Resideo (REZI)

We’re cautious of Resideo. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Resideo Will Underperform

Resideo Technologies, Inc. (NYSE: REZI) is a manufacturer and distributor of technology-driven products and solutions for home comfort, energy management, water management, and safety and security.

- Cash-burning history and the downward spiral in its margin profile make us wonder if it has a viable business model

- Estimated sales growth of 2.9% for the next 12 months implies demand will slow from its two-year trend

- A bright spot is that its ROIC punches in at 12.7%, illustrating management’s expertise in identifying profitable investments

Resideo is in the penalty box. There are better opportunities in the market.

Why There Are Better Opportunities Than Resideo

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Resideo

Resideo is trading at $35.89 per share, or 13.7x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Resideo (REZI) Research Report: Q3 CY2025 Update

Home automation and security solutions provider Resideo Technologies (NYSE:REZI) fell short of the markets revenue expectations in Q3 CY2025 as sales only rose 2% year on year to $1.86 billion. Next quarter’s revenue guidance of $1.87 billion underwhelmed, coming in 2.3% below analysts’ estimates. Its non-GAAP profit of $0.89 per share was 29% above analysts’ consensus estimates.

Resideo (REZI) Q3 CY2025 Highlights:

- Revenue: $1.86 billion vs analyst estimates of $1.87 billion (2% year-on-year growth, 0.6% miss)

- Adjusted EPS: $0.89 vs analyst estimates of $0.69 (29% beat)

- Adjusted EBITDA: $229 million vs analyst estimates of $230 million (12.3% margin, in line)

- Revenue Guidance for Q4 CY2025 is $1.87 billion at the midpoint, below analyst estimates of $1.92 billion

- Management lowered its full-year Adjusted EPS guidance to $2.62 at the midpoint, a 6.8% decrease

- EBITDA guidance for the full year is $825 million at the midpoint, in line with analyst expectations

- Operating Margin: 8.3%, up from 6.9% in the same quarter last year

- Free Cash Flow was -$1.60 billion, down from $125 million in the same quarter last year

- Market Capitalization: $6.16 billion

Company Overview

Resideo Technologies, Inc. (NYSE: REZI) is a manufacturer and distributor of technology-driven products and solutions for home comfort, energy management, water management, and safety and security.

The company was formed in 2018 through a spin-off from Honeywell International Inc. Resideo operates through two business segments: Products and Solutions and ADI Global Distribution.

The Products and Solutions segment, focuses on developing and manufacturing a wide range of products under well-established brands such as Honeywell Home, First Alert, Resideo, Braukmann, and BRK. These offerings include temperature and humidity control systems, thermal and combustion solutions, water and indoor air quality products, smoke and carbon monoxide detectors, security panels, sensors, video cameras, and related software.

ADI Global Distribution, is a leading wholesale distributor of low-voltage security products and related categories. The segment's product range includes security, fire, access control, video, smart home, audio, networking, and structured wiring products.

The company's manufacturing operations for the Products and Solutions segment are spread across several countries, including Mexico, the Czech Republic, Hungary, the United States, Germany, the United Kingdom, Netherlands, and China.

4. Building Materials

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

Competitors in the home comfort, security, and smart home solutions market include Honeywell (NASDAQ:HON), Johnson Controls (NYSE:JCI), and Alarm.com (NASDAQ:ALRM)

5. Revenue Growth

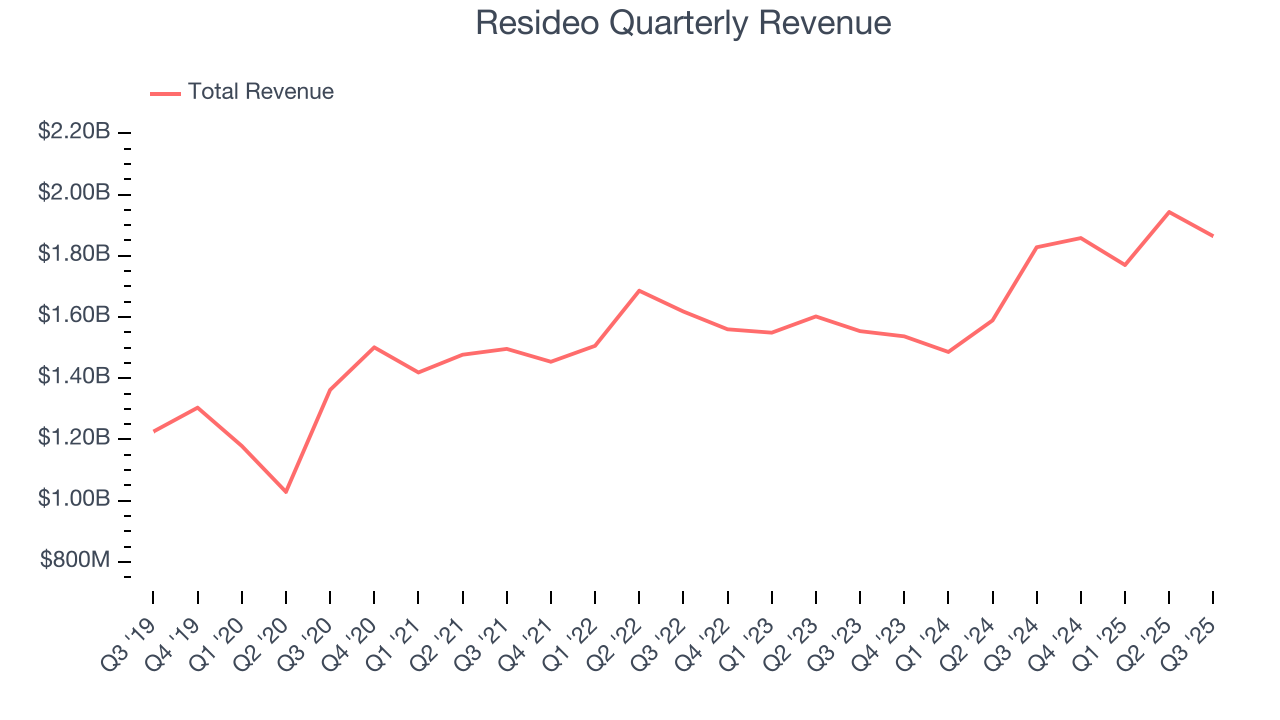

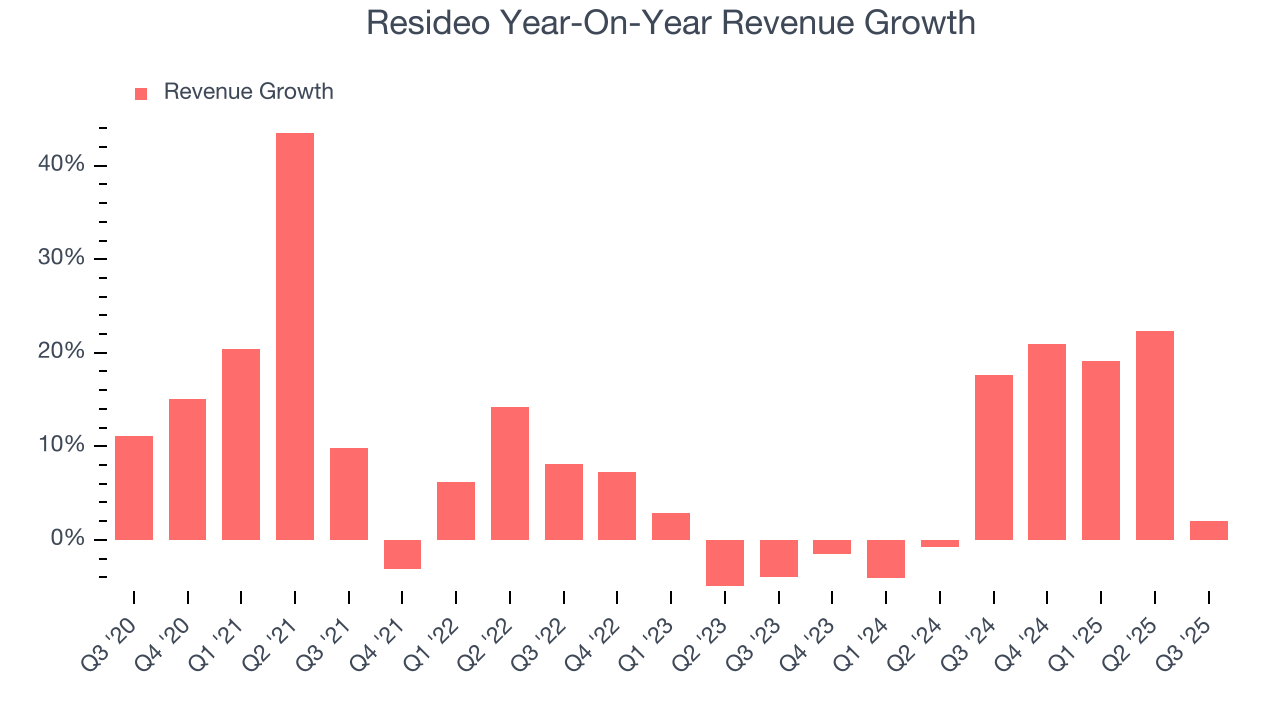

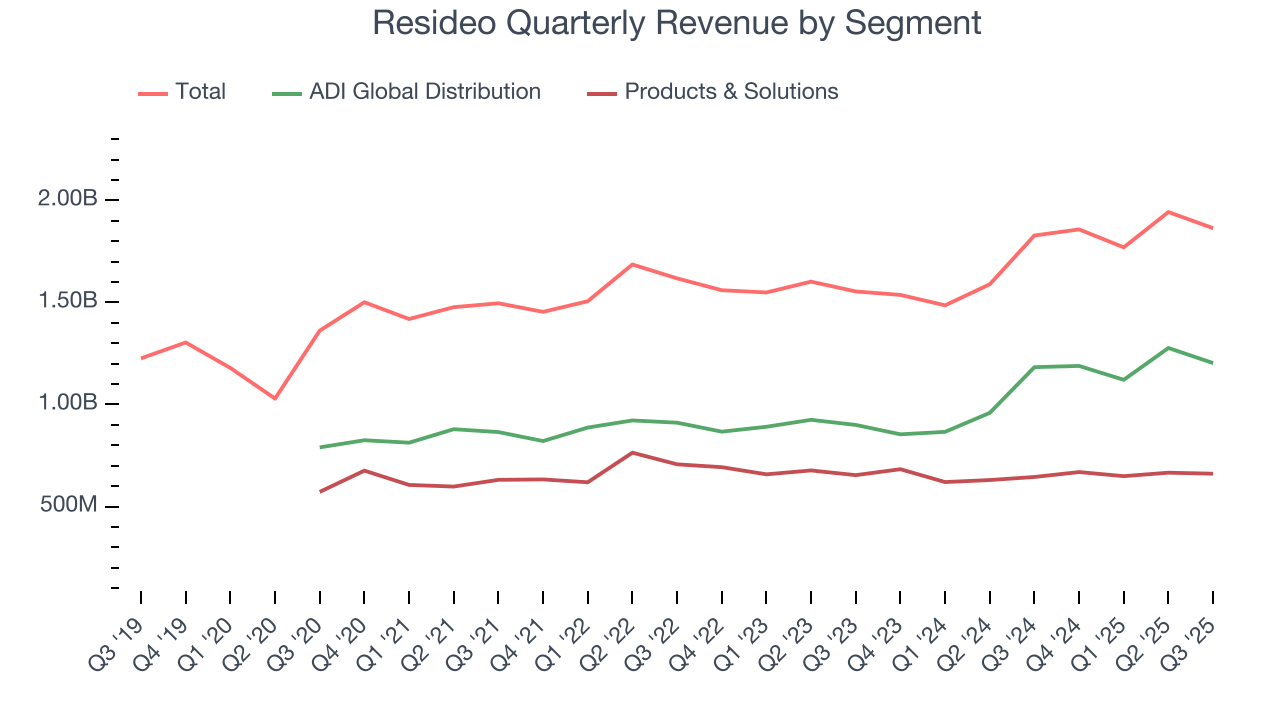

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Resideo grew its sales at a decent 8.8% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Resideo’s annualized revenue growth of 8.9% over the last two years aligns with its five-year trend, suggesting its demand was stable.

We can better understand the company’s revenue dynamics by analyzing its most important segments, ADI Global Distribution and Products & Solutions, which are 64.5% and 35.5% of revenue. Over the last two years, Resideo’s ADI Global Distribution revenue (wholesale distribution of 450k+ products) averaged 16.8% year-on-year growth while its Products & Solutions revenue (branded offerings) was flat.

This quarter, Resideo’s revenue grew by 2% year on year to $1.86 billion, falling short of Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

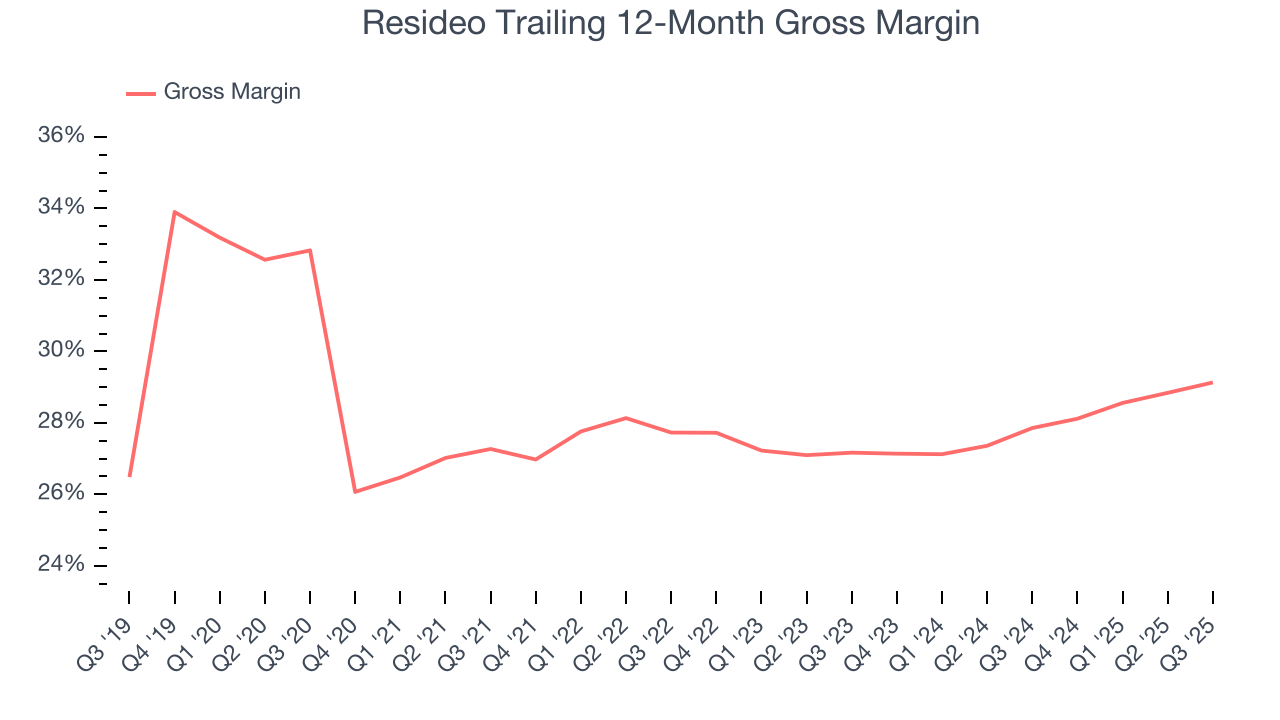

6. Gross Margin & Pricing Power

Resideo’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 27.9% gross margin over the last five years. Said differently, Resideo had to pay a chunky $72.12 to its suppliers for every $100 in revenue.

Resideo’s gross profit margin came in at 29.8% this quarter, marking a 1.2 percentage point increase from 28.7% in the same quarter last year. Resideo’s full-year margin has also been trending up over the past 12 months, increasing by 1.3 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

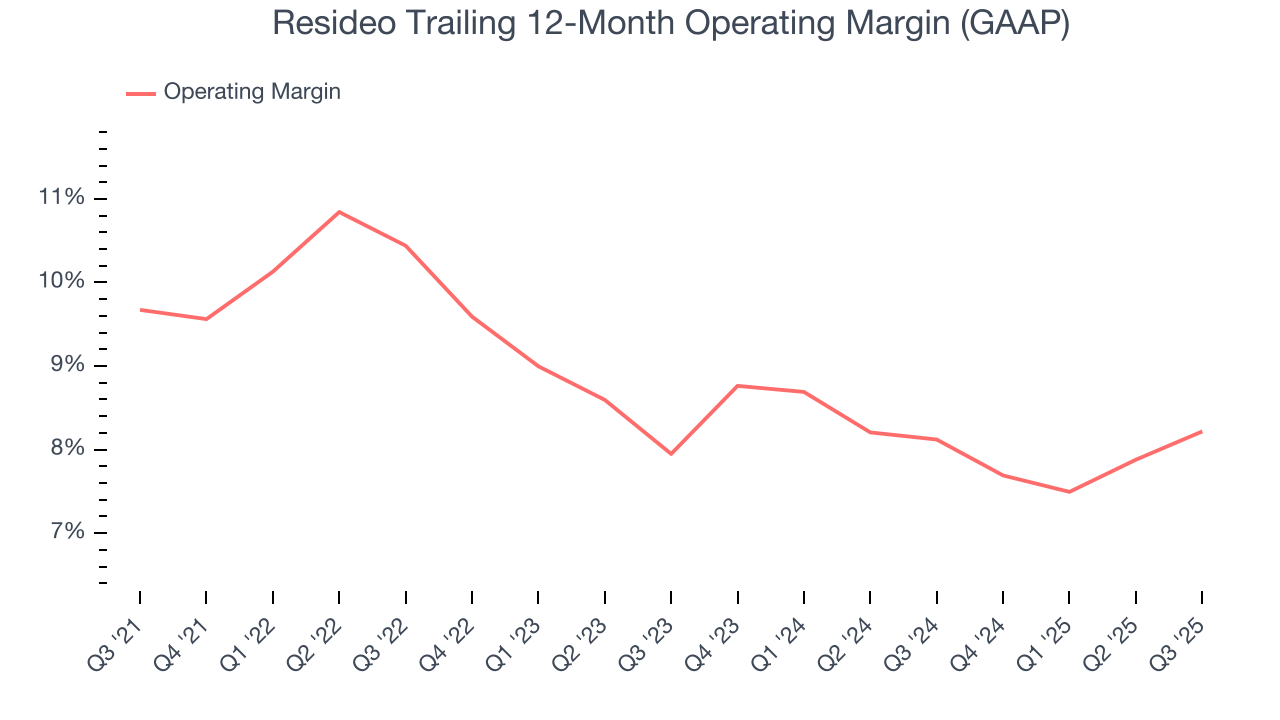

7. Operating Margin

Resideo has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 8.8%, higher than the broader industrials sector.

Looking at the trend in its profitability, Resideo’s operating margin decreased by 1.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Resideo generated an operating margin profit margin of 8.3%, up 1.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

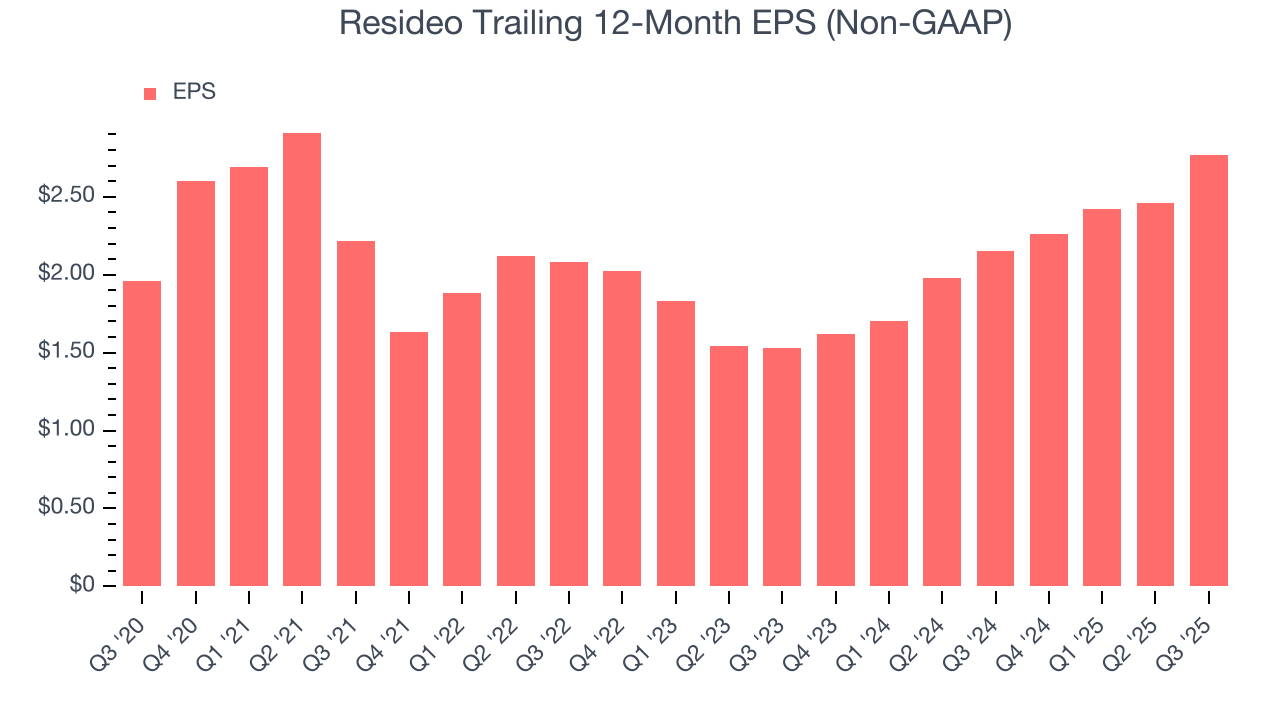

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Resideo’s unimpressive 7.2% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Resideo’s two-year annual EPS growth of 34.4% was fantastic and topped its 8.9% two-year revenue growth.

Diving into the nuances of Resideo’s earnings can give us a better understanding of its performance. Resideo’s operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Resideo reported adjusted EPS of $0.89, up from $0.58 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

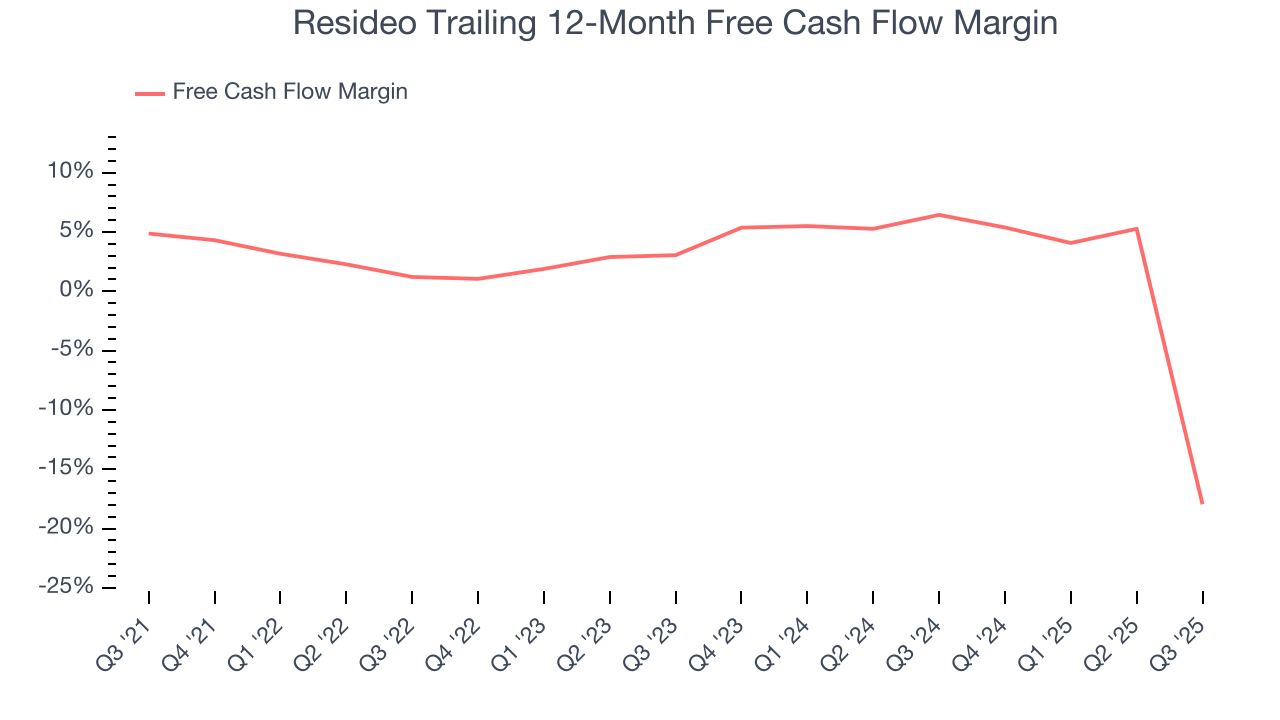

Resideo’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.1%, meaning it lit $1.13 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Resideo’s margin dropped by 22.8 percentage points during that time. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Resideo burned through $1.60 billion of cash in Q3, equivalent to a negative 85.8% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

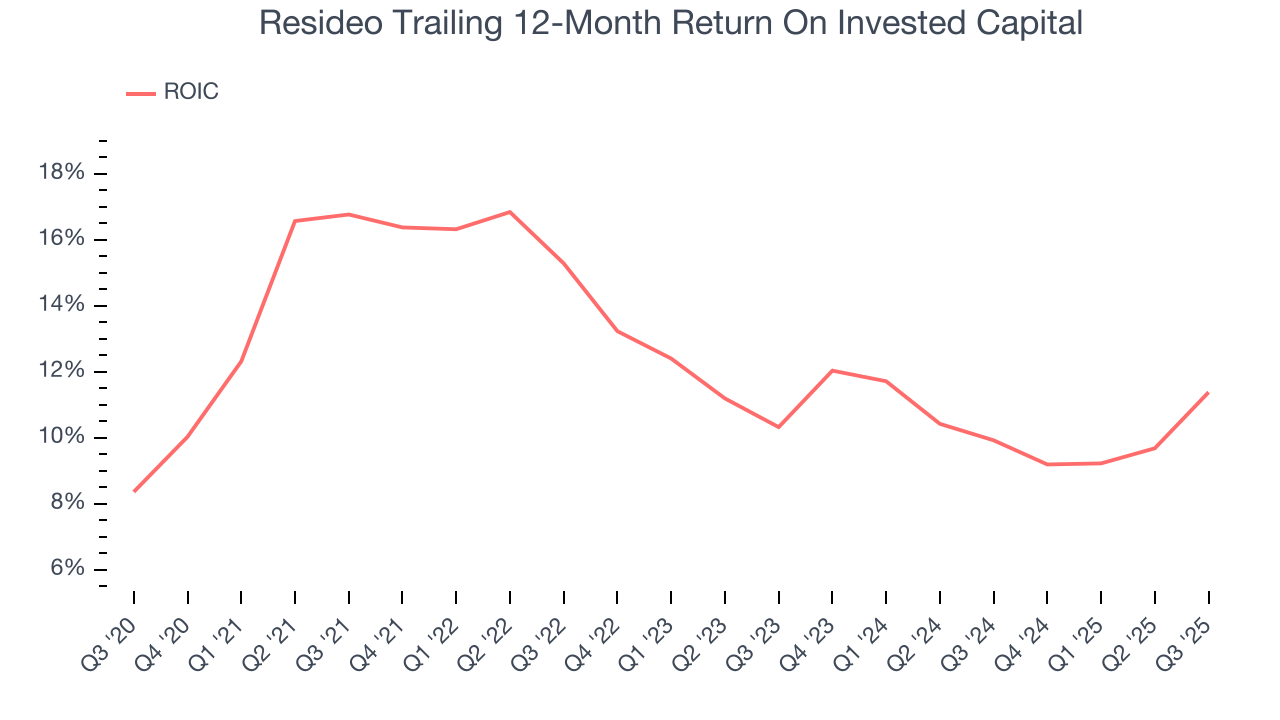

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Resideo’s five-year average ROIC was 12.7%, higher than most industrials businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Resideo’s ROIC has decreased over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

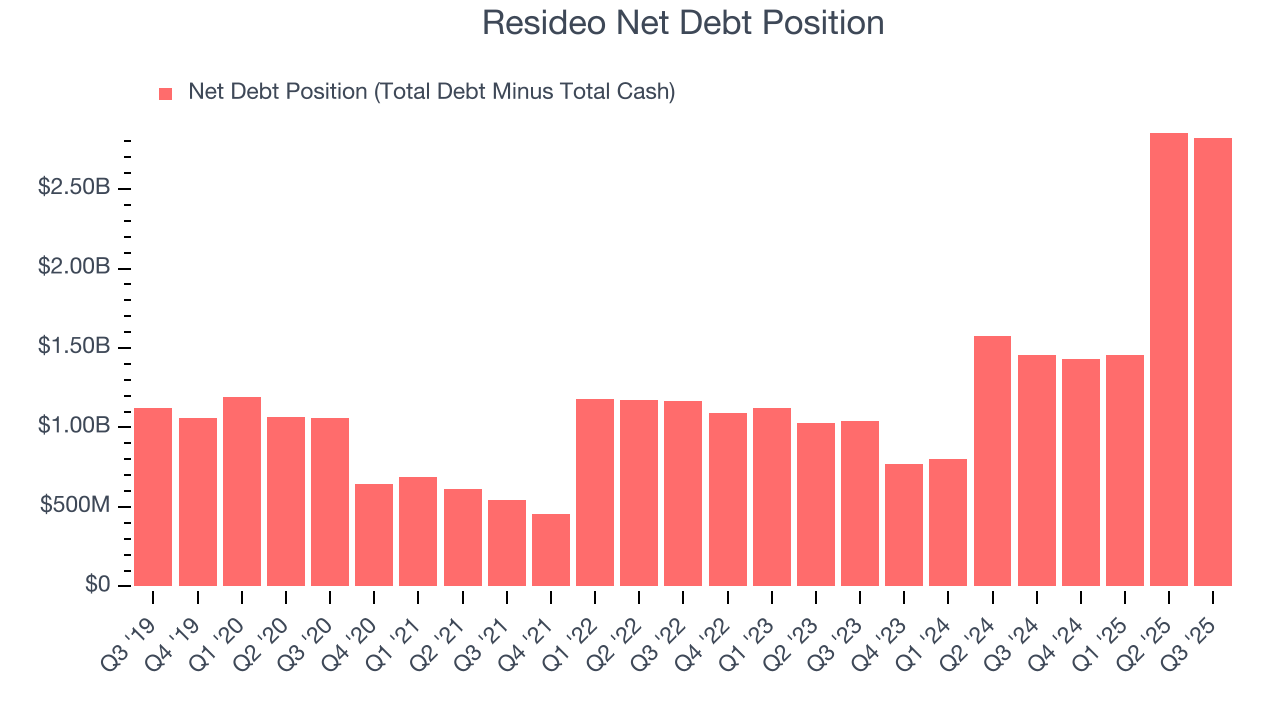

11. Balance Sheet Assessment

Resideo reported $345 million of cash and $3.17 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $794 million of EBITDA over the last 12 months, we view Resideo’s 3.6× net-debt-to-EBITDA ratio as safe. We also see its $38 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Resideo’s Q3 Results

It was good to see Resideo beat analysts’ EPS expectations this quarter. We were also glad its full-year EBITDA guidance was in line with Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed and its Products & Solutions revenue fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 19.6% to $32.97 immediately following the results.

13. Is Now The Time To Buy Resideo?

Updated: January 20, 2026 at 10:15 PM EST

When considering an investment in Resideo, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Resideo isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s solid ROIC suggests it has grown profitably in the past, the downside is its cash profitability fell over the last five years.

Resideo’s P/E ratio based on the next 12 months is 13.7x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $45 on the company (compared to the current share price of $35.89).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.