The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s have a look at how AppLovin (NASDAQ:APP) and the rest of the advertising software stocks fared in Q4.

The digital advertising market is large, growing and becoming more diverse, both in terms of audiences and media. This as a result drives a growing need for a software that enables advertisers to use data to automate and optimize ad placements.

The 6 advertising software stocks we track reported a weaker Q4; on average, revenues beat analyst consensus estimates by 1.42%, while on average next quarter revenue guidance was 0.74% under consensus. Technology stocks have been hit hard on fears of higher interest rates as investors search for near-term cash flows, but advertising software stocks held their ground better than others, with the share prices up 10.7% since the previous earnings results, on average.

AppLovin (NASDAQ:APP)

Co-founded by Adam Foroughi who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is a provider of marketing and monetization tools for mobile app developers and also operates a portfolio of mobile games.

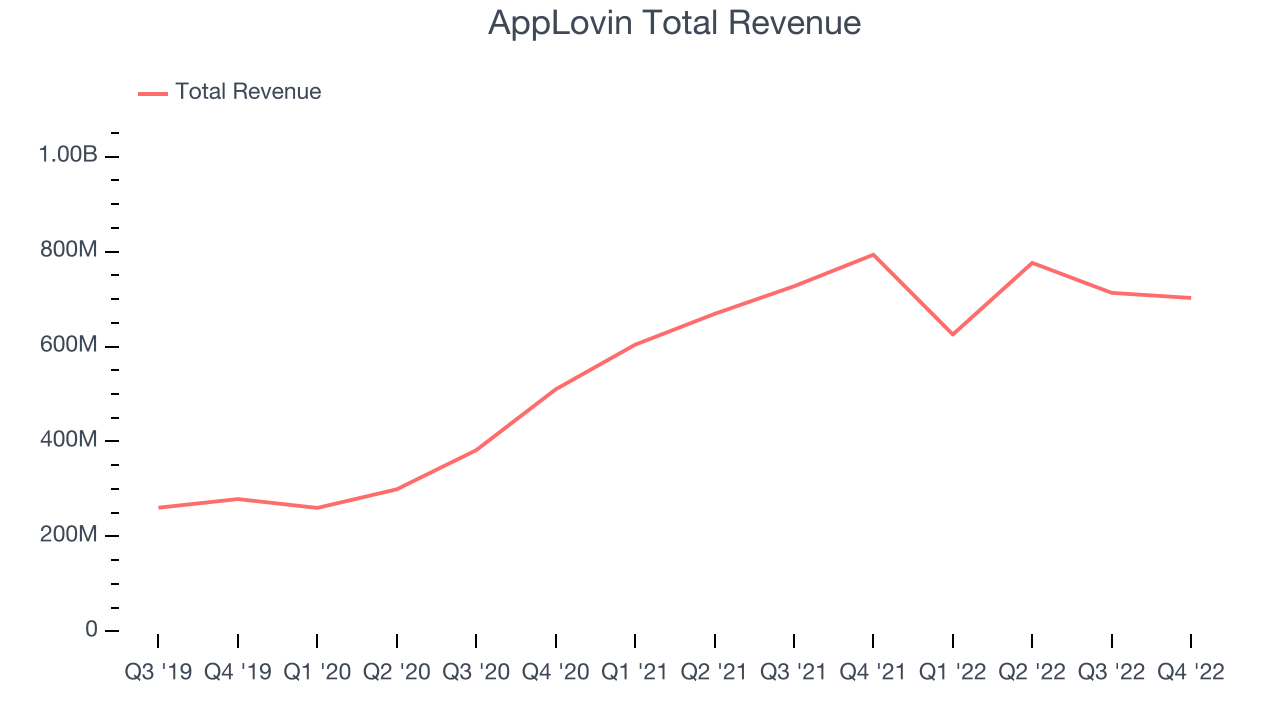

AppLovin reported revenues of $702.3 million, down 11.5% year on year, beating analyst expectations by 1.71%. It was a weak quarter for the company, with declining revenue and gross margin.

AppLovin delivered the slowest revenue growth of the whole group. The stock is up 30.7% since the results and currently trades at $16.6.

Read our full report on AppLovin here, it's free.

Best Q4: Zeta (NYSE:ZETA)

Co-Founded by former Apple CEO, John Scully, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

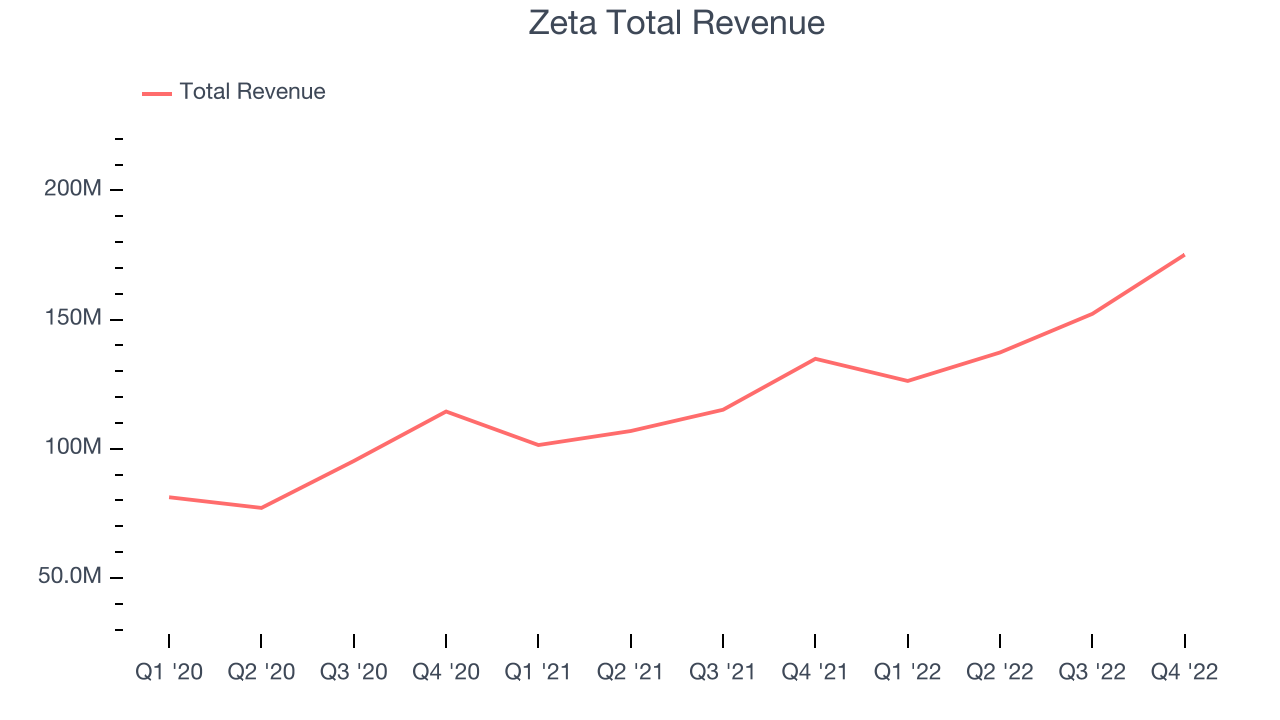

Zeta reported revenues of $175.1 million, up 29.9% year on year, beating analyst expectations by 9.06%. It was a decent quarter for the company, with an impressive beat of analyst estimates but underwhelming guidance for the next year.

Zeta pulled off the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The stock is up 13.2% since the results and currently trades at $10.26.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it's free.

Weakest Q4: PubMatic (NASDAQ:PUBM)

Founded in 2006, as an online ad platform focused on ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $74.3 million, down 1.67% year on year, missing analyst expectations by 3.07%. It was a weak quarter for the company, with slow revenue growth and underwhelming revenue guidance for the next quarter.

PubMatic had the weakest performance against analyst estimates in the group. The stock is down 6.72% since the results and currently trades at $14.15.

Read our full analysis of PubMatic's results here.

DoubleVerify (NYSE:DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE: DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

DoubleVerify reported revenues of $133.6 million, up 26.6% year on year, in line with analyst expectations. It was a slower quarter for the company, with underwhelming guidance for the next year.

The stock is up 17.3% since the results and currently trades at $30.5.

Read our full, actionable report on DoubleVerify here, it's free.

The Trade Desk (NASDAQ:TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ:TTD) offers cloud-based software that uses data to help advertisers better plan, place and target their online ads.

The Trade Desk reported revenues of $490.7 million, up 24% year on year, missing analyst expectations by 0.22%. It was a mixed quarter for the company, with a meaningful improvement in gross margin but a miss of the top line analyst estimates.

The stock is up 23.3% since the results and currently trades at $61.55.

Read our full, actionable report on The Trade Desk here, it's free.

The author has no position in any of the stocks mentioned