WisdomTree (WT)

WisdomTree is in a league of its own. Its elite revenue growth and returns on capital demonstrate it can grow rapidly and profitably.― StockStory Analyst Team

1. News

2. Summary

Why We Like WisdomTree

Originally founded as a financial media company before pivoting to ETF management in 2006, WisdomTree (NYSE:WT) is a financial services company that creates and manages exchange-traded funds (ETFs) and other investment products for individual and institutional investors.

- Incremental sales over the last five years have been highly profitable as its earnings per share increased by 28% annually, topping its revenue gains

- Impressive 18.9% annual revenue growth over the last two years indicates it’s winning market share this cycle

- Stellar return on equity showcases management’s ability to surface highly profitable business ventures

We have an affinity for WisdomTree. The price seems fair when considering its quality, and we think now is a favorable time to buy.

Why Is Now The Time To Buy WisdomTree?

High Quality

Investable

Underperform

Why Is Now The Time To Buy WisdomTree?

WisdomTree’s stock price of $16.59 implies a valuation ratio of 15.3x forward P/E. Scanning the financials landscape, we think this multiple is reasonable - arguably even attractive - for the quality you get.

Entry price matters far less than business fundamentals if you’re investing for a multi-year period. But if you can get a bargain price it’s certainly icing on the cake.

3. WisdomTree (WT) Research Report: Q4 CY2025 Update

Asset management firm WisdomTree (NYSE:WT) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 33.4% year on year to $147.4 million. Its non-GAAP profit of $0.29 per share was 23.4% above analysts’ consensus estimates.

WisdomTree (WT) Q4 CY2025 Highlights:

- Assets Under Management: $144.5 billion vs analyst estimates of $142.1 billion (31.6% year-on-year growth, 1.7% beat)

- Revenue: $147.4 million vs analyst estimates of $143.1 million (33.4% year-on-year growth, 3% beat)

- Pre-tax Profit: $50.46 million (34.2% margin)

- Adjusted EPS: $0.29 vs analyst estimates of $0.24 (23.4% beat)

- Market Capitalization: $2.26 billion

Company Overview

Originally founded as a financial media company before pivoting to ETF management in 2006, WisdomTree (NYSE:WT) is a financial services company that creates and manages exchange-traded funds (ETFs) and other investment products for individual and institutional investors.

WisdomTree specializes in creating innovative ETFs that often follow alternative indexing strategies, moving beyond traditional market capitalization-weighted approaches. The company's products include equity, fixed income, currency, commodity, and alternative strategy ETFs, giving investors tools to diversify their portfolios across various asset classes and geographies. Many of WisdomTree's funds employ a "smart beta" approach, which aims to enhance returns or reduce risk by selecting and weighting securities based on factors other than market value alone.

The firm serves a diverse client base ranging from retail investors who access WisdomTree products through their brokerage accounts to large institutional investors like pension funds, endowments, and wealth management firms. For example, a financial advisor might use WisdomTree's dividend-focused ETFs to provide income-seeking retirees with exposure to dividend-paying companies, or utilize its currency-hedged funds to help clients manage foreign exchange risk in their international investments.

WisdomTree generates revenue primarily through management fees charged as a percentage of assets under management (AUM). As investors buy shares of WisdomTree ETFs, the company's AUM grows, increasing its fee revenue. The company has expanded beyond its U.S. roots to offer products in Europe, Latin America, and Asia, making it a global player in the ETF industry. In addition to its core ETF business, WisdomTree has ventured into digital assets and blockchain-enabled financial services, developing products that bridge traditional finance with emerging technologies.

4. Custody Bank

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

WisdomTree competes with large ETF providers like BlackRock's iShares (NYSE: BLK), Vanguard, State Street Global Advisors (NYSE: STT), and Invesco (NYSE: IVZ), as well as other asset managers offering alternative or specialized investment products.

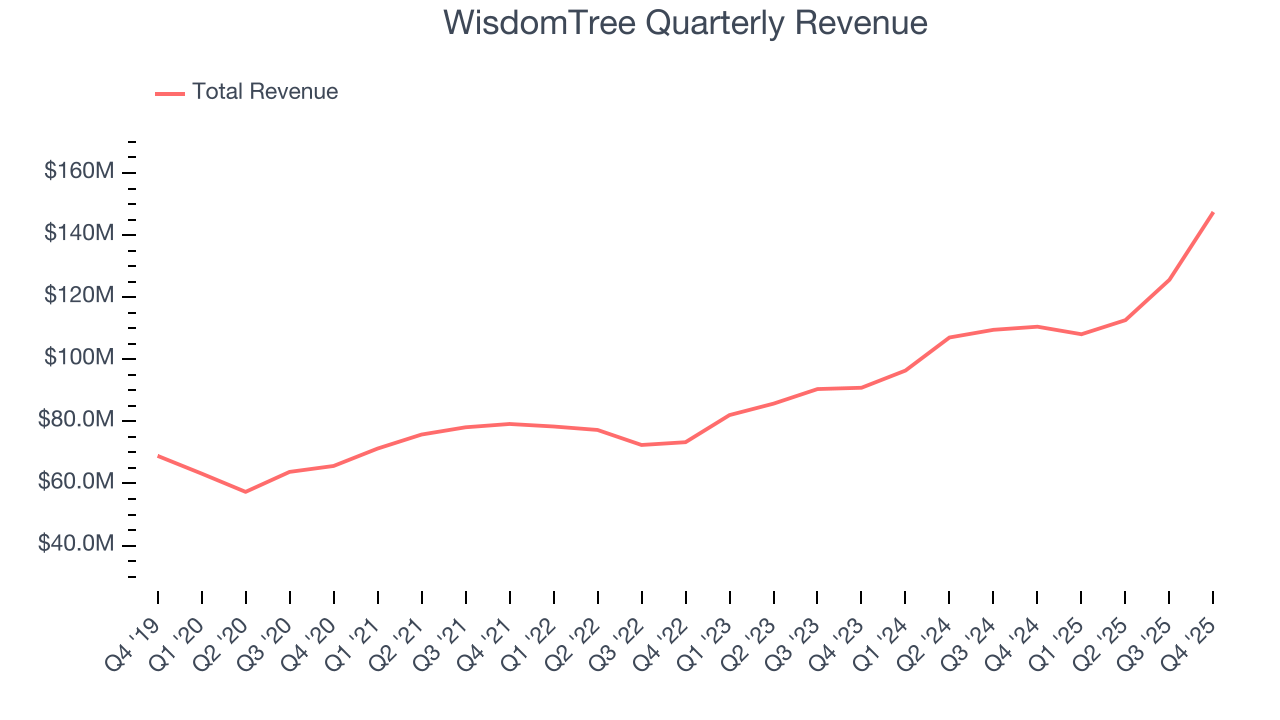

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, WisdomTree’s 14.6% annualized revenue growth over the last five years was impressive. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. WisdomTree’s annualized revenue growth of 18.9% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, WisdomTree reported wonderful year-on-year revenue growth of 33.4%, and its $147.4 million of revenue exceeded Wall Street’s estimates by 3%.

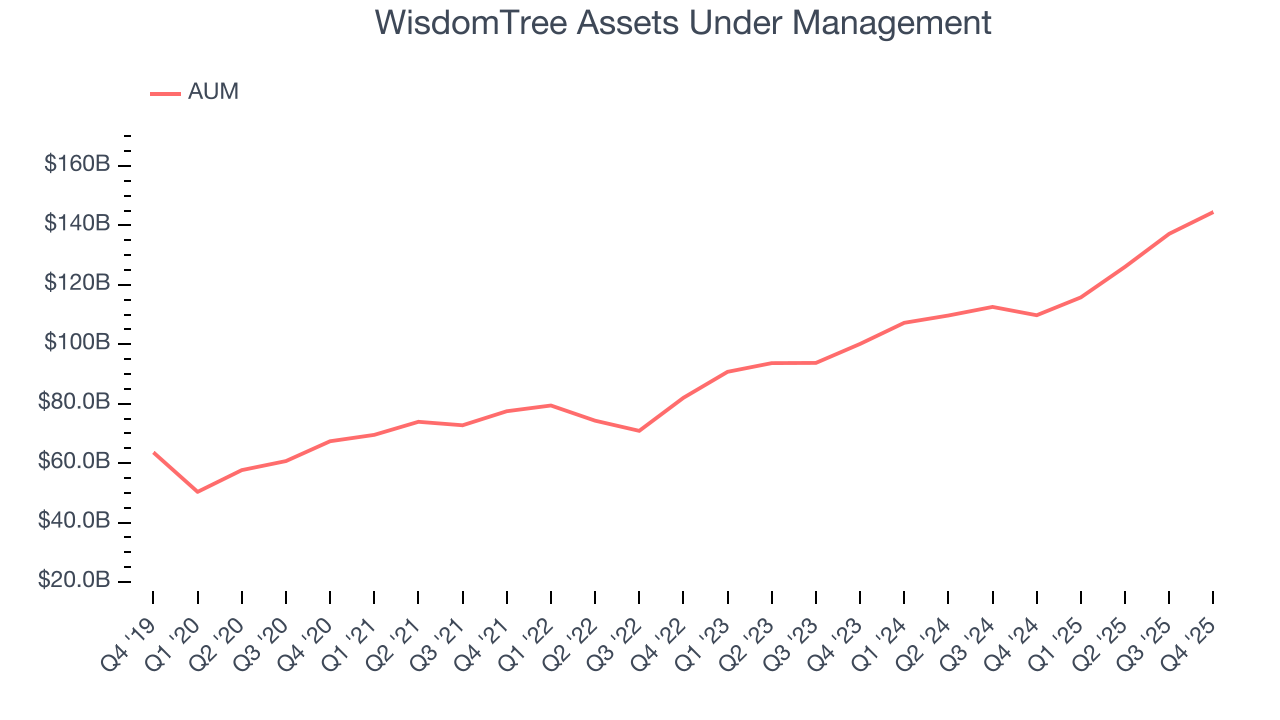

6. Assets Under Management (AUM)

Assets Under Management (AUM) is the cornerstone of a financial firm's investment division, representing all client capital under its stewardship. Management fees on this AUM create reliable, recurring revenue that maintains stability even when investment performance struggles, though prolonged poor returns can eventually affect asset retention and growth.

WisdomTree’s AUM has grown at an annual rate of 17.3% over the last five years, better than the broader financials industry and faster than its total revenue. When analyzing WisdomTree’s AUM over the last two years, we can paint a similar picture as it recorded 17.6% annual growth. Fundraising or short-term investment performance were net detractors to the company over this shorter period since assets grew slower than total revenue. Keep in mind that asset growth can be erratic and seasonal, so we don't rely on it too heavily for our business quality analysis.

WisdomTree’s AUM punched in at $144.5 billion this quarter, beating analysts’ expectations by 1.7%. This print was 31.6% higher than the same quarter last year.

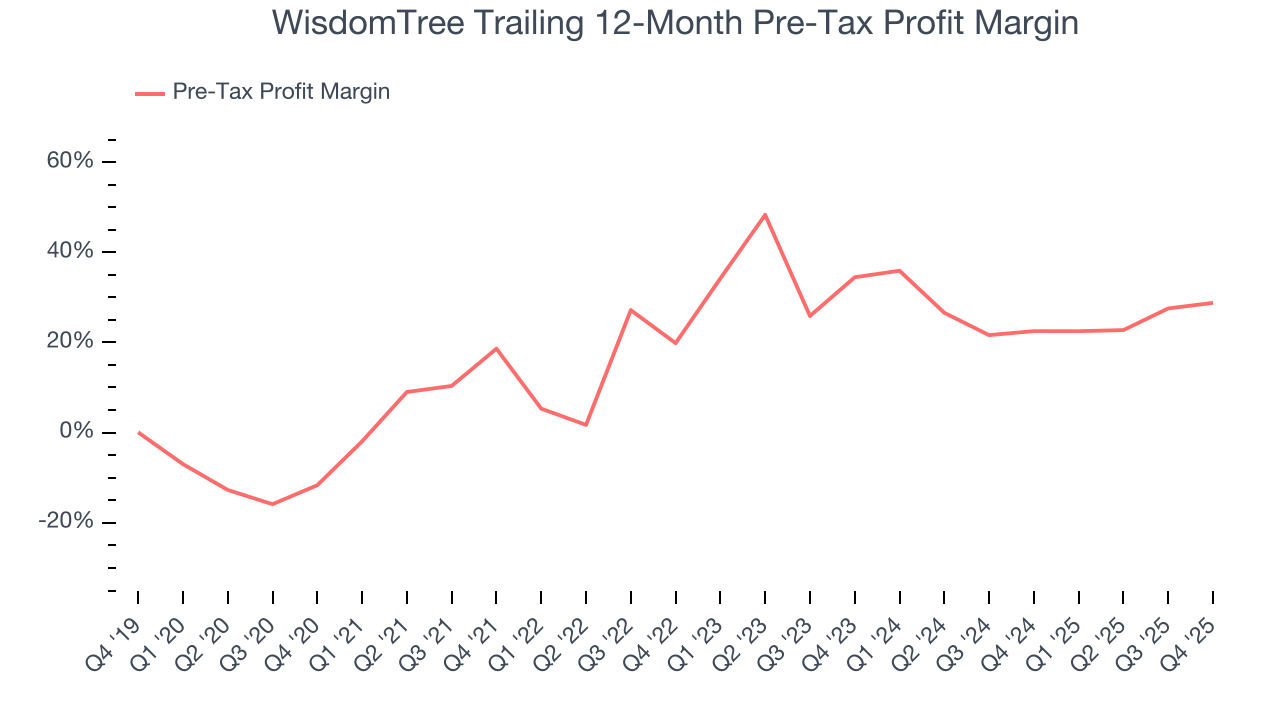

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Custody Bank companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, WisdomTree’s pre-tax profit margin has fallen by 40.5 percentage points, going from 18.6% to 28.8%. However, the company gave back some of its expense savings as its pre-tax profit margin declined by 5.7 percentage points on a two-year basis.

In Q4, WisdomTree’s pre-tax profit margin was 34.2%. This result was 3.3 percentage points better than the same quarter last year.

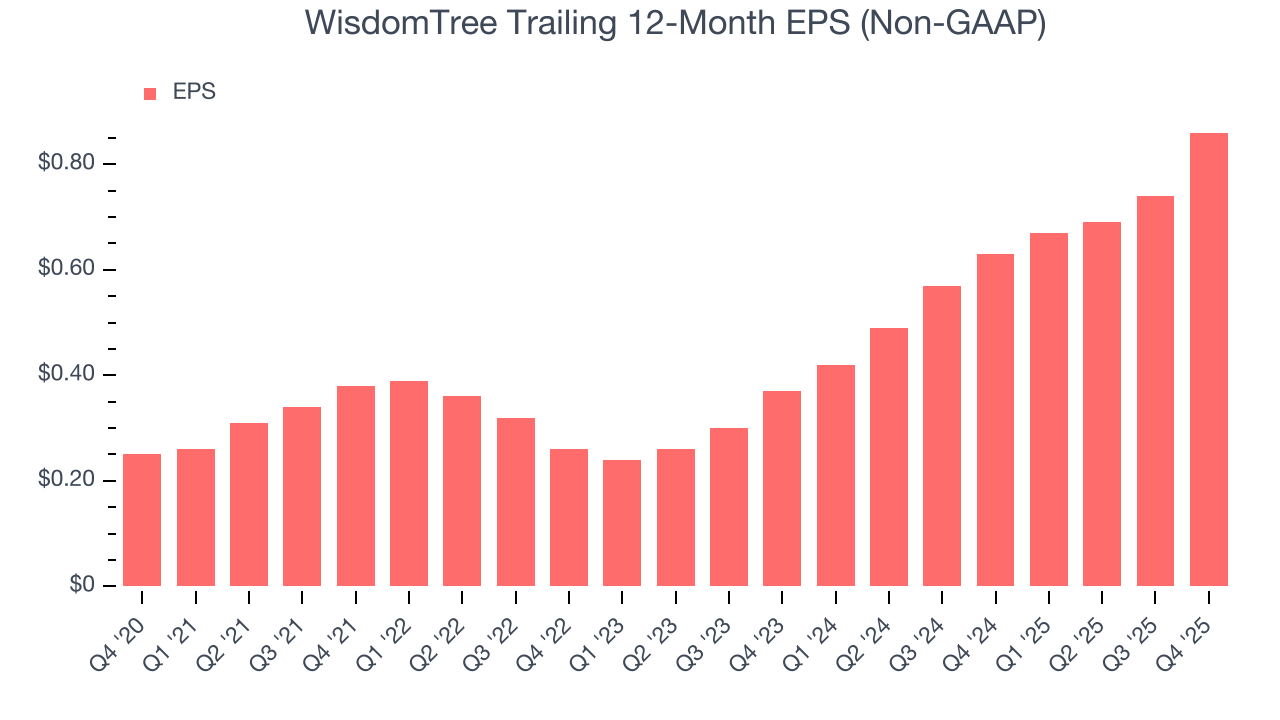

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

WisdomTree’s EPS grew at an astounding 28% compounded annual growth rate over the last five years, higher than its 14.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For WisdomTree, its two-year annual EPS growth of 52.5% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, WisdomTree reported adjusted EPS of $0.29, up from $0.17 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects WisdomTree’s full-year EPS of $0.86 to grow 11.4%.

9. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, WisdomTree has averaged an ROE of 15.8%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows WisdomTree has a decent competitive moat.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

WisdomTree currently has $956.6 million of debt and $413.7 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1.7×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from WisdomTree’s Q4 Results

It was good to see WisdomTree beat analysts’ EPS expectations this quarter. We were also happy its AUM outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 2.1% to $16.90 immediately after reporting.

12. Is Now The Time To Buy WisdomTree?

Updated: March 9, 2026 at 1:22 AM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in WisdomTree.

WisdomTree is one of the best financials companies out there. To begin with, its revenue growth was impressive over the last five years, and its growth over the next 12 months is expected to accelerate. On top of that, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, and its expanding pre-tax profit margin shows the business has become more efficient.

WisdomTree’s P/E ratio based on the next 12 months is 15.3x. Looking across the spectrum of financials businesses, WisdomTree’s fundamentals clearly illustrate it’s a special business. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $19.04 on the company (compared to the current share price of $16.59), implying they see 14.8% upside in buying WisdomTree in the short term.