RH (RH)

RH doesn’t excite us. Not only is its demand weak but also its falling returns on capital suggest it’s becoming less profitable.― StockStory Analyst Team

1. News

2. Summary

Why We Think RH Will Underperform

Formerly known as Restoration Hardware, RH (NYSE:RH) is a specialty retailer that exclusively sells its own brand of high-end furniture and home decor.

- Cash-burning history makes us doubt the long-term viability of its business model

- Modest revenue base of $3.34 billion gives it less fixed cost leverage and fewer distribution channels than larger companies

- Short cash runway increases the probability of a capital raise that dilutes existing shareholders

RH doesn’t fulfill our quality requirements. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than RH

Why There Are Better Opportunities Than RH

RH’s stock price of $157.27 implies a valuation ratio of 15.1x forward P/E. This valuation is fair for the quality you get, but we’re on the sidelines for now.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. RH (RH) Research Report: Q3 CY2025 Update

Luxury furniture retailer RH (NYSE:RH) met Wall Streets revenue expectations in Q3 CY2025, with sales up 8.9% year on year to $883.8 million. On the other hand, next quarter’s revenue guidance of $873.3 million was less impressive, coming in 2.5% below analysts’ estimates. Its non-GAAP profit of $1.71 per share was 20.9% below analysts’ consensus estimates.

RH (RH) Q3 CY2025 Highlights:

- Revenue: $883.8 million vs analyst estimates of $883.5 million (8.9% year-on-year growth, in line)

- Adjusted EPS: $1.71 vs analyst expectations of $2.16 (20.9% miss)

- Adjusted EBITDA: $155.8 million vs analyst estimates of $165.5 million (17.6% margin, 5.9% miss)

- Revenue Guidance for Q4 CY2025 is $873.3 million at the midpoint, below analyst estimates of $896.2 million

- Operating Margin: 12%, in line with the same quarter last year

- Free Cash Flow was $83.03 million, up from -$95.99 million in the same quarter last year

- Market Capitalization: $2.95 billion

Company Overview

Formerly known as Restoration Hardware, RH (NYSE:RH) is a specialty retailer that exclusively sells its own brand of high-end furniture and home decor.

The core customer is typically affluent and discerning, with a taste for high-end home decor. RH’s aesthetic is simple and clean-lined, with a focus on neutral colors and natural materials such as wood, stone, and leather. Antique and vintage elements are also featured in many products. RH’s furniture tends to be larger in size, which means that it is better suited for spacious homes rather than apartments and urban living.

RH stores, referred to as galleries, are typically located in high-end shopping areas. They are known for their expansive size and elegant layouts. Some of the larger galleries feature multiple levels with patios and decks to feature outdoor furniture. Rather than selling all sofas in one area of the store and all rugs in another, RH galleries are designed to showcase the company's furniture and home decor products in complete room formats.

RH has a strong e-commerce offering, which was launched in 2007. The platform not only allows customers to browse and purchase its products but to also read customer reviews and use digital augmented reality products to help customers visual RH products in their own spaces.

4. Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Competitors offering higher-end furniture include public companies Arhaus (NASDAQ:ARHS), MillerKnoll (NASDAQ:MLKN), and Design Capital Ltd. (SEHK:1545). Private company West Elm is also a competitor.

5. Revenue Growth

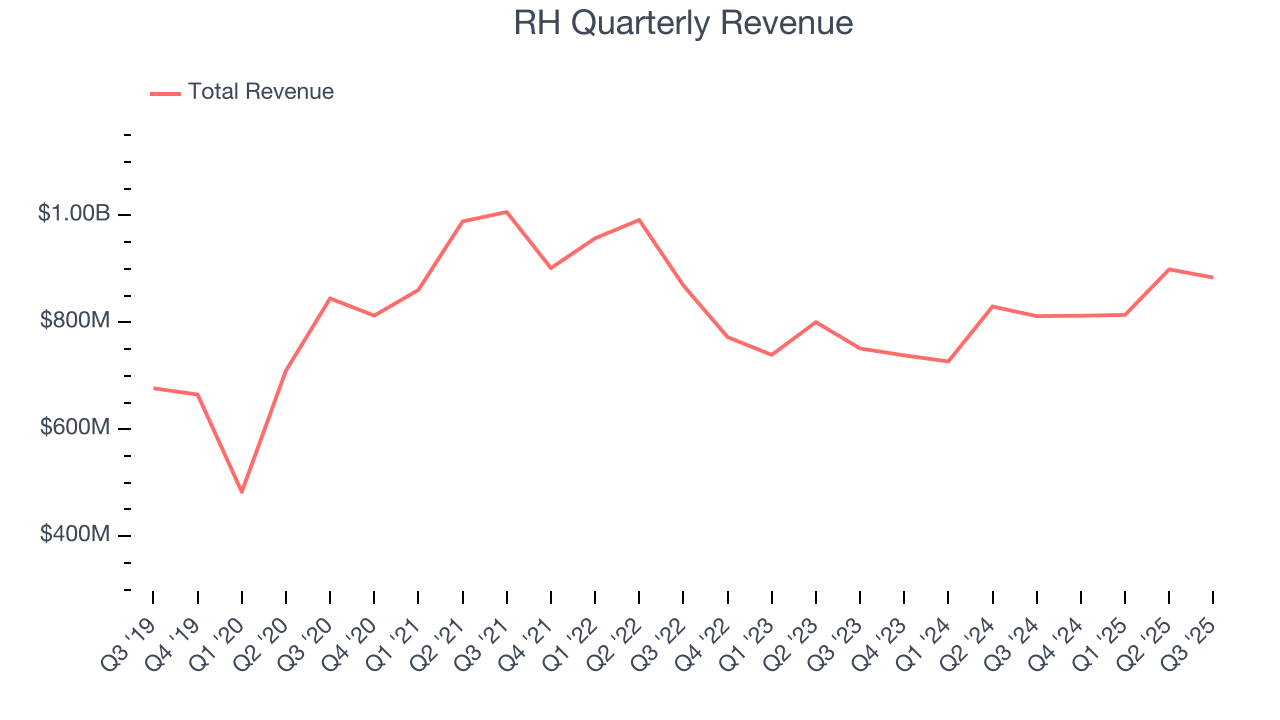

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $3.41 billion in revenue over the past 12 months, RH is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, RH’s revenue declined by 2.9% per year over the last three years (we compare to 2019 to normalize for COVID-19 impacts) despite opening new stores and expanding its reach.

This quarter, RH grew its revenue by 8.9% year on year, and its $883.8 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 7.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.3% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping and indicates its newer products will catalyze better top-line performance.

6. Store Performance

Number of Stores

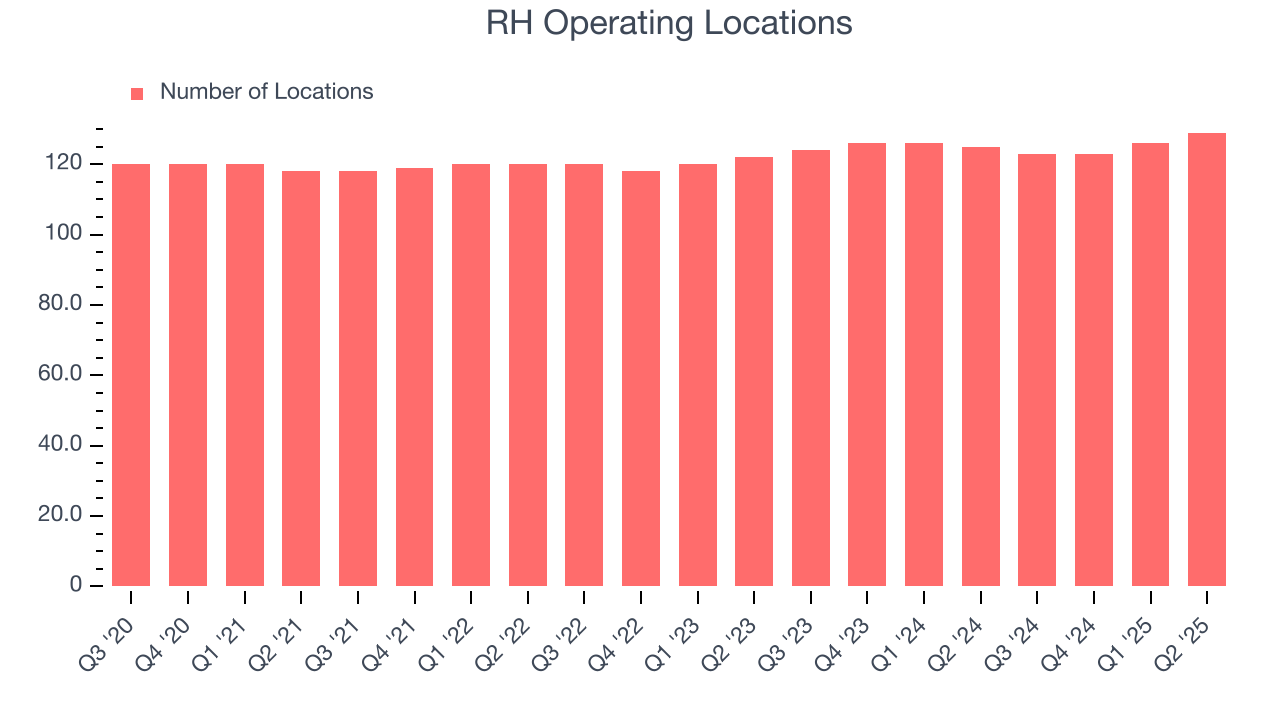

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

RH has generally opened new stores over the last two years and averaged 2% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that RH reports its store count intermittently, so some data points are missing in the chart below.

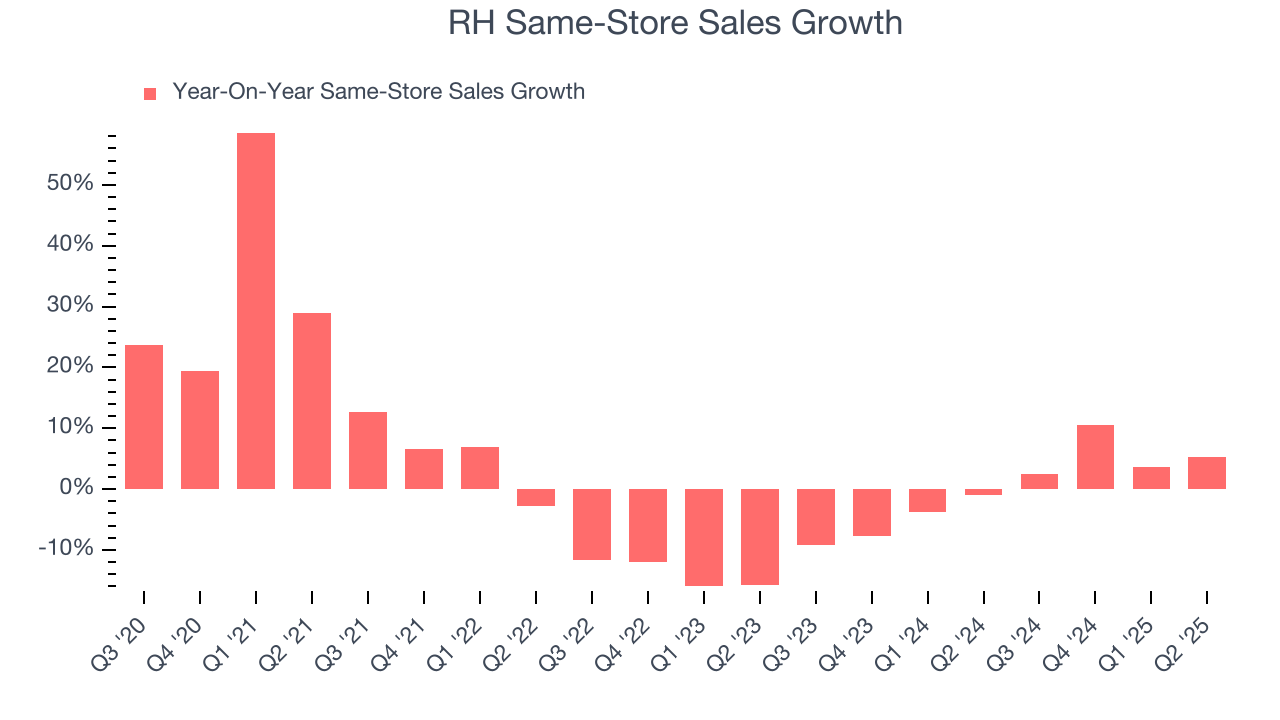

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

RH’s demand within its existing locations has been relatively stable over the last two years but was below most retailers. On average, the company’s same-store sales have grown by 1.3% per year. This performance suggests it should consider improving its foot traffic and efficiency before expanding its store base.

Note that RH reports its same-store sales intermittently, so some data points are missing in the chart below.

7. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

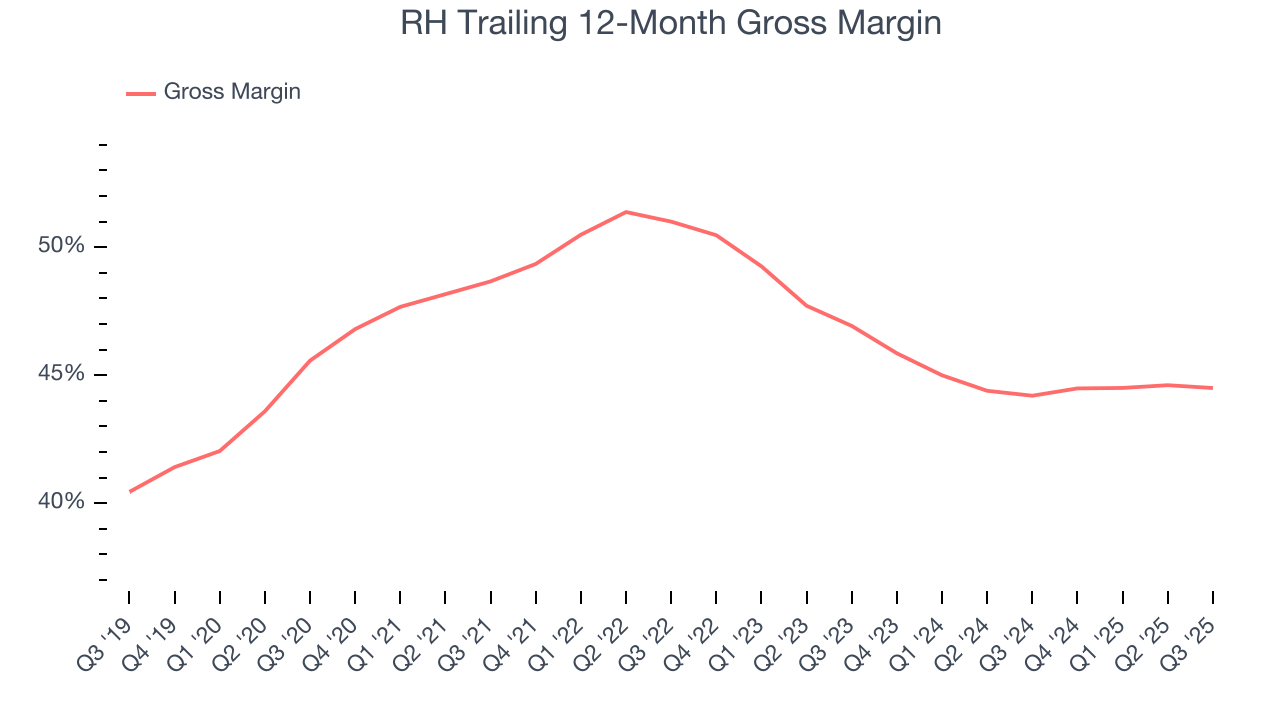

RH has good unit economics for a retailer, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it averaged an impressive 44.4% gross margin over the last two years. That means for every $100 in revenue, $55.64 went towards paying for inventory, transportation, and distribution.

In Q3, RH produced a 44.1% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

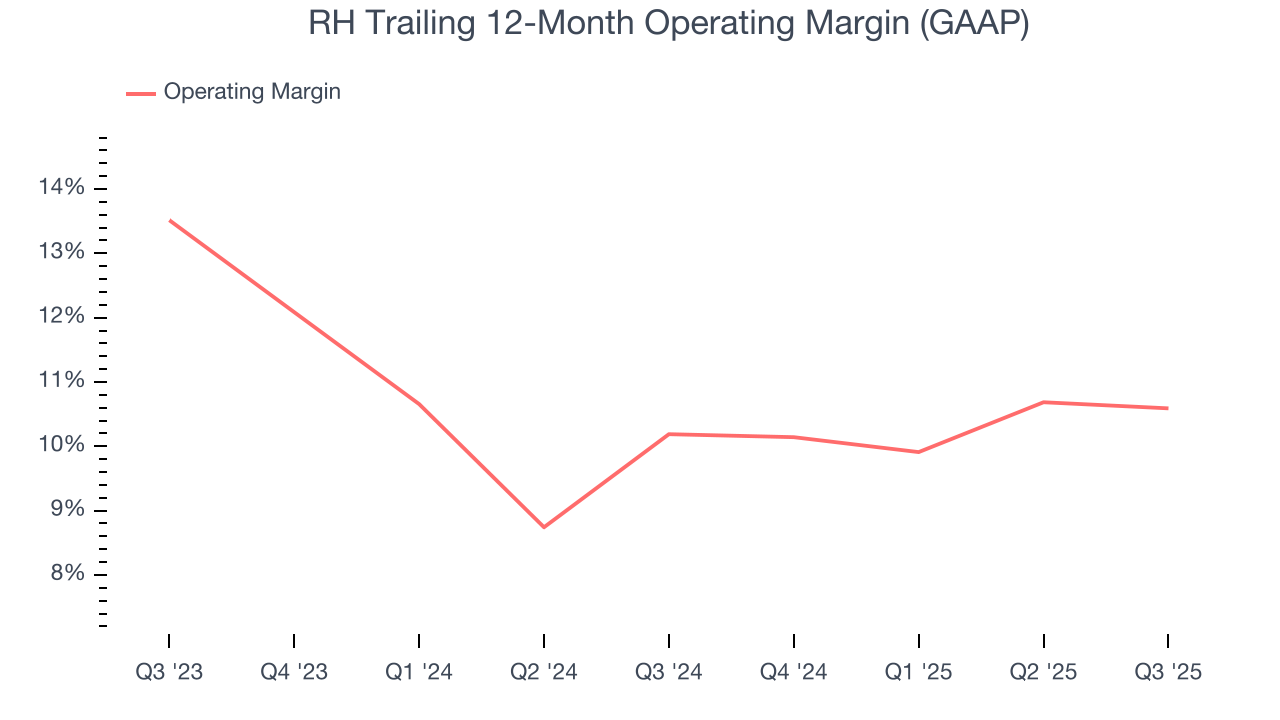

RH’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 10.4% over the last two years. This profitability was solid for a consumer retail business and shows it’s an efficient company that manages its expenses well. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, RH’s operating margin might fluctuated slightly but has generally stayed the same over the last year, highlighting the consistency of its expense base.

In Q3, RH generated an operating margin profit margin of 12%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

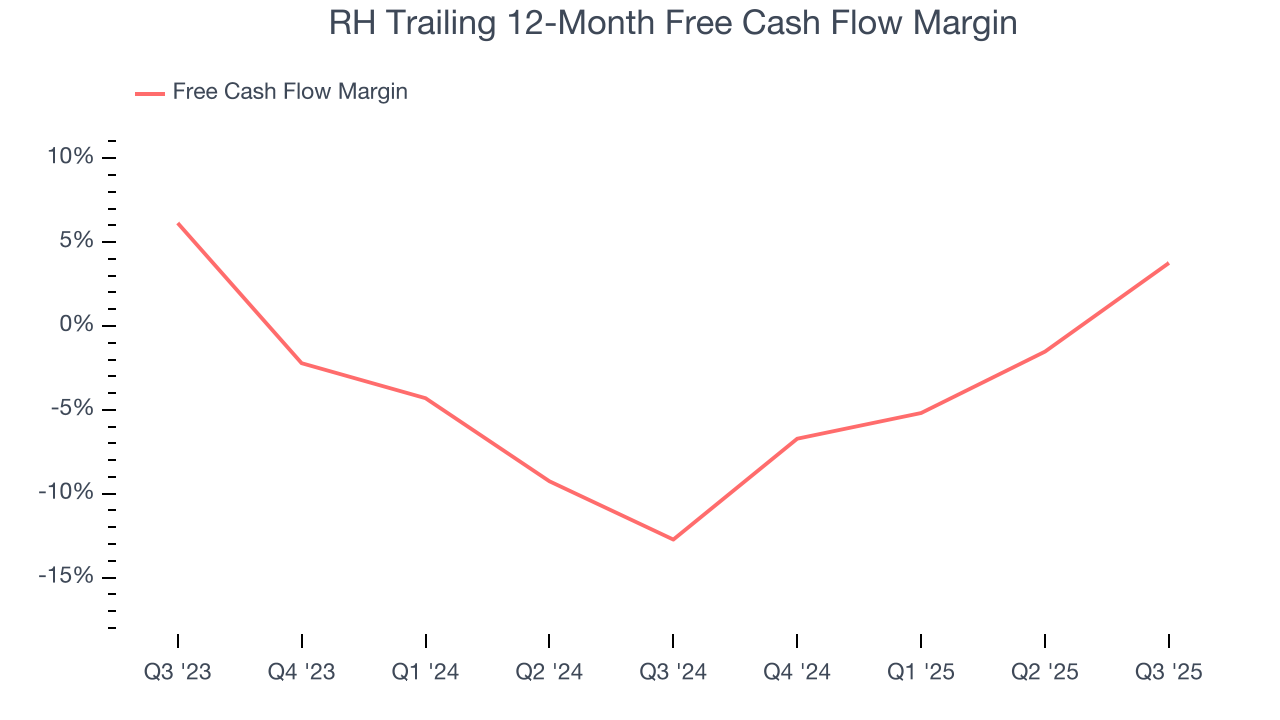

While RH posted positive free cash flow this quarter, the broader story hasn’t been so clean. RH’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 4.1%. This means it lit $4.10 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

Taking a step back, an encouraging sign is that RH’s margin expanded by 16.5 percentage points over the last year. We have no doubt shareholders would like to continue seeing its cash conversion rise.

RH’s free cash flow clocked in at $83.03 million in Q3, equivalent to a 9.4% margin. Its cash flow turned positive after being negative in the same quarter last year, marking a potential inflection point.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although RH hasn’t been the highest-quality company lately because of its poor revenue and EPS performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 30.8%, splendid for a consumer retail business.

11. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

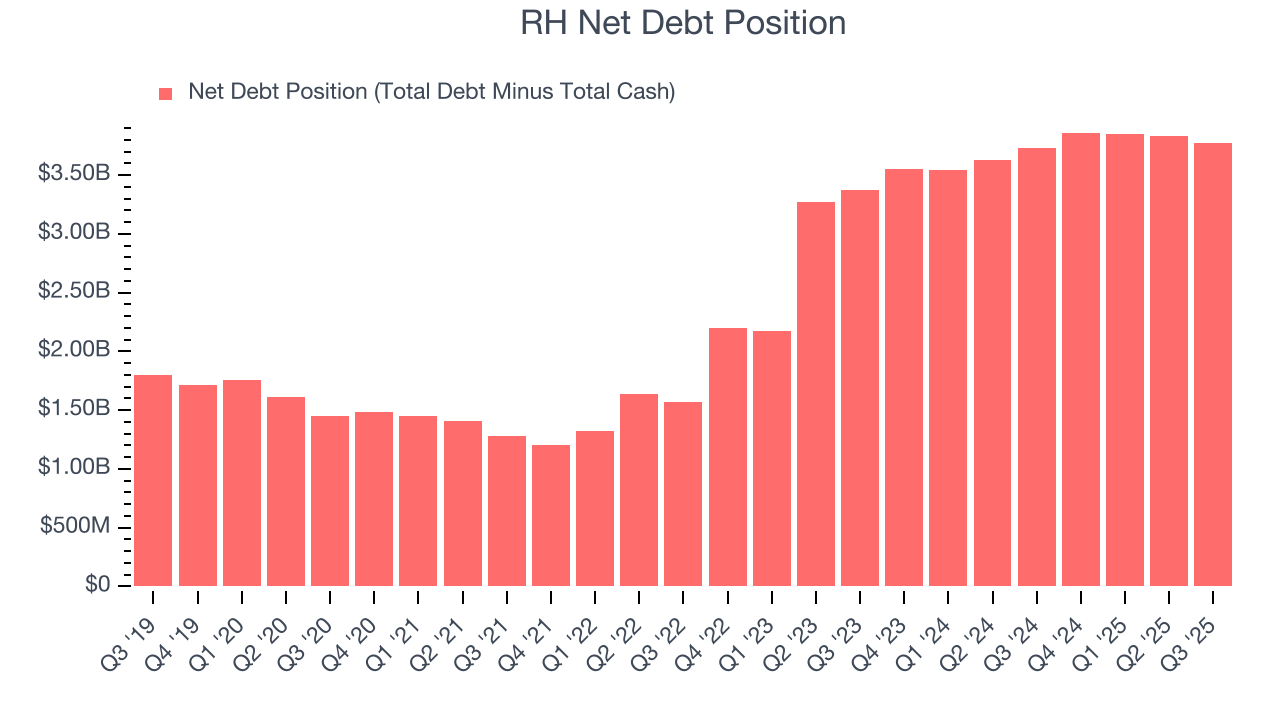

RH’s $3.82 billion of debt exceeds the $43.09 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $586.2 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. RH could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope RH can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from RH’s Q3 Results

We struggled to find many positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded up 5.2% to $163.31 immediately following the results.

13. Is Now The Time To Buy RH?

Are you wondering whether to buy RH or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

RH’s business quality ultimately falls short of our standards. To kick things off, its revenue has declined over the last three years. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

RH’s P/E ratio based on the next 12 months is 12.8x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $254.12 on the company (compared to the current share price of $163.31).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.