As Q1 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers amongst the data storage stocks, including Couchbase (NASDAQ:BASE) and its peers.

Data is the lifeblood of the internet and software in general, and the amount of data created is growing at an accelerating pace. Likewise, the importance of storing the data in scalable and efficient formats continues to rise, especially as the diversity of the data and associated use cases expand from analyzing simple, structured data to high-scale processing of unstructured data, images, audio and video.

The 5 data storage stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 3.76%, while on average next quarter revenue guidance was 0.82% above consensus. The whole tech sector has been facing a sell-off since late last year, but data storage stocks held their ground better than others, with the share price up 14.7% since earnings, on average.

Couchbase (NASDAQ:BASE)

Formed in 2011 with the merger of Membase and CouchOne, Couchbase (NASDAQ:BASE) is a database as a service platform that allows enterprises to store large volumes of semi-structured data.

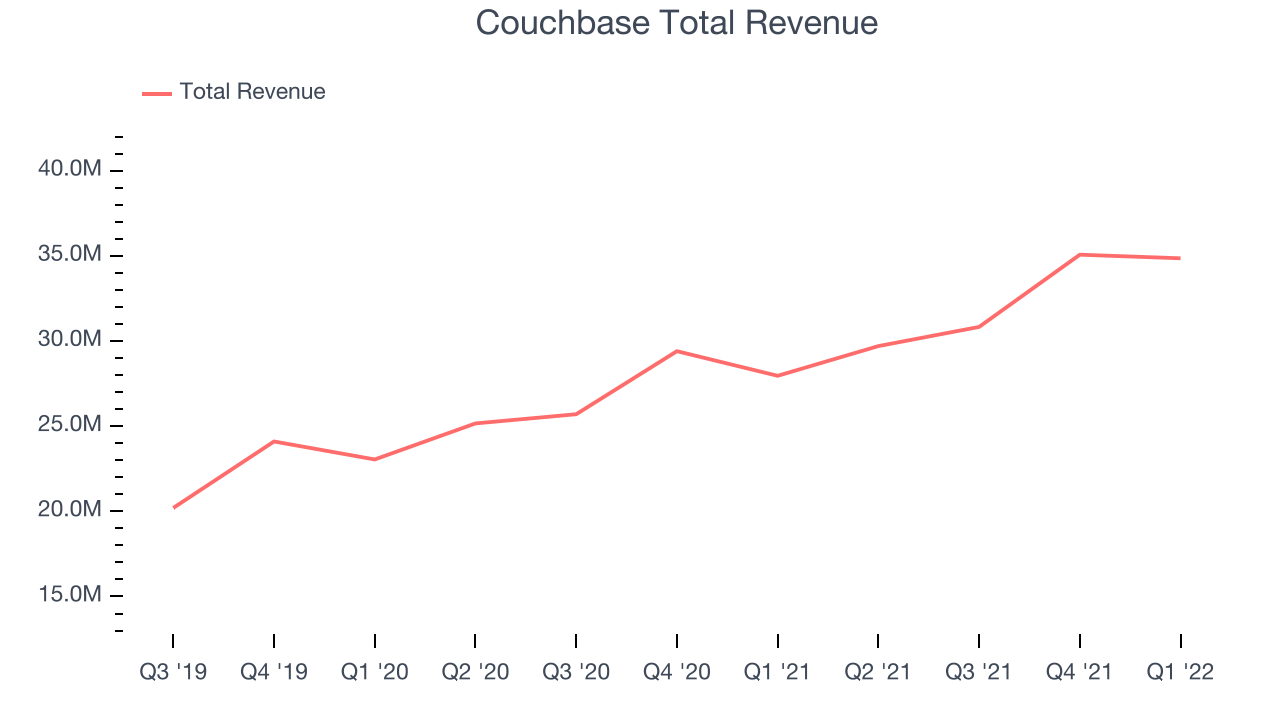

Couchbase reported revenues of $34.8 million, up 24.6% year on year, beating analyst expectations by 6.83%. It was a strong quarter for the company, with a solid beat of analyst estimates.

"We delivered a strong first quarter exceeding the high end of our guidance on all metrics, highlighted by the third straight quarter of accelerating ARR growth," said Matt Cain, President and CEO of Couchbase.

Couchbase achieved the highest full year guidance raise of the whole group. The stock is up 23.7% since the results and currently trades at $17.50.

Is now the time to buy Couchbase? Access our full analysis of the earnings results here, it's free.

Best Q1: MongoDB (NASDAQ:MDB)

Started in 2007 by the team behind Google’s ad platform DoubleClick, MongoDB offers database-as-a-service that helps companies store large volumes of semi-structured data.

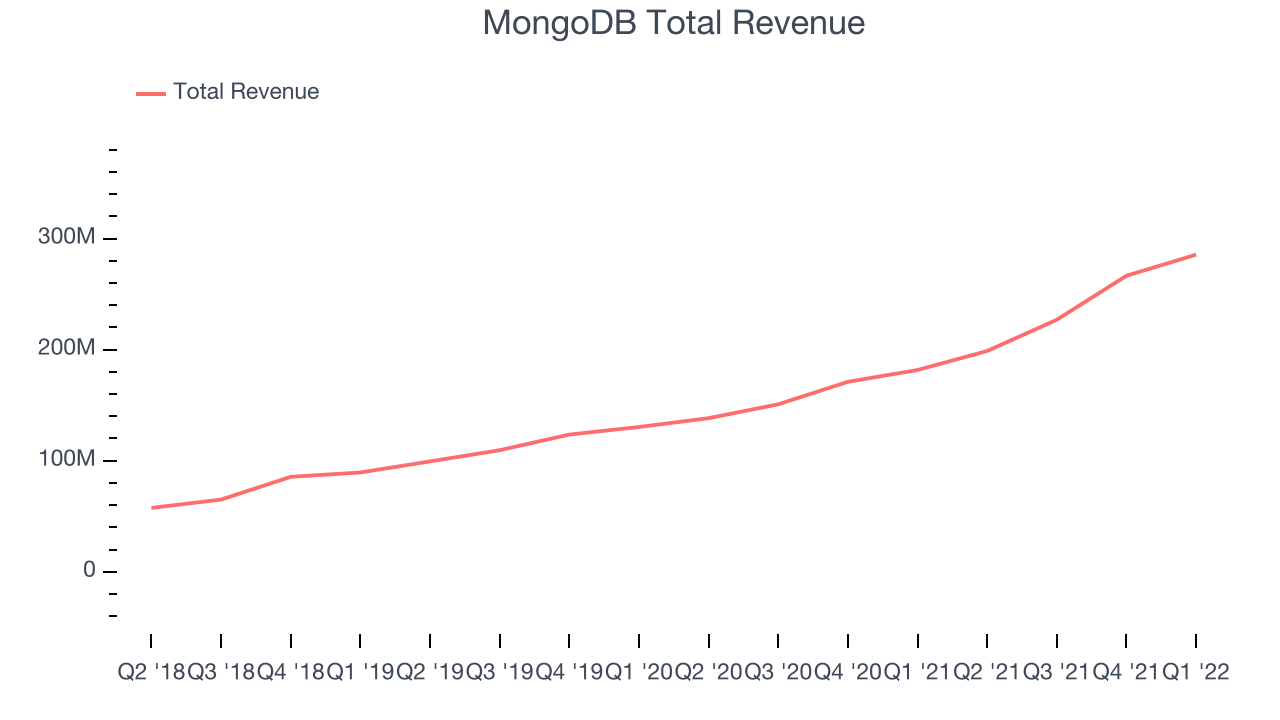

MongoDB reported revenues of $285.4 million, up 57.1% year on year, beating analyst expectations by 6.86%. It was a strong quarter for the company, with an exceptional revenue growth and a solid beat of analyst estimates.

MongoDB scored the strongest analyst estimates beat among its peers. The company added 72 enterprise customers paying more than $100,000 annually to a total of 1,379. The stock is up 26% since the results and currently trades at $304.

Is now the time to buy MongoDB? Access our full analysis of the earnings results here, it's free.

Slowest Q1: Commvault Systems (NASDAQ:CVLT)

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention and compliance.

Commvault Systems reported revenues of $205.9 million, up 7.63% year on year, beating analyst expectations by 1.96%. It was a weaker quarter for the company, with a slow revenue growth.

Commvault Systems had the slowest revenue growth in the group. The company added 1 enterprise customers paying more than $100,000 annually to a total of 226. The stock is up 6.22% since the results and currently trades at $64.50.

Read our full analysis of Commvault Systems's results here.

DigitalOcean (NYSE:DOCN)

Started by brothers Ben and Moisey Uretsky, DigitalOcean (NYSE: DOCN) provides a simple, low-cost platform that allows developers and small and medium sized businesses to host applications and data in the cloud.

DigitalOcean reported revenues of $127.3 million, up 35.9% year on year, in line with analyst expectations. It was a mixed quarter for the company, with an exceptional revenue growth but an underwhelming revenue guidance for the next quarter.

DigitalOcean had the weakest performance against analyst estimates and weakest full year guidance update among the peers. The company added 14,000 customers to a total of 623,000. The stock is up 2.27% since the results and currently trades at $44.49.

Read our full, actionable report on DigitalOcean here, it's free.

Snowflake (NYSE:SNOW)

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE:SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

Snowflake reported revenues of $422.3 million, up 84.5% year on year, beating analyst expectations by 2.26%. It was a mixed quarter for the company, with an exceptional revenue growth but decelerating customer growth.

Snowflake delivered the fastest revenue growth among the peers. The company added 22 enterprise customers paying more than $1m annually to a total of 206. The stock is up 16.1% since the results and currently trades at $154.55.

Read our full, actionable report on Snowflake here, it's free.

The author has no position in any of the stocks mentioned