Redwire (RDW)

We’re skeptical of Redwire. Its negative returns on capital suggest it eroded shareholder value by squandering business opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Redwire Will Underperform

Based in Jacksonville, Florida, Redwire (NYSE:RDW) is a provider of systems and components used in space infrastructure.

- Historical operating margin losses have deepened over the last five years as it prioritized growth over profits

- Cash burn has widened over the last five years, making us question whether it can reliably generate shareholder value

- Short cash runway increases the probability of a capital raise that dilutes existing shareholders

Redwire doesn’t meet our quality standards. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Redwire

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Redwire

At $8.55 per share, Redwire trades at 7,444.5x forward EV-to-EBITDA. This valuation is extremely expensive, especially for the quality you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Redwire (RDW) Research Report: Q4 CY2025 Update

Aerospace and defense company Redwire (NYSE:RDW) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 56.4% year on year to $108.8 million. The company’s full-year revenue guidance of $475 million at the midpoint came in 2.1% above analysts’ estimates. Its GAAP loss of $0.58 per share was significantly below analysts’ consensus estimates.

Redwire (RDW) Q4 CY2025 Highlights:

- Revenue: $108.8 million vs analyst estimates of $98.78 million (56.4% year-on-year growth, 10.1% beat)

- EPS (GAAP): -$0.58 vs analyst estimates of -$0.18 (significant miss)

- Adjusted EBITDA: -$18.05 million (-16.6% margin, 97.3% year-on-year decline)

- Adjusted EBITDA Margin: -16.6%, down from -13.2% in the same quarter last year

- Free Cash Flow was -$30.12 million, down from $4.73 million in the same quarter last year

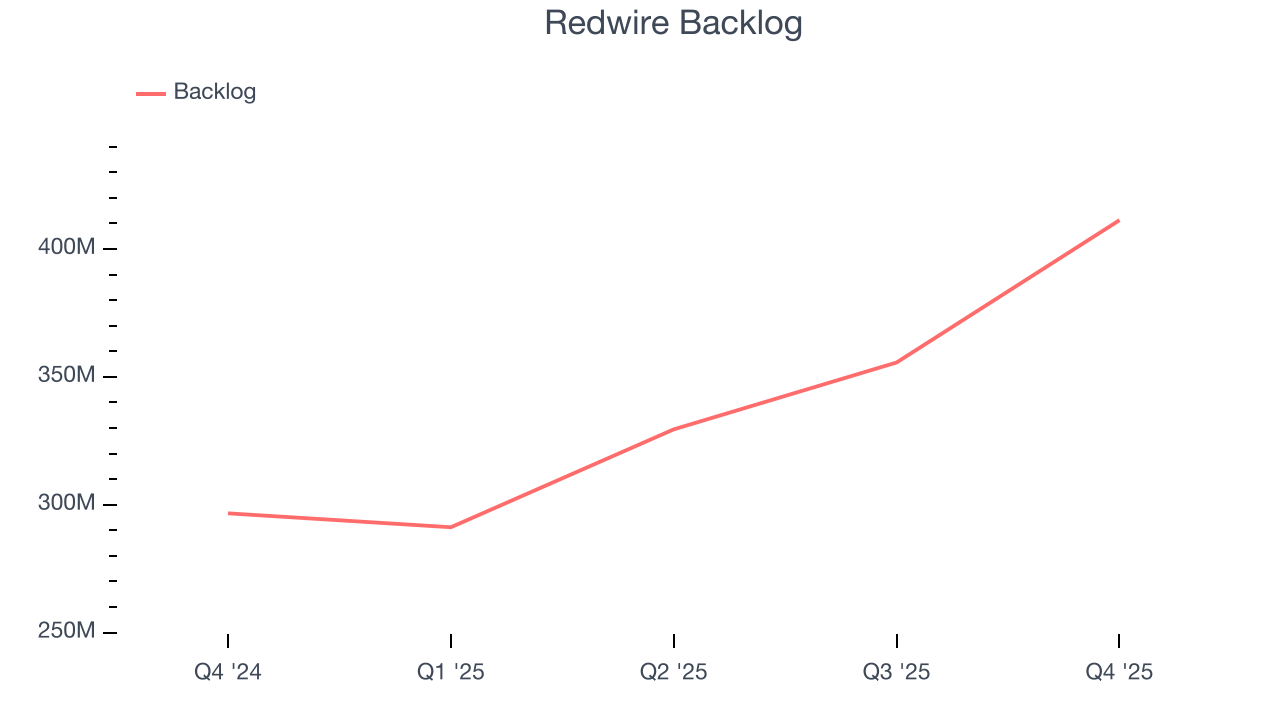

- Backlog: $411.2 million at quarter end, up 38.6% year on year

- Market Capitalization: $1.39 billion

Company Overview

Based in Jacksonville, Florida, Redwire (NYSE:RDW) is a provider of systems and components used in space infrastructure.

Redwire Corporation was established in 2020, following the merger of several companies specializing in space technology and engineering. The company was created to consolidate capabilities in the space sector, focusing on technologies such as in-space manufacturing and robotic systems. Redwire quickly positioned itself as a key provider of infrastructure for space missions, supporting a range of governmental and commercial initiatives.

Today, Redwire provides space systems, including satellite components, robotic systems, and in-space manufacturing capabilities. Its offerings include deployable structures which are used to expand satellite size and function once in orbit, and roll-out solar array (ROSA) systems that unfurl to provide power generation capabilities for spacecraft. They also supply human-rated camera systems designed for operations in space, suitable for capturing high-quality imagery in the harsh space environment. Furthermore, Redwire is at the forefront with robotic assembly technologies, which enable the construction and maintenance of structures while in orbit, enhancing the feasibility of prolonged space missions and habitation.

The company primarily serves space agencies, satellite operators, and firms involved in commercial space activities. It secures long-term contracts with major clients, such as NASA's Archinaut One program, and collaborates closely with the National Security community. Additionally, Redwire's partnerships in the commercial sector are crucial as they navigate the expanding business possibilities in Low Earth Orbit (LEO), exemplified by Virgin Galactic, SpaceX and Blue Origin’s growing offerings of consumer space flights. Revenue streams for Redwire are largely contract based, providing some stability in revenue.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Redwire’s peers and competitors include Kratos Defense (NASDAQ:KTOS) and Lockheed Martin (NYSE:LMT).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Redwire grew its sales at an incredible 49.8% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Redwire’s annualized revenue growth of 17.3% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Redwire’s backlog reached $411.2 million in the latest quarter and averaged 38.6% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Redwire’s products and services but raises concerns about capacity constraints.

This quarter, Redwire reported magnificent year-on-year revenue growth of 56.4%, and its $108.8 million of revenue beat Wall Street’s estimates by 10.1%.

Looking ahead, sell-side analysts expect revenue to grow 36.2% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will catalyze better top-line performance.

6. Operating Margin

Redwire’s high expenses have contributed to an average operating margin of negative 29.4% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Redwire’s operating margin decreased by 30.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Redwire’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Redwire generated a negative 75% operating margin.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

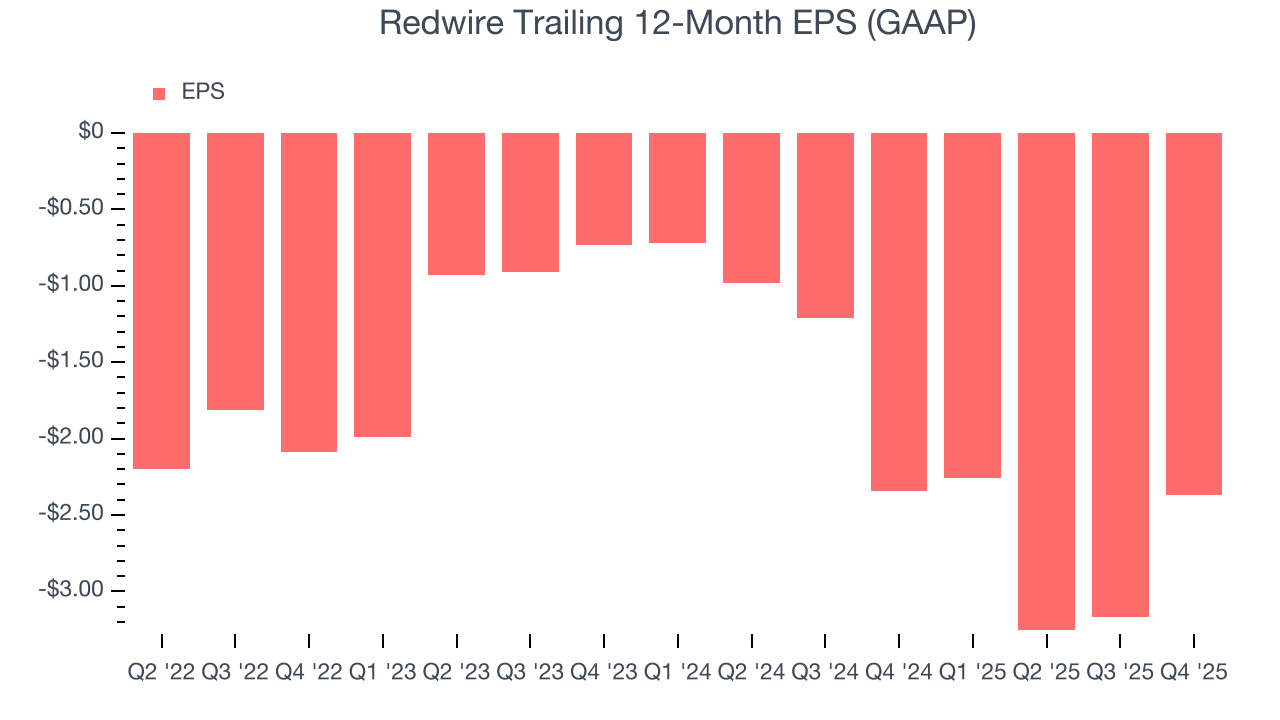

Redwire’s earnings losses deepened over the last four years as its EPS dropped 5.6% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Redwire’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Redwire, its two-year annual EPS declines of 80.2% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Redwire reported EPS of negative $0.58, up from negative $1.38 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Redwire to improve its earnings losses. Analysts forecast its full-year EPS of negative $2.37 will advance to negative $0.37.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Redwire’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 25.2%, meaning it lit $25.17 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Redwire’s margin dropped by 29.3 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Redwire burned through $30.12 million of cash in Q4, equivalent to a negative 27.7% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Redwire’s five-year average ROIC was negative 29.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Redwire’s ROIC averaged 1.3 percentage point increases each year over the last few years. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

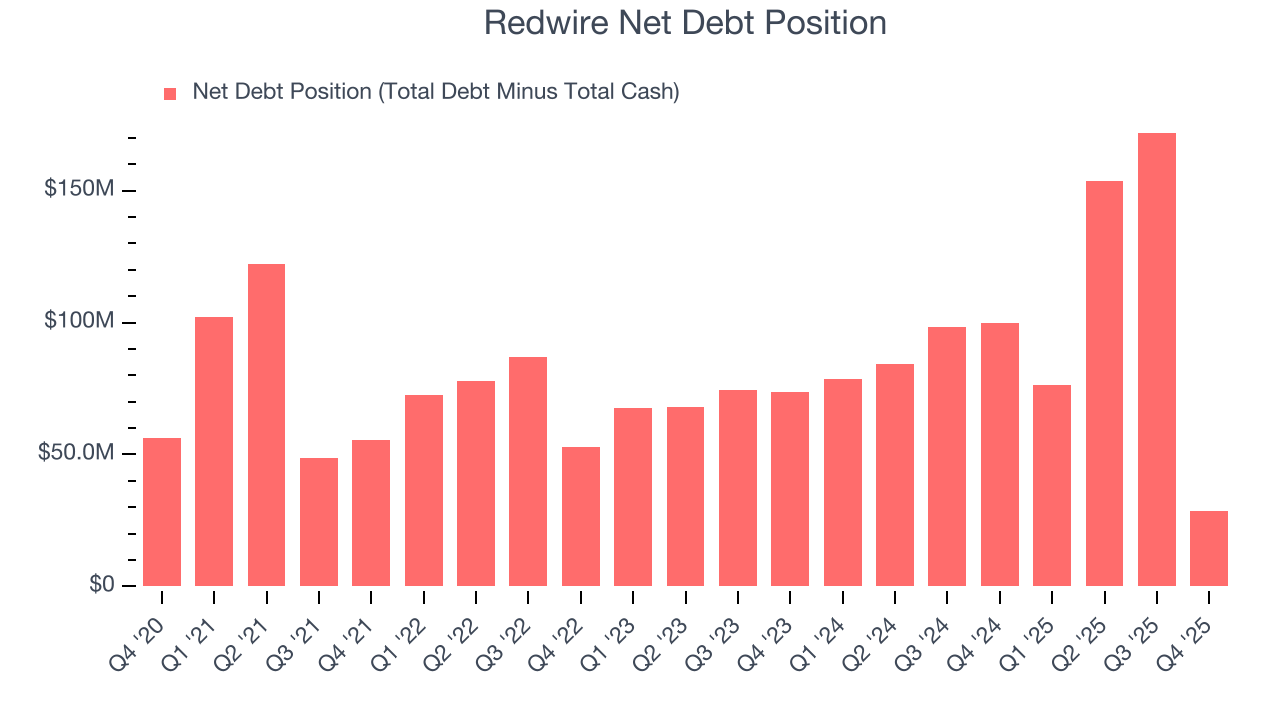

Redwire burned through $194.5 million of cash over the last year, and its $123.8 million of debt exceeds the $95.18 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Redwire’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Redwire until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

11. Key Takeaways from Redwire’s Q4 Results

We were impressed by how significantly Redwire blew past analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 6.4% to $8.09 immediately after reporting.

12. Is Now The Time To Buy Redwire?

Updated: March 7, 2026 at 10:29 PM EST

Before making an investment decision, investors should account for Redwire’s business fundamentals and valuation in addition to what happened in the latest quarter.

Redwire isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s backlog growth has been marvelous, the downside is its declining EPS over the last four years makes it a less attractive asset to the public markets.

Redwire’s EV-to-EBITDA ratio based on the next 12 months is 7,444.5x. This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $13.28 on the company (compared to the current share price of $8.55).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.