West Pharmaceutical Services (WST)

West Pharmaceutical Services doesn’t excite us. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why West Pharmaceutical Services Is Not Exciting

Founded in 1923 and serving as a critical link in the pharmaceutical supply chain, West Pharmaceutical Services (NYSE:WST) manufactures specialized packaging, containment systems, and delivery devices for injectable drugs and healthcare products.

- On the plus side, its ROIC punches in at 26.6%, illustrating management’s expertise in identifying profitable investments

West Pharmaceutical Services’s quality doesn’t meet our bar. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than West Pharmaceutical Services

High Quality

Investable

Underperform

Why There Are Better Opportunities Than West Pharmaceutical Services

West Pharmaceutical Services is trading at $228.66 per share, or 31.1x forward P/E. Not only is West Pharmaceutical Services’s multiple richer than most healthcare peers, but it’s also expensive for its fundamentals.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. West Pharmaceutical Services (WST) Research Report: Q3 CY2025 Update

Healthcare products company West Pharmaceutical Services (NYSE:WST) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.7% year on year to $804.6 million. The company’s full-year revenue guidance of $3.07 billion at the midpoint came in 0.5% above analysts’ estimates. Its non-GAAP profit of $1.96 per share was 16.3% above analysts’ consensus estimates.

West Pharmaceutical Services (WST) Q3 CY2025 Highlights:

- Revenue: $804.6 million vs analyst estimates of $787.7 million (7.7% year-on-year growth, 2.1% beat)

- Adjusted EPS: $1.96 vs analyst estimates of $1.69 (16.3% beat)

- The company slightly lifted its revenue guidance for the full year to $3.07 billion at the midpoint from $3.05 billion

- Management raised its full-year Adjusted EPS guidance to $7.09 at the midpoint, a 5% increase

- Operating Margin: 20.8%, in line with the same quarter last year

- Free Cash Flow was -$159.1 million, down from $98.8 million in the same quarter last year

- Market Capitalization: $19.92 billion

Company Overview

Founded in 1923 and serving as a critical link in the pharmaceutical supply chain, West Pharmaceutical Services (NYSE:WST) manufactures specialized packaging, containment systems, and delivery devices for injectable drugs and healthcare products.

West Pharmaceutical Services operates at the intersection of pharmaceutical manufacturing and patient safety, providing the components that keep injectable medications sterile, stable, and ready for use. The company's product line includes rubber stoppers, seals, syringe components, and self-injection devices that pharmaceutical companies incorporate into their final drug products.

These components might seem simple, but they're highly engineered to address specific challenges. For example, West's stoppers must prevent contamination while also being compatible with the drug formulation—a particularly crucial consideration for sensitive biologic medications. A biopharmaceutical company developing a new injectable treatment for diabetes might use West's components to ensure their medication remains stable and sterile throughout its shelf life.

The company divides its business into two segments. The Proprietary Products segment, which generates most of the company's revenue, focuses on drug packaging and delivery systems sold to pharmaceutical manufacturers. The Contract-Manufactured Products segment provides custom manufacturing services, producing complex medical devices and components according to customer specifications.

West's business model relies on long-term relationships with pharmaceutical companies. Once a drug manufacturer selects West's components for a new medication, these components typically remain part of the approved drug product for its entire lifecycle, creating recurring revenue streams. The company serves thousands of customers globally, including most major pharmaceutical and biotechnology companies.

Beyond manufacturing, West offers analytical laboratory services, regulatory expertise, and technical support to help customers navigate the complex process of bringing injectable drugs to market. The company maintains manufacturing facilities across North America, Europe, and Asia to serve its global customer base.

4. Drug Development Inputs & Services

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

West Pharmaceutical Services competes with companies like Becton, Dickinson and Company (NYSE:BDX), Gerresheimer AG (ETR:GXI), Stevanato Group (NYSE:STVN), and Aptar Pharma, a division of AptarGroup (NYSE:ATR), in the pharmaceutical packaging and drug delivery systems market.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $3.02 billion in revenue over the past 12 months, West Pharmaceutical Services has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

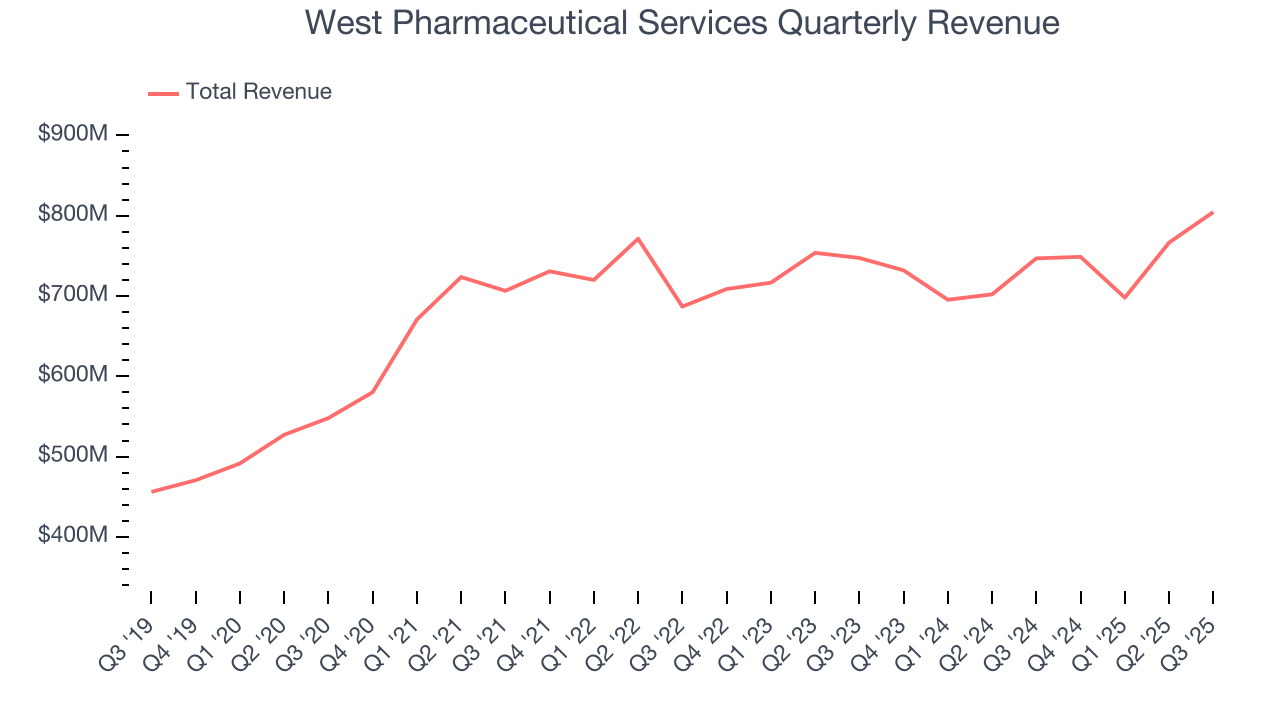

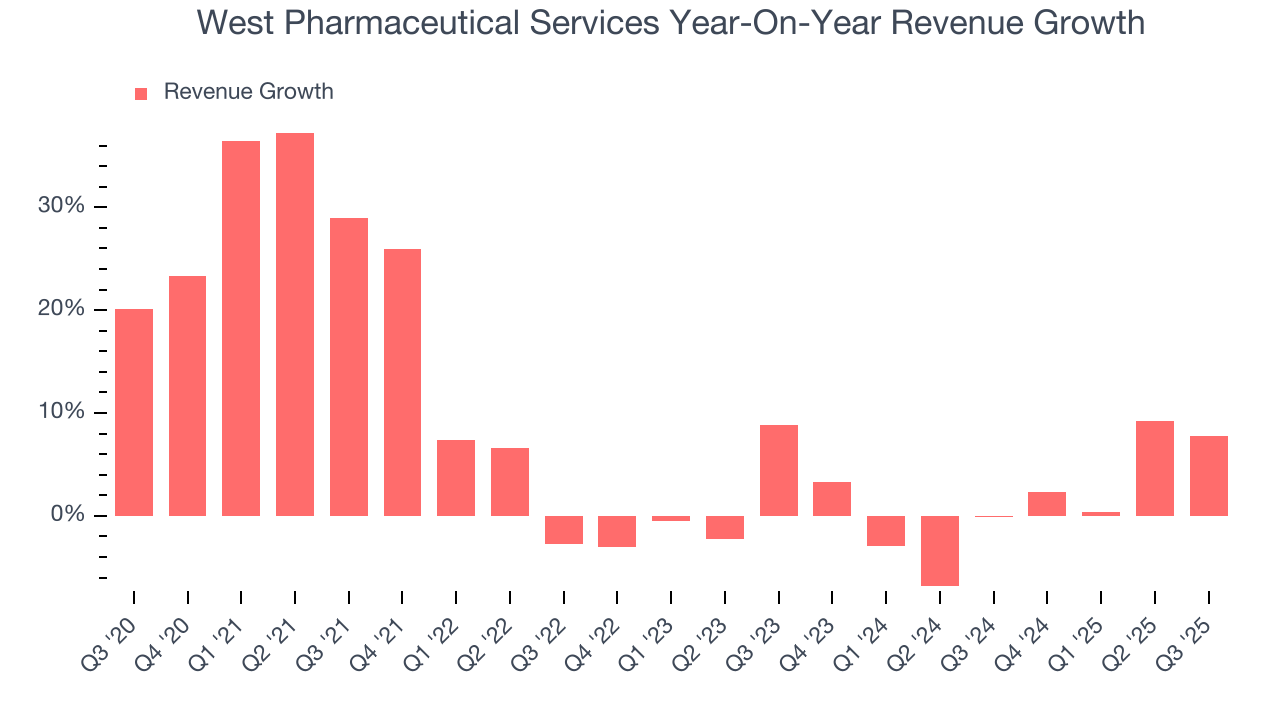

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, West Pharmaceutical Services’s 8.2% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. West Pharmaceutical Services’s recent performance shows its demand has slowed as its annualized revenue growth of 1.5% over the last two years was below its five-year trend.

This quarter, West Pharmaceutical Services reported year-on-year revenue growth of 7.7%, and its $804.6 million of revenue exceeded Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will spur better top-line performance.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

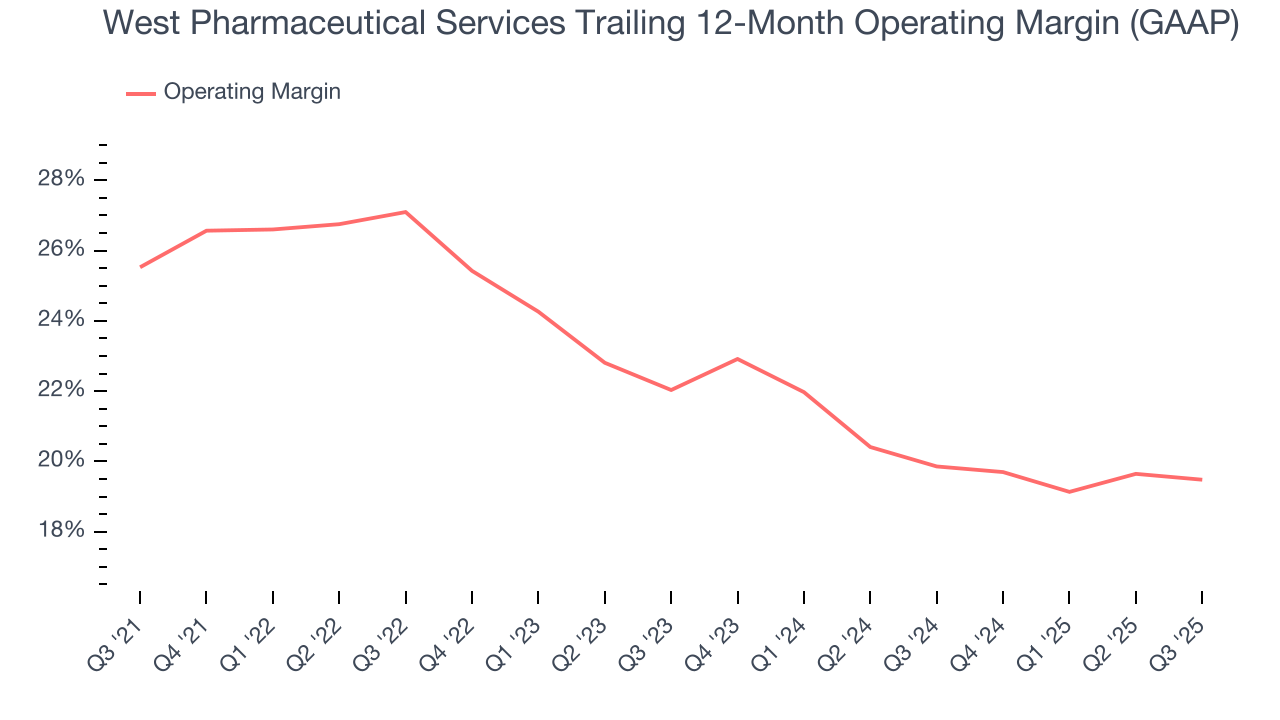

West Pharmaceutical Services has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 22.7%.

Looking at the trend in its profitability, West Pharmaceutical Services’s operating margin decreased by 6 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 2.6 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, West Pharmaceutical Services generated an operating margin profit margin of 20.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

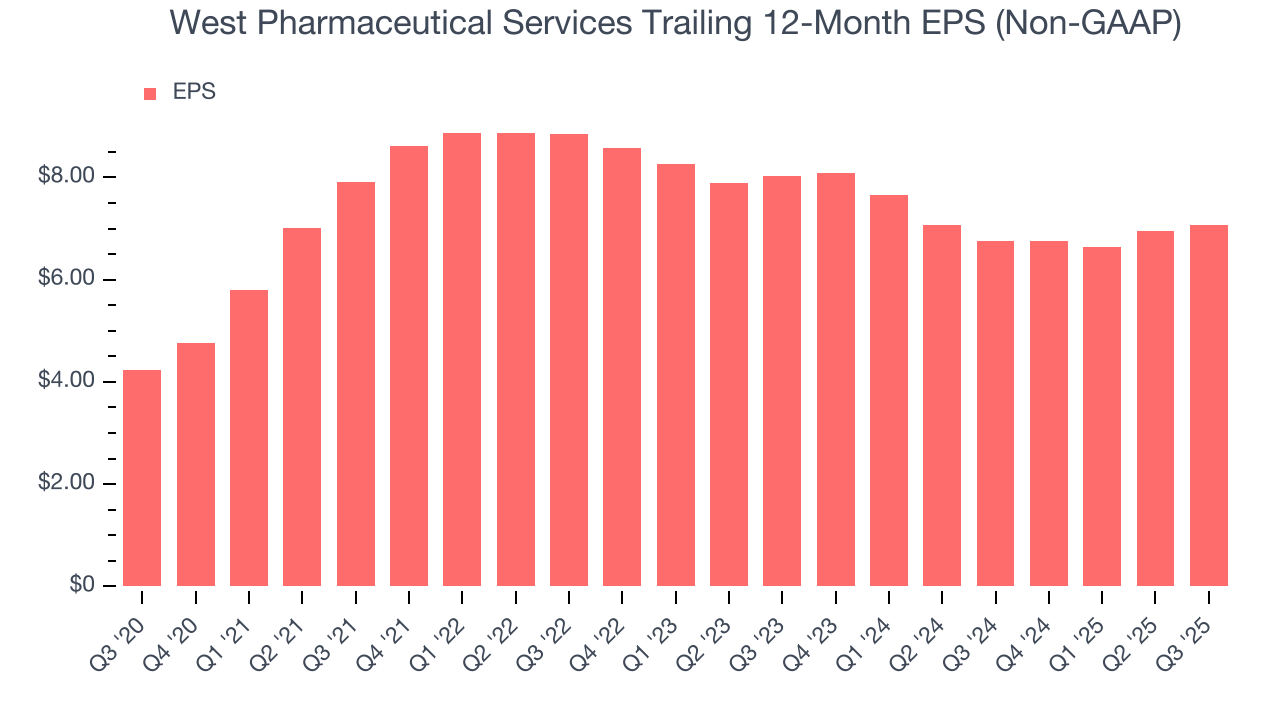

West Pharmaceutical Services’s EPS grew at a remarkable 10.8% compounded annual growth rate over the last five years, higher than its 8.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

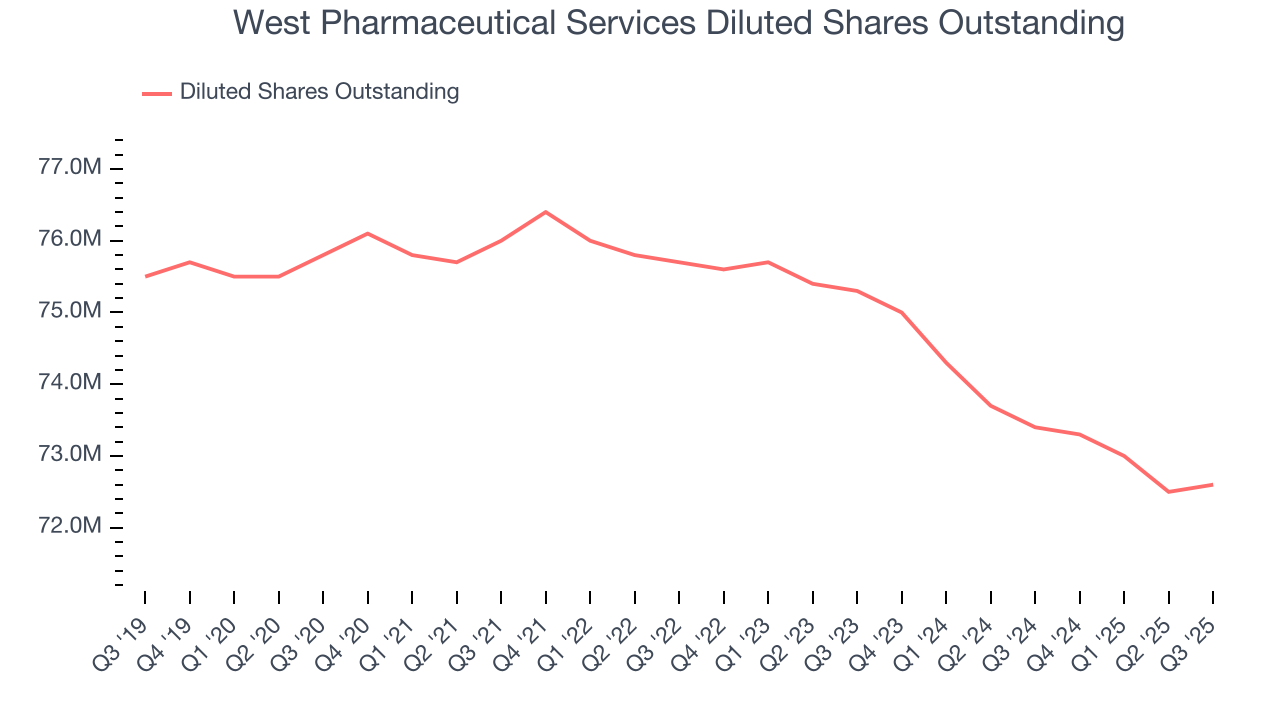

We can take a deeper look into West Pharmaceutical Services’s earnings to better understand the drivers of its performance. A five-year view shows that West Pharmaceutical Services has repurchased its stock, shrinking its share count by 4.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, West Pharmaceutical Services reported adjusted EPS of $1.96, up from $1.85 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects West Pharmaceutical Services’s full-year EPS of $7.07 to grow 2.7%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

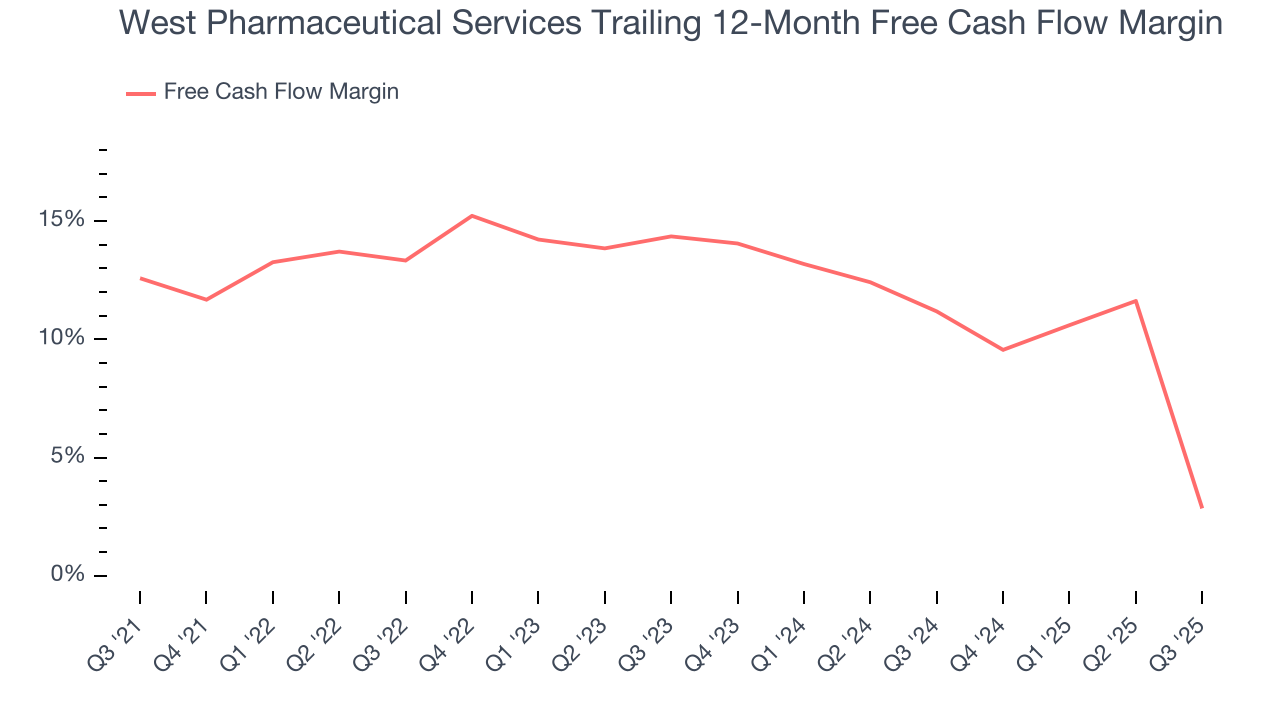

West Pharmaceutical Services has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.8% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that West Pharmaceutical Services’s margin dropped by 9.7 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

West Pharmaceutical Services burned through $159.1 million of cash in Q3, equivalent to a negative 19.8% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

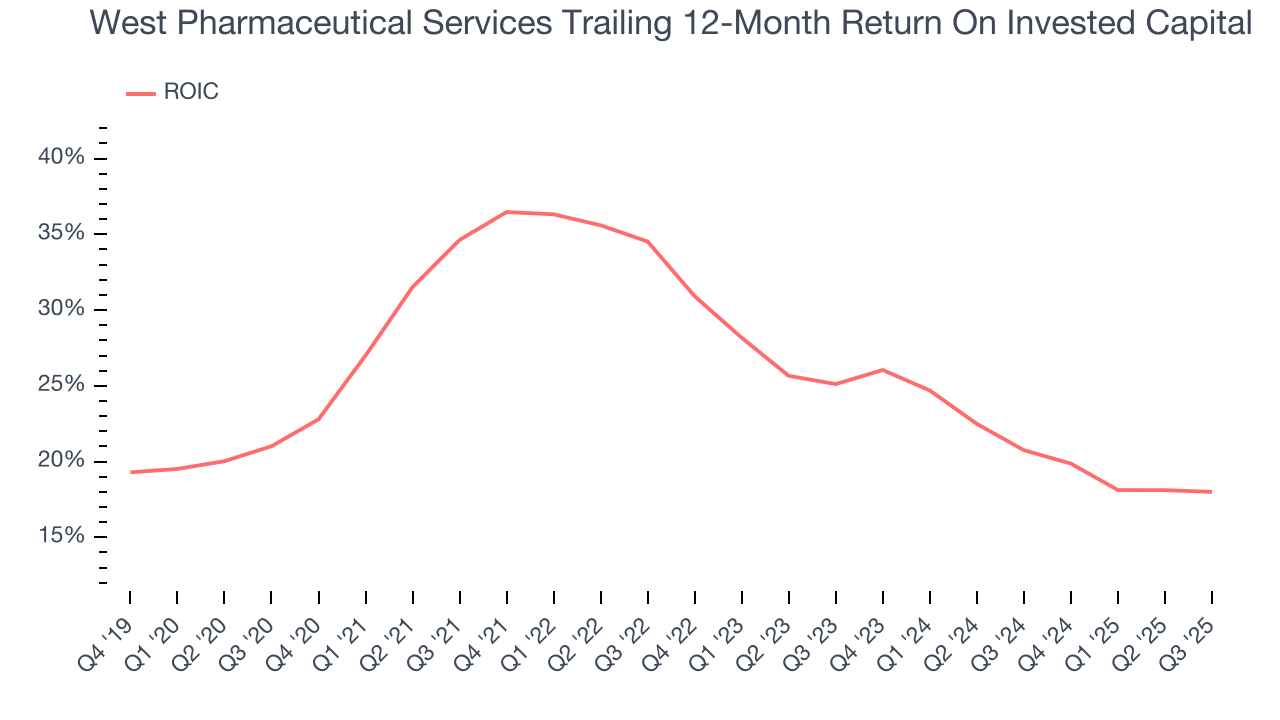

Although West Pharmaceutical Services hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 26.6%, splendid for a healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, West Pharmaceutical Services’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

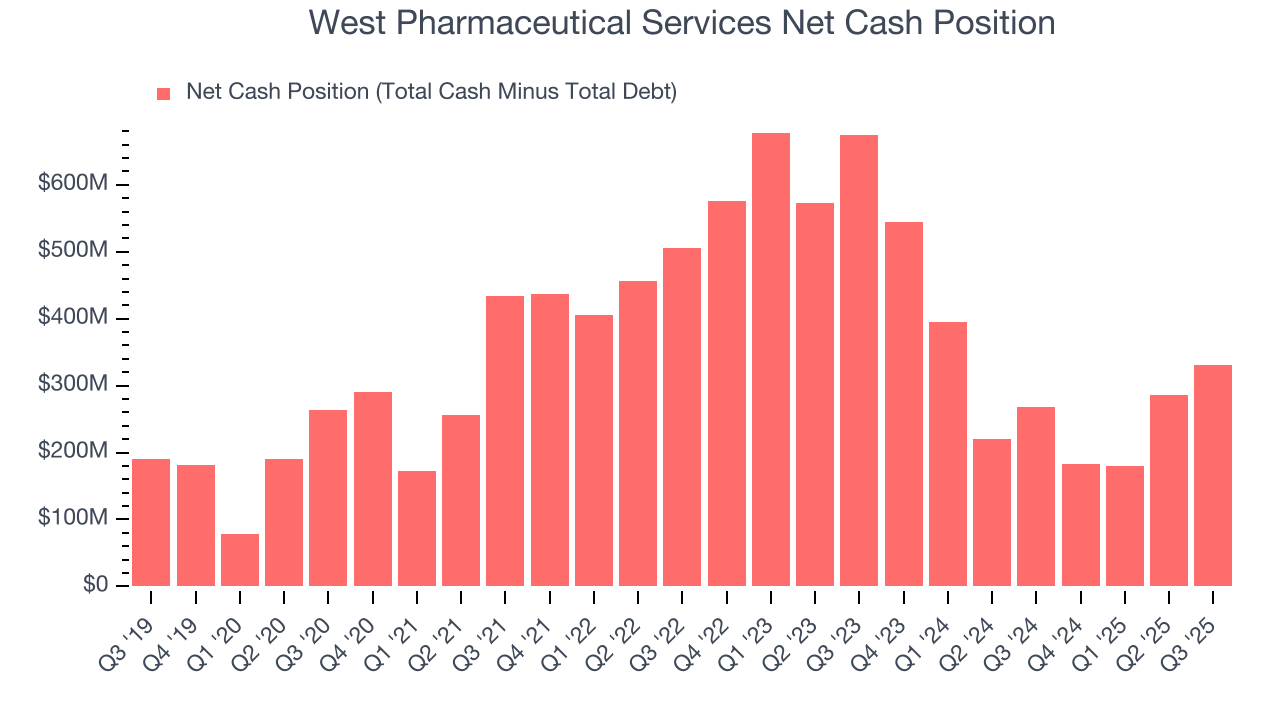

West Pharmaceutical Services is a profitable, well-capitalized company with $628.5 million of cash and $297.6 million of debt on its balance sheet. This $330.9 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from West Pharmaceutical Services’s Q3 Results

We enjoyed seeing West Pharmaceutical Services beat analysts’ full-year EPS guidance expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 4.4% to $289 immediately after reporting.

13. Is Now The Time To Buy West Pharmaceutical Services?

Updated: January 30, 2026 at 11:09 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in West Pharmaceutical Services.

West Pharmaceutical Services isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s stellar ROIC suggests it has been a well-run company historically, the downside is its declining adjusted operating margin shows the business has become less efficient.

West Pharmaceutical Services’s P/E ratio based on the next 12 months is 31.1x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $345.71 on the company (compared to the current share price of $228.66).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.