United Parcel Service (UPS)

United Parcel Service keeps us up at night. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think United Parcel Service Will Underperform

Trademarking its recognizable UPS Brown color, UPS (NYSE:UPS) offers package delivery, supply chain management, and freight forwarding services.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 1.9% annually over the last two years

- Earnings per share were flat over the last five years while its revenue grew, showing its incremental sales were less profitable

- Sales are projected to tank by 2.4% over the next 12 months as its demand continues evaporating

United Parcel Service falls below our quality standards. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than United Parcel Service

High Quality

Investable

Underperform

Why There Are Better Opportunities Than United Parcel Service

United Parcel Service is trading at $109.18 per share, or 15.8x forward P/E. This multiple is lower than most industrials companies, but for good reason.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. United Parcel Service (UPS) Research Report: Q3 CY2025 Update

Parcel delivery company UPS (NYSE:UPS) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 3.8% year on year to $21.4 billion. The company expects next quarter’s revenue to be around $24 billion, close to analysts’ estimates. Its non-GAAP profit of $1.74 per share was 33% above analysts’ consensus estimates.

United Parcel Service (UPS) Q3 CY2025 Highlights:

- Revenue: $21.4 billion vs analyst estimates of $20.89 billion (3.8% year-on-year decline, 2.4% beat)

- Adjusted EPS: $1.74 vs analyst estimates of $1.31 (33% beat)

- Revenue Guidance for Q4 CY2025 is $24 billion at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 8.4%, in line with the same quarter last year

- Market Capitalization: $75.62 billion

Company Overview

Trademarking its recognizable UPS Brown color, UPS (NYSE:UPS) offers package delivery, supply chain management, and freight forwarding services.

UPS was founded in 1907 as a private messenger and delivery service. It was originally named the American Messenger Company, and it started by delivering packages, notes, and luggage by bicycle. Over the decades, UPS grew by acquiring complementary companies like Roadie (enhanced its same-day delivery services) and Cemelog (provided UPS with expertise in handling and transporting sensitive products).

Today, the company provides domestic and international package services through a single pickup and delivery network. This network includes its retail locations, where customers can send and receive packages, and a fleet of trucks and aircraft that fulfill orders. Beyond delivering everyday goods, UPS also handles critical healthcare shipments and manages supply chains for manufacturing companies.

To help customers send, manage, and track shipments, UPS utilizes visibility and billing technologies such as the Digital Access Program which integrates UPS shipping solutions directly into e-commerce platforms, an area of growth. To broaden its e-commerce offerings, UPS acquired Happy Returns in 2023, a technology-focused company that was folded into its Supply Chain Solutions segment.

UPS generates revenue through its package deliveries, freight services, and supply chain services. These offerings provide a mix of transactional (one-time shipments) and contractual revenue streams. On the contractual side, UPS has agreements with businesses that include scheduled pickups and volume-based pricing. The company offers different price points depending on the size and speed of its deliveries.

4. Air Freight and Logistics

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Competitors offering similar products include FedEx (NYSE:FDX), GXO (NYSE:GXO), and Amazon (NASDAQ:AMZN).

5. Revenue Growth

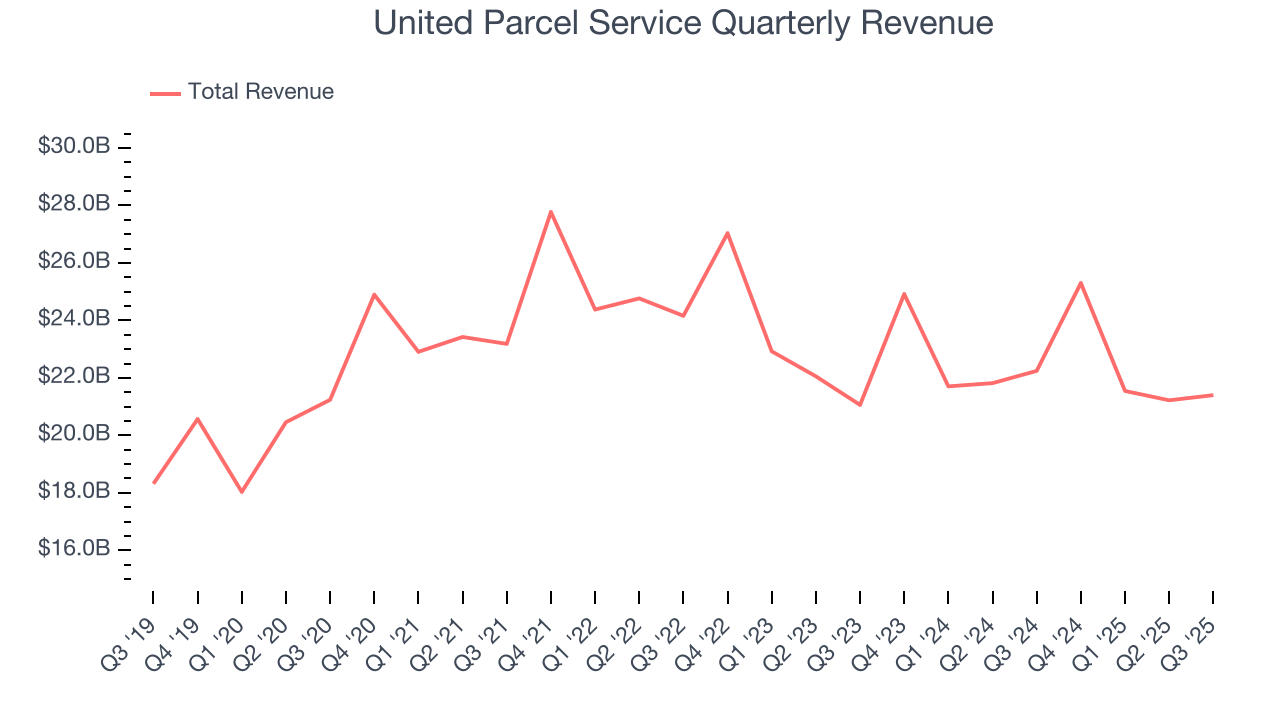

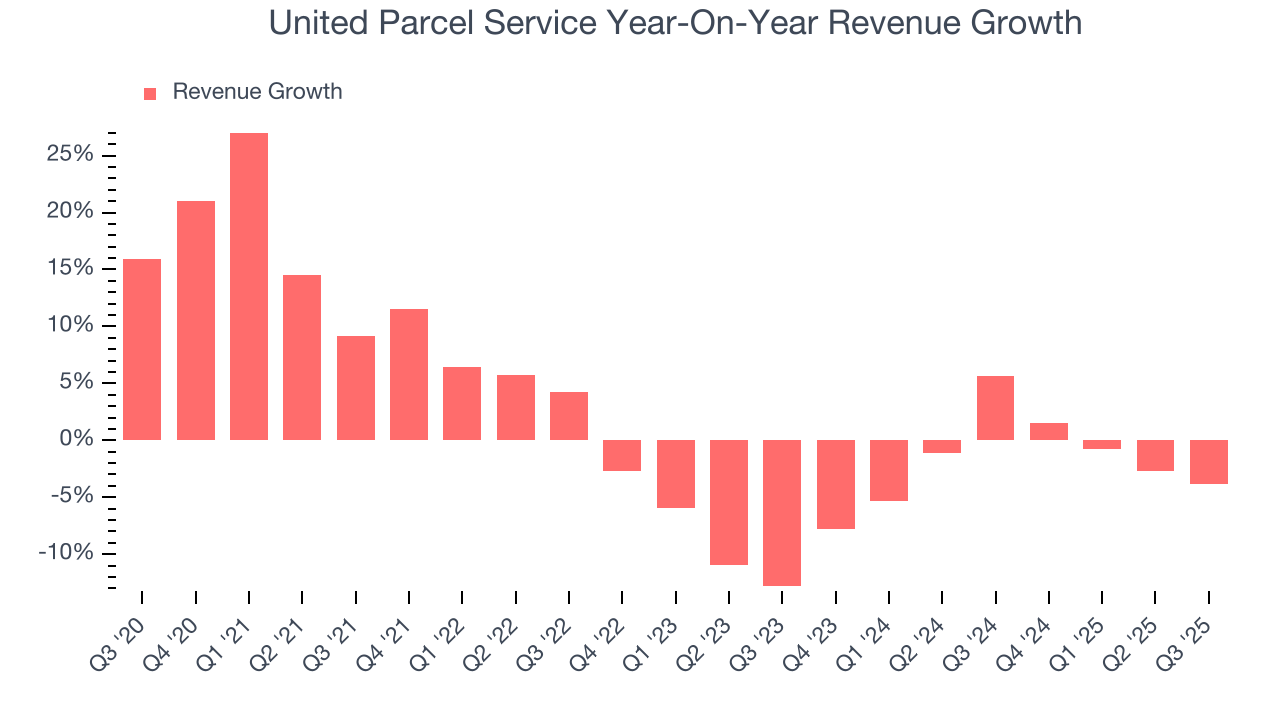

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, United Parcel Service grew its sales at a sluggish 2.2% compounded annual growth rate. This was below our standards and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. United Parcel Service’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2% annually. United Parcel Service isn’t alone in its struggles as the Air Freight and Logistics industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, United Parcel Service’s revenue fell by 3.8% year on year to $21.4 billion but beat Wall Street’s estimates by 2.4%. Company management is currently guiding for a 5.1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 2.4% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not catalyze better top-line performance yet.

6. Gross Margin & Pricing Power

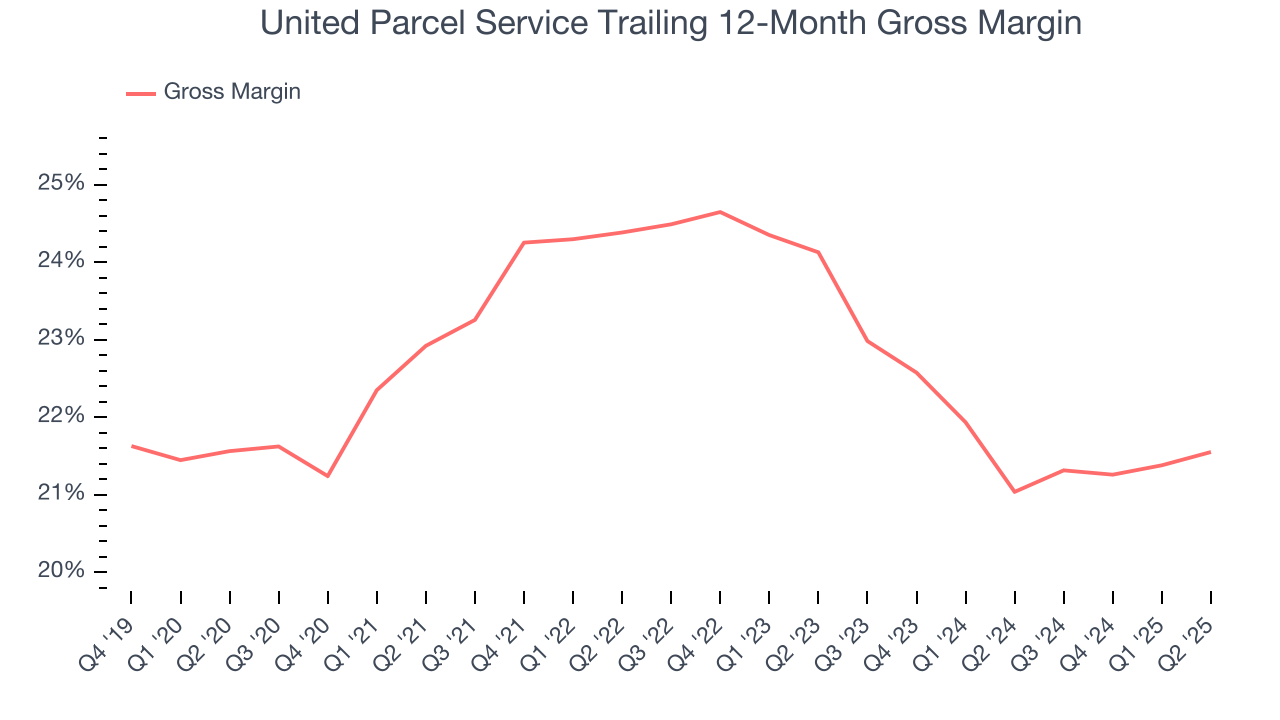

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

United Parcel Service has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 22.8% gross margin over the last five years. Said differently, United Parcel Service had to pay a chunky $77.18 to its suppliers for every $100 in revenue.

7. Operating Margin

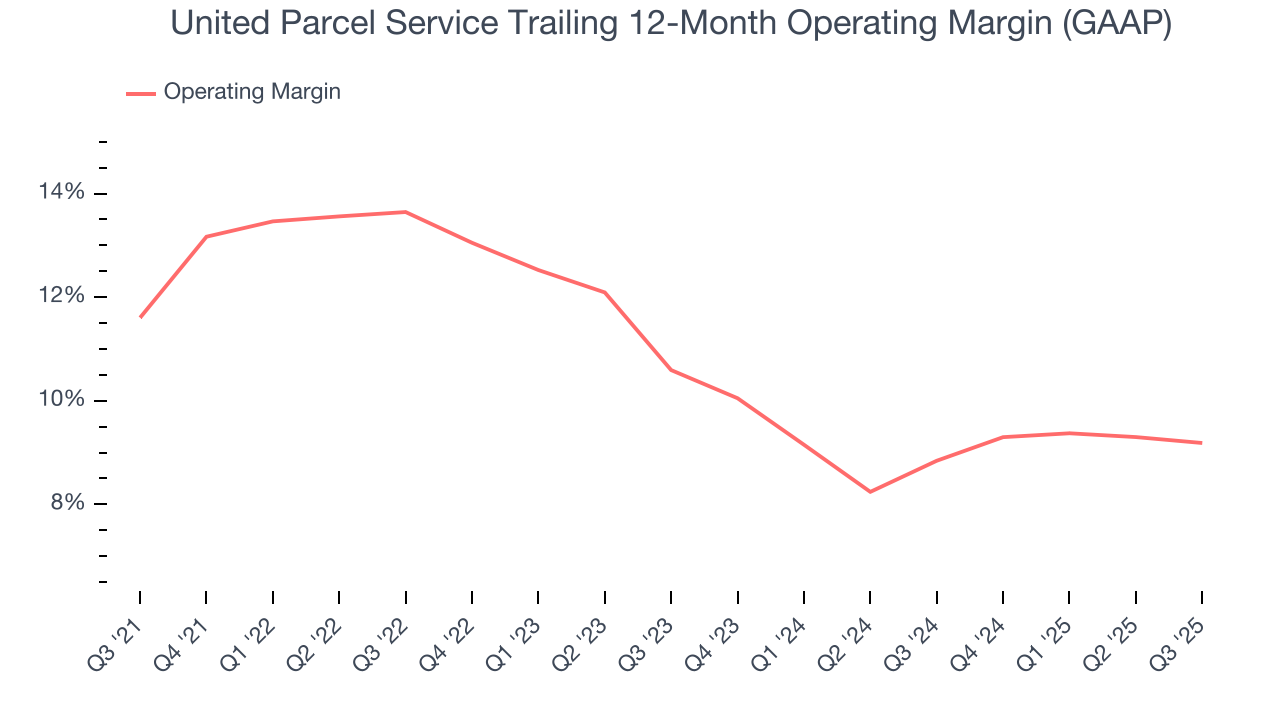

United Parcel Service has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.8%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, United Parcel Service’s operating margin decreased by 2.4 percentage points over the last five years. Many Air Freight and Logistics companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction. We hope United Parcel Service can emerge from this a stronger company, as the silver lining of a downturn is that market share can be won and efficiencies found.

This quarter, United Parcel Service generated an operating margin profit margin of 8.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

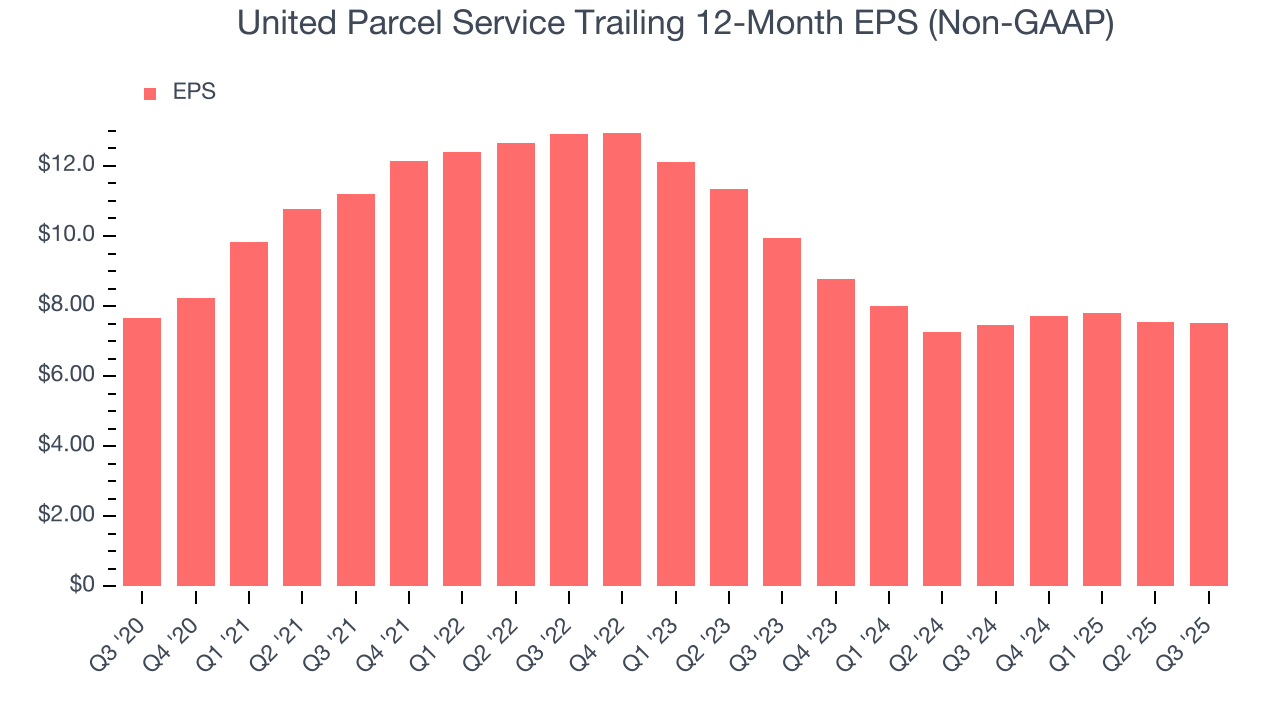

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

United Parcel Service’s flat EPS over the last five years was below its 2.2% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into United Parcel Service’s earnings to better understand the drivers of its performance. As we mentioned earlier, United Parcel Service’s operating margin was flat this quarter but declined by 2.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For United Parcel Service, its two-year annual EPS declines of 12.9% show its recent history was to blame for its underperformance over the last five years. These results were bad no matter how you slice the data.

In Q3, United Parcel Service reported adjusted EPS of $1.74, down from $1.76 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects United Parcel Service’s full-year EPS of $7.53 to shrink by 10.1%.

9. Cash Is King

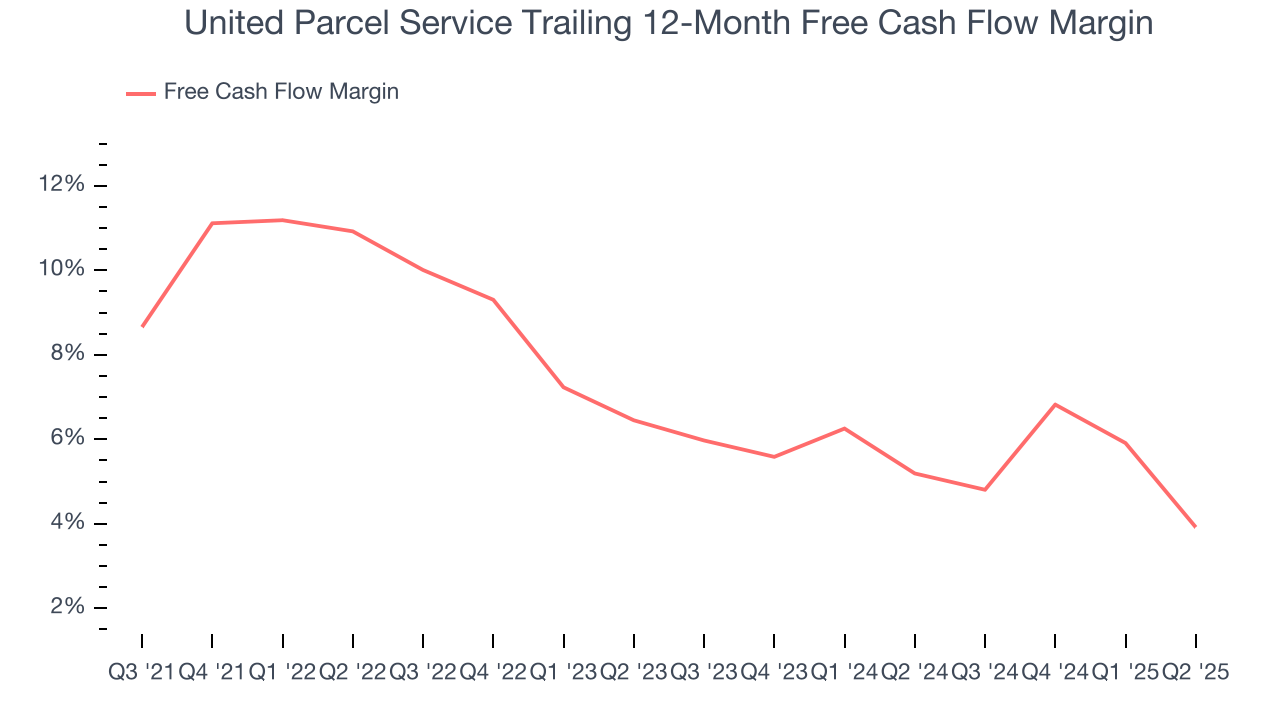

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

United Parcel Service has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that United Parcel Service’s margin dropped by 3.9 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although United Parcel Service hasn’t been the highest-quality company lately because of its poor revenue and EPS performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 31.8%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, United Parcel Service’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

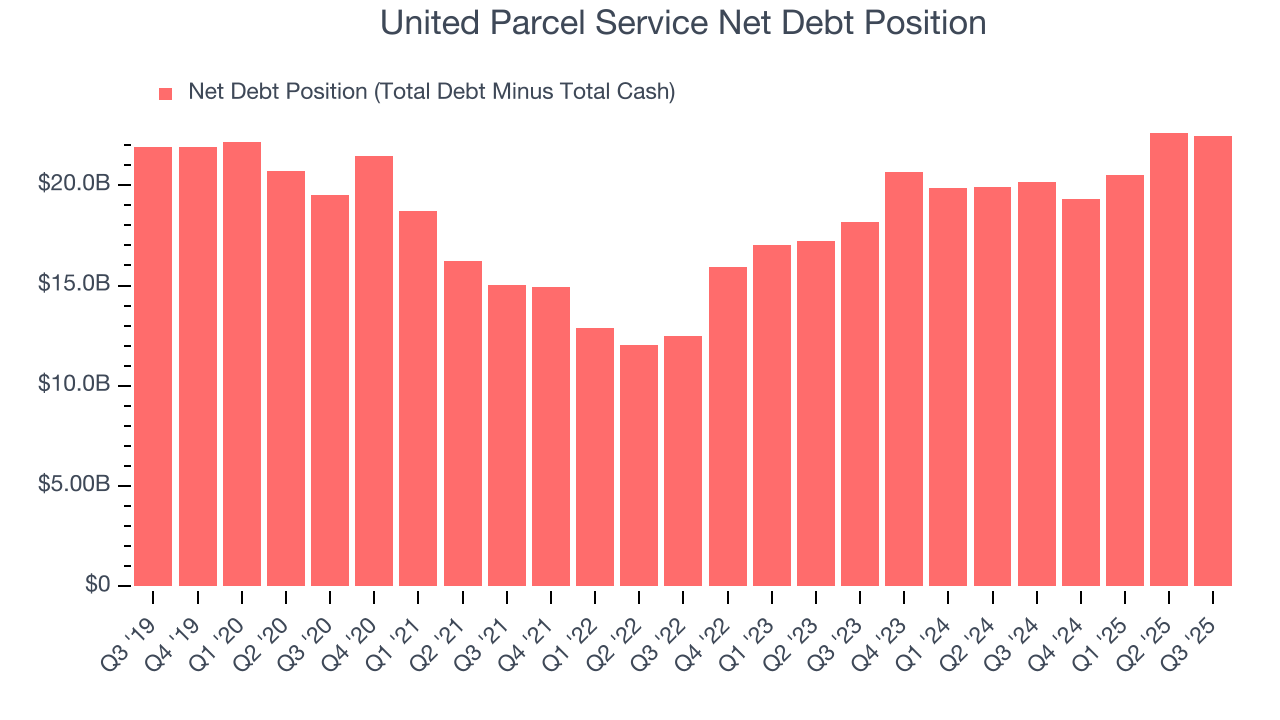

United Parcel Service reported $6.76 billion of cash and $29.21 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $12.56 billion of EBITDA over the last 12 months, we view United Parcel Service’s 1.8× net-debt-to-EBITDA ratio as safe. We also see its $201 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from United Parcel Service’s Q3 Results

It was good to see United Parcel Service beat analysts’ revenue and EPS expectations this quarter. The company said it’s eliminated roughly 34,000 jobs from its workforce as part of its plan to turn around the business. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 18% to $105.35 immediately following the results.

13. Is Now The Time To Buy United Parcel Service?

Updated: January 22, 2026 at 10:37 PM EST

Before deciding whether to buy United Parcel Service or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We cheer for all companies making their customers lives easier, but in the case of United Parcel Service, we’ll be cheering from the sidelines. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its projected EPS for the next year is lacking.

United Parcel Service’s P/E ratio based on the next 12 months is 15.8x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $106.96 on the company (compared to the current share price of $109.18).