RenaissanceRe (RNR)

RenaissanceRe is intriguing. Its rapid revenue growth gives it operating leverage, making it more profitable as it expands.― StockStory Analyst Team

1. News

2. Summary

Why RenaissanceRe Is Interesting

Born in Bermuda after the devastating Hurricane Andrew created a crisis in the catastrophe insurance market, RenaissanceRe (NYSE:RNR) provides property, casualty, and specialty reinsurance and insurance solutions to customers worldwide, primarily through intermediaries.

- Market share has increased this cycle as its 20% annual revenue growth over the last five years was exceptional

- Market penetration was impressive this cycle as its net premiums earned expanded by 21% annually over the last five years

- A downside is its sales are projected to tank by 3.8% over the next 12 months as demand evaporates

RenaissanceRe shows some promise. If you believe in the company, the valuation looks fair.

Why Is Now The Time To Buy RenaissanceRe?

Why Is Now The Time To Buy RenaissanceRe?

RenaissanceRe is trading at $284.50 per share, or 1.2x forward P/B. This multiple is lower than the broader insurance space, and we think it’s fair given the revenue growth.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. RenaissanceRe (RNR) Research Report: Q4 CY2025 Update

Reinsurance provider RenaissanceRe (NYSE:RNR) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 29.6% year on year to $2.97 billion. Its non-GAAP profit of $13.34 per share was 28.2% above analysts’ consensus estimates.

RenaissanceRe (RNR) Q4 CY2025 Highlights:

- Net Premiums Earned: $2.33 billion vs analyst estimates of $2.42 billion (7.6% year-on-year decline, 3.6% miss)

- Revenue: $2.97 billion vs analyst estimates of $2.93 billion (29.6% year-on-year growth, 1.4% beat)

- Combined Ratio: 71.4% vs analyst estimates of 91.3% (1,990 basis point beat)

- Adjusted EPS: $13.34 vs analyst estimates of $10.41 (28.2% beat)

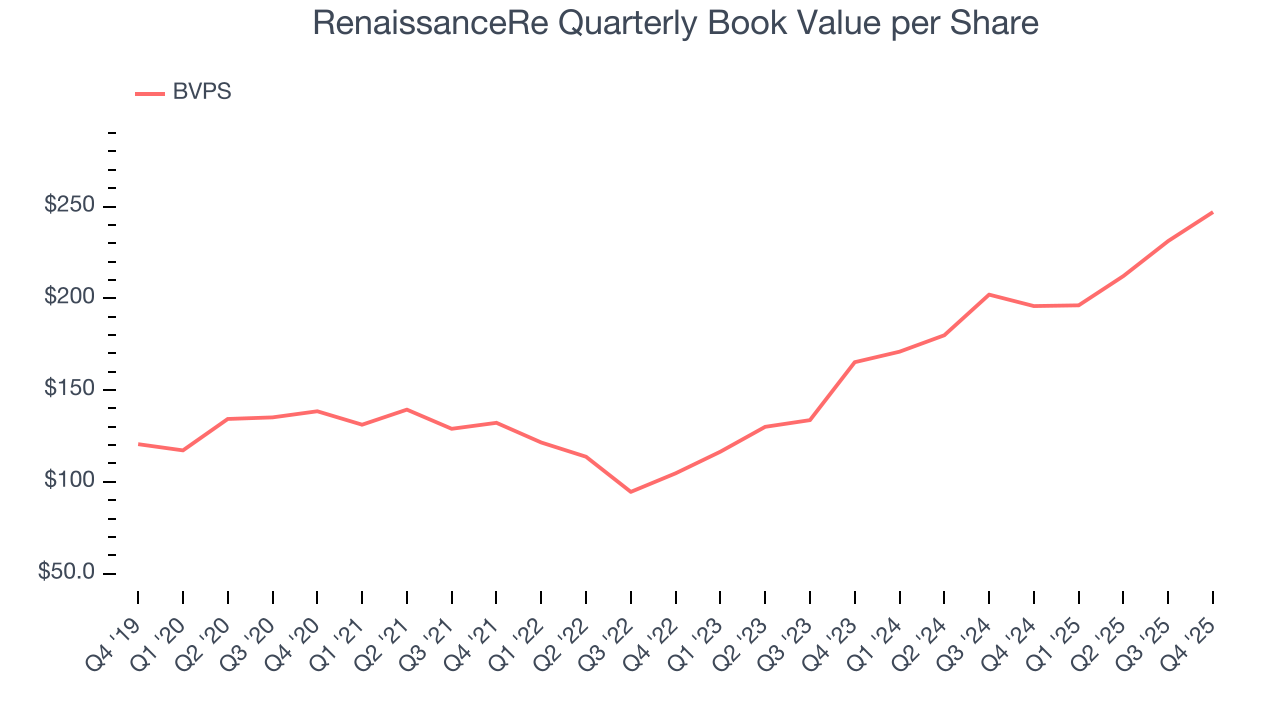

- Book Value per Share: $247 (26.2% year-on-year growth)

- Market Capitalization: $13.12 billion

Company Overview

Born in Bermuda after the devastating Hurricane Andrew created a crisis in the catastrophe insurance market, RenaissanceRe (NYSE:RNR) provides property, casualty, and specialty reinsurance and insurance solutions to customers worldwide, primarily through intermediaries.

RenaissanceRe operates through two main segments: Property and Casualty & Specialty. The Property segment focuses on catastrophe reinsurance, protecting insurers against natural disasters like hurricanes, earthquakes, and floods, as well as man-made catastrophes. The Casualty and Specialty segment covers areas such as general casualty, professional liability, and credit risks.

What sets RenaissanceRe apart is its integrated approach combining superior customer relationships, risk selection, and capital management. The company uses sophisticated risk modeling tools and proprietary data sets to evaluate each risk submission, allowing it to build portfolios with attractive returns while managing volatility.

A distinctive aspect of RenaissanceRe's business model is its Capital Partners unit, which creates and manages joint ventures and managed funds. These vehicles, including DaVinci, Fontana, Medici, and Vermeer, allow third-party investors to access reinsurance risks while generating management and performance fees for RenaissanceRe. For example, a pension fund might invest in Vermeer to gain exposure to U.S. property catastrophe risks, with RenaissanceRe managing the underwriting process.

RenaissanceRe generates income through three principal drivers: underwriting income from its core business, fee income from managing third-party capital, and investment income from its portfolio. With offices across Bermuda, Australia, Canada, Ireland, Singapore, Switzerland, the UK, and the US, the company serves customers globally, primarily through insurance and reinsurance intermediaries.

4. Reinsurance

This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. The primary headwind remains the immense and concentrated exposure to large-scale catastrophe losses, as the growing impact of climate change challenges traditional risk models and creates significant earnings volatility. Additionally, they face the risk of adverse prior-year reserve development, where claims prove more costly than anticipated, while the eventual influx of new capital from alternative sources threatens to soften the market and compress future returns.

RenaissanceRe competes with other major reinsurance providers including Munich Re, Swiss Re, Hannover Re, and Everest Re (NYSE:RE). In the Lloyd's of London market, it faces competition from various syndicates, while in specialty lines it competes with players like Arch Capital Group (NASDAQ:ACGL) and Axis Capital (NYSE:AXS).

5. Revenue Growth

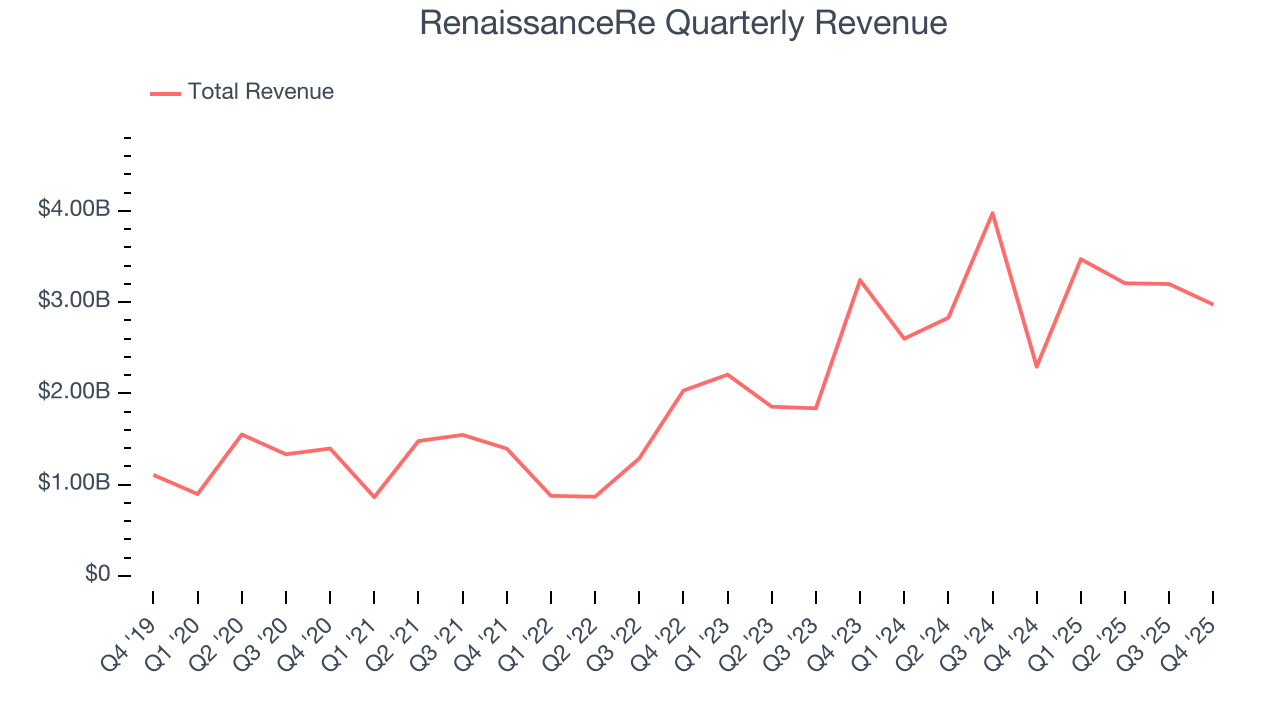

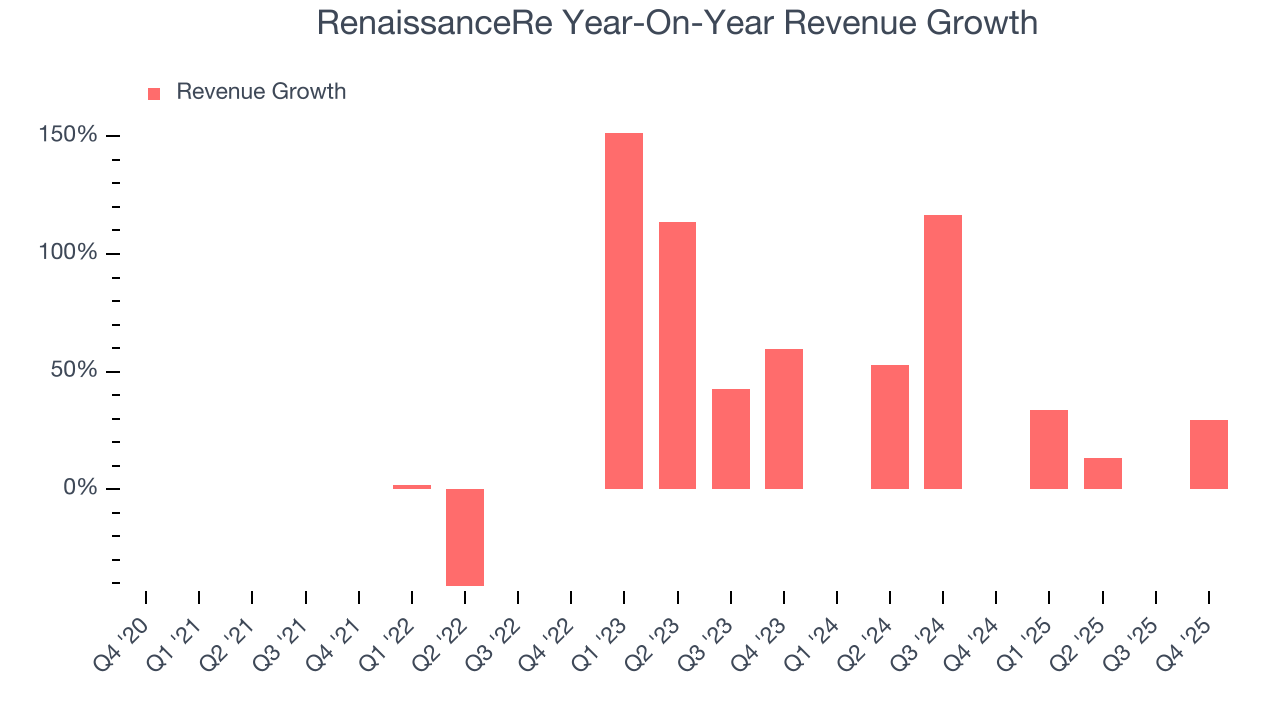

Big picture, insurers generate revenue from three key sources. The first is the core business of underwriting policies. The second source is income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Luckily, RenaissanceRe’s revenue grew at an incredible 20% compounded annual growth rate over the last five years. Its growth beat the average insurance company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. RenaissanceRe’s annualized revenue growth of 18.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, RenaissanceRe reported robust year-on-year revenue growth of 29.6%, and its $2.97 billion of revenue topped Wall Street estimates by 1.4%.

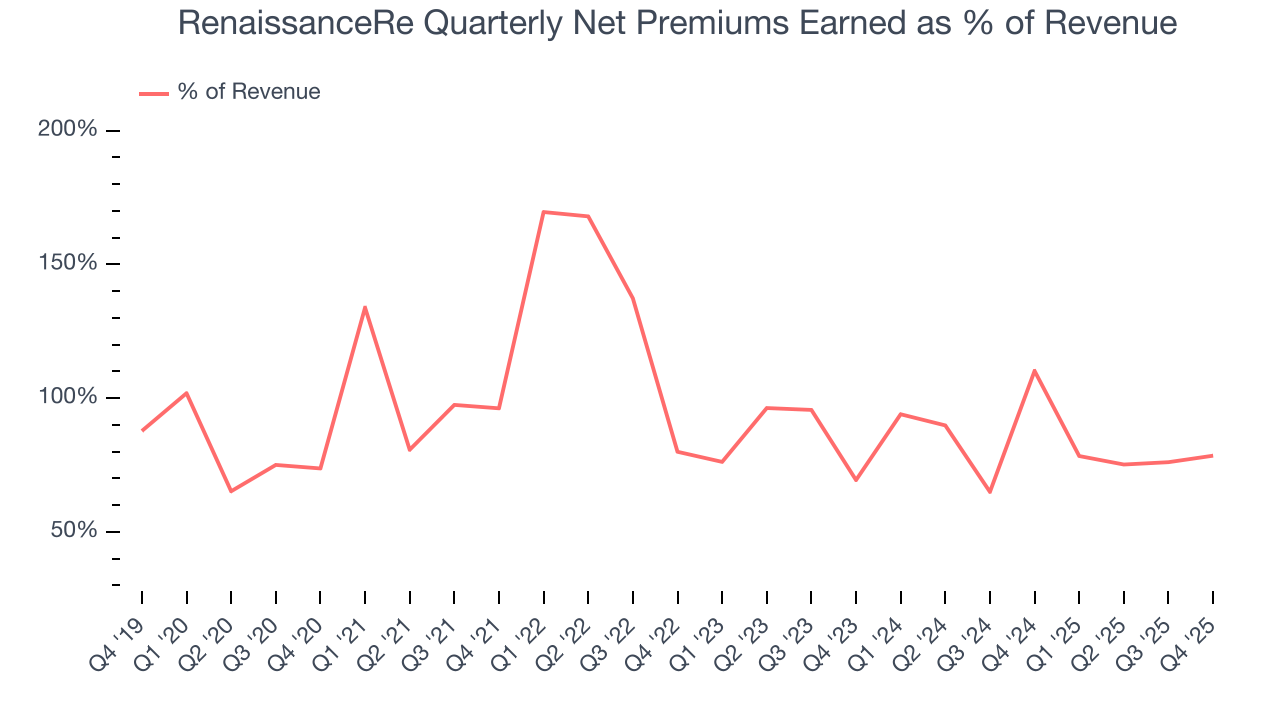

Net premiums earned made up 88.6% of the company’s total revenue during the last five years, meaning RenaissanceRe barely relies on non-insurance activities to drive its overall growth.

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

6. Net Premiums Earned

Net premiums earned are net of what’s paid to reinsurers (insurance for insurance companies), which are used by insurers to protect themselves from large losses.

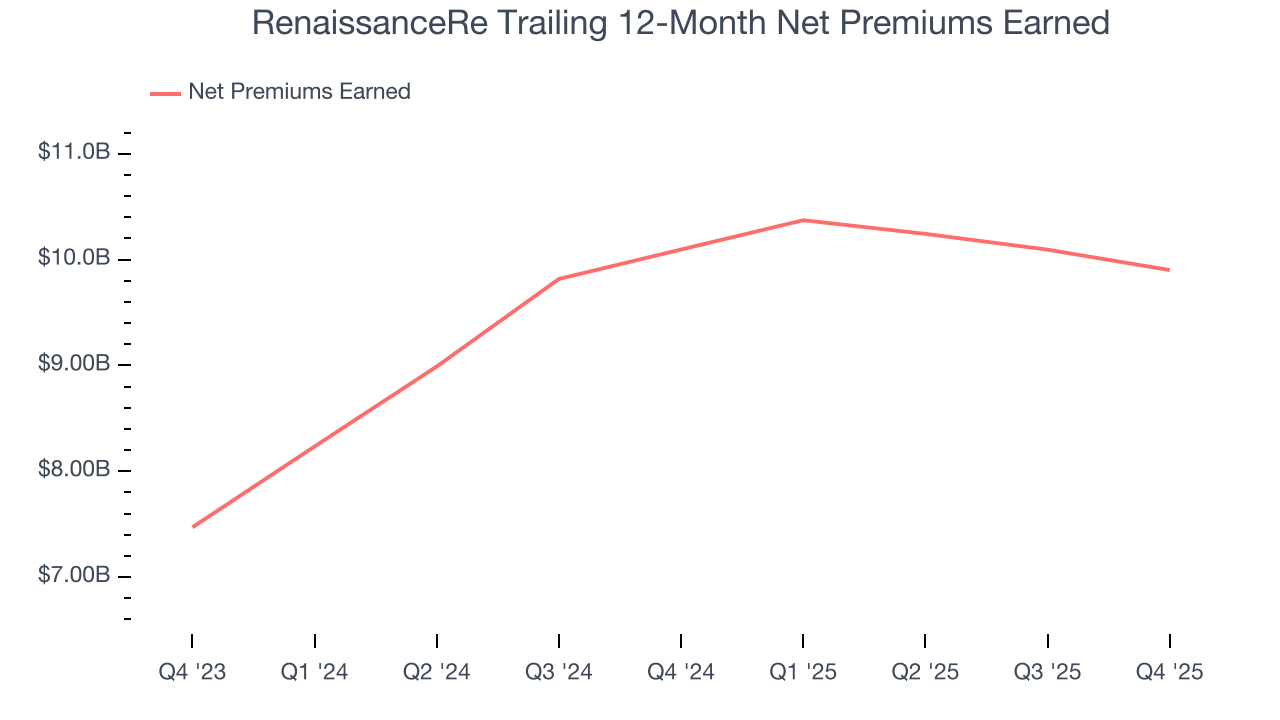

RenaissanceRe’s net premiums earned has grown at a 20.2% annualized rate over the last five years, much better than the broader insurance industry and in line with its total revenue.

When analyzing RenaissanceRe’s net premiums earned over the last two years, we can see that growth decelerated to 15.1% annually. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. While these additional streams certainly contribute to the bottom line, their impact can vary. Some firms have shown greater success and long-term consistency in investing their float compared to peers. However, sharp fluctuations in the fixed income and equity markets can significantly affect short-term performance.

RenaissanceRe’s net premiums earned came in at $2.33 billion this quarter, down 7.6% year on year and short of Wall Street Consensus estimates.

7. Combined Ratio

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

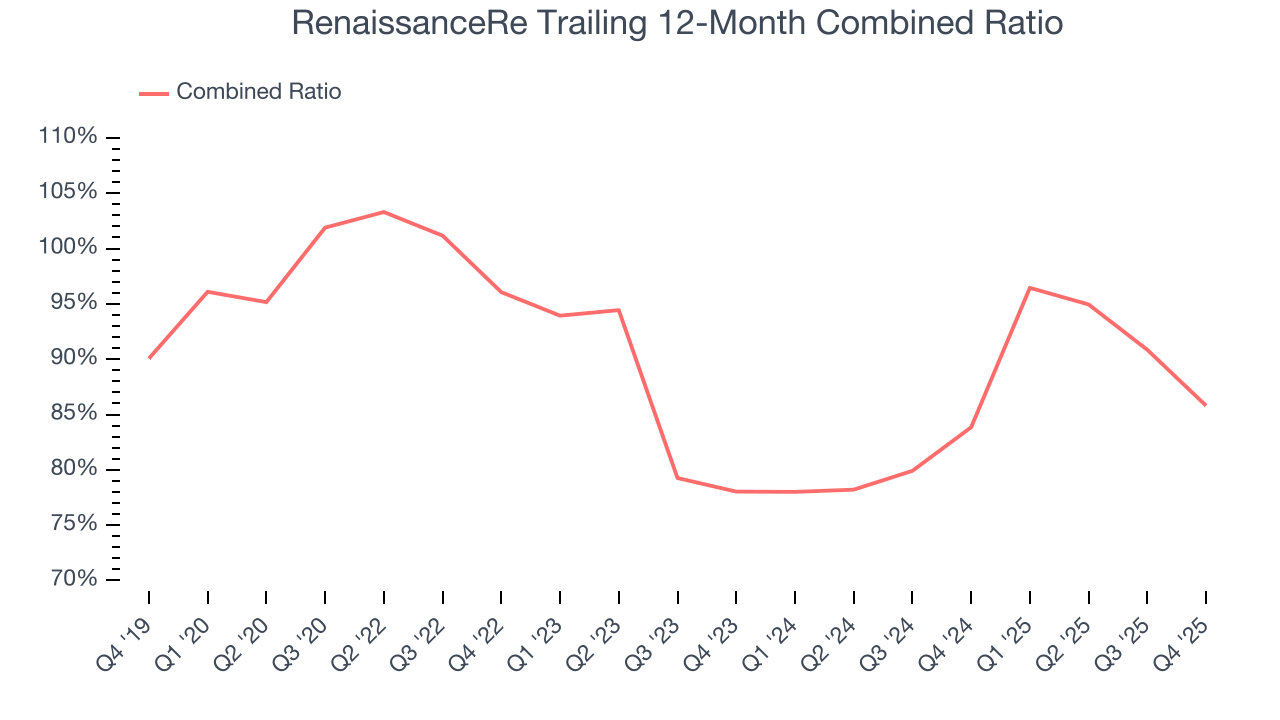

Combined ratio = (costs of underwriting + what an insurer pays out in claims) / net premiums earned. If a company boasts a combined ratio under 100%, it is underwriting profitably. If above 100%, it is losing money on its core operations.

Given the calculation, a lower expense ratio is better. Over the last two years, RenaissanceRe’s combined ratio has increased by 7.8 percentage points, going from 78% to 85.8%. Said differently, the company’s expenses have increased at a faster rate than revenue, which usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

RenaissanceRe’s combined ratio came in at 71.4% this quarter, beating analysts’ expectations by 1,990 basis points (100 basis points = 1 percentage point). This result was 20.2 percentage points better than the same quarter last year.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

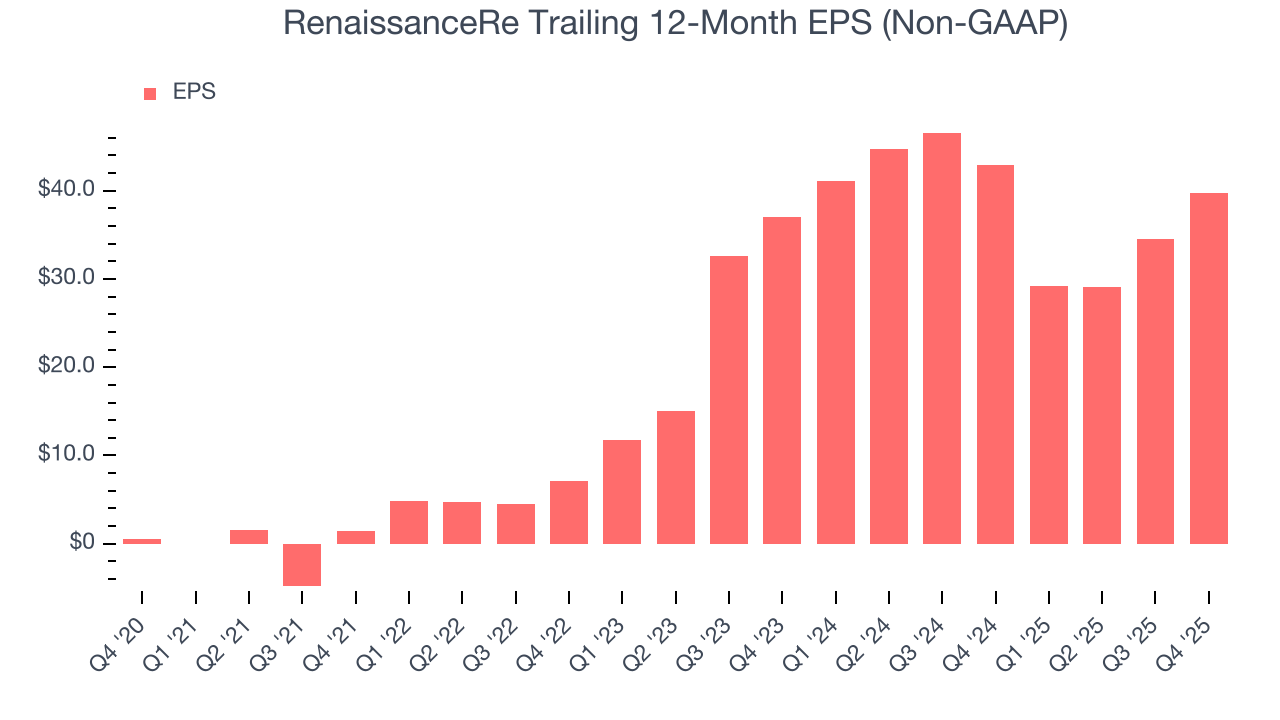

RenaissanceRe’s EPS grew at an astounding 132% compounded annual growth rate over the last five years, higher than its 20% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its combined ratio didn’t improve.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For RenaissanceRe, its two-year annual EPS growth of 3.6% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q4, RenaissanceRe reported adjusted EPS of $13.34, up from $8.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects RenaissanceRe’s full-year EPS of $39.76 to shrink by 8.3%.

9. Book Value Per Share (BVPS)

Insurance companies are balance sheet businesses, collecting premiums upfront and paying out claims over time. The float – premiums collected but not yet paid out – are invested, creating an asset base supported by a liability structure. Book value captures this dynamic by measuring:

- Assets (investment portfolio, cash, reinsurance recoverables) - liabilities (claim reserves, debt, future policy benefits)

BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality. While other (and more commonly known) per-share metrics like EPS can sometimes be lumpy due to reserve releases or one-time items and can be managed or skewed while still following accounting rules, BVPS reflects long-term capital growth and is harder to manipulate.

RenaissanceRe’s BVPS grew at an excellent 12.3% annual clip over the last five years. BVPS growth has also accelerated recently, growing by 22.3% annually over the last two years from $165.20 to $247 per share.

10. Balance Sheet Assessment

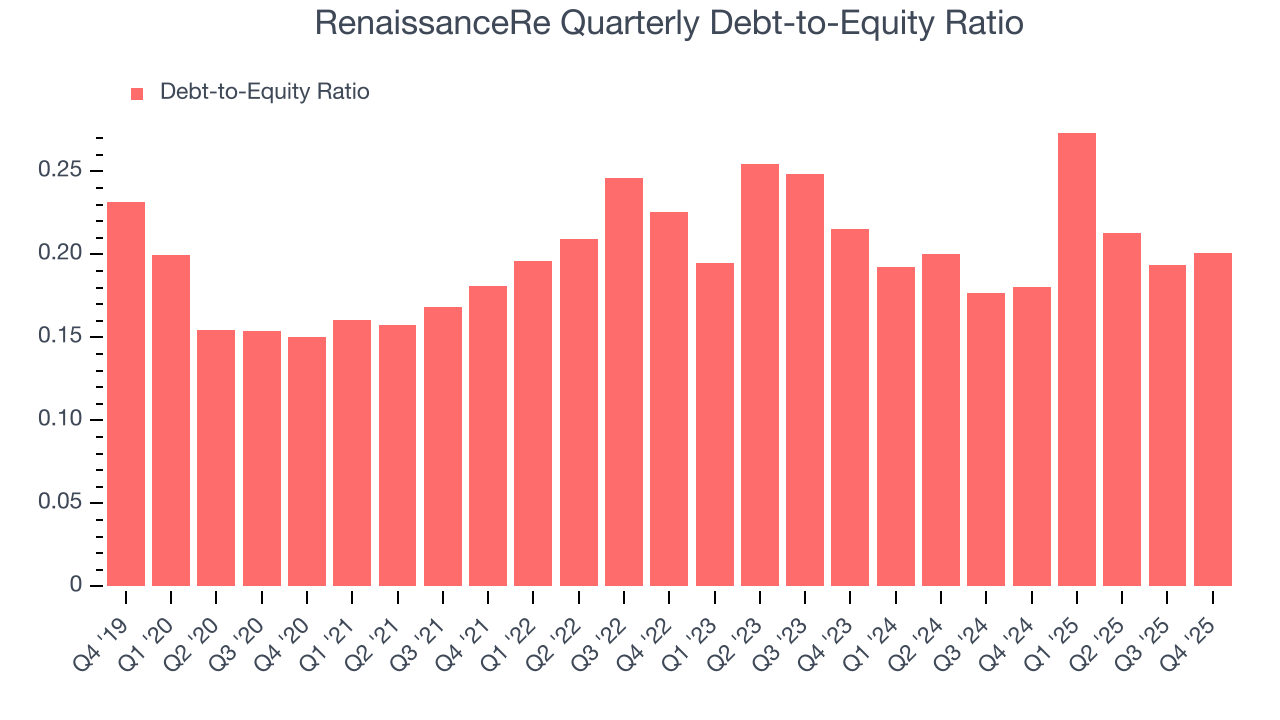

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

RenaissanceRe currently has $2.33 billion of debt and $11.61 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.2×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 1.0× for an insurance business. Anything below 0.5× is a bonus.

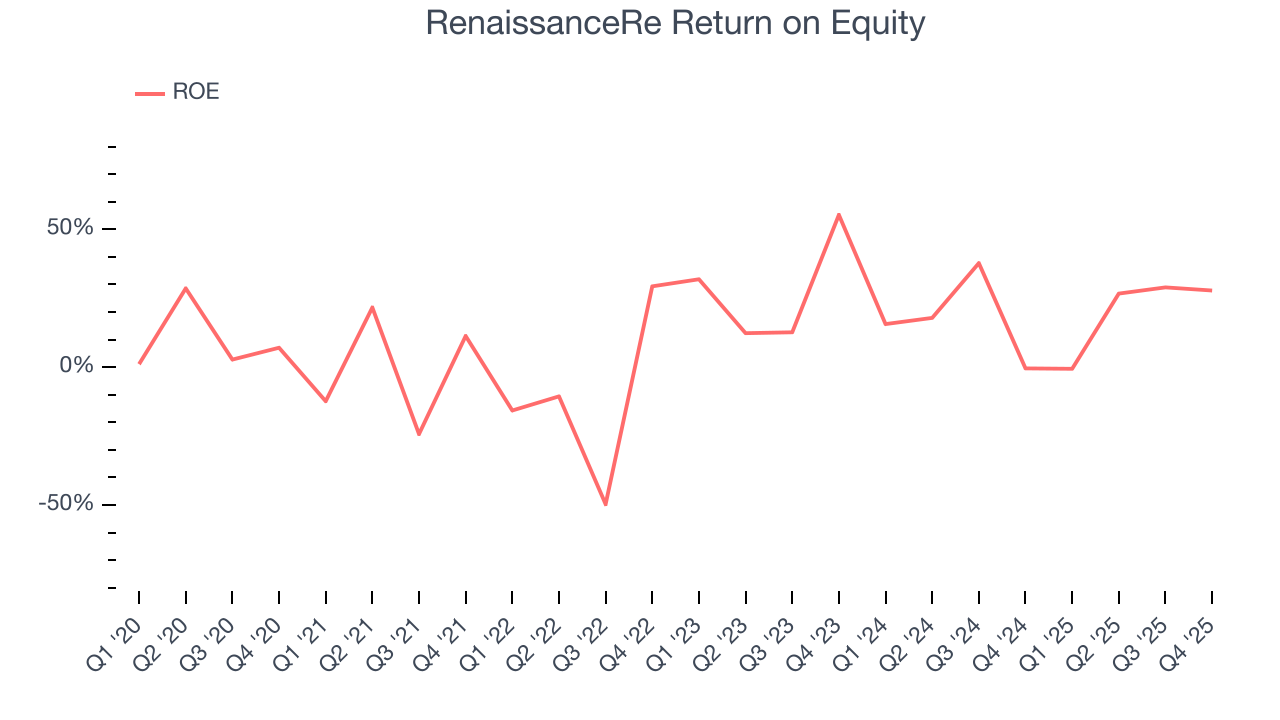

11. Return on Equity

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, RenaissanceRe has averaged an ROE of 10.8%, uninspiring for a company operating in a sector where the average shakes out around 12.5%. We’re optimistic RenaissanceRe can turn the ship around given its success in other measures of financial health.

12. Key Takeaways from RenaissanceRe’s Q4 Results

It was good to see RenaissanceRe beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its net premiums earned missed. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $285.95 immediately after reporting.

13. Is Now The Time To Buy RenaissanceRe?

Updated: February 3, 2026 at 11:58 PM EST

Before investing in or passing on RenaissanceRe, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

RenaissanceRe possesses a number of positive attributes. First off, its revenue growth was exceptional over the last five years. And while RenaissanceRe’s projected EPS for the next year is lacking, its net premiums earned growth was exceptional over the last five years.

RenaissanceRe’s P/B ratio based on the next 12 months is 1.1x. When scanning the insurance space, RenaissanceRe trades at a fair valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $300.27 on the company (compared to the current share price of $285.95), implying they see 5% upside in buying RenaissanceRe in the short term.