Thermo Fisher (TMO)

Thermo Fisher doesn’t excite us. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Thermo Fisher Is Not Exciting

With over 14,000 sales personnel and a portfolio spanning more than 2,500 technology manufacturers, Thermo Fisher Scientific (NYSE:TMO) provides scientific equipment, reagents, consumables, software, and laboratory services to pharmaceutical, biotech, academic, and healthcare customers worldwide.

- Organic revenue growth fell short of our benchmarks over the past two years and implies it may need to improve its products, pricing, or go-to-market strategy

- Performance over the past five years shows its incremental sales were less profitable, as its 3.2% annual earnings per share growth trailed its revenue gains

- On the plus side, its large revenue base of $44.56 billion gives it negotiating leverage and staying power in an industry with high barriers to entry

Thermo Fisher is skating on thin ice. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Thermo Fisher

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Thermo Fisher

At $519 per share, Thermo Fisher trades at 20.9x forward P/E. While valuation is appropriate for the quality you get, we’re still on the sidelines for now.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Thermo Fisher (TMO) Research Report: Q4 CY2025 Update

Life sciences company Thermo Fisher (NYSE:TMO) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 7.2% year on year to $12.22 billion. Its non-GAAP profit of $6.57 per share was 1.9% above analysts’ consensus estimates.

Thermo Fisher (TMO) Q4 CY2025 Highlights:

- Revenue: $12.22 billion vs analyst estimates of $11.96 billion (7.2% year-on-year growth, 2.1% beat)

- Adjusted EPS: $6.57 vs analyst estimates of $6.45 (1.9% beat)

- Adjusted EBITDA: $2.55 billion vs analyst estimates of $3.13 billion (20.8% margin, 18.5% miss)

- Operating Margin: 18.5%, in line with the same quarter last year

- Organic Revenue rose 3% year on year (beat)

- Market Capitalization: $228.4 billion

Company Overview

With over 14,000 sales personnel and a portfolio spanning more than 2,500 technology manufacturers, Thermo Fisher Scientific (NYSE:TMO) provides scientific equipment, reagents, consumables, software, and laboratory services to pharmaceutical, biotech, academic, and healthcare customers worldwide.

Thermo Fisher operates through four main segments that collectively serve as a comprehensive supplier to the scientific community. The Life Sciences Solutions segment offers reagents, instruments, and consumables for biological research, drug discovery, and vaccine development. This includes tools for molecular and protein biology, genomics, and cell culture products essential for developing biological therapeutics.

The Analytical Instruments segment provides sophisticated equipment for sample analysis across pharmaceutical, environmental, and industrial applications. This includes chromatography and mass spectrometry systems that can detect minute quantities of substances, electron microscopes that visualize structures at the atomic level, and chemical analysis tools used in environmental monitoring.

The Specialty Diagnostics segment delivers diagnostic test kits, reagents, and instruments to healthcare and clinical laboratories. These products help medical professionals diagnose conditions ranging from infectious diseases to autoimmune disorders, perform drug testing, and support organ transplantation through tissue typing.

The Laboratory Products and Biopharma Services segment offers both everyday laboratory supplies and specialized outsourced pharmaceutical services. A researcher might order basic lab equipment like pipettes and centrifuges through Thermo Fisher's Fisher Scientific channel, while a pharmaceutical company might engage their Patheon division to manufacture clinical trial materials or commercial drugs.

Thermo Fisher's business model combines manufacturing proprietary products with distributing third-party items, creating a one-stop shop for scientific needs. The company maintains global manufacturing facilities and distribution centers to serve customers across North America, Europe, and Asia-Pacific regions.

Beyond product sales, Thermo Fisher provides critical services including laboratory design, equipment maintenance, clinical trials management, and pharmaceutical manufacturing. This integrated approach allows customers to outsource portions of their research, development, or manufacturing processes to Thermo Fisher's specialized teams.

4. Research Tools & Consumables

The life sciences subsector specializing in research tools and consumables enables scientific discoveries across academia, biotechnology, and pharmaceuticals. These firms supply a wide range of essential laboratory products, ensuring a recurring revenue stream through repeat purchases and replenishment. Their business models benefit from strong customer loyalty, a diversified product portfolio, and exposure to both the research and clinical markets. However, challenges include high R&D investment to maintain technological leadership, pricing pressures from budget-conscious institutions, and vulnerability to fluctuations in research funding cycles. Looking ahead, this subsector stands to benefit from tailwinds such as growing demand for tools supporting emerging fields like synthetic biology and personalized medicine. There is also a rise in automation and AI-driven solutions in laboratories that could create new opportunities to sell tools and consumables. Nevertheless, headwinds exist. These companies tend to be at the mercy of supply chain disruptions and sensitivity to macroeconomic conditions that impact funding for research initiatives.

Thermo Fisher Scientific competes with other life sciences and laboratory equipment providers including Danaher Corporation (NYSE:DHR), Agilent Technologies (NYSE:A), PerkinElmer (NYSE:PKI), and Becton, Dickinson and Company (NYSE:BDX), as well as specialized competitors in specific market segments.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $44.56 billion in revenue over the past 12 months, Thermo Fisher boasts impressive economies of scale. It may not be as large as heavyweights such as UnitedHealth Group and The Cigna Group from a topline perspective, but its heft is still an important advantage in a healthcare industry that is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Thermo Fisher grew its sales at a mediocre 6.7% compounded annual growth rate. This fell short of our benchmark for the healthcare sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Thermo Fisher’s recent performance shows its demand has slowed as its annualized revenue growth of 2% over the last two years was below its five-year trend.

Thermo Fisher also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Thermo Fisher’s organic revenue was flat. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Thermo Fisher reported year-on-year revenue growth of 7.2%, and its $12.22 billion of revenue exceeded Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

7. Operating Margin

Thermo Fisher has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 18.8%.

Analyzing the trend in its profitability, Thermo Fisher’s operating margin decreased by 8.2 percentage points over the last five years, but it rose by 1.4 percentage points on a two-year basis. Still, shareholders will want to see Thermo Fisher become more profitable in the future.

This quarter, Thermo Fisher generated an operating margin profit margin of 18.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

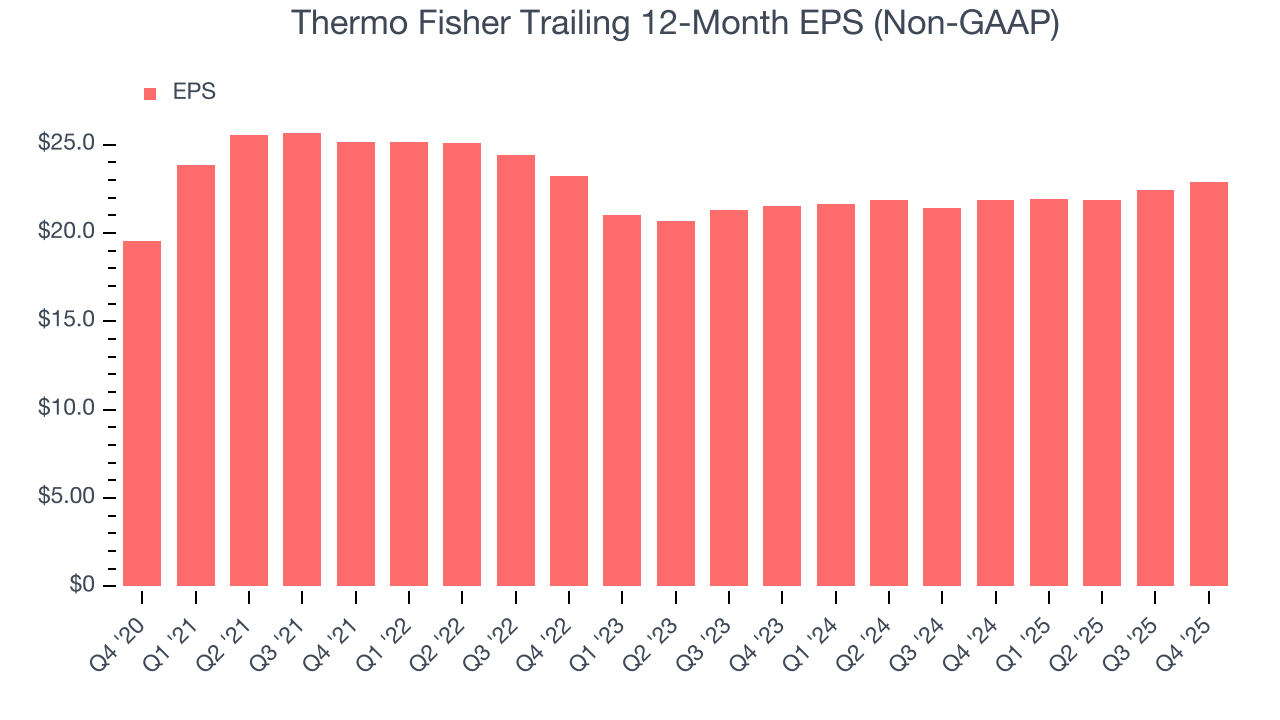

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Thermo Fisher’s EPS grew at an unimpressive 3.2% compounded annual growth rate over the last five years, lower than its 6.7% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Thermo Fisher’s earnings can give us a better understanding of its performance. As we mentioned earlier, Thermo Fisher’s operating margin was flat this quarter but declined by 8.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Thermo Fisher reported adjusted EPS of $6.57, up from $6.10 in the same quarter last year. This print beat analysts’ estimates by 1.9%. Over the next 12 months, Wall Street expects Thermo Fisher’s full-year EPS of $22.87 to grow 7.6%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Thermo Fisher has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 15.4% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that Thermo Fisher’s margin dropped by 7.9 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Thermo Fisher’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 10.3%, slightly better than typical healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Thermo Fisher’s ROIC averaged 4 percentage point decreases over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

Thermo Fisher reported $10.11 billion of cash and $39.39 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $10.54 billion of EBITDA over the last 12 months, we view Thermo Fisher’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $213 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Thermo Fisher’s Q4 Results

It was encouraging to see Thermo Fisher beat analysts’ revenue expectations this quarter. We were also happy its organic revenue narrowly outperformed Wall Street’s estimates. On the other hand, its operating income slightly missed. Overall, this print had some key positives. The stock traded up 1.3% to $615.74 immediately following the results.

13. Is Now The Time To Buy Thermo Fisher?

Updated: March 5, 2026 at 11:27 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Thermo Fisher.

When it comes to Thermo Fisher’s business quality, there are some positives, but it ultimately falls short. Although its revenue growth was mediocre over the last five years and analysts expect growth to slow over the next 12 months, its scale makes it a trusted partner with negotiating leverage. We advise investors to be cautious with this one, however, as its declining adjusted operating margin shows the business has become less efficient.

Thermo Fisher’s P/E ratio based on the next 12 months is 20.9x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $666.46 on the company (compared to the current share price of $519).