Voya Financial (VOYA)

We’re cautious of Voya Financial. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Voya Financial Is Not Exciting

Originally spun off from Dutch financial giant ING in 2013 and rebranded with a name suggesting "voyage," Voya Financial (NYSE:VOYA) provides workplace benefits and savings solutions to U.S. employers, helping their employees achieve better financial outcomes through retirement plans and insurance products.

- Tangible book value per share tumbled by 14.6% annually over the last five years, showing financials sector trends are working against its favor during this cycle

- Sales trends were unexciting over the last five years as its 6.8% annual growth was below the typical financials company

- A positive is that its incremental sales significantly boosted profitability as its annual earnings per share growth of 29.3% over the last five years outstripped its revenue performance

Voya Financial’s quality is inadequate. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than Voya Financial

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Voya Financial

Voya Financial’s stock price of $77.42 implies a valuation ratio of 8.1x forward P/E. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Voya Financial (VOYA) Research Report: Q4 CY2025 Update

Financial services company Voya Financial (NYSE:VOYA) announced better-than-expected revenue in Q4 CY2025, with sales up 11.3% year on year to $2.11 billion. Its non-GAAP profit of $1.94 per share was 6.6% below analysts’ consensus estimates.

Voya Financial (VOYA) Q4 CY2025 Highlights:

- Revenue: $2.11 billion vs analyst estimates of $2.01 billion (11.3% year-on-year growth, 5% beat)

- Pre-tax Profit: $169 million (8% margin)

- Adjusted EPS: $1.94 vs analyst expectations of $2.08 (6.6% miss)

- Market Capitalization: $7.37 billion

Company Overview

Originally spun off from Dutch financial giant ING in 2013 and rebranded with a name suggesting "voyage," Voya Financial (NYSE:VOYA) provides workplace benefits and savings solutions to U.S. employers, helping their employees achieve better financial outcomes through retirement plans and insurance products.

Voya operates through three main segments: Wealth Solutions, Health Solutions, and Investment Management. The Wealth Solutions segment offers retirement plan administration for approximately 38,000 employers and 7 million plan participants across all market segments, from small businesses to large corporations. This includes recordkeeping services, investment options, and financial guidance tools. The company's myVoyage mobile application helps employees visualize their entire financial picture and engage with their workplace benefits.

The Health Solutions segment provides supplemental health and group benefits covering over 7 million individuals, including stop-loss insurance for self-insured employers, group life insurance, disability coverage, and voluntary benefits like critical illness and accident insurance. Through its 2023 acquisition of Benefitfocus, Voya also offers benefits administration technology that serves approximately 12 million employees, helping them select and manage their workplace benefits through an open-architecture platform.

The Investment Management segment manages assets for both institutional and retail clients globally. It offers fixed income, equity, and alternative investment strategies, with particular strength in private assets like private fixed income and secondary private equity. Following a 2022 transaction with Allianz Global Investors, Voya expanded its international distribution capabilities, particularly in Europe and Asia.

Voya generates revenue through a mix of fee income from asset and participant-based services, premium income from insurance products, and investment income from its general account assets. For employers, Voya's integrated platform helps maximize the value of benefits spending while promoting a healthier and more financially secure workforce. For employees, the company's solutions aim to improve financial outcomes by providing tools to better understand and utilize workplace benefits.

4. Custody Bank

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

In retirement solutions, Voya competes with Fidelity, Empower, TIAA, Nationwide, Prudential, and MetLife. In health benefits, its competitors include Sun Life, Tokio Marine HCC, Cigna, Aetna, Aflac, MetLife, and Unum. For benefits administration, Voya faces competition from Alight, Businesssolver, and BSwift, while its investment management business competes with Principal Global Investors, Prudential, Ameriprise, Invesco, T. Rowe Price, and Franklin Templeton.

5. Revenue Growth

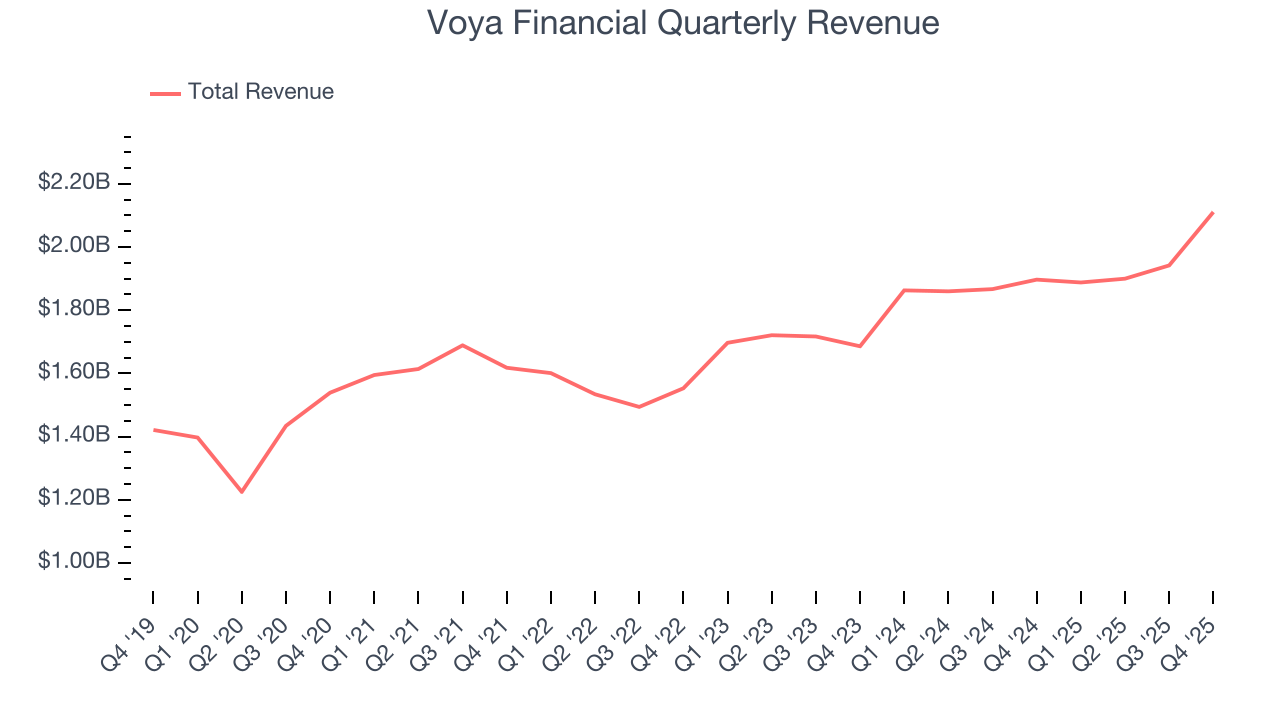

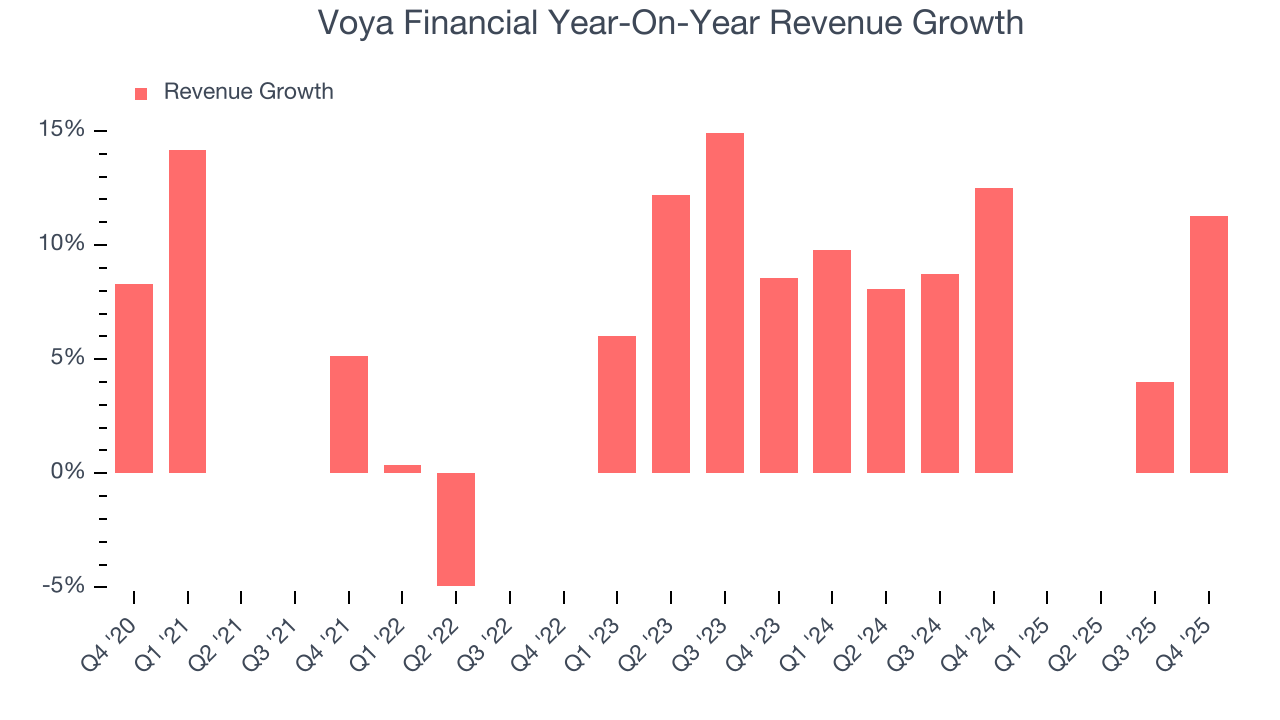

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Voya Financial’s revenue grew at a mediocre 7% compounded annual growth rate over the last five years. This was below our standard for the financials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Voya Financial’s annualized revenue growth of 7.2% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Voya Financial reported year-on-year revenue growth of 11.3%, and its $2.11 billion of revenue exceeded Wall Street’s estimates by 5%.

6. Pre-Tax Profit Margin

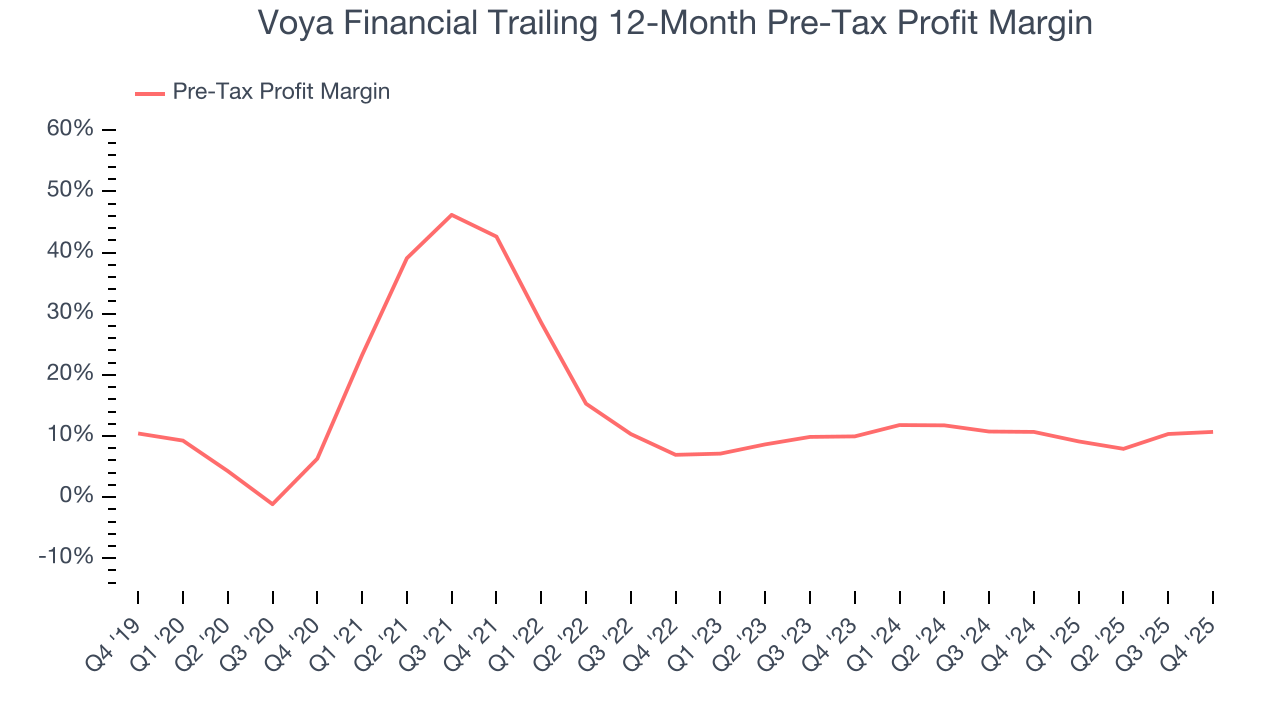

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Custody Bank companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, Voya Financial’s pre-tax profit margin has fallen by 4.4 percentage points, going from 42.6% to 10.7%. However, fixed cost leverage was muted more recently as the company’s pre-tax profit margin was flat on a two-year basis.

Voya Financial’s pre-tax profit margin came in at 8% this quarter. This result was 1.7 percentage points better than the same quarter last year.

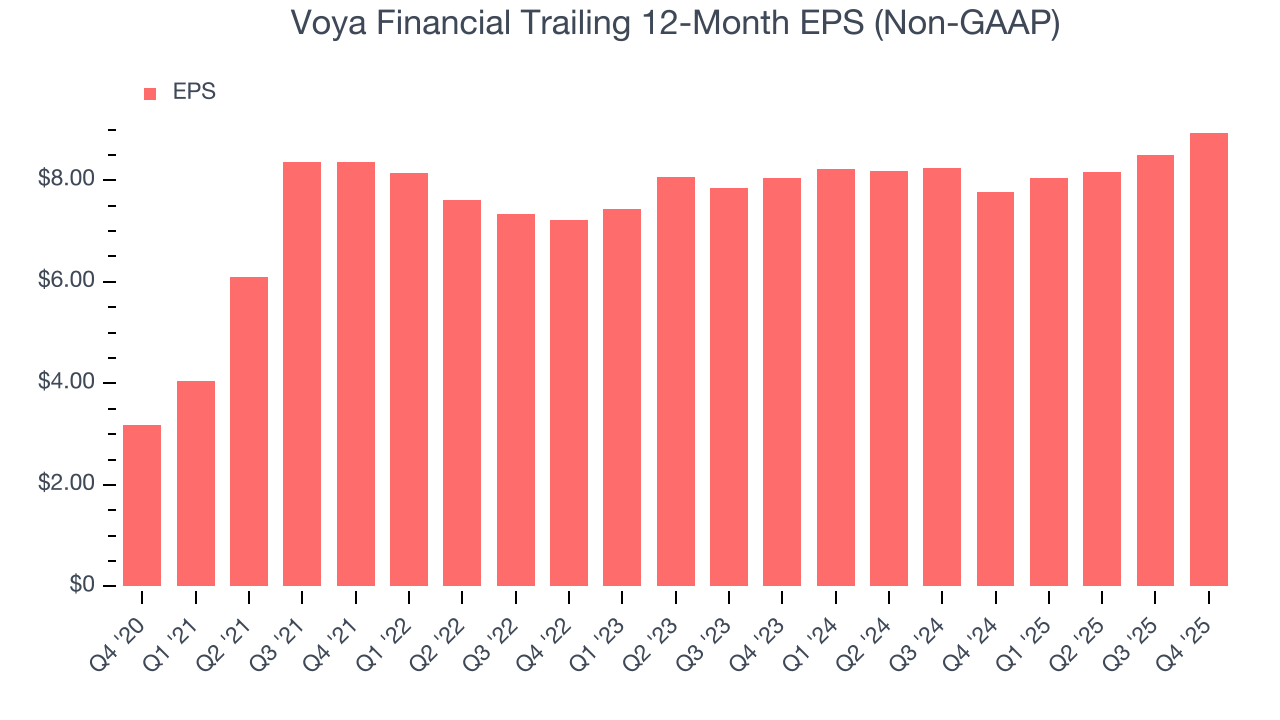

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Voya Financial’s EPS grew at a spectacular 23% compounded annual growth rate over the last five years, higher than its 7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Voya Financial, its two-year annual EPS growth of 5.4% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Voya Financial reported adjusted EPS of $1.94, up from $1.50 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Voya Financial’s full-year EPS of $8.94 to grow 12.5%.

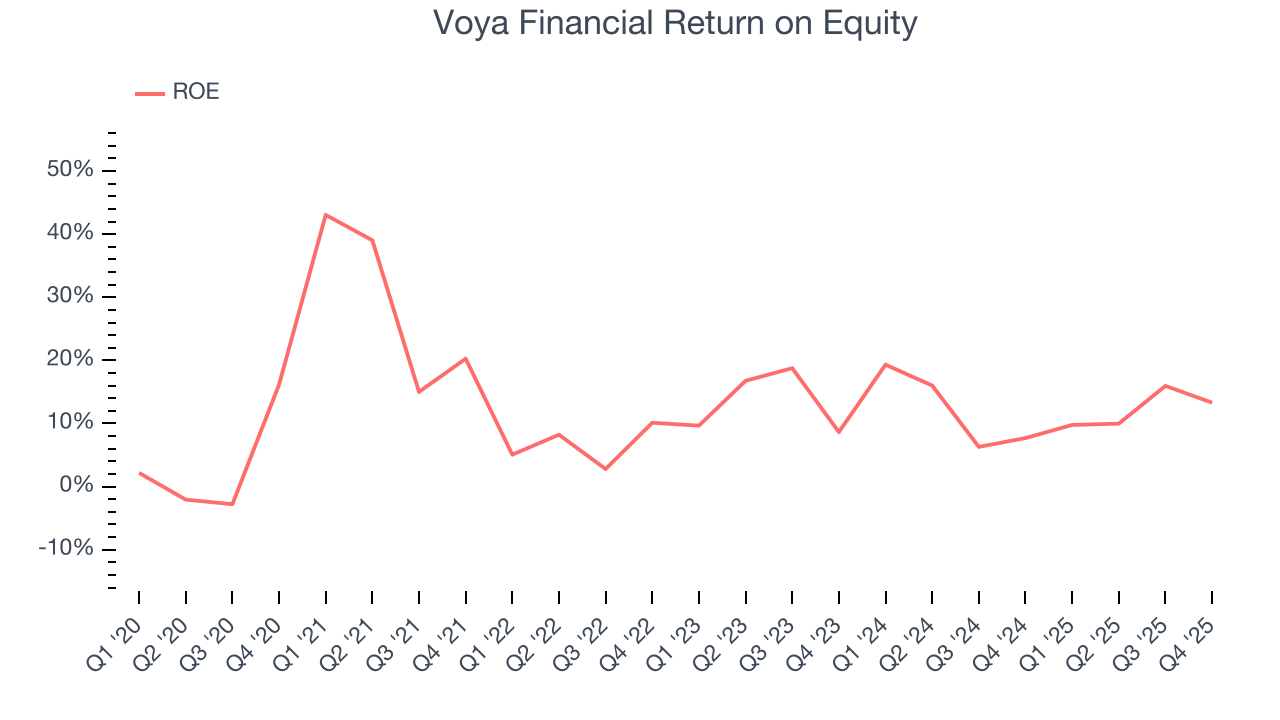

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Voya Financial has averaged an ROE of 14.8%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Voya Financial.

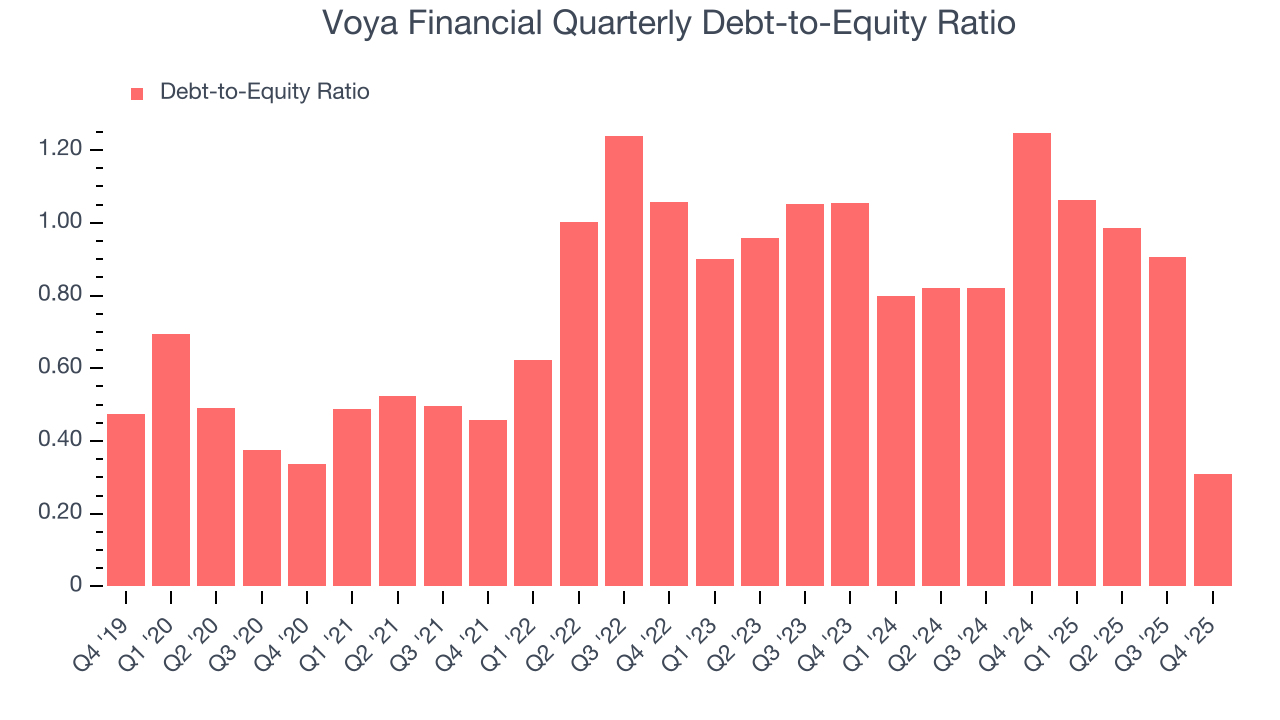

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Voya Financial currently has $2.10 billion of debt and $6.82 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.8×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Voya Financial’s Q4 Results

We enjoyed seeing Voya Financial beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed, and this seems to be dragging down shares. The stock traded down 3% to $73.25 immediately following the results.

11. Is Now The Time To Buy Voya Financial?

Updated: February 3, 2026 at 4:55 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Voya Financial, you should also grasp the company’s longer-term business quality and valuation.

Voya Financial doesn’t top our investment wishlist, but we understand that it’s not a bad business. Although its revenue growth was mediocre over the last five years and analysts expect growth to slow over the next 12 months, its expanding pre-tax profit margin shows the business has become more efficient.

Voya Financial’s P/E ratio based on the next 12 months is 7.5x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $86.80 on the company (compared to the current share price of $73.25).