Tyson Foods (TSN)

Tyson Foods keeps us up at night. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Tyson Foods Will Underperform

Started as a simple trucking business, Tyson Foods (NYSE:TSN) is one of the world’s largest producers of chicken, beef, and pork.

- Gross margin of 7.2% is an output of its commoditized products

- Earnings per share fell by 22.1% annually over the last three years while its revenue was flat, showing each sale was less profitable

- Sales stagnated over the last three years and signal the need for new growth strategies

Tyson Foods doesn’t check our boxes. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Tyson Foods

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Tyson Foods

At $65.63 per share, Tyson Foods trades at 16.6x forward P/E. Yes, this valuation multiple is lower than that of other consumer staples peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Tyson Foods (TSN) Research Report: Q4 CY2025 Update

Meat company Tyson Foods (NYSE:TSN) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 5.1% year on year to $14.31 billion. Its non-GAAP profit of $0.97 per share was 3.1% above analysts’ consensus estimates.

Tyson Foods (TSN) Q4 CY2025 Highlights:

- Revenue: $14.31 billion vs analyst estimates of $13.93 billion (5.1% year-on-year growth, 2.7% beat)

- Adjusted EPS: $0.97 vs analyst estimates of $0.94 (3.1% beat)

- Adjusted EBITDA: $879 million vs analyst estimates of $871.6 million (6.1% margin, 0.8% beat)

- Operating Margin: 2.1%, down from 4.3% in the same quarter last year

- Free Cash Flow Margin: 4.8%, similar to the same quarter last year

- Sales Volumes were flat year on year (1.6% in the same quarter last year)

- Market Capitalization: $23.07 billion

Company Overview

Started as a simple trucking business, Tyson Foods (NYSE:TSN) is one of the world’s largest producers of chicken, beef, and pork.

These humble beginnings can be traced to 1935 when John W. Tyson started his company in Springdale, Arkansas. Over time, this trucking business focused on delivering chickens. During the surge in food demand in the 1940s due to World War II, Tyson began investing in his own chicken hatcheries and feed mills. From there, vertical integration was adopted, where the company controlled every stage of poultry production from hatching to feed to processing.

Today, Tyson Foods is not just a chicken producer–it’s a diversified protein powerhouse that extends beyond meat into prepared foods and alternative protein sources. Among their most recognizable brands are Tyson, Jimmy Dean, Hillshire Farm, and Ball Park (hot dogs).

The Tyson Foods core customer is broad but can generally be understood as someone who shops for the household. This person is seeking convenient meal solutions–whether that’s chicken or beef from a trusted source that can be quickly tossed into a pan or a pre-made meal that just needs to be heated up. However, customers also include large-scale buyers such as restaurants and food service companies in need of bulk protein.

Tyson products are widely distributed in supermarkets, club stores, and special grocery stores. Restaurant and food service customers can procure their meats and prepared foods directly from Tyson, with discounts available for larger orders.

4. Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Competitors in protein and packaged foods include Pilgrim’s Pride (NASDAQ:PPC) and private companies Perdue Farms, Sanderson Farms, and Koch Foods.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $55.13 billion in revenue over the past 12 months, Tyson Foods is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To expand meaningfully, Tyson Foods likely needs to tweak its prices, innovate with new products, or enter new markets.

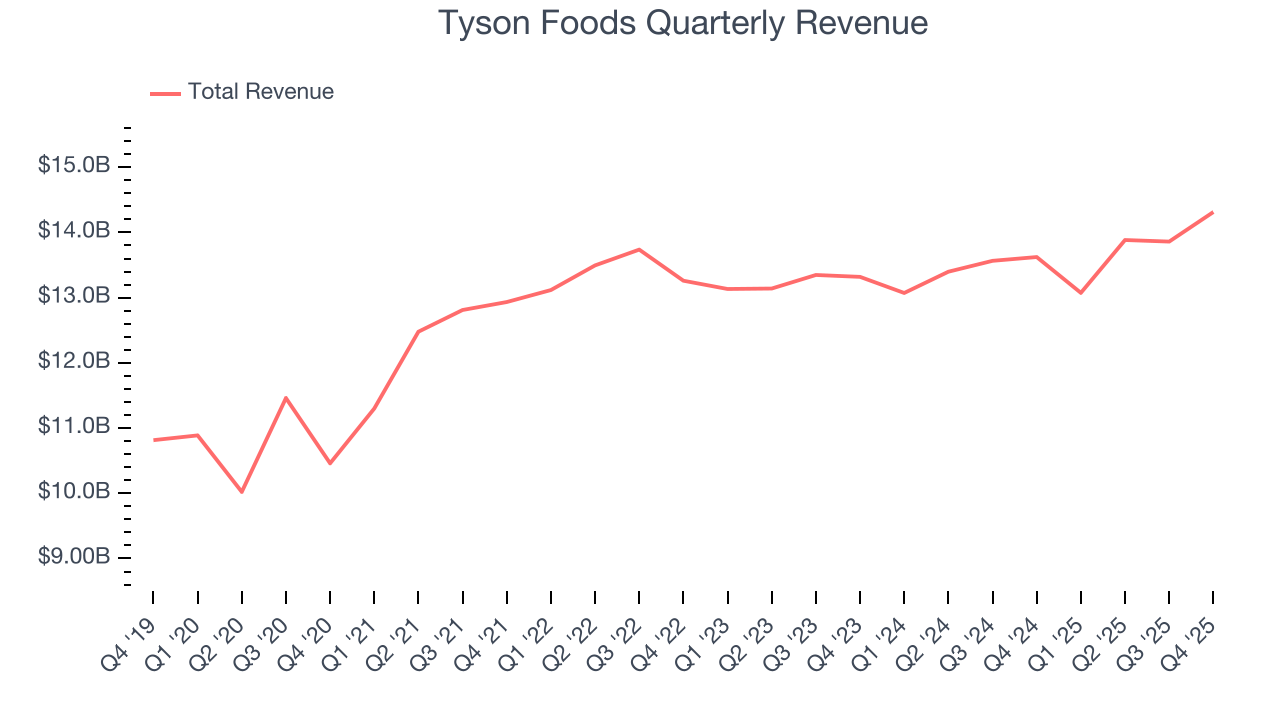

As you can see below, Tyson Foods struggled to increase demand as its $55.13 billion of sales for the trailing 12 months was close to its revenue three years ago. This is mainly because it failed to grow its volumes.

This quarter, Tyson Foods reported year-on-year revenue growth of 5.1%, and its $14.31 billion of revenue exceeded Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months, similar to its three-year rate. This projection is underwhelming and implies its newer products will not lead to better top-line performance yet.

6. Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

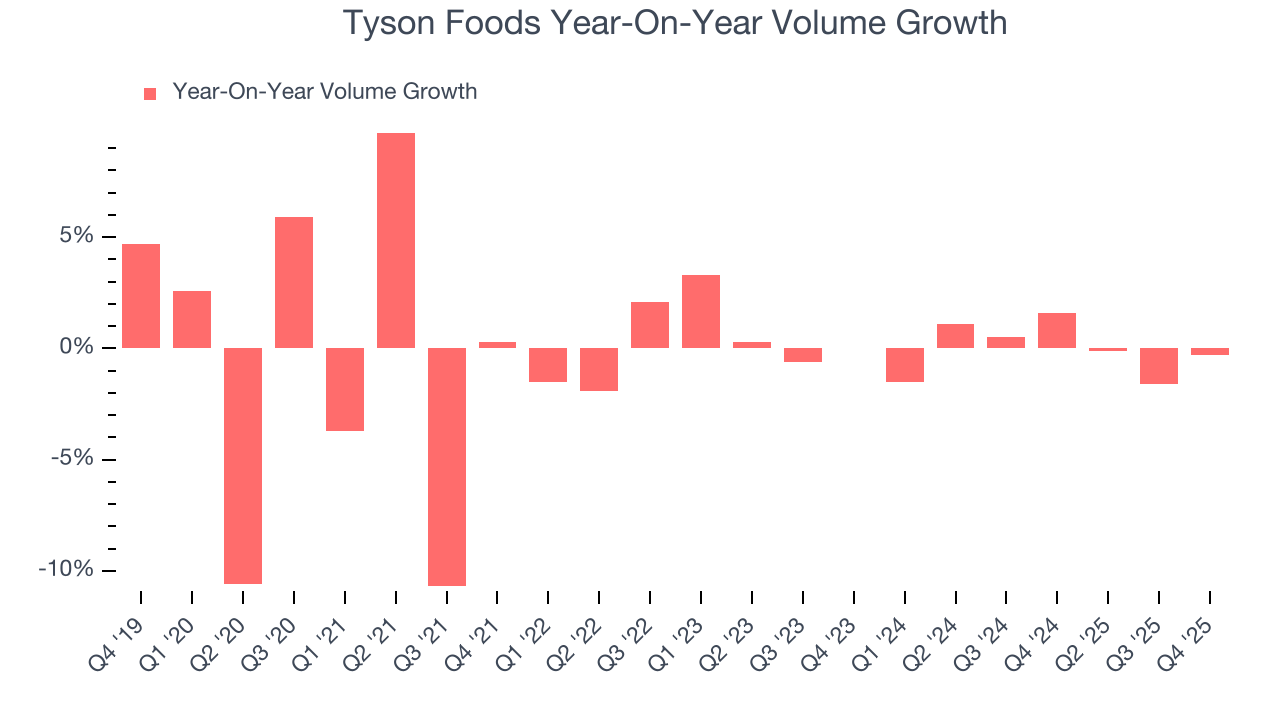

Tyson Foods’s quarterly sales volumes have, on average, stayed about the same over the last two years. This stability is normal because the quantity demanded for consumer staples products typically doesn’t see much volatility.

In Tyson Foods’s Q4 2026, year on year sales volumes were flat. This result was more or less in line with its historical levels.

7. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

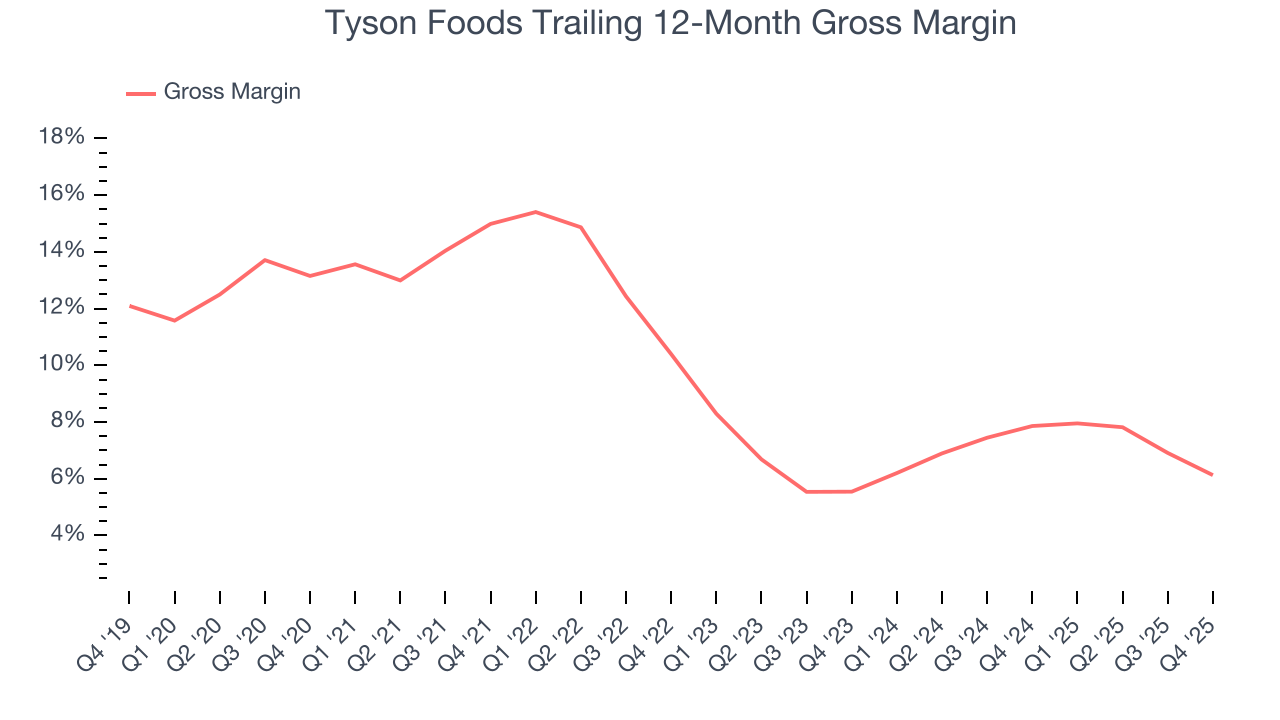

Tyson Foods has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 7% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $93.02 went towards paying for raw materials, production of goods, transportation, and distribution.

Tyson Foods produced a 5.6% gross profit margin in Q4, down 3.1 percentage points year on year. Tyson Foods’s full-year margin has also been trending down over the past 12 months, decreasing by 1.7 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

8. Operating Margin

Operating margin is a key profitability metric because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

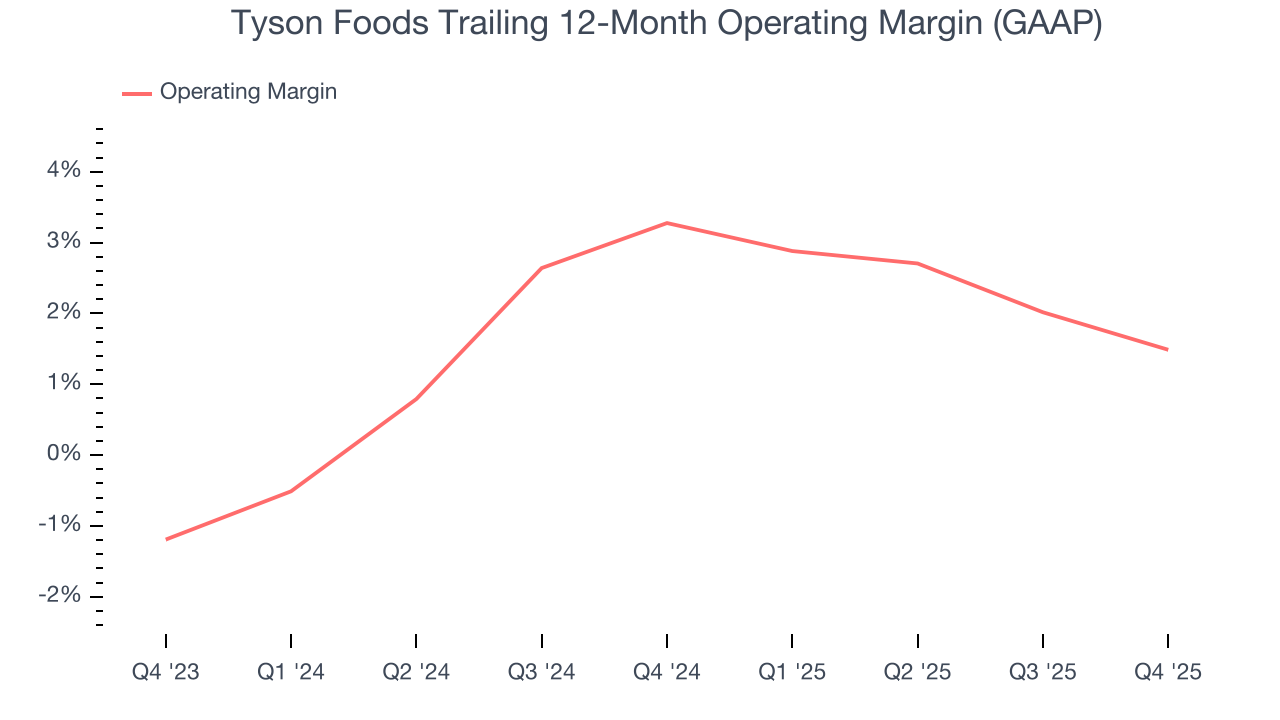

Tyson Foods was profitable over the last two years but held back by its large cost base. Its average operating margin of 2.4% was weak for a consumer staples business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Tyson Foods’s operating margin decreased by 1.8 percentage points over the last year. Tyson Foods’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Tyson Foods generated an operating margin profit margin of 2.1%, down 2.1 percentage points year on year. Since Tyson Foods’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, and administrative overhead expenses.

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

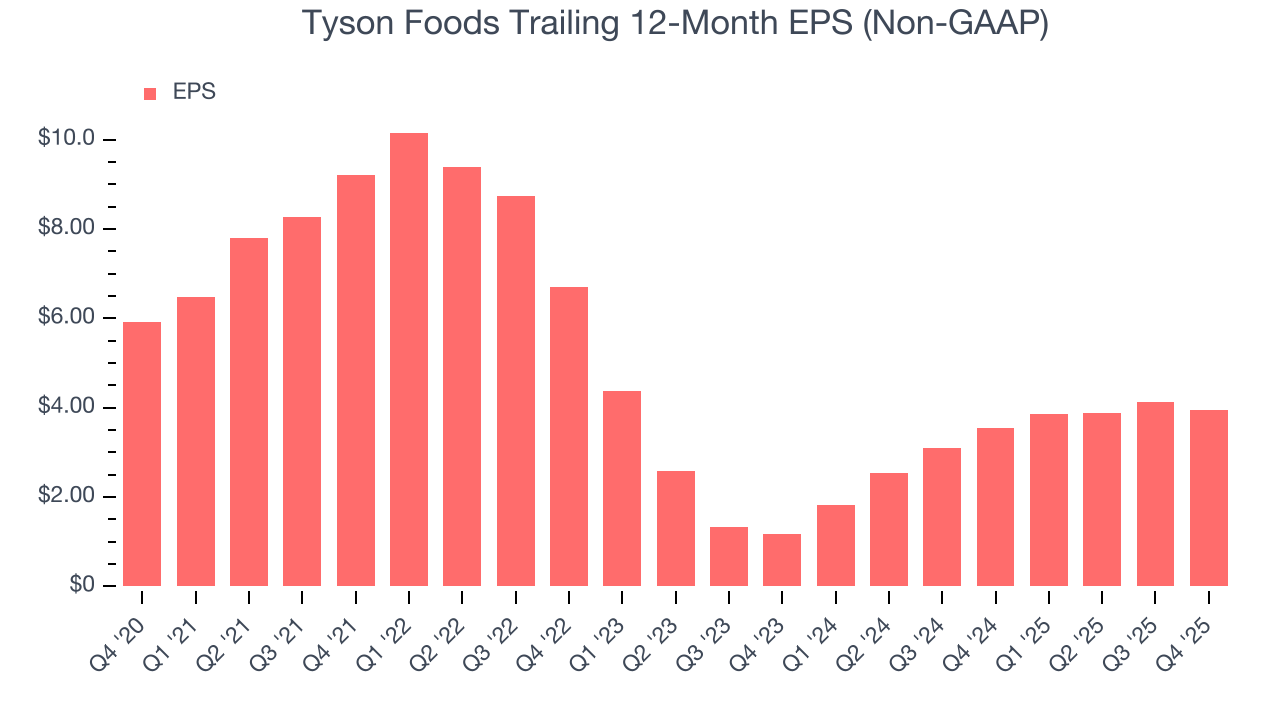

Sadly for Tyson Foods, its EPS declined by 16.2% annually over the last three years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

In Q4, Tyson Foods reported adjusted EPS of $0.97, down from $1.14 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 3.1%. Over the next 12 months, Wall Street expects Tyson Foods’s full-year EPS of $3.95 to grow 2.9%.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

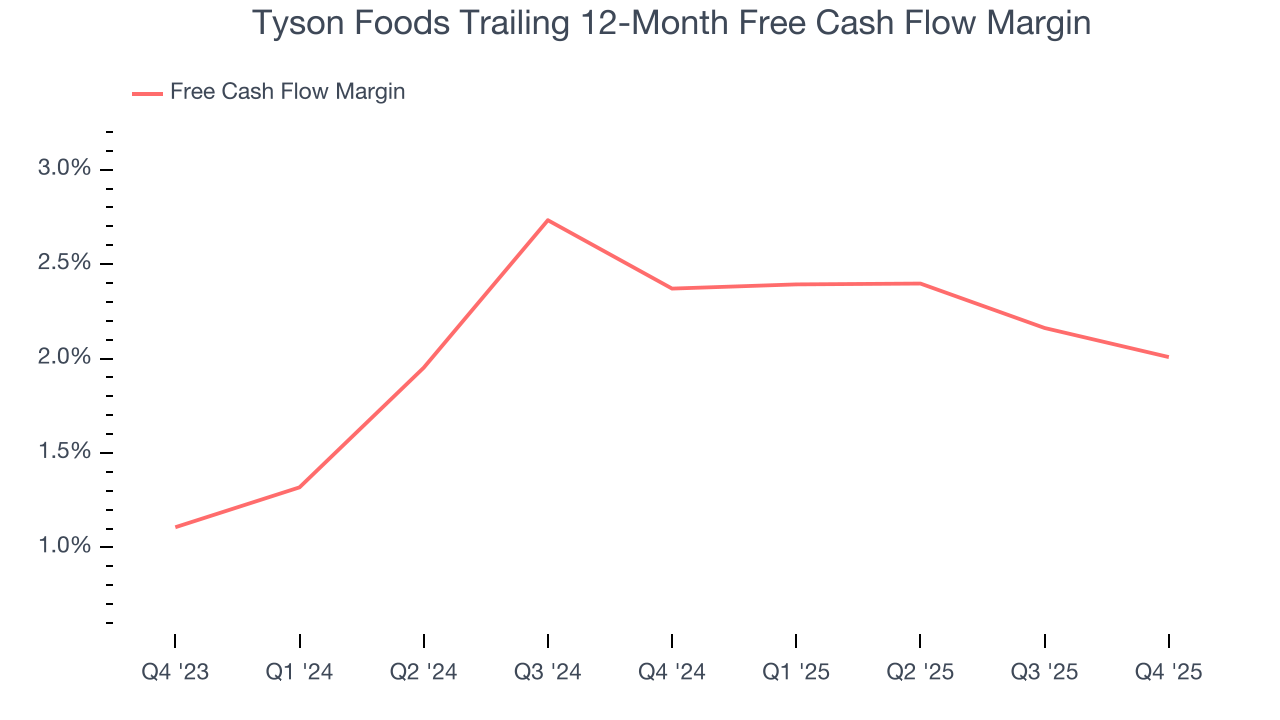

Tyson Foods has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.2%, subpar for a consumer staples business.

Tyson Foods’s free cash flow clocked in at $690 million in Q4, equivalent to a 4.8% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

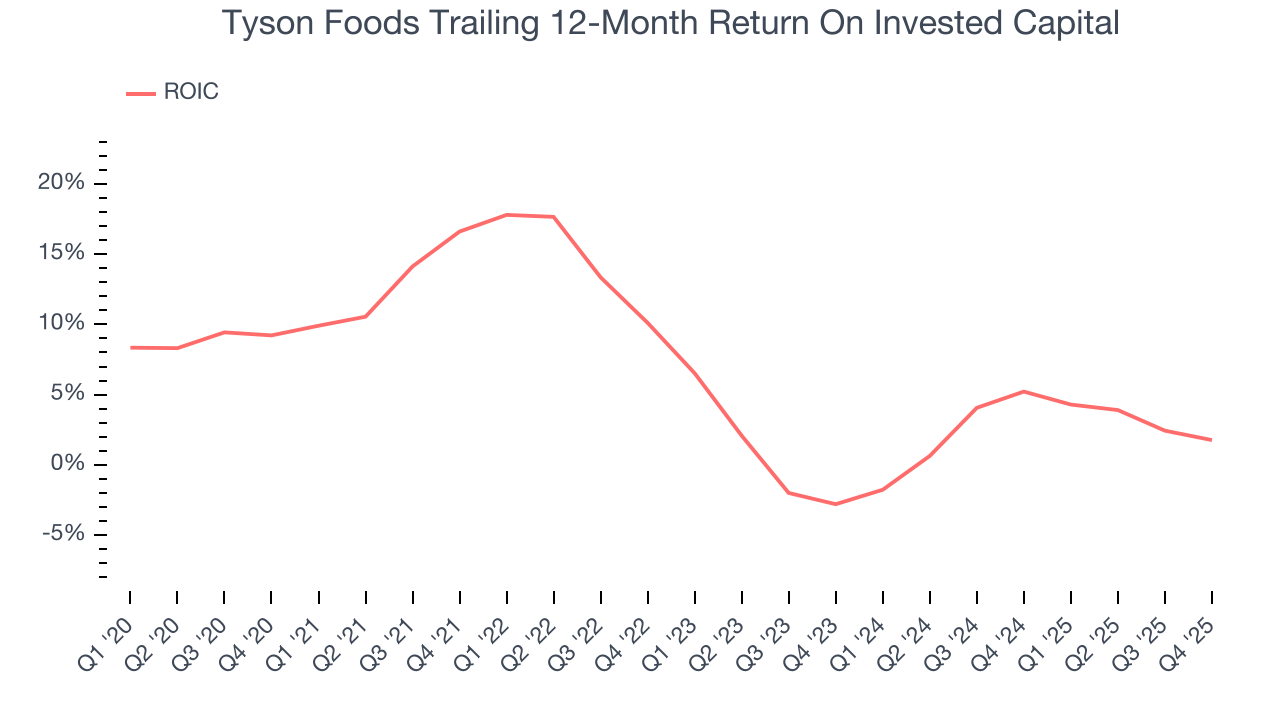

Tyson Foods historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.2%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

12. Balance Sheet Assessment

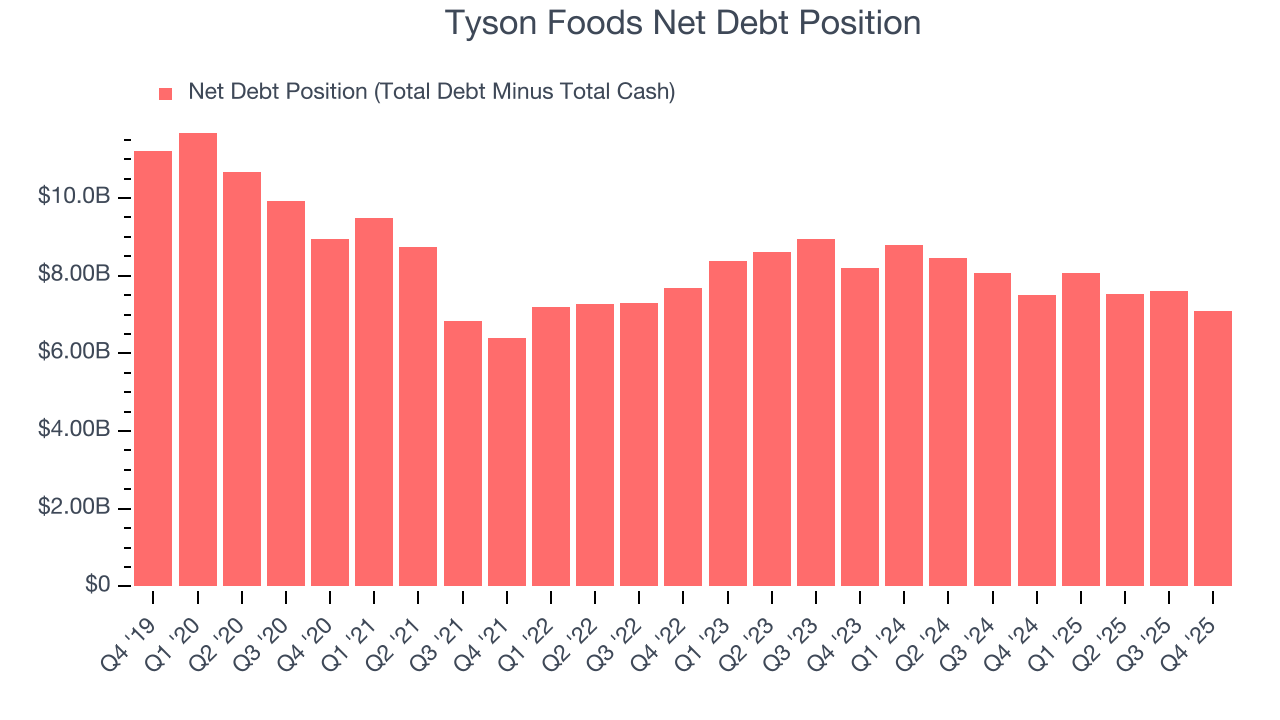

Tyson Foods reported $1.28 billion of cash and $8.36 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.52 billion of EBITDA over the last 12 months, we view Tyson Foods’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $190 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Tyson Foods’s Q4 Results

It was encouraging to see Tyson Foods beat analysts’ revenue expectations this quarter. We were also happy its EBITDA narrowly outperformed Wall Street’s estimates. On the other hand, its gross margin missed. Overall, this print had some key positives. The stock traded up 3.9% to $67.87 immediately after reporting.

14. Is Now The Time To Buy Tyson Foods?

Updated: February 2, 2026 at 7:11 AM EST

Before making an investment decision, investors should account for Tyson Foods’s business fundamentals and valuation in addition to what happened in the latest quarter.

Tyson Foods doesn’t pass our quality test. To begin with, its revenue growth was weak over the last three years, and analysts don’t see anything changing over the next 12 months. And while its unparalleled brand awareness makes it a household name consumers consistently turn to, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its gross margins make it more challenging to reach positive operating profits compared to other consumer staples businesses.

Tyson Foods’s P/E ratio based on the next 12 months is 16.1x. This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $65.17 on the company (compared to the current share price of $67.87), implying they don’t see much short-term potential in Tyson Foods.