Visa (V)

Visa is a compelling stock. Its impressive 44.4% ROE illustrates its ability to invest in high-quality growth initiatives.― StockStory Analyst Team

1. News

2. Summary

Why We Like Visa

Processing over 829 million transactions daily and connecting billions of cards to 150 million merchant locations worldwide, Visa (NYSE:V) operates one of the world's largest electronic payments networks, facilitating secure money movement across more than 200 countries through its VisaNet processing platform.

- Stellar return on equity showcases management’s ability to surface highly profitable business ventures

- Performance over the past five years shows its incremental sales were more profitable, as its annual earnings per share growth of 17.9% outpaced its revenue gains

- Solid 12.9% annual revenue growth over the last five years indicates its offering’s solve complex business issues

Visa is a top-tier company. This is one of the finest financials stocks in our coverage.

Is Now The Time To Buy Visa?

Is Now The Time To Buy Visa?

Visa’s stock price of $326.94 implies a valuation ratio of 25.4x forward P/E. The premium valuation means there’s much good news priced into the stock - we certainly can’t argue with that.

Are you a fan of the company and believe in the bull case? If so, you can own a smaller position, as high-quality companies tend to outperform the market over a long-term period regardless of entry price.

3. Visa (V) Research Report: Q4 CY2025 Update

Global payments technology company Visa (NYSE:V) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 14.6% year on year to $10.9 billion. Its non-GAAP profit of $3.17 per share was 0.9% above analysts’ consensus estimates.

Visa (V) Q4 CY2025 Highlights:

- Net Interest Income: $183 million

- Revenue: $10.9 billion vs analyst estimates of $10.69 billion (14.6% year-on-year growth, 2% beat)

- Pre-tax Profit: $6.73 billion (61.7% margin)

- Adjusted EPS: $3.17 vs analyst estimates of $3.14 (0.9% beat)

- Market Capitalization: $625.3 billion

Company Overview

Processing over 829 million transactions daily and connecting billions of cards to 150 million merchant locations worldwide, Visa (NYSE:V) operates one of the world's largest electronic payments networks, facilitating secure money movement across more than 200 countries through its VisaNet processing platform.

At the heart of Visa's business is VisaNet, its advanced transaction processing network that provides authorization, clearing, and settlement services for payments worldwide. The company enables the movement of money between consumers, merchants, financial institutions, and governments through its four-party model, which has expanded to include digital banks, digital wallets, and fintech companies.

Visa's core products include credit, debit, and prepaid cards and digital credentials, with approximately 4.6 billion payment credentials in circulation that can be used at over 150 million merchant locations globally. The company generates revenue through service fees, data processing charges, international transaction fees, and other value-added services.

Beyond traditional card payments, Visa has diversified into new payment flows through its "network of networks" strategy. Visa Direct enables person-to-person transfers, business payouts, and government disbursements by connecting to billions of cards, bank accounts, and digital wallets worldwide. For businesses, Visa B2B Connect facilitates cross-border corporate payments directly between banks in over 100 countries.

Visa has also developed an extensive suite of value-added services, including fraud prevention tools like Visa Protect, issuer processing capabilities through Visa DPS and Pismo, merchant acceptance solutions via Cybersource, and open banking services following its acquisition of Tink AB. These services help clients manage risk, optimize performance, and create better customer experiences.

The company invests heavily in security technologies like tokenization, which replaces sensitive account information with digital tokens to protect transactions. Visa has provisioned over 11 billion network tokens and continues to advance contactless payments, with Tap to Pay now the dominant payment method in many countries.

4. Credit Card

Credit card companies facilitate electronic payments and extend revolving credit to consumers. Growth comes from increasing digital payment adoption, cross-border transaction growth, and value-added services for cardholders and merchants. Challenges include regulatory scrutiny of fees and practices, competition from alternative payment methods, and potential credit losses during economic downturns.

Visa's primary competitors include Mastercard (NYSE:MA), American Express (NYSE:AXP), and Discover Financial Services (NYSE:DFS) in the card payment network space. The company also faces competition from alternative payment methods such as PayPal (NASDAQ:PYPL), Block's Cash App (NYSE:SQ), and regional payment networks like China's UnionPay and India's RuPay.

5. Revenue Growth

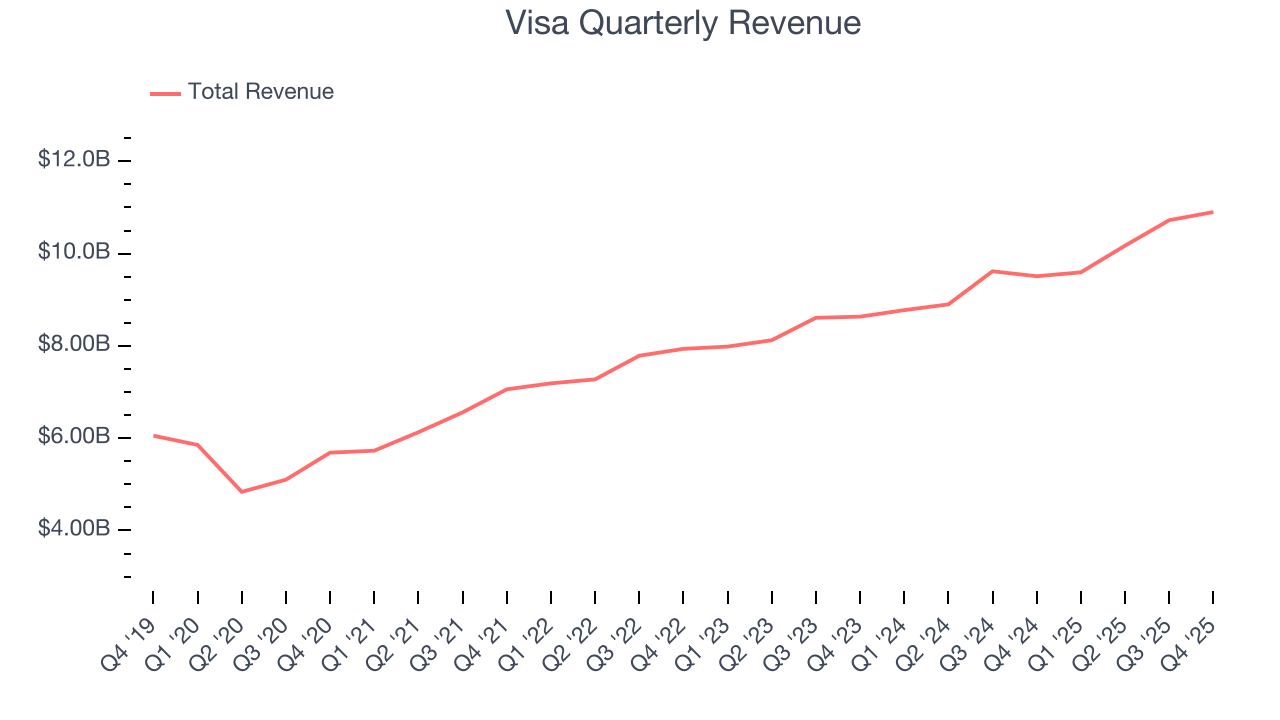

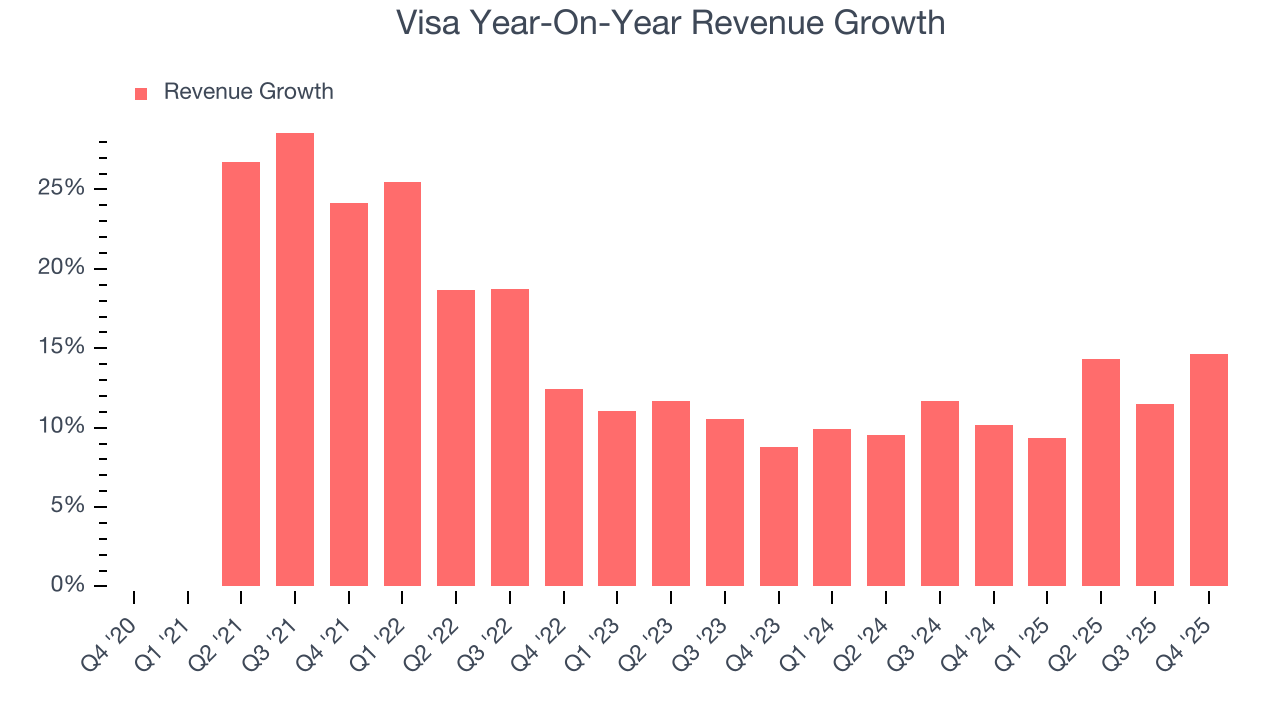

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Visa grew its revenue at a solid 14% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Visa’s annualized revenue growth of 11.4% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Visa reported year-on-year revenue growth of 14.6%, and its $10.9 billion of revenue exceeded Wall Street’s estimates by 2%.

6. Pre-Tax Profit Margin

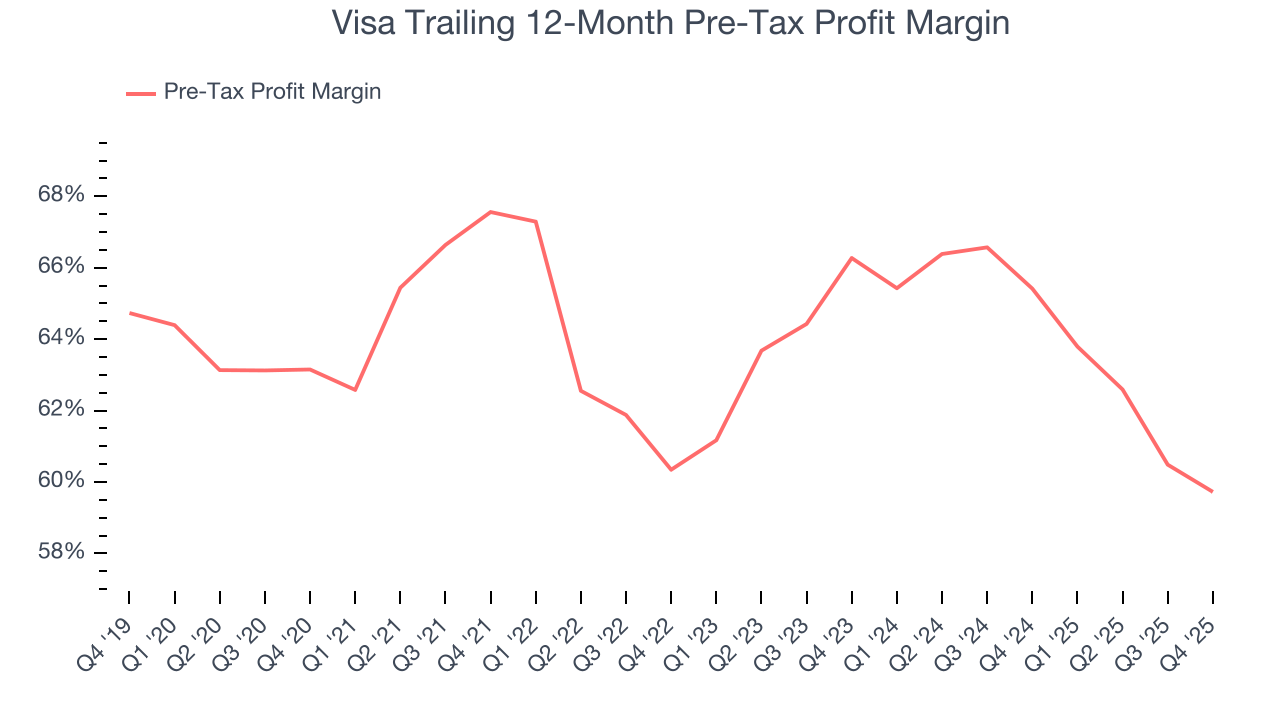

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Credit Card companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Financials companies manage interest-bearing assets and liabilities, making the interest income and expenses included in pre-tax profit essential to their profit calculation. Taxes, being external factors beyond management control, are appropriately excluded from this alternative margin measure.

Over the last five years, Visa’s pre-tax profit margin has risen by 3.4 percentage points, going from 67.6% to 59.7%. It has also declined by 6.5 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

In Q4, Visa’s pre-tax profit margin was 61.7%. This result was 3.5 percentage points worse than the same quarter last year.

7. Earnings Per Share

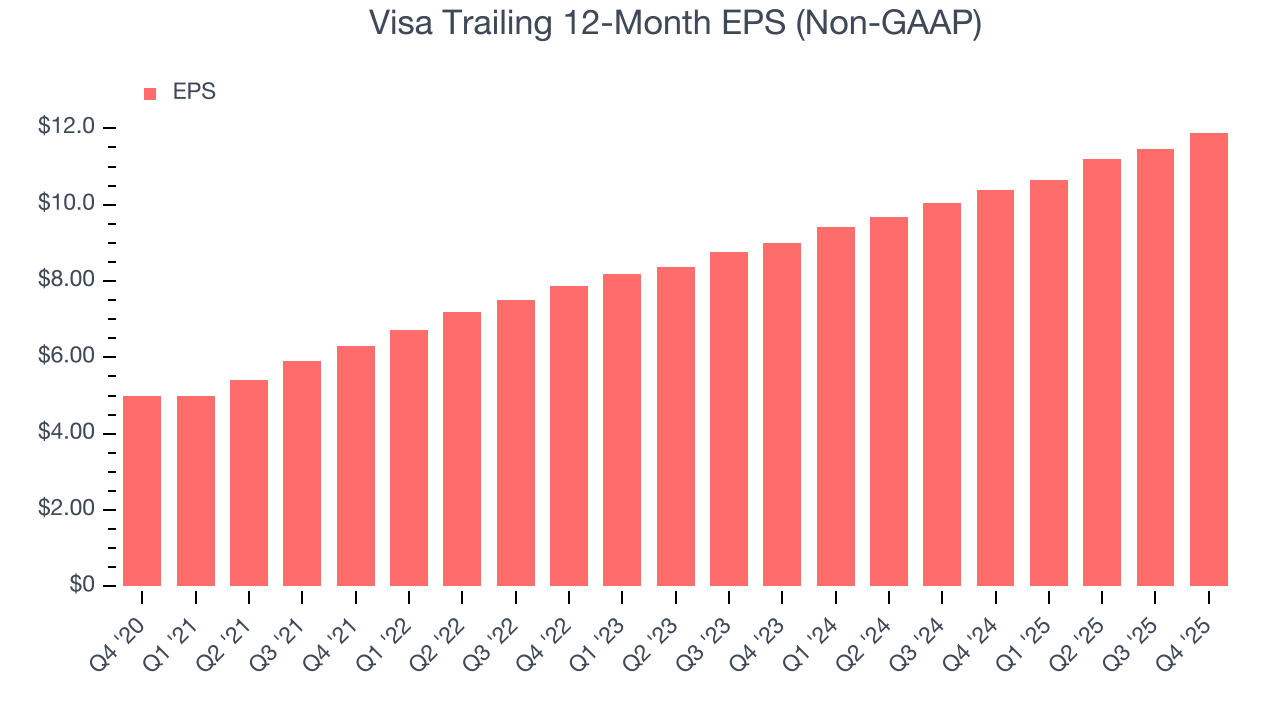

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Visa’s EPS grew at a remarkable 19% compounded annual growth rate over the last five years, higher than its 14% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its pre-tax profit margin didn’t improve.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Visa, its two-year annual EPS growth of 15% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Visa reported adjusted EPS of $3.17, up from $2.75 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Visa’s full-year EPS of $11.89 to grow 10.9%.

8. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Visa has averaged an ROE of 44.9%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Visa has a strong competitive moat.

9. Balance Sheet Assessment

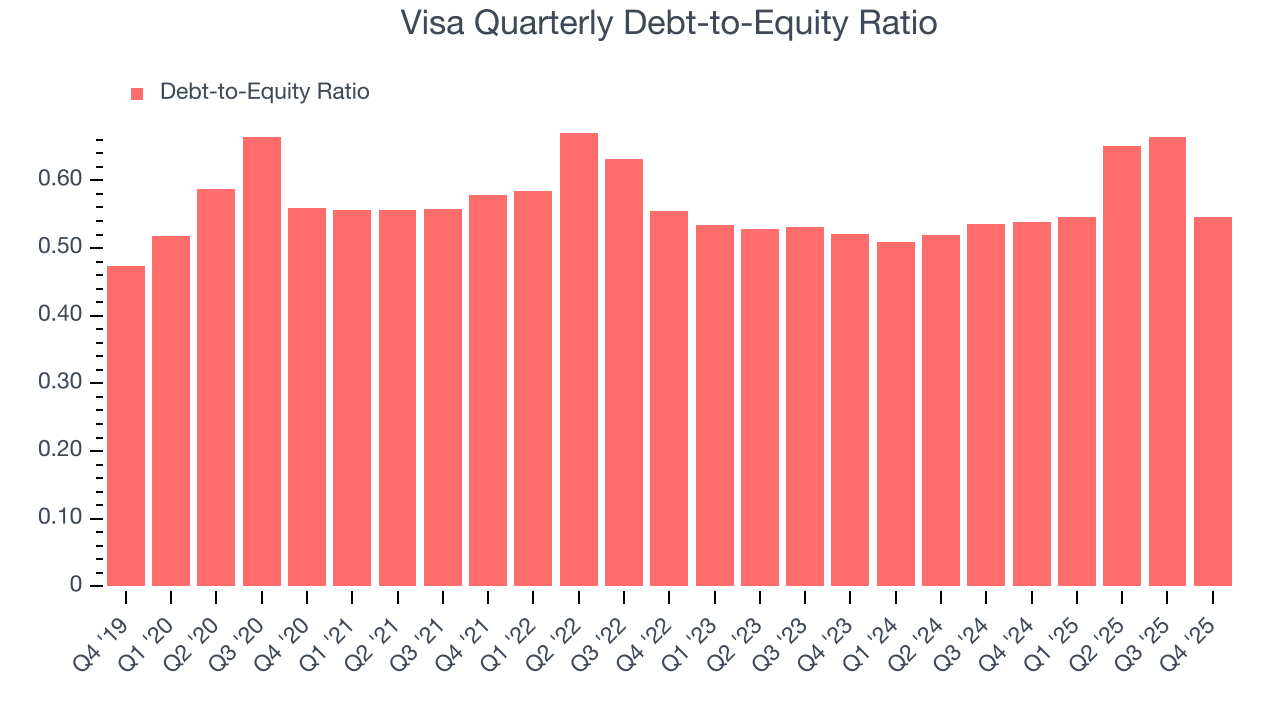

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Visa currently has $21.18 billion of debt and $38.78 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.6×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Visa’s Q4 Results

While Visa beat on revenue and EPS, the magnitude of the beats was quite small. Investors were likely hoping for more, and shares traded down 2% to $325.93 immediately following the results.

11. Is Now The Time To Buy Visa?

Updated: January 29, 2026 at 5:11 PM EST

Before making an investment decision, investors should account for Visa’s business fundamentals and valuation in addition to what happened in the latest quarter.

Visa is an amazing business ranking highly on our list. First of all, the company’s revenue growth was solid over the last five years. And while its declining pre-tax profit margin shows the business has become less efficient, its stellar ROE suggests it has been a well-run company historically. Additionally, Visa’s remarkable EPS growth over the last five years shows its profits are trickling down to shareholders.

Visa’s P/E ratio based on the next 12 months is 25.2x. There’s some optimism reflected in this multiple, but we don’t mind owning a high-quality business, even if it’s slightly expensive. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with relatively high valuations.

Wall Street analysts have a consensus one-year price target of $399.54 on the company (compared to the current share price of $325.93).