TransDigm (TDG)

We’re bullish on TransDigm. Its fusion of growth, outstanding profitability, and encouraging prospects makes it a beloved asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like TransDigm

Supplying parts for nearly all aircraft currently in service, TransDigm (NYSE:TDG) develops and manufactures components and systems for military and commercial aviation.

- Impressive 15.8% annual revenue growth over the last two years indicates it’s winning market share this cycle

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 20.9% over the last five years outstripped its revenue performance

- Successful business model is illustrated by its impressive operating margin, and its profits increased over the last five years as it scaled

TransDigm is a standout company. The price seems fair when considering its quality, and we think now is a prudent time to invest in the stock.

Why Is Now The Time To Buy TransDigm?

High Quality

Investable

Underperform

Why Is Now The Time To Buy TransDigm?

TransDigm’s stock price of $1,449 implies a valuation ratio of 37x forward P/E. Many industrials names may carry a lower valuation multiple, but TransDigm’s price is fair given its business quality.

Entry price may seem important in the moment, but our work shows that time and again, long-term market outperformance is determined by business quality rather than getting an absolute bargain on a stock.

3. TransDigm (TDG) Research Report: Q4 CY2025 Update

Aerospace and defense company TransDigm (NYSE:TDG) announced better-than-expected revenue in Q4 CY2025, with sales up 13.9% year on year to $2.29 billion. The company expects the full year’s revenue to be around $9.94 billion, close to analysts’ estimates. Its non-GAAP profit of $8.23 per share was 2.3% above analysts’ consensus estimates.

TransDigm (TDG) Q4 CY2025 Highlights:

- Revenue: $2.29 billion vs analyst estimates of $2.26 billion (13.9% year-on-year growth, 1.2% beat)

- Adjusted EPS: $8.23 vs analyst estimates of $8.04 (2.3% beat)

- Adjusted EBITDA: $1.20 billion vs analyst estimates of $1.18 billion (52.4% margin, 1.4% beat)

- The company slightly lifted its revenue guidance for the full year to $9.94 billion at the midpoint from $9.85 billion

- Management raised its full-year Adjusted EPS guidance to $38.38 at the midpoint, a 2.3% increase

- EBITDA guidance for the full year is $5.21 billion at the midpoint, in line with analyst expectations

- Operating Margin: 45.6%, down from 48.6% in the same quarter last year

- Organic Revenue rose 7.4% year on year (miss)

- Market Capitalization: $81.04 billion

Company Overview

Supplying parts for nearly all aircraft currently in service, TransDigm (NYSE:TDG) develops and manufactures components and systems for military and commercial aviation.

TransDigm was formed through a merger of four industrial aerospace companies and originally sold a small array of aircraft components such as batteries and pumps. A key part of its business model is to acquire airplane parts companies and raise prices. In its first 25 years of operating, it acquired over 60 businesses, enabling it to manufacture not only aircraft systems but also a range of aircraft components like engines, electronics, and interiors.

TransDigm generally sells its products to four types of customers: defense organizations, commercial airlines, original equipment manufacturers (OEM), and maintenance, repair, and overhaul providers. The company’s products are used by OEMs to create new aircraft while overhaul providers, defense organizations, and commercial airlines use its components for maintenance and upgrading of existing aircraft.

Due to the specificity and wear-and-tear of aircraft components, TransDigm usually enters long-term contracts with most of its customers. A majority of sales come from aftermarket services, and the company uses third-party distributors to reach broader markets.

A potential risk for TransDigm is regulators stepping in and limiting its ability to acquire more businesses and raise prices. The company has come under regulatory security several times, but as of today, continues to march along.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

TransDigm’s peers and competitors include Raytheon (NYSE:RTX), L3Harris Technologies (NYSE:LHX), and Moog Inc. (NYSE:MOG.A).

5. Revenue Growth

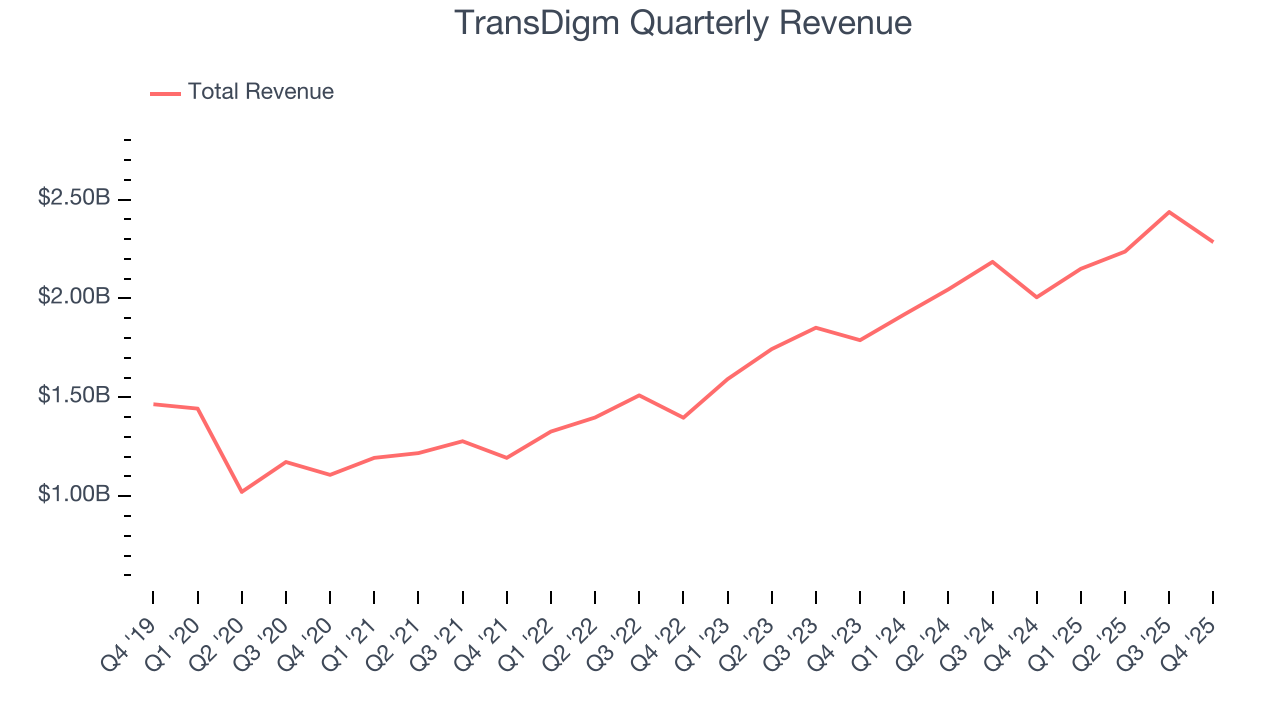

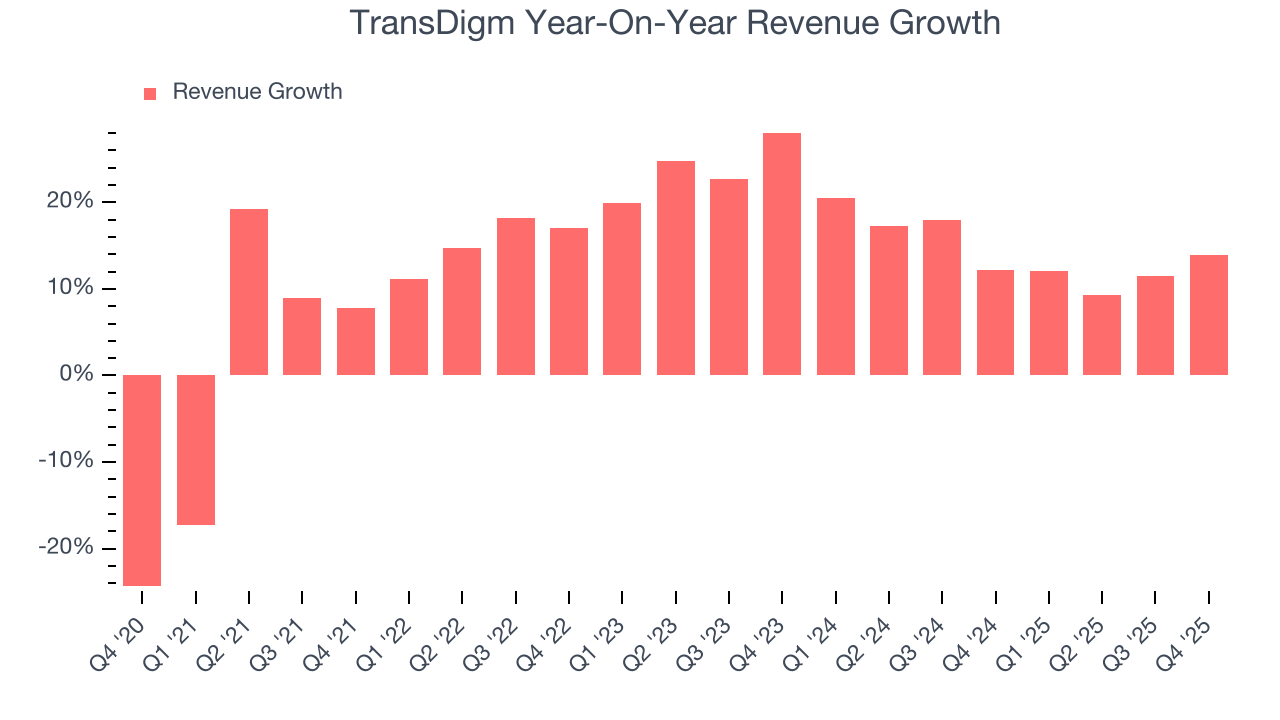

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, TransDigm’s sales grew at an exceptional 13.9% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. TransDigm’s annualized revenue growth of 14.3% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

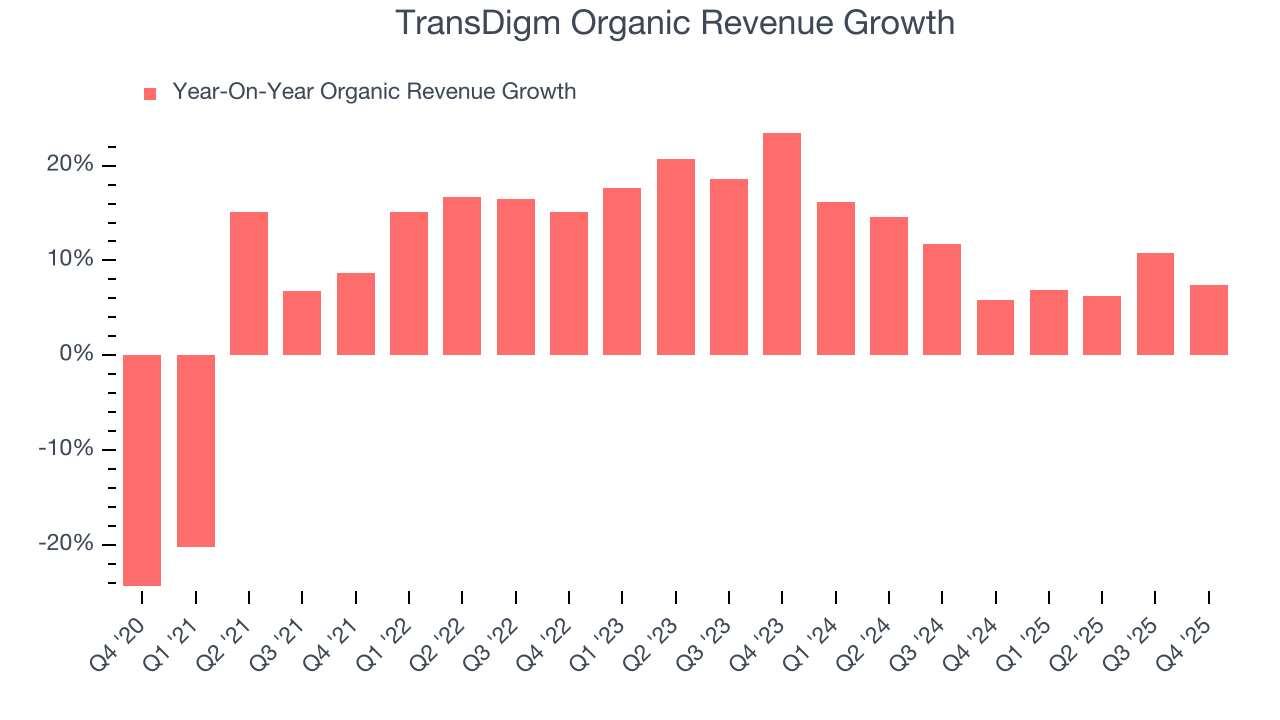

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, TransDigm’s organic revenue averaged 10% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, TransDigm reported year-on-year revenue growth of 13.9%, and its $2.29 billion of revenue exceeded Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 11.4% over the next 12 months, a slight deceleration versus the last two years. Despite the slowdown, this projection is admirable and suggests the market sees success for its products and services.

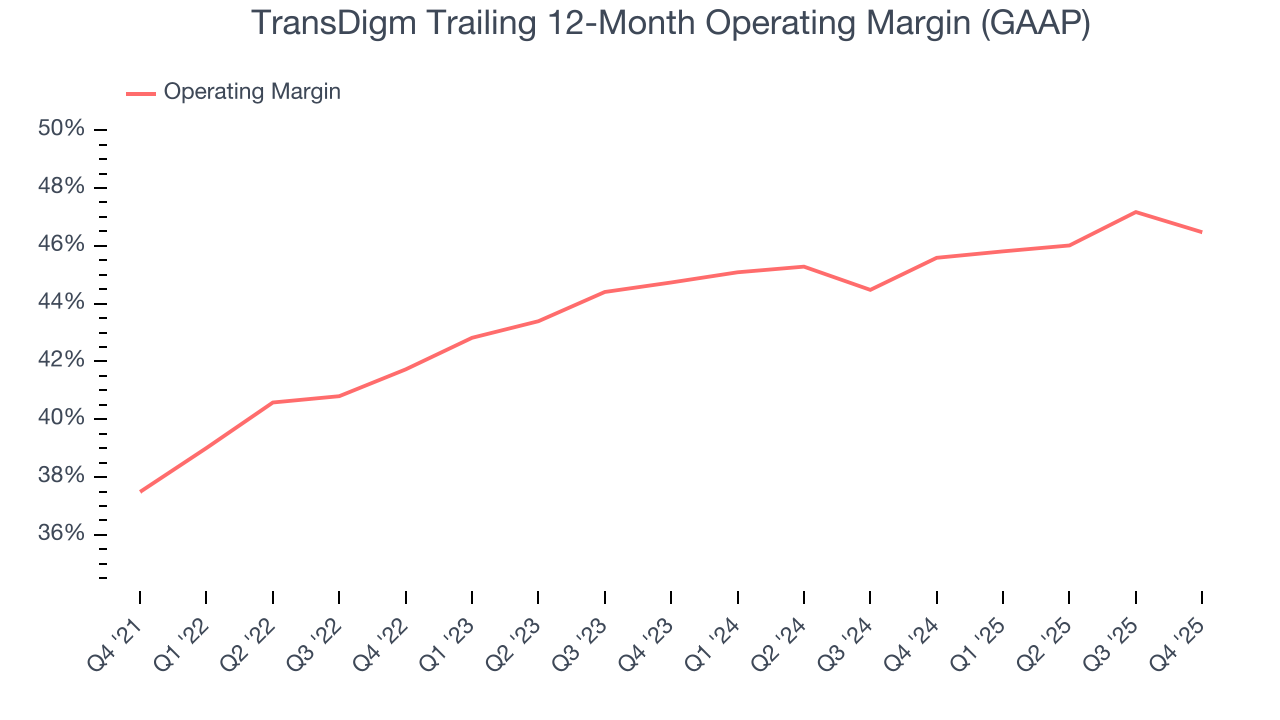

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

TransDigm has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 43.9%.

Analyzing the trend in its profitability, TransDigm’s operating margin rose by 9 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, TransDigm generated an operating margin profit margin of 45.6%, down 3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

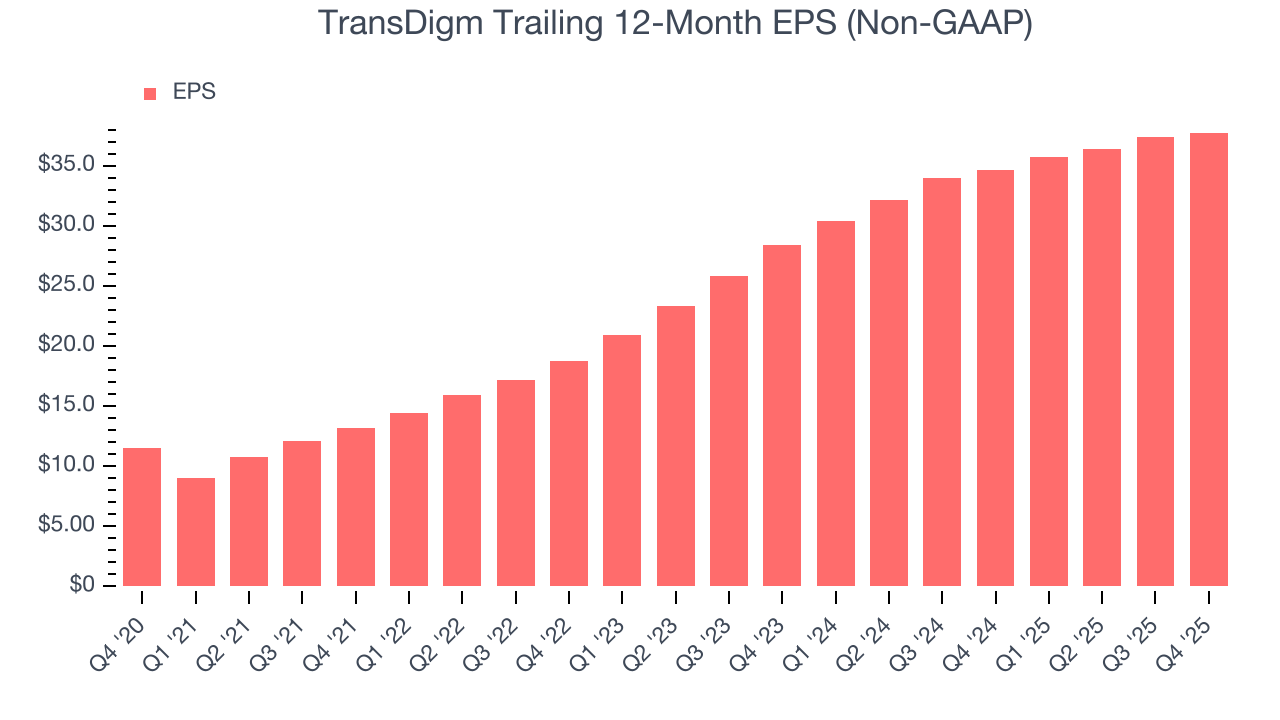

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

TransDigm’s EPS grew at an astounding 26.8% compounded annual growth rate over the last five years, higher than its 13.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into TransDigm’s earnings to better understand the drivers of its performance. As we mentioned earlier, TransDigm’s operating margin declined this quarter but expanded by 9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For TransDigm, its two-year annual EPS growth of 15.3% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, TransDigm reported adjusted EPS of $8.23, up from $7.83 in the same quarter last year. This print beat analysts’ estimates by 2.3%. Over the next 12 months, Wall Street expects TransDigm’s full-year EPS of $37.76 to grow 7.1%.

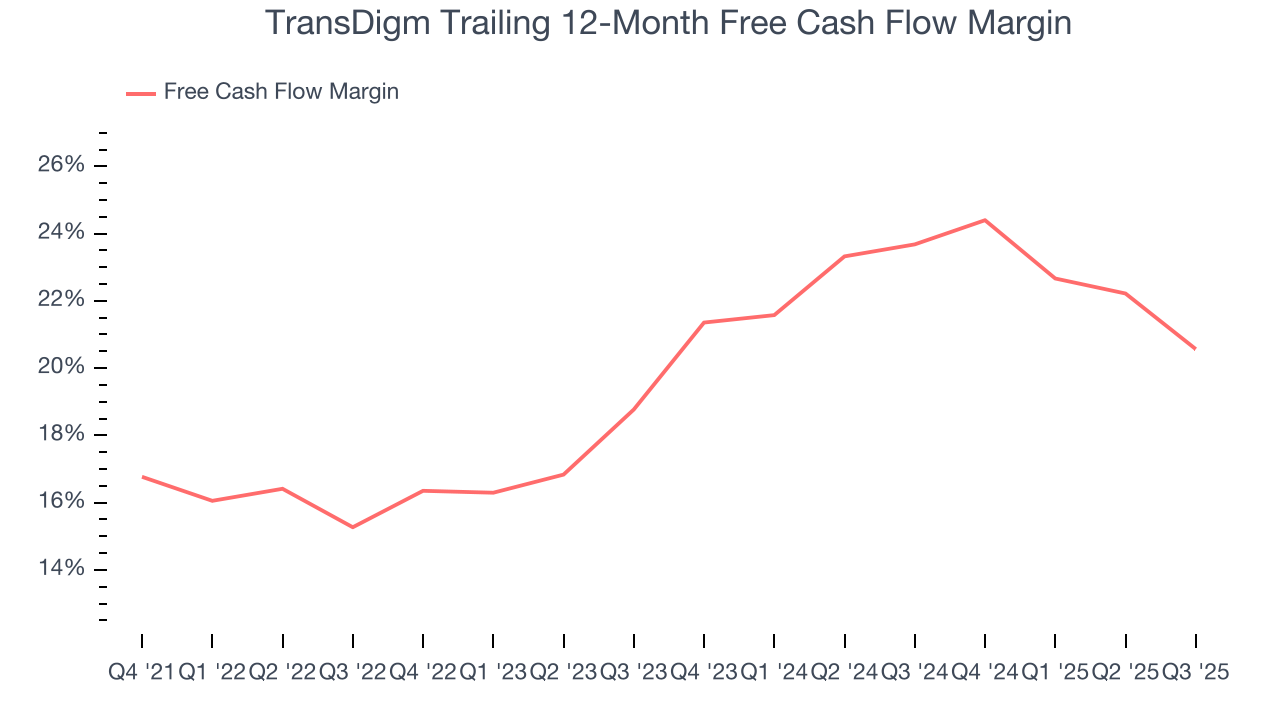

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

TransDigm has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 19.5% over the last five years.

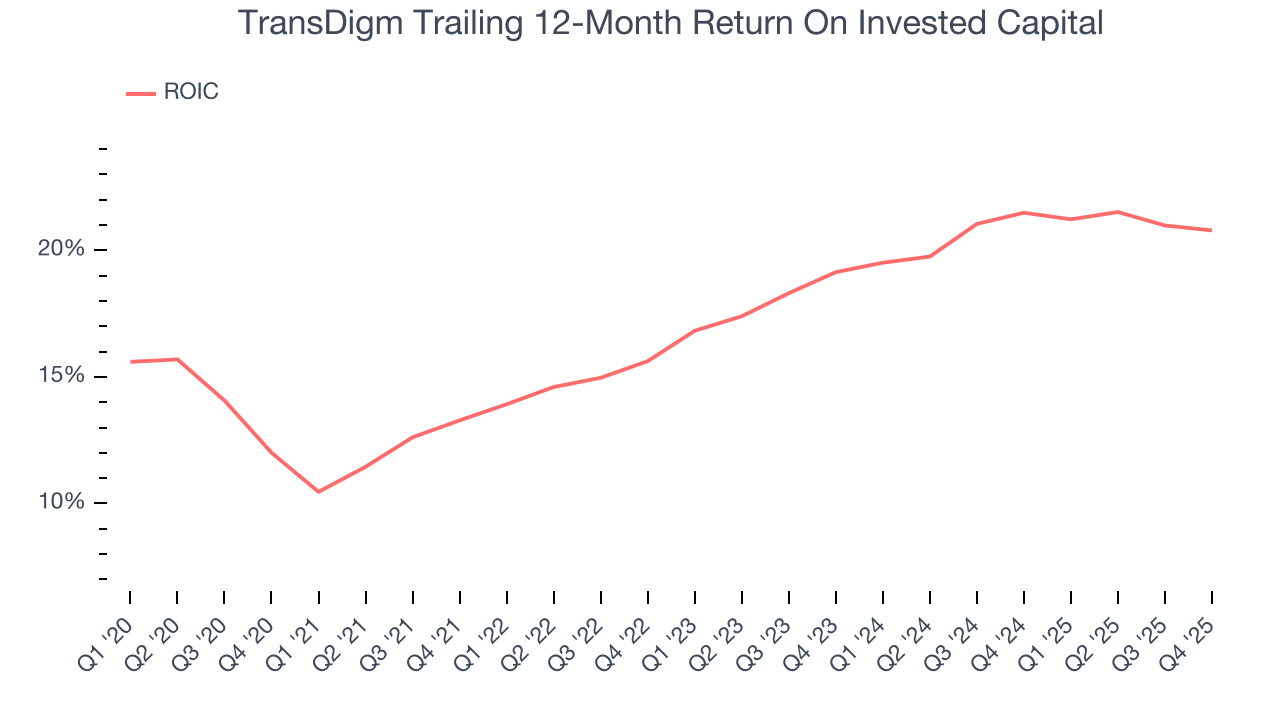

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

TransDigm’s five-year average ROIC was 18.1%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, TransDigm’s ROIC has increased. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

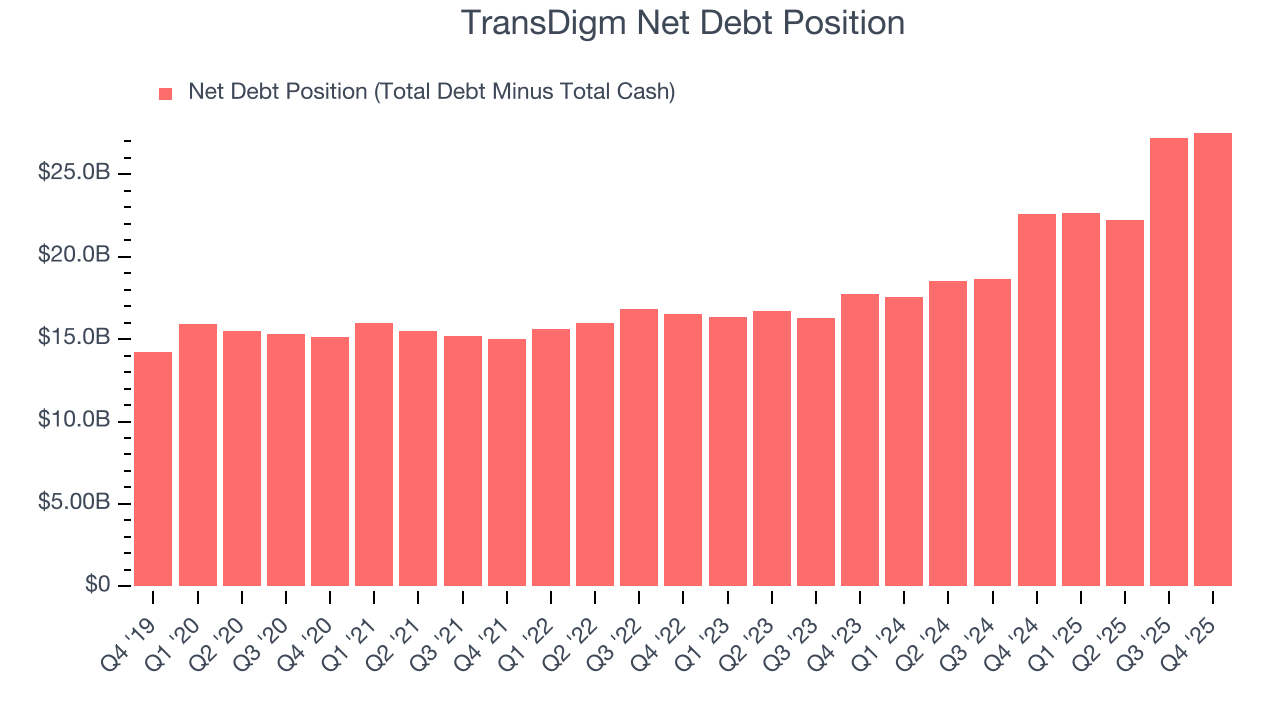

10. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

TransDigm’s $30.05 billion of debt exceeds the $2.53 billion of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $4.90 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. TransDigm could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope TransDigm can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from TransDigm’s Q4 Results

It was good to see TransDigm narrowly top analysts’ revenue expectations this quarter. We were also happy its EBITDA narrowly outperformed Wall Street’s estimates. On the other hand, its organic revenue slightly missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $1,434 immediately following the results.

12. Is Now The Time To Buy TransDigm?

Updated: February 3, 2026 at 7:24 AM EST

Before deciding whether to buy TransDigm or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

TransDigm is a pretty good company if you ignore its balance sheet. For starters, its revenue growth was exceptional over the last five years. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, and its impressive operating margins show it has a highly efficient business model.

TransDigm’s P/E ratio based on the next 12 months is 35.5x. Certain aspects of its fundamentals are attractive, but we aren’t investing at the moment because its balance sheet makes us uneasy. We recommend investors interested in the company wait until it reduces its leverage or increases its profits before getting involved.

Wall Street analysts have a consensus one-year price target of $1,622 on the company (compared to the current share price of $1,434), implying they see 13.1% upside in buying TransDigm in the short term.