Textron (TXT)

We’re skeptical of Textron. Its growth has been lacking and its free cash flow margin has caved, suggesting it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why We Think Textron Will Underperform

Listed on the NYSE in 1947, Textron (NYSE:TXT) provides products and services in the aerospace, defense, industrial, and finance sectors.

- Absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

- Large revenue base makes it harder to increase sales quickly, and its annual revenue growth of 3.4% over the last five years was below our standards for the industrials sector

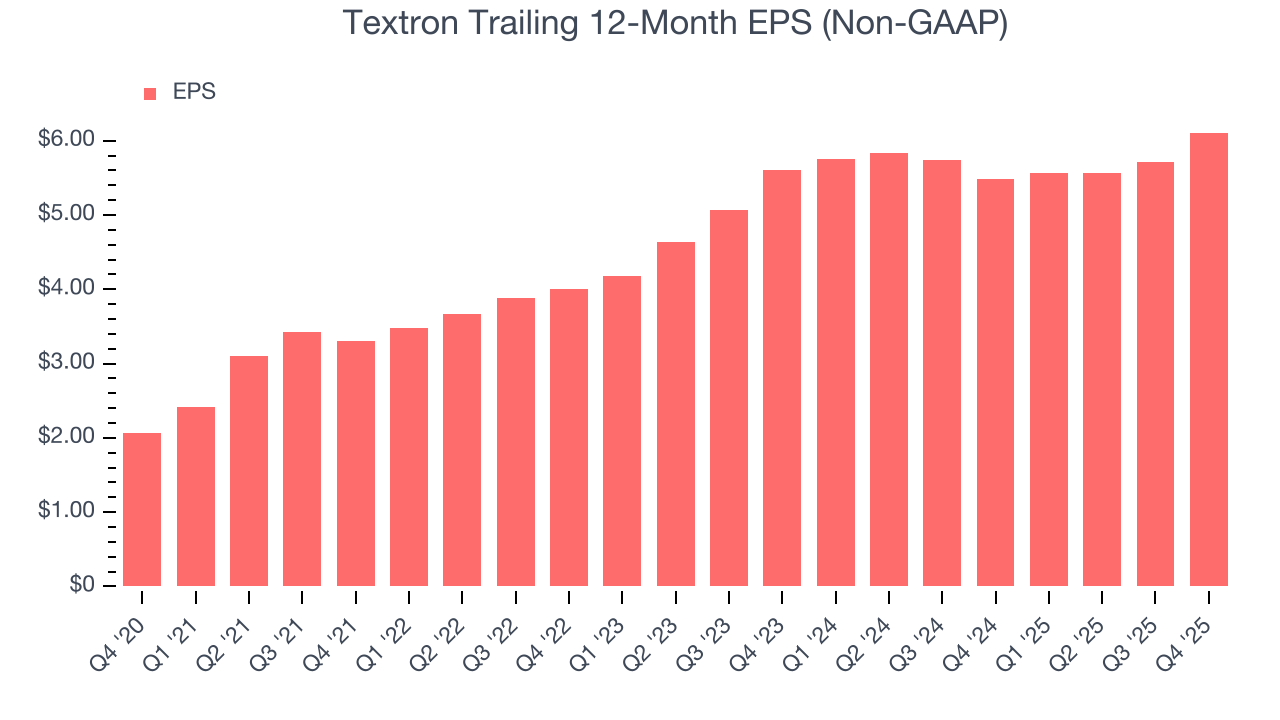

- On the bright side, its earnings per share have outperformed its peers over the last five years, increasing by 22% annually

Textron doesn’t meet our quality standards. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than Textron

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Textron

Textron is trading at $94.63 per share, or 14.3x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Textron (TXT) Research Report: Q4 CY2025 Update

Aerospace and defense company Textron (NYSE:TXT) announced better-than-expected revenue in Q4 CY2025, with sales up 15.6% year on year to $4.18 billion. The company expects the full year’s revenue to be around $15.5 billion, close to analysts’ estimates. Its non-GAAP profit of $1.73 per share was 1.5% above analysts’ consensus estimates.

Textron (TXT) Q4 CY2025 Highlights:

- Revenue: $4.18 billion vs analyst estimates of $4.08 billion (15.6% year-on-year growth, 2.3% beat)

- Adjusted EPS: $1.73 vs analyst estimates of $1.70 (1.5% beat)

- Adjusted EBITDA: $492 million vs analyst estimates of $497.5 million (11.8% margin, 1.1% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $6.50 at the midpoint, missing analyst estimates by 4.9%

- Operating Margin: 9.1%, in line with the same quarter last year

- Free Cash Flow Margin: 12.6%, up from 8.2% in the same quarter last year

- Market Capitalization: $16.61 billion

Company Overview

Listed on the NYSE in 1947, Textron (NYSE:TXT) provides products and services in the aerospace, defense, industrial, and finance sectors.

Textron began its journey in 1923 as a small textile company named Special Yarns Corporation. The company rebranded as Textron in 1956 to reflect its diversification beyond textiles into various industries. Over the years, Textron evolved into a multi-industry company through strategic acquisitions, notably including the purchase of Bell Aircraft Corporation in 1960, which marked its entrance into the aerospace sector.

In the following decades, Textron continued to expand its aerospace capabilities and diversified its holdings by acquiring companies like Cessna Aircraft Company in 1992, further strengthening its position in general aviation. The company also ventured into the defense sector with acquisitions that broadened its product offerings to include unmanned aircraft systems, armored vehicles, and marine craft.

Today, Textron's wide range of products includes aircraft and defense solutions. They build everything from business jets, like the Cessna Citation, to military trainers such as the Beechcraft T-6, serving both private and government needs. Textron also makes advanced helicopters like the V-22 Osprey, which combines the features of helicopters and airplanes for military use, and the Bell 429, used in police work and emergency medical services. In defense, Textron Systems provides everything from drones, such as the Shadow Tactical UAS, to armored vehicles, helping with various security operations. Additionally, through its Kautex subsidiary, Textron manufactures automotive parts like fuel-efficient systems and safety features for cars, enhancing both performance and safety.

Textron generates its revenue through the sale of its diverse products and services across aviation, defense, and industrial sectors, catering to both domestic and international clients including government contracts and commercial entities. Its revenue sources include both direct sales as well as large, multi-year government contracts.

To further enhance its revenue, Textron provides extensive aftermarket services. These services include supplying replacement parts, and offering maintenance, repair, and overhaul services for aviation and rotorcraft products. The company also offers training and support services, including pilot and maintenance training. Additionally, Textron offers retrofitting and modernization services for defense and industrial products, allowing for lifecycle extension and enhancement of existing equipment. This comprehensive approach to aftermarket services helps to secure ongoing customer engagement and also bolsters recurrent revenue, making it a vital aspect of Textron’s business model.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Textron’s peers and competitors include Boeing (NYSE:BA), Raytheon (NYSE:RTX), and General Dynamics (NYSE:GD)

5. Revenue Growth

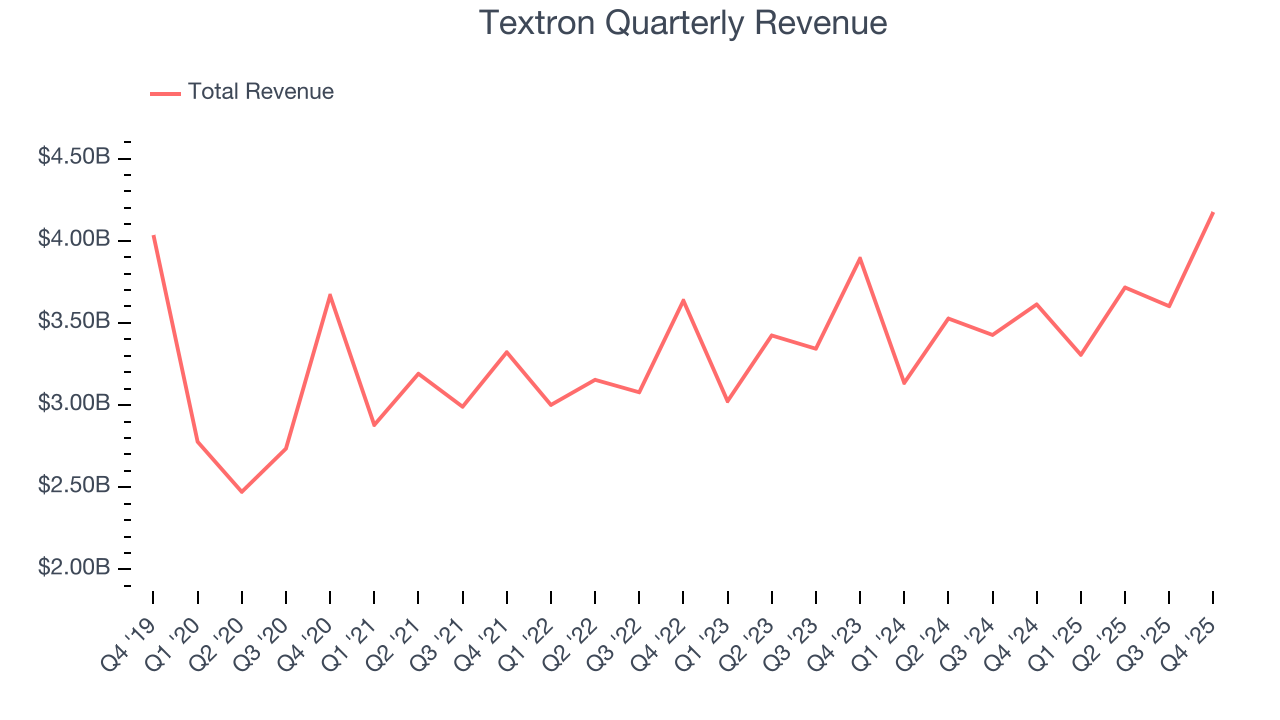

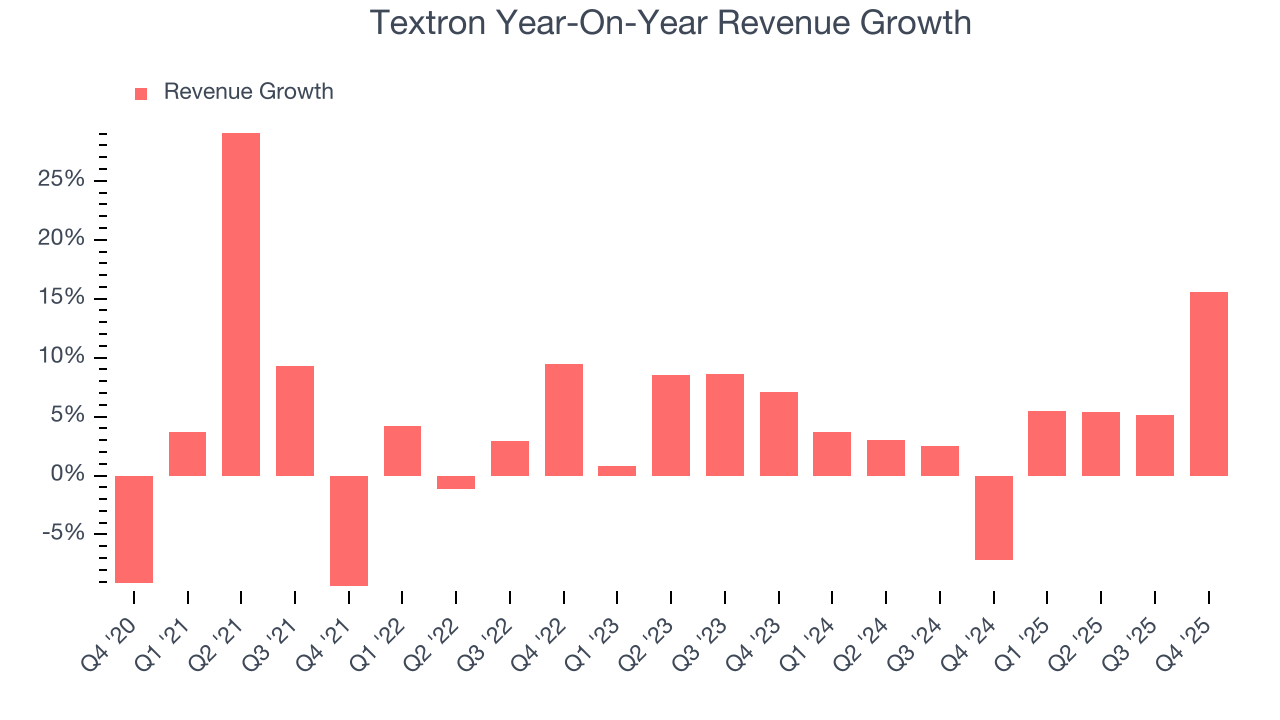

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Textron’s sales grew at a tepid 4.9% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Textron’s annualized revenue growth of 4% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Textron reported year-on-year revenue growth of 15.6%, and its $4.18 billion of revenue exceeded Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not catalyze better top-line performance yet.

6. Operating Margin

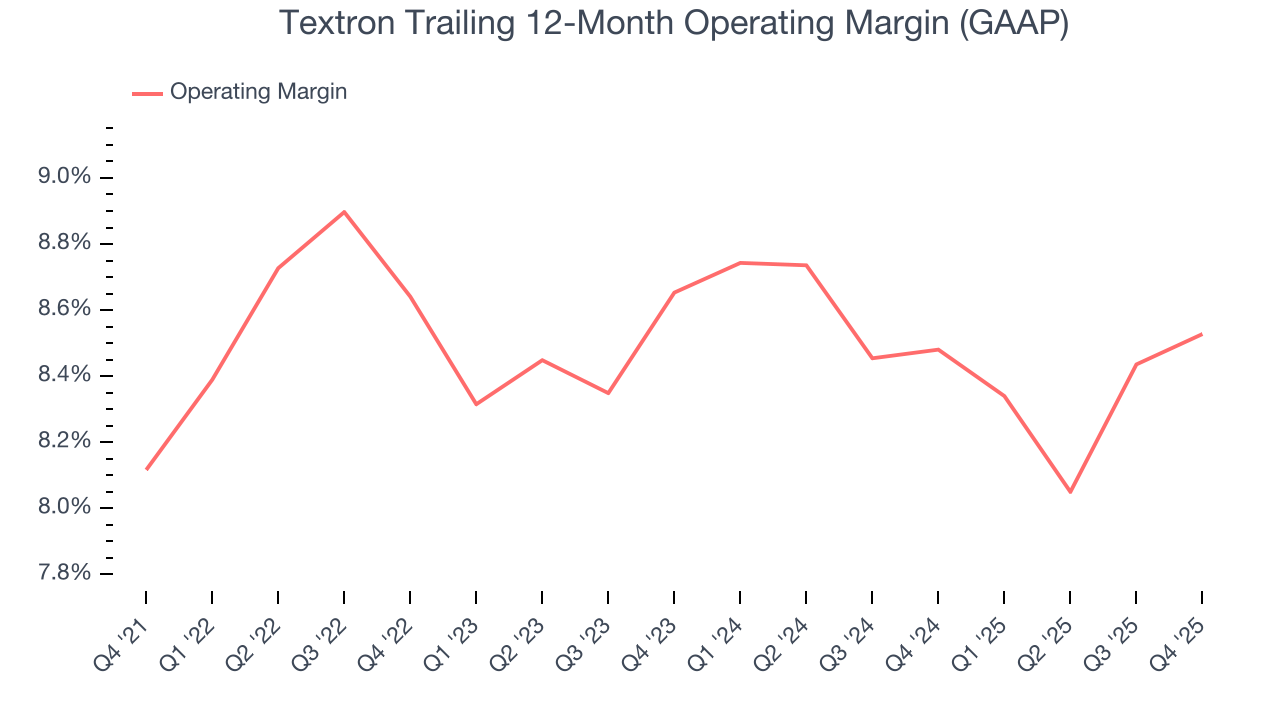

Textron’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 8.5% over the last five years. This profitability was higher than the broader industrials sector, showing it did a decent job managing its expenses.

Analyzing the trend in its profitability, Textron’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Textron generated an operating margin profit margin of 9.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Textron’s EPS grew at an astounding 24.2% compounded annual growth rate over the last five years, higher than its 4.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

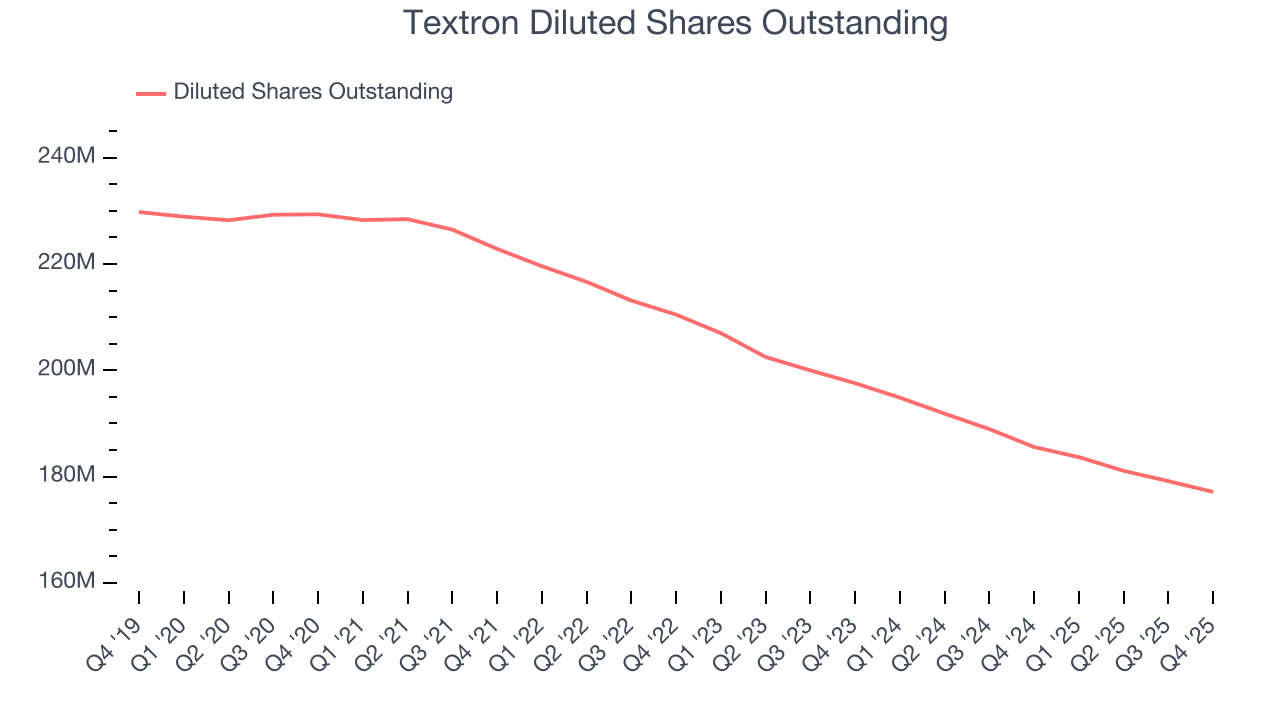

We can take a deeper look into Textron’s earnings quality to better understand the drivers of its performance. A five-year view shows that Textron has repurchased its stock, shrinking its share count by 22.8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Textron, its two-year annual EPS growth of 4.5% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Textron reported adjusted EPS of $1.73, up from $1.34 in the same quarter last year. This print beat analysts’ estimates by 1.5%. Over the next 12 months, Wall Street expects Textron’s full-year EPS of $6.11 to grow 12.8%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

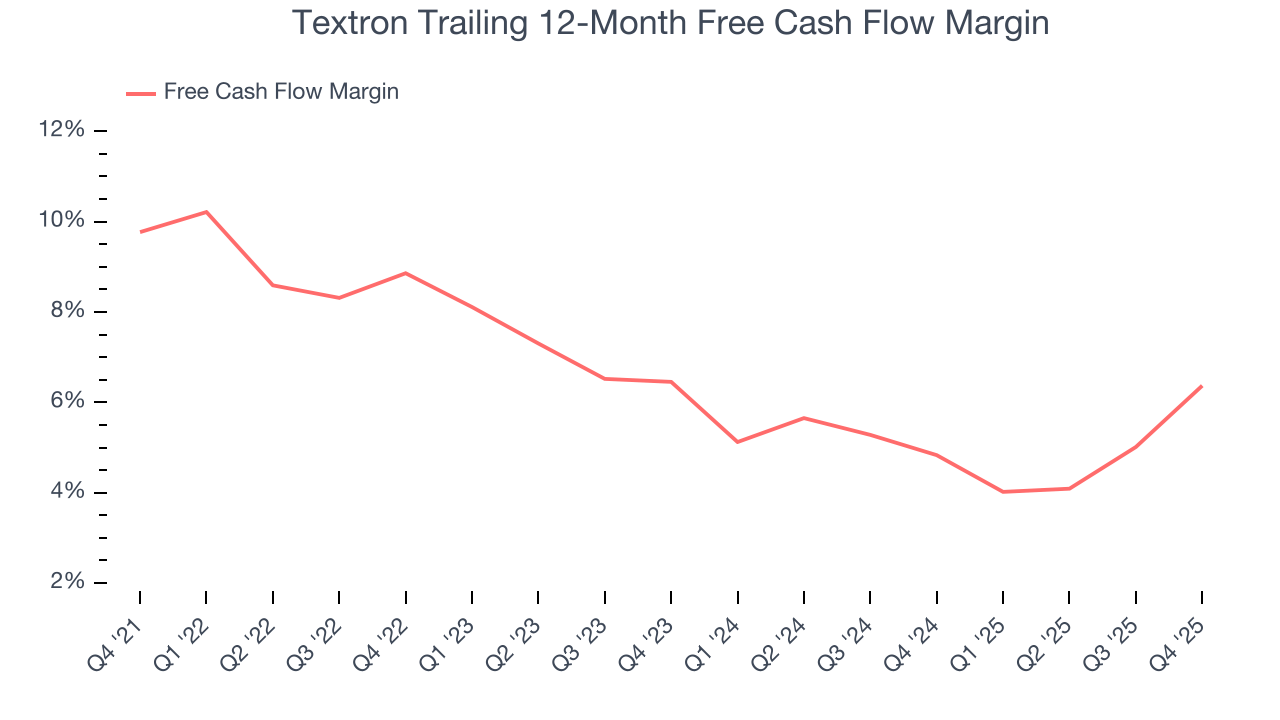

Textron has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.2% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Textron’s margin dropped by 3.4 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Textron’s free cash flow clocked in at $527 million in Q4, equivalent to a 12.6% margin. This result was good as its margin was 4.4 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

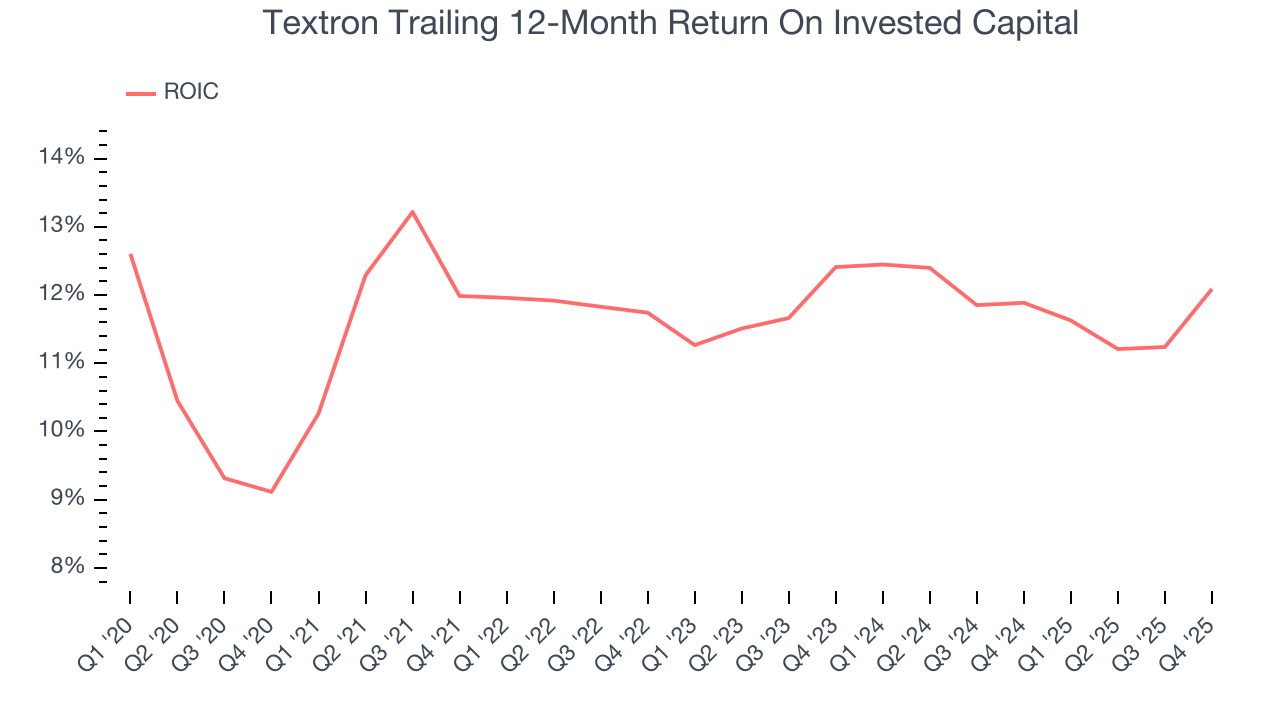

Although Textron hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked. Its five-year average ROIC was 12%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Textron’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

10. Balance Sheet Assessment

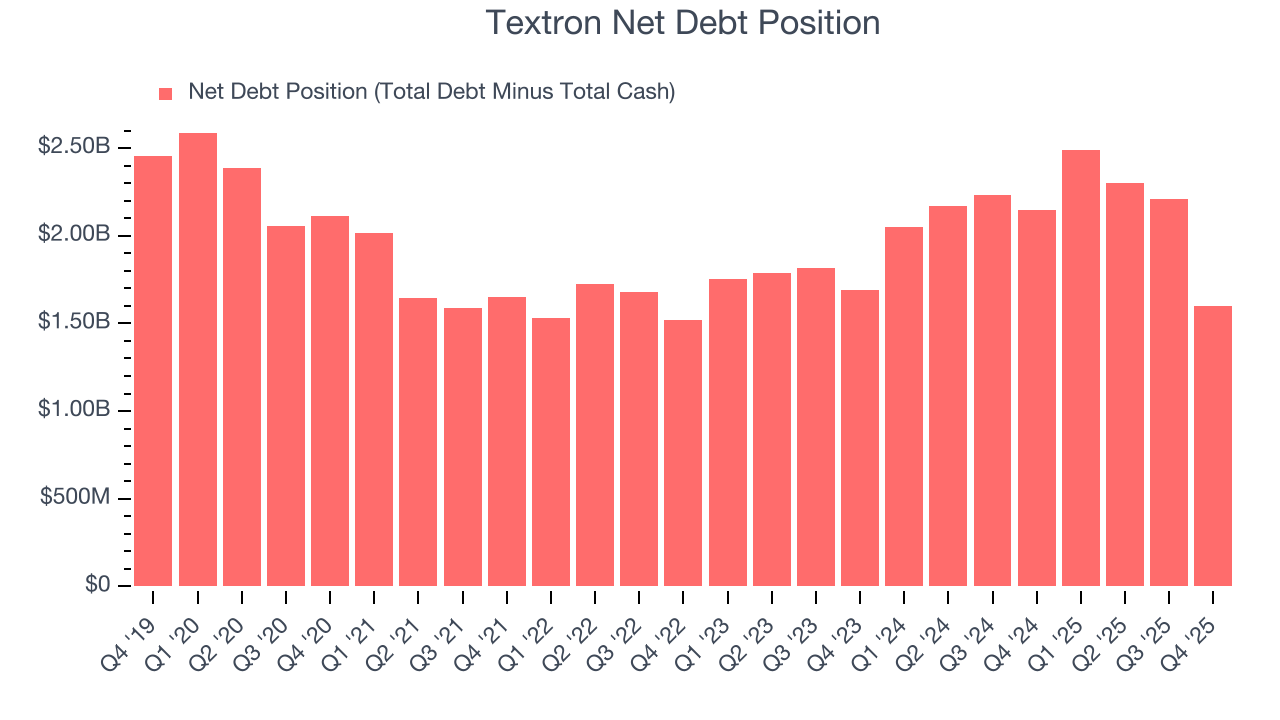

Textron reported $1.94 billion of cash and $3.54 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.83 billion of EBITDA over the last 12 months, we view Textron’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $108 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Textron’s Q4 Results

We enjoyed seeing Textron beat analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance missed and its EBITDA fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 4% to $90.50 immediately after reporting.

12. Is Now The Time To Buy Textron?

Updated: January 28, 2026 at 6:48 AM EST

Are you wondering whether to buy Textron or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Textron isn’t a terrible business, but it doesn’t pass our bar. For starters, its revenue growth was uninspiring over the last five years, and analysts don’t see anything changing over the next 12 months. And while its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its organic revenue growth has disappointed. On top of that, its cash profitability fell over the last five years.

Textron’s P/E ratio based on the next 12 months is 13.7x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $98.41 on the company (compared to the current share price of $90.50).