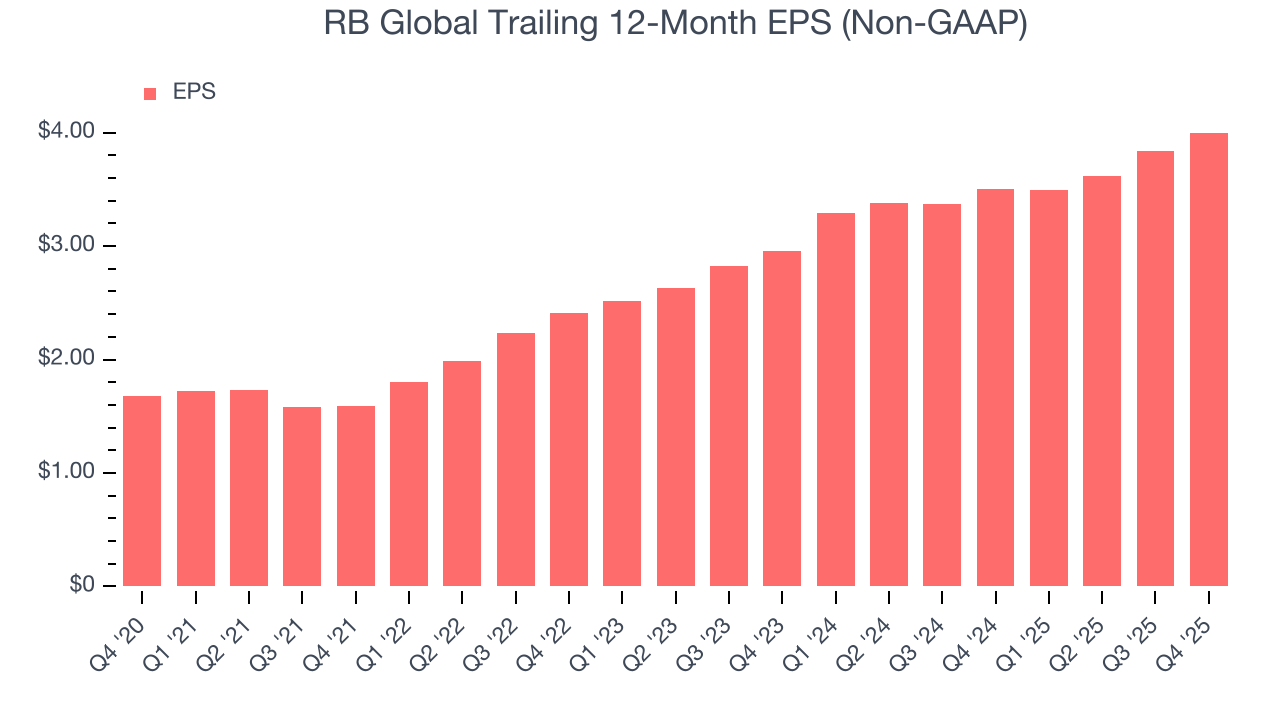

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

RB Global’s EPS grew at an astounding 18.9% compounded annual growth rate over the last five years. However, this performance was lower than its 27.2% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into RB Global’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, RB Global’s operating margin declined by 1.4 percentage points over the last five years. Its share count also grew by 68.7%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For RB Global, its two-year annual EPS growth of 16.2% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, RB Global reported adjusted EPS of $1.11, up from $0.95 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects RB Global’s full-year EPS of $4 to grow 8%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

RB Global has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 15.6% over the last five years.

Taking a step back, we can see that RB Global’s margin dropped by 6 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

RB Global’s free cash flow clocked in at $186.5 million in Q4, equivalent to a 15.5% margin. This result was good as its margin was 6 percentage points higher than in the same quarter last year. We hope the company can build on this trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

RB Global’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 10.9%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, RB Global’s ROIC has unfortunately decreased significantly. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

10. Balance Sheet Assessment

RB Global reported $694.8 million of cash and $4.06 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.4 billion of EBITDA over the last 12 months, we view RB Global’s 2.4× net-debt-to-EBITDA ratio as safe. We also see its $93.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from RB Global’s Q4 Results

It was good to see RB Global beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $108.00 immediately after reporting.

12. Is Now The Time To Buy RB Global?

Updated: March 4, 2026 at 12:00 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in RB Global.

There are multiple reasons why we think RB Global is an amazing business. First of all, the company’s revenue growth was exceptional over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. Additionally, RB Global’s impressive operating margins show it has a highly efficient business model.

RB Global’s P/E ratio based on the next 12 months is 22.7x. Looking across the spectrum of business services companies today, RB Global’s fundamentals shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $129.40 on the company (compared to the current share price of $99.58), implying they see 29.9% upside in buying RB Global in the short term.