Universal Health Services (UHS)

Universal Health Services piques our interest. Its rising free cash flow margin gives it more chips to play with.― StockStory Analyst Team

1. News

2. Summary

Why Universal Health Services Is Interesting

With a network spanning 39 states and three countries, Universal Health Services (NYSE:UHS) operates acute care hospitals and behavioral health facilities across the United States, United Kingdom, and Puerto Rico.

- Additional sales over the last five years increased its profitability as the 15% annual growth in its earnings per share outpaced its revenue

- Revenue base of $16.99 billion gives it economies of scale and some negotiating power

- One pitfall is its lagging comparable store sales over the past two years suggest it might have to change its pricing and marketing strategy to stimulate demand

Universal Health Services has some noteworthy aspects. If you like the company, the price looks reasonable.

Why Is Now The Time To Buy Universal Health Services?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Universal Health Services?

At $206.23 per share, Universal Health Services trades at 8.9x forward P/E. Price is what you pay, and value is what you get. With this in mind, we think the current price is quite attractive.

It could be a good time to invest if you see something the market doesn’t.

3. Universal Health Services (UHS) Research Report: Q3 CY2025 Update

Hospital management company Universal Health Services (NYSE:UHS) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 13.4% year on year to $4.50 billion. The company’s full-year revenue guidance of $17.38 billion at the midpoint came in 0.8% above analysts’ estimates. Its non-GAAP profit of $5.69 per share was 15.4% above analysts’ consensus estimates.

Universal Health Services (UHS) Q3 CY2025 Highlights:

- Revenue: $4.50 billion vs analyst estimates of $4.37 billion (13.4% year-on-year growth, 2.8% beat)

- Adjusted EPS: $5.69 vs analyst estimates of $4.93 (15.4% beat)

- Adjusted EBITDA: $670.6 million vs analyst estimates of $611.5 million (14.9% margin, 9.7% beat)

- The company slightly lifted its revenue guidance for the full year to $17.38 billion at the midpoint from $17.2 billion

- Management raised its full-year Adjusted EPS guidance to $21.80 at the midpoint, a 9% increase

- EBITDA guidance for the full year is $2.59 billion at the midpoint, above analyst estimates of $2.54 billion

- Operating Margin: 11.6%, up from 9.7% in the same quarter last year

- Free Cash Flow Margin: 13.6%, up from 2.1% in the same quarter last year

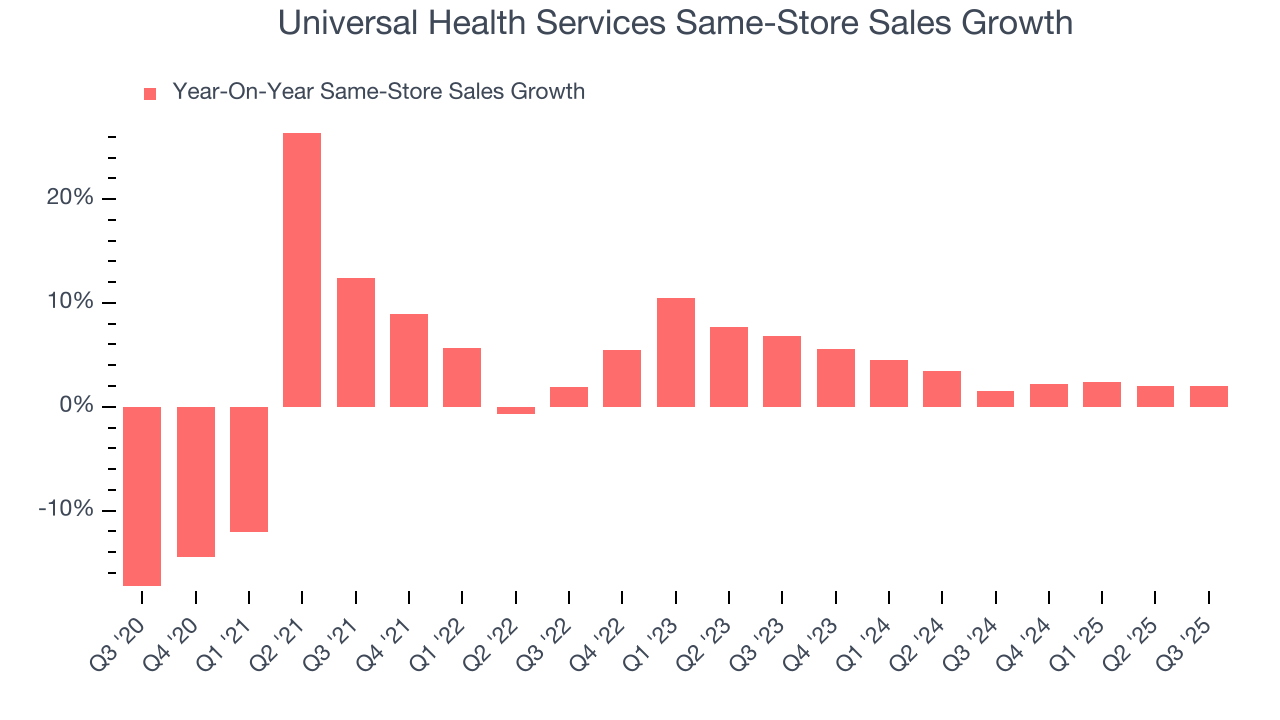

- Same-Store Sales rose 2% year on year, in line with the same quarter last year

- Market Capitalization: $13.41 billion

Company Overview

With a network spanning 39 states and three countries, Universal Health Services (NYSE:UHS) operates acute care hospitals and behavioral health facilities across the United States, United Kingdom, and Puerto Rico.

The company's healthcare operations are divided into two main segments. The acute care division includes inpatient hospitals, free-standing emergency departments, outpatient centers, and surgical hospitals. These facilities provide a range of medical services including general and specialty surgery, internal medicine, obstetrics, emergency care, radiology, oncology, and pharmacy services.

The behavioral health division, which generates about 43% of the company's revenue, encompasses inpatient and outpatient mental health facilities. This segment addresses various psychiatric and substance abuse disorders, offering specialized treatment programs for different patient populations.

A patient experiencing a mental health crisis might be admitted to one of UHS's behavioral health facilities, where they would receive a personalized treatment plan that could include therapy, medication management, and specialized care from mental health professionals. Similarly, someone requiring emergency surgery might be treated at a UHS acute care hospital, benefiting from the facility's surgical expertise and comprehensive post-operative care.

UHS generates revenue primarily through payments from commercial health insurers, Medicare, Medicaid, and self-paying patients. The company provides not just medical services but also management expertise to its facilities, including centralized purchasing, information technology systems, financial controls, physician recruitment, and marketing.

Beyond simply operating existing facilities, UHS pursues strategic growth through acquisitions and new construction. The company maintains quality standards through accreditation by The Joint Commission, and its facilities are certified as Medicare and Medicaid providers. UHS must comply with numerous healthcare regulations, including the Emergency Medical Treatment and Active Labor Act, which requires hospitals to provide emergency care regardless of a patient's ability to pay.

4. Hospital Chains

Hospital chains operate scale-driven businesses that rely on patient volumes, efficient operations, and favorable payer contracts to drive revenue and profitability. These organizations benefit from the essential nature of their services, which ensures consistent demand, particularly as populations age and chronic diseases become more prevalent. However, profitability can be pressured by rising labor costs, regulatory requirements, and the challenges of balancing care quality with cost efficiency. Dependence on government and private insurance reimbursements also introduces financial uncertainty. Looking ahead, hospital chains stand to benefit from tailwinds such as increasing healthcare utilization driven by an aging population that generally has higher incidents of disease. AI can also be a tailwind in areas such as predictive analytics for more personalized treatment and efficiency (intake, staffing, resourcing allocation). However, the sector faces potential headwinds such as labor shortages that could push up wages as well as substantial investments needs for digital infrastructure to support telehealth and electronic health records. Regulatory scrutiny, and reimbursement cuts are also looming topics that could further strain margins.

Universal Health Services competes with other major healthcare facility operators including HCA Healthcare (NYSE:HCA), Tenet Healthcare (NYSE:THC), Community Health Systems (NYSE:CYH), and Acadia Healthcare (NASDAQ:ACHC).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $16.99 billion in revenue over the past 12 months, Universal Health Services has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

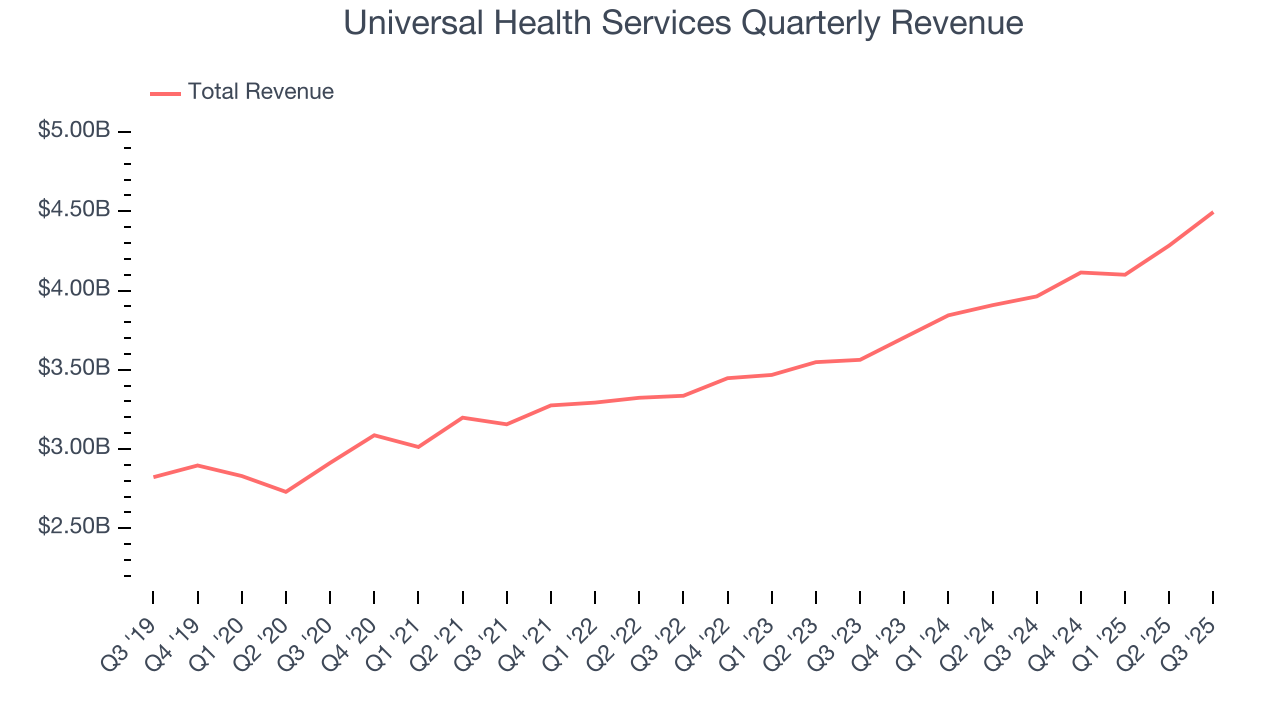

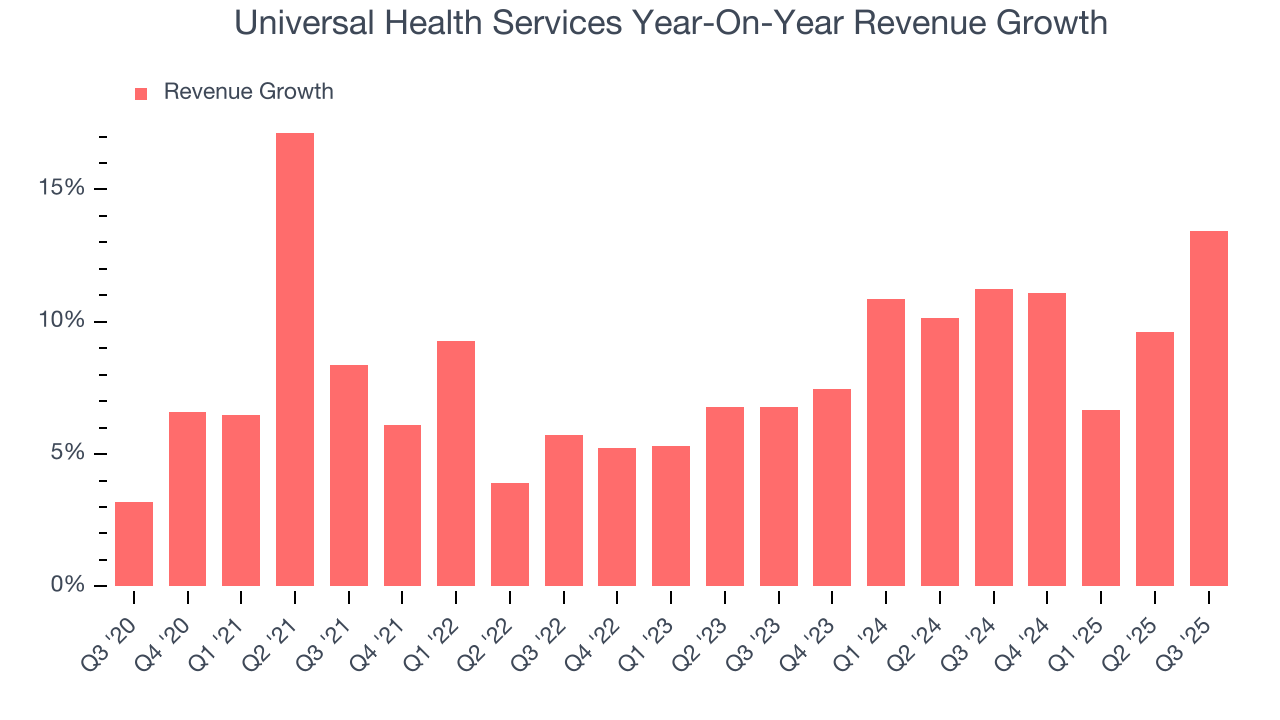

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Universal Health Services’s sales grew at a decent 8.4% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Universal Health Services’s annualized revenue growth of 10.1% over the last two years is above its five-year trend, suggesting some bright spots.

We can better understand the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Universal Health Services’s same-store sales averaged 3% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Universal Health Services reported year-on-year revenue growth of 13.4%, and its $4.50 billion of revenue exceeded Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and indicates the market sees success for its products and services.

7. Operating Margin

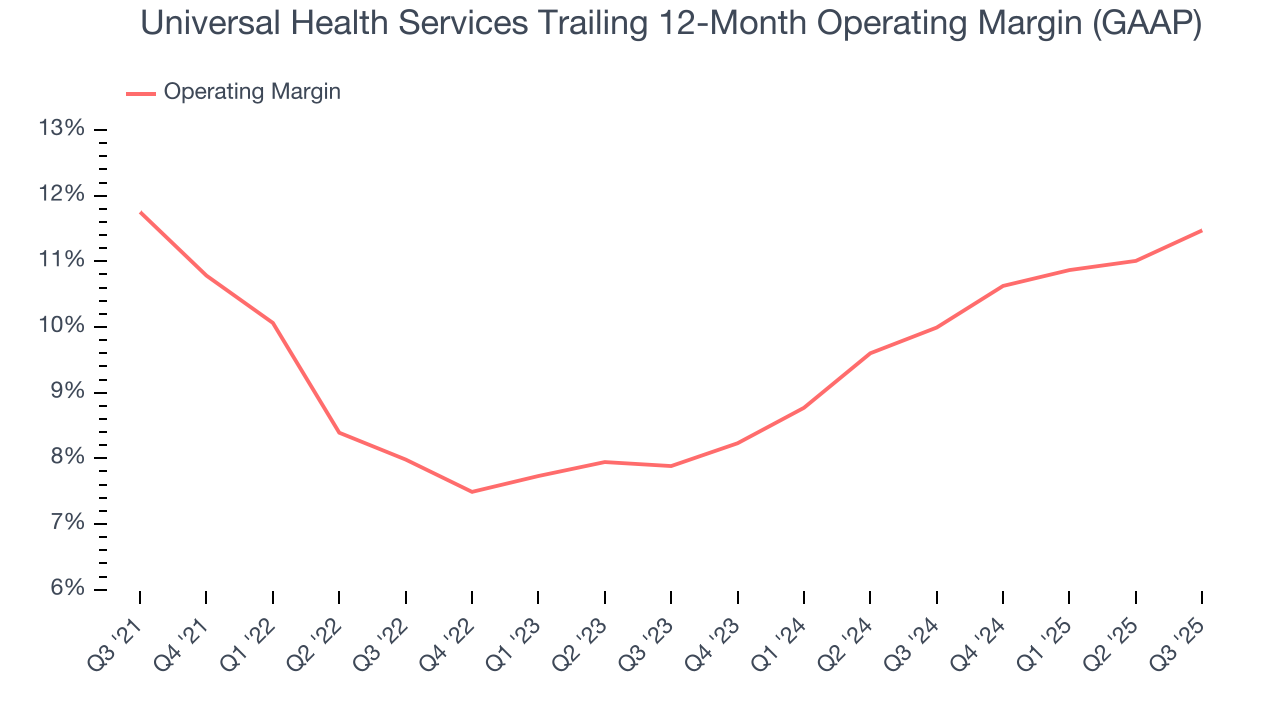

Universal Health Services’s operating margin has risen over the last 12 months and averaged 9.9% over the last five years. Although its profitability is still mediocre, we can see its decent revenue growth is giving it operating leverage as it scales. This gives it a shot at higher long-term profits if it can keep expanding.

Looking at the trend in its profitability, Universal Health Services’s operating margin of 11.5% for the trailing 12 months may be around the same as five years ago, but it has increased by 3.6 percentage points over the last two years. This dynamic unfolded because its sales growth gave it operating leverage and shows it has some momentum on its side.

In Q3, Universal Health Services generated an operating margin profit margin of 11.6%, up 1.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

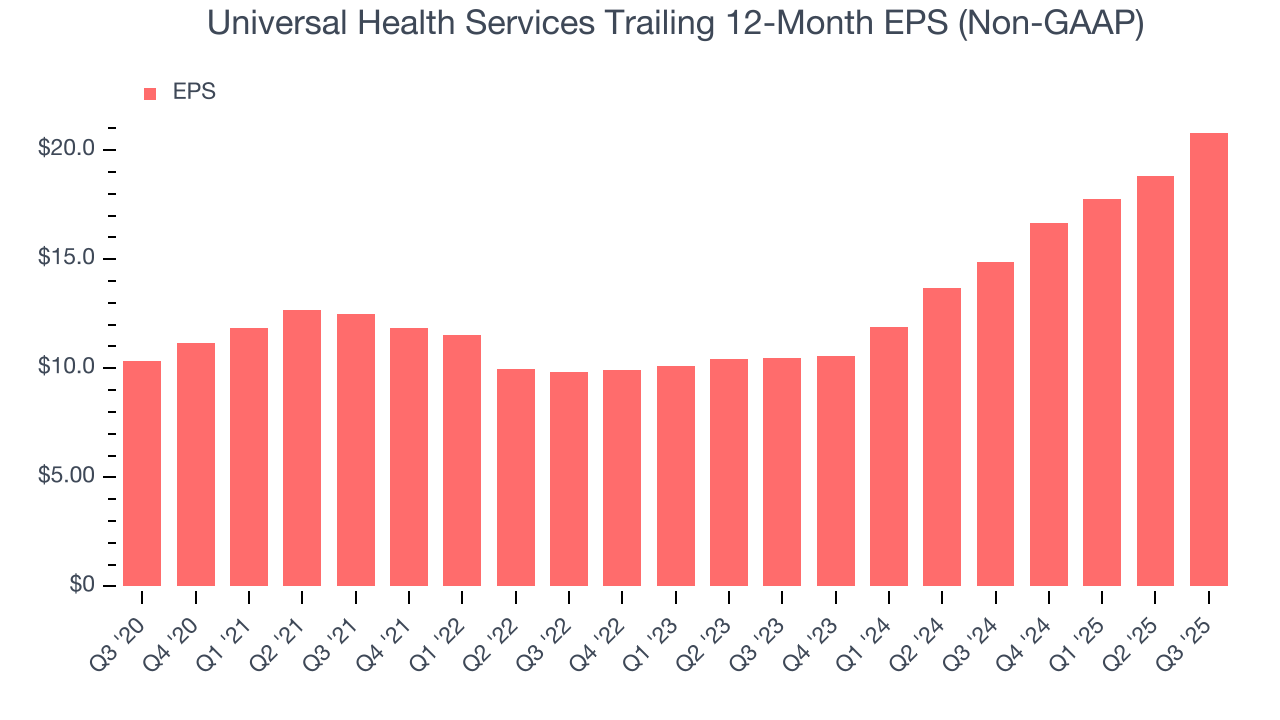

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

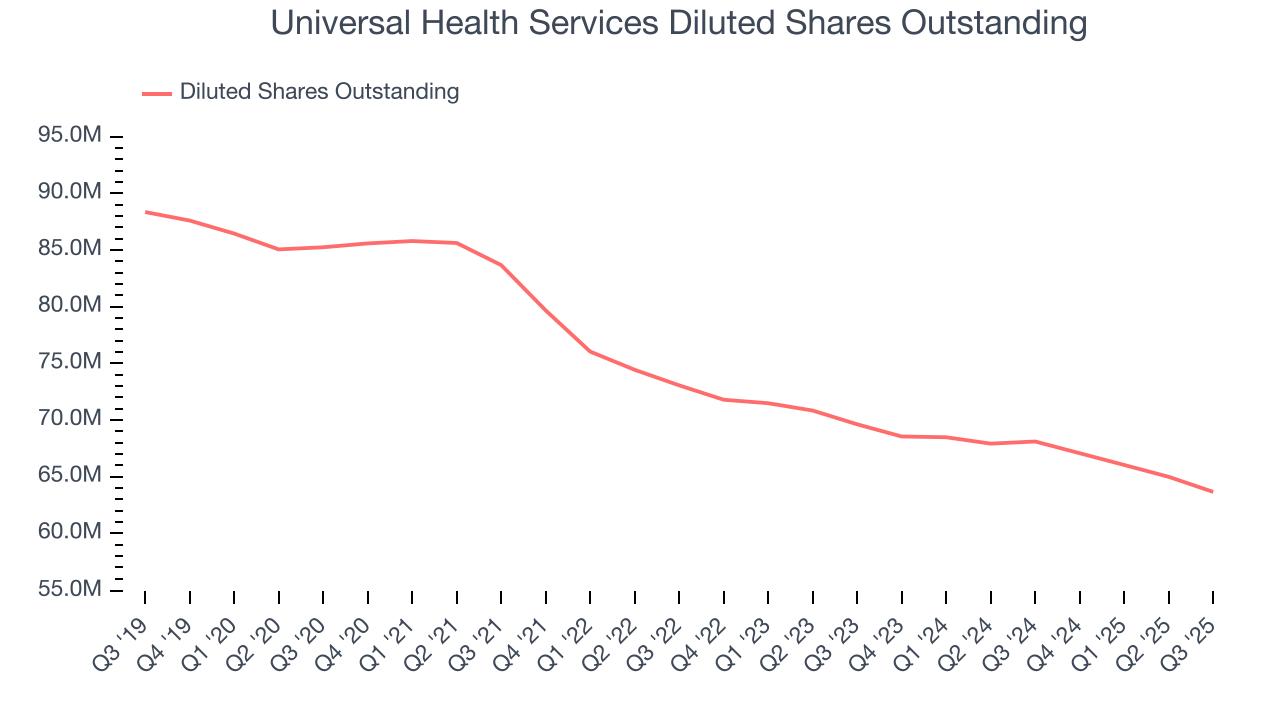

Universal Health Services’s EPS grew at a spectacular 15% compounded annual growth rate over the last five years, higher than its 8.4% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

We can take a deeper look into Universal Health Services’s earnings to better understand the drivers of its performance. A five-year view shows that Universal Health Services has repurchased its stock, shrinking its share count by 25.3%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Universal Health Services reported adjusted EPS of $5.69, up from $3.71 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Universal Health Services’s full-year EPS of $20.80 to grow 4.7%.

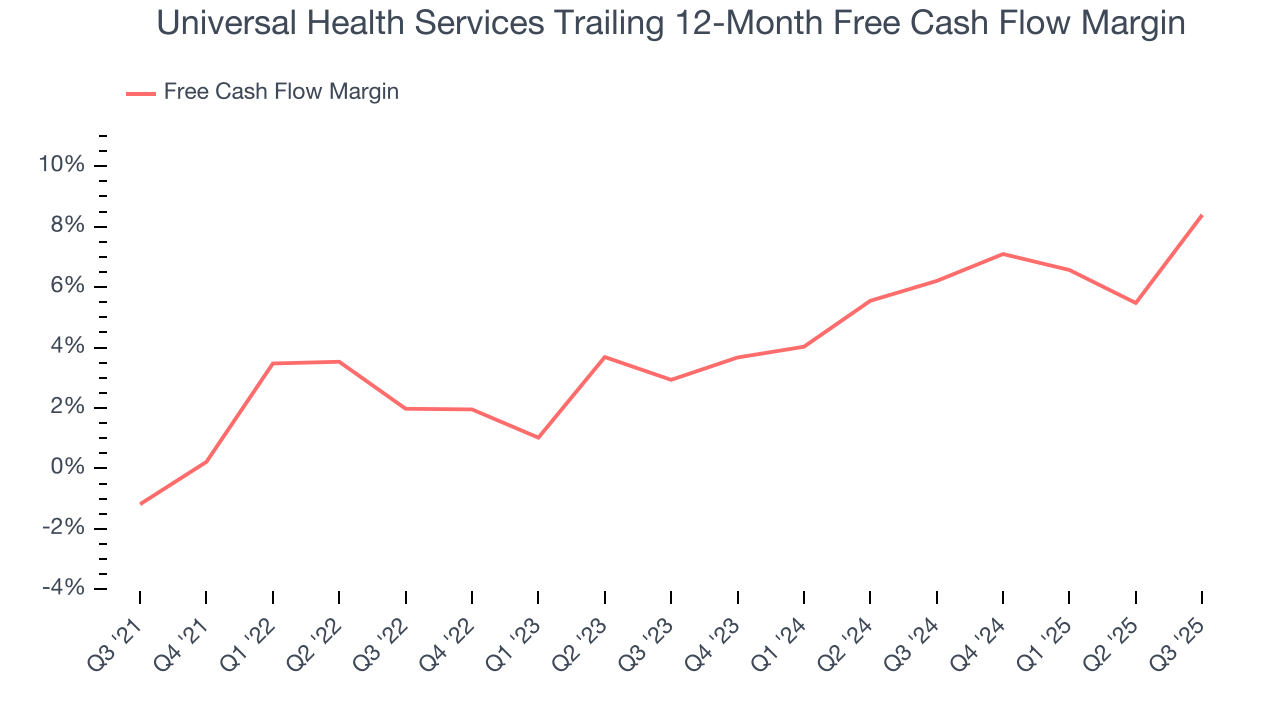

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Universal Health Services has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4%, subpar for a healthcare business.

Taking a step back, an encouraging sign is that Universal Health Services’s margin expanded by 9.6 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Universal Health Services’s free cash flow clocked in at $609.6 million in Q3, equivalent to a 13.6% margin. This result was good as its margin was 11.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

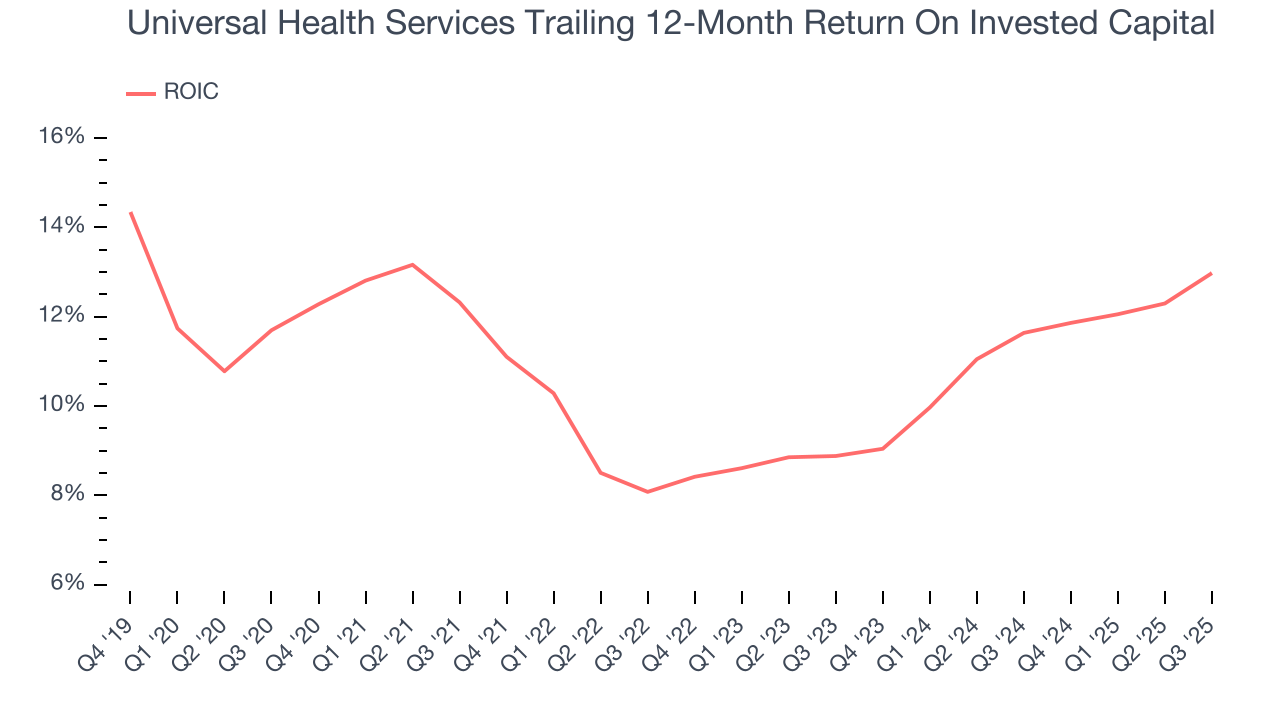

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Universal Health Services’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 10.8%, slightly better than typical healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Universal Health Services’s ROIC increased by 2.1 percentage points annually over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

11. Balance Sheet Assessment

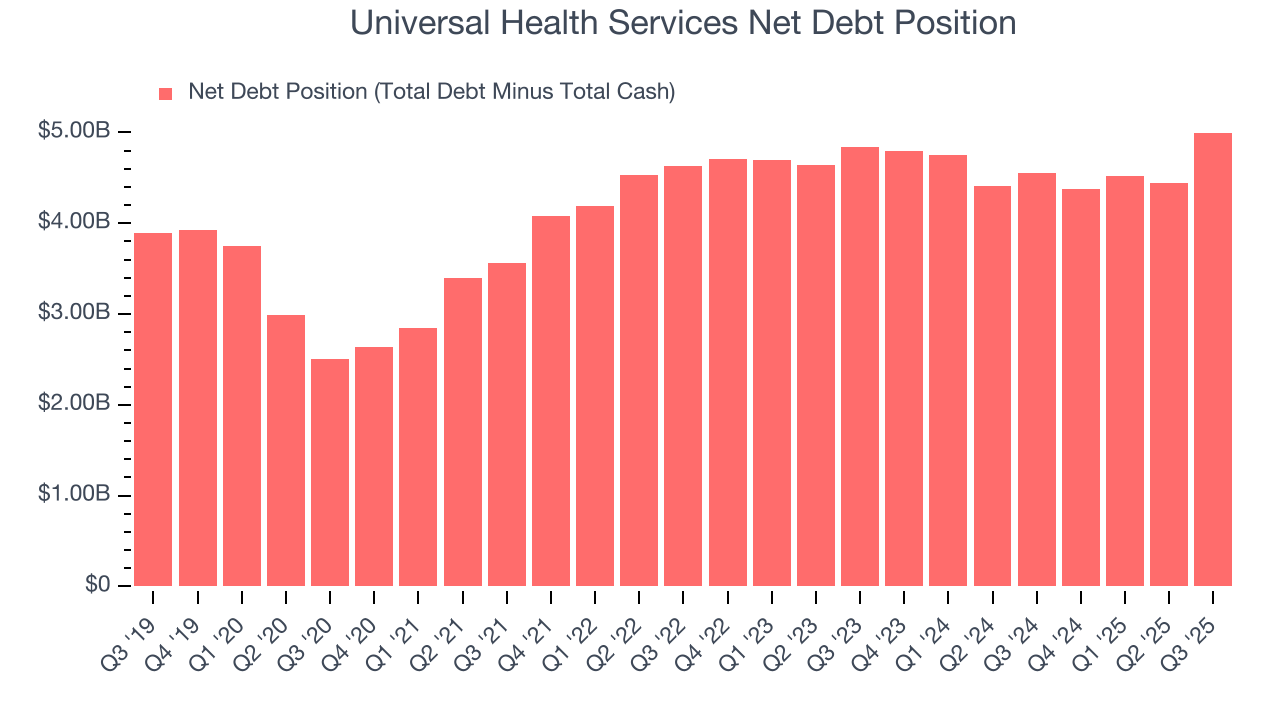

Universal Health Services reported $112.9 million of cash and $5.11 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.55 billion of EBITDA over the last 12 months, we view Universal Health Services’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $75.27 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Universal Health Services’s Q3 Results

We enjoyed seeing Universal Health Services beat analysts’ full-year EPS guidance expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its same-store sales slightly missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 6.4% to $227.80 immediately after reporting.

13. Is Now The Time To Buy Universal Health Services?

Updated: January 23, 2026 at 10:52 PM EST

Are you wondering whether to buy Universal Health Services or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Universal Health Services possesses a number of positive attributes. First off, its revenue growth was decent over the last five years. And while its same-store sales growth has disappointed, its rising cash profitability gives it more optionality. On top of that, its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders.

Universal Health Services’s P/E ratio based on the next 12 months is 8.9x. Looking at the healthcare landscape right now, Universal Health Services trades at a pretty interesting price. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $250.35 on the company (compared to the current share price of $206.23), implying they see 21.4% upside in buying Universal Health Services in the short term.