J. M. Smucker (SJM)

J. M. Smucker faces an uphill battle. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think J. M. Smucker Will Underperform

Best known for its fruit jams and spreads, J.M Smucker (NYSE:SJM) is a packaged foods company whose products span from peanut butter and coffee to pet food.

- Underwhelming 2.1% return on capital reflects management’s difficulties in finding profitable growth opportunities, and its decreasing returns suggest its historical profit centers are aging

- Lackluster 2.4% annual revenue growth over the last three years indicates the company is losing ground to competitors

- Core business is underperforming as its organic revenue has disappointed over the past two years, suggesting it might need acquisitions to stimulate growth

J. M. Smucker’s quality isn’t great. There are more promising prospects in the market.

Why There Are Better Opportunities Than J. M. Smucker

High Quality

Investable

Underperform

Why There Are Better Opportunities Than J. M. Smucker

J. M. Smucker’s stock price of $102.52 implies a valuation ratio of 10.5x forward P/E. This multiple is cheaper than most consumer staples peers, but we think this is justified.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. J. M. Smucker (SJM) Research Report: Q3 CY2025 Update

Packaged foods company J.M Smucker (NYSE:SJM) met Wall Streets revenue expectations in Q3 CY2025, with sales up 2.6% year on year to $2.33 billion. Its non-GAAP profit of $2.10 per share was in line with analysts’ consensus estimates.

J. M. Smucker (SJM) Q3 CY2025 Highlights:

- Revenue: $2.33 billion vs analyst estimates of $2.32 billion (2.6% year-on-year growth, in line)

- Adjusted EPS: $2.10 vs analyst estimates of $2.10 (in line)

- Management reiterated its full-year Adjusted EPS guidance of $9 at the midpoint

- Operating Margin: 18%, up from 7.5% in the same quarter last year

- Free Cash Flow Margin: 12%, down from 14% in the same quarter last year

- Sales Volumes rose 6% year on year (2% in the same quarter last year)

- Market Capitalization: $11.12 billion

Company Overview

Best known for its fruit jams and spreads, J.M Smucker (NYSE:SJM) is a packaged foods company whose products span from peanut butter and coffee to pet food.

The company traces its roots back to 1897 when Ohio farmer Jerome Monroe Smucker began selling apple butter made in his family's orchard. From there, the company innovated around its core fruit spreads, introduced new products, and made strategic acquisitions of brands such as Jif (peanut butter), Folgers (coffee), and Big Heart Brands (pet food brands like Milk-Bone and Meow Mix).

J.M. Smucker caters mostly to middle-income households seeking convenience from trusted brands. Customers who rely on these brands are usually busy and don’t have the time to cook meals or prepare snacks from scratch for themselves and their families. Furthermore, these brands are ones that many customers have been familiar with since childhood, adding an element of comfort.

J.M. Smucker products are widely available in grocery stores, supermarkets, general merchandise retailers that carry food and snacks, convenience stores, and restaurants globally. The company is able to leverage its iconic brands for strong distribution and prominent placement on retailer shelves. For example, if a grocery store or discount food retailer could only carry two or three peanut butter brands, there’s a high likelihood that one of them would be Jif.

4. Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors in packaged food with diverse brand portfolios include Mondelez (NASDAQ:MDLZ), Campbell Soup (NYSE:CPB), General Mills (NYSE:GIS), and Nestle (SWX:NESN).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $8.77 billion in revenue over the past 12 months, J. M. Smucker is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of major retail partners, placing a ceiling on its growth. For J. M. Smucker to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

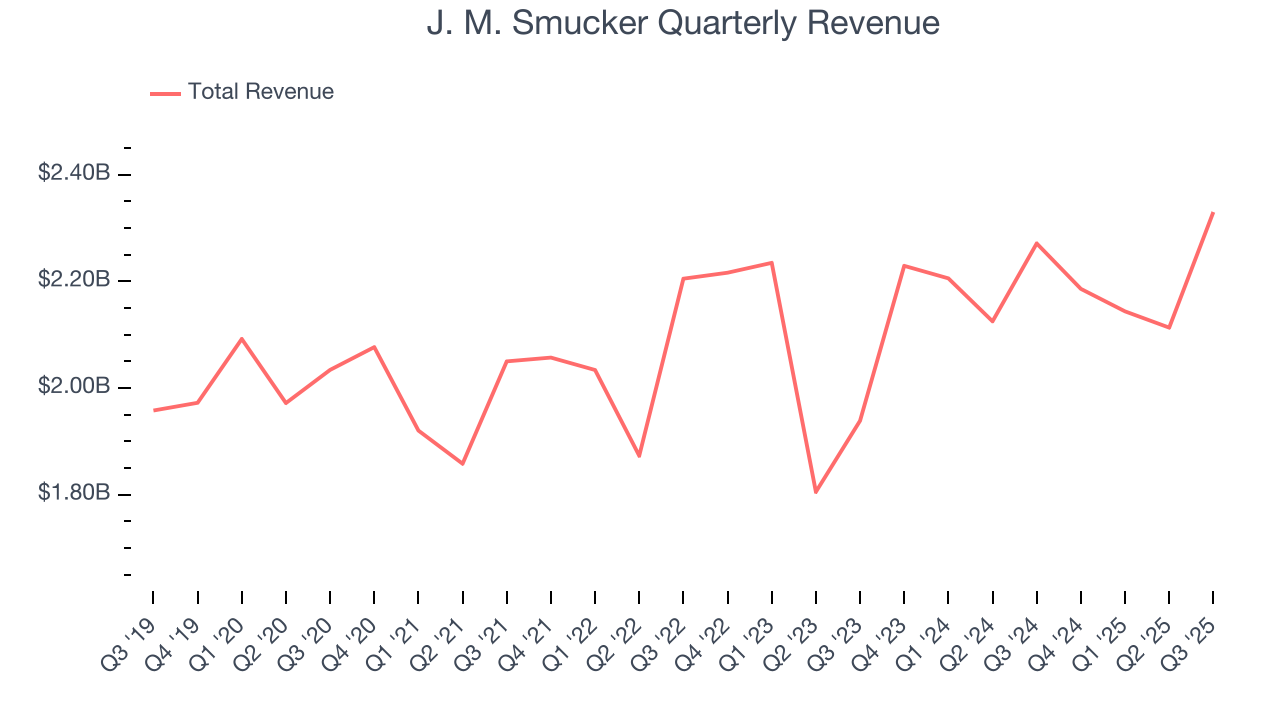

As you can see below, J. M. Smucker’s 2.4% annualized revenue growth over the last three years was sluggish, but to its credit, consumers bought more of its products.

This quarter, J. M. Smucker grew its revenue by 2.6% year on year, and its $2.33 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months, an acceleration versus the last three years. This projection is above the sector average and indicates its newer products will fuel better top-line performance.

6. Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether J. M. Smucker generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

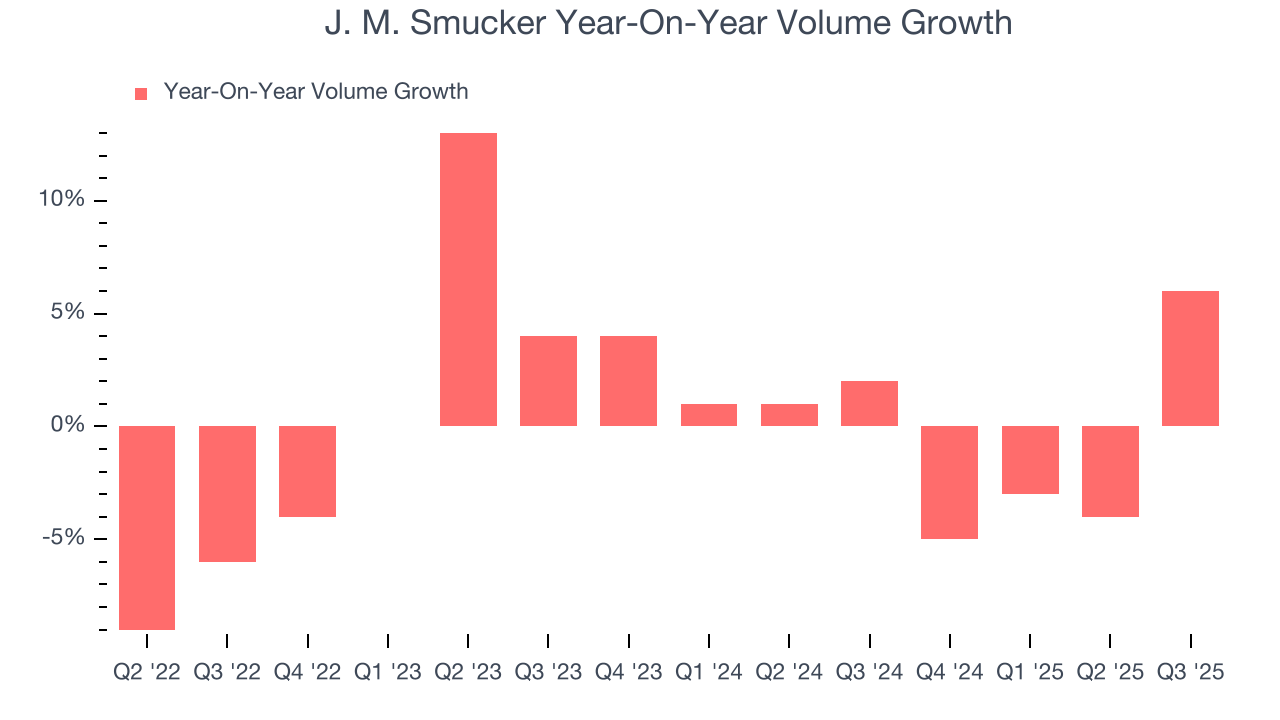

Over the last two years, J. M. Smucker’s quarterly sales volumes have, on average, stayed about the same. This stability is normal as the quantity demanded for consumer staples products typically doesn’t see much volatility. The company’s flat volumes also indicate its average organic revenue growth of 2% was generated from price increases.

In J. M. Smucker’s Q3 2026, sales volumes jumped 6% year on year. This result was an acceleration from its historical levels, certainly a positive signal.

7. Gross Margin & Pricing Power

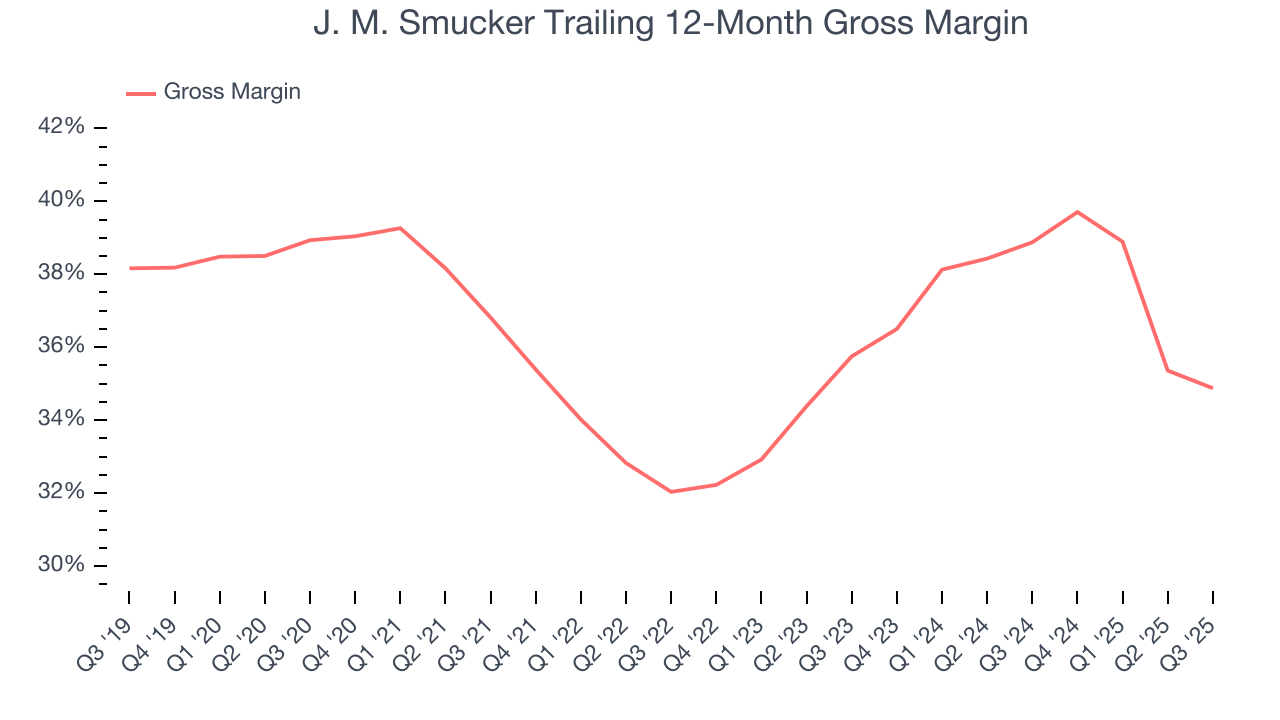

J. M. Smucker has good unit economics for a consumer staples company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it averaged an impressive 36.9% gross margin over the last two years. That means for every $100 in revenue, $63.12 went towards paying for raw materials, production of goods, transportation, and distribution.

J. M. Smucker produced a 37.3% gross profit margin in Q3, down 1.9 percentage points year on year. J. M. Smucker’s full-year margin has also been trending down over the past 12 months, decreasing by 4 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

8. Operating Margin

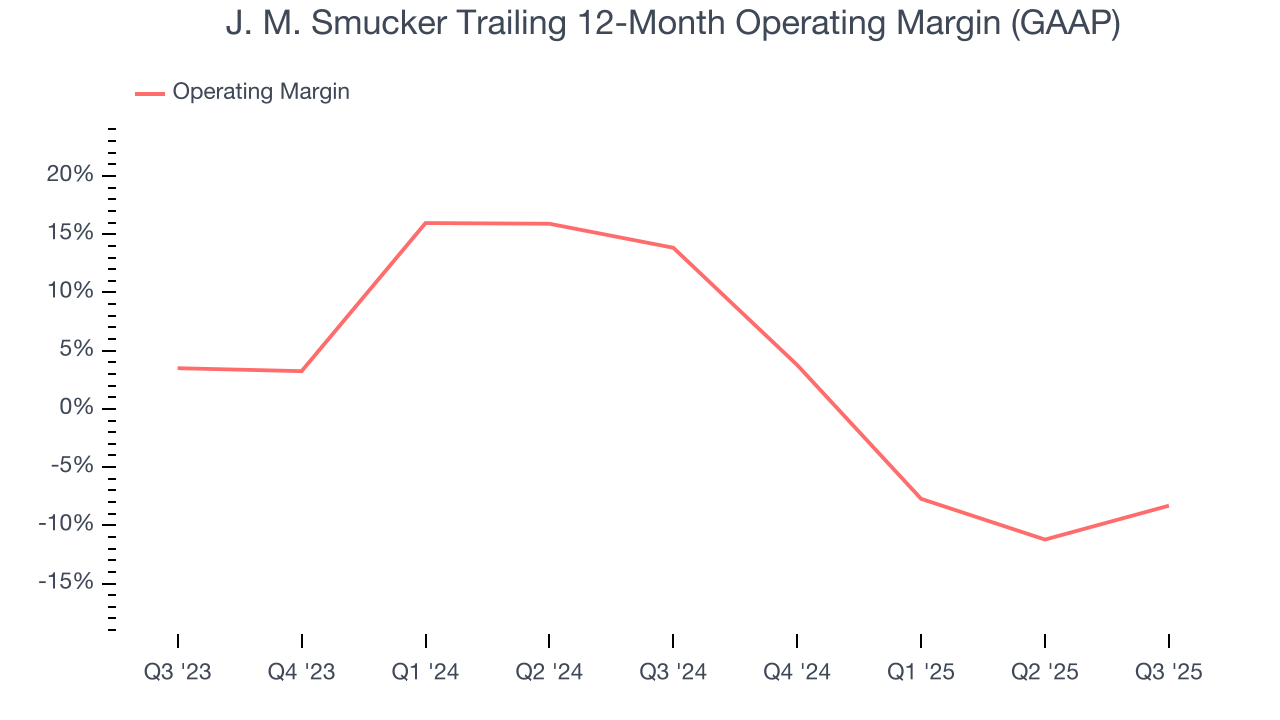

J. M. Smucker was profitable over the last two years but held back by its large cost base. Its average operating margin of 2.8% was weak for a consumer staples business. This result is surprising given its high gross margin as a starting point.

Looking at the trend in its profitability, J. M. Smucker’s operating margin decreased by 22.2 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. J. M. Smucker’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, J. M. Smucker generated an operating margin profit margin of 18%, up 10.5 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, and administrative overhead grew slower than its revenue.

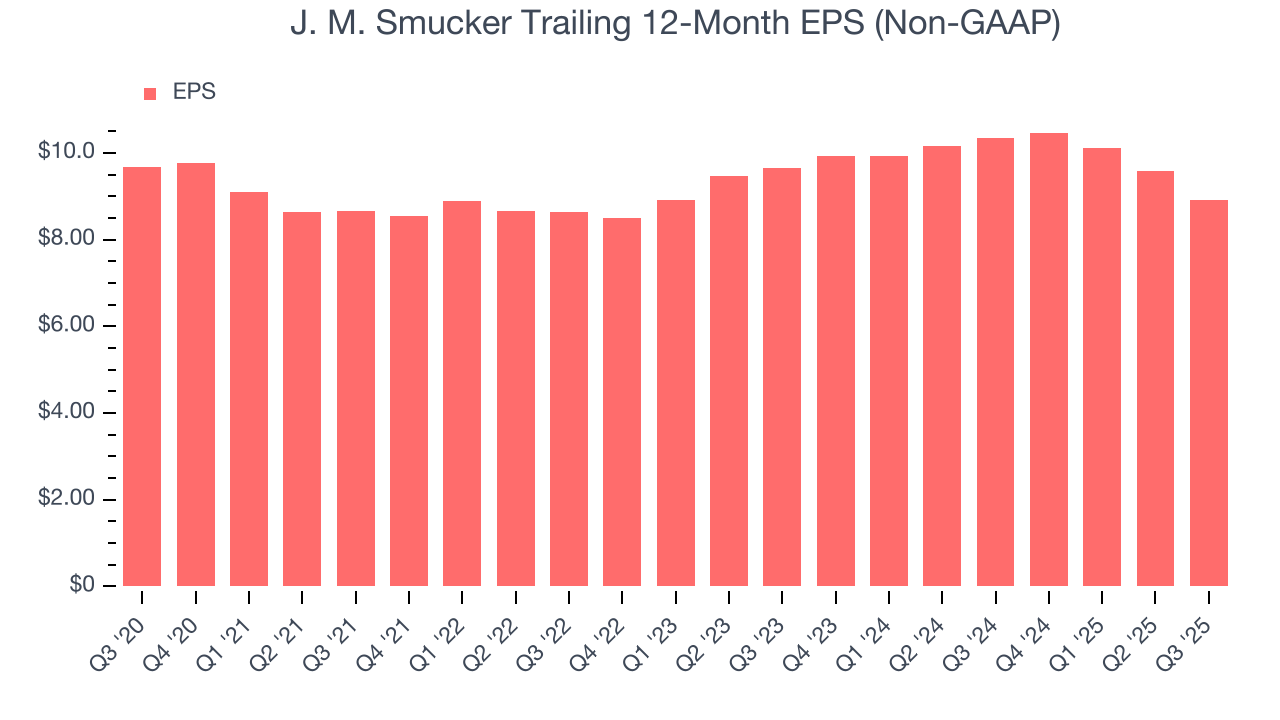

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, J. M. Smucker reported adjusted EPS of $2.10, down from $2.76 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects J. M. Smucker’s full-year EPS of $8.92 to grow 10%.

10. Cash Is King

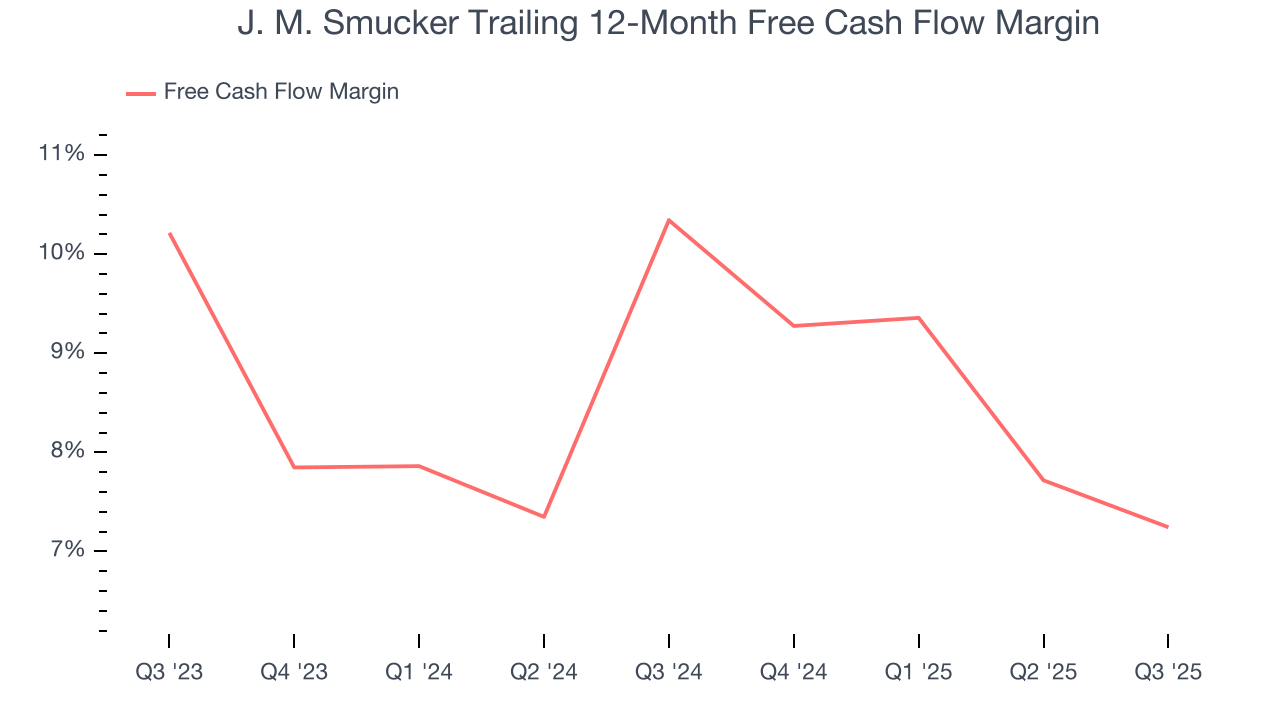

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

J. M. Smucker has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.8% over the last two years, better than the broader consumer staples sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that J. M. Smucker’s margin dropped by 3.1 percentage points over the last year. Continued declines could signal it is in the middle of an investment cycle.

J. M. Smucker’s free cash flow clocked in at $280.2 million in Q3, equivalent to a 12% margin. The company’s cash profitability regressed as it was 1.9 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, leading to short-term swings. Long-term trends are more important.

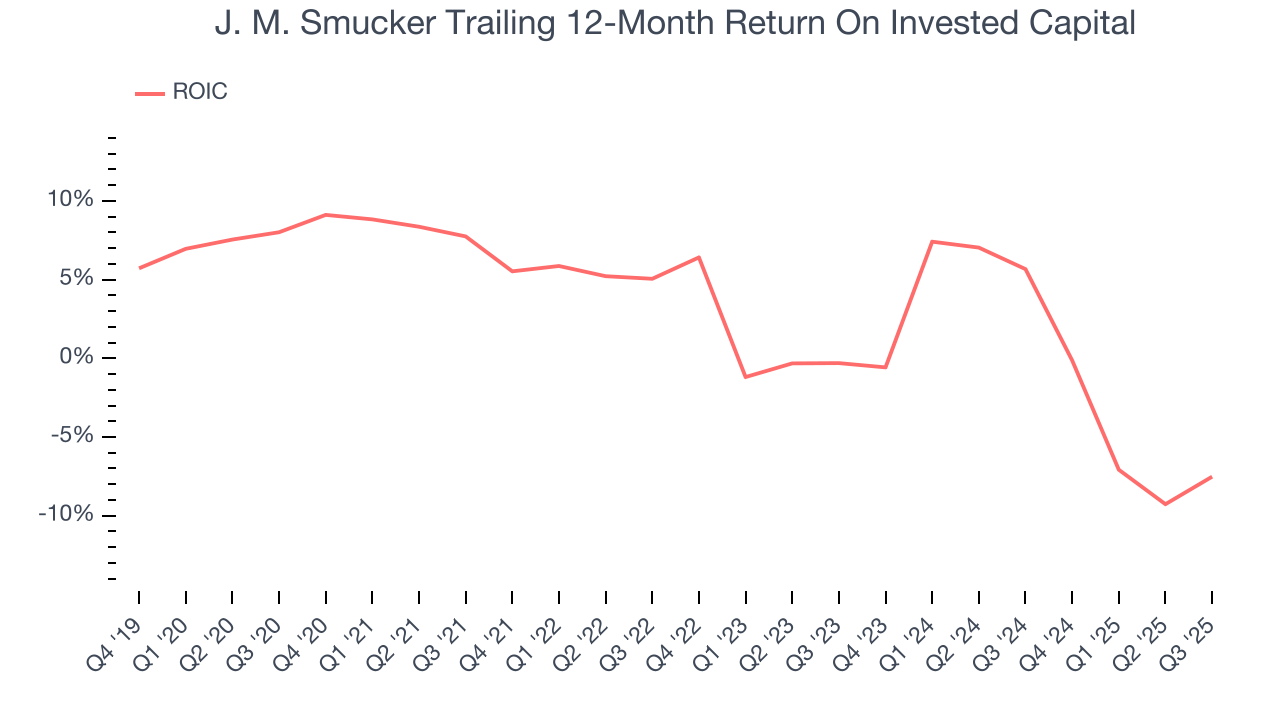

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

J. M. Smucker historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.1%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

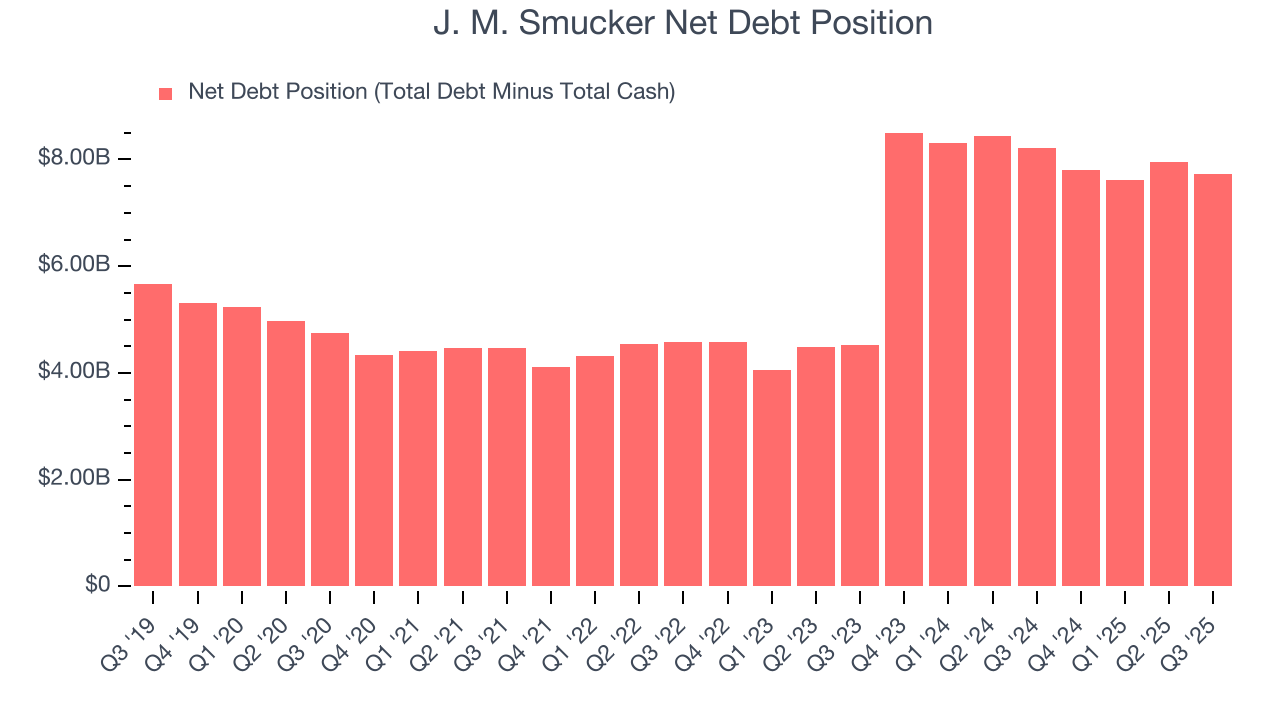

12. Balance Sheet Assessment

J. M. Smucker reported $62.8 million of cash and $7.79 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.04 billion of EBITDA over the last 12 months, we view J. M. Smucker’s 3.8× net-debt-to-EBITDA ratio as safe. We also see its $388.4 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from J. M. Smucker’s Q3 Results

Revenue and EPS were both in line, and management reiterated full-year EPS guidance. This quarter was without many surprises, good or bad. The stock remained flat at $104.39 immediately following the results.

14. Is Now The Time To Buy J. M. Smucker?

Updated: January 23, 2026 at 9:42 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We cheer for all companies serving everyday consumers, but in the case of J. M. Smucker, we’ll be cheering from the sidelines. For starters, its revenue growth was uninspiring over the last three years. And while its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cushion, the downside is its declining operating margin shows the business has become less efficient. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

J. M. Smucker’s P/E ratio based on the next 12 months is 10.5x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $115.07 on the company (compared to the current share price of $102.52).