Pet company Central Garden & Pet (NASDAQGS:CENT) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue up 6% year on year to $750.1 million. Turning to EPS, Central Garden & Pet made a GAAP profit of $0.05 per share, improving from its loss of $0.04 per share in the same quarter last year.

Is now the time to buy Central Garden & Pet? Find out by accessing our full research report, it's free.

Central Garden & Pet (CENT) Q4 FY2023 Highlights:

- Revenue: $750.1 million vs analyst estimates of $735.1 million (2.1% beat)

- EPS: $0.05 vs analyst expectations of $0.06 (11.8% miss)

- Free Cash Flow of $141 million, down 55.1% from the previous quarter

- Gross Margin (GAAP): 26.3%, down from 28.2% in the same quarter last year

"We are proud of what Team Central was able to achieve in a challenging environment characterized by evolving consumer behavior, unfavorable retailer inventory dynamics, high inflation and extreme weather. Despite these headwinds, we delivered non-GAAP EPS within our revised fiscal 2023 guidance, successfully turned inventories into cash, generated record cash flow and continued to make progress on our Cost and Simplicity program," said Beth Springer, Interim CEO of Central Garden & Pet.

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQGS:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Household Products

Household products companies engage in the manufacturing, distribution, and sale of goods that maintain and enhance the home environment. This includes cleaning supplies, home improvement tools, kitchenware, small appliances, and home decor items. Companies within this sector must focus on product quality, innovation, and cost efficiency to remain competitive. Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options.

Sales Growth

Central Garden & Pet is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

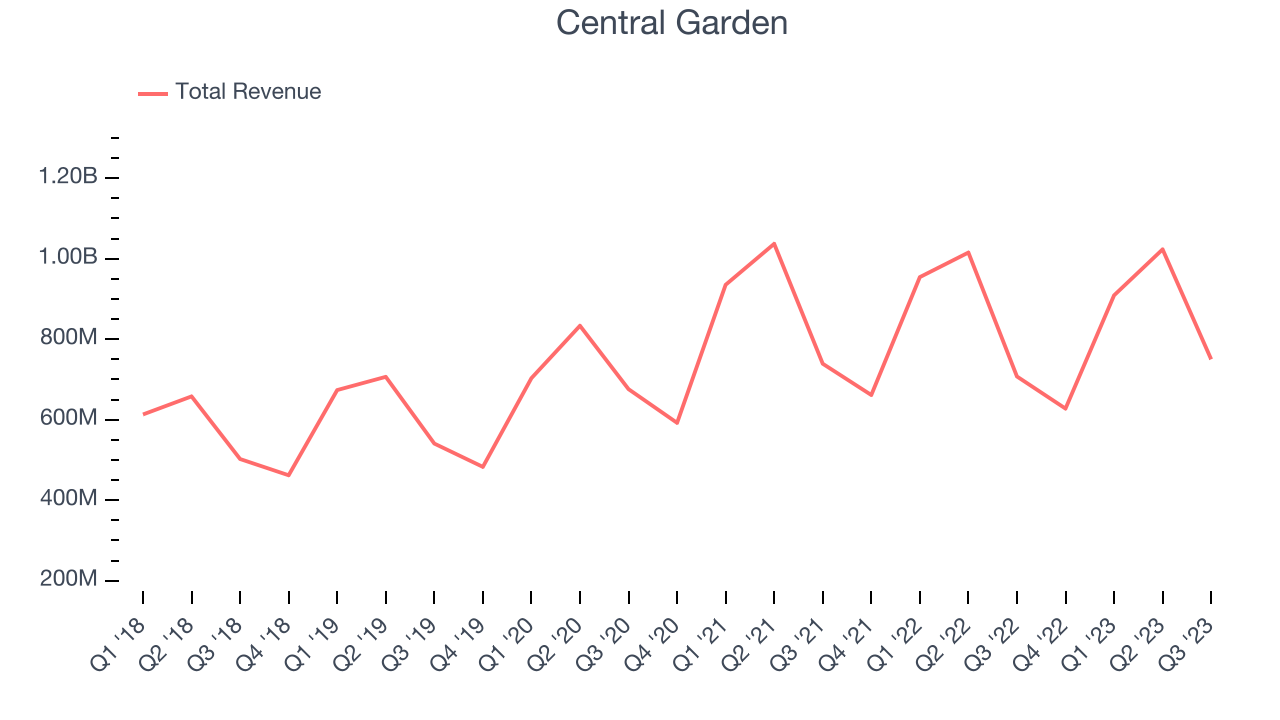

As you can see below, the company's annualized revenue growth rate of 7.1% over the last three years was decent for a consumer staples business.

This quarter, Central Garden & Pet reported solid year-on-year revenue growth of 6%, and its $750.1 million in revenue outperformed Wall Street's estimates by 2.1%. Looking ahead, analysts expect sales to grow 1.6% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Key Takeaways from Central Garden & Pet's Q4 Results

Sporting a market capitalization of $2.21 billion, Central Garden & Pet is among smaller companies, but its more than $502.9 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

It was good to see Central Garden & Pet beat analysts' revenue expectations this quarter, driven by better-than-expected performance in its pet segment (which overshadowed its underperformance in the garden segment). On the other hand, its operating margin, adjusted EBITDA, and EPS missed analysts' expectations. Its full-year EPS guidance also underwhelmed. Overall, this was a mediocre quarter for Central Garden & Pet. The stock is flat after reporting and currently trades at $43.66 per share.

Central Garden & Pet may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.