Super Group (SGHC)

1. News

2. Super Group (SGHC) Research Report: Q3 CY2025 Update

Online gambling company Super Group (NYSE:SGHC) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 25.7% year on year to $557 million. Its GAAP profit of $0.19 per share was 27.3% above analysts’ consensus estimates.

Super Group (SGHC) Q3 CY2025 Highlights:

- Revenue: $557 million vs analyst estimates of $510 million (25.7% year-on-year growth, 9.2% beat)

- EPS (GAAP): $0.19 vs analyst estimates of $0.15 (27.3% beat)

- Adjusted EBITDA: $152 million vs analyst estimates of $114 million (27.3% margin, 33.3% beat)

- Operating Margin: 23.5%, up from 5.7% in the same quarter last year

- Free Cash Flow Margin: 22.4%, up from 6.8% in the same quarter last year

- Customers: 5.51 million, up from 5.5 million in the previous quarter

- Market Capitalization: $5.86 billion

Company Overview

With betting operations spanning 20 jurisdictions and attracting nearly 5 million monthly customers, Super Group (NYSE:SGHC) operates global online sports betting and gaming platforms through its two primary offerings: the Betway sports betting brand and Spin multi-brand casino portfolio.

The company's dual-brand strategy targets different segments of the online gambling market. Betway functions as a premium, sports-focused platform offering betting on more than 70 different sports along with casino gaming options. The brand has cultivated global recognition through high-profile sports partnerships with organizations like Manchester City, Arsenal, and Williams Racing in Formula 1.

Meanwhile, Spin operates as a multi-brand casino business with more than 16 different casino brands offering over 1,500 games from various suppliers. In 2024, Super Group completed its acquisition of Jumpman Gaming, which added approximately 200 additional brands to its portfolio, primarily focused on the UK market.

Super Group's business infrastructure combines proprietary technology with strategic partnerships with gaming software providers like Apricot. These relationships allow the company to quickly adapt its offerings to new regulatory environments while maintaining consistent user experiences across markets.

A customer looking to bet on a Premier League match might use the Betway app to place a pre-game wager on Manchester City to win, then transition to in-game betting as the match progresses, and perhaps later explore the platform's casino games. Super Group generates revenue primarily through the "house edge" built into its betting odds and casino games, with additional income from licensing the Betway brand to third parties in certain regions.

3. Casino Operator

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

Super Group faces competition from global online gambling operators like Flutter Entertainment (NYSE:FLUT), which owns FanDuel and PokerStars, DraftKings (NASDAQ:DKNG), Entain (OTCMKTS:GMVHF), which owns Ladbrokes and BetMGM, and privately-owned Bet365.

4. Revenue Growth

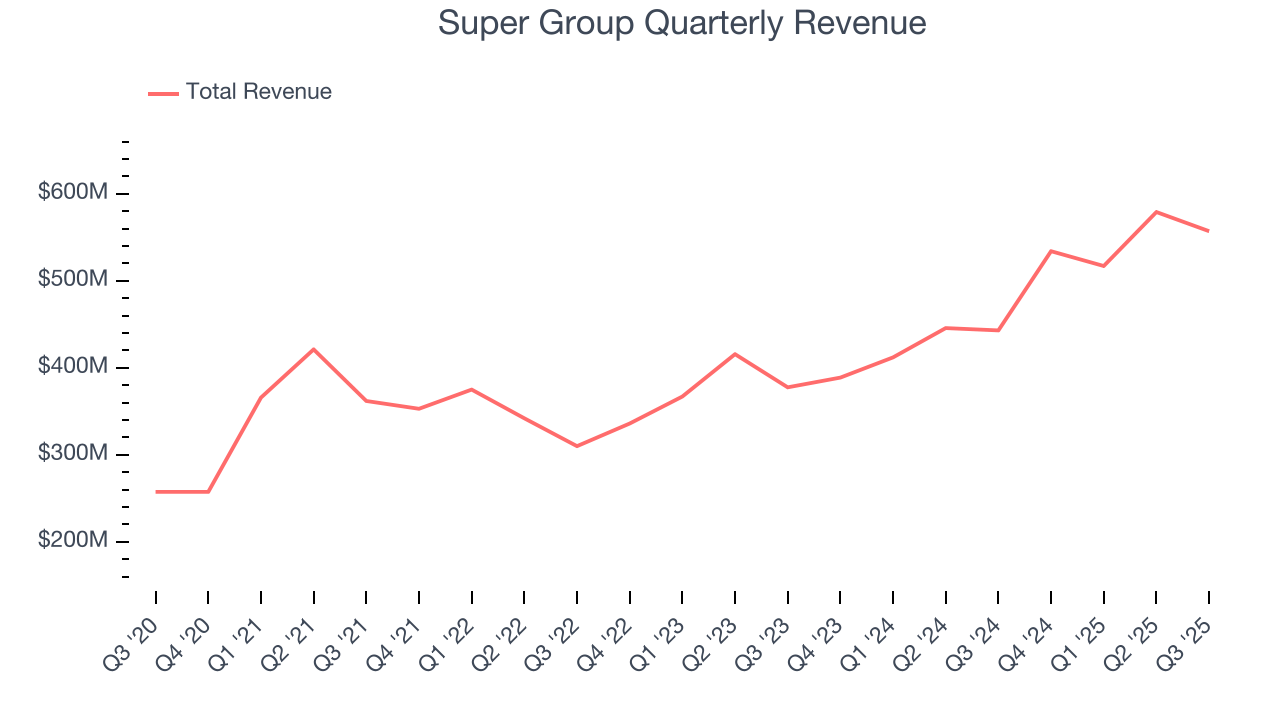

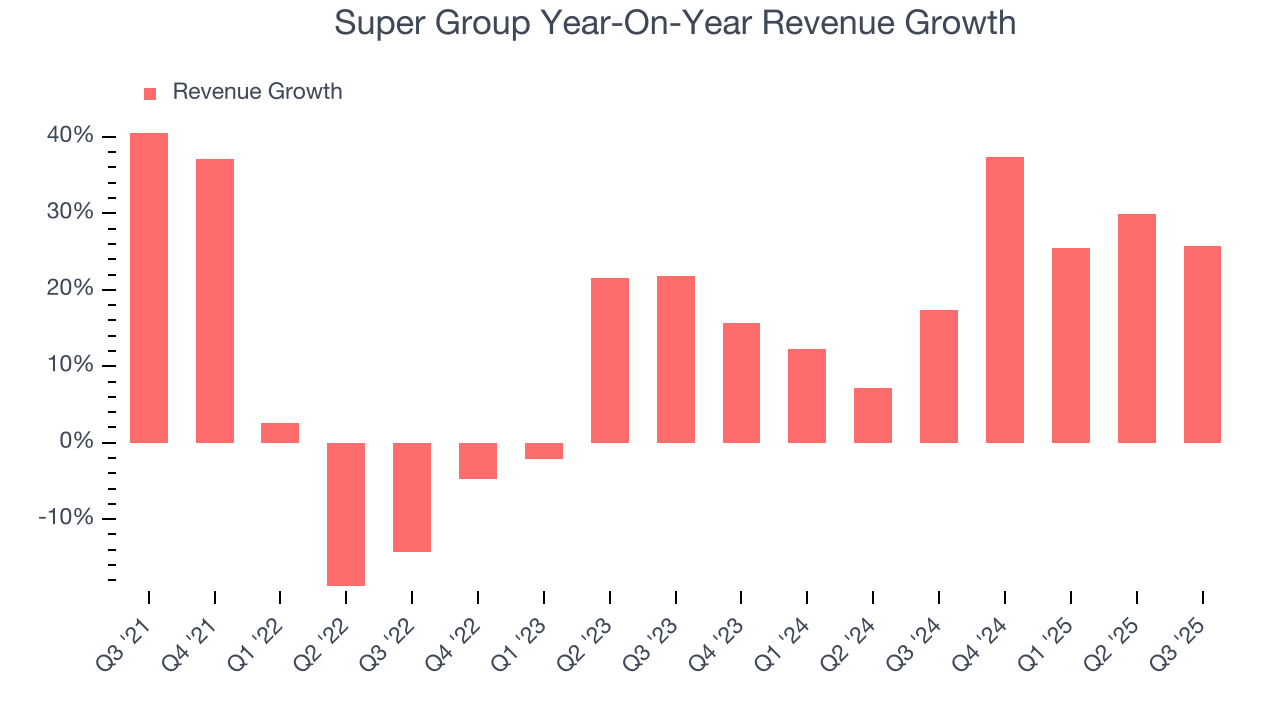

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last four years, Super Group grew its sales at a 11.7% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Super Group’s annualized revenue growth of 20.9% over the last two years is above its four-year trend, but we were still disappointed by the results. Note that COVID hurt Super Group’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 5.51 million in the latest quarter. Over the last two years, Super Group’s customer base averaged 22.3% year-on-year growth. Because this number is in line with its revenue growth, we can see the average customer spent roughly the same amount each year on the company’s products and services.

This quarter, Super Group reported robust year-on-year revenue growth of 25.7%, and its $557 million of revenue topped Wall Street estimates by 9.2%.

Looking ahead, sell-side analysts expect revenue to grow 9.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

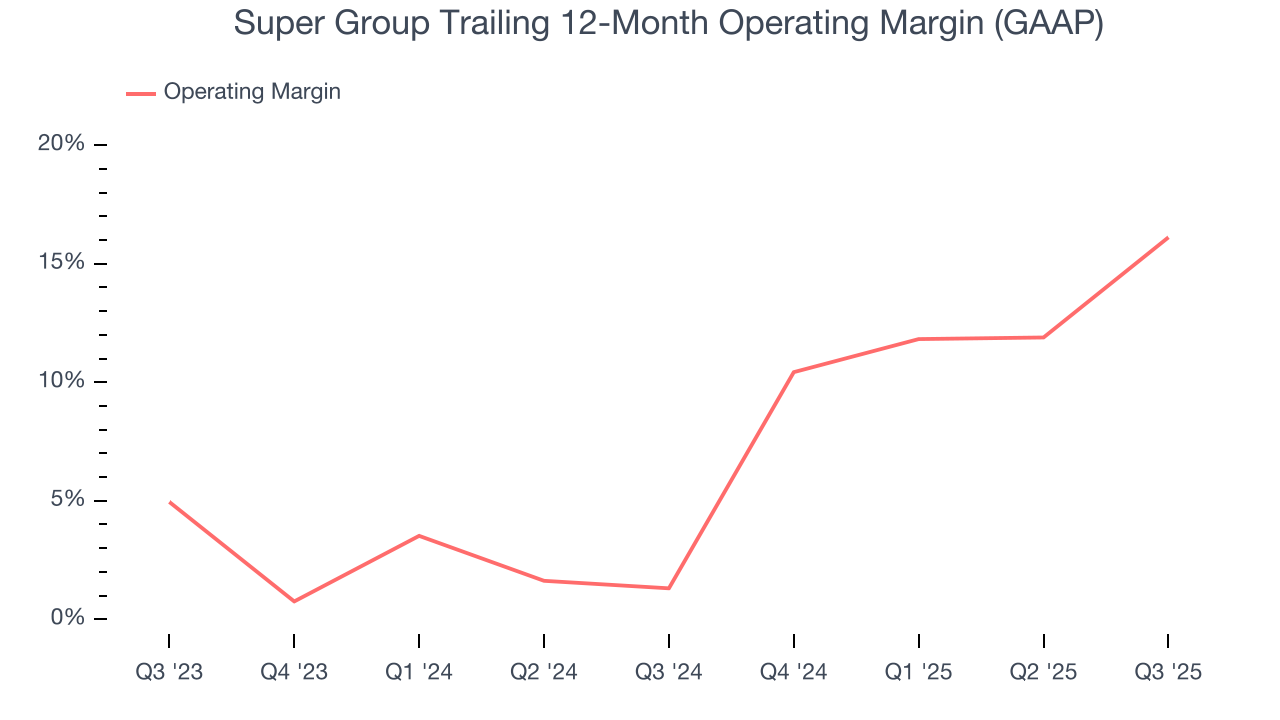

5. Operating Margin

Super Group’s operating margin has risen over the last 12 months and averaged 9.7% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, Super Group generated an operating margin profit margin of 23.5%, up 17.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

6. Earnings Per Share

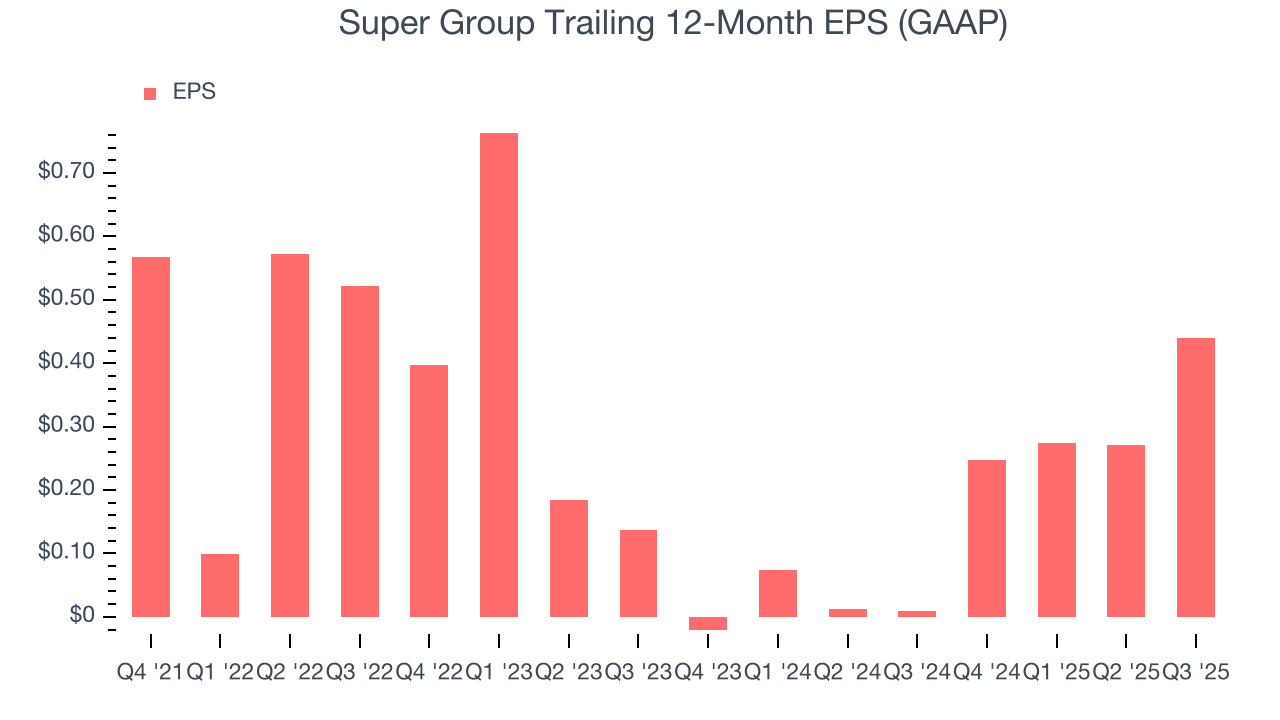

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Super Group, its EPS declined by 6% annually over the last four years while its revenue grew by 11.7%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q3, Super Group reported EPS of $0.19, up from $0.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Super Group’s full-year EPS of $0.44 to grow 73.8%.

7. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

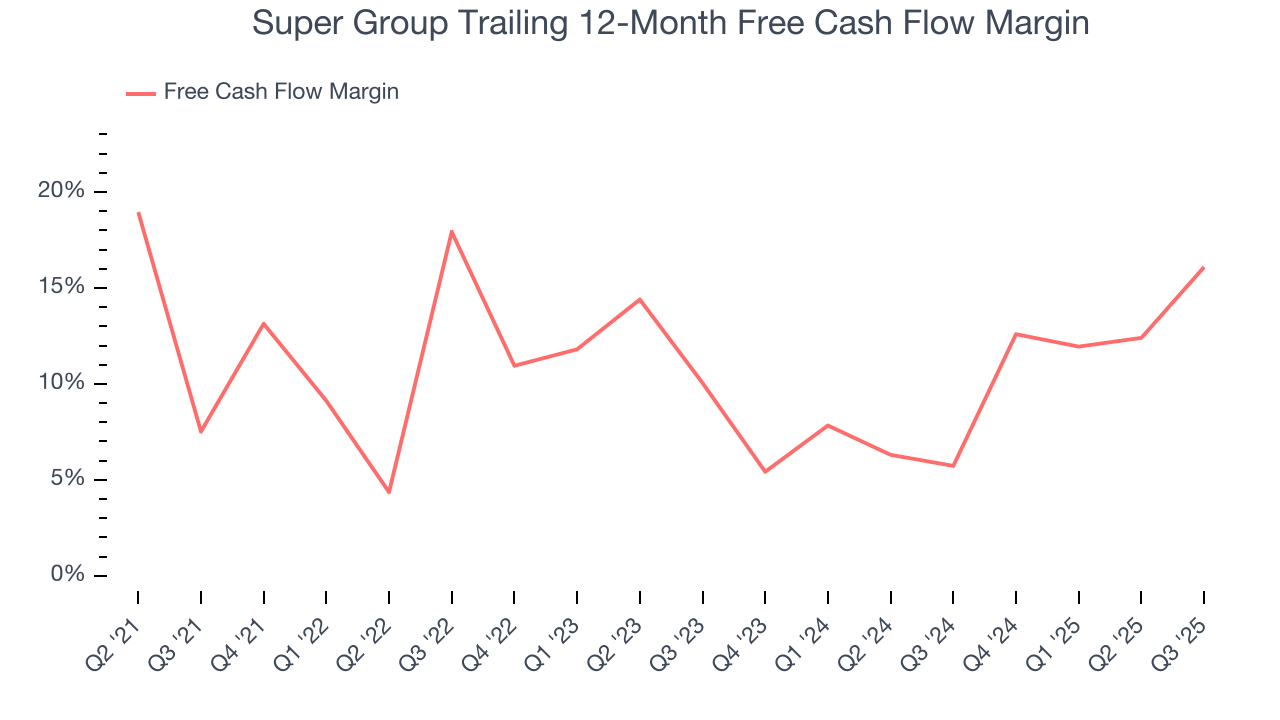

Super Group has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 11.6%, lousy for a consumer discretionary business.

Super Group’s free cash flow clocked in at $124.8 million in Q3, equivalent to a 22.4% margin. This result was good as its margin was 15.6 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

8. Balance Sheet Assessment

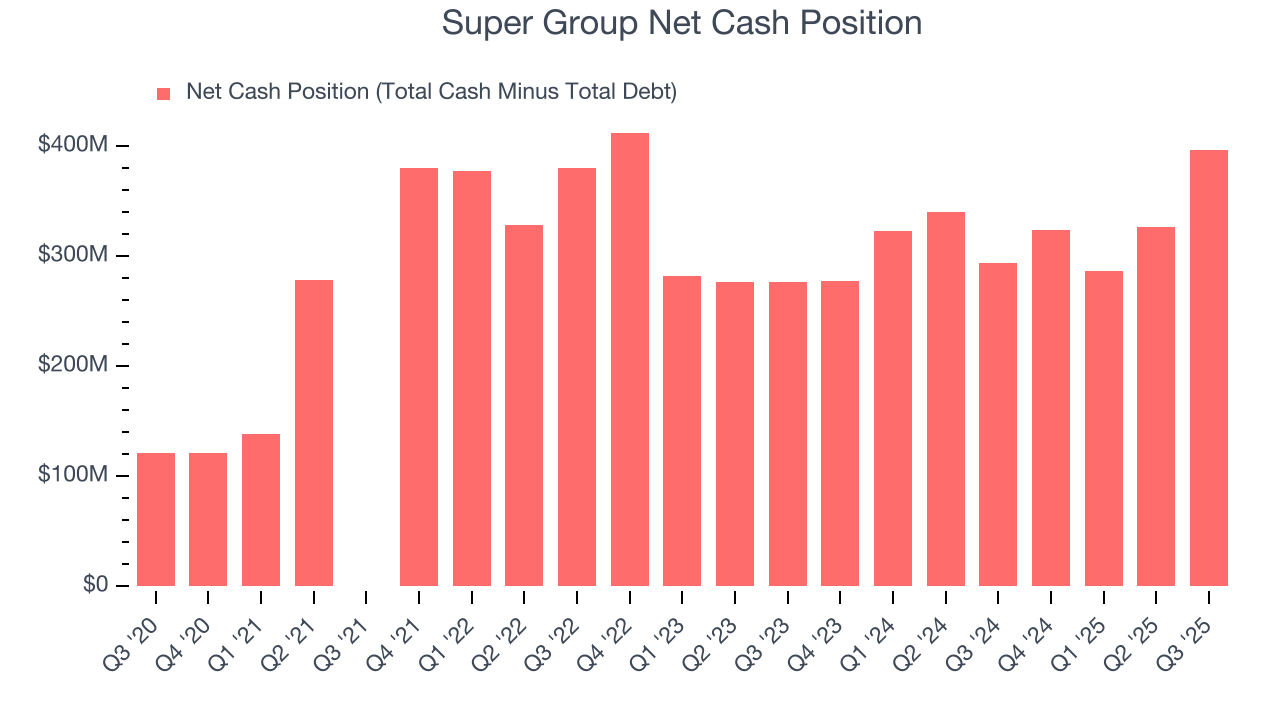

Companies with more cash than debt have lower bankruptcy risk.

Super Group is a profitable, well-capitalized company with $469 million of cash and $72 million of debt on its balance sheet. This $397 million net cash position is 6.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

9. Key Takeaways from Super Group’s Q3 Results

We were impressed by how significantly Super Group blew past analysts’ EBITDA expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock remained flat at $11.72 immediately following the results.

10. Is Now The Time To Buy Super Group?

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Super Group.

We see the value of companies helping consumers, but in the case of Super Group, we’re out. First off, its revenue growth was weak over the last four years, and analysts expect its demand to deteriorate over the next 12 months. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last four years makes it a less attractive asset to the public markets. On top of that, its low free cash flow margins give it little breathing room.

Super Group’s P/E ratio based on the next 12 months is 16.8x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $17.63 on the company (compared to the current share price of $11.72).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.