Williams-Sonoma (WSM)

We’re wary of Williams-Sonoma. Not only is its demand weak but also its falling returns on capital suggest it’s becoming less profitable.― StockStory Analyst Team

1. News

2. Summary

Why We Think Williams-Sonoma Will Underperform

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE:WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

- Annual sales declines of 3.2% for the past three years show its products struggled to connect with the market

- Ongoing store closures and lackluster same-store sales indicate sluggish demand and a focus on consolidation

- A positive is that its excellent operating margin highlights the strength of its business model

Williams-Sonoma falls below our quality standards. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Williams-Sonoma

Why There Are Better Opportunities Than Williams-Sonoma

Williams-Sonoma’s stock price of $211.83 implies a valuation ratio of 24.2x forward P/E. This multiple is high given its weaker fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. Williams-Sonoma (WSM) Research Report: Q3 CY2025 Update

Kitchenware and home goods retailer Williams-Sonoma (NYSE:WSM) announced better-than-expected revenue in Q3 CY2025, with sales up 4.6% year on year to $1.88 billion. Its GAAP profit of $1.96 per share was 4.7% above analysts’ consensus estimates.

Williams-Sonoma (WSM) Q3 CY2025 Highlights:

- Revenue: $1.88 billion vs analyst estimates of $1.87 billion (4.6% year-on-year growth, 0.6% beat)

- EPS (GAAP): $1.96 vs analyst estimates of $1.87 (4.7% beat)

- Adjusted EBITDA: $406.8 million vs analyst estimates of $368.4 million (21.6% margin, 10.4% beat)

- Operating Margin: 17%, in line with the same quarter last year

- Free Cash Flow Margin: 13.2%, up from 9.4% in the same quarter last year

- Locations: 513 at quarter end, down from 525 in the same quarter last year

- Same-Store Sales rose 4% year on year (-2.9% in the same quarter last year)

- Market Capitalization: $22.01 billion

Company Overview

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE:WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

Today, the company has expanded beyond its French cookware roots to offer everything from bedding and bath linens to gourmet food and specialty appliances. The unifying theme in a Williams-Sonoma store is products that are both beautiful and practical.

The core Williams-Sonoma customer is typically a higher-income, educated suburban consumer who values quality and design and isn’t afraid to pay a bit more for it. Some brands that a shopper can find in a Williams-Sonoma store include Le Creuset, KitchenAid, Nespresso, and the company’s own line of kitchenware.

Williams-Sonoma has been one of the more successful retailers to adapt to e-commerce. Before online shopping caught fire, the company was able to build a large database of customer information because of its catalog mailing list. This turned into an email marketing list and a relatively early e-commerce presence.

4. Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Competitors that offer kitchenware and home goods include TJX (NYSE:TJX), Target (NYSE:TGT), and Walmart (NYSE:WMT).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

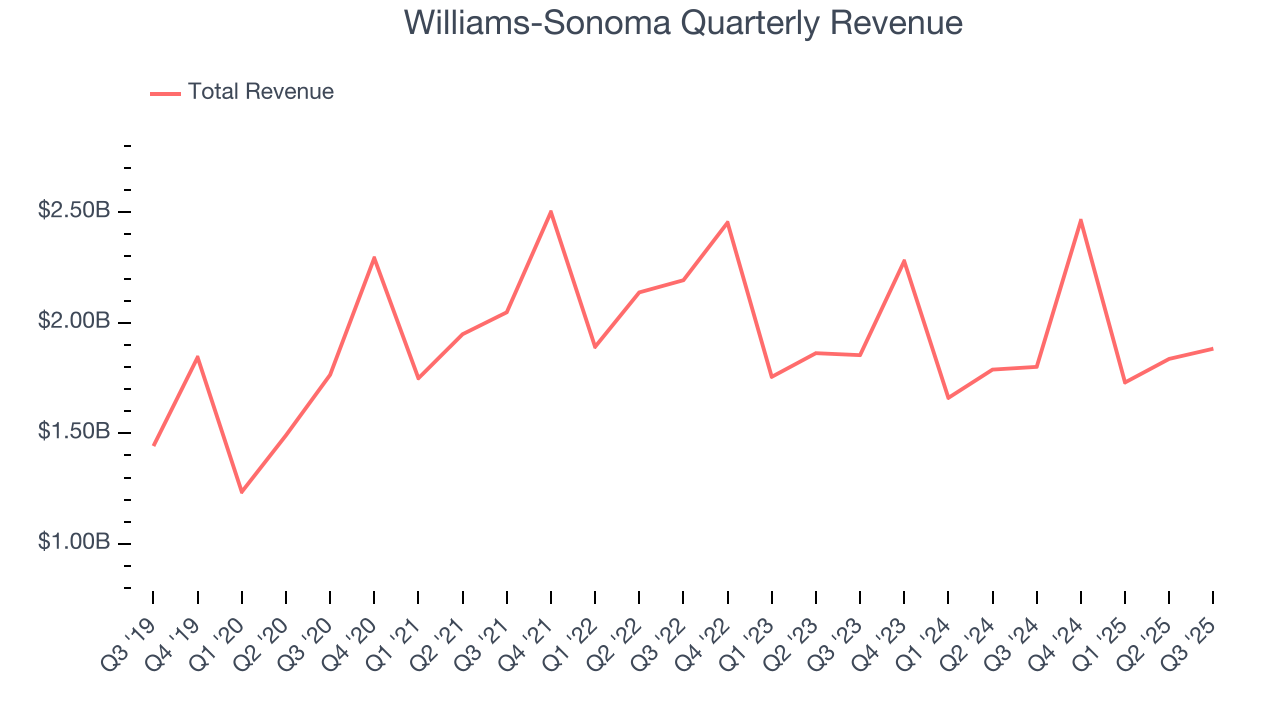

With $7.91 billion in revenue over the past 12 months, Williams-Sonoma is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Williams-Sonoma’s sales grew at a tepid 5% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it closed stores.

This quarter, Williams-Sonoma reported modest year-on-year revenue growth of 4.6% but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 1.3% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and suggests its products will see some demand headwinds.

6. Store Performance

Number of Stores

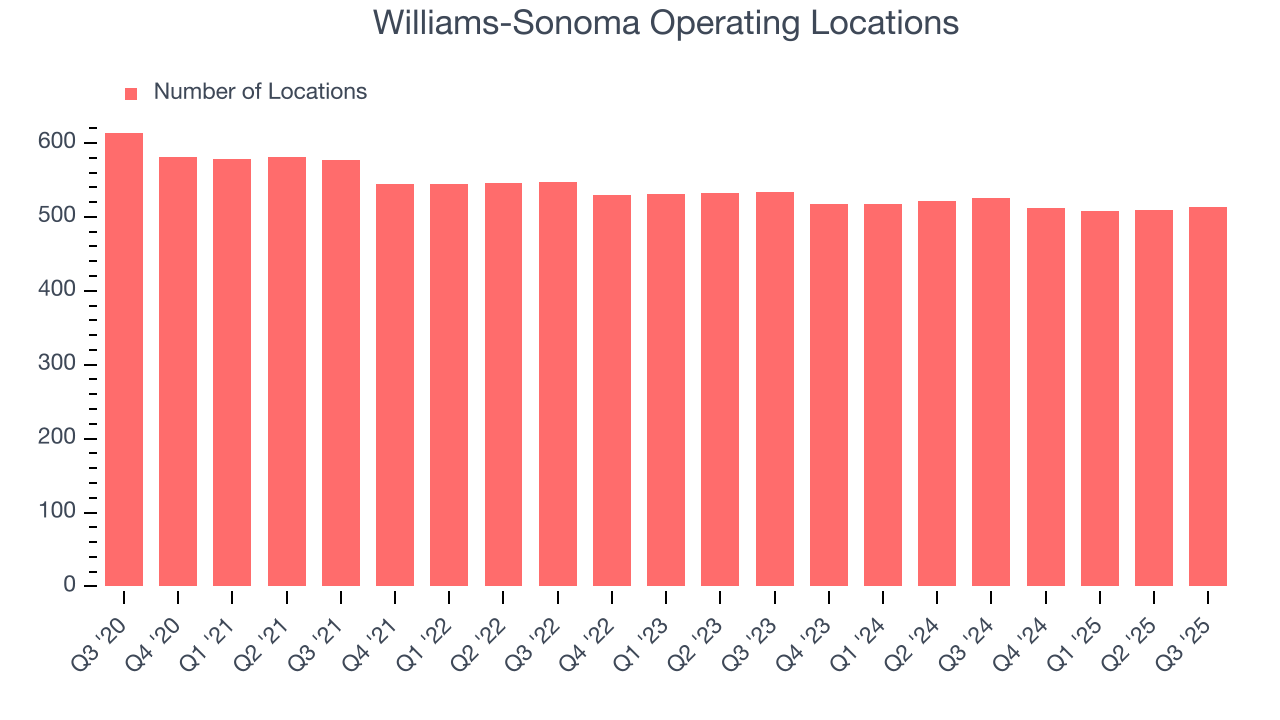

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Williams-Sonoma operated 513 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 2% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

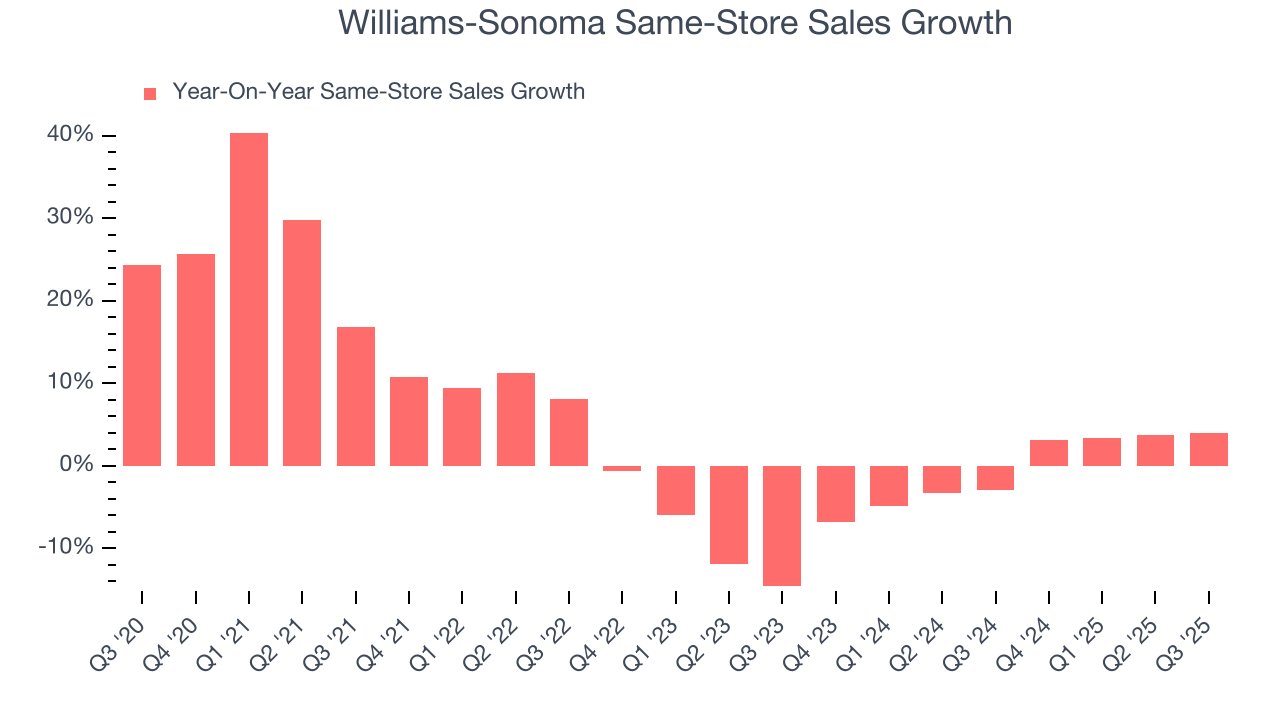

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Williams-Sonoma’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Williams-Sonoma is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Williams-Sonoma’s same-store sales rose 4% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

7. Gross Margin & Pricing Power

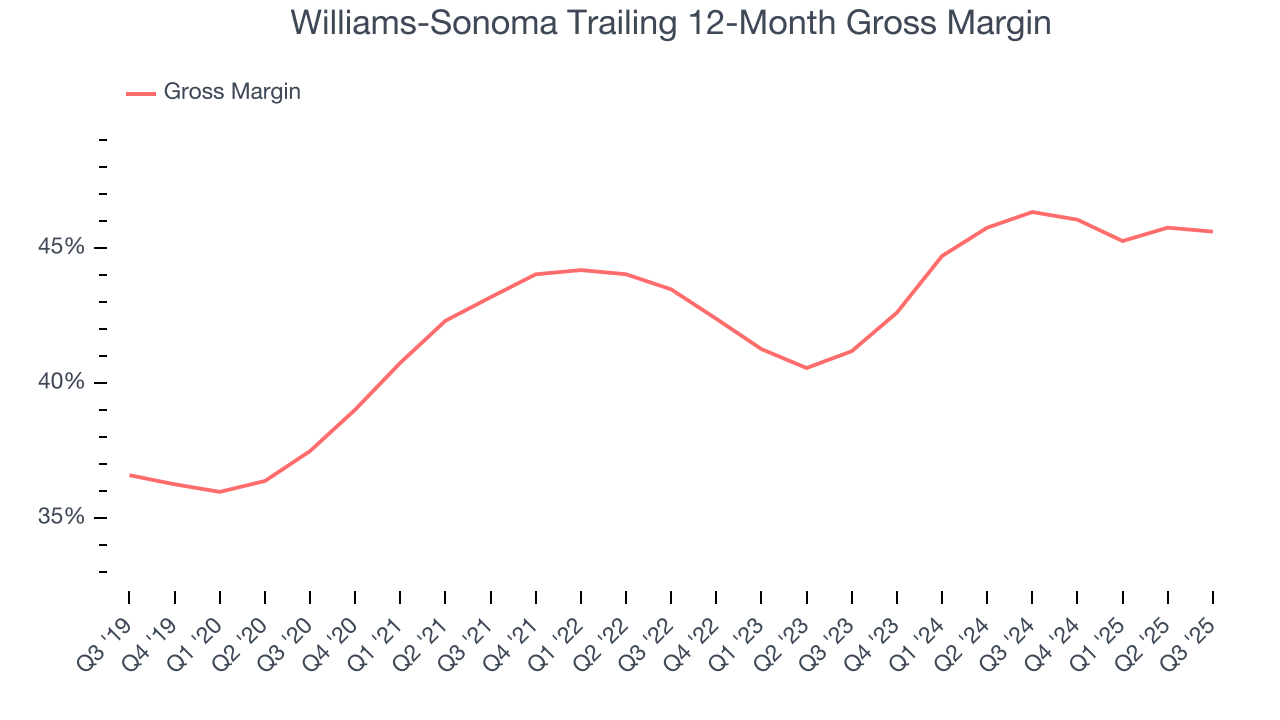

Williams-Sonoma has great unit economics for a retailer, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an excellent 46% gross margin over the last two years. That means Williams-Sonoma only paid its suppliers $54.02 for every $100 in revenue.

Williams-Sonoma’s gross profit margin came in at 46.1% this quarter, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

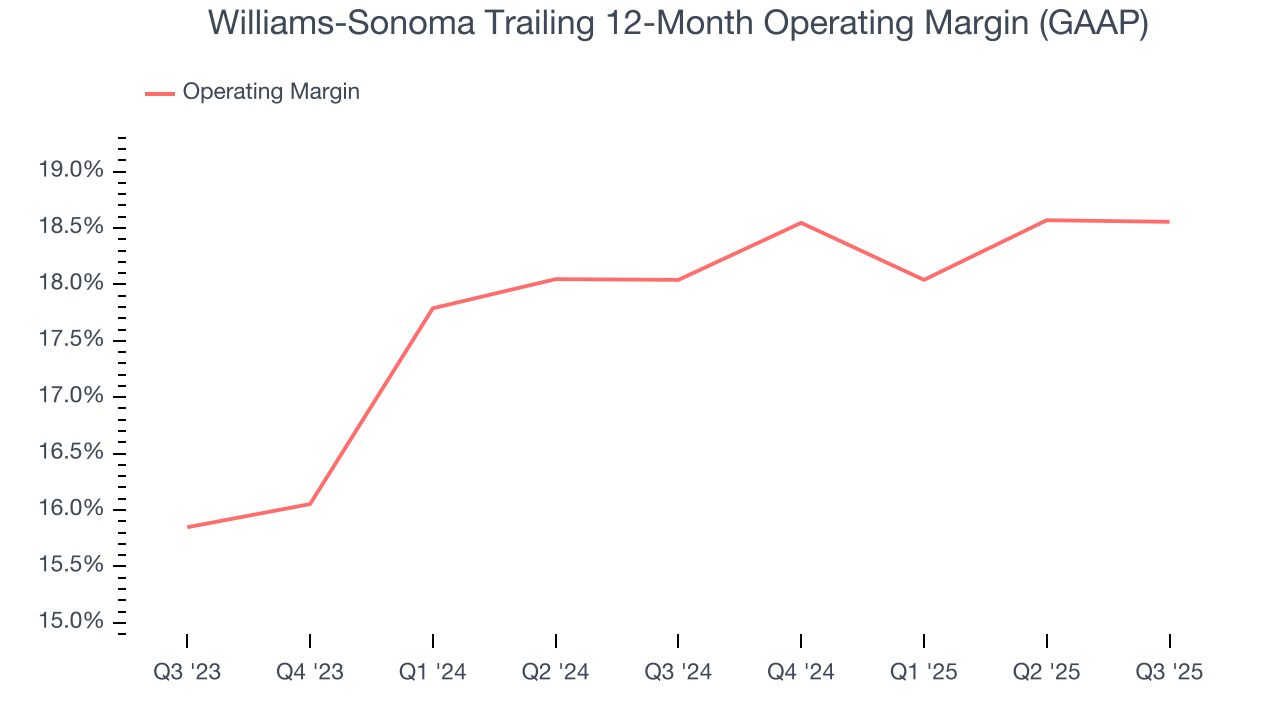

Williams-Sonoma’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 18.3% over the last two years. This profitability was elite for a consumer retail business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Williams-Sonoma’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Williams-Sonoma generated an operating margin profit margin of 17%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Earnings Per Share

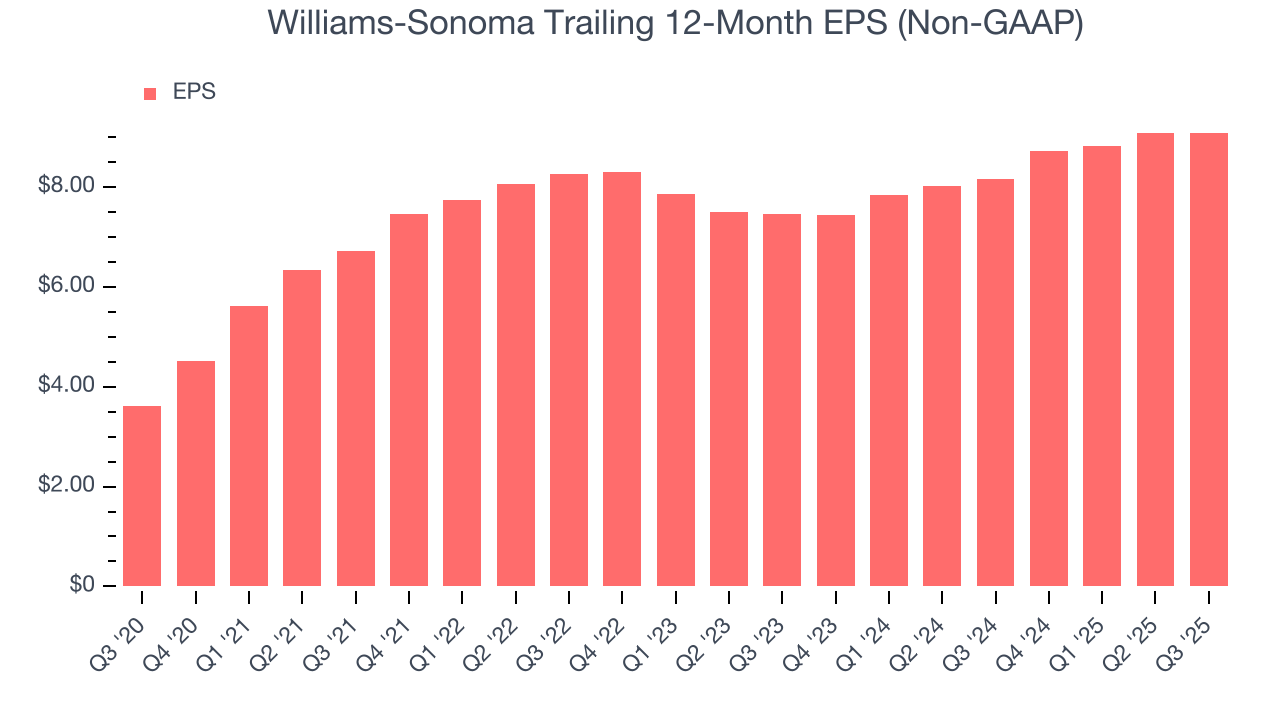

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Williams-Sonoma’s EPS grew at an unimpressive 3.3% compounded annual growth rate over the last three years. On the bright side, this performance was better than its 3.2% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

In Q3, Williams-Sonoma reported adjusted EPS of $1.96, in line with the same quarter last year. This print beat analysts’ estimates by 4.7%. Over the next 12 months, Wall Street expects Williams-Sonoma’s full-year EPS of $9.09 to shrink by 2.5%.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

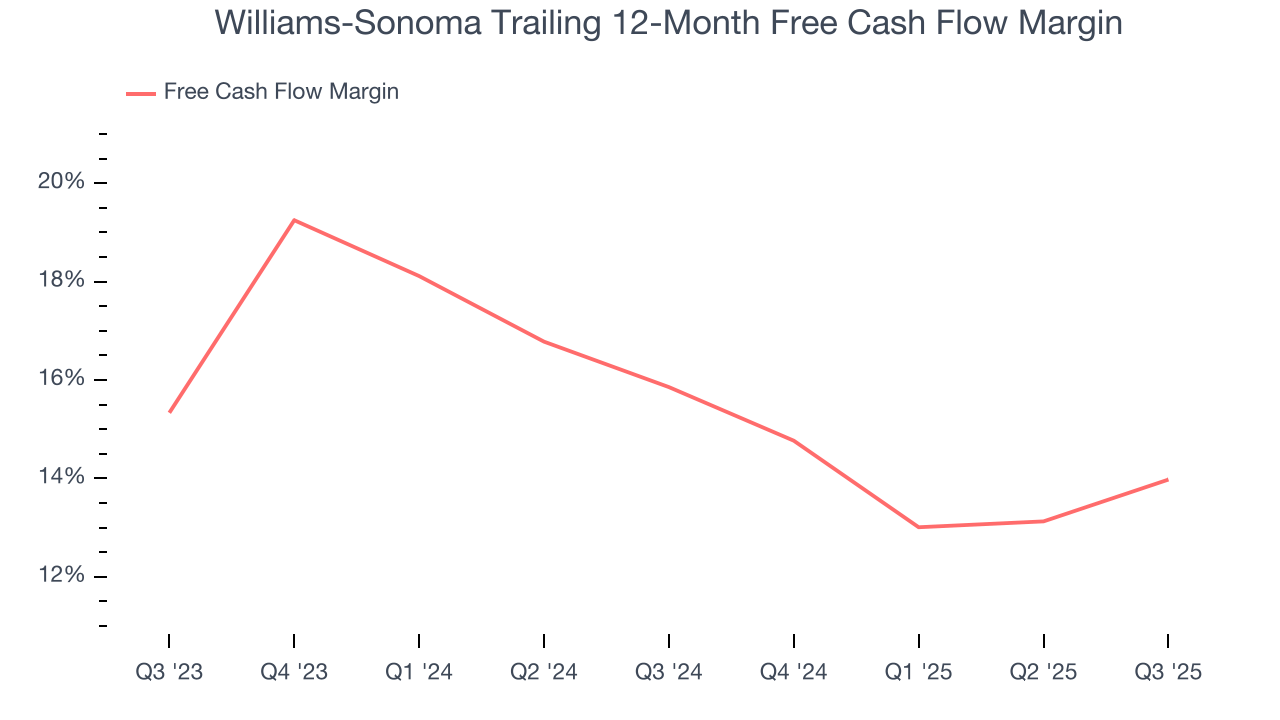

Williams-Sonoma has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer retail sector, averaging 14.9% over the last two years.

Taking a step back, we can see that Williams-Sonoma’s margin dropped by 1.9 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity.

Williams-Sonoma’s free cash flow clocked in at $248.1 million in Q3, equivalent to a 13.2% margin. This result was good as its margin was 3.7 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Williams-Sonoma hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 44.4%, splendid for a consumer retail business.

12. Balance Sheet Assessment

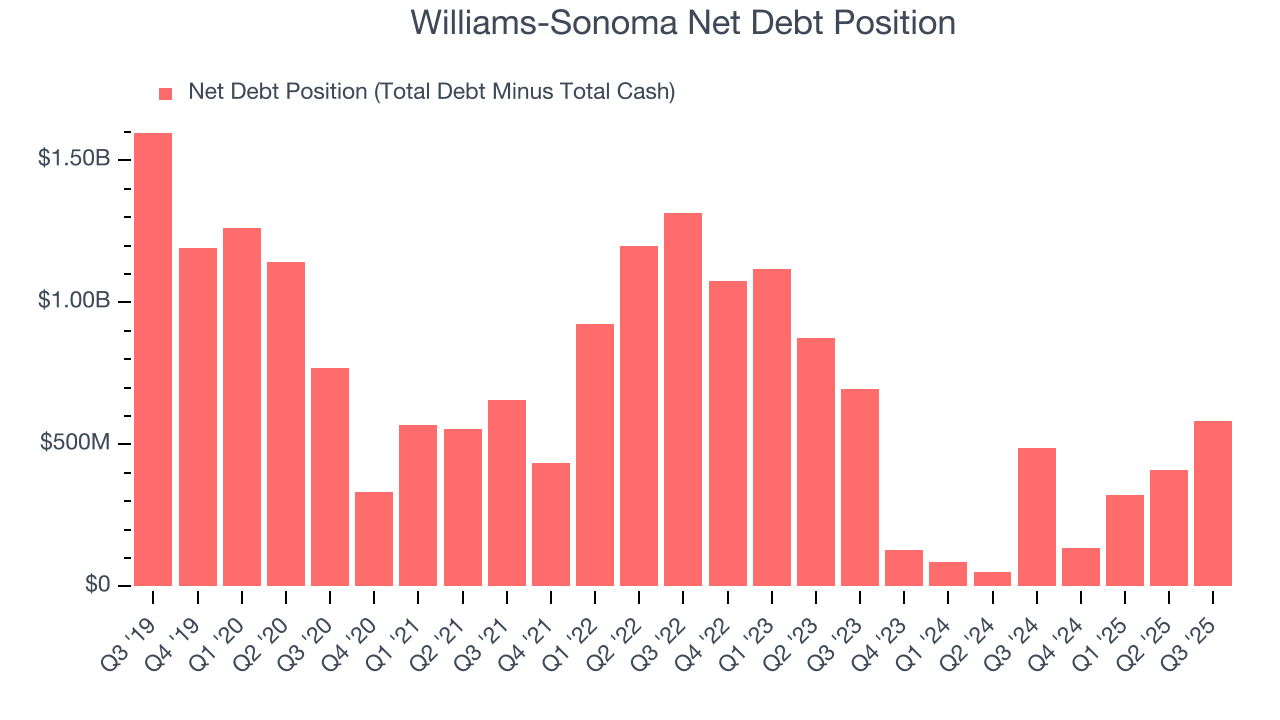

Williams-Sonoma reported $884.7 million of cash and $1.47 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.73 billion of EBITDA over the last 12 months, we view Williams-Sonoma’s 0.3× net-debt-to-EBITDA ratio as safe. We also see its $40.88 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Williams-Sonoma’s Q3 Results

We were impressed by how significantly Williams-Sonoma blew past analysts’ EBITDA expectations this quarter. We were also glad its gross margin outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. Investors were likely hoping for more, and shares traded down 6.5% to $169 immediately following the results.

14. Is Now The Time To Buy Williams-Sonoma?

Updated: February 18, 2026 at 9:39 PM EST

When considering an investment in Williams-Sonoma, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Williams-Sonoma isn’t a terrible business, but it isn’t one of our picks. To begin with, its revenue has declined over the last three years. While its impressive operating margins show it has a highly efficient business model, the downside is its declining physical locations suggests its demand is falling. On top of that, its poor same-store sales performance has been a headwind.

Williams-Sonoma’s P/E ratio based on the next 12 months is 23.9x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $204.79 on the company (compared to the current share price of $213.95), implying they don’t see much short-term potential in Williams-Sonoma.