Tilly's (TLYS)

Tilly's keeps us up at night. Its falling revenue and negative returns on capital suggest it’s destroying value as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think Tilly's Will Underperform

With an emphasis on skate and surf culture, Tilly’s (NYSE:TLYS) is a specialty retailer that sells clothing, footwear, and accessories geared towards fashion-forward teens and young adults.

- Ongoing store closures and lackluster same-store sales indicate sluggish demand and a focus on consolidation

- Products aren't resonating with the market as its revenue declined by 7.8% annually over the last three years

- Unprofitable operations could lead to additional rounds of dilutive equity financing if the credit window closes

Tilly's is skating on thin ice. There are more appealing investments to be made.

Why There Are Better Opportunities Than Tilly's

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Tilly's

Tilly's is trading at $1.39 per share, or 0.1x forward price-to-sales. The market typically values companies like Tilly's based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

We’d rather pay a premium for quality. Cheap stocks can look like a great deal at first glance, but they can be value traps. Less earnings power means more reliance on a re-rating to generate good returns; this can be an unlikely scenario for low-quality companies.

3. Tilly's (TLYS) Research Report: Q3 CY2025 Update

Young adult apparel retailer Tilly’s (NYSE:TLYS) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 2.7% year on year to $139.6 million. Guidance for next quarter’s revenue was better than expected at $148.5 million at the midpoint, 1.6% above analysts’ estimates. Its GAAP loss of $0.05 per share was 83.3% above analysts’ consensus estimates.

Tilly's (TLYS) Q3 CY2025 Highlights:

- Revenue: $139.6 million vs analyst estimates of $136.9 million (2.7% year-on-year decline, 2% beat)

- EPS (GAAP): -$0.05 vs analyst estimates of -$0.30 (83.3% beat)

- Adjusted EBITDA: $619,000 (0.4% margin, 111% year-on-year growth)

- Revenue Guidance for Q4 CY2025 is $148.5 million at the midpoint, above analyst estimates of $146.1 million

- EPS (GAAP) guidance for Q4 CY2025 is -$0.16 at the midpoint, beating analyst estimates by 51.6%

- Operating Margin: -1.4%, up from -4.4% in the same quarter last year

- Free Cash Flow was -$11.66 million compared to -$25.05 million in the same quarter last year

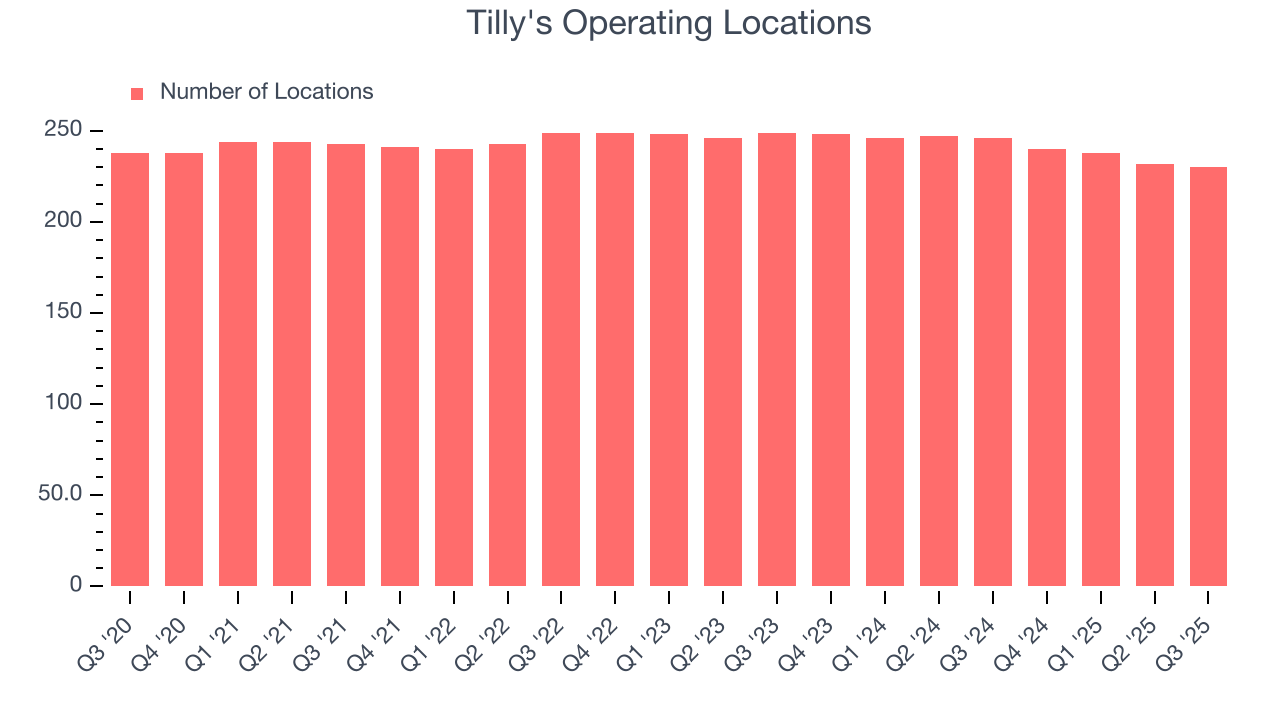

- Locations: 230 at quarter end, down from 246 in the same quarter last year

- Same-Store Sales rose 2% year on year (3.4% in the same quarter last year)

- Market Capitalization: $44.8 million

Company Overview

With an emphasis on skate and surf culture, Tilly’s (NYSE:TLYS) is a specialty retailer that sells clothing, footwear, and accessories geared towards fashion-forward teens and young adults.

Vans, Billabong, Hurley, and Volcom are some of the brands that can be commonly found for sale. The core Tilly’s customer is usually a teen or young adult steeped in skate and surf culture who has a desire to signal these interests through fashion.

On average, stores tend to be moderate in size, roughly 7,500 square feet. They are often located in suburban malls or shopping centers alongside other mass market retailers. Upon entering a Tilly’s store, a shopper will likely notice the vibrant and colorful displays and signage as well as music that fits with the prevailing skate and surf lifestyle. A store is usually divided into men’s, women’s and kid’s clothing. There may also be a limited selection of skate decks and other equipment, although this is not the primary focus.

4. Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Competitors that sell edgy or skate-inspired young adult clothing include Urban Outfitters (NASDAQ:URBN), Zumiez (NASDAQ:ZUMZ), and Genesco’s (NYSE:GCO) Journeys banner.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $545.7 million in revenue over the past 12 months, Tilly's is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, Tilly’s revenue declined by 7.8% per year over the last three years (we compare to 2019 to normalize for COVID-19 impacts) as it closed stores and observed lower sales at existing, established locations.

This quarter, Tilly’s revenue fell by 2.7% year on year to $139.6 million but beat Wall Street’s estimates by 2%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection suggests its newer products will spur better top-line performance, it is still below the sector average.

6. Store Performance

Number of Stores

Tilly's operated 230 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 2.6% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Tilly’s demand has been shrinking over the last two years as its same-store sales have averaged 5.2% annual declines. This performance isn’t ideal, and Tilly's is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Tilly’s same-store sales rose 2% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

7. Gross Margin & Pricing Power

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

Tilly’s unit economics are higher than the typical retailer, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 40.2% gross margin over the last two years. That means for every $100 in revenue, $59.79 went towards paying for inventory, transportation, and distribution.

This quarter, Tilly’s gross profit margin was 31.2%, marking a 9.5 percentage point decrease from 40.7% in the same quarter last year. Tilly’s full-year margin has also been trending down over the past 12 months, decreasing by 1.6 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to discount products and higher input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Despite the consumer retail industry’s secular decline, unprofitable public companies are few and far between. Unfortunately, Tilly's was one of them over the last two years as its high expenses contributed to an average operating margin of negative 7.4%.

Analyzing the trend in its profitability, Tilly’s operating margin decreased by 2.5 percentage points over the last year. Tilly’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Tilly's generated a negative 1.4% operating margin. The company's consistent lack of profits raise a flag.

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Tilly's, its EPS declined by 53.3% annually over the last three years, more than its revenue. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q3, Tilly's reported EPS of negative $0.05, up from negative $0.43 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Tilly's to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.14 will advance to negative $0.80.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Tilly’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 5.1%, meaning it lit $5.07 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Tilly’s margin expanded by 5.1 percentage points over the last year. We have no doubt shareholders would like to continue seeing its cash conversion rise.

Tilly's burned through $11.66 million of cash in Q3, equivalent to a negative 8.4% margin. The company’s cash burn was similar to its $25.05 million of lost cash in the same quarter last year.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Tilly’s five-year average ROIC was negative 10.8%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer retail sector.

12. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

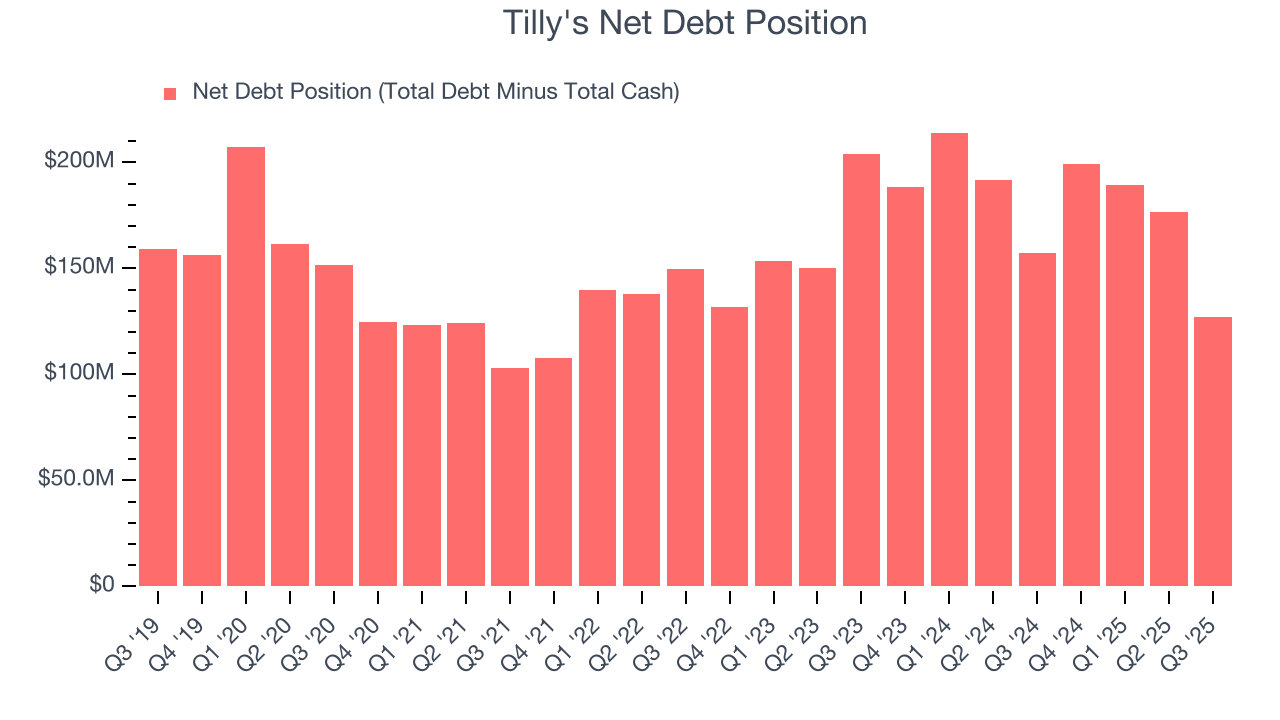

Tilly's posted negative $43.98 million of EBITDA over the last 12 months, and its $165.9 million of debt exceeds the $39.04 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade Tilly's if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Tilly's can improve its profitability and remain cautious until then.

13. Key Takeaways from Tilly’s Q3 Results

We were impressed by Tilly’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 13.9% to $2.08 immediately following the results.

14. Is Now The Time To Buy Tilly's?

Updated: February 23, 2026 at 9:39 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Tilly's.

Tilly's falls short of our quality standards. To begin with, its revenue has declined over the last three years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its brand caters to a niche market. On top of that, its declining EPS over the last three years makes it a less attractive asset to the public markets.

Tilly’s forward price-to-sales ratio is 0.1x. The market typically values companies like Tilly's based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $2.25 on the company (compared to the current share price of $1.39).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.