West Pharmaceutical Services (WST)

We’re skeptical of West Pharmaceutical Services. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why West Pharmaceutical Services Is Not Exciting

Founded in 1923 and serving as a critical link in the pharmaceutical supply chain, West Pharmaceutical Services (NYSE:WST) manufactures specialized packaging, containment systems, and delivery devices for injectable drugs and healthcare products.

- A silver lining is that its ROIC punches in at 26.6%, illustrating management’s expertise in identifying profitable investments

West Pharmaceutical Services doesn’t meet our quality standards. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than West Pharmaceutical Services

High Quality

Investable

Underperform

Why There Are Better Opportunities Than West Pharmaceutical Services

West Pharmaceutical Services’s stock price of $244.77 implies a valuation ratio of 32.6x forward P/E. This multiple is higher than most healthcare companies, and we think it’s quite expensive for the quality you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. West Pharmaceutical Services (WST) Research Report: Q4 CY2025 Update

Healthcare products company West Pharmaceutical Services (NYSE:WST) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 7.5% year on year to $805 million. The company expects the full year’s revenue to be around $3.25 billion, close to analysts’ estimates. Its non-GAAP profit of $2.04 per share was 11.5% above analysts’ consensus estimates.

West Pharmaceutical Services (WST) Q4 CY2025 Highlights:

- Revenue: $805 million vs analyst estimates of $793.4 million (7.5% year-on-year growth, 1.5% beat)

- Adjusted EPS: $2.04 vs analyst estimates of $1.83 (11.5% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $8.02 at the midpoint, beating analyst estimates by 3.4%

- Operating Margin: 19.5%, down from 21.3% in the same quarter last year

- Free Cash Flow Margin: 21.7%, up from 11.4% in the same quarter last year

- Market Capitalization: $17.71 billion

Company Overview

Founded in 1923 and serving as a critical link in the pharmaceutical supply chain, West Pharmaceutical Services (NYSE:WST) manufactures specialized packaging, containment systems, and delivery devices for injectable drugs and healthcare products.

West Pharmaceutical Services operates at the intersection of pharmaceutical manufacturing and patient safety, providing the components that keep injectable medications sterile, stable, and ready for use. The company's product line includes rubber stoppers, seals, syringe components, and self-injection devices that pharmaceutical companies incorporate into their final drug products.

These components might seem simple, but they're highly engineered to address specific challenges. For example, West's stoppers must prevent contamination while also being compatible with the drug formulation—a particularly crucial consideration for sensitive biologic medications. A biopharmaceutical company developing a new injectable treatment for diabetes might use West's components to ensure their medication remains stable and sterile throughout its shelf life.

The company divides its business into two segments. The Proprietary Products segment, which generates most of the company's revenue, focuses on drug packaging and delivery systems sold to pharmaceutical manufacturers. The Contract-Manufactured Products segment provides custom manufacturing services, producing complex medical devices and components according to customer specifications.

West's business model relies on long-term relationships with pharmaceutical companies. Once a drug manufacturer selects West's components for a new medication, these components typically remain part of the approved drug product for its entire lifecycle, creating recurring revenue streams. The company serves thousands of customers globally, including most major pharmaceutical and biotechnology companies.

Beyond manufacturing, West offers analytical laboratory services, regulatory expertise, and technical support to help customers navigate the complex process of bringing injectable drugs to market. The company maintains manufacturing facilities across North America, Europe, and Asia to serve its global customer base.

4. Drug Development Inputs & Services

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

West Pharmaceutical Services competes with companies like Becton, Dickinson and Company (NYSE:BDX), Gerresheimer AG (ETR:GXI), Stevanato Group (NYSE:STVN), and Aptar Pharma, a division of AptarGroup (NYSE:ATR), in the pharmaceutical packaging and drug delivery systems market.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $3.07 billion in revenue over the past 12 months, West Pharmaceutical Services has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

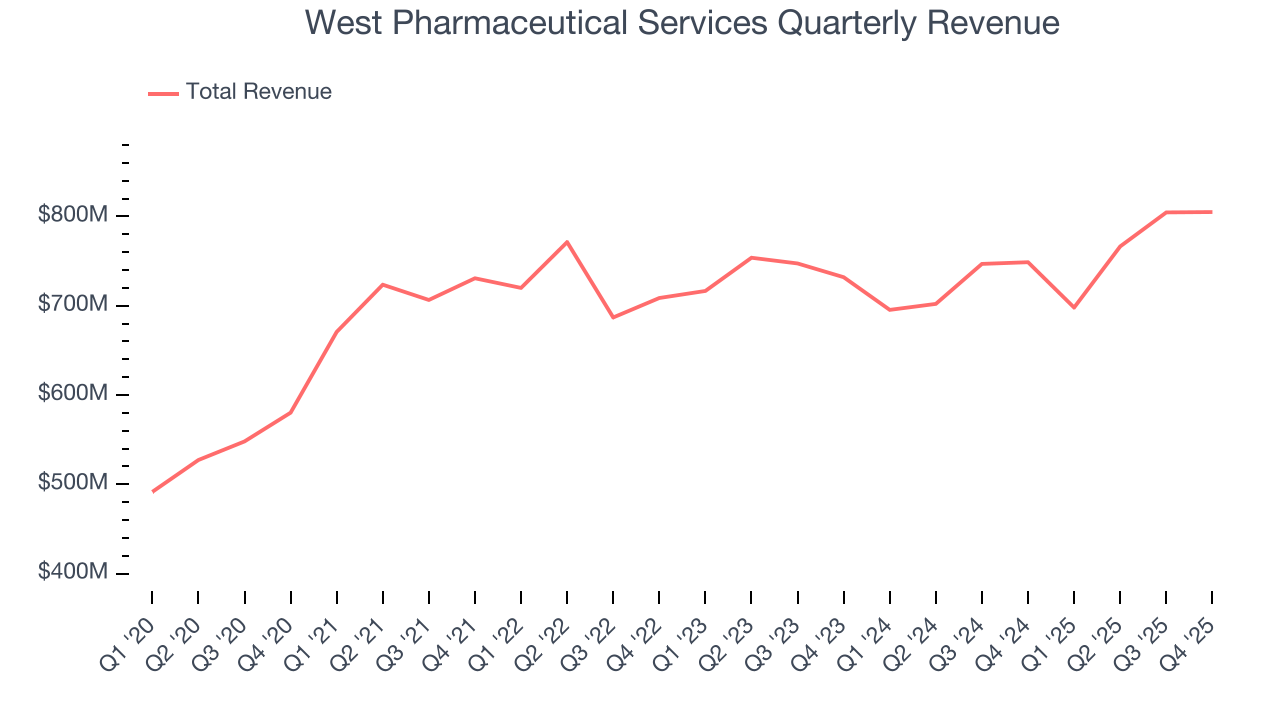

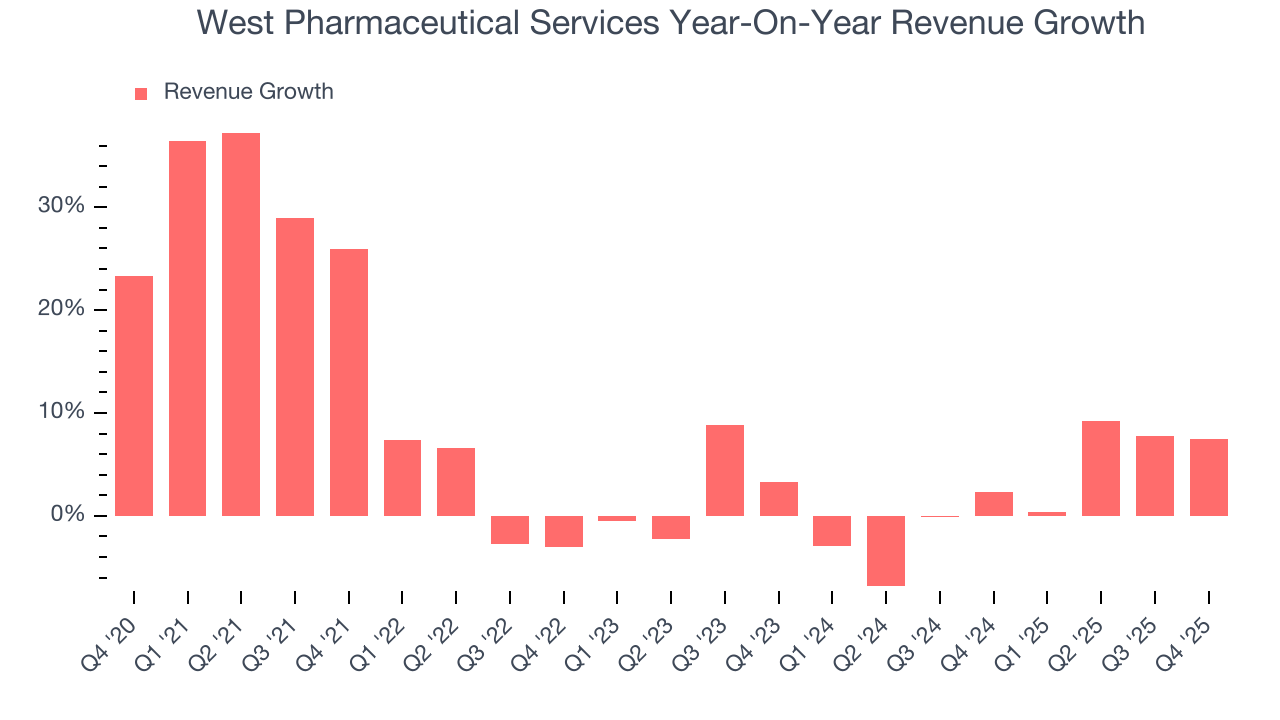

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, West Pharmaceutical Services grew its sales at a mediocre 7.4% compounded annual growth rate. This was below our standard for the healthcare sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. West Pharmaceutical Services’s recent performance shows its demand has slowed as its annualized revenue growth of 2.1% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, West Pharmaceutical Services reported year-on-year revenue growth of 7.5%, and its $805 million of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and indicates its newer products and services will spur better top-line performance.

7. Operating Margin

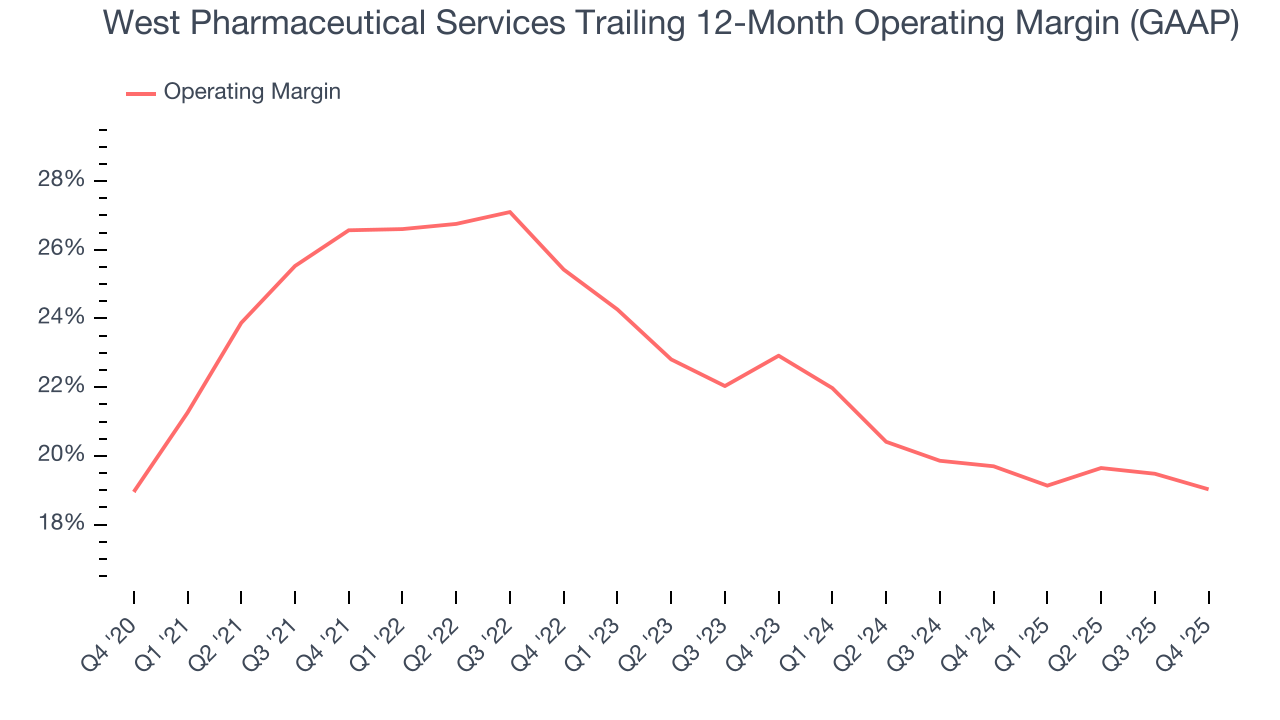

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

West Pharmaceutical Services has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 22.7%.

Analyzing the trend in its profitability, West Pharmaceutical Services’s operating margin decreased by 7.5 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 3.9 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, West Pharmaceutical Services generated an operating margin profit margin of 19.5%, down 1.9 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

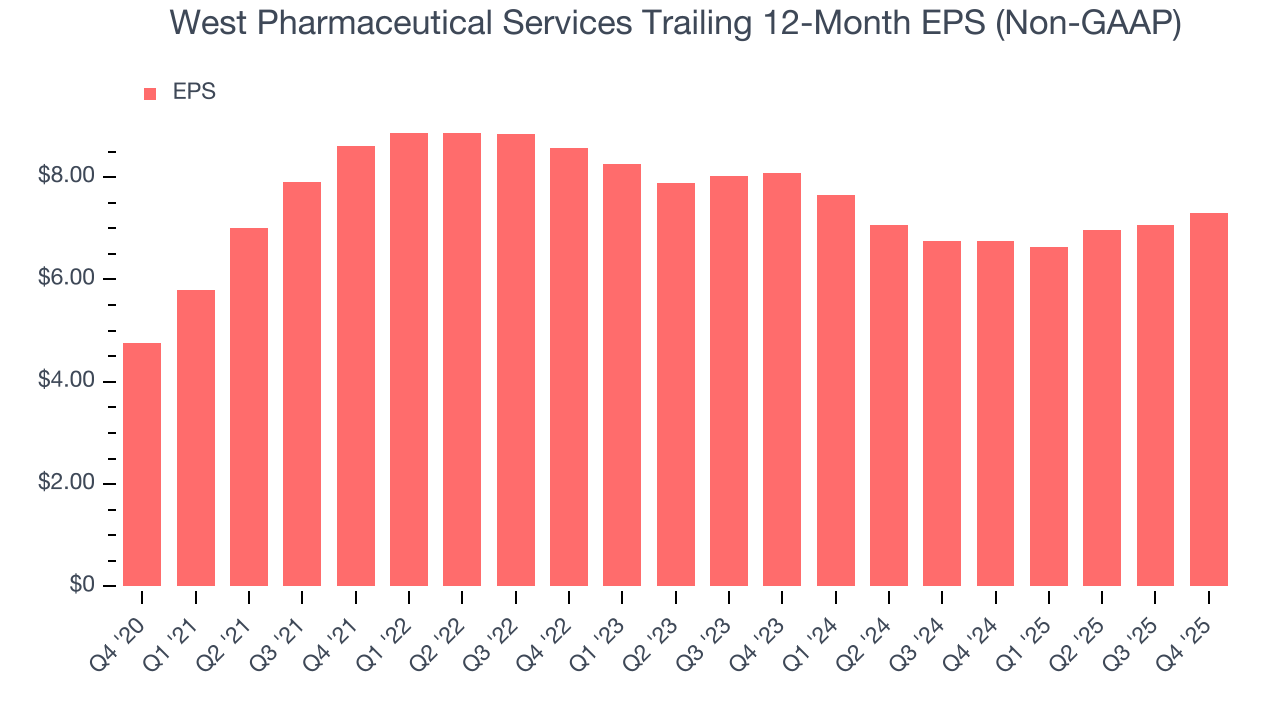

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

West Pharmaceutical Services’s solid 8.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, West Pharmaceutical Services reported adjusted EPS of $2.04, up from $1.82 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects West Pharmaceutical Services’s full-year EPS of $7.29 to grow 5.5%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

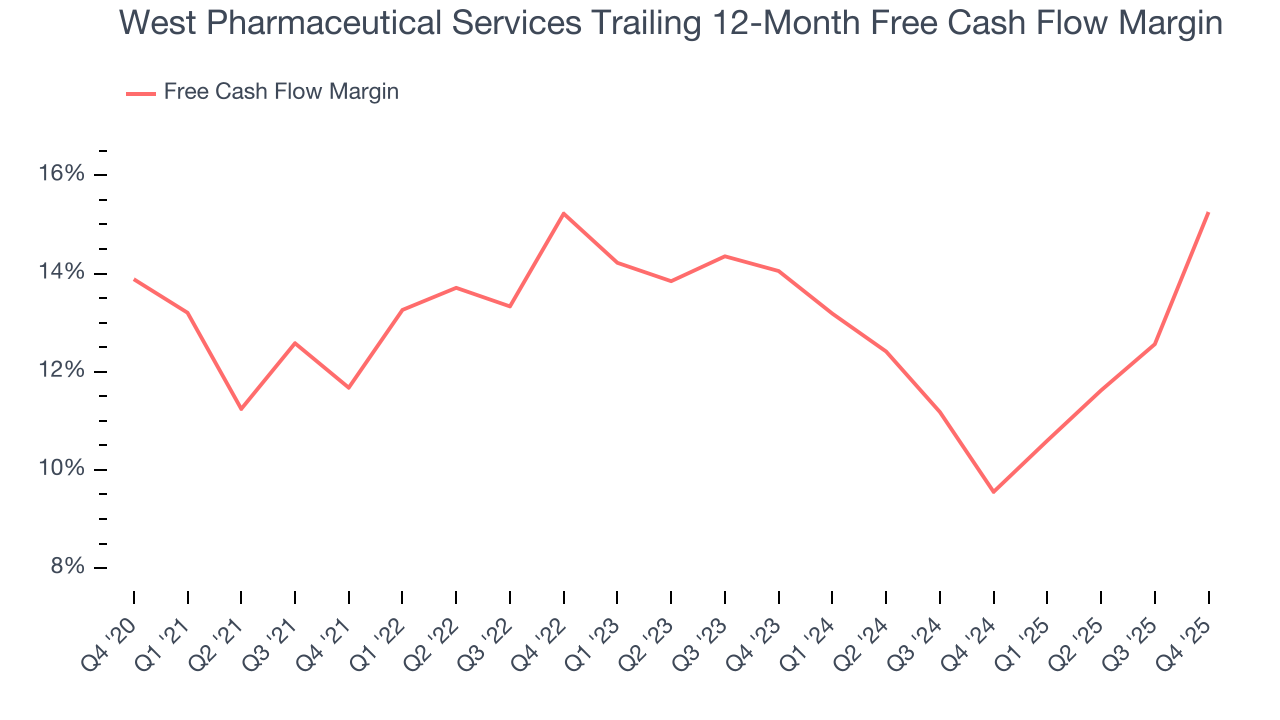

West Pharmaceutical Services has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.2% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that West Pharmaceutical Services’s margin expanded by 3.6 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

West Pharmaceutical Services’s free cash flow clocked in at $175 million in Q4, equivalent to a 21.7% margin. This result was good as its margin was 10.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

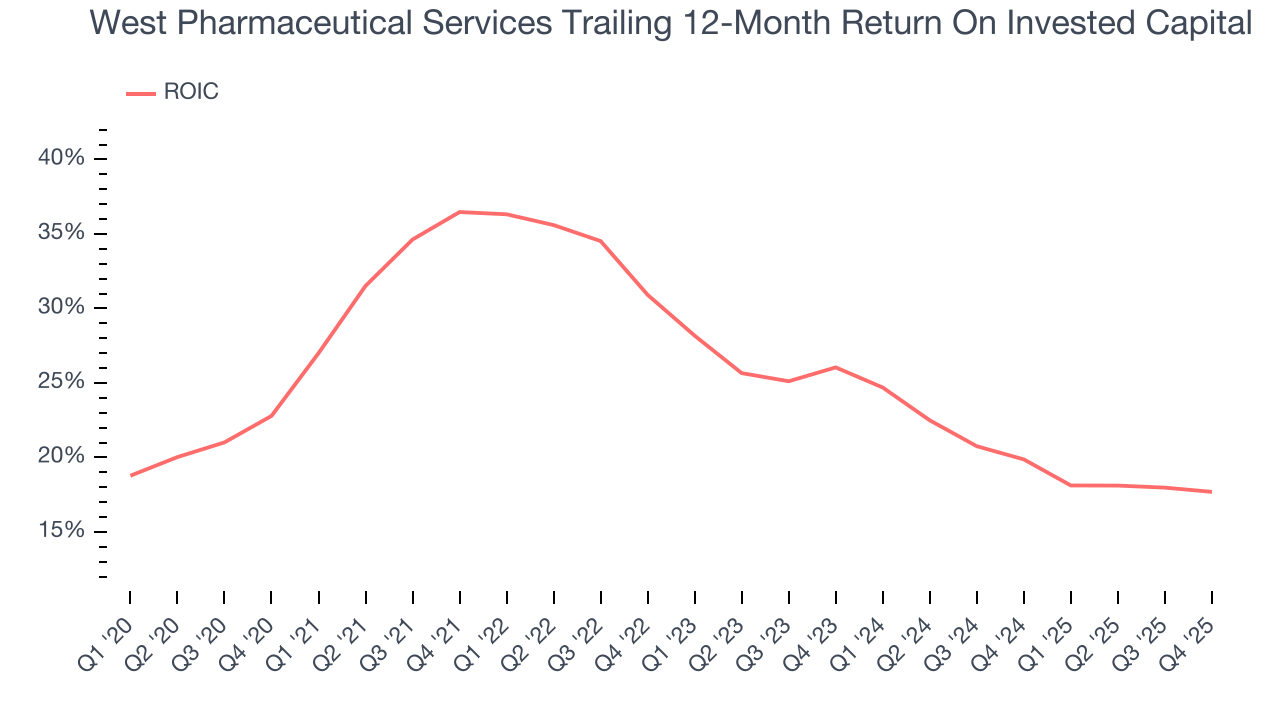

Although West Pharmaceutical Services hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 26.2%, splendid for a healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, West Pharmaceutical Services’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Key Takeaways from West Pharmaceutical Services’s Q4 Results

We enjoyed seeing West Pharmaceutical Services beat analysts’ full-year EPS guidance expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 7.4% to $264.50 immediately following the results.

12. Is Now The Time To Buy West Pharmaceutical Services?

Updated: February 12, 2026 at 6:11 AM EST

Are you wondering whether to buy West Pharmaceutical Services or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

West Pharmaceutical Services isn’t a terrible business, but it isn’t one of our picks. First off, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its stellar ROIC suggests it has been a well-run company historically, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining operating margin shows the business has become less efficient.

West Pharmaceutical Services’s P/E ratio based on the next 12 months is 32x. At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $333.57 on the company (compared to the current share price of $264.50).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.